Global Electronics Components Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD5627

December 2024

94

About the Report

Global Electronics Components Market Overview

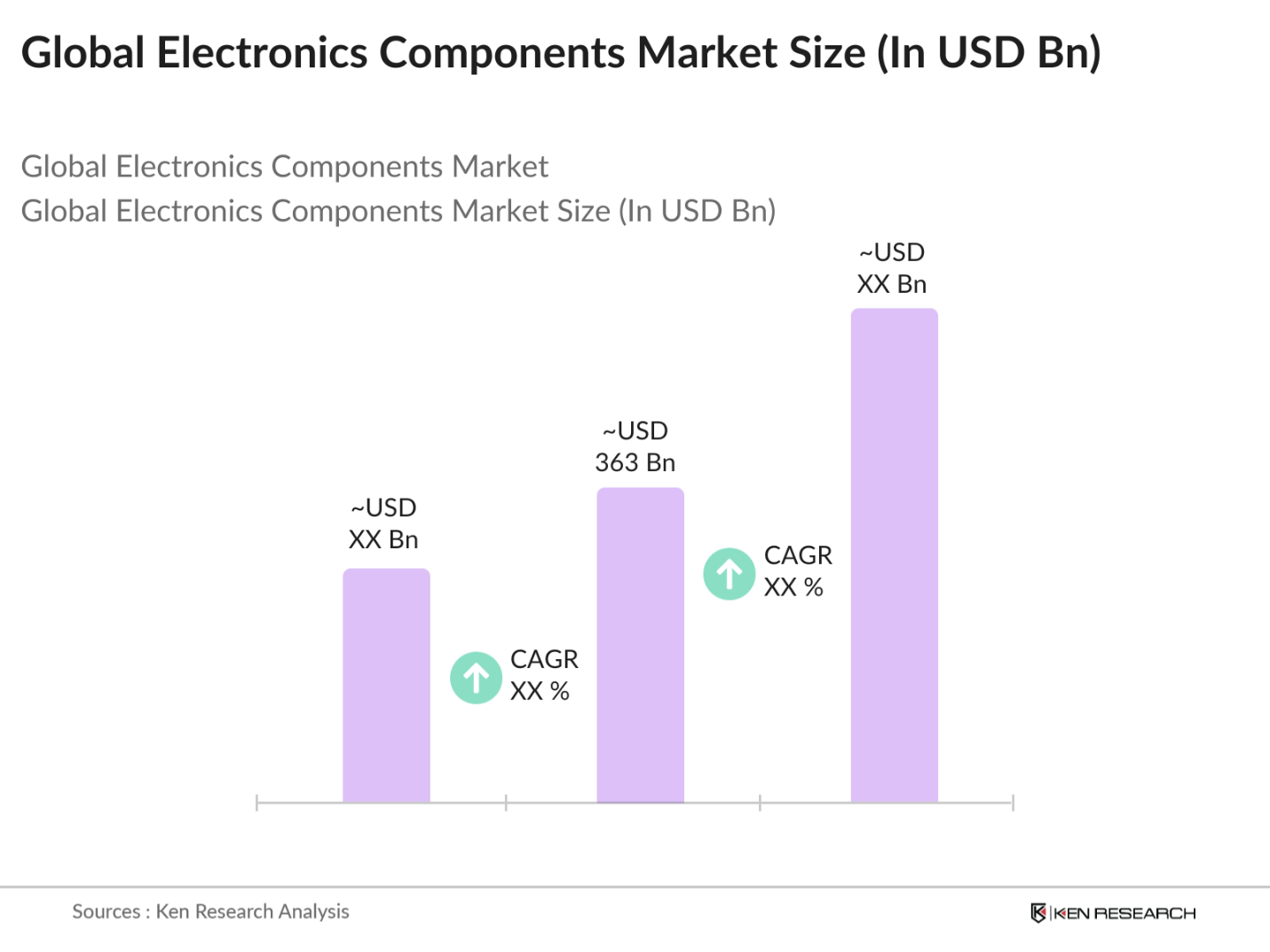

- The Global Electronics Components Market is valued at USD 363 billion, based on a five-year historical analysis. This market's growth is driven by the increased demand for miniaturized, efficient components across industries like consumer electronics, automotive, and telecommunications. The rapid expansion of IoT devices and 5G technology is boosting demand for semiconductors, passive components, and electromechanical systems, further fueling market growth. `

