Global Field-Programmable Gate Array (FPGA) Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6206

November 2024

98

About the Report

Global Field-Programmable Gate Array (FPGA) Market Overview

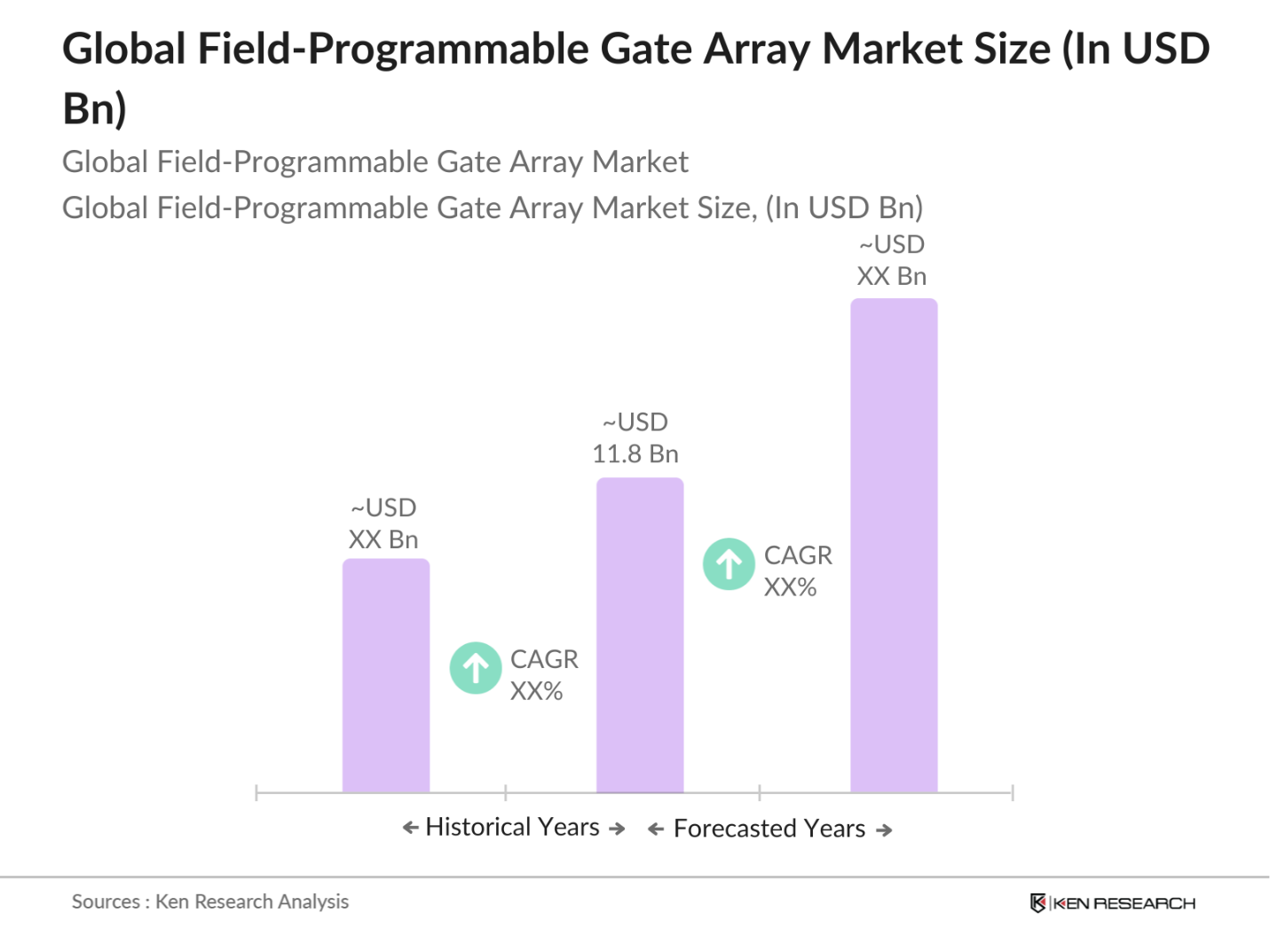

- The Field-Programmable Gate Array (FPGA) market is valued at USD 11.8 billion based on a five-year historical analysis, driven by its increasing adoption across several industries including telecommunications, automotive, and consumer electronics. The rise of 5G technology and its deployment globally have significantly contributed to the market's growth, as FPGAs are extensively used in networking and data processing hardware. The scalability and flexibility of FPGAs for applications in AI, machine learning, and cloud computing further drive their adoption across diverse sectors.

