Global Education Technology Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD2040

October 2024

87

About the Report

Global Education Technology Market Overview

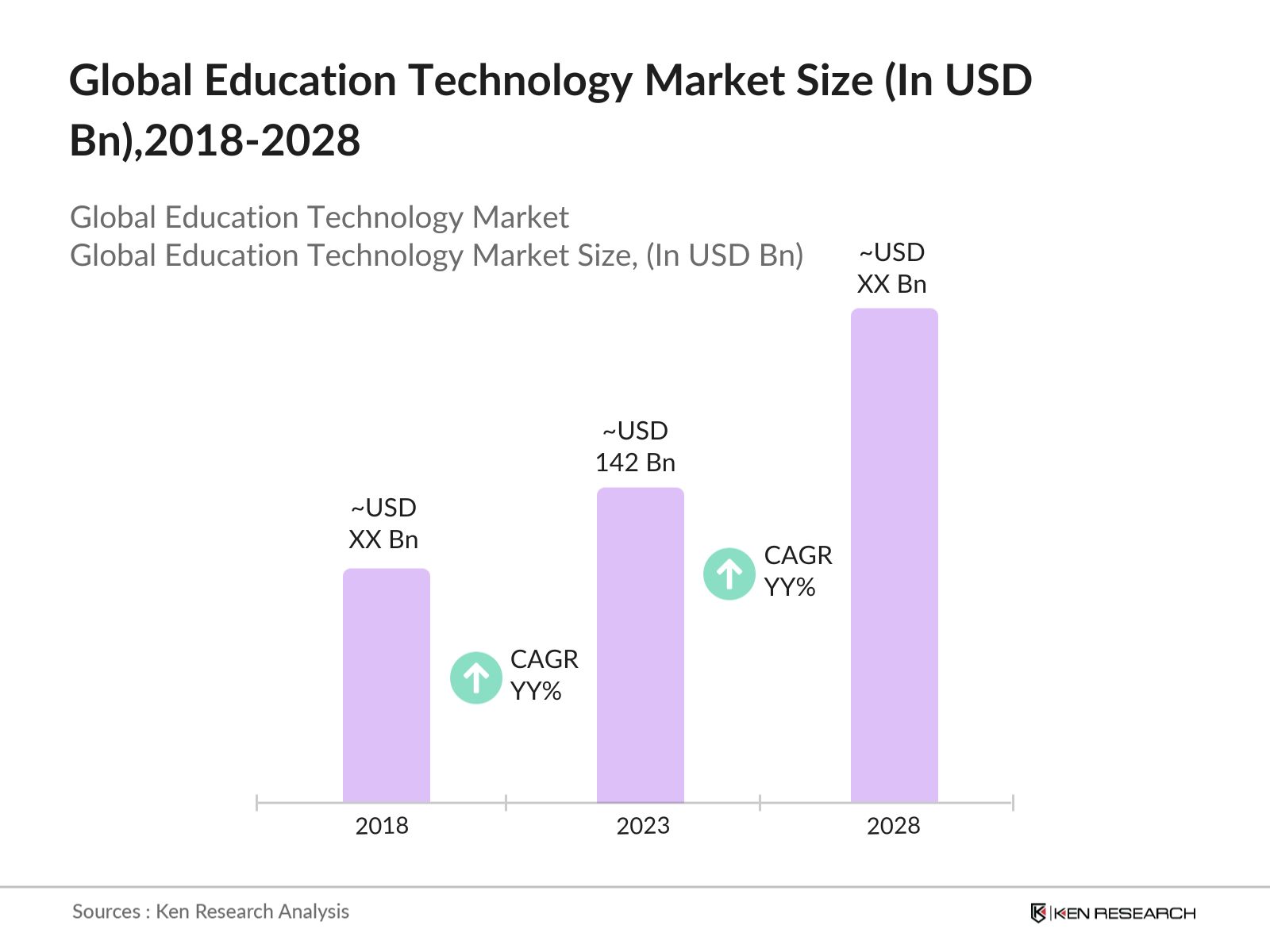

- The global Education Technology (EdTech) market reached a valuation of USD 142 billion in 2023, driven by the widespread adoption of digital learning platforms, increased demand for online courses, and rising investments in workforce training programs. The expansion of online education in both K-12 and higher education, along with corporate upskilling initiatives, is propelling market growth.

