Global Electric Vehicle Charging Equipment Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-002

June 2025

91

About the Report

Global Electric Vehicle Charging Equipment Market Overview

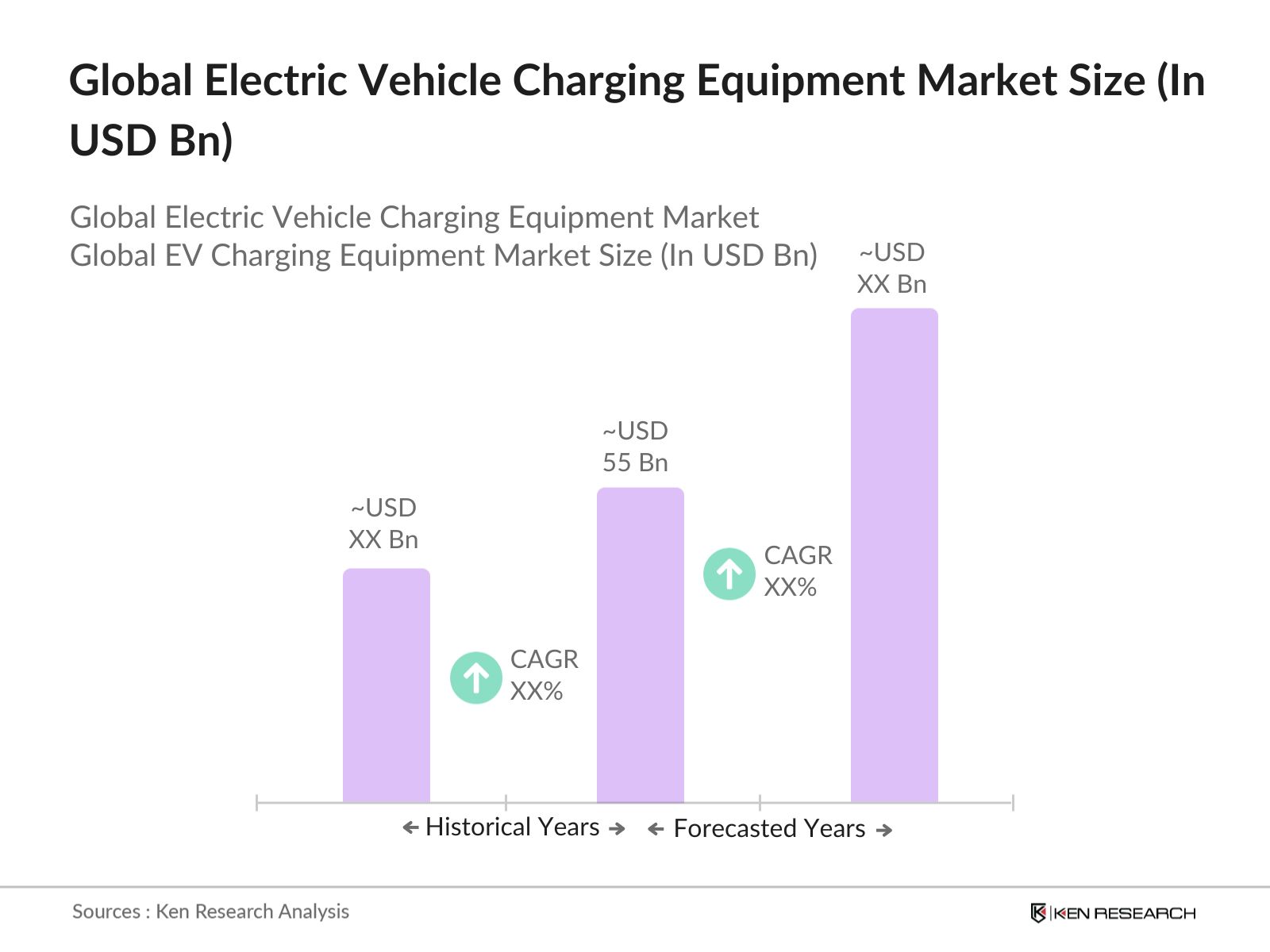

- The Global Electric Vehicle Charging Equipment Market was valued at USD 55 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of electric vehicles, government incentives promoting sustainable transportation, and advancements in charging technology. The rising consumer awareness regarding environmental issues has further accelerated the demand for efficient charging solutions.

