Global Electric Switchgear Market Outlook to 2030

Region:Global

Author(s):Khushi Khatreja

Product Code:KROD5252

November 2024

87

About the Report

Global Electric Switchgear Market Overview

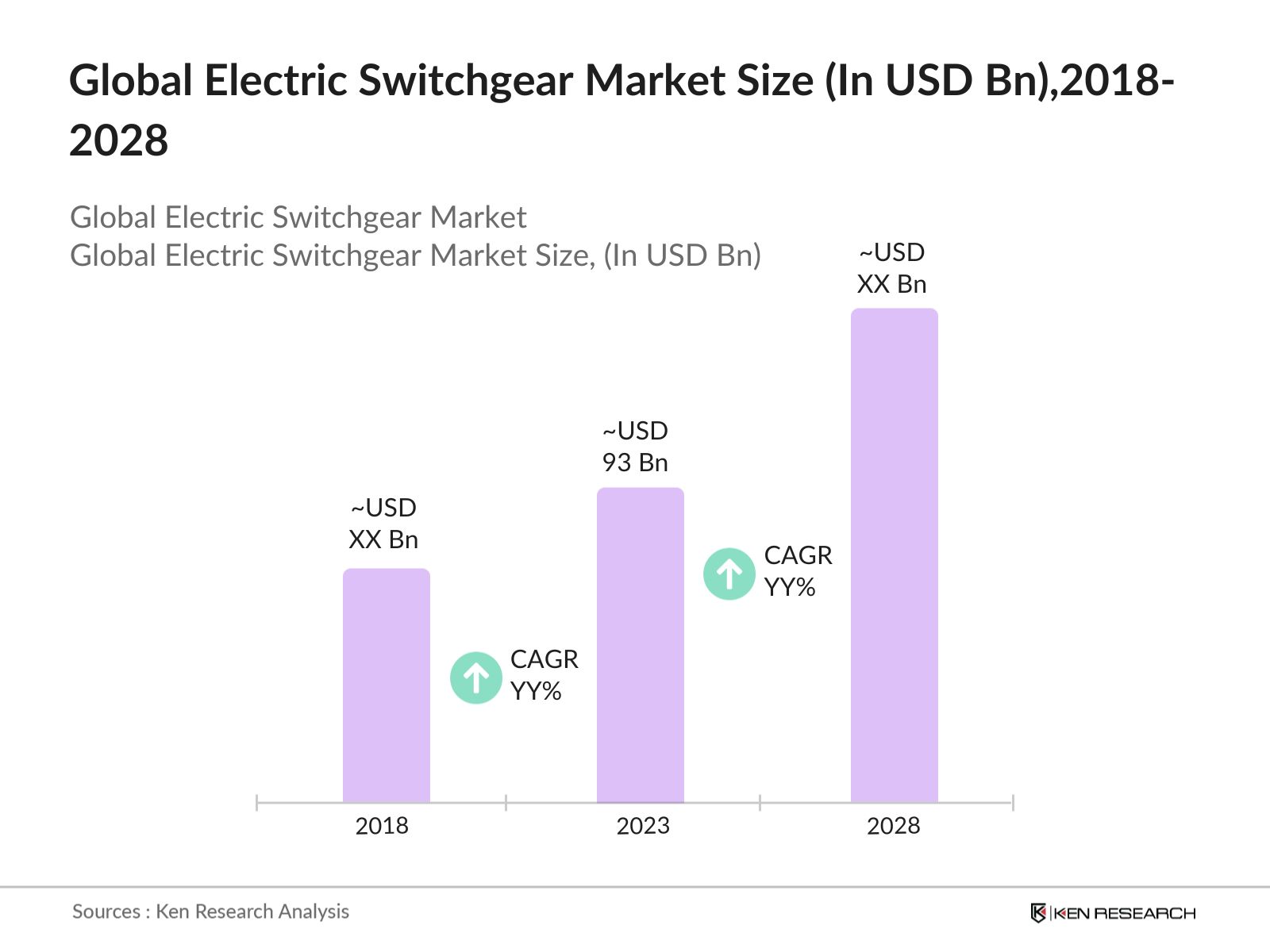

- The Global Electric Switchgear Market has experienced notable growth, reaching a valuation of USD 93 billion in 2023. This growth is driven by the rapid expansion of power generation and distribution infrastructure worldwide.

