Global Erythropoietin Drugs Market Outlook to 2030

Region:Global

Author(s):Sanjeev kumar

Product Code:KROD4672

December 2024

98

About the Report

Global Erythropoietin Drugs Market Overview

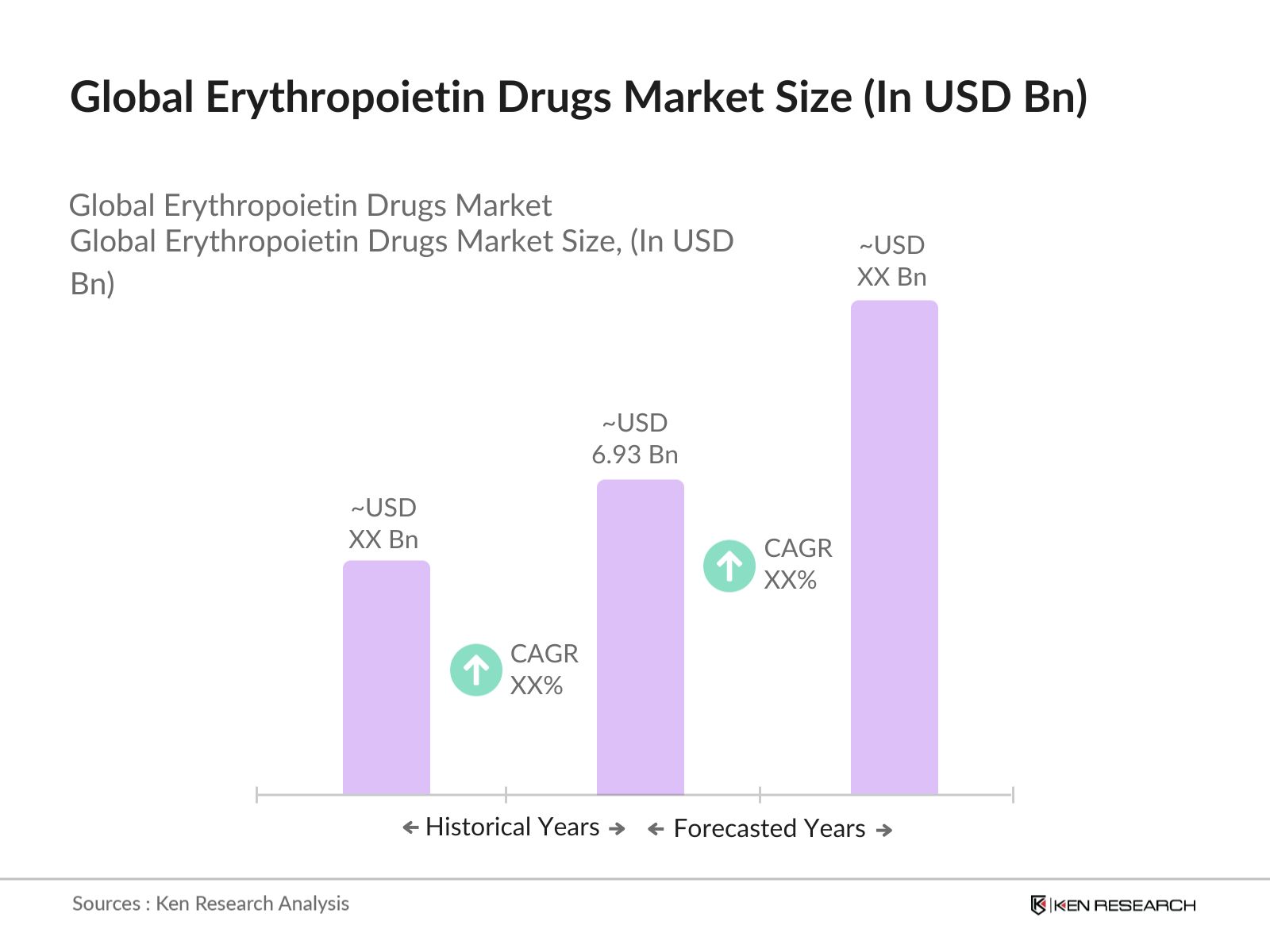

- The Global Erythropoietin (EPO) Drugs market, valued at USD 6.93 billion based on a five-year historical analysis, is driven primarily by the increasing prevalence of chronic diseases such as chronic kidney disease (CKD), cancer-induced anemia, and HIV-induced anemia. As biotechnology advances and demand for effective anemia treatment grows, erythropoietin drugs continue to be a cornerstone in managing anemia caused by these conditions. Further adoption of biosimilars is fueling market growth as well, offering cost-effective alternatives to patented products, especially in price-sensitive regions.

