Global Fast Food Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3972

November 2024

97

About the Report

Global Fast Food Market Overview

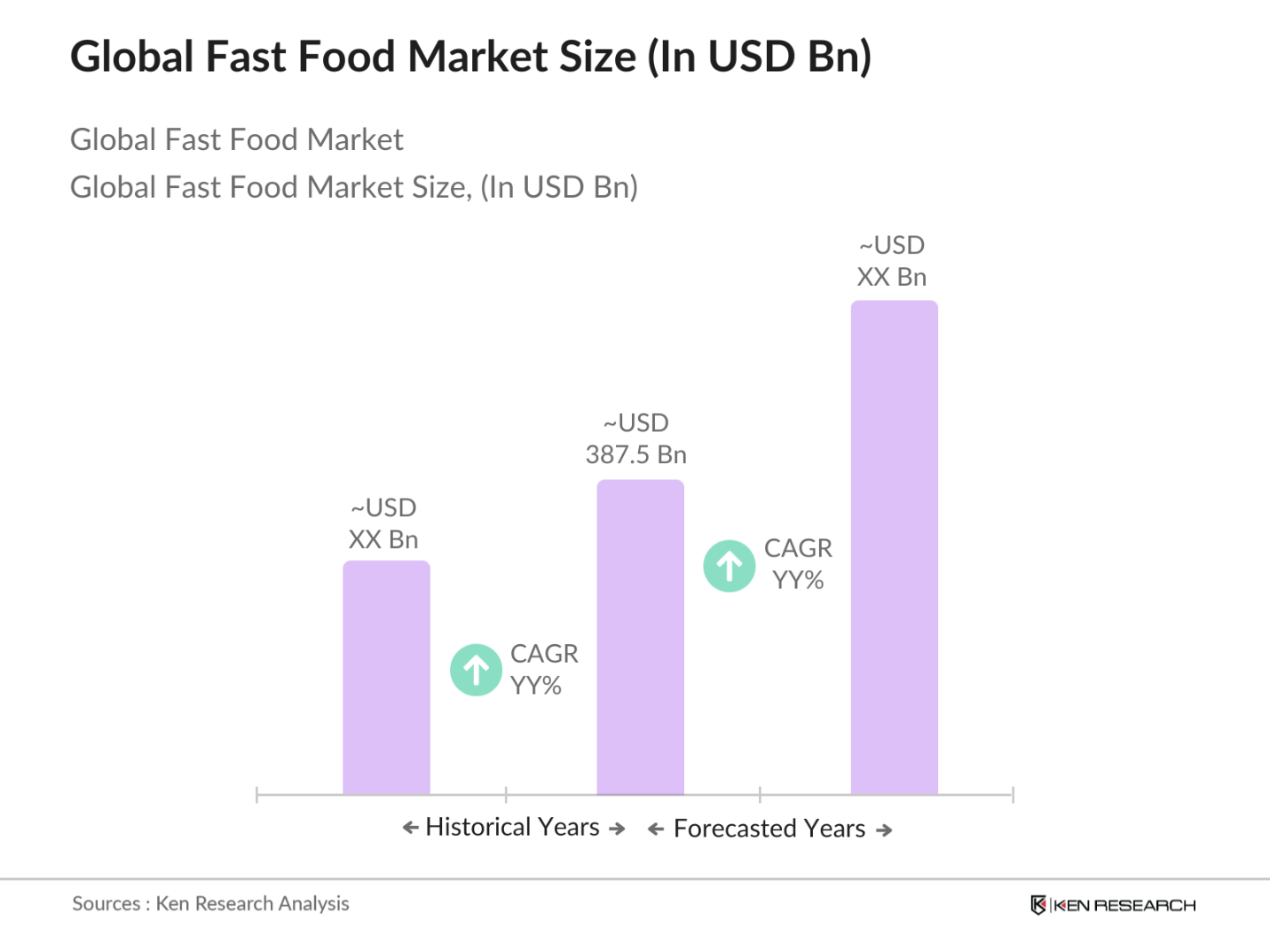

- The global fast food market was valued at approximately USD 387.5 billion, based on credible market data. This growth is primarily driven by rapid urbanization, evolving consumer preferences for quick-service meals, and the rising adoption of digital food delivery platforms. Additionally, increased disposable income, particularly in emerging economies, has further fueled demand. Consumers busy lifestyles and the convenience offered by fast food chains continue to make this market a dominant force in the global foodservice sector.

