Global Electric Vehicle Fluids Market Outlook to 2030

Region:Global

Author(s):Samanyu

Product Code:KROD1293

November 2024

95

About the Report

Global Electric Vehicle Fluids Market Overview

- The global EV fluids market was valued at USD 1.2 Bn in 2023, is driven by increasing adoption of electric vehicles due to environmental concerns and stringent emission regulations. The demand for specialized fluids, including coolants, transmission fluids, and greases, tailored for EV requirements, has surged as automakers seek to enhance vehicle performance and longevity.

- The key players in the market include Shell, ExxonMobil, TotalEnergies, BP, and FUCHS. These companies have established themselves as leaders through extensive R&D investments, strategic partnerships, and a robust distribution network. Shell, for instance, has been focusing on developing high-performance fluids specifically designed for electric drivetrains, while ExxonMobil has expanded its product portfolio to cater to the unique needs of electric vehicles.

- In 2023, Shell launched its E-Fluids range, which includes specialized transmission and cooling fluids designed for electric powertrains. These products are engineered to meet the high-performance demands of modern EV systems, enhancing efficiency and reliability12. Notably, Shell's E-Thermal Fluid E5 M is formulated for use in batteries and electric motors, utilizing non-corrosive base oil technology to operate effectively across various temperatures

- Cities like Shanghai, Los Angeles, and Oslo dominate the EV fluids market due to their high EV adoption rates, robust charging infrastructure, and supportive government policies. Shanghai has over 300,000 registered electric vehicles, supported by extensive charging networks and government incentives, making it a significant market for EV fluids. Similarly, Los Angeles and Oslo have proactive policies promoting EV usage, contributing to their dominance in the market.

Global Electric Vehicle Fluids Market Segmentation

The Global Electric Vehicle Fluids Market can be segmented based on several factors:

- By Fluid Type: Global electric vehicle fluids market segmentation by fluid type is divided into coolants, transmission fluids and greases. In 2023, coolants dominate the market, driven by their crucial role in managing battery and motor temperatures. This dominance is fueled by the growing adoption of EVs and advancements in coolant technology, which enhance vehicle performance and safety.

