Region:Global

Author(s):Geetanshi

Product Code:KRAD0045

Pages:90

Published On:August 2025

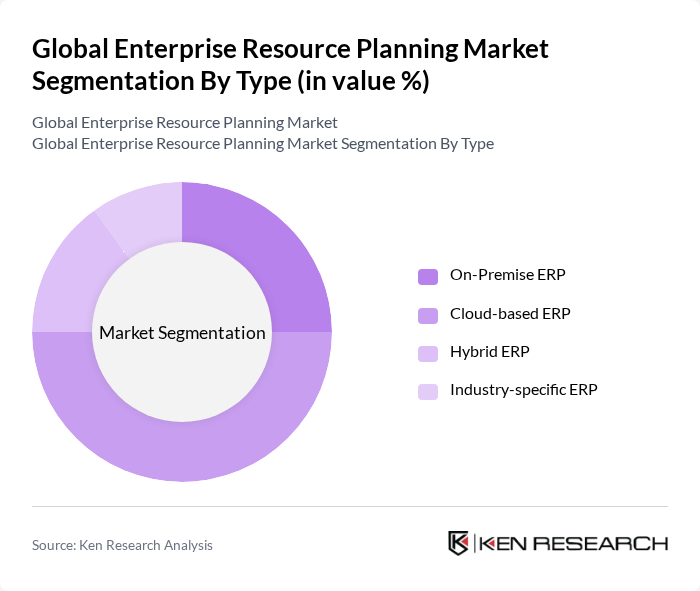

By Type:The market is segmented into On-Premise ERP, Cloud-based ERP, Hybrid ERP, and Industry-specific ERP. Each of these sub-segments addresses distinct business needs and deployment preferences. Cloud-based ERP is currently leading the segment, driven by its flexibility, scalability, and cost-effectiveness. Organizations are increasingly opting for cloud solutions to reduce IT overhead, enable remote access, and accelerate digital transformation initiatives .

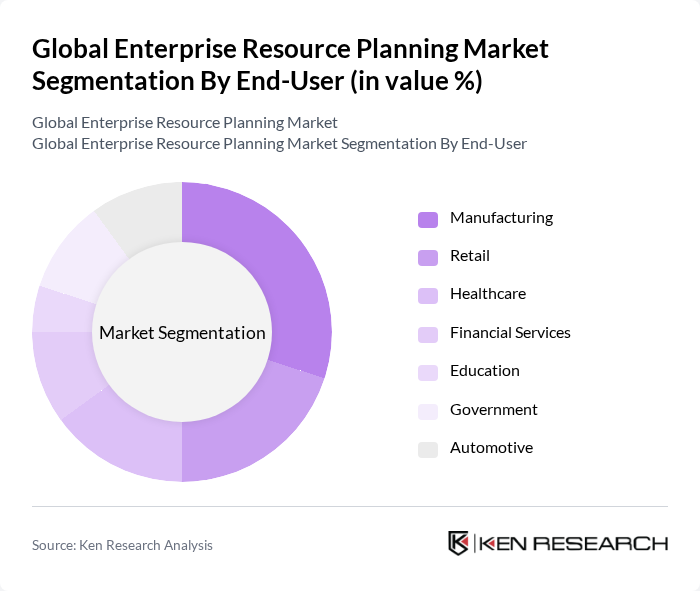

By End-User:The end-user segmentation includes Manufacturing, Retail, Healthcare, Financial Services, Education, Government, and Automotive. The Manufacturing sector is the largest consumer of ERP solutions, driven by the need for efficient supply chain management, production planning, and real-time analytics. Retail and Healthcare are also significant users, focusing on inventory management, omnichannel integration, and patient data management, respectively. Financial Services and Government sectors are adopting ERP for compliance, transparency, and operational efficiency .

The Global Enterprise Resource Planning Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, Infor, Inc., Sage Group plc, Workday, Inc., Epicor Software Corporation, NetSuite Inc., IFS AB, Acumatica, Inc., SYSPRO, Unit4, Odoo S.A., QAD Inc., Deltek, Inc., Intuit Inc., FIS (Fidelity National Information Services, Inc.), Totvs S.A., Yonyou Network Technology Co., Ltd., Cornerstone OnDemand, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ERP market is poised for significant transformation, driven by technological advancements and evolving business needs. As organizations increasingly prioritize digital transformation, the integration of AI and machine learning into ERP systems will enhance predictive analytics and automation capabilities. Additionally, the shift towards subscription-based models will democratize access to ERP solutions, enabling smaller enterprises to leverage advanced functionalities without substantial upfront investments, fostering a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premise ERP Cloud-based ERP Hybrid ERP Industry-specific ERP |

| By End-User | Manufacturing Retail Healthcare Financial Services Education Government Automotive |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premise |

| By Functionality | Financial Management Supply Chain Management Human Resource Management Customer Relationship Management Project Management Inventory & Order Management |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-based One-time License Fee Freemium Model Pay-as-you-go |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing ERP Solutions | 120 | Manufacturing Managers, IT Directors |

| Retail ERP Implementations | 90 | Retail Operations Managers, Supply Chain Analysts |

| Healthcare ERP Systems | 70 | Healthcare Administrators, IT Managers |

| Financial Services ERP Adoption | 60 | Finance Directors, Compliance Officers |

| SME ERP Solutions | 50 | Small Business Owners, IT Consultants |

The Global Enterprise Resource Planning Market is valued at approximately USD 81 billion, reflecting a significant growth trend driven by the increasing need for integrated business processes and the adoption of cloud-based solutions across various industries.