Global EUV Lithography Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD8073

December 2024

81

About the Report

Global EUV Lithograph Market Overview

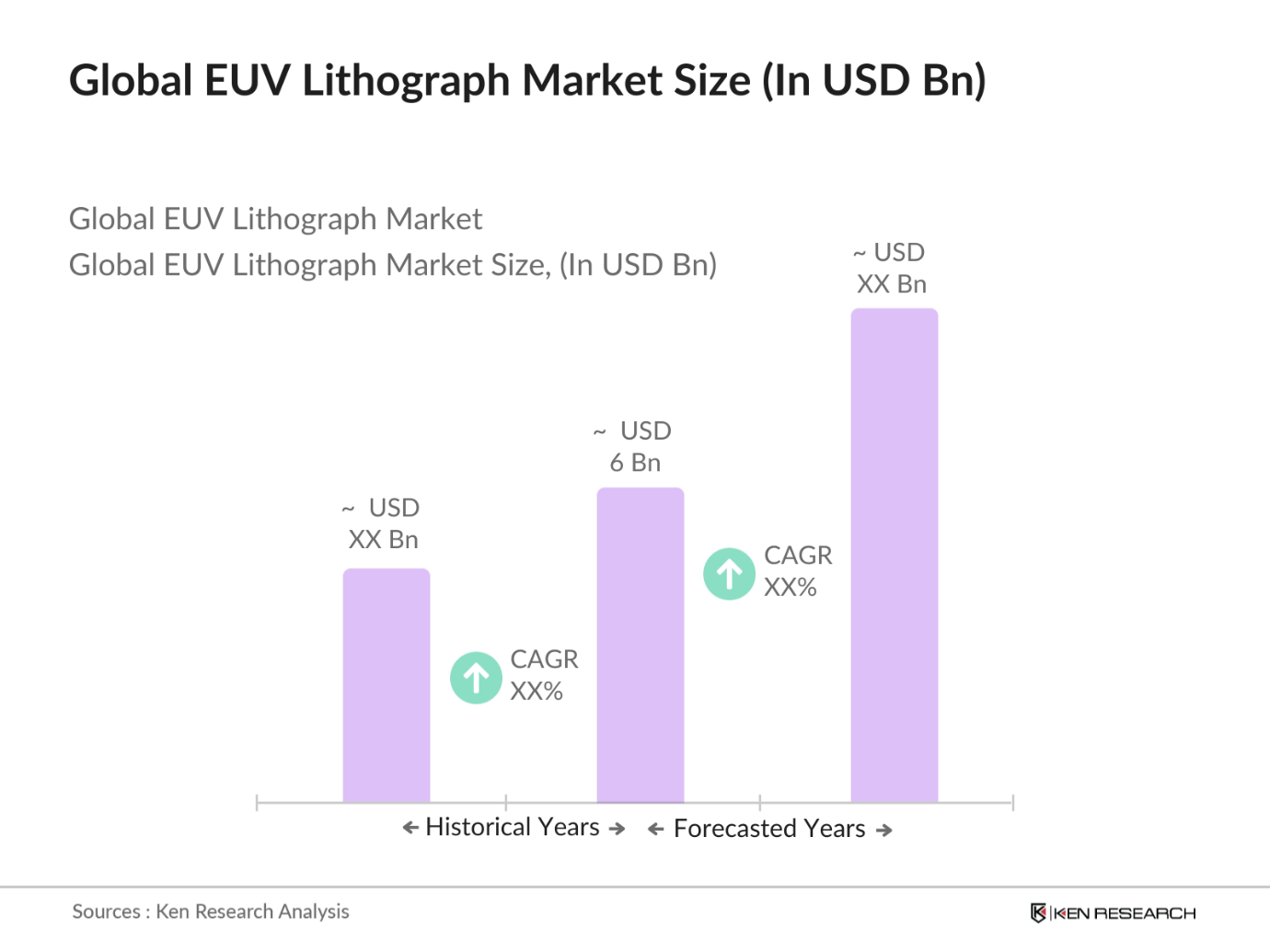

- The Global EUV Lithography market, valued at USD 6 billion, is driven by rapid advancements in semiconductor manufacturing technology and increased demand for smaller, more efficient chips in consumer electronics and data centers. With substantial investments from major players like ASML, the market continues to expand as global manufacturers seek high-precision lithography solutions to support the production of advanced integrated circuits. EUV technology is crucial for meeting the industrys growing demand for efficient, low-energy processes, particularly in high-volume markets such as the U.S., Japan, and Taiwan.