- Countries such as the United States, China, and Germany dominate the market due to their robust electric vehicle infrastructure, significant investments in renewable energy, and supportive government policies. These nations have established extensive networks of charging stations, making electric vehicles more accessible and appealing to consumers, thus fostering market growth.

- In 2023, the European Union implemented the Alternative Fuels Infrastructure Regulation (AFIR), mandating member states to ensure a sufficient number of charging points for electric vehicles. This regulation aims to facilitate the transition to electric mobility by requiring the installation of charging stations at regular intervals along major transport routes, thereby enhancing the overall charging infrastructure.

Global Electric Vehicle Charging Equipment Market Segmentation

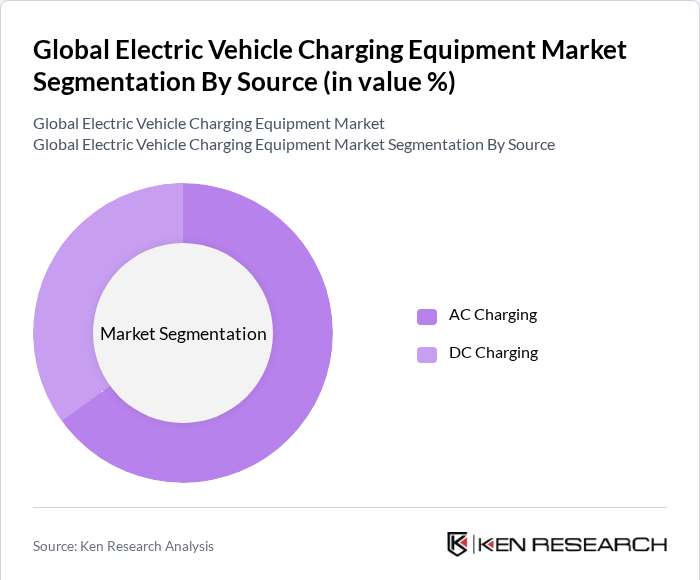

By Source: The market is segmented into two primary sources: AC (Alternating Current) and DC (Direct Current) charging equipment. Among these, AC charging equipment dominates the market due to its widespread availability and lower installation costs. AC chargers are commonly used in residential and commercial settings, making them more accessible to consumers. The growing trend of home charging solutions and the increasing number of public AC charging stations contribute to the significant market share of this segment.

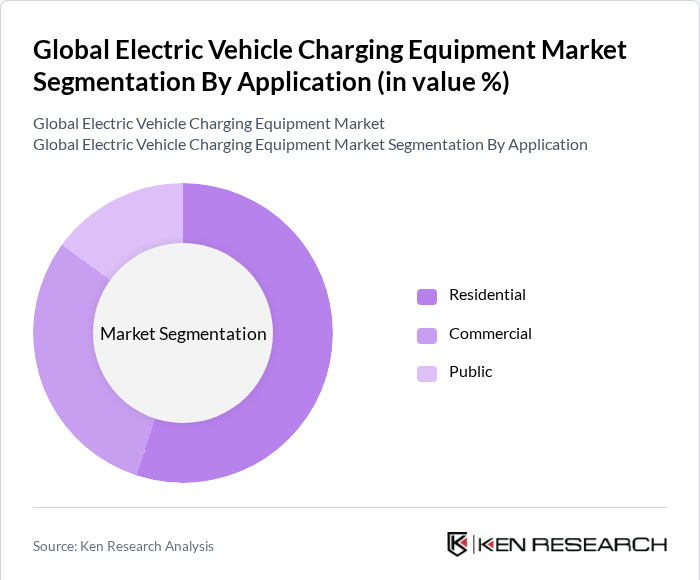

By Application: The market is categorized into residential, commercial, and public applications. The residential segment holds the largest market share, driven by the increasing number of electric vehicle owners who prefer home charging solutions for convenience and cost-effectiveness. The rise in smart home technologies and the availability of incentives for home charger installations further bolster this segment's growth. Additionally, the commercial and public applications are gaining traction as businesses and municipalities invest in charging infrastructure to support the growing electric vehicle market.