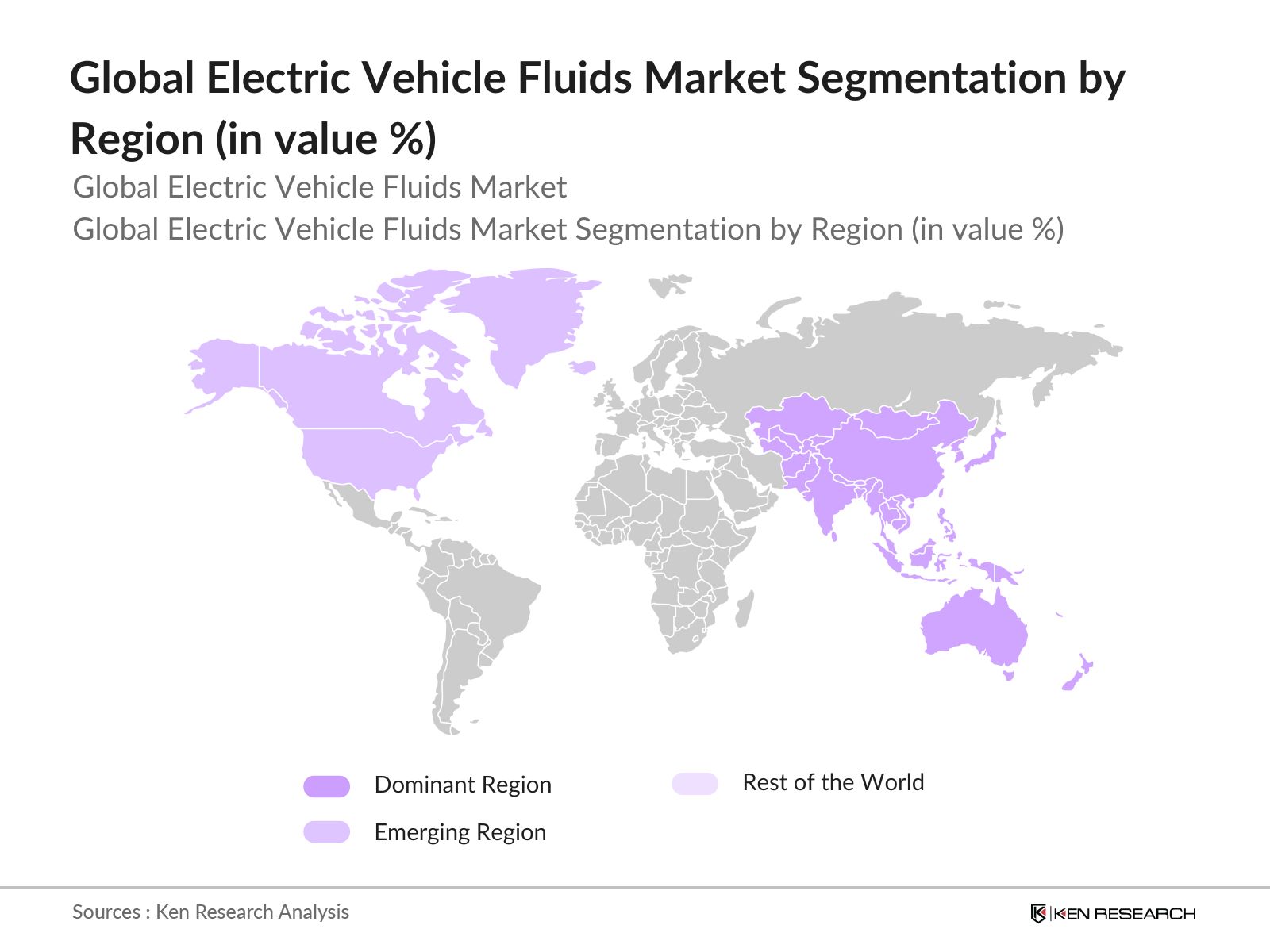

- By Region: Global electric vehicle fluids market segmentation by region is divided into North America, Europe, MEA, Latin America and APAC. In 2023, APAC dominates the market, driven by rapid urbanization, strong EV incentives, and significant infrastructure investments. The regions growth is supported by rising EV demand and favorable regulatory environments.

- By Vehicle Type: Global electric vehicle fluids market segmentation by vehicle type is divided into battery EV, plug-in hybrid EV and hybrid EV. In 2023, Battery Electric Vehicles (BEVs) dominate the market, driven by advancements in battery technology, rising environmental concerns, and supportive government policies. These factors boost the demand for BEV-specific fluids.

Global Electric Vehicle Fluids Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Shell |

1907 |

London, UK |

|

ExxonMobil |

1999 |

Irving, Texas, USA |

|

TotalEnergies |

1924 |

Courbevoie, France |

|

BP |

1908 |

London, UK |

|

FUCHS |

1931 |

Mannheim, Germany |

- TotalEnergies: On November 1, 2022, TotalEnergies Marketing India Private Limited (TEMIPL) introduced its new range of electric vehicle fluids, specifically designed for electric and hybrid cars as well as electric bikes. The product lineup includesQuartz EV Fluidfor cars andHi-Perf EV Fluidfor bikes. These fluids are engineered to meet the unique cooling, insulating, and lubrication needs of modern EV systems, ensuring optimal performance throughout their operational lifespan.

- ExxonMobil: In 2023, ExxonMobil unveiled its Mobil EV Therm, a thermal management fluid specifically engineered for cooling high-performance EV batteries. This product is crucial for maintaining optimal battery temperatures, which enhances efficiency and prolongs battery life. The fluid's formulation aims to support the sustainability goals of EV manufacturers by ensuring effective thermal management, a vital aspect of electric vehicle operation

Global Electric Vehicle Fluids Industry Analysis

Growth Drivers

- Increasing Electric Vehicle Adoption: In 2023, the number of electric vehicles on the road globally surpassed 26 million, driven by strong sales in key markets such as China, the USA, and Europe. The growing environmental awareness and stringent government regulations aimed at reducing carbon emissions have significantly boosted EV adoption. According to the International Energy Agency (IEA), global EV sales are projected to reach 30 million by 2030. This surge in electric vehicle numbers directly increases the demand for specialized fluids.