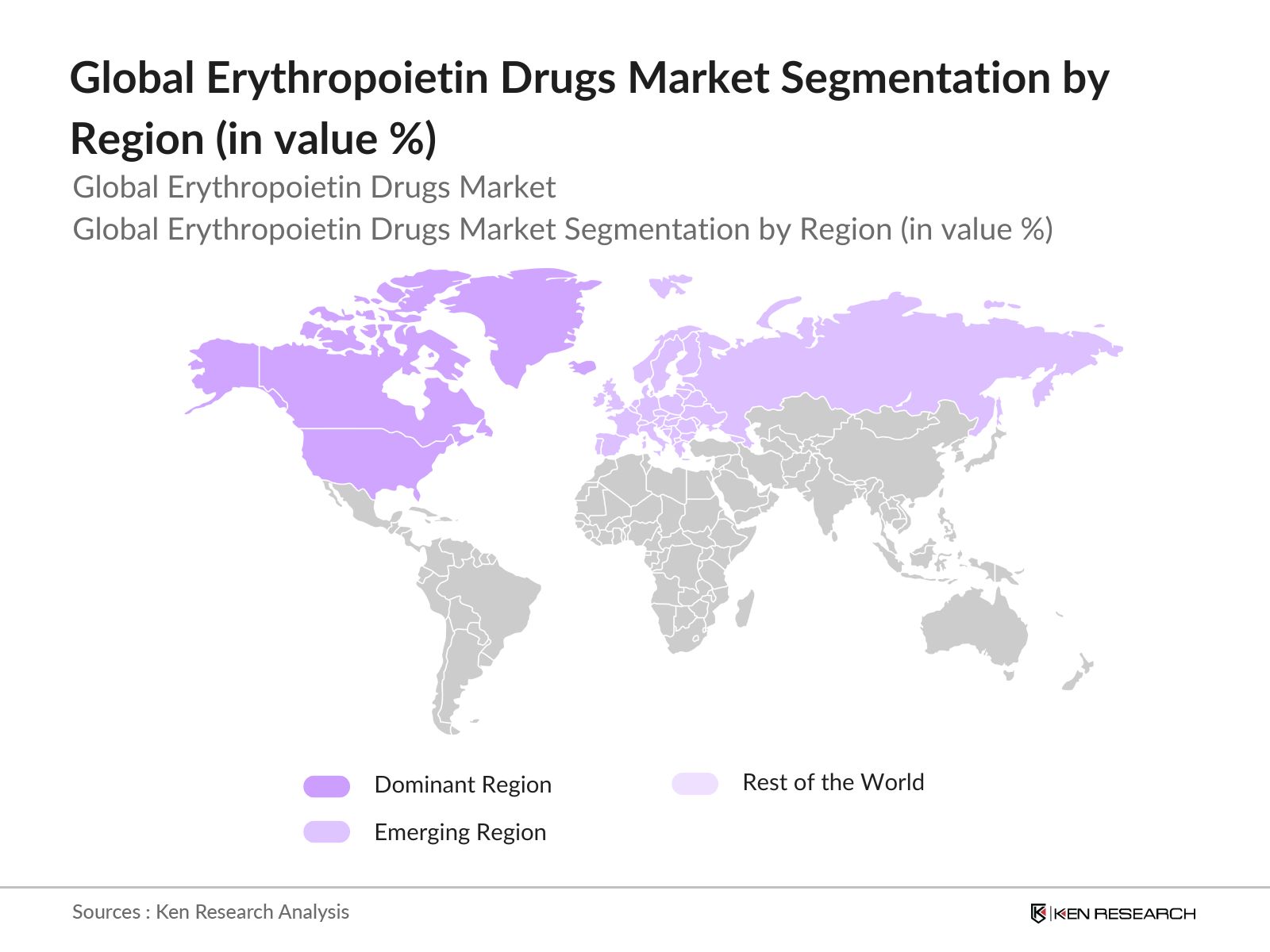

- Dominant regions such as North America and Europe lead the erythropoietin drugs market due to advanced healthcare infrastructure, high awareness, and substantial healthcare spending. In North America, the presence of key market players and advanced biotechnology sectors foster a conducive environment for erythropoietin drug production and innovation. Meanwhile, Europe benefits from strong regulatory support for biosimilars and increasing government initiatives to support advanced therapies in treating anemia.