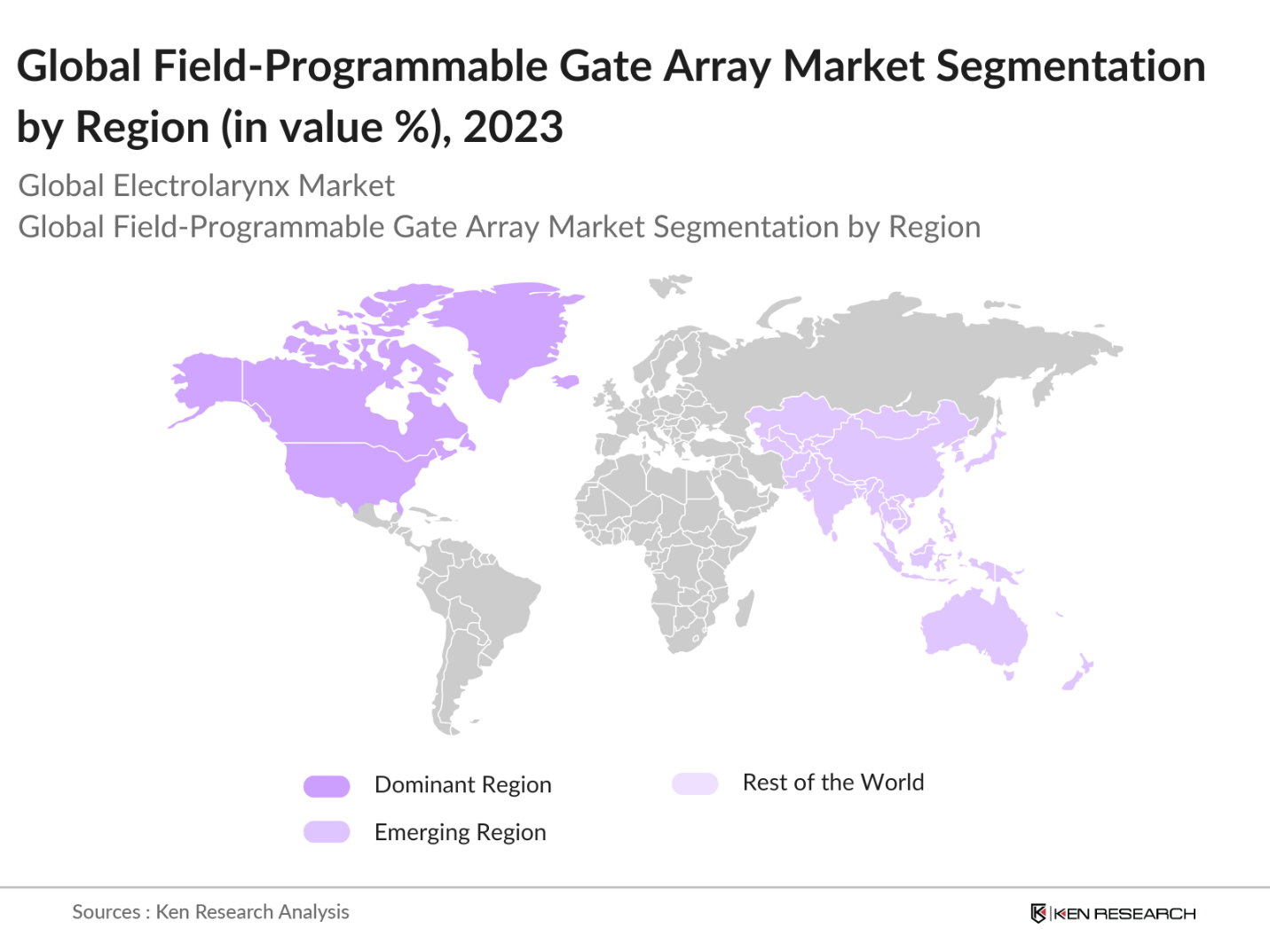

- Countries like the United States, China, and Japan dominate the FPGA market due to their technological advancements and strong presence of semiconductor manufacturing facilities. In the U.S., key players benefit from strategic defense contracts and the rise of autonomous driving technologies, while Chinas dominance is attributed to its massive investments in AI and cloud computing. Japans dominance stems from its strong automotive industry, which increasingly utilizes FPGAs for advanced driver assistance systems (ADAS) and infotainment solutions.

