Global Electric Powertrain Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD3273

November 2024

92

About the Report

Global Electric Powertrain Market Overview

- The global electric powertrain market is valued at USD 97 billion, driven by the rapid shift towards electric vehicles (EVs) in the automotive industry. Increasing government incentives for EV adoption, advancements in battery technology, and stringent emission regulations are the key factors contributing to this growth. The market's expansion is further supported by a rising focus on sustainability and the need to reduce carbon emissions, particularly in high-emission industries such as automotive. Major automotive manufacturers are investing heavily in electric powertrain R&D, further accelerating market growth.

- The market is predominantly dominated by countries such as China, the United States, and Germany. Chinas dominance is driven by strong government policies supporting EV manufacturing and sales, coupled with substantial investments in EV infrastructure. The U.S. is home to key market players like Tesla, which continues to push innovations in electric powertrain technologies. Germany, as the center of Europes automotive industry, maintains a strong presence due to the country's well-established automotive sector and increasing focus on sustainability through electric mobility solutions.

- Global governments are accelerating the deployment of EV infrastructure. The United States federal government committed $7.5 billion to building 500,000 EV charging stations by 2025. The European Union has invested 5.3 billion for EV charging infrastructure, aiming to install 1 million charging points by 2025. China has invested over 30 billion in charging infrastructure, establishing 810,000 charging points by the end of 2023, the largest network globally. This focus on infrastructure directly correlates to the growing adoption of electric powertrains globally.

Global Electric Powertrain Market Segmentation

By Component Type:

The global electric powertrain market is segmented by component type into electric motors, power electronics, transmission systems, and battery management systems. Electric motors hold a dominant share in the market. This is primarily due to the critical role electric motors play in EV propulsion and the continuous innovations in motor efficiency and power output. Major automotive manufacturers are collaborating with electric motor manufacturers to enhance vehicle performance, which has led to increased demand in this segment.

