Global Ethylene Vinyl Acetate Market Outlook to 2030

Region:Global

Author(s):Sanjeev kumar

Product Code:KROD6543

December 2024

89

About the Report

Global Ethylene Vinyl Acetate Market Overview

- The global Ethylene Vinyl Acetate (EVA) market, driven by growing demand from the solar energy, packaging, and footwear industries, reached a valuation of USD 11 billion. This rise in value is primarily due to its extensive applications in encapsulant films for photovoltaic solar cells and packaging materials. EVAs excellent thermal, adhesive, and flexibility properties have also fueled its demand across diverse industries, reinforcing its global market size. Credible sources such as industry reports and manufacturing databases corroborate this market valuation.

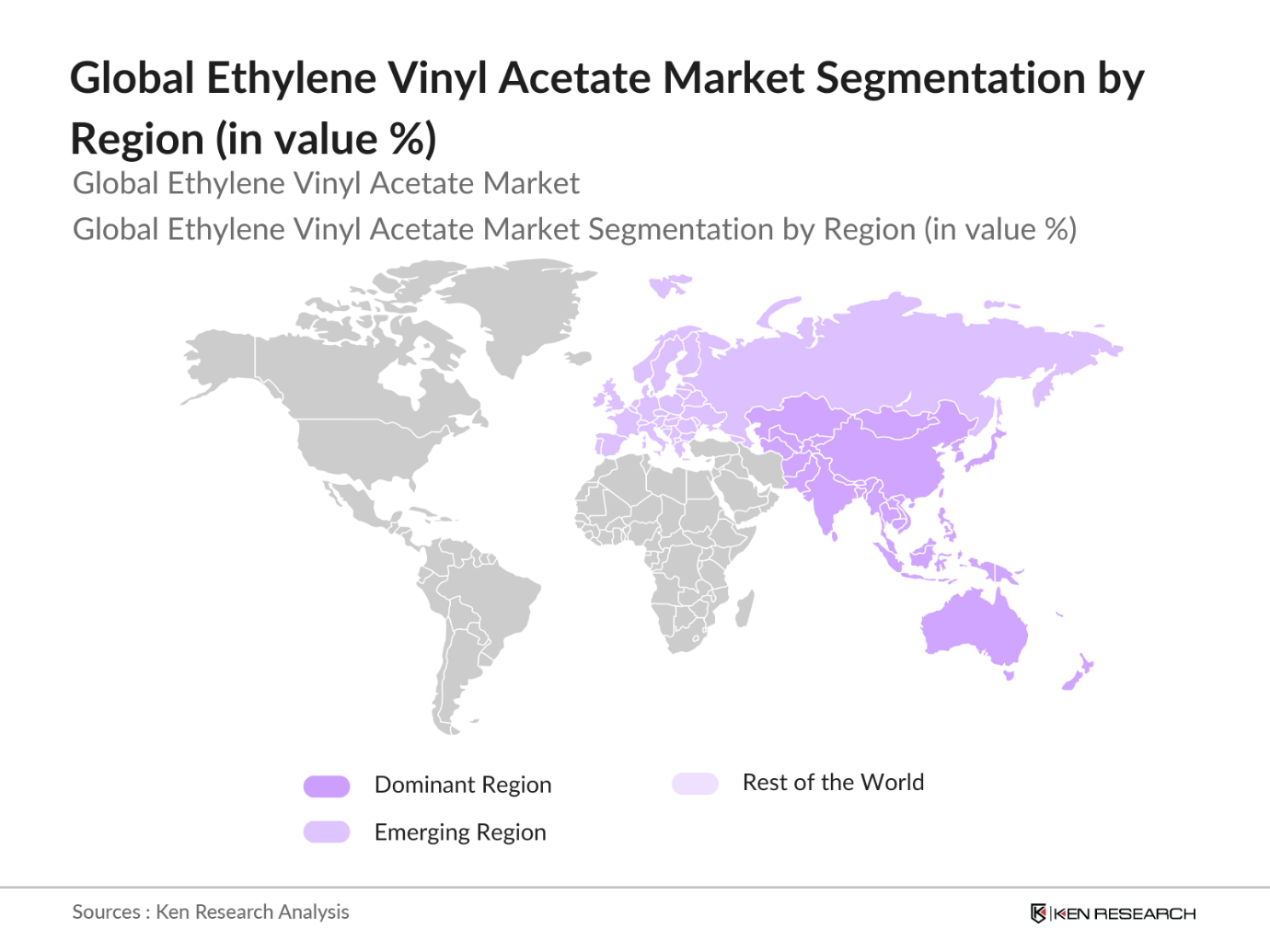

- Countries like China, the United States, and Germany dominate the EVA market. China, due to its large-scale solar panel manufacturing and packaging industries, plays a critical role. The United States holds a strong position due to its robust automotive and packaging industries, while Germanys focus on renewable energy and sustainability places it at the forefront of EVA consumption in the European market. These regions have established manufacturing hubs and advanced technologies that reinforce their dominance in the EVA market.

- Governments worldwide are offering incentives to promote renewable energy projects, boosting demand for EVA in solar panel applications. For example, the US government provided over $10 billion in incentives through the Inflation Reduction Act in 2023 to accelerate renewable energy projects. This is leading to a higher demand for solar PV modules, where EVA is critical as an encapsulation material. Similar initiatives are being seen in the EU, with substantial funding directed toward solar energy infrastructure.

Global Ethylene Vinyl Acetate Market Segmentation

- By Grade: The global Ethylene Vinyl Acetate market is segmented by grade into Low VA Content, Medium VA Content, and High VA Content. Low VA content EVA is the dominant segment due to its high demand in industries such as footwear and adhesives, where strength and flexibility are critical. Its low cost, combined with superior performance, makes it a preferred choice for foam and footwear applications, driving its dominance in this segment.

- By Region: The global EVA market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the market, led by China, South Korea, and Japan, which have strong manufacturing bases for solar panels and footwear. The regions low production costs and strong industrial infrastructure make it the largest contributor to EVA production and consumption. Europe is the second-largest region, driven by increasing demand in automotive and renewable energy sectors.

- By Application: The EVA market is segmented by application into Films, Foam, Adhesives, Solar Cell Encapsulation, and Others (e.g., Wires & Cables, Hot Melt Adhesives). Films have the largest market share, primarily due to the demand for packaging materials and solar panel encapsulation. EVA films offer excellent protection against moisture and UV radiation, making them highly preferred in the photovoltaic industry. The rapid growth of renewable energy projects has further strengthened the demand for EVA in this application.