- FPGAs, being classified as dual-use technology, are subject to stringent export control regulations in several countries, particularly the U.S. These regulations are enforced to prevent the use of FPGAs in military applications by adversarial nations. In 2024, over 30 countries have implemented new export restrictions on semiconductors and FPGA components, particularly for technology exports to China and Russia. The complex regulatory environment has added compliance costs for companies, influencing market dynamics in defense and aerospace sectors.

Global Field-Programmable Gate Array (FPGA) Market Segmentation

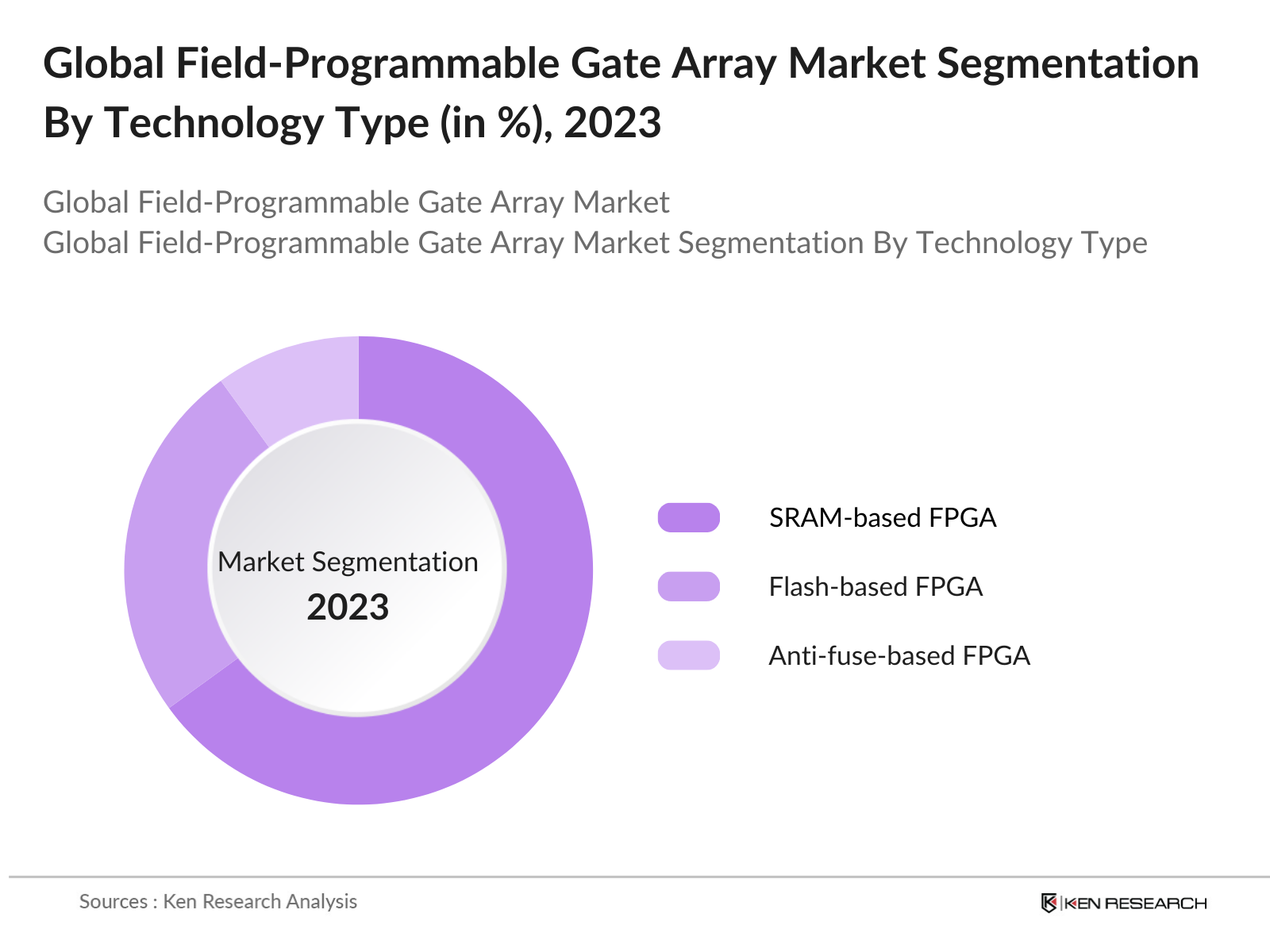

By Technology: The FPGA market is segmented by technology into SRAM-based, Flash-based, and Anti-fuse-based FPGAs. SRAM-based FPGAs hold a dominant share in the market, largely due to their reprogrammability and high-speed performance, making them ideal for applications in 5G, AI, and real-time data processing. SRAM-based FPGAs are frequently used in sectors like data centers and cloud infrastructure, where high performance and flexibility are crucial. These FPGAs are extensively adopted by industries that require continuous updates and upgrades to their systems, making them a preferred choice for dynamic application environments.

By Region: The FPGA market by region is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market, owing to the presence of major FPGA manufacturers and the extensive use of FPGAs in sectors such as defense, aerospace, and automotive. The U.S. in particular leads the region due to its high demand for advanced driver-assistance systems (ADAS) in the automotive industry, and its robust defense technology infrastructure, which consistently drives the need for high-performance FPGAs.

By Application: The FPGA market by application is segmented into Consumer Electronics, Telecommunications, Automotive, Aerospace & Defense, and Industrial IoT. The telecommunications segment leads the market, primarily driven by the deployment of 5G technology. FPGAs play a crucial role in base stations, network infrastructure, and signal processing applications, enabling faster data transmission and supporting the high bandwidth demands of 5G networks. The telecommunications industry relies on FPGAs for their ability to be reprogrammed post-deployment, making them an essential component in evolving communication protocols.

Global Field-Programmable Gate Array (FPGA) MArket Competitive Landscape

