Global Exhaust System Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD2224

October 2024

96

About the Report

Global Exhaust System Market Overview

- The global exhaust system market has reached USD 31.6 billion. The increasing production of automobiles, particularly in developing economies such as China and India, drives the growth of this market. The demand for emission control technologies is also on the rise due to stricter environmental regulations and government mandates aimed at reducing pollution levels. The adoption of advanced exhaust systems, such as selective catalytic reduction (SCR) and diesel particulate filters (DPF), plays a critical role in market expansion.

- The global exhaust system market is highly competitive, with major players such as Faurecia (France), Tenneco Inc. (USA), Eberspcher Group (Germany), Friedrich Boysen GmbH & Co. (Germany), and Benteler Automotive (Germany) leading the market. These companies are continually investing in R&D to develop innovative solutions that meet stringent emissions regulations. Their strong presence across key markets and collaborations with leading automakers gives them a competitive advantage.

- In 2023, Faurecia launched its latest exhaust system technology in collaboration with Hyundai Motor Group. This partnership resulted in the implementation of Faurecias new generation DPF, which significantly reduces nitrogen oxide emissions. This development aligns with the European Unions Euro 7 regulations, scheduled to take effect by 2025, further tightening emission standards for passenger vehicles and light commercial vehicles. This move highlights the industry's efforts to innovate in line with global environmental mandates.

- Cities like Shanghai and Detroit dominate the global exhaust system market. Shanghai, as one of the largest automobile manufacturing hubs in the world, benefits from the rapid growth of the automotive sector in China. Meanwhile, Detroit, home to the U.S. automotive industry, remains a leading center due to its strong R&D in emission control technologies. Both cities play a crucial role in the global supply chain of exhaust systems and contribute to the demand for advanced emission reduction technologies.

