Global Elderly Walker Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD4434

November 2024

99

About the Report

Global Elderly Walker Market Overview

- The global elderly walker market is valued at USD 1.6 billion, based on a five-year historical analysis. This market is primarily driven by a growing elderly population, alongside increasing incidences of mobility-related health issues such as arthritis and osteoporosis. Additionally, innovations in walker technology, including lightweight materials and ergonomic designs, are enhancing accessibility and convenience for users. The demand for advanced mobility aids is also rising as more elderly individuals seek independent living solutions, especially within home care and assisted living settings, where support and stability are paramount.

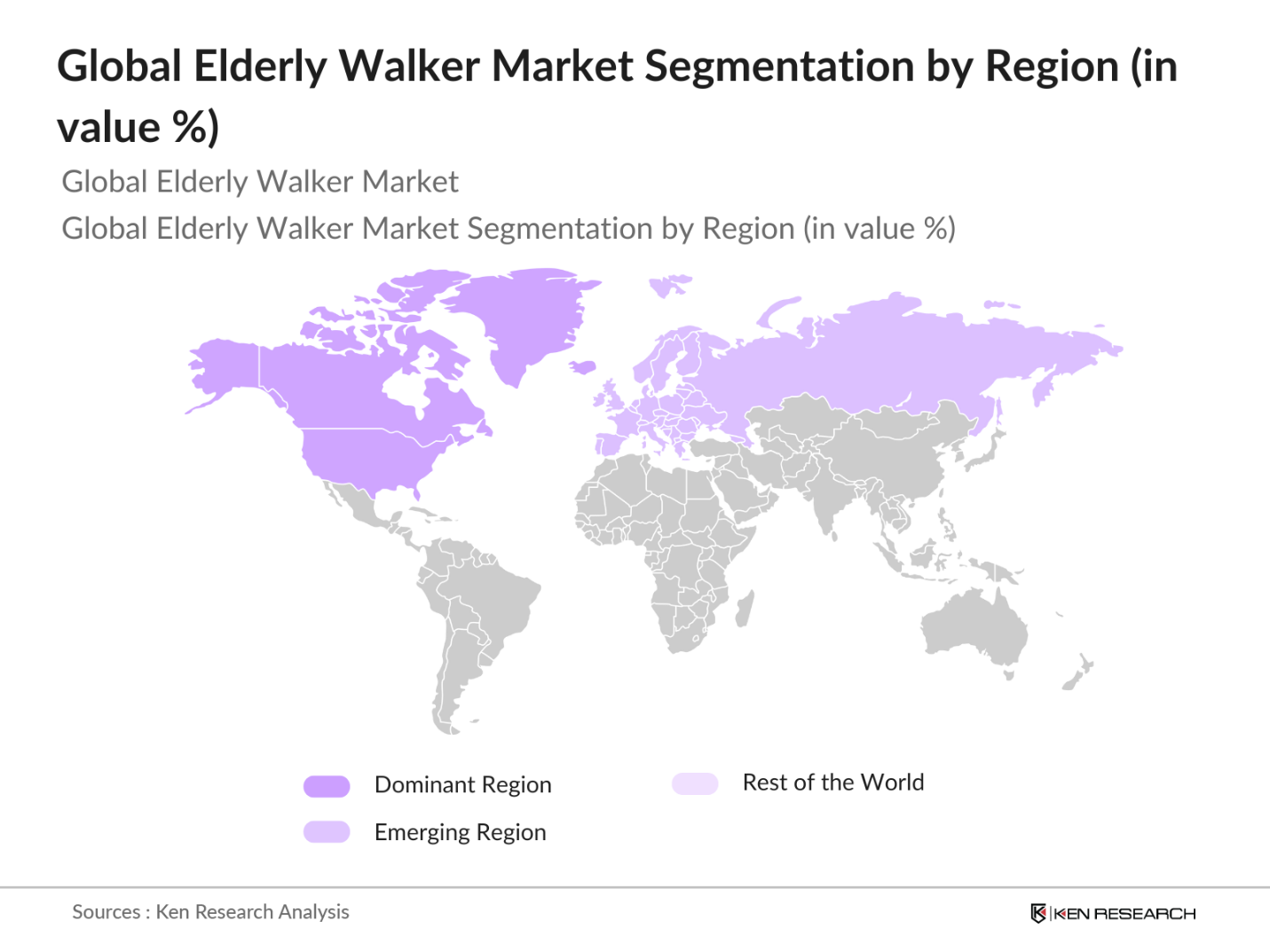

- Regionally, North America, particularly the United States, dominates the elderly walker market due to well-developed healthcare systems, high healthcare spending, and a growing geriatric population. Meanwhile, the Asia-Pacific region is anticipated to show strong growth, supported by increasing healthcare investments, growing elderly populations in countries like Japan and China, and heightened awareness of mobility aids.

