Global Femtocell Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD8112

November 2024

97

About the Report

Global Femtocell Market Overview

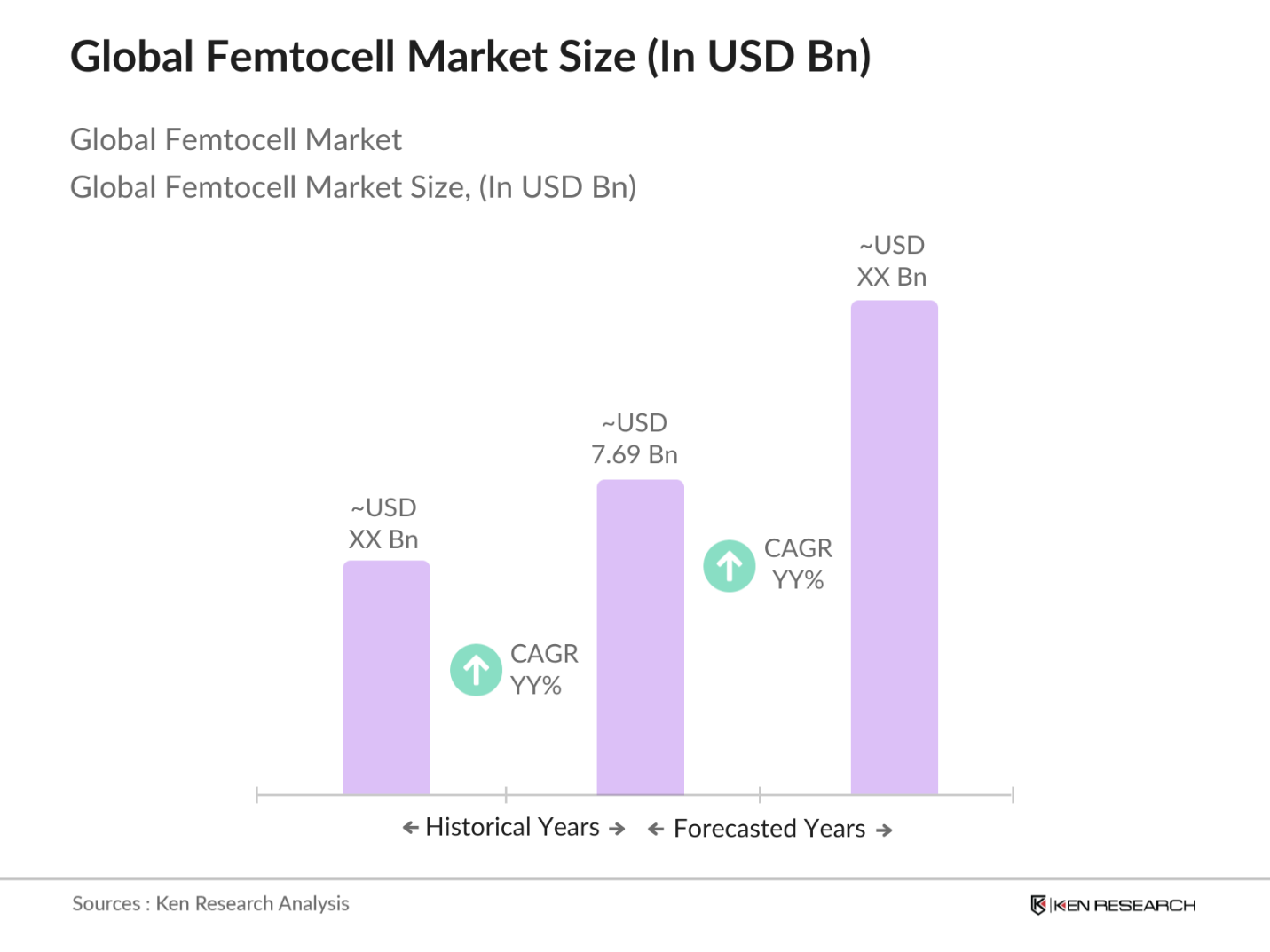

- The global femtocell market is valued at USD 7.69 billion, driven primarily by the rise in demand for wireless networks and the widespread adoption of 5G technology. Femtocells offer significant advantages in network densification, providing low-power solutions that enhance mobile network capacity and offer low-latency, high-speed connections in both residential and commercial spaces. This demand has been fueled by the growing adoption of mobile and internet services globally, especially as businesses and individuals increasingly rely on remote work and digital applications for their daily needs.