- Major players in the global EdTech market include Coursera, BYJU'S, Blackboard Inc., Chegg, and Udemy. These companies are at the forefront of the market, owing to their strategic partnerships with educational institutions, continuous platform innovations, and strong user bases. These organizations are also focused on enhancing their offerings by integrating AI-based adaptive learning technologies and expanding into new geographical markets to maintain a competitive edge.

- In 2023, Coursera introduced its Coursera Career Academy, which offers personalized career coaching and job-specific learning tracks to over 150 million learners globally. BYJUS expanded its global presence by acquiring the Austrian coding platform Tynker, with a focus on increasing coding literacy among children. Similarly, Udemy partnered with Fortune 500 companies to enhance their corporate training offerings, further contributing to the growth of the global EdTech market.

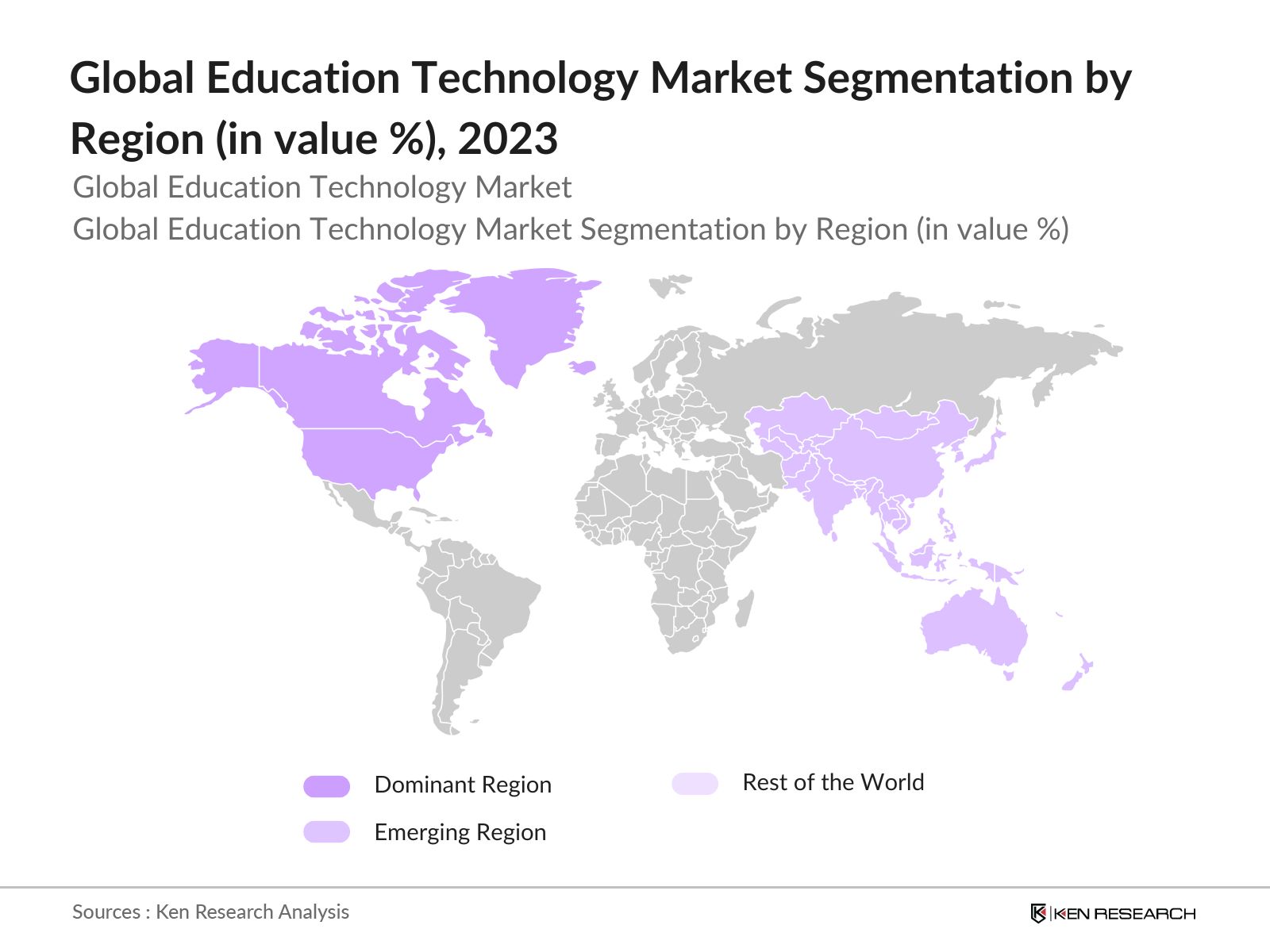

- North America leads the global EdTech market, primarily due to the robust digital infrastructure and high internet penetration rates in the region. The US dominates the market with strong government support for digital education through initiatives such as the "Every Student Succeeds Act" and the increasing adoption of digital tools in higher education. The regions high concentration of EdTech startups and the rising demand for flexible, online learning solutions are key contributors to its market leadership.

