Region:Global

Author(s):Geetanshi

Product Code:KRAA0075

Pages:85

Published On:August 2025

By Type:The market is segmented into three main types: Synthetic Antioxidants, Natural Antioxidants, and Blended/Customized Antioxidant Solutions. Among these,synthetic antioxidantssuch as BHA, BHT, and ethoxyquin currently account for the largest share due to their cost-effectiveness and stability. However,natural antioxidantslike tocopherols and rosemary extract are gaining traction, driven by increasing consumer preference for organic and natural products and regulatory restrictions on synthetic additives. Blended solutions are also emerging as they offer tailored formulations to meet specific nutritional and preservation needs .

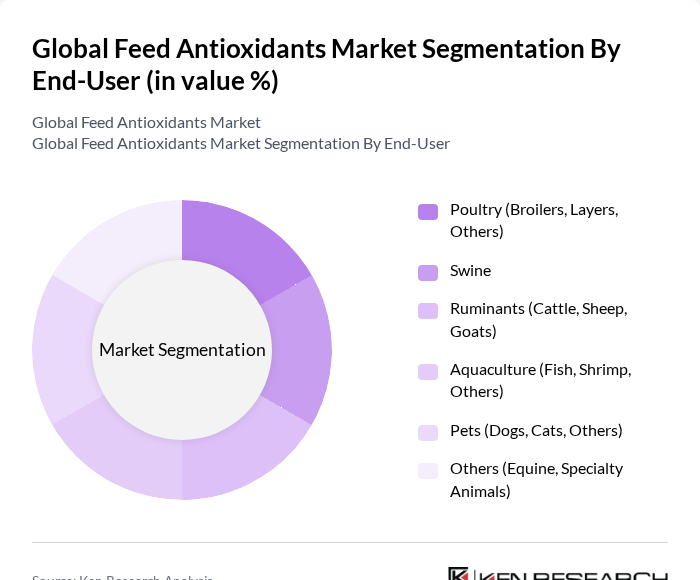

By End-User:The end-user segmentation includes Poultry, Swine, Ruminants, Aquaculture, Pets, and Others. ThePoultrysegment is the largest consumer of feed antioxidants, driven by the high demand for chicken meat and eggs globally. Swine and ruminants also represent significant portions of the market, as the health of these animals directly impacts meat quality and production efficiency. TheAquaculturesegment is growing rapidly due to the increasing consumption of fish and seafood, while thePetsegment is expanding as pet owners become more conscious of their pets' health .

The Global Feed Antioxidants Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Cargill, Incorporated, ADM Animal Nutrition (Archer Daniels Midland Company), Kemin Industries, Inc., Alltech, Inc., Nutreco N.V., DSM-Firmenich (formerly DSM Nutritional Products), Evonik Industries AG, Novus International, Inc., Phibro Animal Health Corporation, Impextraco NV, BioCare Copenhagen A/S, Camlin Fine Sciences Ltd., Natural Remedies Pvt. Ltd., Perstorp Holding AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the feed antioxidants market appears promising, driven by increasing consumer demand for high-quality animal products and a shift towards sustainable practices. Innovations in natural antioxidants and organic feed solutions are expected to gain traction, aligning with the growing trend of health-conscious consumers. Additionally, collaborations between feed manufacturers and research institutions will likely foster the development of advanced feed additives, enhancing the overall efficiency and sustainability of livestock production systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Antioxidants (e.g., BHA, BHT, Ethoxyquin) Natural Antioxidants (e.g., Tocopherols, Rosemary Extract, Vitamin E, Citric Acid) Blended/Customized Antioxidant Solutions |

| By End-User | Poultry (Broilers, Layers, Others) Swine Ruminants (Cattle, Sheep, Goats) Aquaculture (Fish, Shrimp, Others) Pets (Dogs, Cats, Others) Others (Equine, Specialty Animals) |

| By Formulation | Dry (Powder, Granules) Liquid Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Rest of Europe) Asia-Pacific (China, India, Japan, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (South Africa, GCC, Rest of MEA) |

| By Application | Feed for Livestock Feed for Pets Feed Premixes Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Feed Antioxidants | 60 | Feed Formulators, Poultry Nutritionists |

| Swine Feed Antioxidants | 50 | Swine Producers, Animal Health Specialists |

| Ruminant Feed Antioxidants | 40 | Dairy Farmers, Livestock Feed Managers |

| Pet Food Antioxidants | 40 | Pet Food Manufacturers, Veterinary Nutritionists |

| Feed Additive Distributors | 45 | Supply Chain Managers, Sales Directors |

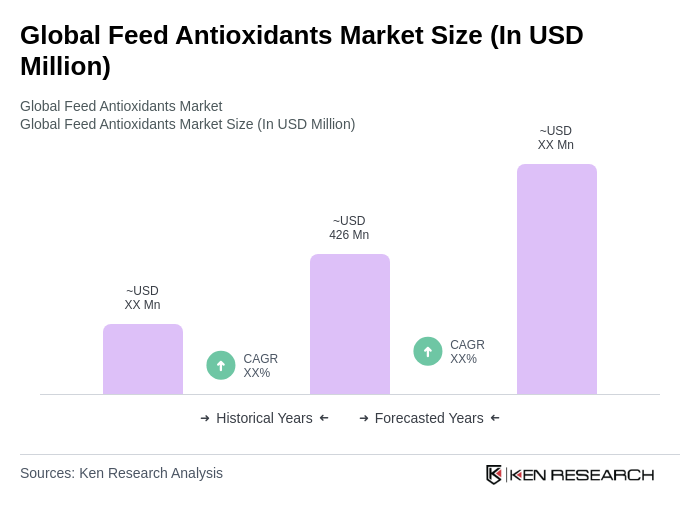

The Global Feed Antioxidants Market is valued at approximately USD 426 million, reflecting a significant growth driven by the increasing demand for high-quality animal feed and the rising awareness of the benefits of antioxidants in livestock nutrition.