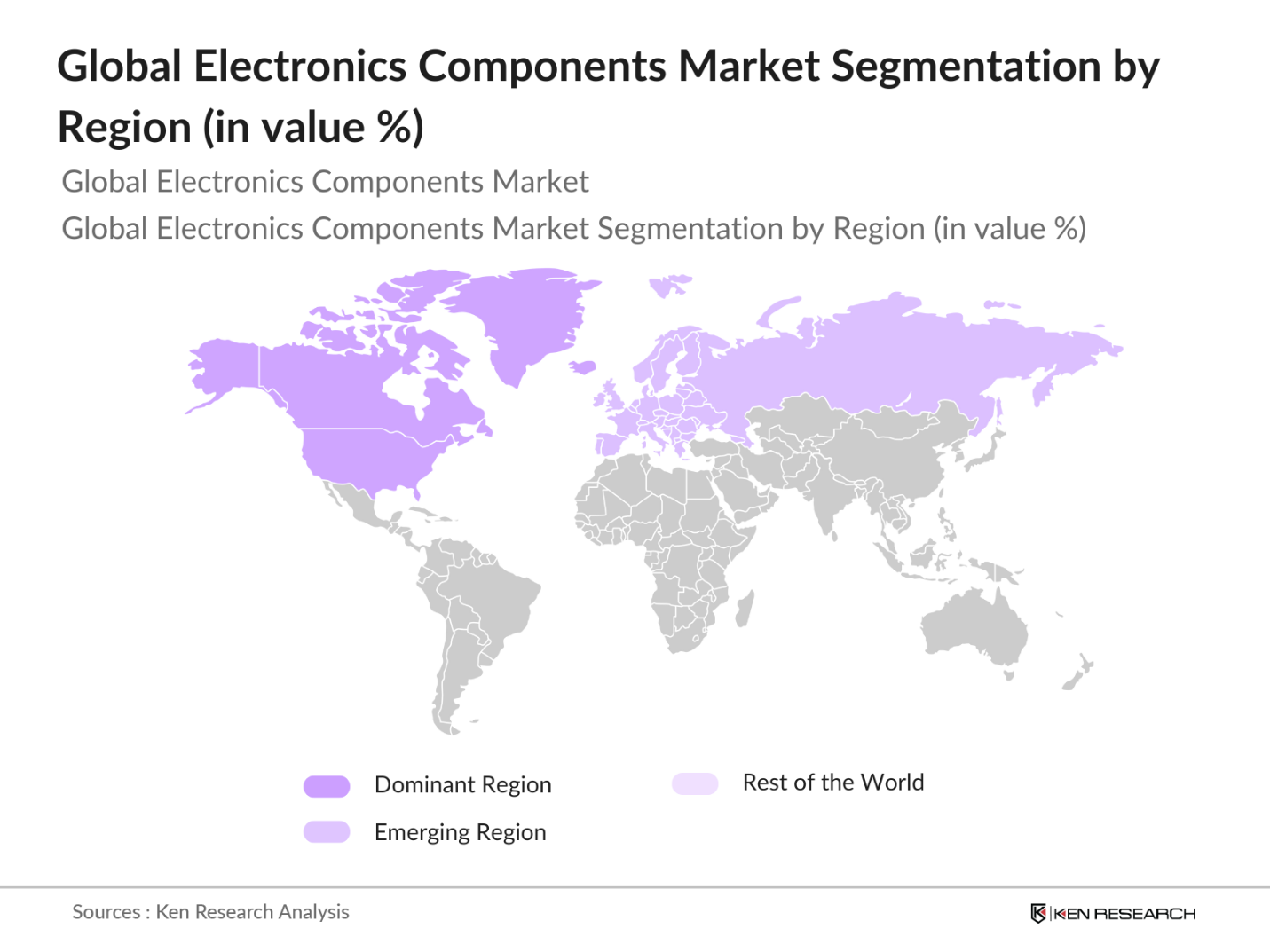

- Countries in the Asia-Pacific (APAC) region, North America, and Europe dominate the global electronics components market. APAC leads due to its strong manufacturing infrastructure and the presence of key suppliers in countries like China, South Korea, and Japan, enabling economies of scale and lower production costs. North America, particularly the United States, maintains a competitive edge through high-tech innovation and significant R&D investments in semiconductor and electronics technologies. Europes market strength is driven by its advanced automotive and industrial sectors, which are key consumers of electronic components.

- Regional trade agreements significantly impact the sourcing and pricing of electronic components. In 2023, the Regional Comprehensive Economic Partnership (RCEP) came into effect, affecting trade across 15 Asian countries. This agreement reduces tariffs on electronic components, boosting trade within the region. The U.S.-Mexico-Canada Agreement (USMCA) also plays a role in regulating the flow of components, providing tariff benefits for North American manufacturers.

