Global Financial Brokerage Market Outlook to 2030

Region:Global

Author(s):Rebecca

Product Code:KROD-026

June 2025

80

About the Report

Global Financial Brokerage Market Overview

- The Global Financial Brokerage Market was valued at USD 4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for investment services, the rise of retail trading, and rapid advancements in technology enabling online and mobile trading platforms. The influx of both institutional and retail investors continues to fuel robust expansion in the sector.

- Key players in this market include the United States, the United Kingdom, and Japan. The dominance of these countries is attributed to their established financial systems, strong regulatory frameworks, and the presence of major global financial institutions. High financial literacy rates and a growing interest in investment opportunities among their populations further reinforce their leading positions.

- In 2023, the SEC adopted new Rule 10c-1(a) aimed at increasing transparency and efficiency specifically in the securities lending market, requiring certain persons to report detailed information about securities loans to a registered national securities association (RNSA), such as FINRA. This rule enhances transparency around securities lending transactions.

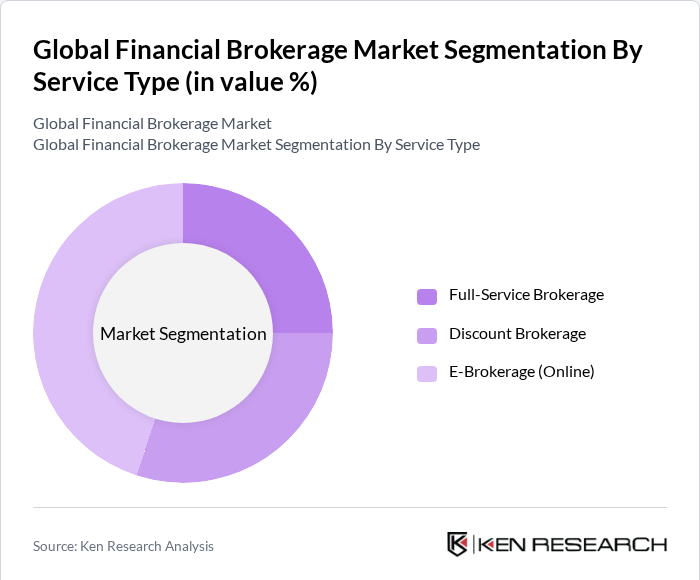

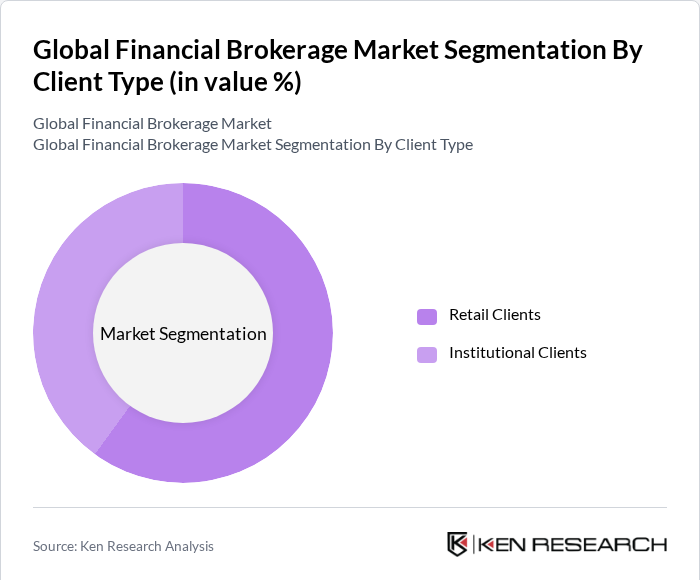

Global Financial Brokerage Market Segmentation

By Service Type: The financial brokerage market is segmented into full-service brokerage, discount brokerage, and e-brokerage (online brokerage). Among these, e-brokerage (online brokerage) has emerged as the dominant sub-segment, driven by the widespread adoption of digital technology and internet-based trading platforms. Retail investors increasingly prefer online platforms due to their lower fees, ease of access, and the ability to trade at any time. The proliferation of mobile trading applications has further accelerated this trend, enabling users to manage investments on-the-go.

By Client Type: The market is further segmented by client type into retail clients and institutional clients. Retail clients have emerged as the dominant force in the market, driven by a surge in individual investor participation across capital markets. The widespread availability of online trading platforms has democratized access to investment opportunities, enabling retail investors to play a more active role than ever before.