- The electric switchgear market is dominated by key players such as Siemens AG, ABB Ltd., Schneider Electric, General Electric, and Eaton Corporation. These companies have established a strong global presence, leveraging their extensive product portfolios, technological innovations, and strategic partnerships.

- In 2023, Siemens AG announced the launch of its new gas-insulated switchgear (GIS) solution, which is designed to significantly reduce the environmental impact by minimizing the use of sulfur hexafluoride (SF6), a potent greenhouse gas. This innovation aligns with the industry's move towards more sustainable practices.

- Cities like Shanghai, New York, and Mumbai are leading the global electric switchgear market due to their massive urbanization projects and ongoing upgrades to electrical infrastructure. Shanghai, with its focus on smart city initiatives, has been investing heavily in advanced switchgear solutions to support its growing demand for reliable and efficient power distribution.

Global Electric Switchgear Market Segmentation

Global Electric Switchgear Market is divided into further segments:

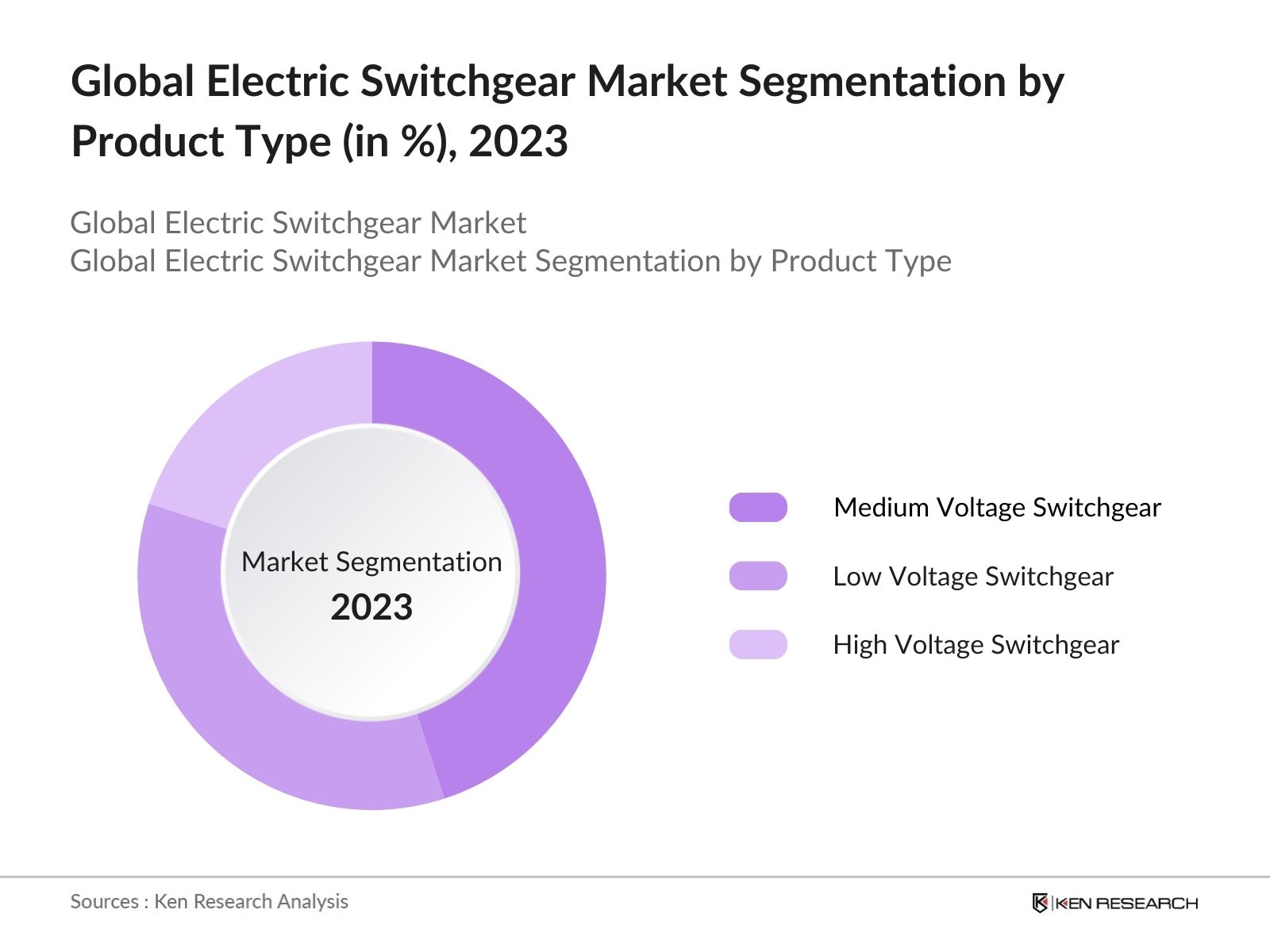

- By Product Type: The Global Electric Switchgear Market is segmented by product type into low voltage, medium voltage, and high voltage switchgear. In 2023, medium voltage switchgear dominated the market share, driven by its widespread application in industrial and commercial sectors.