- Government grants supporting mobility solutions have seen substantial growth, with accessibility funds allocated in the U.S., U.K., and India. For instance, the U.S. Department of Health and Human Services allocated USD 5 billion toward elderly care accessibility, while the U.K. invested in community initiatives supporting elderly independence. These grants provide economic support for walker purchases and infrastructure improvements.

Global Elderly Walker Market Segmentation

By Product Type: The elderly walker market is segmented by product type into standard walkers, knee walkers, and rollators. Rollators hold a dominant market share within this segment, due to their popularity for ease of use, mobility, and additional support features such as brakes and foldability. Rollators are especially favored by elderly users who require stability and easy maneuverability, particularly for outdoor usage, making them the most widely adopted product type.

By End-Use: The elderly walker market is segmented by end-use into hospitals, home care, and assisted living facilities. The home care segment leads this market, as many elderly individuals prefer to remain independent within their homes. With an increasing emphasis on home-based healthcare, walkers offer mobility support that facilitates independence, making this segment dominant in the elderly walker market.

By Region: The global elderly walker market is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America holds the largest market share, primarily driven by high elderly populations and advanced healthcare infrastructure. However, the Asia-Pacific region is rapidly growing due to increased healthcare investments, particularly in countries like China and India.

Global Elderly Walker Market Competitive Landscape

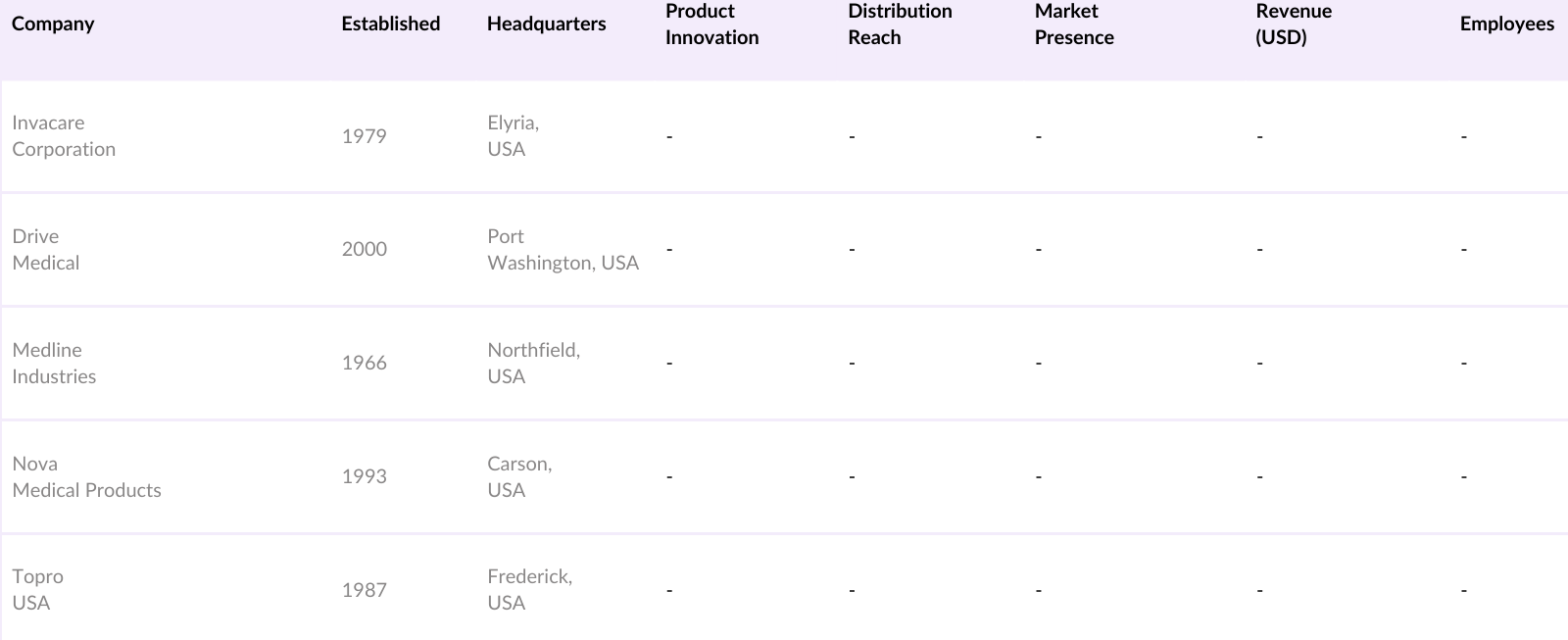

The elderly walker market is dominated by major players that focus on innovation and strategic partnerships to increase market share. This competition drives continuous improvements in design, affordability, and user-centered features across the market.