- Major countries that dominate the fast food market include the U.S., China, and India. In the U.S., fast food thrives due to the prevalence of dual-income households, high urbanization rates, and the well-established infrastructure of global fast food chains. China and India, on the other hand, have experienced massive growth owing to rising middle-class populations, expanding urban centers, and increased demand for convenient food options through delivery services.

- Under the "Digital India" initiative, the Indian government has actively promoted the adoption of digital payments, which has fueled the growth of online food delivery platforms. By 2023, India recorded over 50 billion digital payment transactions, including payments through food delivery apps like Swiggy and Zomato. The initiative has enhanced the accessibility of fast food for consumers in urban and semi-urban areas, streamlining cashless transactions and encouraging greater adoption of food delivery services. This drive for digitization is expected to further bolster food delivery app usage.

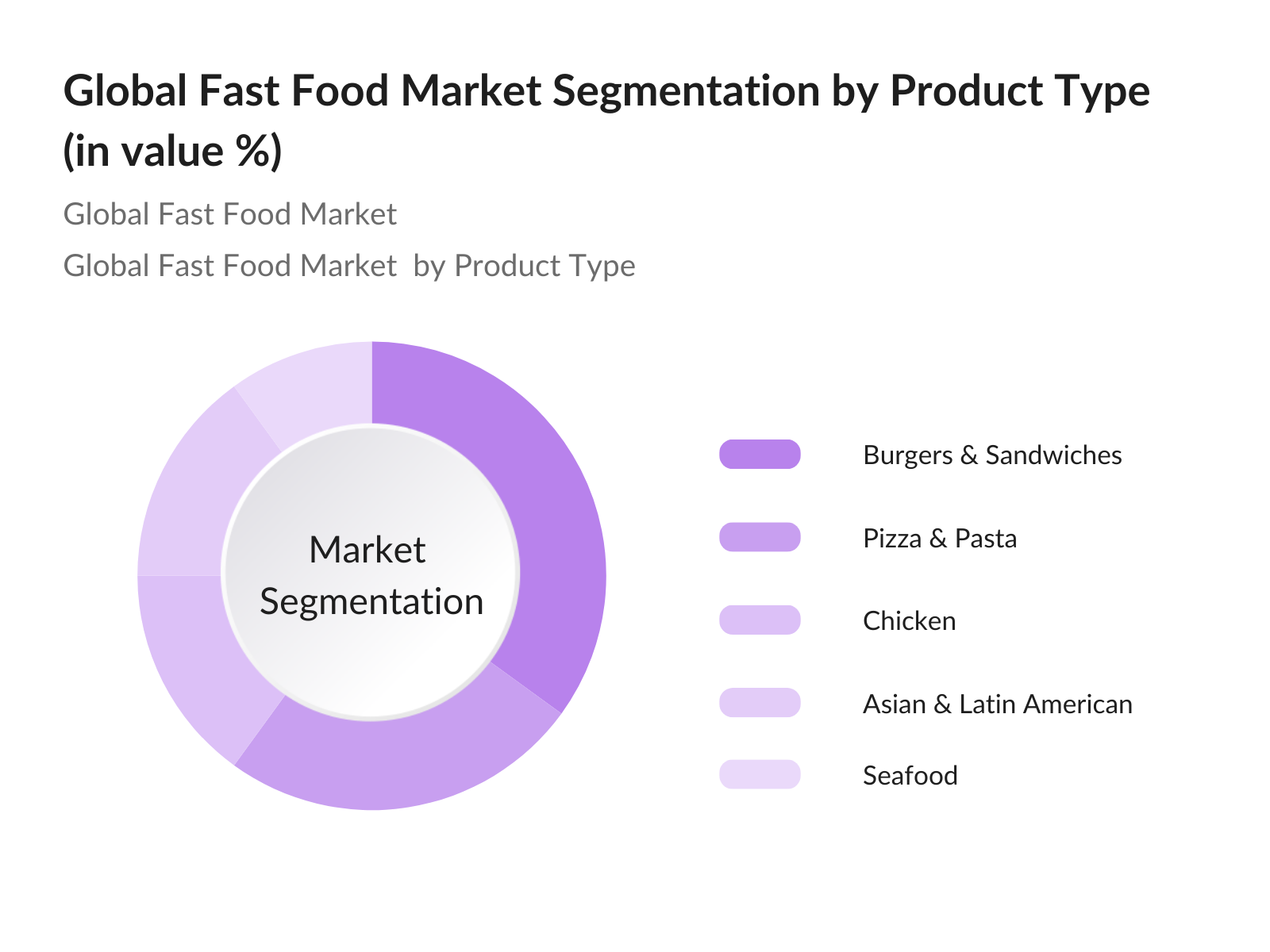

Global Fast Food Market Segmentation

By Product Type: The global fast food market is segmented by product type into burgers and sandwiches, pizza and pasta, chicken, Asian and Latin American cuisine, and seafood. Recently, the burgers and sandwiches segment has held a dominant share due to the ingrained presence of global brands like McDonalds and Burger King. Their ability to localize menus to suit regional tastes, combined with aggressive expansion into new markets, has cemented their dominance. Consumers preference for quick, affordable, and familiar meals further contributes to the success of this segment.