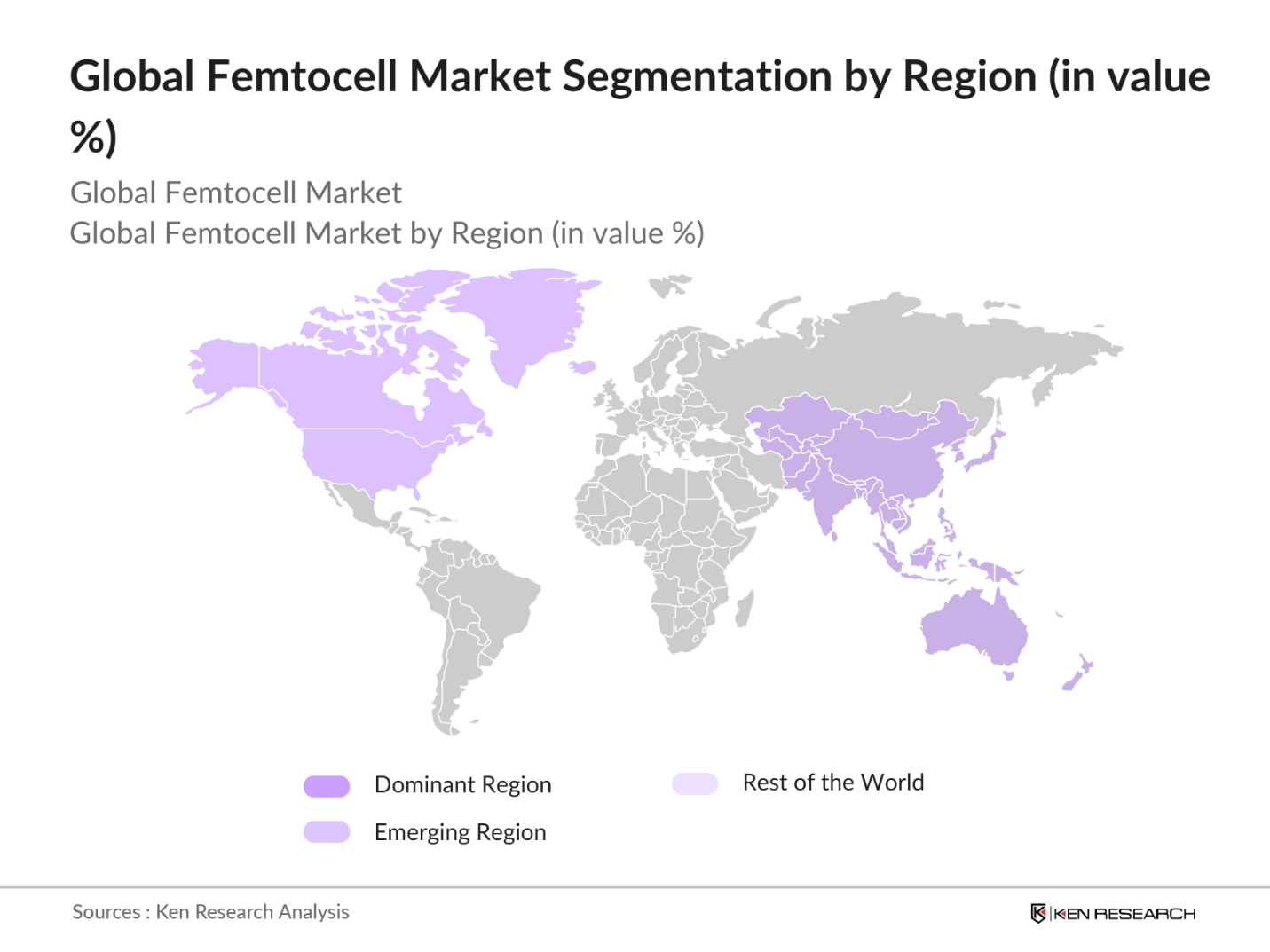

- Countries such as the U.S., China, and Japan dominate the femtocell market due to their advanced telecommunications infrastructure and early adoption of 5G technologies. In these regions, the need for enhanced indoor coverage, particularly in urban environments, is a critical driver. Additionally, these countries have invested significantly in upgrading their mobile networks, enabling femtocell deployment in high-demand areas such as stadiums, office complexes, and residential spaces.