Global Education Technology Market Segmentation

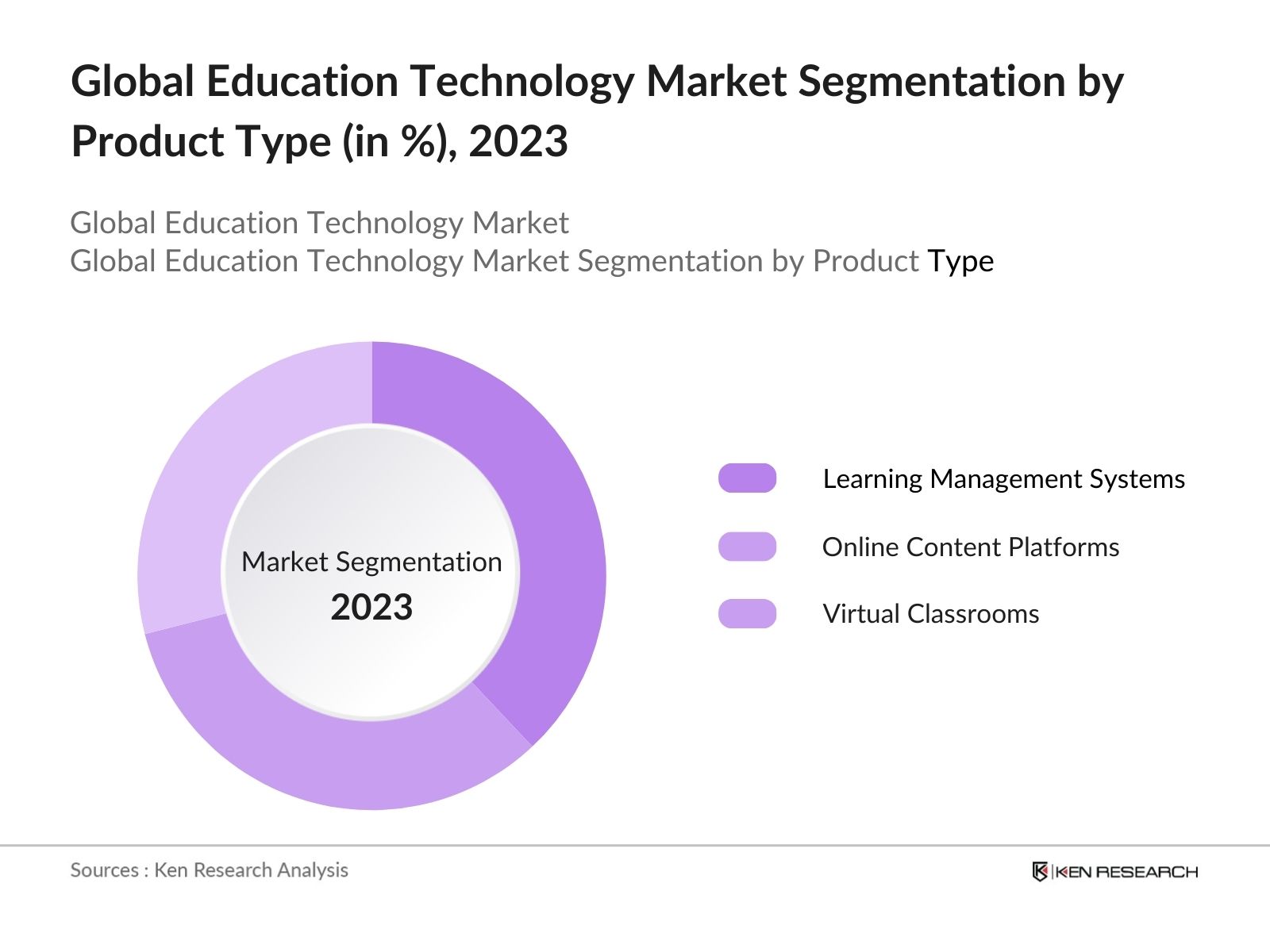

The Global Education Technology Market can be segmented based on Product Type, End-User, and Region.

By Product Type: The global EdTech market is segmented by product type into learning management systems (LMS), online content platforms, and virtual classrooms. In 2023, LMS held the dominant market share of 38%, driven by their widespread adoption across universities and corporate sectors to manage educational content and training. The flexibility, scalability, and integration capabilities of LMS platforms make them a preferred choice for educational institutions and businesses globally.

By End-User: The market is further segmented by end-users into K-12, higher education, and corporate sectors. In 2023, the higher education segment accounted for the largest market share at 40%, as universities and colleges expanded their digital offerings to accommodate remote and blended learning models. Platforms like Coursera and edX, in partnership with leading universities, are driving the demand for digital learning solutions in this sector.

By Region: Geographically, the EdTech market is segmented into North America, Europe, Asia-Pacific, Latin America, and MEA. North America dominated the market in 2023, holding 45% of the market share due to its strong digital infrastructure and government initiatives promoting online education. The US is particularly dominant in the region, with its large number of EdTech startups and partnerships between educational institutions and technology providers.

Global Education Technology Market Competitive Landscape

|

Company |

Headquarters |

Establishment Year |

|

Coursera |

Mountain View, USA |

2012 |

|

BYJUS |

Bangalore, India |

2011 |

|

Blackboard Inc. |

Washington D.C., USA |

1997 |

|

Chegg |

Santa Clara, USA |

2005 |

|

Udemy |

San Francisco, USA |

2010 |