- Countries like the United States, South Korea, and Taiwan dominate the EUV Lithography market due to their robust semiconductor manufacturing industries, supported by extensive R&D infrastructure and a favorable regulatory environment for technological advancement. The U.S. leads in technology innovation and maintains a strong competitive advantage through its concentration of leading manufacturers, while Taiwan and South Korea benefit from high semiconductor production demand and strategic government policies encouraging industry growth.

- EUV lithography manufacturers are required to meet stringent international standards governing semiconductor production. These standards are in place to ensure the quality, efficiency, and environmental sustainability of manufacturing processes. In the semiconductor sector, the International Organization for Standardization (ISO) mandates several protocols for materials and production, particularly affecting high-precision lithography. These compliance requirements add layers of complexity but ensure that manufacturers deliver consistent, globally accepted products

Global EUV Lithography Market Segmentation

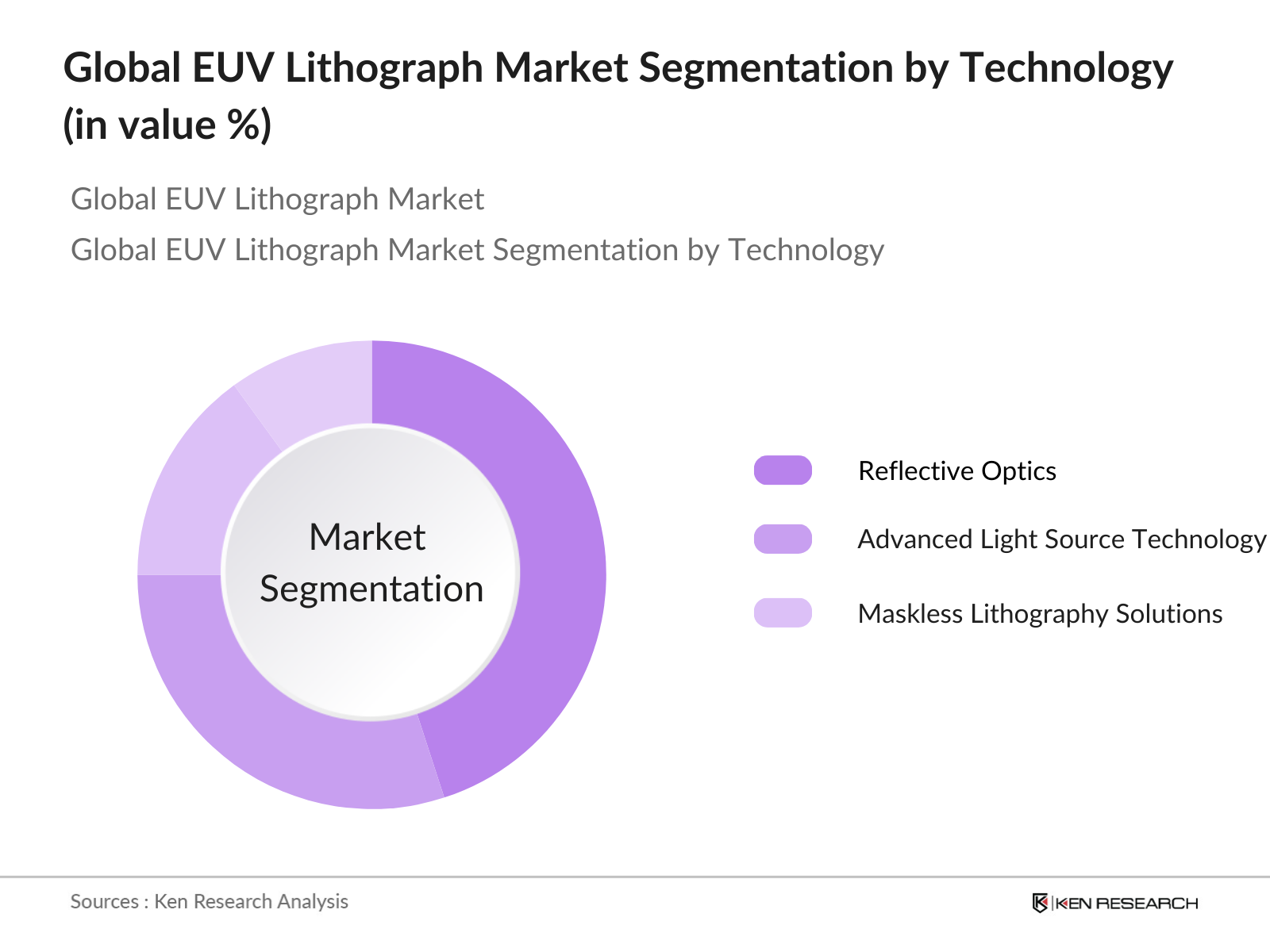

By Technology

The Global EUV Lithography market is segmented by technology into Reflective Optics, Advanced Light Source Technology, and Maskless Lithography Solutions. Reflective Optics holds a dominant share within this segment due to its ability to enhance imaging resolution and accuracy, essential for semiconductor production. The adoption of reflective optics technology by major players facilitates precise patterning on chips, which has become critical in the push for miniaturization and high-performance electronic devices.