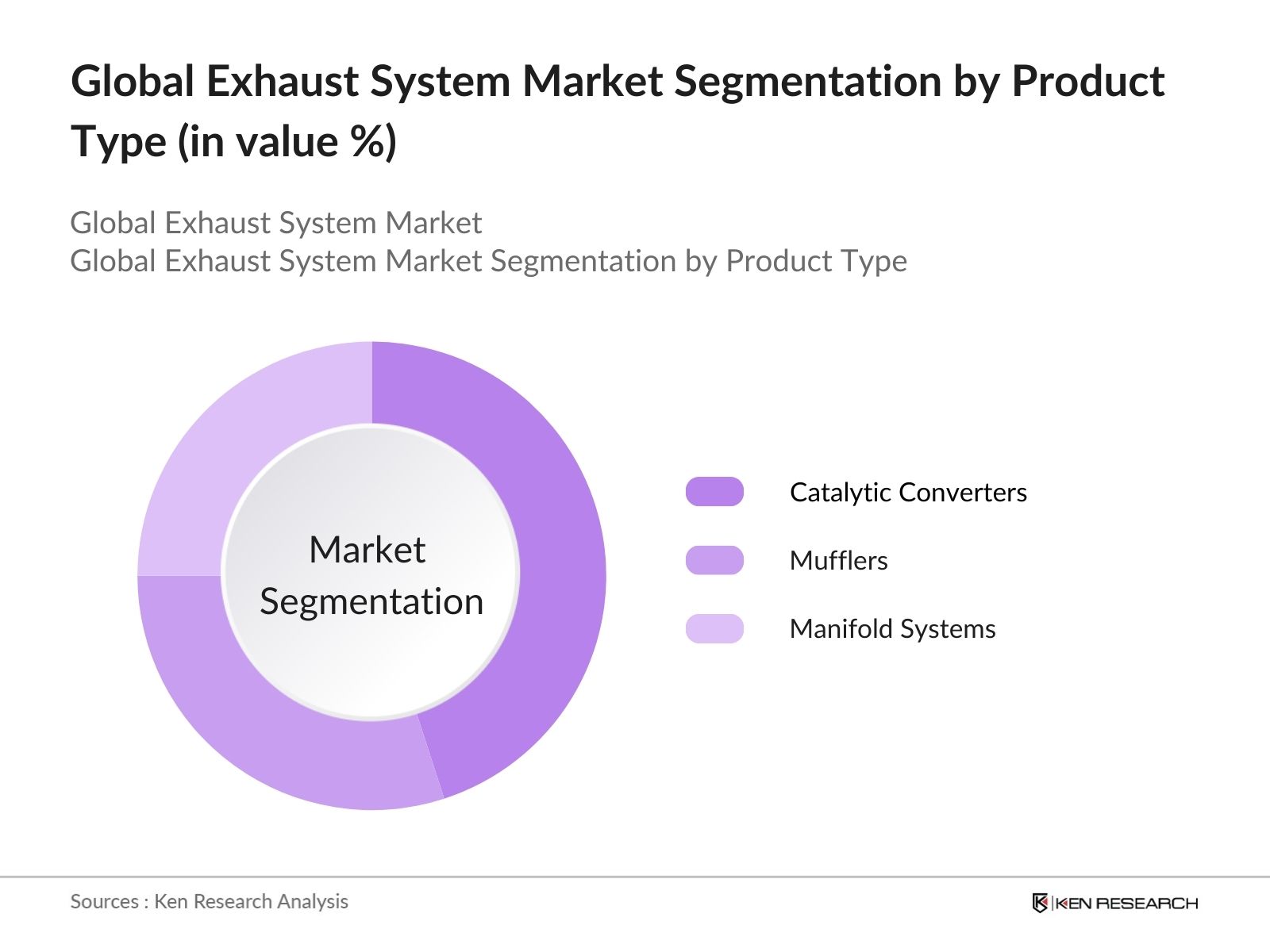

Global Exhaust System Market Segmentation

By Product Type: The global exhaust system market is segmented by product type into manifold systems, catalytic converters, and mufflers. In 2023, catalytic converters held the dominant market share due to increasing regulatory pressure to curb greenhouse gas emissions. The introduction of advanced catalytic converter technologies, such as three-way catalytic converters in developed regions like North America and Europe, has contributed to their dominance.