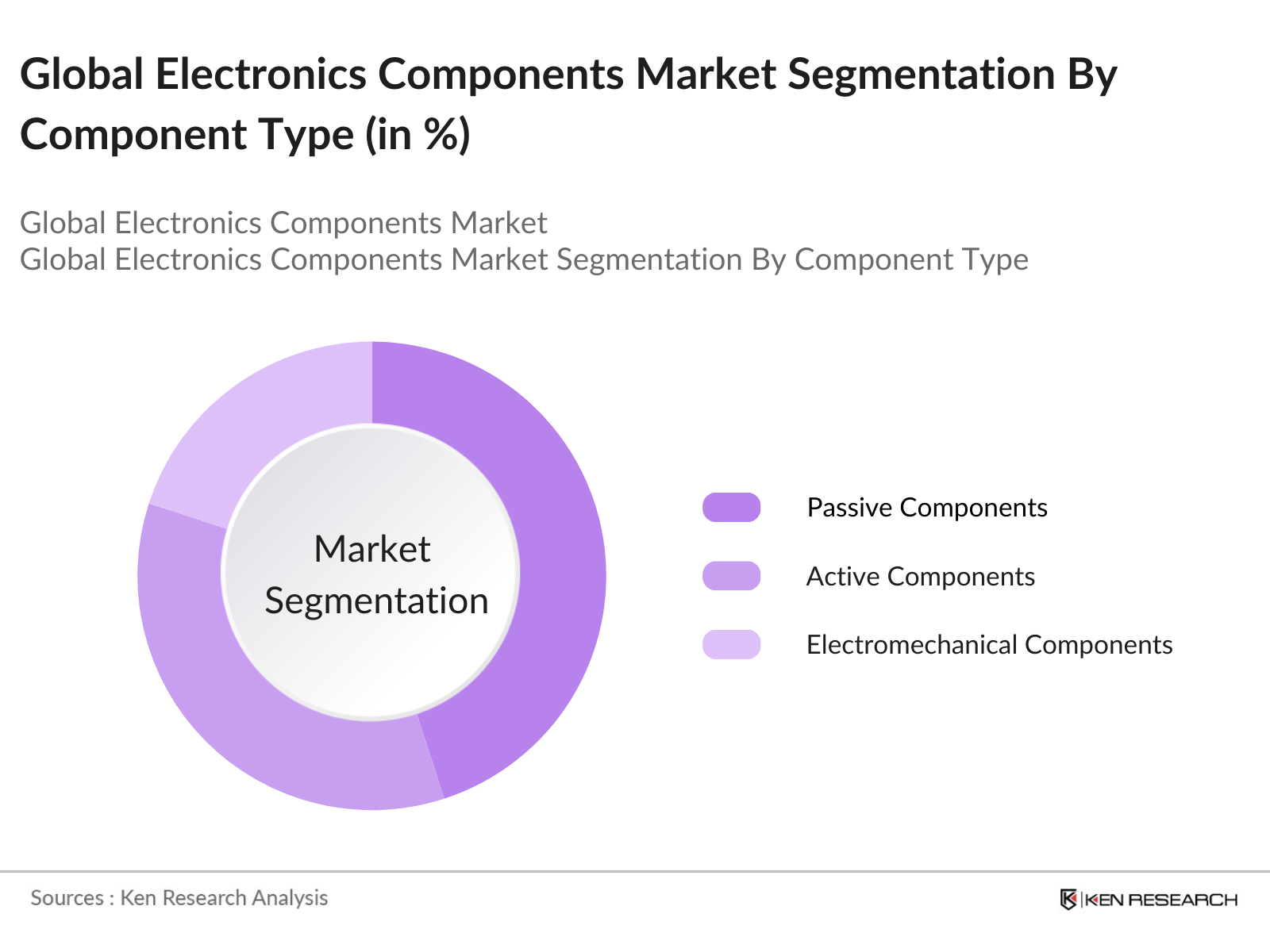

Global Electronics Components Market Segmentation

By Component Type: The market is segmented by component type into passive components, active components, and electromechanical components. Passive components, including resistors, capacitors, and inductors, dominate the market share due to their widespread use across various industries, especially in consumer electronics and telecommunications.

By Application: The market is segmented by application into automotive electronics, consumer electronics, telecommunications, industrial electronics, and medical devices. Consumer electronics hold the largest share of the market due to the continuous demand for smartphones, tablets, laptops, and wearables. The integration of advanced technologies such as artificial intelligence, IoT, and cloud computing into these devices has further fueled their demand, driving the market for electronic components.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific leads the market due to its strong manufacturing capabilities and the presence of leading electronic component manufacturers in countries like China, Japan, and South Korea. The availability of raw materials, low labor costs, and strong governmental support for the electronics industry in these countries also contribute to the region's dominance.

Global Electronics Components Market Competitive Landscape

The global electronics components market is dominated by a mix of established global players and specialized manufacturers. Major companies leverage innovation, strategic partnerships, and heavy R&D investments to maintain their competitive advantage. For instance, companies like Intel and Samsung are focusing on developing cutting-edge semiconductor technologies for AI and quantum computing applications.

Global Electronics Components Industry Analysis

Growth Drivers

- Increased Demand for IoT Devices: The demand for IoT devices continues to surge globally, with more than 14 billion connected IoT devices in 2023, driving demand for electronic components. The expansion of smart homes, connected vehicles, and industrial automation requires a large number of sensors, microcontrollers, and other components. Governments, such as in the USA, are investing heavily in IoT technology to modernize infrastructure.

- Expansion of 5G Technology: With the rollout of 5G technology globally, the need for high-performance electronic components has risen significantly. In 2023, more than 1.6 billion people had access to 5G, according to the GSMA. This expansion demands components such as RF filters, power amplifiers, and antennas. China is leading the charge with over 2.9 million 5G base stations installed by mid-2023, further boosting the need for electronic components.

- Rising Adoption of Electric Vehicles (EVs): The global shift towards electric vehicles (EVs) is a major growth driver for the electronic components market. In 2023, more than 10 million electric cars were sold globally, according to the International Energy Agency (IEA). EVs require complex electronic systems such as power management circuits, battery management systems, and control units, increasing the demand for semiconductors and other components.

