Global Farm Equipment Rental Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11369

November 2024

82

About the Report

Global Farm Equipment Rental Market Overview

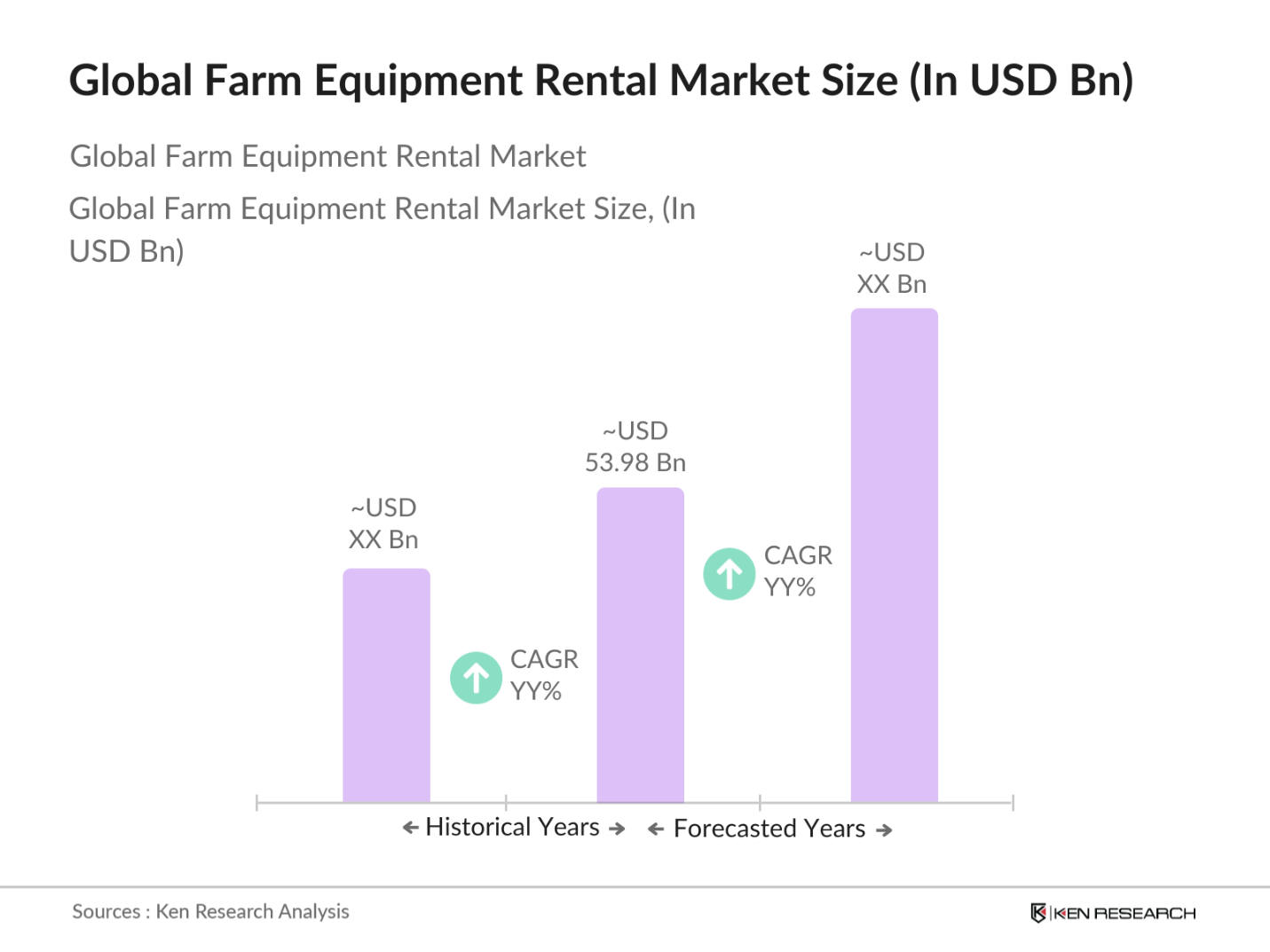

- The global farm equipment rental market is valued at approximately USD 53.98 billion, driven by increasing agricultural productivity and the rising need for financial flexibility among farmers. This sector has witnessed a significant shift towards rental services, allowing farmers to access the latest machinery without the substantial capital outlay associated with purchasing equipment. This trend is further accelerated by government initiatives promoting sustainable agriculture and innovative technologies designed to enhance efficiency in farming practices.