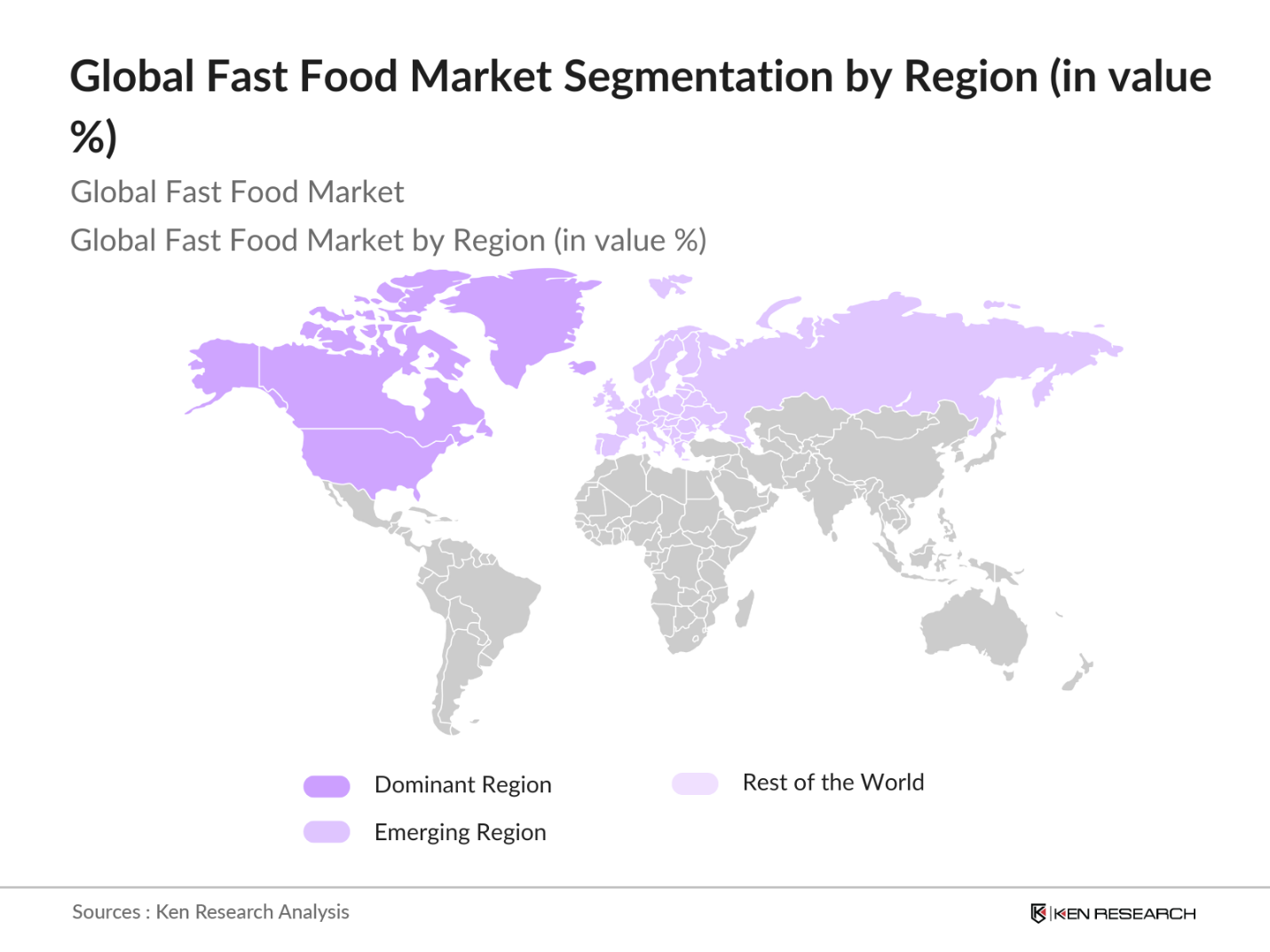

By Region: The global fast food market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In North America, the fast food market holds a significant share due to the presence of key industry players like McDonalds, Wendys, and Burger King. The region's high disposable income, widespread urbanization, and busy lifestyle have contributed to the dominance of fast food outlets. Moreover, the rise in digital food delivery platforms has allowed these chains to expand their reach across diverse urban and suburban areas.

Global Fast Food Market Competitive Landscape

The global fast food market is dominated by well-established players, characterized by their extensive global presence and consistent menu offerings. Major players include McDonalds, Yum Brands (KFC, Pizza Hut, Taco Bell), Restaurant Brands International (Burger King, Popeyes), and Dominos Pizza. These companies are continually expanding their digital presence to capitalize on the growing demand for food delivery. Furthermore, partnerships with local franchises have helped these brands localize their offerings and cater to regional tastes.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Global Locations |

Number of Outlets |

Digital Sales Share |

Menu Localization |

Sustainability Initiatives |

|

McDonalds Corporation |

1940 |

Chicago, USA |

USD 24 billion |

- |

- |

- |

- |

- |

|

Yum Brands Inc. (KFC, Pizza Hut) |

1997 |

Kentucky, USA |

USD 6 billion |

- |

- |

- |

- |

- |

|

Restaurant Brands International |

2014 |

Toronto, Canada |

USD 5 billion |

- |

- |

- |

- |

- |

|

Dominos Pizza Inc. |

1960 |

Michigan, USA |

USD 4.5 billion |

- |

- |

- |

- |

- |

|

Wendys International Inc. |

1969 |

Ohio, USA |

USD 1.7 billion |

- |

- |

- |

- |

- |

Global Fast Food Market Analysis

Market Growth Drivers