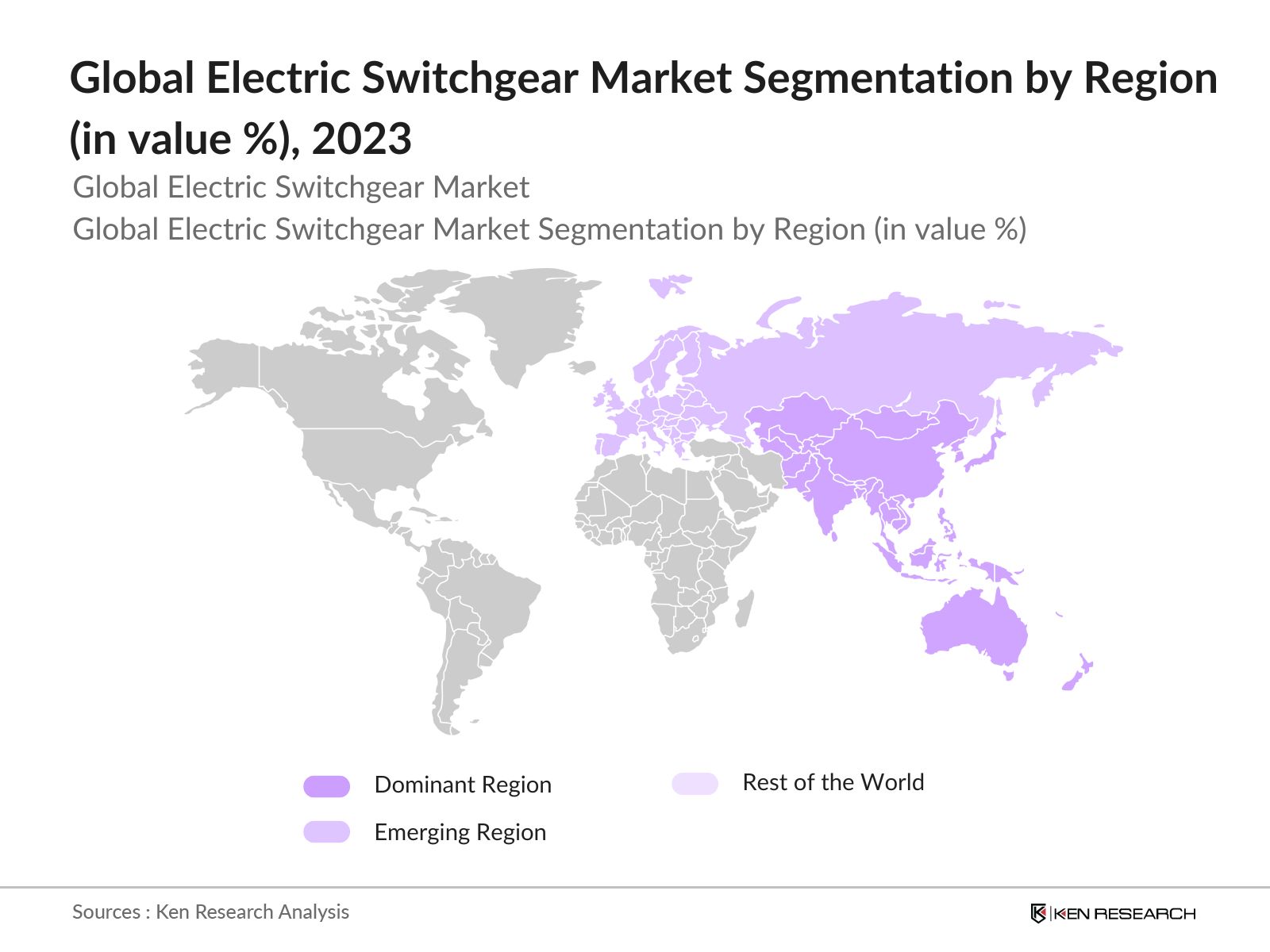

- By Region: The Global Electric Switchgear Market is segmented by region into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA). In 2023, the Asia-Pacific region dominated the market share, largely due to the rapid urbanization and industrialization in countries like China and India.

- By End-User: The electric switchgear market is segmented by end-users into utilities, industrial, and commercial sectors. In 2023, the utilities segment held the largest market share due to the increasing investments in upgrading power distribution networks and the integration of renewable energy sources.

Global Electric Switchgear Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Siemens AG |

1847 |

Munich, Germany |

|

ABB Ltd. |

1883 |

Zurich, Switzerland |

|

Schneider Electric |

1836 |

Rueil-Malmaison, France |

|

General Electric |

1892 |

Boston, USA |

|

Eaton Corporation |

1911 |

Dublin, Ireland |

- ABB Ltd.: In 2024, ABB launched a breakthrough eco-efficient switchgear solution that uses a new gas mixture called AirPlus™ to minimize environmental impact compared to traditional SF6 gas-insulated switchgear. ABB's AirPlus™ technology represents a significant advancement in sustainable electrical infrastructure, aligning with the industry's growing demand for environmentally friendly solutions.

- Schneider Electric: In 2024, Schneider Electric expanded its product portfolio with the introduction of modular switchgear systems designed for easy integration into smart grid projects. These systems are particularly suited for urban environments where space is limited. Schneider Electric has secured contracts for these modular systems in major cities across Europe and Asia.

Global Electric Switchgear Industry Analysis

Global Electric Switchgear MarketGrowth Drivers

- Expansion of Renewable Energy Projects: The global shift towards renewable energy is driving increased demand for electric switchgear. As countries expand their renewable capacities, especially in wind and solar, the need for efficient switchgear systems grows. For example, China plans to add 50 GW of wind energy capacity by 2024, requiring advanced switchgear for effective integration into the national grid.

- Increased Industrialization in Emerging Economies: Emerging economies in the Asia-Pacific region are undergoing rapid industrialization, leading to increased electricity demand and a corresponding rise in the need for electric switchgear. In 2024, India's manufacturing sector is expected to grow by 8.2%, fueled by initiatives like "Make in India," which aims to establish India as a global manufacturing hub.