- Dominant players in the market include countries such as the United States and Germany, which have robust agricultural sectors and advanced technological infrastructures. The U.S. leads due to its extensive land area, advanced mechanization, and the prevalence of large-scale farms that require diverse and specialized equipment. Germanys strong focus on innovation in agricultural technologies and its significant export of farming machinery also contribute to its dominance in the global farm equipment rental landscape.

- Government subsidies play a pivotal role in promoting agricultural productivity and access to rental equipment. In 2023, the U.S. government allocated approximately $4.5 billion in subsidies aimed at promoting mechanization in agriculture. These subsidies not only assist farmers in accessing modern machinery but also encourage them to consider rental options for costly equipment. Such initiatives significantly enhance the growth prospects of the farm equipment rental market by lowering the financial barriers for farmers. These subsidies are designed to support not only small-scale farmers but also large agricultural operations, thus stimulating overall industry growth.

Global Farm Equipment Rental Market Segmentation

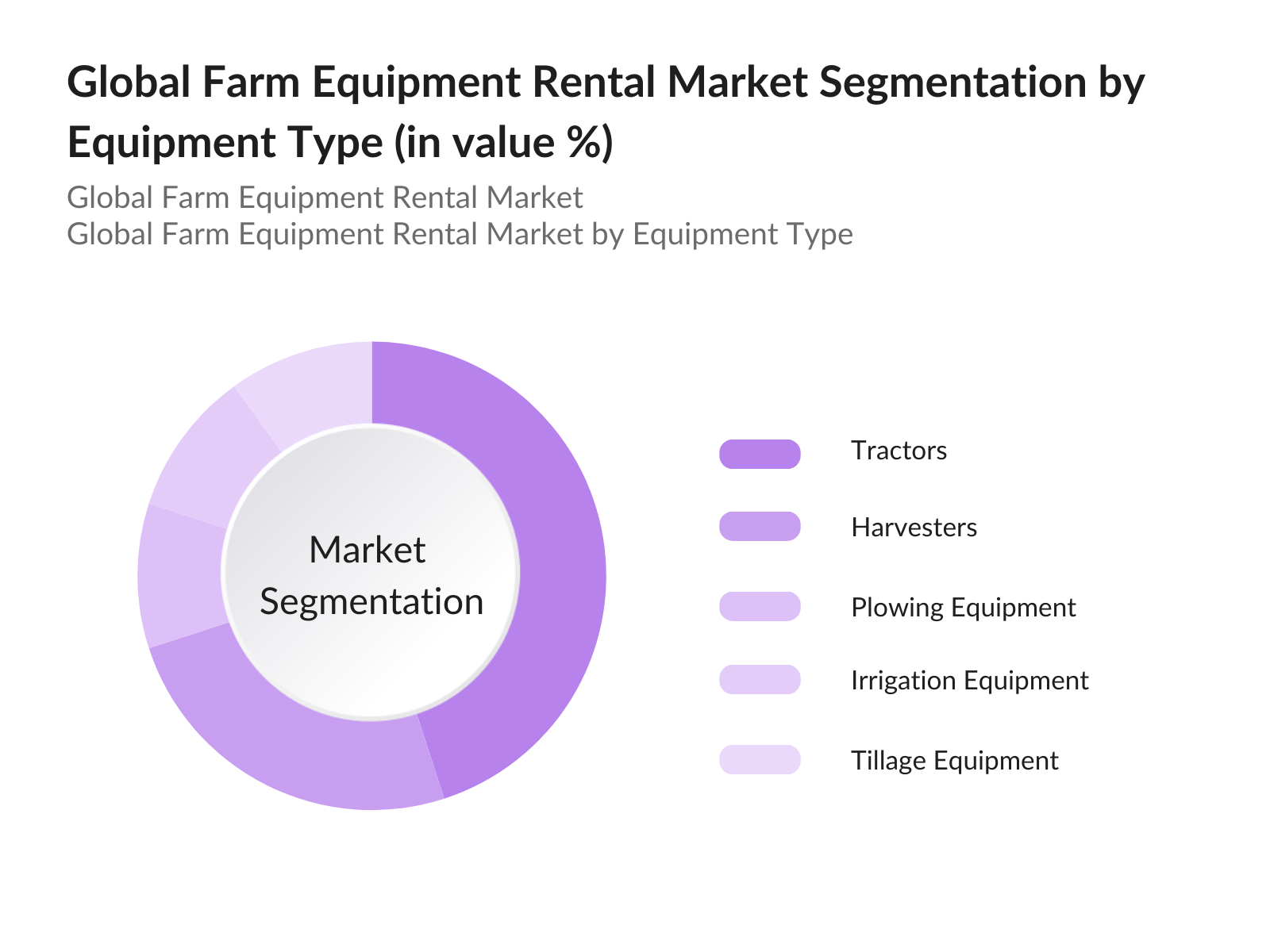

By Equipment Type: The global farm equipment rental market is segmented by equipment type into tractors, harvesters, plowing equipment, irrigation equipment, and tillage equipment. Currently, tractors dominate this segment due to their essential role in various farming activities, from plowing to hauling. Their versatility and efficiency make them indispensable for both small and large-scale operations. With advancements in technology and an increase in mechanization, the demand for tractors remains high, particularly in regions with large agricultural sectors.

By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America is the leading region in the farm equipment rental market, attributed to its advanced agricultural practices and large-scale farming operations. The significant presence of established rental companies and a high level of mechanization among farmers contribute to the dominance of this region. Europe follows closely, with a strong emphasis on innovation and sustainability in farming.