- Coursera: In 2024, Coursera expanded its enterprise learning solutions by partnering with over 100 new companies, including Fortune 500 corporations, to provide upskilling programs for their employees. Coursera also added new degree programs in collaboration with top universities, offering affordable education to students globally. These partnerships have helped Coursera maintain its leadership in the EdTech market.

- BYJUS: In 2023, BYJUS announced the acquisition of Austria-based Geogebra, an interactive mathematics learning platform, for USD 100 million. This acquisition aims to enhance BYJUS content offerings, particularly in math and science, and is expected to help the company expand its presence in European markets. With this move, BYJU'S continues to be a dominant player in the global EdTech space.

Global Education Technology Market Analysis

Market Growth Drivers

- Growing Adoption of Online Learning in Higher Education: The increasing demand for flexible, online learning solutions in higher education continues to drive growth in the EdTech market. In 2024, universities worldwide are projected to invest over USD 2 billion in expanding their digital education platforms to accommodate remote learning, hybrid models, and micro-credentials. This demand is particularly strong in North America and Europe, where institutions are incorporating AI and machine learning technologies into their curriculums to provide personalized and data-driven learning experiences.

- Corporate Upskilling and Reskilling Initiatives: With the rise of automation and technological advancements, companies are investing heavily in employee upskilling and reskilling programs. In 2024, corporate investments in EdTech platforms are expected to surpass USD 180 billion globally, with a focus on AI-driven learning tools that deliver personalized content to employees. Sectors such as IT, finance, and healthcare are leading this trend, with companies leveraging EdTech solutions to enhance employee skills and remain competitive.