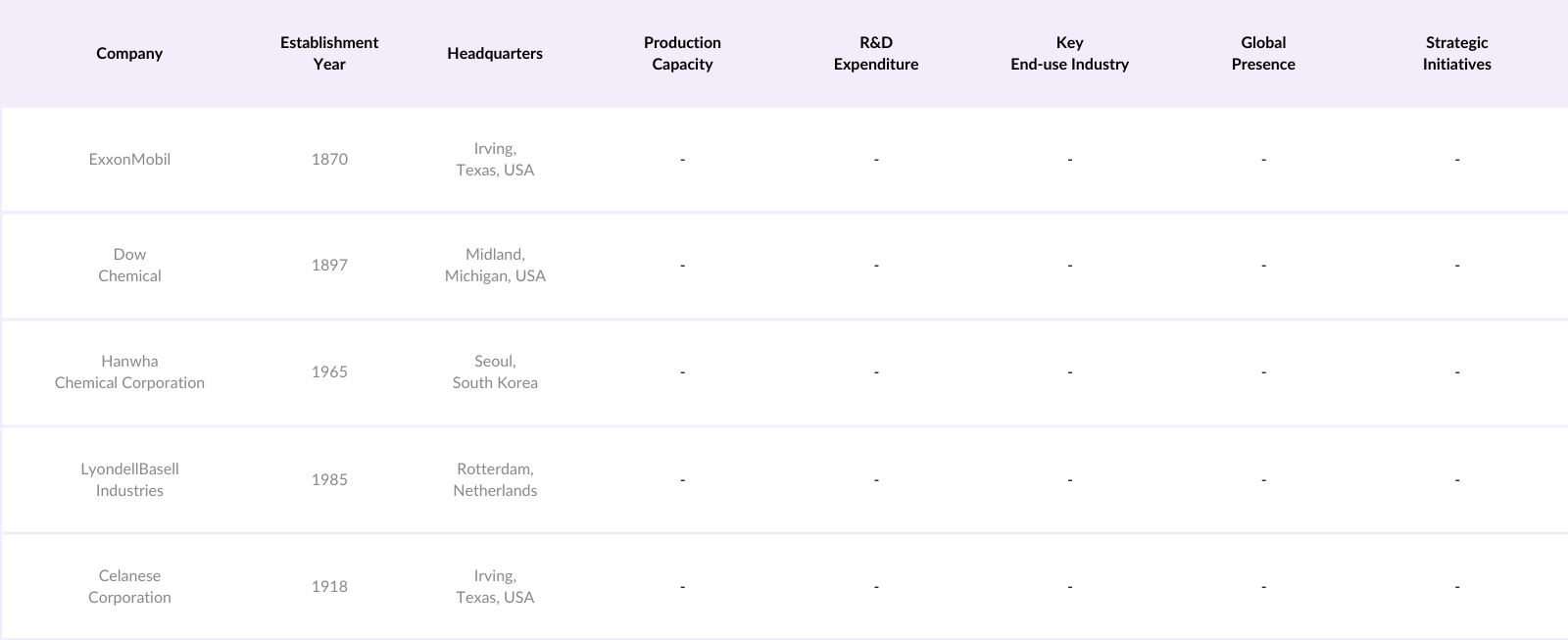

Global Ethylene Vinyl Acetate Market Competitive Landscape

The global Ethylene Vinyl Acetate market is highly competitive, with several major players actively investing in research and development to innovate new products and improve their market share. The market is consolidated, with companies like ExxonMobil and Dow Chemical dominating production, while regional players also hold significant shares in localized markets. These companies have established strong supply chains, production capacities, and partnerships, which help them maintain their leadership in the EVA market.

Global Ethylene Vinyl Acetate Industry Analysis

Growth Drivers

- Rising Demand from Solar Photovoltaics: Ethylene Vinyl Acetate (EVA) is widely used as an encapsulant material in solar photovoltaic (PV) modules due to its durability, flexibility, and UV resistance. The International Renewable Energy Agency (IRENA) reports that global solar PV capacity reached 1,185 GW by 2023, reflecting the growing renewable energy sector. With the global push for renewable energy, particularly in the EU and China, EVA demand is driven by large-scale solar installations. As solar panel installations grow, particularly in the EU and India, the need for EVA in encapsulation is expected to sustain. The shift towards green energy solutions in Asia and Europe is expected to support this demand.

- Increasing Usage in Packaging Applications: EVA is increasingly used in packaging for food, medical devices, and consumer goods, providing durability and flexibility in manufacturing. According to the World Bank, global trade for packaged goods rose steadily from 2022-2023, reaching $19.5 trillion in exports. The packaging industry saw a rise in flexible packaging demand, with countries like the US and China being major contributors. EVA films are a preferred choice for heat sealing and adhesive layers in flexible packaging, leading to its rising use in packaging applications globally. The robust trade of packaged goods is directly influencing EVA demand in packaging sectors.

- Growth in Footwear Industry: EVA plays a vital role in footwear manufacturing, especially in cushioning midsoles and outsole materials. The global footwear industry continues to expand, with production exceeding 24 billion pairs in 2023, according to the International Labour Organization (ILO). Asia-Pacific, especially China, accounts for over 70% of global footwear production, where EVA is commonly used in casual, athletic, and safety footwear. This expansion in manufacturing is driving the demand for EVA, particularly in markets where durable, lightweight footwear is required for everyday use and sports applications.

Market Restraints

- Fluctuation in Raw Material Prices: EVA is derived from ethylene, a petroleum-based product, making it vulnerable to crude oil price fluctuations. The average price of crude oil has been volatile, ranging between $75 to $95 per barrel throughout 2022-2023, as per the US Energy Information Administration (EIA). These fluctuations increase the cost of raw materials for EVA production, directly affecting manufacturers' margins. Additionally, geopolitical tensions and supply chain disruptions in key oil-exporting regions, such as the Middle East, further contribute to raw material price uncertainty.

- Environmental Concerns Regarding Plastic Usage: The global shift towards reducing plastic waste is a challenge for EVA production. Despite EVA being non-toxic and flexible, it is not biodegradable, raising concerns about its environmental footprint. Governments across the European Union, under the European Green Deal, are pushing for stricter regulations on plastic usage, with a target to reduce plastic waste by 50% by 2025. This has led to a demand for more sustainable alternatives to traditional EVA, making it difficult for the EVA market to sustain growth without developing eco-friendly options.