Global Farm Equipment Rental Market Competitive Landscape

The global farm equipment rental market is characterized by the presence of several major players, including local and international companies. The competitive landscape features companies such as United Rentals, Ashtead Group, and Herc Rentals, which have established strong market positions through diverse service offerings and extensive networks. The consolidation of these key players indicates a significant influence on market trends and customer preferences.

|

Company |

Establishment Year |

Headquarters |

Market Specific Parameters 1 |

Market Specific Parameters 2 |

Market Specific Parameters 3 |

Market Specific Parameters 4 |

Market Specific Parameters 5 |

Market Specific Parameters 6 |

|

United Rentals |

1997 |

Stamford, CT, USA |

Equipment Variety |

- |

- |

- |

- |

- |

|

Ashtead Group |

1984 |

London, UK |

Equipment Utilization |

- |

- |

- |

- |

- |

|

Herc Rentals |

1965 |

Bonita Springs, FL, USA |

Flexible Rental Terms |

- |

- |

- |

- |

- |

|

Sunbelt Rentals |

1983 |

Charlotte, NC, USA |

Local Market Focus |

- |

- |

- |

- |

- |

|

EquipmentShare |

2014 |

Columbia, MO, USA |

Digital Platforms |

- |

- |

- |

- |

- |

Global Farm Equipment Rental Market Analysis

Market Growth Drivers

- Increasing Agricultural Productivity: Farmers are increasingly seeking advanced equipment rental services to enhance their productivity in light of rising global food demands. The Food and Agriculture Organization (FAO) highlighted that to meet the needs of the expanding population, crop yields must improve significantly. In 2022, the agricultural productivity index in developing countries rose, reflecting a broader trend towards utilizing rental services for modern machinery. Rental services allow farmers to access state-of-the-art equipment without substantial upfront investment, thus supporting their efforts to maximize output and efficiency in farming operations.