- Governments around the world are increasingly prioritizing the treatment of chronic diseases and improving access to essential medications like erythropoietin drugs. In 2024, countries such as India, China, and Brazil have launched national healthcare programs aimed at providing subsidized treatment for anemia and CKD patients. These initiatives are contributing to increased drug accessibility in regions where cost has traditionally been a barrier. Government support for healthcare improvements continues to drive the market for erythropoietin drugs.

Global Erythropoietin Drugs Market Segmentation

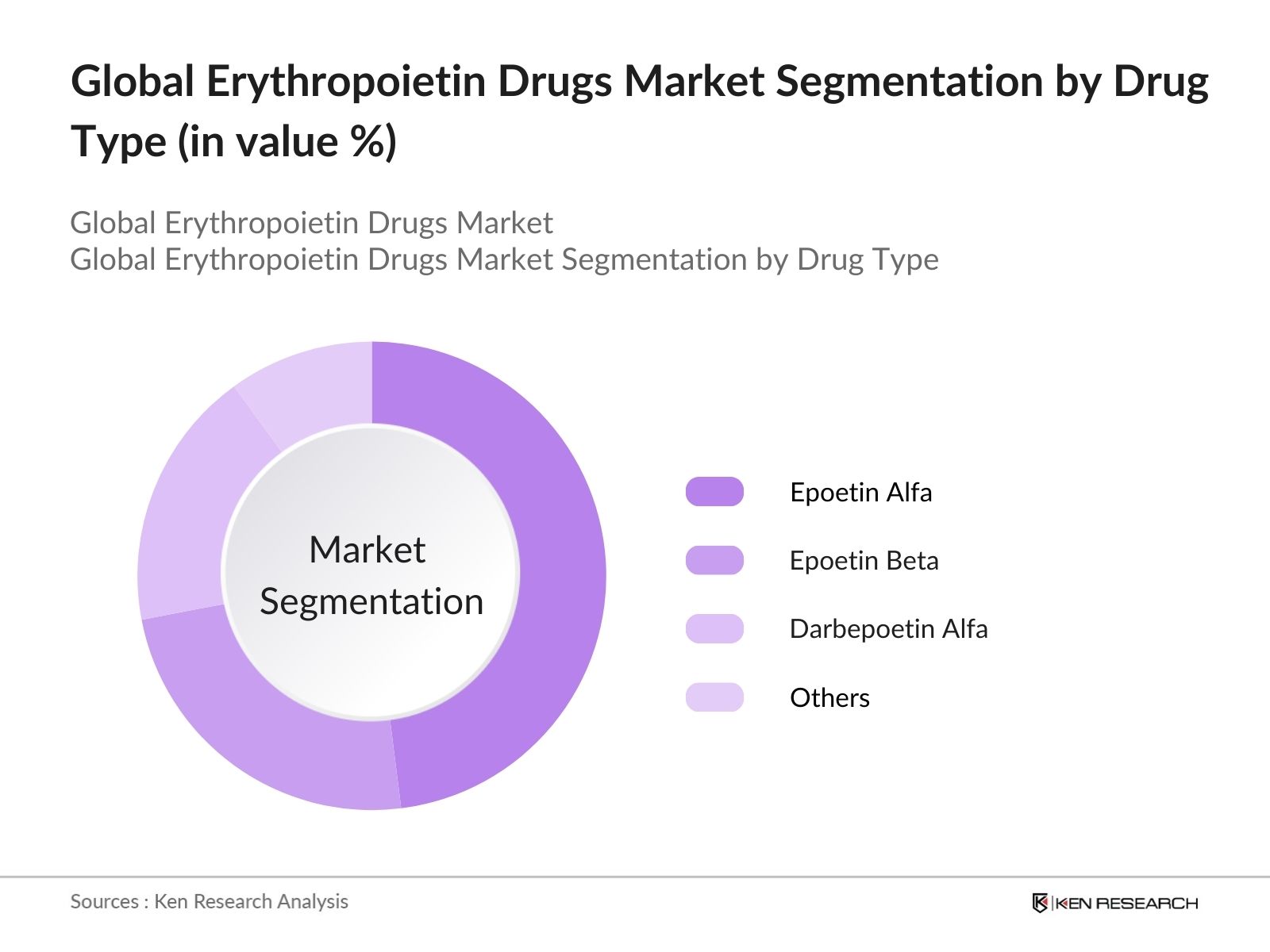

- By Drug Type: The Erythropoietin Drugs market is segmented by drug type into Epoetin Alfa, Epoetin Beta, Darbepoetin Alfa, and Others. Among these, Epoetin Alfa holds the dominant share due to its widespread use in treating anemia associated with chronic kidney disease and chemotherapy. The effectiveness and established presence of Epoetin Alfa have made it the go-to choice for physicians in major markets, bolstered by strong patent protection and brand recognition. Furthermore, Epoetin Alfa's well-documented safety profile enhances its market position.

- By Region: The Erythropoietin Drugs market is segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America leads the market, driven by the strong presence of biopharmaceutical companies, high healthcare expenditure, and an aging population susceptible to anemia. The region also benefits from the high adoption of biosimilars, which helps maintain market stability amid patent expirations. Europe follows closely, with its strong regulatory framework favoring biosimilar adoption and robust pharmaceutical manufacturing capabilities.

- By Application: In terms of application, the Erythropoietin Drugs market is categorized into Chronic Kidney Disease, Cancer-Related Anemia, HIV-Related Anemia, Surgery-Related Anemia, and Others. Chronic Kidney Disease dominates the market due to the high incidence of CKD globally, particularly in aging populations. EPO drugs are a critical component of the treatment regimen for CKD patients undergoing dialysis, which has driven consistent demand in developed regions such as North America and Europe.

Global Erythropoietin Drugs Market Competitive Landscape

The Global Erythropoietin Drugs market is dominated by key players who have established strong footholds through robust research and development activities, patent holdings, and extensive product portfolios. These companies are continually involved in expanding their biosimilar pipelines, fostering competition while maintaining dominance in various regions.