Global Ethylene Vinyl Acetate Future Outlook

Over the next five years, the global Ethylene Vinyl Acetate (EVA) market is expected to experience substantial growth, driven by the increasing use of EVA in renewable energy, particularly solar panel encapsulation, packaging, and footwear. The shift towards sustainable and biodegradable EVA products, coupled with growing investments in R&D by key market players, is projected to drive further market expansion. The rise of electric vehicles and the automotive industrys focus on lightweight materials will also provide new avenues for EVA consumption.

Market Opportunities

- Expansion in Renewable Energy Applications: EVAs role in solar panel encapsulation provides a significant growth opportunity as governments worldwide push for renewable energy adoption. Solar energy investments exceeded $300 billion globally in 2023, with China, the US, and the EU leading the charge, according to the International Energy Agency (IEA). This massive push towards renewable energy is leading to a higher demand for solar PV modules, where EVA encapsulant films are essential. With solar energy capacity forecasted to continue rising, EVAs role in solar applications is set to expand further.

- Rising Demand for Biodegradable and Sustainable EVA Grades: As environmental concerns increase, the demand for biodegradable and sustainable EVA variants is rising. The development of bio-based EVA, which uses natural feedstocks, offers a more environmentally friendly alternative. In 2023, the European Bioplastics Association reported a 15% increase in the production of bio-based polymers, indicating growing market potential. Countries with stringent environmental policies, such as Germany and Japan, are encouraging the use of eco-friendly materials, positioning biodegradable EVA as a key market growth area.

Scope of the Report

|

By Grade |

Low VA Content, Medium VA Content, High VA Content |

|

By Application |

Films, Foam, Adhesives, Solar Cell Encapsulation, Others |

|

By End-use Industry |

Packaging, Solar Energy, Automotive, Footwear, Healthcare |

|

By Distribution Channel |

Direct Sales, Distributors, Online Retail |

|

By Region |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Environmental Protection Agency, European Commission)

Solar Panel Manufacturers

Footwear Manufacturers

Packaging Manufacturers

Automotive Industry Stakeholders

Healthcare Device Manufacturers

Adhesive Manufacturers

Companies

Players Mentioned in the Report:

ExxonMobil Corporation

Dow Chemical Company

Hanwha Chemical Corporation

LyondellBasell Industries Holdings B.V.

Celanese Corporation

BASF SE

Arkema S.A.

LG Chem Ltd.

Wacker Chemie AG

Sumitomo Chemical Co., Ltd.

Braskem S.A.

Tosoh Corporation

Westlake Chemical Corporation

Repsol S.A.

DuPont de Nemours, Inc.

Table of Contents

1. Global Ethylene Vinyl Acetate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Ethylene Vinyl Acetate production, demand, and price trends)

1.4. Market Segmentation Overview (By Grade, Application, End-use Industry, Distribution Channel, Region)

2. Global Ethylene Vinyl Acetate Market Size (In USD Mn)

2.1. Historical Market Size (Analysis of EVA production volumes, consumption, and imports/exports)

2.2. Year-On-Year Growth Analysis (EVA demand growth from key end-use sectors like solar energy and packaging)

2.3. Key Market Developments and Milestones (Technological advancements, innovations, and industrial growth)

3. Global Ethylene Vinyl Acetate Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand from Solar Photovoltaics

3.1.2. Increasing Usage in Packaging Applications

3.1.3. Growth in Footwear Industry

3.1.4. Expanding Healthcare Industry

3.2. Market Challenges

3.2.1. Fluctuation in Raw Material Prices (Crude Oil and Ethylene)

3.2.2. Environmental Concerns Regarding Plastic Usage

3.2.3. Competition from Substitute Materials

3.3. Opportunities

3.3.1. Expansion in Renewable Energy Applications (EVA usage in encapsulant films for solar panels)

3.3.2. Rising Demand for Biodegradable and Sustainable EVA Grades

3.3.3. Growth of EVA in Automotive Sector

3.4. Trends

3.4.1. Adoption of Bio-based EVA

3.4.2. Development of High-performance EVA Grades

3.4.3. Growing Investment in Solar Energy Projects

3.5. Government Regulation

3.5.1. Environmental Regulations on EVA Production

3.5.2. Import/Export Tariffs on EVA Resins

3.5.3. Industry Standards for EVA in Packaging and Footwear

3.5.4. Incentives for Renewable Energy Sector

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Supply Chain Players, Buyers, Substitutes, New Entrants, Competitive Rivalry)