The FPGA market is highly competitive, dominated by a few key players with significant market influence. These companies invest heavily in R&D and continuously innovate to maintain their edge in the market. Xilinx and Intel Corporation are market leaders, with Xilinx benefiting from its vast portfolio of high-performance FPGAs for telecommunications and Intel leveraging its acquisition of Altera to expand into data centers and AI applications. Lattice Semiconductor is a prominent player in low-power FPGAs, favored in mobile and IoT applications.

Global Field-Programmable Gate Array (FPGA) Industry Analysis

Growth Drivers

- Rising Adoption of IoT Devices: The rising adoption of IoT devices globally has fueled the demand for FPGAs due to their flexibility and capacity for handling complex algorithms in real-time. As of 2024, there are approximately 38.6 billion IoT devices in operation worldwide, significantly increasing the need for efficient and scalable processing solutions. FPGAs, with their adaptability and parallel processing capabilities, are becoming crucial in supporting diverse IoT applications from smart homes to industrial automation. The global IoT market is also projected to surpass $1 trillion in revenues by 2025, pushing the FPGA market forward due to the need for enhanced connectivity.

- Increased Demand for 5G Infrastructure: With over 4.5 billion 5G subscriptions expected by 2025, the expansion of 5G networks is driving the demand for FPGAs, which are critical in the development of low-latency, high-speed communication systems. These chips are widely used in network equipment to meet the bandwidth and data transfer demands of 5G technology. The 5G market itself is expected to generate over $720 billion in global economic output by 2025, contributing significantly to the adoption of FPGAs in communication infrastructures to handle the massive data processing requirements.

- Growth in AI and Machine Learning Applications: Artificial Intelligence (AI) and Machine Learning (ML) applications, such as autonomous vehicles, facial recognition, and natural language processing, are increasingly leveraging FPGAs for their high processing power and flexibility. In 2024, AI-driven technologies contributed nearly $500 billion to the global economy, with FPGAs playing a crucial role in edge AI applications. This growing reliance on AI and ML across industries like healthcare, automotive, and finance is pushing for more advanced and energy-efficient FPGA solutions, especially as these technologies demand faster processing and lower latency.