- Rising Adoption of Advanced Technologies: Technological advancements in agriculture, such as precision farming tools and smart farming equipment, are crucial for enhancing operational efficiency. In 2023, the World Bank reported that many farmers in developed nations have adopted technologies like GPS-guided equipment and IoT-based monitoring systems. The integration of these technologies not only improves yield but also supports environmental sustainability. The total value of precision agriculture in 2022 was estimated at $7 billion, reflecting a growing recognition of the benefits of technology in modern farming.

- Financial Flexibility for Farmers: Farmers face fluctuating income levels due to market volatility and climate impacts. The International Monetary Fund (IMF) noted that agricultural income variability can be significant annually in some regions. By opting for rental equipment, farmers can manage operational costs more effectively, allowing for better financial planning. In 2022, many farmers indicated that renting machinery helped stabilize their cash flow during lean months, providing crucial financial flexibility. This trend is essential for small to medium-sized farms, which often operate on tight budgets.

Market Challenges:

- Seasonal Demand Variability: The agricultural sector is inherently seasonal, leading to fluctuating demand for rental equipment. For instance, the peak season for renting combines and tractors usually occurs from May to August in the Northern Hemisphere. During off-peak months, rental companies experience a notable decline in demand. This variability can strain rental businesses, leading to potential revenue losses. A 2022 report highlighted challenges faced by rental companies in maintaining consistent income due to these seasonal fluctuations.

- High Operational Costs: Operating and maintaining farm equipment incurs substantial costs, which can be prohibitive for rental companies. The World Bank noted that maintenance costs for heavy machinery can account for a significant portion of total operational expenses. Furthermore, in 2023, the average maintenance cost per piece of equipment reached approximately $5,000 annually, creating a financial burden on rental services. High operational costs can deter new entrants into the market, limiting competition and innovation.

Global Farm Equipment Rental Market Future Outlook

Over the next five years, the global farm equipment rental market is expected to experience substantial growth, propelled by technological advancements and increased demand for sustainable agricultural practices. As farmers look to optimize production while managing costs, rental services will become an increasingly attractive option. Additionally, government support and incentives for modernization and mechanization will further drive the expansion of this market, making it a pivotal component of the agricultural sector.

Market Opportunities:

- Expansion in Emerging Markets: Emerging markets present significant growth opportunities for the farm equipment rental sector. In 2023, countries like India and Brazil demonstrated a growing interest in mechanized agriculture, with rural development policies focusing on increasing productivity. The World Bank reported that agricultural investment in India increased by $1.3 billion in 2022, encouraging farmers to adopt modern technologies, including rental services for equipment. This trend is expected to continue, reflecting a shift in agricultural practices towards more efficient methods.

- Collaborative Farming Initiatives: Collaborative farming is gaining traction as farmers seek to share resources and reduce costs. Initiatives like co-ops and community-supported agriculture (CSA) are facilitating access to rented equipment. In 2022, over 1,000 new farming cooperatives were established in the U.S. alone, emphasizing shared equipment rental models. This approach not only lowers individual costs but also fosters a sense of community, enabling farmers to leverage advanced machinery that they might not afford independently.

Scope of the Report

|

By Equipment Type |

Tractors Harvesters Plowing Equipment Irrigation Equipment Tillage Equipment |

|

By Application |

Crop Production Horticulture Livestock Farming |

|

By Rental Model |

Short-Term Rentals Long-Term Rentals |

|

By End-User |

Individual Farmers Agricultural Cooperatives Government and NGOs |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Agricultural Cooperatives

Large-Scale Farmers

Small and Medium Enterprises (SMEs)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FAO)

Agricultural Equipment Manufacturers

Agricultural Consultants

Farm Management Software Providers

Companies

Players Mention in the Report

United Rentals

Ashtead Group

Herc Rentals

Sunbelt Rentals

EquipmentShare

Alamo Group

Caterpillar Inc.