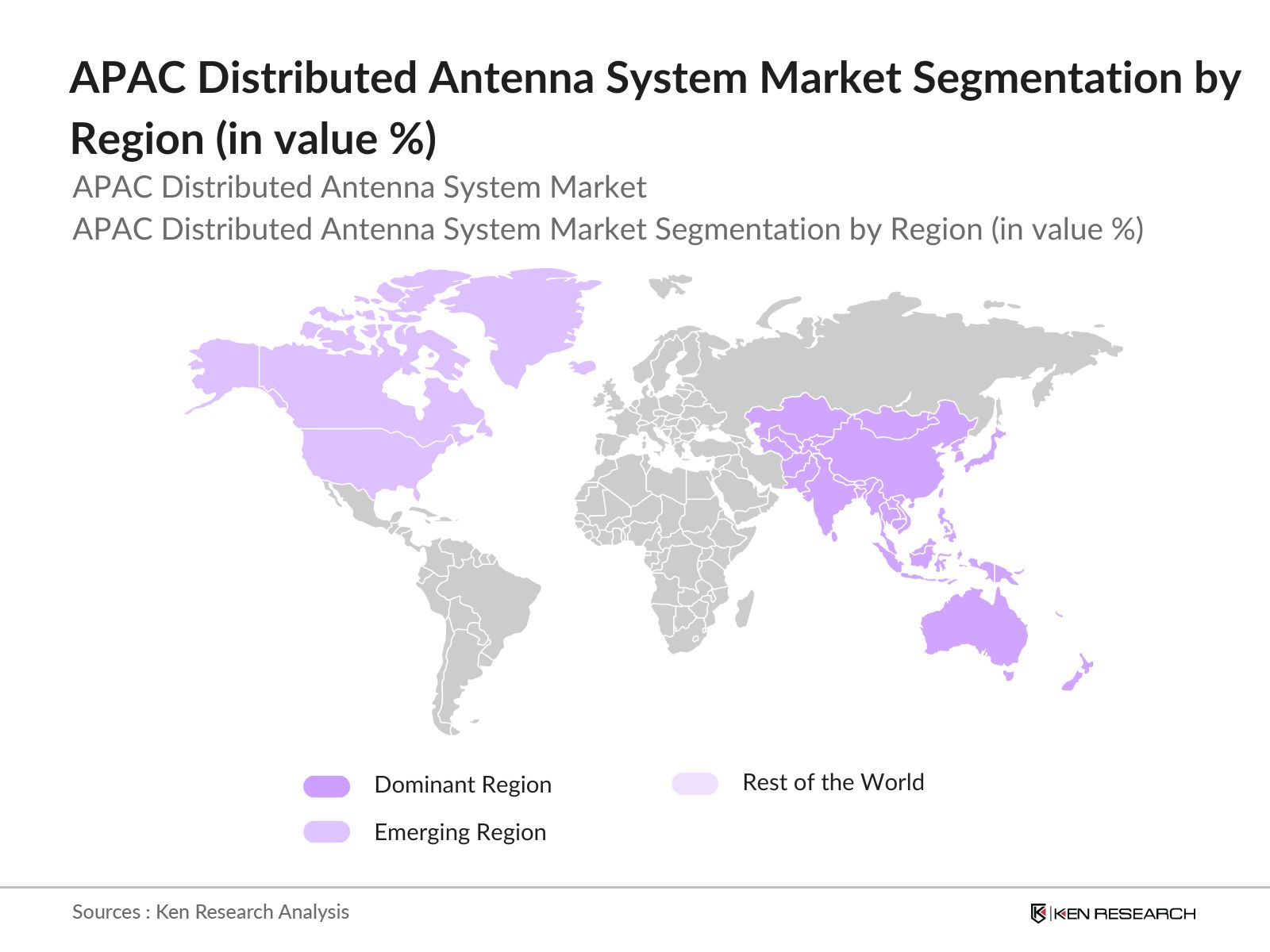

By Region: The global exhaust system market is segmented by region into North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and Latin America. In 2023, Asia-Pacific dominated the market, accounting for the largest share due to the rapid industrialization and increasing automotive production Government initiatives promoting eco-friendly vehicles further support this regional dominance.

By Vehicle Type: The market is also segmented by vehicle type into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). In 2023, passenger cars held the largest share, driven by the growing consumer demand for vehicles and increased production in emerging markets such as India and China. Stringent emission standards for passenger vehicles, particularly in Europe and North America, have further fueled the demand for efficient exhaust systems in this segment. Automakers have been incorporating advanced exhaust technologies to comply with environmental regulations.

Global Exhaust System Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Faurecia |

1997 |

Nanterre, France |

|

Tenneco Inc. |

1940 |

Illinois, USA |

|

Eberspcher Group |

1865 |

Esslingen, Germany |

|

Friedrich Boysen GmbH & Co |

1921 |

Altensteig, Germany |

|

Benteler Automotive |

1876 |

Paderborn, Germany |

- Faurecia: In April 2023, Faurecia expanded its production capabilities in India by establishing a new manufacturing facility in Pune. The plant specializes in producing advanced emission control technologies and has a projected annual output of 1 million units. This move comes in response to India's BS-VI norms, aiming to reduce emissions in the automotive sector, thus expanding Faurecias presence in the Asia-Pacific region.

- Tenneco: Tenneco, a leading player in the global exhaust system market, launched its latest SCR exhaust system in September 2023. This system was specifically designed for heavy commercial vehicles to meet Euro 7 emission standards. The new technology can reduce nitrogen oxide emissions by over 90%, positioning Tenneco as a leader in low-emission solutions for the commercial vehicle segment.

Global Exhaust System Market Analysis

Growth Drivers

- Stricter Emission Regulations Across Major Economies: Governments globally have tightened emission standards, driving the demand for advanced exhaust systems in automobiles. In 2023, the European Union implemented its stringent Euro 7 standards, reducing the allowable limits of nitrogen oxides and particulate matter in exhaust emissions. This regulatory push has driven automakers to invest in catalytic converters and selective catalytic reduction (SCR) technologies to comply with the standards. Similarly, India enforced BS-VI norms in 2023, targeting a 50% reduction in NOx emissions from diesel engines, prompting the need for sophisticated exhaust solutions.

- Rising Automotive Production in Emerging Markets: The growth of the automotive industry in emerging markets such as China, India, and Brazil continue to fuel the demand for exhaust systems. China alone produced over 26 million vehicles in 2023, making it the largest automotive producer worldwide. With governments in these regions pushing for cleaner air policies, automakers are increasingly integrating advanced exhaust technologies, such as diesel particulate filters (DPFs) and three-way catalytic converters, to meet both consumer demand and regulatory requirements.

- Growing Adoption of Hybrid Vehicles: Hybrid vehicles, combining internal combustion engines with electric powertrains, have experienced substantial market growth, driving demand for tailored exhaust solutions. In 2024, the global sales of hybrid vehicles surpassed 12 million units, particularly in regions like North America and Europe, where hybrid vehicle adoption rates have been highest. These vehicles still require advanced exhaust systems for their internal combustion engines, increasing demand for emission control technologies like SCR and low-emission catalytic converters.