Market Challenges

- Semiconductor Shortage: The semiconductor shortage has significantly impacted the electronics components market. In 2023, semiconductor lead times averaged 26.7 weeks, causing production delays across industries. Governments, such as the U.S. and EU, have committed billions to boost domestic chip manufacturing; the U.S. CHIPS Act provided $52 billion in funding. This shortage has been exacerbated by geopolitical tensions and increasing demand from sectors like automotive and consumer electronics.

- Complex Supply Chain Dependencies: The electronic components market is highly dependent on global supply chains, making it vulnerable to disruptions. In 2023, shipping delays and rising freight costs increased production lead times for critical components by up to 30%. The dependency on countries like China and Taiwan for semiconductor manufacturing also creates risks due to political tensions.

Global Electronics Components Market Future Outlook

Over the next five years, the global electronics components market is expected to witness significant growth, driven by the continuous advancements in 5G technology, growing demand for electric vehicles, and the rising integration of AI in consumer and industrial electronics. Increasing investment in renewable energy infrastructure and smart cities will also spur demand for electronic components, particularly in the power electronics and sensor segments.

Market Opportunities

- Growth in Renewable Energy Applications: The growth of renewable energy is creating significant opportunities for the electronic components market. In 2023, global investments in renewable energy reached $495 billion, driving demand for components like inverters, controllers, and sensors. The push for solar and wind energy generation requires high-performance electronic components to ensure efficient energy conversion and storage. The U.S. Inflation Reduction Act of 2022, which provides substantial subsidies for clean energy projects, further boosts this demand.

- Expanding Smart Cities Initiatives: Smart city initiatives are expanding globally, creating new opportunities for the electronic components market. In 2023, over 1,000 smart city projects were underway worldwide, with investments exceeding $100 billion. These projects require a variety of electronic components for applications such as smart grids, traffic management systems, and public safety infrastructure.

Scope of the Report

|

By Component Type |

Passive Components (Resistors, Capacitors, Inductors) |

|

By Application |

Automotive Electronics |

|

By Material Type |

Silicon-based Components |

|

By End User |

Original Equipment Manufacturers (OEMs) |

|

By Region |

North America |

Products

Key Target Audience

Original Equipment Manufacturers (OEMs)

Automotive Companies

Telecommunications Firms

Consumer Electronics Manufacturers

Government and Regulatory Bodies (e.g., Environmental Protection Agency, European Commission)

Data Centers and Cloud Service Providers

Investments and Venture Capitalist Firms

Renewable Energy Companies

Companies

Players Mentioned in the Report

Intel Corporation

Samsung Electronics

Qualcomm Technologies

Murata Manufacturing Co. Ltd.

NXP Semiconductors

Vishay Intertechnology

Infineon Technologies

STMicroelectronics

TDK Corporation

Analog Devices, Inc.

Table of Contents

1. Global Electronics Components Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (influenced by miniaturization trends, automation, and consumer electronics demand)

1.4. Market Segmentation Overview

2. Global Electronics Components Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Electronics Components Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for IoT Devices

3.1.2. Expansion of 5G Technology

3.1.3. Rising Adoption of Electric Vehicles (EVs)

3.1.4. Technological Advancements in AI and Machine Learning

3.2. Market Challenges

3.2.1. Semiconductor Shortage

3.2.2. Complex Supply Chain Dependencies

3.2.3. Environmental and Regulatory Compliance (RoHS, WEEE)

3.3. Opportunities

3.3.1. Growth in Renewable Energy Applications

3.3.2. Expanding Smart Cities Initiatives

3.3.3. Global Expansion of Data Centers

3.4. Trends

3.4.1. Rising Demand for Miniaturized Components

3.4.2. Advanced Packaging Solutions

3.4.3. Increasing Investment in R&D for Quantum Computing

3.5. Government Regulation

3.5.1. Regional Trade Agreements (impacting tariffs and component sourcing)

3.5.2. Environmental Regulations (RoHS, REACH, conflict minerals compliance)

3.5.3. Standards for Electronic Components (IPC, JEDEC)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, OEMs, Distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Electronics Components Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Passive Components (Resistors, Capacitors, Inductors)