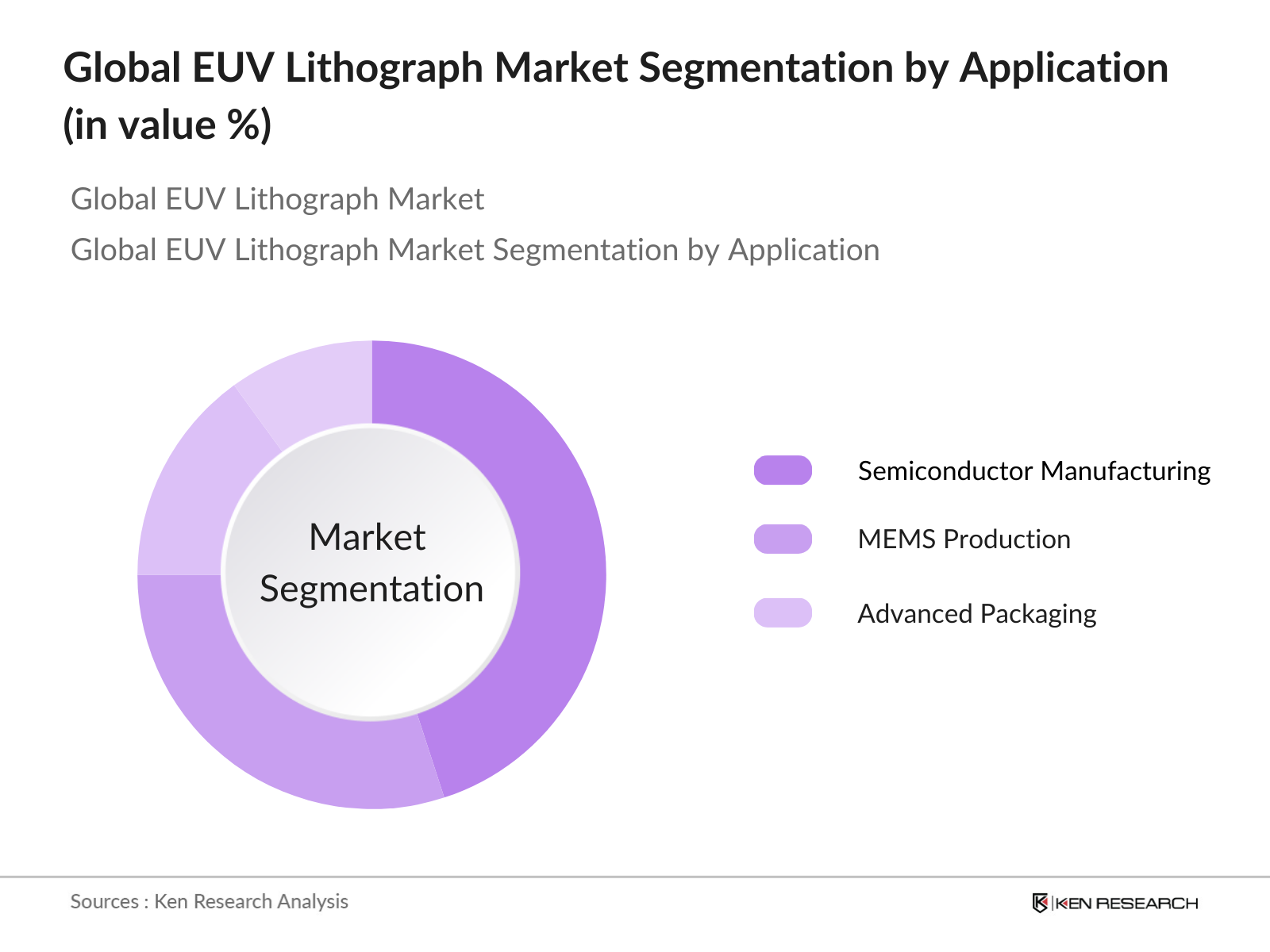

By Application

The market is segmented by application into Semiconductor Manufacturing, MEMS Production, and Advanced Packaging. Semiconductor Manufacturing leads this category due to its high demand in various industries, including consumer electronics, automotive, and telecommunications. The continuous rise in demand for advanced chips used in AI and 5G technologies contributes to the dominance of semiconductor manufacturing within the EUV lithography applications, with leading companies prioritizing this sector for its growth potential.

Global EUV Lithography Market Competitive Landscape

The competitive landscape of the Global EUV Lithography market is dominated by a few key players with substantial market influence due to technological innovation and strategic partnerships. Leading companies like ASML hold a prominent position due to their advanced R&D capabilities and extensive patent portfolios, while competitors from Japan and South Korea contribute to a competitive environment with specialized solutions and diversified product offerings.

Global EUV Lithograph Market Analysis

Growth Drivers

- Rising Demand for Semiconductor Miniaturization: The Global EUV Lithography market is increasingly driven by the semiconductor industry's shift toward miniaturized components. Semiconductor devices, essential in sectors like automotive, consumer electronics, and telecommunications, require advanced lithography solutions for achieving smaller, more powerful chips. According to the World Bank, global electronics exports grew by 12% in 2023, with significant contributions from chip manufacturing hubs in East Asia. As devices shrink in size, EUV lithography offers precision manufacturing solutions that meet the high demand for intricate patterning and superior processing speeds, enabling manufacturers to deliver more efficient products across diverse industries

- Government Support for Advanced Manufacturing: Government initiatives worldwide play a pivotal role in supporting the EUV Lithography market. For example, in 2023, the U.S. government allocated over USD 50 billion for advancing semiconductor manufacturing capabilities through the CHIPS Act, aimed at enhancing domestic production and technological self-reliance. In Asia, countries like South Korea and Taiwan have introduced subsidies for research and development in chip-making technologies, reflecting a strong commitment to supporting the semiconductor ecosystem, where EUV lithography remains a cornerstone technology for producing cutting-edge chips