Global Elderly Walker Industry Analysis

Growth Drivers

- Increasing Aging Population: The global elderly population has seen a significant increase, with more than 1 billion people aged 60 and above as of 2024, according to the UNs World Population Aging Report. This growth is driven by declining birth rates and rising life expectancy worldwide. For instance, Japan's elderly population represents over 30 million people, while Chinas aging demographic exceeds 250 million, influencing market demand for elderly mobility aids.

- Prevalence of Chronic Conditions (e.g., Arthritis, Parkinsons Disease): Chronic conditions affecting mobility, such as arthritis and Parkinsons disease, are particularly prevalent among the elderly, contributing to a surge in demand for mobility aids. For example, the CDC reports that over 55 million adults have arthritis in the United States alone, with a significant percentage of these individuals aged 65 and above. Similarly, Parkinsons disease impacts more than 10 million individuals globally.

- Innovations in Walker Technology (e.g., Lightweight Materials, Advanced Braking Systems): Advancements in walker technology, including the adoption of lightweight, durable materials and advanced braking systems, are increasingly essential in providing reliable support to users. For instance, materials like carbon fiber and titanium alloys, which are widely used in aerospace, have been incorporated into walker designs, reducing weight by up to 20% compared to traditional models.

Market Challenges

- High Product Costs in Developing Markets: The average cost of advanced walkers remains a barrier for consumers in developing regions, where per capita income often limits purchasing power. For instance, in low-income economies such as India, where the per capita income is approximately USD 2,400, the price of a high-quality walker is considered expensive. This economic barrier limits accessibility for low-income seniors, creating a gap in adequate mobility support for aging populations in these regions.

- Infrastructure Barriers (e.g., Accessibility Issues): In many countries, infrastructure lacks accessibility features, creating barriers for walker users. For example, the WHO reports that only about 10% of cities globally meet accessibility standards for the elderly, which impacts walker usability and limits the adoption rate in urban areas. This issue is particularly notable in densely populated urban regions in Asia, Africa, and Latin America, where sidewalk conditions, building access, and public transportation accessibility are still evolving.

Global Elderly Walker Market Future Outlook

Over the next five years, the global elderly walker market is expected to experience robust growth, spurred by rising demand for assistive technologies and a significant increase in the aging population worldwide. Key factors such as the integration of advanced features, including ergonomic designs and digital sensors, along with the expansion of home healthcare services, are projected to drive further adoption of elderly walkers globally. Increased accessibility through online channels and a focus on affordable pricing will further enhance market growth.

Market Opportunities

- Technological Advancements (e.g., Smart Sensors, Digital Integration): Incorporating smart technology in walkers, such as sensors that monitor user stability and detect falls, offers significant potential. As of 2024, over 75 million devices worldwide integrate health monitoring technology, reflecting broader consumer interest in digital health solutions. These advancements, already prevalent in high-income countries, are projected to drive growth in the elderly walker market as manufacturers integrate sensors and tracking features for safer use.

- Growth of E-Commerce Distribution Channels: Online retail channels have surged, with e-commerce sales projected to represent 18% of all retail sales globally in 2024, according to the World Bank. This shift provides accessibility to elderly individuals or caregivers in remote areas, enabling direct purchase options without relying on physical stores. Increased internet access, with global penetration surpassing 60%, has also supported the growth of online channels for mobility aids like walkers.

Scope of the Report

|

Product Type |

Standard Walkers Wheeled Walkers Knee Walkers Rollators |

|

Application |

Orthopedic Care Emergency Care Geriatric Care Rehabilitation |

|

Distribution Channel |

Specialty Stores Online Retail Pharmacies Direct-to-Consumer |

|

End-User |

Hospitals Home Care Assisted Living Facilities |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Elderly and Geriatric Care Facilities

Hospitals and Rehabilitation Centers

Home Healthcare Providers

Distributors and Specialty Medical Retailers

Government and Regulatory Bodies (e.g., FDA, European Medicines Agency)

Technological Innovators in Assistive Mobility

Investment and Venture Capital Firms

Insurance Providers and Healthcare Agencies

Companies

Players Mentioned in the Report

Invacare Corporation

Drive Medical

Medline Industries

Nova Medical Products

Topro USA

GF Health Products, Inc.