- Increasing Electrification Needs: The demand for electrification, especially in rural and remote regions, is a significant factor driving market growth. Governments are establishing goals to improve electricity access, which is resulting in increased investments in power infrastructure and switchgear solutions to facilitate these efforts.

Global Electric Switchgear Market Challenges

- Intense Competition from Unorganized Sector: Prominent switchgear manufacturers face significant competition from the unorganized sector, which includes local and gray market players offering inexpensive, low-quality products. For instance: Gray market players acquire and distribute switchgear via unauthorized dealers, providing lower-cost products that compete with established branded offerings.

- Compatibility Issues with Aging Infrastructure: Integrating new technology switchgear into aging electrical infrastructure can lead to compatibility issues, requiring extensive testing and validation. Older switchgear uses electromechanical relays for protection, while modern systems employ digital relays and Intelligent Electronic Devices (IEDs). Integrating these technologies requires extensive testing to ensure coordination and avoid nuisance tripping.

Global Electric Switchgear Market Government Initiatives

- The European Green Deal: The European Green Deal was introduced in 2019 by the European Commission with the overarching aim of making the European Union climate neutral by 2050.In 2023, the EU reached provisional agreements on key elements of the "Fit for 55" package, including reforms to the Emissions Trading System (ETS) and the introduction of a Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage.

- 13th Five-Year Plan for Energy Development: The 13th Five-Year Plan for Energy Development in China was introduced in 2016, outlining strategies to modernize the energy sector and promote the integration of renewable energy sources. In October 2023, the Chinese government announced plans to invest heavily in renewable energy projects and smart grid technologies as part of its ongoing efforts to meet the goals set out in the 13th Five-Year Plan.

Global Electric Switchgear Market Future Outlook

The global electric switchgear market is ready for significant growth in the coming years, driven by the increasing adoption of renewable energy, the need for infrastructure modernization, rising demand from developing regions, advancements in switchgear technologies, and strategic collaborations among industry players.

Future Market trends

- Increased Adoption of Smart Grid Technologies: Over the next five years, the adoption of smart grid technologies is expected to accelerate, driven by the need for more efficient and reliable power distribution. By 2028, it is projected that majority of new grid infrastructure projects will incorporate smart grid components, including digital switchgear.

- Growth in Demand for Eco-Friendly Switchgear: The demand for eco-friendly switchgear solutions is expected to grow significantly through 2028, as more countries implement stringent environmental regulations. Manufacturers will continue to innovate in this space, developing new materials and technologies to replace SF6 and other harmful gases, driven by regulations in the EU and other regions.

Scope of the Report

|

By Product Type |

Low Voltage Switchgear Medium Voltage Switchgear High Voltage Switchgear |

|

By End-User |

Utilities Industrial Commercial |

|

By Region |

North America Europe APAC Latin America MEA |

|

By Insulation Type |

Air-Insulated Gas-Insulated Oil-Insulated |

|

By Voltage Rating |

Below 1 kV 1 kV to 36 kV Above 36 kV |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing this Report:

Industrial Manufacturers

Commercial Building Developers

Renewable Energy Companies

Infrastructure Development Firms

Government and Regulatory Bodies (Federal Energy Regulatory Commission - FERC in the U.S., NTPC Limited in India)

Investment and Venture Capitalist Firms

Smart Grid Technology Providers

Power Distribution Companies

Defense and Military Infrastructure Agencies

Disaster Management Authorities

Transmission System Operators (TSOs)

Companies

Players mentioned in the report

Siemens AG

ABB Ltd.

Schneider Electric

General Electric

Eaton Corporation

Hitachi Energy Ltd.

Mitsubishi Electric Corporation

Toshiba Corporation

Fuji Electric Co., Ltd.

Hyosung Corporation

Larsen & Toubro Limited

CG Power and Industrial Solutions Ltd.

Powell Industries, Inc.

Lucy Electric Ltd.