- Governments around the world are investing heavily in the development of 5G infrastructure to accelerate the digital economy. For example, in 2023, the U.S. government committed over $40 billion under the Infrastructure Investment and Jobs Act to expand 5G coverage, particularly in underserved rural areas. Similarly, the European Union allocated 2 billion through its Digital Europe Programme for the advancement of 5G technology. These government-backed initiatives are crucial in driving the adoption of femtocells, as they play a pivotal role in enhancing network capacity and coverage in key regions.

Global Femtocell Market Segmentation

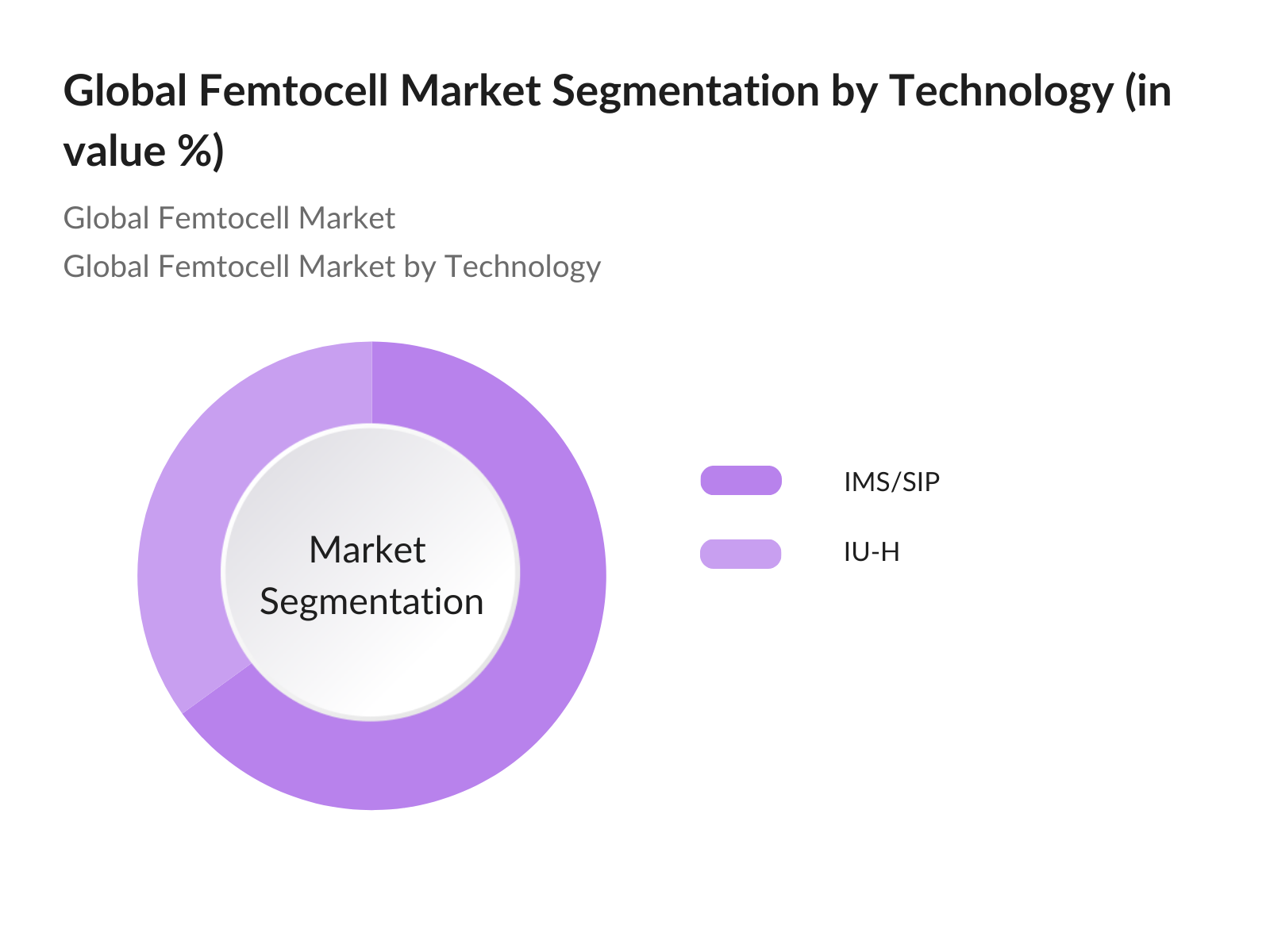

By Technology: The global femtocell market is segmented by technology into IMS/SIP and IU-H technologies. IMS/SIP dominates this segment due to its widespread use in providing high-quality voice, video, and data services over a unified network. The technologys flexibility and integration with existing mobile networks make it a preferred choice for enterprises and public spaces requiring reliable and high-capacity coverage. IMS/SIP technology has gained traction due to its capability to deliver seamless voice and multimedia services, enhancing the user experience for customers who demand uninterrupted connectivity.

By Region: The global femtocell market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the market due to rapid urbanization and the substantial investments in 5G infrastructure, particularly in countries like China, Japan, and South Korea. China leads in the adoption of 5G technology, which drives the deployment of femtocells in densely populated urban areas to provide better indoor coverage and support high-speed internet applications.

Global Femtocell Market Competitive Landscape

The global femtocell market is dominated by a mix of established telecom giants and emerging players, focusing on developing advanced small-cell solutions to enhance indoor and outdoor coverage. Companies such as Nokia, Samsung, and Cisco are prominent, leveraging their expertise in 5G infrastructure and telecommunications to capture a significant share of the market. Additionally, emerging players like ZTE and Huawei continue to introduce innovative products that further drive competition.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Employees |

Technology Focus |

Global Presence |