|

Company |

Year Established |

Headquarters |

Revenue (USD Billion) |

Product Portfolio |

Sustainability Initiatives |

Brand Recognition |

Market Share |

Innovation |

Collaborations |

|

Amgen Inc. |

1980 |

California, USA |

- |

- |

- |

- |

- |

- |

- |

|

Johnson & Johnson |

1886 |

New Jersey, USA |

- |

- |

- |

- |

- |

- |

- |

|

Roche Holding AG |

1896 |

Basel, Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

Pfizer Inc. |

1849 |

New York, USA |

- |

- |

- |

- |

- |

- |

- |

|

Biocon Limited |

1978 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

- |

Global Erythropoietin Drugs Industry Analysis

Growth Drivers

- Increasing Incidence of Anemia: Anemia remains a significant public health concern, affecting approximately 1.74 billion people globally, according to the World Health Organization (WHO). In 2024, anemia continues to be prevalent, especially in regions with high rates of malnutrition and chronic diseases. Chronic kidney disease (CKD), which affects 10% of the global population, often leads to anemia due to reduced erythropoietin production. This increases the demand for erythropoietin drugs as a treatment option for anemia caused by CKD and other conditions. The aging population further exacerbates this issue, as anemia is more prevalent among the elderly.

- Rise in Kidney Disorders: Chronic kidney disease (CKD) affects more than 850 million people globally, according to the National Kidney Foundation, and this number is growing due to risk factors such as diabetes and hypertension. With the global diabetes prevalence rising to 463 million in 2024 (International Diabetes Federation), a significant percentage of patients will develop CKD. This drives the need for erythropoietin drugs to manage the associated anemia. CKD remains a leading cause of erythropoietin deficiency, making these drugs essential for managing the condition effectively.

- Advancements in Biotechnology: The biopharmaceutical industry is making significant strides in the development of recombinant DNA technology, leading to more efficient and scalable production of erythropoietin drugs. Biotechnology advancements have enabled the mass production of erythropoietin drugs, allowing for improved formulations and better patient outcomes. In 2024, nearly 20% of all new drug applications in the U.S. FDA pipeline involve biologic-based drugs, highlighting the growing role of biotechnology in medical treatments, including erythropoietin drugs. This innovation is expected to improve drug efficacy and reduce production costs in the long term.