4.1.2. Active Components (Semiconductors, Diodes, Transistors)

4.1.3. Electromechanical Components (Relays, Switches, Connectors)

4.2. By Application (In Value %)

4.2.1. Automotive Electronics

4.2.2. Consumer Electronics

4.2.3. Telecommunications

4.2.4. Industrial Electronics

4.2.5. Medical Devices

4.3. By Material Type (In Value %)

4.3.1. Silicon-based Components

4.3.2. Gallium Nitride (GaN) Components

4.3.3. Silicon Carbide (SiC) Components

4.4. By End User (In Value %)

4.4.1. Original Equipment Manufacturers (OEMs)

4.4.2. Aftermarket/Replacement Components

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Electronics Components Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Intel Corporation

5.1.2. Samsung Electronics

5.1.3. Qualcomm Technologies

5.1.4. Texas Instruments

5.1.5. Murata Manufacturing Co. Ltd.

5.1.6. NXP Semiconductors

5.1.7. Vishay Intertechnology

5.1.8. Infineon Technologies AG

5.1.9. STMicroelectronics

5.1.10. TDK Corporation

5.1.11. Analog Devices, Inc.

5.1.12. Broadcom Inc.

5.1.13. Rohm Semiconductor

5.1.14. Kyocera Corporation

5.1.15. Yageo Corporation

5.2 Cross Comparison Parameters (Revenue, Component Types, Technology Focus, Market Share, R&D Investments, No. of Employees, Global Reach, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Electronics Components Market Regulatory Framework

6.1. Environmental Standards (RoHS, WEEE, REACH)

6.2. Compliance Requirements (Conflict Minerals, Trade Regulations)

6.3. Certification Processes (ISO 9001, ISO/TS 16949)

7. Global Electronics Components Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Electronics Components Future Market Segmentation

8.1. By Component Type (In Value %)

8.2. By Application (In Value %)

8.3. By Material Type (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Global Electronics Components Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we identified key variables influencing the global electronics components market through extensive desk research. This included mapping the ecosystem with stakeholders such as manufacturers, suppliers, and OEMs, leveraging secondary databases and proprietary information to understand market dynamics.

Step 2: Market Analysis and Construction

During this phase, historical data on market performance was compiled and analyzed. The analysis included evaluating market penetration rates, demand trends across industries, and revenue patterns, ensuring the accuracy of estimates.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses were validated through consultations with industry experts. These experts provided first-hand insights into market trends, operational challenges, and financial performance, which helped refine the market projections.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research findings into a comprehensive market analysis. This included acquiring detailed insights from manufacturers and comparing the results with the data obtained through a bottom-up approach to ensure the final output was robust and credible.

Frequently Asked Questions

01. How big is the global electronics components market?

The Global Electronics Components Market is valued at USD 363 billion, based on a five-year historical analysis. This market's growth is driven by the increased demand for miniaturized, efficient components across industries like consumer electronics, automotive, and telecommunications.

02. What are the challenges in the global electronics components market?

Challenges in the market include supply chain disruptions, the ongoing semiconductor shortage, and regulatory compliance requirements like RoHS and REACH. Additionally, the high cost of raw materials has also affected the profitability of key players.

03. Who are the major players in the global electronics components market?

Key players include Intel Corporation, Samsung Electronics, Qualcomm Technologies, Murata Manufacturing, and Infineon Technologies. These companies dominate due to their innovation, global presence, and extensive product portfolios.

04. What are the growth drivers for the global electronics components market?

The market is driven by rising demand for consumer electronics, the rapid adoption of electric vehicles, the deployment of 5G networks, and increasing investments in renewable energy solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.