Market Strategy |

|

Nokia Corporation |

1865 |

Finland |

24 |

||||

|

Samsung Electronics |

1938 |

South Korea |

240 |

||||

|

Cisco Systems, Inc. |

1984 |

USA |

52 |

||||

|

ZTE Corporation |

1985 |

China |

15 |

||||

|

Huawei Technologies |

1987 |

China |

136 |

Global Femtocell Market Analysis

Market Growth Drivers

- Increased Adoption of 5G Networks (Technology, Demand): The global expansion of 5G networks is driving the demand for femtocells, particularly as enterprises require faster and more reliable wireless connectivity. By 2024, it is expected that over 1 billion devices will be connected to 5G networks, supported by major telecommunications infrastructure developments across Europe and Asia. The rapid rollout of 5G has spurred a higher demand for small cell solutions like femtocells, which are cost-efficient and optimize network capacity. In China alone, the government has facilitated the deployment of over 2.3 million 5G base stations as of 2023.

- Growing Demand for Wireless Connectivity in Enterprises (Application, End User): The need for seamless wireless connectivity in enterprise environments has surged, especially as hybrid work models continue to proliferate. Additionally, the demand for wireless enterprise solutions has been bolstered by increased investments in cloud technologies and private 5G infrastructure. This acceleration of wireless solutions, including femtocells, is transforming office and industrial environments by enhancing connectivity and operational efficiency. The rise in demand for flexible, secure, and high-performance network solutions is a critical factor driving the adoption of femtocells in enterprise settings across various industries.

- Rising Mobile Data Traffic (End User, Application): Mobile data traffic has grown exponentially, with global mobile network data traffic exceeding 130 exabytes per month by the end of 2023, according to the International Telecommunication Union (ITU). This increase is largely driven by high-definition video streaming, online gaming, and cloud services, leading to network congestion. Femtocells are increasingly being deployed as a solution to offload traffic from macro networks and enhance connectivity for both individual and enterprise users. The ITU reports that mobile data traffic will continue to rise due to the increasing number of connected devices and 5G network usage.