- Increasing Urbanization (Impact of Urban Workforce): The fast food market is experiencing significant growth, driven by the rising urban workforce. As of 2023, the global urban population stands at approximately 4.4 billion, with urbanization accelerating rapidly in emerging economies such as India and Nigeria. In India, a substantial portion of the workforce now resides in urban areas, where fast-paced lifestyles and longer work hours have increased reliance on fast food. In Nigeria, urbanization is also advancing, reflecting similar trends. This shift in demographics has made fast food a convenient choice for urban workers. According to the UN, urbanization is expected to continue rising, reinforcing demand for quick service restaurants in densely populated cities globally.

- Growing Adoption of Food Delivery Apps (Integration of Digital Platforms): With over 900 million people using smartphones in 2023, the adoption of food delivery apps has surged globally. Digital platforms like UberEats and Zomato reported handling over 200 million monthly orders, marking a significant shift in consumer behavior. The integration of technology into food delivery systems is enhancing operational efficiency and accessibility, particularly among the digital-savvy population. This trend is especially noticeable in urban areas where food delivery has become a popular choice for consumers. Moreover, food delivery is gaining traction in emerging markets, expanding access to fast food in previously underserved regions.

- Expansion of QSR Chains in Emerging Markets (New Franchise Openings): In 2023, multinational fast food chains like McDonald's and KFC opened over 1,500 new franchises across Asia and Africa, focusing on countries with rising middle-class populations. McDonald's reported opening 150 new stores in India alone, a market where fast food penetration remains relatively low. These expansions have contributed significantly to market growth in Tier 2 and 3 cities in countries like India, where disposable income levels have risen. Fast food outlets are targeting these regions with localized menus to attract the diverse consumer base in emerging markets, driving market growth.