Market Restraints

- Patent Expiration of Key Drugs: Several erythropoietin drugs have lost patent protection in recent years, including Epoetin alfa, creating market challenges due to the entry of biosimilars. As of 2024, biosimilar versions are being developed and marketed, which has intensified competition and reduced the market share of original branded drugs. This shift has prompted pharmaceutical companies to innovate in drug formulations or focus on personalized treatment options. However, patent expirations also offer cost-effective alternatives for healthcare systems.

- Side Effects and Risks: Erythropoietin drugs, while effective, are associated with potential side effects, including hypertension, thrombosis, and increased risk of cardiovascular events. In 2024, clinical data from post-marketing surveillance continue to highlight these risks, with the U.S. FDA issuing warnings for the overuse of erythropoietin drugs in certain patient populations. These risks limit their use in specific demographics, particularly patients with a history of heart disease. The potential side effects contribute to hesitancy among healthcare providers when prescribing these treatments.

Global Erythropoietin Drugs Market Future Outlook

Over the next five years, the Erythropoietin Drugs market is expected to witness steady growth driven by factors such as rising incidences of chronic diseases like kidney disease and cancer, the growing geriatric population, and advancements in biotechnology. In particular, the increased development of biosimilars is expected to democratize access to these essential drugs in cost-sensitive markets, which will bolster global growth prospects. Regions such as Asia Pacific and Latin America are also expected to witness considerable growth due to improving healthcare infrastructure and rising healthcare investments.

Market Opportunities

- Growing Use in Cancer Treatment: Erythropoietin drugs have increasingly been adopted in cancer care to manage anemia caused by chemotherapy. In 2024, cancer affects over 19.3 million people globally, as per WHO data, and chemotherapy-induced anemia is a common side effect, affecting up to 68% of patients. Erythropoietin drugs help mitigate anemia and improve quality of life during treatment. The growing incidence of cancer worldwide, coupled with the need for supportive therapies, presents a significant growth opportunity for erythropoietin drugs.

- Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, are seeing rapid improvements in healthcare infrastructure and an increasing focus on treating chronic diseases like CKD and cancer. As of 2024, Asia-Pacific is home to more than 60% of the worlds population, and the demand for erythropoietin drugs is expected to rise due to improving access to healthcare services. Government healthcare initiatives in these regions also support drug accessibility, creating opportunities for market expansion.

Scope of the Report

|

Drug Type |

Epoetin Alfa Epoetin Beta Darbepoetin Alfa Others |

|

Application |

Chronic Kidney Disease Cancer-Related Anemia HIV-Related Anemia Surgery-Related Anemia Others |

|

Mode of Administration |

Intravenous Subcutaneous |

|

Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics, Dialysis Centers)

Pharmaceutical Manufacturers

Biotechnology Firms

Government and Regulatory Bodies (FDA, EMA)

Investors and Venture Capitalist Firms

Medical Research Institutes

Pharmaceutical Distributors

Contract Research Organizations (CROs)

Companies

Players Mentioned in the Report:

Amgen Inc.

Johnson & Johnson

Roche Holding AG

Pfizer Inc.

Novartis AG

GlaxoSmithKline Plc

Biocon Limited

Teva Pharmaceutical Industries Ltd.

Intas Pharmaceuticals Ltd.

Dr. Reddys Laboratories Ltd.

3SBio Inc.

Celltrion Healthcare

Cipla Ltd.

Sun Pharmaceutical Industries Ltd.

LG Chem Ltd.

Table of Contents

1. Global Erythropoietin Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, YoY growth)

1.4. Market Segmentation Overview (Drug Type, Application, Mode of Administration, Distribution Channel, Region)

2. Global Erythropoietin Drugs Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Erythropoietin Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Incidence of Anemia