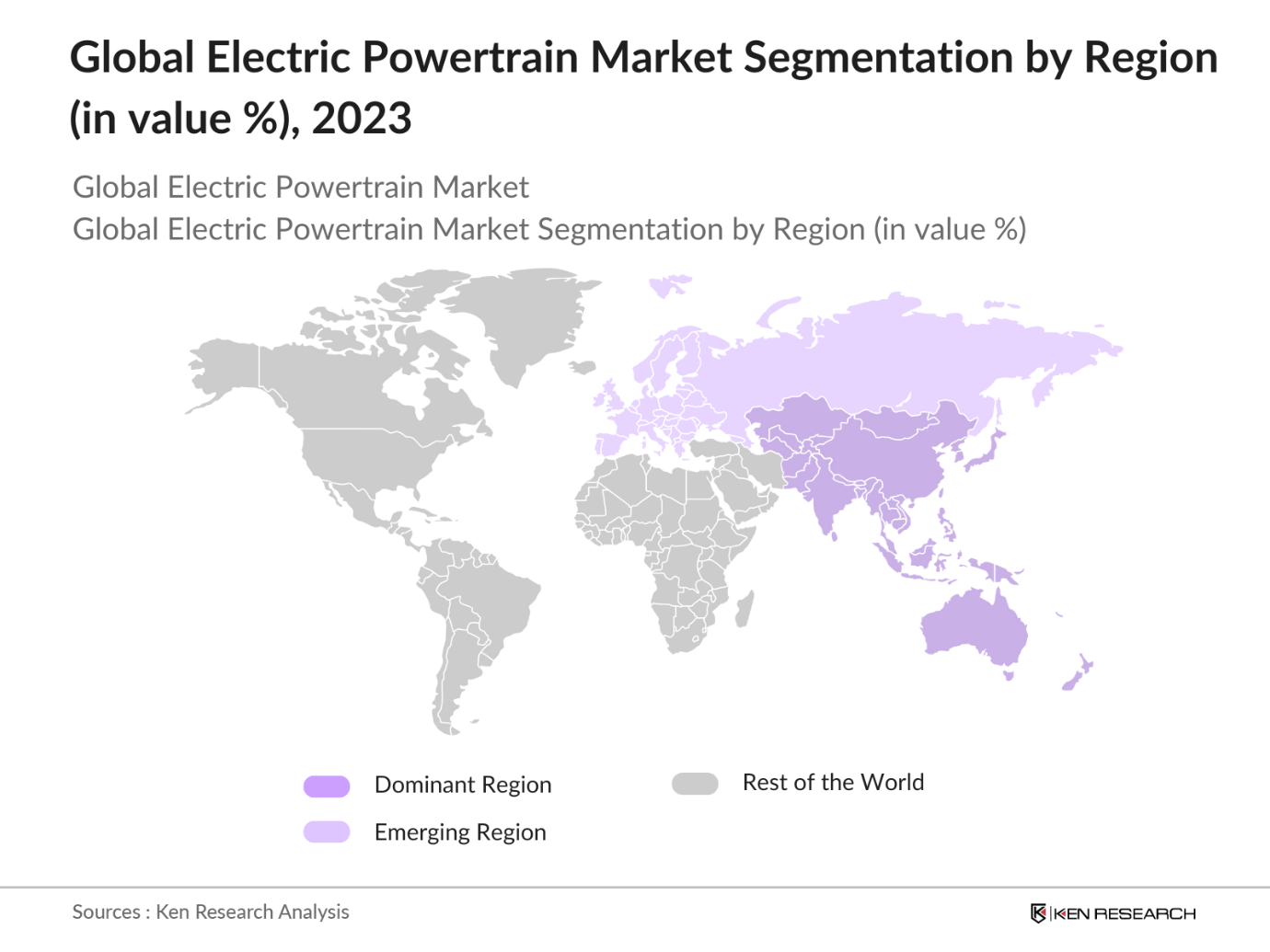

By Region:

The global electric powertrain market is segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominates the market, driven by the rapid adoption of EVs in China and India. Strong government support for EV infrastructure, coupled with the presence of major automotive manufacturers, makes Asia Pacific a leader in the electric powertrain market. Europe follows closely behind, due to stringent emission regulations and the presence of prominent automotive companies transitioning to electric mobility.

By Vehicle Type:

The electric powertrain market is segmented into passenger vehicles, commercial vehicles, two-wheelers, and buses & coaches. Passenger vehicles dominate the market. The increasing popularity of electric passenger cars, driven by consumer demand for eco-friendly options and government incentives, contributes to this dominance. Additionally, the high adoption rate of electric passenger vehicles in urban areas and growing charging infrastructure development further supports this segments growth.

Global Electric Powertrain Market Competitive Landscape

The global electric powertrain market is characterized by the presence of key players such as Tesla, Toyota, and BYD, which have a significant influence on market dynamics. These companies are heavily investing in R&D, which has contributed to the introduction of advanced electric powertrain technologies. Furthermore, strategic collaborations between automotive manufacturers and battery technology firms have helped consolidate the market.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Product Portfolio |

R&D Expenditure |

Global Reach |

Patents Owned |

Strategic Collaborations |

|

Tesla, Inc. |

2003 |

California, USA |

|||||||

|

Toyota Motor Corp. |

1937 |

Toyota City, Japan |

|||||||

|

BYD Company Ltd. |

1995 |

Shenzhen, China |

|||||||

|

Robert Bosch GmbH |

1886 |

Gerlingen, Germany |

|||||||

|

Nissan Motor Co. |

1933 |

Yokohama, Japan |

Global Electric Powertrain Maret Analysis

Growth Drivers

- Surge in Electric Vehicle Sales: The global electric vehicle (EV) market has seen significant growth due to rising consumer demand and government backing. In 2023, over 10.6 million EVs were sold worldwide, a sharp rise compared to previous years. China, the largest EV market, registered sales of 6.8 million units in 2023. In the U.S., EV sales reached 1.2 million units, boosted by incentives under the Inflation Reduction Act. The European Union saw sales of 2.5 million EVs. These numbers are fueled by stricter environmental policies and rising awareness of climate change.

- Technological Advancements in Battery Efficiency: Technological innovations in battery production have enhanced the viability of electric powertrains. Lithium-ion battery energy densities increased to 285 Wh/kg in 2023, from 250 Wh/kg in 2021, improving vehicle range and reducing charging frequency. The U.S. Department of Energy is funding research to push energy densities beyond 400 Wh/kg by 2025, targeting better efficiency and performance. The global average cost of EV batteries has decreased to $132 per kWh in 2023 due to these advancements, lowering the overall cost of EV production and supporting higher adoption.