3.9. Competitive Landscape (EVA production hubs and supply chain integration)

4. Global Ethylene Vinyl Acetate Market Segmentation

4.1. By Grade (In Value %)

4.1.1. Low VA (Vinyl Acetate) Content

4.1.2. Medium VA Content

4.1.3. High VA Content

4.2. By Application (In Value %)

4.2.1. Films (Packaging, Agriculture)

4.2.2. Foam (Footwear, Sports Equipment)

4.2.3. Adhesives

4.2.4. Solar Cell Encapsulation

4.2.5. Others (Wires & Cables, Hot Melt Adhesives)

4.3. By End-use Industry (In Value %)

4.3.1. Packaging

4.3.2. Solar Energy

4.3.3. Automotive

4.3.4. Footwear

4.3.5. Healthcare

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Distributors

4.4.3. Online Retail

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Ethylene Vinyl Acetate Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Arkema S.A.

5.1.2. BASF SE

5.1.3. Celanese Corporation

5.1.4. Dow Chemical Company

5.1.5. ExxonMobil Corporation

5.1.6. Hanwha Chemical Corporation

5.1.7. LyondellBasell Industries Holdings B.V.

5.1.8. LG Chem Ltd.

5.1.9. Tosoh Corporation

5.1.10. Westlake Chemical Corporation

5.1.11. Braskem S.A.

5.1.12. Sumitomo Chemical Co., Ltd.

5.1.13. DuPont de Nemours, Inc.

5.1.14. Wacker Chemie AG

5.1.15. Repsol S.A.

5.2 Cross Comparison Parameters (Revenue, Market Share, EVA Production Capacity, End-use Industry Diversification, Key Innovations, R&D Expenditure, Global Presence, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, R&D Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Ethylene Vinyl Acetate Market Regulatory Framework

6.1. Environmental Compliance for EVA Manufacturing

6.2. Safety Standards for EVA Usage in Healthcare and Packaging

6.3. EVA Import/Export Regulations

6.4. Certification Requirements for EVA Grades

7. Global Ethylene Vinyl Acetate Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Ethylene Vinyl Acetate Future Market Segmentation

8.1. By Grade (In Value %)

8.2. By Application (In Value %)

8.3. By End-use Industry (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Ethylene Vinyl Acetate Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with the identification of the key stakeholders and variables within the Ethylene Vinyl Acetate market. This involves extensive desk research utilizing industry reports, company databases, and proprietary information to gather relevant data on EVA production, demand, and pricing.

Step 2: Market Analysis and Construction

The next phase includes compiling historical data on EVA market penetration, end-use applications, and supply chain dynamics. This analysis is focused on understanding the EVA production capacities, key market players, and regional market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses are developed and validated through interviews with industry experts, including manufacturers and distributors. The objective is to gain insights into market drivers, challenges, and opportunities, and to refine the data collected from secondary sources.

Step 4: Research Synthesis and Final Output

The final phase consolidates data from various sources, including primary research, to develop a comprehensive report on the Ethylene Vinyl Acetate market. This includes finalizing market share estimates, growth projections, and competitive landscape analysis to ensure accuracy.

Frequently Asked Questions

01. How big is the Global Ethylene Vinyl Acetate Market?

The global Ethylene Vinyl Acetate market was valued at USD 11 billion, primarily driven by its growing applications in solar energy, packaging, and footwear industries.

02. What are the challenges in the Global Ethylene Vinyl Acetate Market?

Key challenges include fluctuating raw material prices, environmental concerns related to plastic usage, and competition from substitute materials such as polyolefins.

03. Who are the major players in the Global Ethylene Vinyl Acetate Market?

Major players in the market include ExxonMobil, Dow Chemical, Hanwha Chemical, LyondellBasell, and Celanese, who dominate through extensive production capacities and strong end-use industry partnerships.

04. What are the growth drivers of the Global Ethylene Vinyl Acetate Market?

The market is driven by increased demand in renewable energy applications, particularly solar panel encapsulation, as well as the packaging and footwear industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.