- Demand from Key End-User Industries: End-user industries, particularly automotive, data centers, and consumer electronics, are primary drivers of the EUV Lithography market. The automotive industry's shift toward electric vehicles has intensified the demand for high-performance semiconductors, with electric vehicle sales growing 35% in 2023, as noted by the International Energy Agency. Similarly, the global data center market is projected to continue expanding, with increased investments in high-performance chips that rely on EUV lithography for precise, efficient production, aligning with the tech industrys push for reliable, high-density chip solutions

Market Challenges

- High Capital Investment: The EUV Lithography market faces substantial financial barriers, as manufacturing equipment costs often exceed USD 100 million per unit. This high capital requirement poses a challenge for smaller companies, creating a landscape dominated by large players who can absorb these expenses. In the United States, where the cost of manufacturing remains high, significant investment in infrastructure and skilled labor further compounds these expenses, resulting in slower market entry for new companies. The World Banks 2023 analysis underscores the need for sustainable funding models to address these high upfront costs

- Technical Challenges in Lithography Integration: Technical complexities inherent in EUV lithography integration pose another significant challenge. The technology requires ultra-clean environments and high-precision optics, which can be challenging for manufacturers to maintain, especially when scaling operations. Data from the International Technology Roadmap for Semiconductors (ITRS) in 2023 highlights the ongoing efforts to overcome obstacles related to source power, mask defectivity, and overall system reliability, issues that require continuous research and development investment by industry players

Global EUV Lithograph Market Future Outlook

Over the next five years, the Global EUV Lithography market is projected to expand significantly, driven by advances in semiconductor technology, increased demand for compact chip designs, and governmental support for high-tech manufacturing. The market is expected to see growing investments in high-resolution imaging and automation, aligning with the demand for faster and more energy-efficient lithography solutions. Major players are anticipated to increase R&D spending, further consolidating their market positions.