John Deere

AGCO Corporation

Kubota Corporation

Mahindra & Mahindra Ltd.

CNH Industrial N.V.

JCB

Trimble Inc.

Volvo Group

Table of Contents

01. Global Farm Equipment Rental Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Farm Equipment Rental Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Farm Equipment Rental Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Agricultural Productivity

3.1.2. Rising Adoption of Advanced Technologies

3.1.3. Financial Flexibility for Farmers

3.2. Market Challenges

3.2.1. Seasonal Demand Variability

3.2.2. High Operational Costs

3.2.3. Equipment Maintenance and Management Issues

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Collaborative Farming Initiatives

3.3.3. Technological Integration in Rental Services

3.4. Trends

3.4.1. Digitization of Rental Services

3.4.2. Sustainable Farming Practices

3.4.3. Rise of Precision Agriculture Equipment

3.5. Government Regulation

3.5.1. Agricultural Subsidies

3.5.2. Environmental Impact Policies

3.5.3. Safety and Compliance Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global Farm Equipment Rental Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Tractors

4.1.2. Harvesters

4.1.3. Plowing Equipment

4.1.4. Irrigation Equipment

4.1.5. Tillage Equipment

4.2. By Application (In Value %)

4.2.1. Crop Production

4.2.2. Horticulture

4.2.3. Livestock Farming

4.3. By Rental Model (In Value %)

4.3.1. Short-Term Rentals

4.3.2. Long-Term Rentals

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East and Africa

4.5. By End-User (In Value %)

4.5.1. Individual Farmers

4.5.2. Agricultural Cooperatives

4.5.3. Government and NGOs

05. Global Farm Equipment Rental Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. United Rentals, Inc.

5.1.2. Ashtead Group PLC

5.1.3. Herc Rentals Inc.

5.1.4. Sunbelt Rentals, Inc.

5.1.5. EquipmentShare

5.1.6. Ahern Rentals, Inc.

5.1.7. Alamo Group Inc.

5.1.8. Caterpillar Inc.

5.1.9. John Deere

5.1.10. CNH Industrial N.V.

5.1.11. AGCO Corporation

5.1.12. Kubota Corporation

5.1.13. JCB

5.1.14. Mahindra & Mahindra Ltd.

5.1.15. Trimble Inc.

5.2. Cross Comparison Parameters (Market Share, Revenue, Number of Employees, Geographic Presence, Fleet Size, Rental Rates, Service Offerings, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Farm Equipment Rental Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. Global Farm Equipment Rental Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Farm Equipment Rental Market Future Segmentation

8.1. By Equipment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Rental Model (In Value %)

8.4. By Region (In Value %)

8.5. By End-User (In Value %)

09. Global Farm Equipment Rental Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global farm equipment rental market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global farm equipment rental market. This includes assessing market penetration, the ratio of rental services to ownership, and the resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple rental service providers to acquire detailed insights into service offerings, customer preferences, pricing strategies, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the global farm equipment rental market.

Frequently Asked Questions

01. How big is the global farm equipment rental market?

The global farm equipment rental market is valued at USD 53.98 billion, driven by increasing agricultural productivity and the rising need for financial flexibility among farmers.

02. What are the challenges in the global farm equipment rental market?

Challenges include high operational costs, seasonal demand variability, and the need for efficient maintenance and management of rented equipment, which can impact profitability and service quality.

03. Who are the major players in the global farm equipment rental market?

Key players in the market include United Rentals, Ashtead Group, Herc Rentals, and EquipmentShare, which dominate due to their extensive service networks and comprehensive equipment offerings.

04. What are the growth drivers of the global farm equipment rental market?

The market is propelled by factors such as increasing demand for mechanization in agriculture, government incentives for sustainable practices, and the financial flexibility offered by rental services to farmers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.