Meidensha Corporation

Table of Contents

1. Global Electric Switchgear Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Electric Switchgear Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Electric Switchgear Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Renewable Energy Projects

3.1.2. Increased Industrialization in Emerging Economies

3.1.3. Increasing Electrification Needs

3.2. Challenges

3.2.1. Intense Competition from Unorganized Sector

3.2.2. Compatibility Issues with Aging Infrastructure

3.2.3. Environmental Concerns and Regulatory Pressures

3.3. Opportunities

3.3.1. Technological Advancements in Switchgear

3.3.2. Expansion into Developing Regions

3.3.3. Growing Demand for Digital and Eco-Friendly Solutions

3.4. Trends

3.4.1. Adoption of Digital Switchgear

3.4.2. Shift Towards Eco-Friendly Switchgear

3.4.3. Rising Investments in Smart Grids

3.5. Government Initiatives

3.5.1. The European Green Deal

3.5.2. 13th Five-Year Plan for Energy Development (China)

3.5.3. U.S. Infrastructure Investment and Jobs Act

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Electric Switchgear Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Low Voltage Switchgear

4.1.2. Medium Voltage Switchgear

4.1.3. High Voltage Switchgear

4.2. By End-User (in Value %)

4.2.1. Utilities

4.2.2. Industrial

4.2.3. Commercial

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific (APAC)

4.3.4. Latin America

4.3.5. Middle East & Africa (MEA)

4.4. By Insulation Type (in Value %)

4.4.1. Air-Insulated

4.4.2. Gas-Insulated

4.4.3. Oil-Insulated

4.5. By Voltage Rating (in Value %)

4.5.1. Below 1 kV

4.5.2. 1 kV to 36 kV

4.5.3. Above 36 kV

4.6. By Application (in Value %)

4.6.1. Power Generation

4.6.2. Power Distribution

4.6.3. Infrastructure & Transportation

5. Global Electric Switchgear Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. ABB Ltd.

5.1.3. Schneider Electric

5.1.4. General Electric

5.1.5. Eaton Corporation

5.1.6. Hitachi Energy Ltd.

5.1.7. Mitsubishi Electric Corporation

5.1.8. Toshiba Corporation

5.1.9. Fuji Electric Co., Ltd.

5.1.10. Hyosung Corporation

5.1.11. Larsen & Toubro Limited

5.1.12. CG Power and Industrial Solutions Ltd.

5.1.13. Powell Industries, Inc.

5.1.14. Lucy Electric Ltd.

5.1.15. Meidensha Corporation

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Electric Switchgear Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Electric Switchgear Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Electric Switchgear Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Electric Switchgear Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

9.4. By Insulation Type (in Value %)

9.5. By Voltage Rating (in Value %)

9.6. By Application (in Value %)

10. Global Electric Switchgear Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 Market Building:

Collating statistics on Global Electric Switchgear Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Electric Switchgear industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research Output:

Our team will approach multiple Electric Switchgear industry companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Global Electric Switchgear industry companies.

Frequently Asked Questions

01 How big is Global Automated Data Processing Market?

The Global Electric Switchgear Market has witnessed significant growth, achieving a valuation of USD 93 billion in 2023. This expansion is primarily fueled by the swift development of power generation and distribution infrastructure across the globe.

02 Who are the major players in the Global Electric Switchgear Market?

Key players in the Global Electric Switchgear Market include Siemens AG, ABB Ltd., Schneider Electric, General Electric, and Eaton Corporation. These companies dominate due to their technological innovations, extensive product portfolios, and strong global presence.

03 What are the growth drivers of the Global Electric Switchgear Market?

The Global Electric Switchgear Market is driven by the expansion of renewable energy projects, significant government investments in power infrastructure, and the rapid industrialization in emerging economies, which has increased the demand for reliable power distribution systems.

04 What are the challenges in the Global Electric Switchgear Market?

Challenges in the Global Electric Switchgear Market include the high initial costs of advanced switchgear systems, the complexity of upgrading aging infrastructure, and environmental concerns related to the use of SF6 gas, which has led to increased regulatory pressures.

Tables:

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.