Market Opportunities

- Integration with AI and Quantum Computing: EUV lithography stands to benefit from the rapid integration of artificial intelligence and quantum computing, which demand high-precision and efficient chips. AI and quantum computing markets grew by 23% in 2023, with a clear shift toward smaller, more complex semiconductors. This trend provides EUV lithography manufacturers with a growing customer base that requires high-end patterning and efficient production methods. As companies innovate in AI-driven devices and quantum computing capabilities, EUV lithographys role in facilitating miniaturization and performance optimization offers significant growth potential

- Emerging Markets and Expansion of Manufacturing Facilities: Emerging markets in Southeast Asia, notably Vietnam and Malaysia, are rapidly expanding their semiconductor manufacturing capacities, offering a new avenue for EUV lithography. These countries recorded a collective 15% increase in high-tech manufacturing output in 2023, backed by government incentives and foreign investments. As semiconductor demand continues to grow globally, these markets are establishing production facilities, creating substantial opportunities for EUV lithography to penetrate new regions with high-tech, cost-efficient solutions

Scope of the Report

|

Segment |

Sub-Segments |

|

Equipment Type |

Light Sources, Masks and Mask Pellicles, Optics Components |

|

Wavelength |

13.5 nm, Other EUV Wavelengths |

|

Application |

Logic Circuits, Memory Chips, Power Management ICs |

|

End-User |

Semiconductor Manufacturing, Foundries, Integrated Device Manufacturers (IDMs) |

|

Region |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Commerce, EU Technology Commission)

Semiconductor Manufacturing Companies

Photomask and Optical Component Manufacturers

Electronics and Consumer Goods Corporations

R&D Institutes in Semiconductor Technology

Equipment Leasing and Financing Firms

Automation and Robotics Companies

Companies

Players mentioned in the report

ASML Holding N.V.

Canon Inc.

Nikon Corporation

Toppan Printing Co., Ltd.

Lam Research Corporation

KLA Corporation

Tokyo Electron Limited

Screen Holdings Co., Ltd.

Rudolph Technologies, Inc.

SSS MicroTec AG

ASMI

Veeco Instruments Inc.

Advanced Energy Industries, Inc.

Cymer (a division of ASML)

Applied Materials, Inc.