- Government Support for Digital Literacy: Governments around the world are prioritizing digital literacy as a critical part of education reform. In 2024, the European Union has allocated EUR 9 billion for its Digital Education Action Plan, which aims to enhance digital skills and infrastructure across educational institutions. Similarly, in the US, Every Student Succeeds Act has allocated USD 1.5 billion towards improving STEM education through EdTech platforms. These initiatives are driving increased adoption of digital learning tools in both K-12 and higher education.

Global Education Technology Market Challenges

- Unequal Access to Technology: Despite the growing adoption of EdTech, access to technology remains uneven, particularly in developing regions. In Sub-Saharan Africa, nearly 300 million students lack reliable internet connectivity, which significantly hampers the adoption of digital learning platforms. The digital divide in these regions presents a major challenge for the global EdTech market, as many governments and institutions lack the infrastructure and resources needed to provide equitable access to technology.

- Data Privacy and Security Concerns: As more educational institutions and corporations adopt digital platforms, concerns over data privacy and security are increasing. A report from the European Commission indicated that 75% of students and educators are worried about the safety of their personal data on EdTech platforms. Stricter regulations, such as the GDPR in Europe, have been implemented to address these concerns, but compliance remains a significant challenge for many EdTech providers.

Global Education Technology Market Government Initiatives

- US Every Student Succeeds Act (2024): Every Student Succeeds Act (ESSA) in the United States provides USD 1.5 billion in funding for STEM education, supporting the integration of digital learning tools in K-12 schools across the country. The initiative focuses on improving access to technology for underprivileged students, ensuring equitable access to quality education through digital platforms.

- UK's National Centre for Computing Education 2024: In the UK, the government continues to support digital learning through its "National Centre for Computing Education," which received an additional GBP 200 million in funding in 2024. The initiative focuses on enhancing digital literacy and computational thinking among students and teachers. With an aim to train over 40,000 teachers and integrate advanced computing into the curriculum, this initiative is set to drive further EdTech adoption in UK schools, particularly in computational sciences and coding.

Global Education Technology Market Future Market Outlook

The Global Education Technology Market is set for significant growth, driven by technological advancements, rising demand for personalized learning solutions, and increased government investments in digital education infrastructure.

Future Market Trends

- Advancements in AI-Powered Learning Platforms: By 2028, AI-powered personalized learning platforms will become a standard in both K-12 and higher education sectors. These platforms will utilize advanced machine learning algorithms to track student progress and provide tailored learning experiences, significantly improving student outcomes. The global adoption of AI-driven tools is expected to rise, with schools and universities increasingly relying on data-driven insights to optimize learning.

- Growth in Corporate Micro-Credentials: Over the next five years, micro-credentials and nano-degrees will see widespread adoption, particularly in the corporate sector. Companies will continue to invest in short-term, job-specific learning programs that allow employees to quickly acquire new skills. By 2028, micro-credentials will be recognized as a key component of workforce development strategies, enabling employees to remain competitive in a rapidly evolving job market.

Scope of the Report

|

By Product |

Learning Management Systems Online Content Platforms Virtual Classrooms |

|

By End-User |

Higher Education K-12 Corporate Sector |

|

By Region |

North America Europe APAC Latin America MEA |

|

By Technology |

Artificial Intelligence (AI) Augmented Reality/Virtual Reality (AR/VR) Blockchain |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Educational Institutions (K-12 and Higher Education)

Corporate Training Departments

Online Learning Platforms and Service Providers

Government and Regulatory Bodies (e.g., U.S. Department of Education, European Commission)

Investment and Venture Capitalist Firms

Technology Developers and Vendors (AI, AR/VR Solutions)

Workforce Development Agencies

Digital Content Creators for Education

International Educational Organizations

EdTech-Focused Incubators and Accelerators

Companies

Players Mentioned in the Report

Coursera

BYJU'S

Blackboard Inc.