Market Challenges

- High Cost of FPGA Design and Implementation: The high cost associated with FPGA design, prototyping, and implementation poses a challenge for wider market adoption, particularly for small and mid-sized enterprises. The average development cost for a custom FPGA solution can exceed $2 million, which limits its use to larger organizations. Additionally, the lack of standardized development tools further increases the cost for companies looking to implement FPGA-based systems, as they often need to invest in proprietary software and engineering expertise, which can also lead to longer development cycles.

- Complexity of Programming and Design Flexibility: FPGA programming remains complex due to the requirement of hardware description languages (HDLs) such as Verilog and VHDL, which are less familiar to many software developers. This learning curve adds time and costs to product development. The complexity of FPGA programming hinders the rapid adoption of these solutions in industries where time-to-market is critical. The availability of more user-friendly programming environments is improving, but the intricacies of customization and hardware-specific tuning continue to be barriers for faster adoption.

Global Field-Programmable Gate Array (FPGA) Market Future Outlook

Over the next five years, the Global FPGA market is expected to show significant growth, driven by the increasing adoption of 5G technology, advancements in AI and machine learning, and the expansion of cloud computing infrastructure. The demand for customizable, high-performance FPGAs in sectors like automotive, aerospace, and telecommunications will remain strong as industries continue to shift towards digital transformation. Additionally, the ongoing development of low-power FPGAs will open new opportunities in the IoT and mobile device sectors.

Opportunities

- Increasing Use in Edge Computing Applications: The rise of edge computing presents significant opportunities for FPGA adoption, as these devices are ideal for localized data processing with low power consumption. In 2024, the global edge computing market is valued at over $18 billion, with FPGAs playing a critical role in real-time processing of large data sets at the network edge. Their adaptability allows for faster deployment in sectors like healthcare, manufacturing, and telecommunications, where localized processing is essential for tasks such as predictive maintenance and real-time analytics.

- Potential in Network Security Enhancements: With cybersecurity threats risingestimated to cause damages of over $6 trillion globally in 2024FPGAs are increasingly being utilized to enhance network security infrastructure. FPGAs offer high customization and speed for encryption algorithms, intrusion detection, and secure data processing, making them highly attractive for secure communication systems. Their ability to be reconfigured on the fly offers a distinct advantage in adapting to new threats and implementing advanced cryptographic solutions.

Scope of the Report

|

By Technology |

SRAM-Based FPGA Flash-Based FPGA Anti-Fuse-Based FPGA |

|

By Application |

Consumer Electronics Telecommunications Automotive Aerospace and Defense Industrial IoT |

|

By Configuration |

Low-End FPGAs Mid-Range FPGAs High-End FPGAs |

|

By End-User |

OEMs Contract Manufacturers R&D Institutes |

|

By Region |

North America Europe, Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

OEMs and Contract Manufacturing Companies

Cloud Service Provider Companies

Data Center Operator Companies

Automotive Companies

Aerospace & Defense Industries

Semiconductor Manufacturing Industries

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Defense, European Commission, Ministry of Industry and Information Technology of China)

Companies

Players Mentioned in the Report

Xilinx, Inc.

Intel Corporation (Altera)

Lattice Semiconductor Corporation

Microchip Technology Inc.

QuickLogic Corporation

Achronix Semiconductor Corporation

Efinix, Inc.

S2C Inc.

Aldec, Inc.

GOWIN Semiconductor Corp.

Table of Contents

1. Global Field-Programmable Gate Array (FPGA) Market Overview 1.1. Definition and Scope

1.2. FPGA Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Field-Programmable Gate Array (FPGA) Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Field-Programmable Gate Array (FPGA) Market Analysis

3.1. Growth Drivers

3.1.1. Rising Adoption of IoT Devices

3.1.2. Increased Demand for 5G Infrastructure

3.1.3. Growth in AI and Machine Learning Applications

3.1.4. Expanding Use in Automotive and Aerospace Sectors

3.2. Market Challenges

3.2.1. High Cost of FPGA Design and Implementation

3.2.2. Complexity of Programming and Design Flexibility

3.2.3. Competition from ASIC and Microcontroller-based Solutions

3.3. Opportunities

3.3.1. Increasing Use in Edge Computing Applications

3.3.2. Potential in Network Security Enhancements

3.3.3. Expansion in Emerging Markets

3.4. Trends

3.4.1. Adoption of FPGA-as-a-Service (FPGAaaS)

3.4.2. Integration with Cloud-Based Solutions

3.4.3. Collaboration with AI and Quantum Computing Developments

3.5. Government Regulations

3.5.1. Export Control Regulations

3.5.2. Defense and Security Standards for FPGA Chips

3.5.3. Environmental and Sustainability Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Global Field-Programmable Gate Array (FPGA) Market Segmentation