- Climate Change Mitigation Policies: Governments across the globe are leveraging climate change mitigation policies to drive electric vehicle adoption. As part of its National Climate Plan, the U.S. government aims to reduce greenhouse gas emissions by 50-52% by 2030 from 2005 levels, with EVs playing a critical role. The EU is enforcing its Fit for 55 package, which mandates all new cars sold from 2035 to be zero-emission vehicles. Chinas 14th Five-Year Plan focuses heavily on electric vehicles to meet its goal of carbon neutrality by 2060.

Market Challenges

- High Costs of R&D and Raw Materials: Electric powertrain development is capital-intensive, with research and development (R&D) costs reaching billions annually. Additionally, the prices of essential raw materials like lithium, cobalt, and nickel have risen sharply, with lithium prices climbing to over $85,000 per ton in 2023, a 75% increase compared to 2022. These cost hikes directly impact the affordability of EVs and powertrains, creating barriers to mass-market penetration.

- Insufficient Charging Infrastructure: While governments are investing heavily, global EV charging infrastructure still lags behind rising demand. In the United States, there are currently only 145,000 public charging stations, far below the estimated 500,000 needed by 2025. In India, despite rapid EV adoption, there are just 2,300 public chargers to serve a growing market. Europe faces similar challenges, as Germany and France combined have only about 80,000 charging points in operation. The shortage of charging stations poses a significant barrier to broader EV adoption.

Global Electric Powertrain Market Future Outlook

Over the next five years, the global electric powertrain market is expected to see robust growth driven by continuous technological advancements in electric vehicles, increasing government support, and growing consumer demand for eco-friendly transportation solutions. The rise of autonomous electric vehicles and the integration of renewable energy sources in EV charging infrastructure will further bolster market growth.

Market Opportunities

- Growth in Emerging EV Markets: Emerging markets such as India, Brazil, and Southeast Asian countries are becoming hotbeds for EV growth. India, for instance, saw a rise in EV registrations, with 800,000 EVs registered in 2023, an increase from 400,000 in 2022. Indonesias government plans to boost domestic EV production to 600,000 units annually by 2025, catering to both domestic and export markets. These nations are adopting aggressive EV policies and infrastructure investments, creating significant opportunities for electric powertrain manufacturers.

- Development of Next-Gen Battery Technologies: The development of next-generation solid-state batteries is revolutionizing the EV market. Companies like Toyota and QuantumScape are working on batteries with energy densities exceeding 450 Wh/kg, promising enhanced vehicle ranges and shorter charging times. By 2023, Toyota has already built prototypes that show double the range compared to traditional lithium-ion batteries. These advancements present substantial growth potential for electric powertrain manufacturers, as solid-state batteries are projected to play a crucial role in the future of EV technology.

Scope of the Report

|

Segment |

Sub-segments |

|

By Component Type |

Electric Motors, Power Electronics, Transmission Systems, Battery Management Systems (BMS), Others |

|

By Vehicle Type |

Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Buses & Coaches |

|

By Power Source |

Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs) |

|

By End-User |

OEMs, Aftermarket |

|

By Region |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Electric Vehicle Manufacturers

Battery Technology Firms

Automotive OEMs

Powertrain Component Suppliers

Government and Regulatory Bodies (U.S. Department of Transportation, European Commission)

Energy Providers

Investors and Venture Capitalist Firms

Electric Vehicle Infrastructure Providers

Companies

Major Players

Tesla, Inc.

Toyota Motor Corporation

BYD Company Ltd.

Robert Bosch GmbH

Nissan Motor Co., Ltd.

Magna International Inc.

Continental AG

Siemens AG

LG Chem Ltd.

Panasonic Corporation

Valeo SA

Nidec Corporation

BorgWarner Inc.

ZF Friedrichshafen AG

Delphi Technologies

Table of Contents

1. Global Electric Powertrain Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Electric Powertrain Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Electric Powertrain Market Analysis