3.1.2. Rise in Kidney Disorders

3.1.3. Advancements in Biotechnology

3.1.4. Increasing Geriatric Population

3.2. Market Challenges

3.2.1. High Cost of Erythropoietin Drugs

3.2.2. Patent Expiration of Key Drugs

3.2.3. Side Effects and Risks

3.3. Opportunities

3.3.1. Growing Use in Cancer Treatment

3.3.2. Expansion in Emerging Markets

3.3.3. Biosimilar Drug Development

3.4. Trends

3.4.1. Shift towards Biosimilars

3.4.2. Personalized Medicine Approaches

3.4.3. Government Healthcare Initiatives

3.5. Regulatory Landscape

3.5.1. FDA and EMA Approvals

3.5.2. Patent Regulations

3.5.3. Clinical Trials Requirements

3.5.4. Post-marketing Surveillance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Pharmaceutical companies, Healthcare providers, Regulatory bodies)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Erythropoietin Drugs Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. Epoetin Alfa

4.1.2. Epoetin Beta

4.1.3. Darbepoetin Alfa

4.1.4. Others

4.2. By Application (In Value %)

4.2.1. Chronic Kidney Disease

4.2.2. Cancer-Related Anemia

4.2.3. HIV-Related Anemia

4.2.4. Surgery-Related Anemia

4.2.5. Others

4.3. By Mode of Administration (In Value %)

4.3.1. Intravenous

4.3.2. Subcutaneous

4.4. By Distribution Channel (In Value %)

4.4.1. Hospital Pharmacies

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Erythropoietin Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amgen Inc.

5.1.2. Johnson & Johnson

5.1.3. Roche Holding AG

5.1.4. Pfizer Inc.

5.1.5. Novartis AG

5.1.6. GlaxoSmithKline Plc

5.1.7. Biocon Limited

5.1.8. Teva Pharmaceutical Industries Ltd.

5.1.9. Intas Pharmaceuticals Ltd.

5.1.10. Dr. Reddys Laboratories Ltd.

5.1.11. 3SBio Inc.

5.1.12. Celltrion Healthcare

5.1.13. Cipla Ltd.

5.1.14. Sun Pharmaceutical Industries Ltd.

5.1.15. LG Chem Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Biosimilars Pipeline, Manufacturing Capabilities, Regulatory Approvals, Geographic Presence, Mergers & Acquisitions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Erythropoietin Drugs Market Regulatory Framework

6.1. Drug Approval Process

6.2. Biosimilar Regulations

6.3. Market Authorization Requirements

6.4. Post-Marketing Surveillance

6.5. Labeling and Packaging Standards

7. Global Erythropoietin Drugs Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Erythropoietin Drugs Future Market Segmentation

8.1. By Drug Type (In Value %)

8.2. By Application (In Value %)

8.3. By Mode of Administration (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Erythropoietin Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining the key parameters influencing the Global Erythropoietin Drugs market. This is achieved through extensive desk research and utilizing a variety of proprietary and publicly available databases. Major stakeholders such as pharmaceutical manufacturers, healthcare providers, and regulatory bodies are mapped to understand market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed to build a foundation for understanding market trends and penetration levels. Key metrics such as drug adoption rates, regulatory approvals, and market share are studied in detail to provide accurate revenue estimates and insights.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through direct interviews and surveys with industry experts, including pharmaceutical executives and healthcare professionals. These consultations provide critical insights into market trends, pricing dynamics, and product development strategies, adding depth to the analysis.

Step 4: Research Synthesis and Final Output

In the final phase, data is synthesized, and insights are refined through rigorous cross-verification techniques, ensuring the accuracy and reliability of the research. The reports final output is subjected to additional validation by market experts to maintain the highest level of data integrity and relevance.

Frequently Asked Questions

01. How big is the Global Erythropoietin Drugs Market?

The Global Erythropoietin Drugs market, valued at USD 6.93 billion based on a five-year historical analysis, is driven by the rising incidences of chronic diseases, advancements in biotechnology, and the growing geriatric population.

02. What are the challenges in the Erythropoietin Drugs Market?

Challenges include high manufacturing costs, patent expirations leading to biosimilar competition, and regulatory hurdles in getting drug approvals. These factors can limit market profitability and growth in certain regions.

03. Who are the major players in the Erythropoietin Drugs Market?

Key players in the market include Amgen Inc., Johnson & Johnson, Roche Holding AG, Pfizer Inc., and Novartis AG. These companies maintain dominance due to their extensive product portfolios, R&D investments, and global presence.

04. What drives growth in the Erythropoietin Drugs Market?

Growth is driven by increasing incidences of chronic kidney disease, cancer-related anemia, and advancements in biotechnology. Additionally, the growing use of biosimilars is making treatment more affordable in cost-sensitive regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.