Market Challenges:

- Competition with Wi-Fi and Other Small Cells (Competition, Cost): Wi-Fi, which is already a prevalent solution in residential and enterprise environments, poses significant competition to femtocells. As of 2023, over 14 billion Wi-Fi devices are in use globally, according to the Wi-Fi Alliance. While femtocells provide superior coverage in areas with limited cellular reception, Wi-Fi's ubiquitous nature and free access in many public areas make it a strong alternative. Additionally, Wi-Fi 6 advancements continue to narrow the performance gap between the two technologies, potentially limiting femtocell adoption in certain markets.

- High Initial Setup Costs (Cost, Deployment): The initial cost of setting up femtocell networks can be prohibitive, particularly for small enterprises and residential users. A typical femtocell unit costs between $150 and $500, while deployment at scale requires additional investments in supporting infrastructure and maintenance. This creates a barrier to entry for many users compared to other wireless solutions. A 2022 report from the International Monetary Fund (IMF) noted that in low-income countries, telecom operators face significant financial challenges in deploying advanced wireless networks due to high upfront capital requirements.

Global Femtocell Market Future Outlook

Over the next five years, the global femtocell market is expected to witness significant growth driven by the continued roll-out of 5G networks, the expansion of smart cities, and the rising demand for low-latency, high-speed internet connections. Femtocells will play a crucial role in ensuring robust wireless network coverage in densely populated urban centers, commercial buildings, and remote areas. The rapid adoption of IoT devices and the increasing reliance on mobile services for business and personal use will further accelerate market expansion.

Market Opportunities:

- Expansion into Emerging Markets (Region, Demand): Emerging markets present a significant opportunity for femtocell deployment, especially as mobile penetration increases in regions like Africa and Southeast Asia. By 2023, over 500 million people in Africa were using mobile internet services, representing a major opportunity for wireless infrastructure expansion, according to the GSM Association. Femtocells can provide low-cost and efficient solutions to improve network coverage in these regions, particularly in rural areas where macrocell deployments are less feasible due to financial constraints.

- Growth in Internet of Things (IoT) Connectivity (Application, Technology): The proliferation of IoT devices is driving demand for localized wireless networks, making femtocells a suitable solution for connecting a wide array of smart devices. According to the International Energy Agency (IEA), by 2024, there will be over 30 billion connected IoT devices globally, creating an urgent need for optimized network infrastructure. Femtocells provide the low-latency, high-speed connectivity required to support these devices in various applications, from smart homes to industrial IoT systems.

Scope of the Report

|

By Product Type |

IMS/SIP IU-H |

|

By Femtocell Type |

2G Femtocell 3G Femtocell 4G Femtocell 5G Femtocell |

|

By Application |

Indoor Outdoor |

|

By End-User |

Residential Commercial Public Space |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Mobile Network Operators

Internet Service Providers (ISPs)

Femtocell Manufacturers

Government and Regulatory Bodies (Federal Communications Commission, Ministry of Industry and Information Technology)

Telecommunication Service Providers

Real Estate Developers

Smart City Planners

Investment and Venture Capitalist Firms

Companies

Players Mention in the Reports

Nokia Corporation

Samsung Electronics Co., Ltd.

Cisco Systems, Inc.

Ericsson AB

ZTE Corporation

Huawei Technologies Co., Ltd.

Fujitsu Ltd.

Qualcomm Inc.

Airvana Inc.

Netgear Inc.

CommScope Inc.

Vodafone Group Plc

Telefonaktiebolaget LM Ericsson

Aricent Inc.