Chegg

Udemy

2U, Inc.

Knewton

Khan Academy

Instructure (Canvas)

Skillshare

Table of Contents

1. Global Education Technology Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Education Technology Market Size (in USD Billion), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Education Technology Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of Online Learning in K-12 and Higher Education

3.1.2. Corporate Investment in Workforce Upskilling

3.1.3. Government Support for Digital Literacy Programs

3.2. Restraints

3.2.1. Unequal Access to Technology in Developing Regions

3.2.2. High Implementation Costs for Educational Institutions

3.2.3. Data Privacy and Security Concerns

3.3. Opportunities

3.3.1. Rising Demand for AI-Driven Personalized Learning

3.3.2. Expansion of EdTech in Emerging Markets

3.3.3. Growing Popularity of Gamified Learning Solutions

3.4. Trends

3.4.1. Integration of AI, AR/VR in Learning Environments

3.4.2. Micro-Credentials and Nano-Degree Programs

3.4.3. Increased Adoption of Blockchain for Credentialing

3.5. Government Regulations

3.5.1. US Every Student Succeeds Act (ESSA)

3.5.2. European Unions Digital Education Action Plan 2027

3.5.3. Indias National Digital Education Policy 2024

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Education Technology Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Learning Management Systems (LMS)

4.1.2. Online Content Platforms

4.1.3. Virtual Classrooms

4.2. By End-User (in Value %)

4.2.1. K-12

4.2.2. Higher Education

4.2.3. Corporate Sector

4.3. By Technology (in Value %)

4.3.1. Artificial Intelligence (AI)

4.3.2. Augmented Reality/Virtual Reality (AR/VR)

4.3.3. Blockchain

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. MEA

5. Global Education Technology Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Coursera

5.1.2. BYJU'S

5.1.3. Blackboard Inc.

5.1.4. Chegg

5.1.5. Udemy

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Education Technology Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Education Technology Market Regulatory Framework

7.1. Digital Education Standards and Guidelines

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Education Technology Future Market Size (in USD Billion), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Education Technology Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Technology (in Value %)

9.4. By Region (in Value %)

10. Global Education Technology Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Building an ecosystem for all major entities within the Global Education Technology Market by referencing a combination of secondary and proprietary databases. This step includes analyzing market trends, understanding user preferences, and tracking technological advancements across different segments.

Step 2: Market Building

Compiling data on the Global Education Technology Market over the years, analyzing penetration rates across various product and end-user segments, and evaluating the performance of key market players. The research involves studying the adoption of online education, corporate training tools, and personalized learning systems to quantify market demand.

Step 3: Validating and Finalizing

Developing hypotheses and conducting Computer Assisted Telephone Interviews (CATIs) with industry experts and stakeholders from leading EdTech companies. These interviews validate collected data, refine growth forecasts, and provide operational insights directly from key market players.

Step 4: Research Output

Collaborating with multiple industry leaders to understand the dynamics of educational tools, market needs, sales channels, and growth challenges. A bottom-up approach is used to validate data, ensuring that the insights reflect actual market conditions and support effective decision-making for stakeholders.

Frequently Asked Questions

01 How big is the Global Education Technology Market?

The global Education Technology (EdTech) market reached a valuation of USD 142 billion in 2023, driven by the widespread adoption of digital learning platforms, increased demand for online courses, and rising investments in workforce training programs.

02 What are the challenges in the Global Education Technology Market?

Key challenges include unequal access to technology, especially in developing regions, high implementation costs for schools and universities, and concerns about data privacy and security as more institutions adopt digital platforms.

03 Who are the major players in the Global Education Technology Market?

Key players in the market include Coursera, BYJU'S, Blackboard Inc., Chegg, and Udemy. These companies dominate the EdTech space due to their innovative solutions, partnerships with educational institutions, and strong presence in global markets.

04 What are the growth drivers of the Global Education Technology Market?

Growth is driven by the increasing demand for online learning in K-12 and higher education, corporate investments in upskilling and reskilling, and government support for digital literacy programs. AI-driven personalized learning tools are also contributing to the market's expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.