Challenges

- High Development Costs of Advanced Exhaust Technologies: The development of advanced exhaust systems, such as SCR and DPF technologies, comes with significant costs. Manufacturers must invest heavily in research and development to meet stringent emissions standards like Euro 7 and BS-VI. This challenge is further exacerbated in regions with lower vehicle profit margins, such as Latin America.

- Fluctuating Raw Material Prices: The production of exhaust systems relies heavily on raw materials like steel and platinum, which are used in catalytic converters. Price fluctuations in these commodities create challenges for manufacturers by increasing production costs. This volatility makes it difficult for exhaust system manufacturers to maintain profitability while adhering to competitive pricing in global markets.

Government Initiatives

- Indias BS-VI Phase II Implementation: In 2023, India enforced BS-VI Phase II norms that mandate automakers to reduce tailpipe emissions for both commercial and passenger vehicles. These norms require vehicles to include advanced exhaust after-treatment systems like SCR and DPF, which help reduce particulate matter and nitrogen oxide emissions. This has resulted in increased demand for exhaust systems tailored for Indian climatic and road conditions, fueling market growth.

- Chinas Blue Sky Environmental Action Plan: In 2024, the Chinese government expanded its Blue Sky action plan, which includes strict vehicle emissions controls to curb air pollution in urban areas. As part of this initiative, China has implemented the China 6b emission standards, which require automakers to equip vehicles with state-of-the-art catalytic converters and DPF systems. The government is also offering subsidies for manufacturers that produce emission-compliant vehicles, further driving demand for advanced exhaust systems.

Global Exhaust System Market Future Outlook

The Global Exhaust System Market is projected to grow exponentially in future. This growth will be driven by stricter emission regulations across major economies, rising automotive production in emerging markets and growing adoption of hybrid vehicles.

Future Trends

- Increased Demand for Hybrid and Plug-in Hybrid Vehicle Exhaust Systems: Over the next five years, the market for exhaust systems specifically designed for hybrid and plug-in hybrid vehicles will grow significantly. As these vehicles continue to require exhaust systems for their internal combustion engines, the demand for low-emission exhaust technologies, such as selective catalytic reduction (SCR) systems, will rise substantially.

- Rise in Exhaust System Innovations for Commercial Vehicles: By 2028, the commercial vehicle segment will witness an influx of advanced exhaust systems that cater to stricter emission regulations. Heavy-duty vehicles will require more efficient and durable exhaust systems, particularly in regions like North America, where emissions standards are expected to tighten further. Manufacturers are likely to focus on developing lighter and more efficient exhaust systems that improve fuel economy while reducing emissions.

Scope of the Report

|

By Product Type |

Catalytic Converters |

|

By Region |

North America |

|

By Vehicle Type |

Passenger vehicles |

|

By Technology |

Active exhaust systems |

|

By End User |

OEMS (Original Equipment Manufacturers) Aftermarket |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Exhaust System Manufacturers

Electric Vehicle Manufacturers

Emission Control Technology Developers

Automotive Aftermarket Companies

Automotive Component Suppliers

Automotive Industry Associations

Emission Testing Companies

Government and Regulatory Bodies (e.g., European Commission, Environmental Protection Agency)

Venture Capitalists and Investment Firms

Companies

Players mentioned in the report:

Faurecia

Tenneco Inc.

Eberspcher Group

Friedrich Boysen GmbH & Co.

Benteler Automotive

Bosal

Sejong Industrial Co., Ltd.

Sango Co., Ltd.

Harbin Airui Automotive Exhaust Systems Co., Ltd.

Yutaka Giken Co., Ltd.