Table of Contents

1. Global EUV Lithography Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Technology Progression)

1.4 Market Segmentation Overview

2. Global EUV Lithography Market Size

2.1 Historical Market Size (USD Mn)

2.2 Year-on-Year Growth Analysis (Production Output)

2.3 Key Technological Milestones

2.4 Industry Landscape

3. Global EUV Lithography Market Analysis

3.1 Growth Drivers (Manufacturing Integration)

3.1.1 Semiconductor Demand

3.1.2 Technological Advancements

3.1.3 Government Incentives for Chip Production

3.1.4 Global Chip Demand

3.2 Market Challenges (Supply Chain Disruptions)

3.2.1 High Manufacturing Costs

3.2.2 Skilled Workforce Shortage

3.2.3 R&D Intensity Requirements

3.3 Opportunities (Automated Production)

3.3.1 AI and IoT Integration in Semiconductor Design

3.3.2 Rising Demand in Automotive Industry

3.3.3 Industry 4.0 and 5G Expansion

3.4 Trends (Nanofabrication)

3.4.1 Compact Chip Development

3.4.2 Power Efficiency Optimization

3.4.3 Increasing Lithography Resolution

3.5 Government Regulation (National Semiconductor Policy)

3.5.1 Compliance and Quality Standards

3.5.2 Trade Regulations and Tariffs

3.5.3 R&D Funding Initiatives

3.6 SWOT Analysis (Market Resilience)

3.7 Stakeholder Ecosystem (Supplier Integration)

3.8 Porters Five Forces (Supply Chain Dependency)

3.9 Competitive Landscape (Strategic Positioning)

4. Global EUV Lithography Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Light Sources

4.1.2 Masks and Mask Pellicles

4.1.3 Optics Components

4.2 By Wavelength (In Value %)

4.2.1 13.5 nm

4.2.2 Other EUV Wavelengths

4.3 By Application (In Value %)

4.3.1 Logic Circuits

4.3.2 Memory Chips

4.3.3 Power Management ICs

4.4 By End-User (In Value %)

4.4.1 Semiconductor Manufacturing

4.4.2 Foundries

4.4.3 Integrated Device Manufacturers (IDMs)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global EUV Lithography Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ASML Holding N.V.

5.1.2 Nikon Corporation

5.1.3 Canon Inc.

5.1.4 Applied Materials, Inc.

5.1.5 Tokyo Electron Limited

5.1.6 LAM Research Corporation

5.1.7 Carl Zeiss AG

5.1.8 Ultratech, Inc.

5.1.9 Gigaphoton Inc.

5.1.10 Veeco Instruments Inc.

5.1.11 KLA-Tencor Corporation

5.1.12 Dainippon Screen Group

5.1.13 Cymer (a subsidiary of ASML)

5.1.14 Toppan Printing Co., Ltd.

5.1.15 Ushio Inc.

5.2 Cross-Comparison Parameters (Technology Integration, R&D Investment, Employee Count, Headquarters, Revenue, Strategic Partnerships, Production Capacity, Market Share)

5.3 Market Share Analysis (By Revenue %)

5.4 Strategic Initiatives (Partnerships & Collaborations)

5.5 Mergers and Acquisitions (Recent Deals)

5.6 Investment Analysis (Global Investments in EUV)

5.7 Government Subsidies and Funding

5.8 Private Equity Investments

5.9 Venture Capital Insights

6. Global EUV Lithography Market Regulatory Framework

6.1 Compliance Standards

6.2 Certification and Licensing

6.3 International Trade Restrictions

7. Global EUV Lithography Future Market Size

7.1 Future Market Projections

7.2 Key Growth Factors

8. Global EUV Lithography Future Market Segmentation

8.1 By Equipment Type (Value %)

8.2 By Wavelength (Value %)

8.3 By Application (Value %)

8.4 By End-User (Value %)

8.5 By Region (Value %)

9. Global EUV Lithography Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Technology Adoption Metrics

9.3 Regional Expansion Strategy

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all relevant stakeholders in the EUV Lithography market, identifying critical factors influencing market dynamics, including technology advancements and regulatory factors.

Step 2: Market Analysis and Construction

This phase includes gathering historical data on market penetration and revenue trends in the EUV Lithography industry, assessing the adoption rates of key technologies and their impact on revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through interviews with industry experts from major semiconductor firms, offering insights into operational challenges and growth potential across different applications.

Step 4: Research Synthesis and Final Output

This phase consolidates findings from primary and secondary research, ensuring a comprehensive analysis of the market dynamics, segmentation, and competitive landscape for a reliable, data-driven market report.

Frequently Asked Questions

01. How big is the Global EUV Lithography Market?

The Global EUV Lithography market was valued at approximately USD 6 billion, driven by rising demand for miniaturized and high-performance semiconductor devices.

02. What are the key growth drivers of the Global EUV Lithography Market?

The market is driven by the increasing need for advanced semiconductor manufacturing processes, adoption of high-resolution lithography, and extensive R&D in chip design.

03. What challenges does the Global EUV Lithography Market face?

Challenges include the high capital investment required for EUV lithography technology, complexities in operational integration, and maintaining compliance with stringent environmental regulations.

04. Who are the major players in the Global EUV Lithography Market?

Key players include ASML Holding N.V., Canon Inc., Nikon Corporation, Toppan Printing Co., Ltd., and Lam Research Corporation, each contributing significant advancements to the market.

05. What are the key applications in the Global EUV Lithography Market?

Primary applications include semiconductor manufacturing, MEMS production, and advanced packaging, with semiconductor manufacturing leading due to high demand from consumer electronics and automotive industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.