Rollz International

Apex Medical Corporation

Dolomite

Bischoff & Bischoff GmbH

Table of Contents

1. Global Elderly Walker Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Elderly Walker Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Elderly Walker Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Aging Population

3.1.2 Prevalence of Chronic Conditions (e.g., Arthritis, Parkinsons Disease)

3.1.3 Innovations in Walker Technology (e.g., Lightweight Materials, Advanced Braking Systems)

3.1.4 Home-Based Care Demand

3.2 Market Challenges

3.2.1 High Product Costs in Developing Markets

3.2.2 Infrastructure Barriers (e.g., Accessibility Issues)

3.2.3 Lack of Reimbursement in Some Regions

3.3 Opportunities

3.3.1 Technological Advancements (e.g., Smart Sensors, Digital Integration)

3.3.2 Growth of E-Commerce Distribution Channels

3.3.3 Expansion in Emerging Markets (e.g., Asia Pacific)

3.4 Trends

3.4.1 Shift Toward Foldable and Lightweight Models

3.4.2 Customizable Features for Enhanced Comfort

3.4.3 Rise of Direct-to-Consumer Sales Channels

3.5 Government and Institutional Support

3.5.1 Accessibility Grants and Funding (U.S., U.K., India)

3.5.2 Assisted Living Initiatives

3.5.3 Integration with Home Care Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4. Global Elderly Walker Market Segmentation

4.1 By Product Type (In Revenue, %)

4.1.1 Standard Walkers

4.1.2 Wheeled Walkers

4.1.3 Knee Walkers

4.1.4 Rollators

4.2 By Application (In Revenue, %)

4.2.1 Orthopedic Care

4.2.2 Emergency Care

4.2.3 Geriatric Care

4.2.4 Rehabilitation

4.3 By Distribution Channel (In Revenue, %)

4.3.1 Specialty Stores

4.3.2 Online Retail

4.3.3 Pharmacies

4.3.4 Direct-to-Consumer

4.4 By End-User (In Revenue, %)

4.4.1 Hospitals

4.4.2 Home Care

4.4.3 Assisted Living Facilities

4.5 By Region (In Revenue, %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Elderly Walker Market Competitive Analysis

5.1 Key Players and Market Share Analysis

5.1.1 Invacare Corporation

5.1.2 Drive Medical

5.1.3 Carex Health Brands

5.1.4 Medline Industries

5.1.5 Topro USA

5.1.6 GF Health Products, Inc

5.1.7 Kaye Products, Inc

5.1.8 Nova Medical Products

5.1.9 Just Walkers

5.1.10 Rollz International

5.1.11 Apex Medical Corporation

5.1.12 Eurovema

5.1.13 Dolomite

5.1.14 Bischoff & Bischoff GmbH

5.1.15 HomCom (Aosom LLC)

5.2 Cross-Comparison Parameters (Headquarters, Revenue, Product Portfolio, Innovation Pipeline, Pricing Strategy, Distribution Reach, R&D Spending, Market Presence)

5.3 Strategic Initiatives (Mergers & Acquisitions, Partnerships)

5.4 R&D Investments and Innovation Focus

5.5 Marketing Strategies and Brand Positioning

5.6 Product Launches and Innovations

6. Global Elderly Walker Market Regulatory Framework

6.1 Safety and Quality Standards (ISO Standards, FDA Approvals)

6.2 Regional Compliance Requirements

6.3 Government Subsidies and Reimbursement Policies

7. Global Elderly Walker Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Drivers of Future Market Growth

8. Global Elderly Walker Market Future Segmentation

8.1 By Product Type

8.2 By Application

8.3 By Distribution Channel

8.4 By End-User

8.5 By Region

9. Global Elderly Walker Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation and Preference Insights

9.3 Marketing and Positioning Recommendations

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves identifying crucial variables and stakeholders that influence the elderly walker market dynamics, using desk research from secondary and proprietary databases to define essential market variables.

Step 2: Market Analysis and Construction

Historical data on market size, user demographics, and trends was collected to evaluate past and current market conditions, focusing on penetration and end-user adoption metrics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts. Interviews were conducted with senior executives to gather operational insights and validate data.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing insights and data collected from stakeholders and market participants to provide a comprehensive, validated analysis of the elderly walker market.

Frequently Asked Questions

01. How big is the Global Elderly Walker Market?

The global elderly walker market is valued at USD 1.6 billion, based on a five-year historical analysis. This market is primarily driven by a growing elderly population, alongside increasing incidences of mobility-related health issues such as arthritis and osteoporosis.

02. What are the growth drivers in the Elderly Walker Market?

Key growth drivers include increasing demand for home-based healthcare, rising elderly populations, and advancements in walker technology, such as ergonomic designs and sensor integration.

03. Which regions dominate the Elderly Walker Market?

North America leads due to advanced healthcare infrastructure and high healthcare spending, while Asia-Pacific is expected to grow rapidly due to demographic changes and healthcare investment.

04. Who are the major players in the Elderly Walker Market?

Prominent players include Invacare Corporation, Drive Medical, Medline Industries, Nova Medical Products, and Topro USA, all known for their innovative products and extensive distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.