- Advancements in EV Technology: Technological advancements in battery technology and electric drivetrains have revolutionized the EV industry. In 2024, major breakthroughs in solid-state battery technology were reported, leading to longer battery life, faster charging times, and improved safety. Companies like Toyota and Volkswagen have announced plans to integrate solid-state batteries into their EVs by 2025. These advancements necessitate the development of advanced EV fluids that can meet the higher thermal management and lubrication requirements of these next-generation batteries and drivetrains.

- Expansion of Charging Infrastructure: The expansion of EV charging infrastructure is a major driver for the EV fluids market. In 2023, the number of public charging points globally reached 1.3 million, with substantial investments from governments and private entities. The European Union, for example, committed USD 1.073 billion in 2023 to enhance the EV charging network across member states. A well-developed charging infrastructure encourages EV adoption, subsequently increasing the need for maintenance fluids that ensure the longevity and efficiency of EV components.

Market Challenges

- Environmental Regulations and Compliance: Stringent environmental regulations concerning the production and disposal of automotive fluids pose a challenge to the EV fluids market. Governments worldwide are enforcing regulations to minimize the environmental impact of chemical production and waste. In 2023, the European Union implemented the REACH regulation, which imposes strict guidelines on the use of hazardous substances in automotive fluids.

- High Cost of Specialized EV Fluids: The production of specialized fluids for electric vehicles involves advanced formulations and high-quality materials, leading to higher costs compared to conventional automotive fluids. For instance, the cost of high-performance EV coolants is higher than standard coolants. This cost disparity poses a challenge for manufacturers and consumers, especially in price-sensitive markets.

Government Initiatives

- New EV Policy: In March 2023, the Indian government approved a new EV policy worth USD 500 million aimed at attracting investments from global EV manufacturers. This policy includes incentives tied to local investment and domestic value addition, aiming for 25% domestic value addition by the third year of manufacturing. Additionally, it sets a minimum investment requirement of USD 498 million, with no upper limit on investment, to encourage significant capital inflow into the electric vehicle sector.

- U.S. Infrastructure Investment and Jobs Act: The U.S. Infrastructure Investment and Jobs Act, enacted in 2023, allocates USD 7.5 billion to build a national network of 500,000 EV chargers by 2030. This initiative aims to accelerate the adoption of electric vehicles in the United States by addressing the charging infrastructure gap. The act also includes provisions for grants and incentives for EV manufacturers and suppliers, promoting the development and usage of specialized EV fluids to enhance vehicle performance and reliability.

Global Electric Vehicle Fluids Future Market Outlook

The market is expected to show significant growth by 2028, driven by the increasing adoption of electric vehicles, advancements in EV technology, and the expansion of charging infrastructure. The market is expected to witness substantial investments in R&D for developing advanced fluids that cater to the evolving needs of electric vehicles.

Future Market Trends

- Development of Next-Generation EV Fluids: Manufacturers will focus on developing next-generation EV fluids that offer superior thermal management and lubrication properties. These advanced fluids will cater to the specific needs of high-performance electric drivetrains and solid-state batteries, enhancing vehicle efficiency and lifespan.

- Increased Integration of AI and IoT in EV Fluid Management: The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in EV fluid management will become more prevalent. Smart sensors and predictive analytics will enable real-time monitoring and optimization of fluid performance, ensuring optimal vehicle operation and reducing maintenance costs.

Scope of the Report

|

By Fluid Type |

Coolants Transmission Fluids Greases |

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product |

Coolants Transmission fluids Greases |

|

By Vehicle Type |

Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) |

|

By Fill Type |

First Fill Service Fill |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

- Electric Vehicle Manufacturers

- Battery Manufacturers

- Automotive Component Suppliers

- Electric Vehicle Fleet Operators

- Charging Infrastructure Providers

- Automotive Repair and Maintenance Services

- Banks and Financial Institutions

- Investors and VCs

- Regulatory Bodies (Department of Energy, European Commission)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report

Shell

ExxonMobil

TotalEnergies

BP

FUCHS

Valvoline

Chevron

Idemitsu Kosan

BASF

Castrol

Sinopec

PETRONAS

Eneos

Lubrizol

Gulf Oil

Table of Contents

01 Global Electric Vehicle Fluids Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02 Global Electric Vehicle Fluids Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03 Global Electric Vehicle Fluids Market Analysis