Table of Contents

1. Global Exhaust System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

1.5. Market Growth Rate Analysis

2. Global Exhaust System Market Size

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Developments and Milestones

3. Global Exhaust System Market Analysis

3.1. Key Growth Drivers

3.1.1. Regulatory Push for Emission Control

3.1.2. Growing Automotive Production in Emerging Markets

3.1.3. Technological Advancements in Exhaust Systems

3.2. Key Market Challenges

3.2.1. High Development Costs of Advanced Systems

3.2.2. Transition to Full Electrification

3.2.3. Fluctuating Raw Material Prices

3.3. Opportunities for Market Players

3.3.1. Expansion in Emerging Economies

3.3.2. Aftermarket Opportunities for Exhaust Components

3.3.3. Increasing Hybrid Vehicle Adoption

3.4. Key Market Trends

3.4.1. Integration of Lightweight Materials

3.4.2. Diesel Exhaust Fluid (DEF) Expansion

3.4.3. Demand for Advanced Catalytic Converters

3.5. Government Initiatives and Regulations

3.5.1. European Unions Euro 7 Standards

3.5.2. Indias BS-VI Norms

3.5.3. Chinas Blue Sky Action Plan

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem Analysis

3.8. Competition Ecosystem

4. Global Exhaust System Market Segmentation

4.1. By Product Type

4.1.1. Catalytic Converters

4.1.2. Diesel Particulate Filters (DPFs)

4.1.3. Selective Catalytic Reduction (SCR) Systems

4.2. By Vehicle Type

4.2.1. Passenger Vehicles

4.2.2. Light Commercial Vehicles

4.2.3. Heavy Commercial Vehicles

4.3. By End-User

4.3.1. OEMs (Original Equipment Manufacturers)

4.3.2. Aftermarket

4.4. By Technology

4.4.1. Active Exhaust Systems

4.4.2. Passive Exhaust Systems

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Exhaust System Market Competitive Landscape

5.1. Market Share Analysis

5.2. Company Profiles

5.2.1. Faurecia

5.2.2. Tenneco Inc.

5.2.3. Eberspcher Group

5.2.4. Benteler Automotive

5.2.5. Friedrich Boysen GmbH & Co.

5.2.6. Bosal

5.2.7. Sejong Industrial Co., Ltd.

5.2.8. Sango Co., Ltd.

5.2.9. Harbin Airui Automotive Exhaust Systems Co., Ltd.

5.2.10. Yutaka Giken Co., Ltd.

5.2.11. Katcon

5.2.12. Futaba Industrial Co., Ltd.

5.2.13. Donaldson Company, Inc.

5.2.14. Cummins Emission Solutions

5.2.15. Walker Exhaust Systems

5.3. Recent Developments and Strategic Initiatives

5.4. Mergers, Acquisitions, and Partnerships

6. Global Exhaust System Market Financial and Operational Parameters

6.1. Revenue Analysis by Key Players

6.2. Operational Efficiency Analysis (Production Output, Profit Margins)

6.3. Investments and R&D Focus

6.4. Investment Analysis

6.4.1. Venture Capital and Private Equity Investments

6.4.2. Government Grants and Subsidies

7. Global Exhaust System Market Regulatory Framework

7.1. Environmental Standards (Global and Regional)

7.2. Compliance Requirements and Certifications

7.3. Industry-Specific Regulations and Penalties

8. Global Exhaust System Market Future Outlook

8.1. Future Market Projections

8.2. Key Factors Driving Future Growth

8.2.1. Growth of Hybrid and Electric Vehicles

8.2.2. Innovation in Low Emission Exhaust Technologies

8.2.3. Government Push for Cleaner Air and Low Emission Standards

8.3. Emerging Opportunities in Key Markets

8.4. Analysts' Recommendations

9. Global Exhaust System Market Cross-Comparative Analysis

9.1. Cross Comparison of Major Competitors

9.2. Key Financial Metrics Comparison (Revenue, R&D Spend)

9.3. Geographic Presence and Market Penetration Analysis

10 Global Exhaust System Market Analysts' Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing and Distribution Strategy

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Global Exhaust System Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Exhaust System Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from manufacturing companies.

Frequently Asked Questions

01. How big is the Global Exhaust System Market?

The global exhaust system market was valued at USD 46 billion in 2023, driven by growing automotive production, stricter emission regulations, and the adoption of advanced exhaust technologies in key markets such as North America, Europe, and Asia-Pacific.

02. What are the challenges in the Global Exhaust System Market?

Challenges in the global exhaust system market include the high costs associated with developing advanced exhaust technologies, the increasing adoption of electric vehicles (which do not require exhaust systems), and fluctuating prices of raw materials such as steel and platinum.

03. Who are the major players in the Global Exhaust System Market?

Key players in the global exhaust system market include Faurecia, Tenneco Inc., Eberspcher Group, Benteler Automotive, and Friedrich Boysen GmbH & Co. These companies maintain dominance due to their strong R&D capabilities, extensive global reach, and partnerships with leading automakers.

04. What are the growth drivers of the Global Exhaust System Market?

The global exhaust system market is driven by stringent emission regulations, rising automotive production in emerging markets, and increasing demand for hybrid and plug-in hybrid vehicles, which still require advanced exhaust systems to control emissions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.