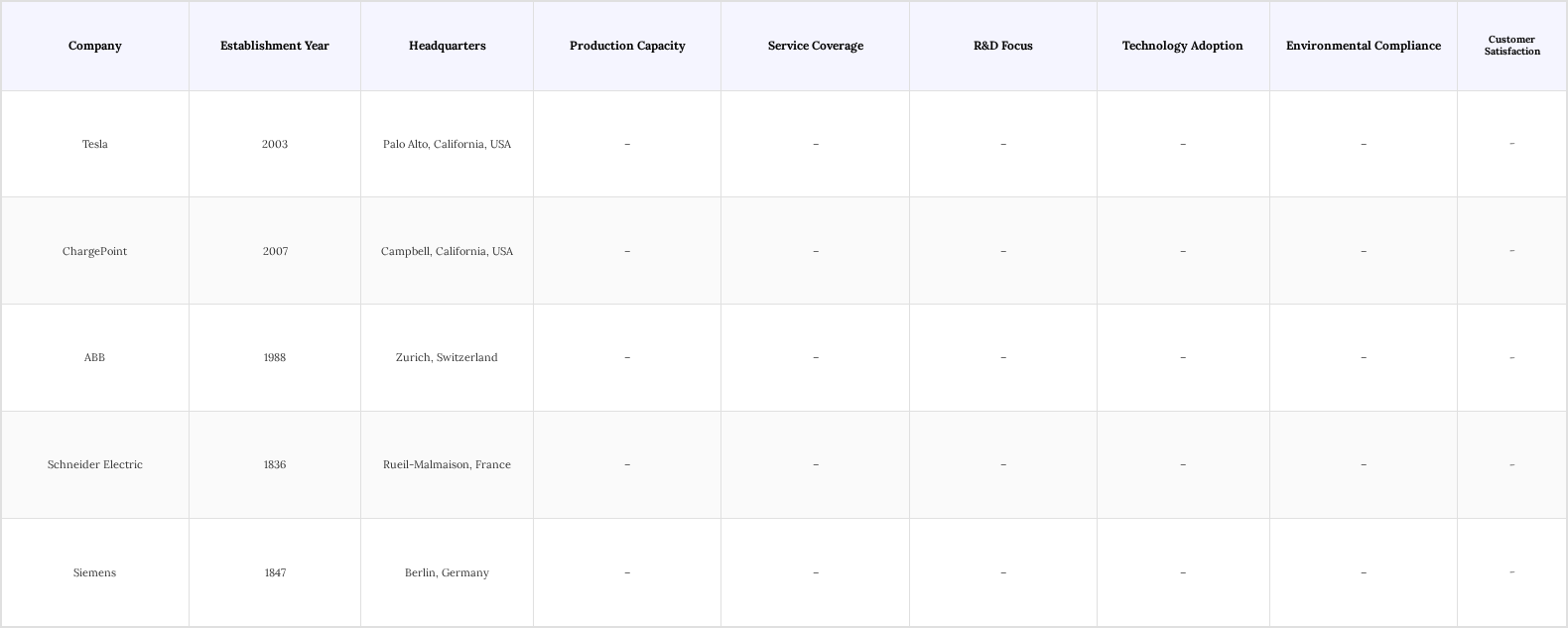

Global Electric Vehicle Charging Equipment Market Competitive Landscape

The Global Electric Vehicle Charging Equipment Market is characterized by a competitive landscape with several key players driving innovation and market growth. Companies such as Tesla, ChargePoint, ABB, Schneider Electric, and Siemens are prominent in this sector, focusing on expanding their product offerings and enhancing charging infrastructure. The market is witnessing increased collaboration between manufacturers and governments to improve charging networks and promote electric vehicle adoption.