3.1. Growth Drivers

3.1.1. Surge in Electric Vehicle Adoption

3.1.2. Stringent Emission Regulations

3.1.3. Technological Advancements in EV Fluids

3.1.4. Expansion of EV Charging Infrastructure

3.2. Market Challenges

3.2.1. High Cost of Specialized Fluids

3.2.2. Limited Awareness Among Consumers

3.2.3. Variability in Regional Regulations

3.2.4. Competition from Conventional Automotive Fluids

3.3. Opportunities

3.3.1. Development of Bio-Based and Sustainable Fluids

3.3.2. Collaboration with EV Manufacturers

3.3.3. Expansion into Emerging Markets

3.3.4. Integration with Advanced Thermal Management Systems

3.4. Trends

3.4.1. Adoption of High-Performance Lubricants

3.4.2. Focus on Battery Thermal Management Fluids

3.4.3. Increasing Use of Coolants for Fast-Charging Systems

3.4.4. Development of Fluids for Hybrid and Plug-In Hybrid Vehicles

3.5. Government Regulations

3.5.1. Environmental Standards for Automotive Fluids

3.5.2. Incentives for EV Adoption

3.5.3. Policies Promoting Sustainable Automotive Practices

3.5.4. Compliance Requirements for Fluid Manufacturers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter's Five Forces Analysis

3.9. Competitive Landscape

04 Global Electric Vehicle Fluids Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Engine Oils

4.1.2. Coolants

4.1.3. Transmission Fluids

4.1.4. Greases

4.1.5. Brake Fluids

4.2. By Propulsion Type (In Value %)

4.2.1. Battery Electric Vehicles (BEVs)

4.2.2. Hybrid Electric Vehicles (HEVs)

4.2.3. Plug-In Hybrid Electric Vehicles (PHEVs)

4.3. By Vehicle Type (In Value %)

4.3.1. Passenger Vehicles

4.3.2. Commercial Vehicles

4.3.3. Two-Wheelers

4.4. By Distribution Channel (In Value %)

4.4.1. OEMs

4.4.2. Aftermarket

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05 Global Electric Vehicle Fluids Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ExxonMobil Corporation

5.1.2. Royal Dutch Shell plc

5.1.3. TotalEnergies SE

5.1.4. BP plc

5.1.5. FUCHS Petrolub SE

5.1.6. Valvoline Inc.

5.1.7. Castrol Limited

5.1.8. Petronas Lubricants International

5.1.9. Chevron Corporation

5.1.10. Idemitsu Kosan Co., Ltd.

5.1.11. ENEOS Corporation

5.1.12. Repsol S.A.

5.1.13. Sinopec Lubricant Company

5.1.14. Phillips 66 Company

5.1.15. Amsoil Inc.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters Location, Year of Establishment, Annual Revenue, Product Portfolio, R&D Investment, Regional Presence, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

06 Global Electric Vehicle Fluids Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07 Global Electric Vehicle Fluids Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08 Global Electric Vehicle Fluids Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Propulsion Type (In Value %)

8.3. By Vehicle Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

09 Global Electric Vehicle Fluids Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on global EV fluids market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for global EV fluids market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple EV fluids manufacturers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from EV fluids manufacturers.

Frequently Asked Questions

01. How big is Global Electric Vehicle Fluids Market?

The global EV fluids market was valued at USD 1.2 Bn in 2023, is driven by increasing adoption of electric vehicles due to environmental concerns and stringent emission regulations. The demand for specialized fluids, including coolants, transmission fluids, and greases, tailored for EV requirements, has surged as automakers seek to enhance vehicle performance and longevity.

02. What are the challenges in Global Electric Vehicle Fluids Market?

Challenges in global EV fluids market include the high cost of specialized EV fluids, limited awareness and technical expertise among automotive service providers, and stringent environmental regulations. These factors impact the market's growth and profitability.

03. Who are the major players in Global Electric Vehicle Fluids Market?

Key players in the global EV fluid market include Shell, ExxonMobil, Total Energies, BP, and FUCHS. These companies lead the market due to their extensive R&D investments, strategic partnerships, and robust distribution networks.

04 What are the growth drivers of the Global Electric Vehicle Fluids Market?

Growth drivers in global EV fluids market include the increasing adoption of electric vehicles, technological advancements in battery and drivetrain technologies, and the expansion of EV charging infrastructure. These factors contribute to the rising demand for specialized EV fluids.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.