Market Challenges:

- Supply Chain Disruptions (Post-Pandemic Recovery): Post-pandemic supply chain disruptions continue to challenge the fast food sector. Global shipping costs surged to record highs in 2022, with delays impacting the availability of key ingredients like chicken, wheat, and edible oils, which are essential for fast food production. For instance, the cost of transporting food items from major suppliers in Asia to the U.S. tripled in 2022, creating a significant cost burden for fast food chains. These supply chain challenges have caused price volatility and operational inefficiencies, slowing the growth of many fast food chains globally.

- Health Concerns and Rising Obesity Rates (Public Health Policy Impact): Rising obesity rates are a growing challenge for the fast food industry. In 2023, over 650 million adults worldwide were classified as obese, according to the World Health Organization. Countries like Mexico and the UK have introduced taxes on sugary drinks and unhealthy foods, which directly impact fast food chains. In the U.S., more than 40% of adults are considered obese, leading to increased scrutiny on fast food menus. Governments are also pushing for reformulation of fast food menus to reduce sugar, salt, and fat content, making it a key challenge for fast food chains to adapt.

Global Fast Food Market Future Outlook

Over the next few years, the global fast food market is expected to witness substantial growth driven by increasing urbanization, rising disposable income, and advancements in digital platforms. A key factor will be the continued expansion of food delivery services, which is likely to outpace traditional dine-in options. Additionally, fast food companies are expected to focus more on sustainability, offering plant-based menu items and adopting eco-friendly packaging as consumer awareness of health and environmental issues increases.

Market Opportunities:

- Technological Advancements in Food Delivery (Drone Deliveries, Automation): Advancements in technology are paving the way for innovative food delivery methods. In 2023, companies like Wing (Alphabet) piloted drone deliveries in the U.S., managing over 100,000 drone flights for fast food items. Automation has also been embraced by chains such as Domino's, which used robotic systems to deliver pizza in urban areas. This innovation is reducing delivery times and operational costs, enabling fast food companies to optimize customer experience. The increasing adoption of autonomous technology in the fast food delivery sector presents a significant opportunity for the market to expand its reach.

- New Market Penetration (Tier 2 and 3 Cities): Tier 2 and Tier 3 cities are becoming hotbeds for fast food market expansion. In India, cities such as Lucknow and Coimbatore saw a 35% increase in the number of fast food outlets in 2023 as chains move to capture these untapped markets. With an increasingly aspirational population and rising incomes, consumers in smaller cities are demanding quick service restaurants that offer a blend of affordability and convenience. Similar trends are seen across Southeast Asia, where fast food companies are establishing footholds in regions previously dominated by traditional street food vendors.

Scope of the Report

|

By Product Type |

Burgers & Sandwiches Pizza & Pasta Chicken Asian & Latin American Seafood |

|

By Service Type |

On-Premise Delivery & Takeaway Drive-Thru Service |

|

By End-User |

Quick Service Restaurants (QSRs) Fast Casual Restaurants |

|

By Food Category |

Vegan/Vegetarian Plant-Based Traditional Fast Food Gluten-Free Halal/Kosher |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Fast Food Chains

Quick Service Restaurants (QSRs)

Food Delivery Platforms

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration, FSSAI)

Franchise Operators

Food Packaging Suppliers

Restaurant Technology Providers

Companies

Players Mention in the Report

McDonalds Corporation

Yum Brands Inc. (KFC, Pizza Hut, Taco Bell)

Restaurant Brands International (Burger King, Popeyes)

Dominos Pizza Inc.

Wendys International Inc.

Subway

Dunkin Brands Group Inc.

Chipotle Mexican Grill

CKE Restaurants Holdings Inc. (Carls Jr., Hardees)

Little Caesars Enterprises Inc.

Inspire Brands Inc. (Arbys, Sonic)

Papa Johns International Inc.

Doctors Associates Inc. (Subway)

Firehouse Subs

Jack in the Box Inc.