Global Electric Vehicle Charging Equipment Market Industry Analysis

Growth Drivers

- Increasing Adoption of Electric Vehicles: Global electric vehicle (EV) sales reached nearly 14 million units in 2023, marking a 35% increase from 2022, with the total global electric fleet rising to 40 million vehicles. In the first quarter of 2024 alone, EV sales grew by 25% compared to the same period in 2023. The market is projected to hit 17 million units sold by the end of 2024, with EVs expected to account for about 20% of total car sales globally. China, Europe, and the USA remain the largest markets, together representing around 95% of sales in 2023. The availability of electric car models is also expanding, with 590 models offered in 2023, a 15% increase from the previous year.

- Government Incentives and Subsidies for EV Infrastructure: Globally, governments are making substantial investments to accelerate the development of electric vehicle (EV) charging infrastructure. The United States has allocated $7.5 billion under the Bipartisan Infrastructure Law, funding over 11,500 new charging ports and aiming to build 500,000 public chargers by 2030. The European Union targets at least 1 million public charging points by 2025, supported by regulatory frameworks and funding programs to enhance accessibility across member states.

- Rising Environmental Concerns and Emission Regulations: Growing global awareness of climate change and air pollution is prompting governments and regulatory bodies to implement stricter emission standards. The European Union’s Green Deal, for example, targets a 55% reduction in greenhouse gas emissions by 2030, while countries like China and the United States have set ambitious goals for carbon neutrality by mid-century. These regulatory frameworks are accelerating the shift from internal combustion engine vehicles to electric vehicles (EVs), driving increased demand for expanded charging infrastructure worldwide.

Market Challenges

- High Initial Investment Costs for Charging Infrastructure: The establishment of EV charging stations requires significant capital investment, especially for fast-charging setups. These high upfront costs can deter businesses and municipalities from committing to infrastructure projects, particularly in regions with lower electric vehicle adoption. As a result, the limited availability of charging stations may slow down the overall growth of the electric vehicle market.

- Limited Charging Infrastructure in Certain Regions: Despite increasing EV adoption, many areas—especially rural and underserved urban regions—still lack sufficient charging infrastructure. This uneven distribution creates accessibility challenges and can lead to range anxiety among potential EV buyers, ultimately restraining market expansion in these regions.

Global Electric Vehicle Charging Equipment Market Future Outlook

The future of the electric vehicle charging equipment market appears promising, driven by technological advancements and increased investment in renewable energy. As battery technology improves, charging times are expected to decrease, enhancing user convenience. Additionally, the integration of smart grid technology will facilitate more efficient energy distribution, further supporting the growth of charging infrastructure. With ongoing government support and rising consumer awareness, the market is poised for significant expansion in the coming years, fostering a more sustainable transportation ecosystem.

Market Opportunities

- Expansion of Renewable Energy Sources for Charging: The integration of solar and wind energy into charging stations presents a significant opportunity. By utilizing renewable energy, charging stations can reduce operational costs and appeal to environmentally conscious consumers. This shift not only enhances sustainability but also aligns with global efforts to transition to cleaner energy sources, potentially increasing market share for providers who adopt these technologies.

- Development of Smart Charging Solutions: The rise of smart charging technologies, which optimize charging times based on grid demand and energy prices, offers a lucrative opportunity. These solutions can enhance user experience and reduce costs, making EV ownership more attractive. As smart home technologies gain traction, integrating charging solutions into this ecosystem can further drive adoption and create new revenue streams for charging equipment manufacturers.

Scope of the Report

| By Source |

AC DC |

| By Application |

Residential Commercial Public |

| By Charging Speed |

Slow Charging Fast Charging Ultra-Fast Charging |

| By Connector Type |

Type 1 Type 2 CHAdeMO CCS |

| By Region |

North America Europe Asia-Pacific Rest of the World |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, European Commission)

Manufacturers and Producers

Distributors and Retailers

Electric Utility Companies

Charging Network Operators

Automotive OEMs (Original Equipment Manufacturers)

Infrastructure Development Agencies

Companies

Players Mentioned in the Report:

Tesla

ChargePoint

ABB

Schneider Electric

Siemens

EVBox

Blink Charging

Wallbox

Tritium

Electrify America

Table of Contents

1. Global Electric Vehicle Charging Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Electric Vehicle Charging Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Electric Vehicle Charging Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Electric Vehicles

3.1.2. Government Incentives and Subsidies for EV Infrastructure

3.1.3. Rising Environmental Concerns and Emission Regulations

3.2. Market Challenges

3.2.1. High Initial Investment Costs for Charging Infrastructure

3.2.2. Limited Charging Infrastructure in Certain Regions

3.2.3. Technological Compatibility Issues Among Different EV Models

3.3. Opportunities

3.3.1. Expansion of Renewable Energy Sources for Charging

3.3.2. Development of Smart Charging Solutions

3.3.3. Growth in Fleet Electrification for Commercial Use

3.4. Trends

3.4.1. Integration of Charging Stations with Smart Grids

3.4.2. Emergence of Wireless Charging Technologies

3.4.3. Increasing Popularity of Fast and Ultra-Fast Charging Solutions

3.5. Government Regulation

3.5.1. National and Local Policies Supporting EV Adoption

3.5.2. Standards for Charging Equipment Safety and Performance

3.5.3. Incentives for Renewable Energy Integration in Charging Stations

3.5.4. Regulations on Emission Reductions and Sustainability Goals

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Electric Vehicle Charging Equipment Market Segmentation

4.1. By Source

4.1.1. AC

4.1.2. DC

4.2. By Application

4.2.1. Residential

4.2.2. Commercial

4.2.3. Public

4.3. By Charging Speed

4.3.1. Slow Charging

4.3.2. Fast Charging

4.3.3. Ultra-Fast Charging

4.4. By Connector Type

4.4.1. Type 1

4.4.2. Type 2

4.4.3. CHAdeMO

4.4.4. CCS

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Rest of the World

5. Global Electric Vehicle Charging Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tesla

5.1.2. ChargePoint

5.1.3. ABB

5.1.4. Schneider Electric

5.1.5. Siemens

5.1.6. EVBox

5.1.7. Blink Charging

5.1.8. Wallbox

5.1.9. Tritium

5.1.10. Electrify America

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Portfolio Diversity

5.2.3. Geographic Presence

5.2.4. Technological Innovation

5.2.5. Customer Service and Support

5.2.6. Pricing Strategies

5.2.7. Partnerships and Collaborations

5.2.8. Sustainability Initiatives

6. Global Electric Vehicle Charging Equipment Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Electric Vehicle Charging Equipment Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Electric Vehicle Charging Equipment Market Future Market Segmentation

8.1. By Source

8.1.1. AC

8.1.2. DC

8.2. By Application

8.2.1. Residential

8.2.2. Commercial

8.2.3. Public

8.3. By Charging Speed

8.3.1. Slow Charging

8.3.2. Fast Charging

8.3.3. Ultra-Fast Charging

8.4. By Connector Type

8.4.1. Type 1

8.4.2. Type 2

8.4.3. CHAdeMO

8.4.4. CCS

8.5. By Region

8.5.1. North America

8.5.2. Europe

8.5.3. Asia-Pacific

8.5.4. Rest of the World

9. Global Electric Vehicle Charging Equipment Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all major stakeholders within the Global Electric Vehicle Charging Equipment Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data related to the Global Electric Vehicle Charging Equipment Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts from a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Global Electric Vehicle Charging Equipment Market.

Frequently Asked Questions

01. How big is the Global Electric Vehicle Charging Equipment Market?

The Global Electric Vehicle Charging Equipment Market is valued at USD 55 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Electric Vehicle Charging Equipment Market?

Key challenges in the Global Electric Vehicle Charging Equipment Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Electric Vehicle Charging Equipment Market?

Major players in the Global Electric Vehicle Charging Equipment Market include Tesla, ChargePoint, ABB, Schneider Electric, Siemens, among others.

04. What are the growth drivers for the Global Electric Vehicle Charging Equipment Market?

The primary growth drivers for the Global Electric Vehicle Charging Equipment Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.