Region:Global

Author(s):Dev

Product Code:KRAB0627

Pages:100

Published On:August 2025

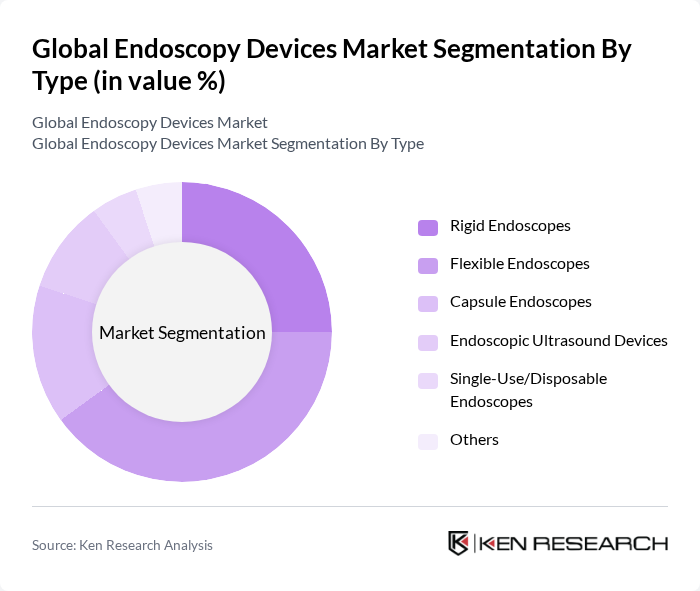

By Type:The endoscopy devices market is segmented into Rigid Endoscopes, Flexible Endoscopes, Capsule Endoscopes, Endoscopic Ultrasound Devices, Single-Use/Disposable Endoscopes, and Others. Among these, Flexible Endoscopes are the most widely used due to their versatility and ability to navigate complex anatomical structures, making them essential for a broad range of diagnostic and therapeutic procedures. The demand for Rigid Endoscopes remains significant, particularly in surgical specialties such as orthopedics and gynecology, where precision and stability are crucial. Capsule Endoscopes are gaining traction for non-invasive gastrointestinal diagnostics, while Single-Use Endoscopes are rapidly expanding in adoption due to infection control priorities .

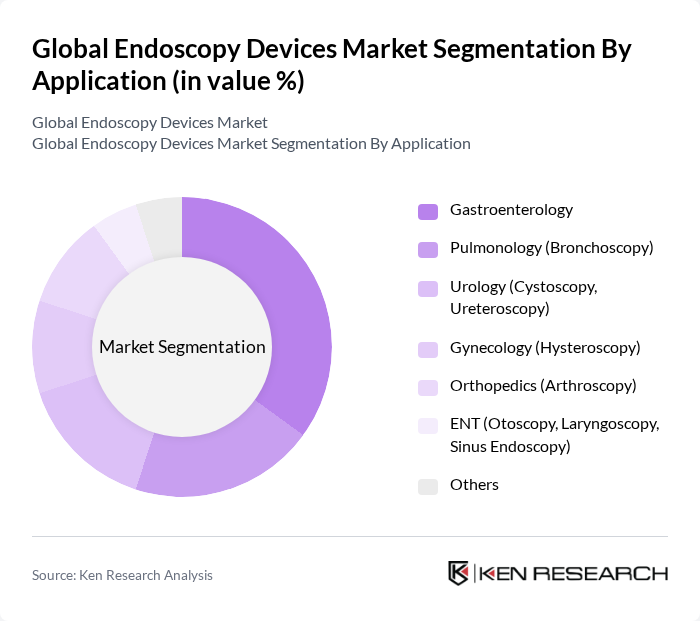

By Application:The applications of endoscopy devices include Gastroenterology, Pulmonology (Bronchoscopy), Urology (Cystoscopy, Ureteroscopy), Gynecology (Hysteroscopy), Orthopedics (Arthroscopy), ENT (Otoscopy, Laryngoscopy, Sinus Endoscopy), and Others. Gastroenterology is the leading application segment, driven by the high prevalence of gastrointestinal disorders such as colorectal cancer and inflammatory bowel disease, as well as the increasing adoption of screening and therapeutic endoscopic procedures. Pulmonology and Urology are also significant segments, supported by the rising incidence of respiratory and urinary tract conditions. The growing awareness of preventive healthcare and early diagnosis further contributes to the demand for endoscopic applications across these specialties .

The Global Endoscopy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Olympus Corporation, Stryker Corporation, Johnson & Johnson (Ethicon Endo-Surgery, LLC), KARL STORZ SE & Co. KG, Fujifilm Holdings Corporation, Hoya Corporation (Pentax Medical), CONMED Corporation, Ambu A/S, Richard Wolf GmbH, Cook Medical LLC, B. Braun Melsungen AG, Teleflex Incorporated, Smith & Nephew plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the endoscopy devices market in None appears promising, driven by ongoing technological advancements and an increasing focus on patient-centered care. As healthcare systems continue to prioritize minimally invasive procedures, the integration of artificial intelligence and robotics is expected to enhance procedural efficiency and safety. Additionally, the expansion of telemedicine will facilitate remote monitoring and follow-up care, further supporting the growth of endoscopic services in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Endoscopes Flexible Endoscopes Capsule Endoscopes Endoscopic Ultrasound Devices Single-Use/Disposable Endoscopes Others |

| By Application | Gastroenterology Pulmonology (Bronchoscopy) Urology (Cystoscopy, Ureteroscopy) Gynecology (Hysteroscopy) Orthopedics (Arthroscopy) ENT (Otoscopy, Laryngoscopy, Sinus Endoscopy) Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Diagnostic Centers Research Institutions |

| By Component | Endoscopes Visualization Systems (Cameras, Monitors, Light Sources) Operative Devices (Forceps, Scissors, Snares) Accessories (Insufflators, Irrigation Pumps, Trocars) Others |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale Direct-to-Consumer |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 100 | Gastroenterologists, Clinic Managers |

| Hospitals with Surgical Departments | 120 | Surgeons, Operating Room Coordinators |

| Medical Device Distributors | 60 | Sales Representatives, Product Managers |

| Healthcare Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Endoscopy Device Manufacturers | 50 | Product Development Managers, R&D Directors |

The Global Endoscopy Devices Market is valued at approximately USD 61 billion, driven by factors such as the increasing prevalence of chronic diseases, technological advancements, and a growing demand for minimally invasive surgical procedures.