Corning Incorporated

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

2. Global Femtocell Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments

3. Market Analysis

3.1 Growth Drivers

3.1.1 Increased Adoption of 5G Networks (Technology, Demand)

3.1.2 Growing Demand for Wireless Connectivity in Enterprises (Application, End User)

3.1.3 Rising Mobile Data Traffic (End User, Application)

3.1.4 Cost Efficiency and Low Power Consumption of Femtocells (Technology, Cost Structure)

3.2 Market Challenges

3.2.1 Competition with Wi-Fi and Other Small Cells (Competition, Cost)

3.2.2 High Initial Setup Costs (Cost, Deployment)

3.2.3 Interference in Dense Urban Areas (Application, Technology)

3.3 Opportunities

3.3.1 Expansion into Emerging Markets (Region, Demand)

3.3.2 Growth in Internet of Things (IoT) Connectivity (Application, Technology)

3.3.3 Private 5G Networks (Application, Technology)

3.4 Trends

3.4.1 Adoption of IMS/SIP Technology for Better Connectivity (Technology)

3.4.2 Integration with Smart City Projects (Application, Region)

3.4.3 Deployment of 5G-Compatible Femtocells (Technology)

4. Global Femtocell Market Segmentation

4.1 By Technology (In Value %)

4.1.1 IMS/SIP

4.1.2 IU-H

4.2 By Femtocell Type (In Value %)

4.2.1 2G Femtocell

4.2.2 3G Femtocell

4.2.3 4G Femtocell

4.2.4 5G Femtocell

4.3 By Application (In Value %)

4.3.1 Indoor

4.3.2 Outdoor

4.4 By End User (In Value %)

4.4.1 Residential

4.4.2 Commercial

4.4.3 Public Space

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Femtocell Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Nokia Corporation

5.1.2 Samsung Electronics Co., Ltd.

5.1.3 Cisco Systems, Inc.

5.1.4 Ericsson AB

5.1.5 Fujitsu Ltd.

5.1.6 ZTE Corporation

5.1.7 Huawei Technologies Co., Ltd.

5.1.8 Qualcomm Inc.

5.1.9 Airvana Inc.

5.1.10 Netgear Inc.

5.1.11 CommScope Inc.

5.1.12 Vodafone Group Plc

5.1.13 Aricent Inc.

5.1.14 Motorola Solutions, Inc.

5.1.15 Corning Incorporated

5.2 Cross-Comparison Parameters (Revenue, Headquarters, Number of Employees, Inception Year, Market Share, Product Portfolio, Regional Presence, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Mergers, Acquisitions, Investments)

5.5 Investment and Funding Analysis

6. Global Femtocell Market Regulatory Framework

6.1 Government Regulations (Telecom Regulations, 5G Licensing)

6.2 Spectrum Allocation (By Region)

6.3 Compliance Standards

7. Future Market Size (In USD Bn)

7.1 Market Projections

7.2 Key Drivers of Future Growth

8. Future Market Segmentation

8.1 By Technology (IMS/SIP, IU-H)

8.2 By Application (Indoor, Outdoor)

8.3 By Femtocell Type (2G, 3G, 4G, 5G)

8.4 By End User (Residential, Commercial, Public Space)

8.5 By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa)

9. Analysts Recommendations

9.1 Market Penetration Strategies

9.2 Potential Market Expansion

9.3 Key Marketing Initiatives

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the major stakeholders in the global femtocell market, including telecom operators, hardware manufacturers, and government agencies. Extensive desk research is conducted to gather information on key drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

In this step, historical market data is analyzed to assess market penetration and growth trends. A thorough evaluation of product performance, market demand, and network infrastructure is conducted to develop accurate revenue models.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through consultations with industry experts, including executives from leading telecom companies and small-cell infrastructure providers. These insights are crucial in refining the market estimates and forecasts.

Step 4: Research Synthesis and Final Output

The final phase consolidates data from primary and secondary sources to create a comprehensive view of the femtocell market. Detailed analysis of market segments, competitive landscape, and emerging trends is presented to ensure accuracy and reliability.

Frequently Asked Questions

01. How big is the global femtocell market?

The global femtocell market is valued at USD 7.69 billion, driven by the rapid deployment of 5G networks and the increasing demand for enhanced indoor coverage.

02. What are the challenges in the femtocell market?

Key challenges include competition with Wi-Fi and other small cells, as well as high initial setup costs for deploying femtocell infrastructure in densely populated urban areas.

03. Who are the major players in the femtocell market?

Major players include Nokia Corporation, Samsung Electronics, Cisco Systems, Huawei Technologies, and ZTE Corporation, all of which dominate the market due to their expertise in 5G and small-cell solutions.

04. What are the growth drivers of the femtocell market?

The market is driven by the increasing demand for high-speed, low-latency wireless networks, especially in urban environments, as well as the growing adoption of 5G technology and the proliferation of IoT devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.