4.1. By Technology (In Value %)

4.1.1. SRAM-Based FPGA

4.1.2. Flash-Based FPGA

4.1.3. Anti-Fuse-Based FPGA

4.2. By Application (In Value %)

4.2.1. Consumer Electronics

4.2.2. Telecommunications

4.2.3. Automotive

4.2.4. Aerospace and Defense

4.2.5. Industrial IoT

4.3. By Configuration (In Value %)

4.3.1. Low-End FPGAs

4.3.2. Mid-Range FPGAs

4.3.3. High-End FPGAs

4.4. By End-User (In Value %)

4.4.1. OEMs

4.4.2. Contract Manufacturers

4.4.3. R&D Institutes

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Field-Programmable Gate Array (FPGA) Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Xilinx, Inc.

5.1.2. Intel Corporation

5.1.3. Lattice Semiconductor Corporation

5.1.4. Microchip Technology Inc.

5.1.5. QuickLogic Corporation

5.1.6. Achronix Semiconductor Corporation

5.1.7. Efinix, Inc.

5.1.8. S2C Inc.

5.1.9. Aldec, Inc.

5.1.10. GOWIN Semiconductor Corp.

5.1.11. Flex Logix Technologies, Inc.

5.1.12. Atmel Corporation

5.1.13. SiliconBlue Technologies Corp.

5.1.14. Faraday Technology Corp.

5.1.15. Actel Corporation

5.2. Cross-Comparison Parameters

5.2.1. R&D Spending

5.2.2. Product Portfolio

5.2.3. Revenue Contribution by Region

5.2.4. Design Flexibility

5.2.5. Customer Support and Services

5.2.6. Supply Chain Efficiency

5.2.7. Strategic Partnerships

5.2.8. Innovation in Low-Power FPGAs

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Field-Programmable Gate Array (FPGA) Market Regulatory Framework

6.1. International Standards for FPGA Design and Manufacturing

6.2. Compliance Requirements for Telecommunications

6.3. Certification Processes for Automotive and Aerospace

7. Global Field-Programmable Gate Array (FPGA) Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Field-Programmable Gate Array (FPGA) Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By Configuration (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Field-Programmable Gate Array (FPGA) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map of the FPGA market. We identified key stakeholders including semiconductor manufacturers, OEMs, and government agencies. This step utilized extensive desk research, combining secondary data from proprietary databases to define variables that affect market dynamics.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data related to the FPGA market, focusing on market penetration and revenue generation. This phase included an evaluation of technological advancements, as well as service quality statistics to provide accurate estimates of the market's size and performance.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses were developed and validated through consultations with industry experts. These interviews provided valuable operational insights, which were essential for refining the market data and ensuring its accuracy.

Step 4: Research Synthesis and Final Output

This final phase involved direct engagement with FPGA manufacturers, which helped verify sales data, consumer preferences, and other critical factors. These insights were incorporated into the final output, ensuring a comprehensive and validated analysis of the FPGA market.

Frequently Asked Questions

01. How big is the Global FPGA Market?

The global FPGA market was valued at USD 11.8 billion, driven by growing adoption across telecommunications, automotive, and data center applications.

02. What are the challenges in the FPGA Market?

Challenges include high initial costs, complex programming requirements, and competition from alternative technologies such as ASICs and microcontrollers, which are more specialized but less flexible.

03. Who are the major players in the FPGA Market?

Key players in the market include Xilinx, Intel Corporation (Altera), Lattice Semiconductor, Microchip Technology, and QuickLogic Corporation, which lead the market due to their strong product portfolios and strategic partnerships.

04. What are the growth drivers of the FPGA Market?

The market is propelled by advancements in 5G technology, AI and machine learning applications, and the increasing demand for reprogrammable hardware in telecommunications and data centers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.