3.1. Growth Drivers (Increased EV Adoption, Sustainability Policies, Technological Innovations)

3.1.1. Surge in Electric Vehicle Sales

3.1.2. Government Support for EV Infrastructure

3.1.3. Technological Advancements in Battery Efficiency

3.1.4. Climate Change Mitigation Policies

3.2. Market Challenges (Cost Barriers, Infrastructure Deficiencies, Supply Chain Constraints)

3.2.1. High Costs of R&D and Raw Materials

3.2.2. Insufficient Charging Infrastructure

3.2.3. Global Semiconductor Shortages

3.3. Opportunities (Emerging Markets, Battery Advancements, Public-Private Collaborations)

3.3.1. Growth in Emerging EV Markets

3.3.2. Development of Next-Gen Battery Technologies

3.3.3. Partnerships between Automakers and Energy Providers

3.4. Trends (Autonomous Electric Vehicles, Integration of Renewable Energy, Lightweight Materials)

3.4.1. Rise of Autonomous Electric Vehicle Production

3.4.2. Integration of Renewable Energy in Charging Networks

3.4.3. Use of Lightweight Materials for Increased Efficiency

3.5. Government Regulation (EV Policies, Emission Standards, Incentive Programs)

3.5.1. Global Emission Reduction Mandates

3.5.2. National Electric Vehicle Incentive Schemes

3.5.3. Stricter CO2 Emission Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Electric Powertrain Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Electric Motors

4.1.2. Power Electronics

4.1.3. Transmission Systems

4.1.4. Battery Management Systems (BMS)

4.1.5. Others

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Two-Wheelers

4.2.4. Buses & Coaches

4.3. By Power Source (In Value %)

4.3.1. Battery Electric Vehicles (BEVs)

4.3.2. Hybrid Electric Vehicles (HEVs)

4.3.3. Plug-in Hybrid Electric Vehicles (PHEVs)

4.3.4. Fuel Cell Electric Vehicles (FCEVs)

4.4. By End-User (In Value %)

4.4.1. OEMs

4.4.2. Aftermarket

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Electric Powertrain Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla, Inc.

5.1.2. Toyota Motor Corporation

5.1.3. BYD Company Ltd.

5.1.4. Robert Bosch GmbH

5.1.5. Nissan Motor Co., Ltd.

5.1.6. Continental AG

5.1.7. Magna International Inc.

5.1.8. Nidec Corporation

5.1.9. BorgWarner Inc.

5.1.10. Siemens AG

5.1.11. Delphi Technologies

5.1.12. LG Chem Ltd.

5.1.13. Valeo SA

5.1.14. ZF Friedrichshafen AG

5.1.15. Panasonic Corporation

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, Product Portfolio, Partnerships, Market Penetration, EV Innovation, Global Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Electric Powertrain Market Regulatory Framework

6.1. EV Infrastructure Regulations

6.2. Compliance Requirements

6.3. Certification Processes

6.4. Environmental Standards

7. Global Electric Powertrain Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Electric Powertrain Future Market Segmentation

8.1. By Component Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Power Source (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Electric Powertrain Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase involves creating a detailed market map, identifying all relevant stakeholders, such as electric vehicle manufacturers, battery technology providers, and regulatory authorities. Secondary research from industry reports and proprietary databases is used to identify market drivers, barriers, and trends influencing the electric powertrain market.

Step 2: Market Analysis and Construction

This step focuses on the compilation and analysis of historical market data, focusing on factors like market size, penetration rates, and component adoption rates. Additionally, we assess powertrain performance metrics and cost analyses across the product lifecycle to provide accurate insights.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated using interviews with industry experts and company executives. These consultations offer valuable insights into electric vehicle powertrain innovations and market dynamics, further refining the data.

Step 4: Research Synthesis and Final Output

The final phase involves compiling data from industry players, providing detailed insights into the global electric powertrain market. The synthesized data is cross-verified with primary research, ensuring a comprehensive and accurate report.

Frequently Asked Questions

01. How big is the Global Electric Powertrain Market?

The global electric powertrain market is valued at USD 97 billion, primarily driven by the shift toward electric vehicles and increasing government incentives supporting the development of EV infrastructure.

02. What are the challenges in the Global Electric Powertrain Market?

Challenges in global electric powertrain market include high R&D and production costs, semiconductor shortages, and insufficient charging infrastructure, which hinder the rapid adoption of electric powertrains across regions.

03. Who are the major players in the Global Electric Powertrain Market?

Key players in global electric powertrain the market include Tesla, Toyota, BYD, Robert Bosch, and Nissan, which dominate the market due to their advanced technologies and extensive R&D efforts.

04. What are the growth drivers of the Global Electric Powertrain Market?

Growth in electric powertrain market is driven by rising environmental concerns, government policies promoting zero-emission vehicles, advancements in electric powertrain technologies, and increasing consumer demand for sustainable transportation solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.