Table of Contents

01. Global Fast Food Market Overview

Definition and Scope

Market Taxonomy

Market Structure (Quick Service Restaurants (QSRs), Fast Casual, Delivery/Takeaway)

Market Drivers and Challenges

02. Global Fast Food Market Size (USD Billion)

Historical Market Size (In USD)

Year-on-Year Growth Analysis

Key Market Developments and Milestones

03. Global Fast Food Market Analysis

Growth Drivers

Increasing Urbanization (Impact of Urban Workforce)

Growing Adoption of Food Delivery Apps (Integration of Digital Platforms)

Expansion of QSR Chains in Emerging Markets (New Franchise Openings)

Rising Disposable Income (Influence on Consumer Preferences)

Market Challenges

Health Concerns and Rising Obesity Rates (Public Health Policy Impact)

Supply Chain Disruptions (Post-Pandemic Recovery)

Opportunities

Technological Advancements in Food Delivery (Drone Deliveries, Automation)

Demand for Sustainable and Health-Conscious Food Options

New Market Penetration (Tier 2 and 3 Cities)

Trends

Plant-Based and Alternative Protein Products (Vegan and Vegetarian Menu Growth)

Increasing Focus on Customer Personalization (Digital Ordering Systems)

Health-Conscious Menus (Low-Calorie, Organic Options)

04. Global Fast Food Market Segmentation (By Value % and Volume)

By Product Type

Burgers & Sandwiches

Pizza & Pasta

Chicken

Asian & Latin American Cuisine

Seafood

By Service Type

On-Premise (Dine-In)

Delivery & Takeaway

Drive-Thru Service

By End-User

Quick Service Restaurants (QSRs)

Fast Casual Restaurants

By Region

North America (U.S., Canada, Mexico)

Europe (U.K., Germany, France)

Asia Pacific (China, India, Japan)

Latin America

Middle East & Africa

05. Global Fast Food Competitive Analysis

Detailed Profiles of Major Companies

McDonalds Corporation

Yum Brands Inc. (KFC, Pizza Hut, Taco Bell)

Restaurant Brands International (Burger King, Popeyes)

Domino's Pizza Inc.

Wendys International Inc.

Subway

Papa Johns International

Dunkin' Brands Group

Chipotle Mexican Grill

Inspire Brands (Arbys, Sonic)

Jack in the Box Inc.

CKE Restaurants Holdings (Carls Jr., Hardee's)

Firehouse Subs

Little Caesars Enterprises

Doctor's Associates Inc. (Subway)

Cross Comparison Parameters (Number of Outlets, Regional Presence, Revenue, Market Share, Digital Engagement, Menu Innovation, Sustainability Initiatives, Consumer Preferences)

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

06. Global Fast Food Market Regulatory Environment

Health and Safety Regulations (FDA, FSSAI)

Environmental and Sustainability Compliance (Plastic Usage, Carbon Emissions)

Labor and Employment Laws (Impact on Wages and Working Conditions)

07. Global Fast Food Future Market Size Projections (USD Billion)

Key Factors Driving Future Growth

Digital Transformation and AI Integration in Delivery

08. Global Fast Food Future Market Segmentation (By Value %)

By Product Type

By Service Type

By Region

09. Global Fast Food Market Analysts Recommendations

TAM/SAM/SOM Analysis

Consumer Segmentation and Targeting (Health-Conscious, Millennials, Gen Z)

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves mapping out key stakeholders in the global fast food market. Through desk research and secondary data collection, critical market variables are identified, such as consumer behavior, market penetration, and revenue trends.

Step 2: Market Analysis and Construction

In this phase, historical market data from proprietary databases are analyzed to understand growth patterns. Metrics like market size, service adoption rates, and global expansion strategies are evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews to validate key market assumptions. These consultations provide practical insights into operational strategies and regional market dynamics.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all gathered data into a comprehensive market report, ensuring accuracy through bottom-up and top-down approaches.

Frequently Asked Questions

01. How big is the global fast food market?

The global fast food market was valued at USD 387.5 billion, driven by increased urbanization and the widespread adoption of food delivery services.

02. What are the challenges in the global fast food market?

Challenges include rising health concerns over fast food consumption, the increasing regulatory pressure to offer healthier options, and environmental sustainability issues related to packaging and waste management.

03. Who are the major players in the global fast food market?

Key players include McDonalds, Yum Brands, Restaurant Brands International, Dominos, and Wendys, all of which have extensive global operations.

04. What are the growth drivers of the fast food market?

Growth drivers include increased disposable income, growing urban populations, and the rise of digital ordering platforms, which have enhanced convenience for consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.