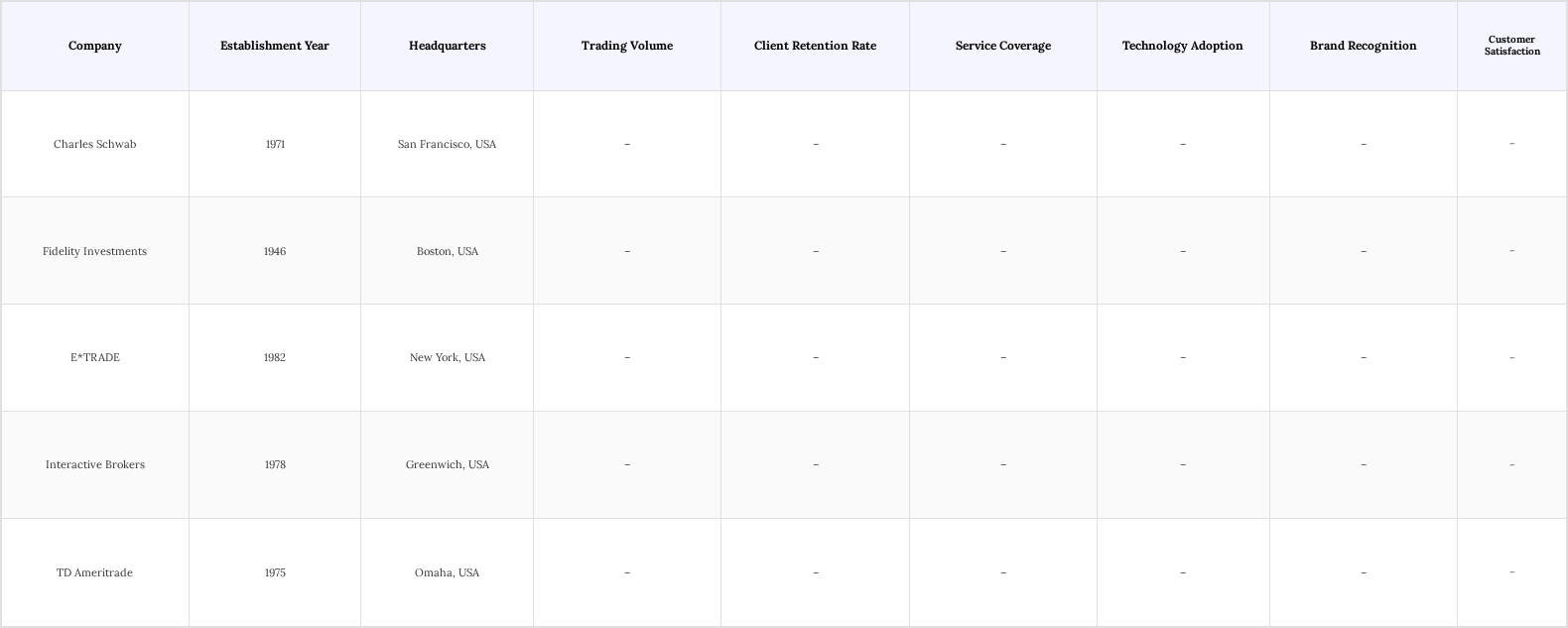

Global Financial Brokerage Market Competitive Landscape

The Global Financial Brokerage Market is characterized by intense competition among key players such as Charles Schwab, Fidelity Investments, E*TRADE, Interactive Brokers, and TD Ameritrade. These companies are recognized for their innovative trading platforms, comprehensive service offerings, and strong customer support. The market is experiencing a trend toward consolidation, with larger firms acquiring smaller brokerages to expand their market reach and enhance technological capabilities.

Global Financial Brokerage Market Industry Analysis

Growth Drivers

- Increasing Demand for Online Trading Platforms: The global shift toward digitalization has significantly boosted online trading platforms, with over 60% of retail investors preferring these services in 2023. The number of online brokerage accounts increased by 25 million globally, reaching around 150 million, driven by the convenience and accessibility of trading anytime and anywhere. This trend is expanding market participation and democratizing access to financial markets.

- Rising Disposable Income Among Retail Investors: As global economies recover post-pandemic, disposable income is projected to rise by 4.4% in 2024, enabling more individuals to invest in financial markets. Retail trading volumes in North America and Asia-Pacific have surged by 30% year-on-year, driven by increased market participation from diverse and younger investors leveraging digital platforms and tech-enabled wealth management tools.

- Technological Advancements in Trading Tools: The financial brokerage sector is rapidly advancing technologically, with innovations like algorithmic trading, advanced analytics, and AI-driven insights enhancing trading efficiency and decision-making. While global fintech investment declined to $51.2 billion in 2023, about 70% of brokerage firms are adopting AI technologies, which is expected to improve trading outcomes, attract more clients, and fuel market growth.

Market Challenges

- Regulatory Compliance and Legal Challenges: The financial brokerage industry operates under stringent regulatory oversight, with agencies such as the SEC and FCA enforcing complex rules aimed at ensuring transparency and investor protection. While essential, these regulations can reduce operational flexibility and require substantial investment in compliance infrastructure. Failure to meet these standards can result in penalties and reputational harm, ultimately impacting profitability and market growth.

- High Competition Among Brokerage Firms: The financial brokerage market is intensely competitive, with numerous firms vying for market share. This high level of competition often leads to price undercutting and shrinking profit margins. To stand out, many firms are investing heavily in technology upgrades and marketing strategies. However, these efforts can place financial pressure on organizations, particularly smaller players, and may challenge long-term sustainability in a saturated marketplace.

Global Financial Brokerage Market Future Outlook

The financial brokerage market is poised for significant transformation, driven by technological innovations and evolving investor preferences. The rise of digital assets and cryptocurrencies is expected to reshape investment strategies, attracting a new generation of investors. Additionally, the increasing focus on sustainable investing will likely influence product offerings, as firms adapt to changing consumer demands. As regulatory frameworks evolve, firms that embrace compliance and innovation will be better positioned to capitalize on emerging opportunities in this dynamic landscape.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets hold significant growth potential with an estimated 1.5 billion potential retail investors. Increasing internet penetration and digital adoption enable brokerage firms to expand their client base by up to 30% over the next five years. Younger generations, especially in Asia and Latin America, are driving this trend, with 30% of Gen Z starting to invest early, supported by growing financial literacy and tech-enabled investment tools.

- Development of Innovative Financial Products: In 2023, global sustainable investment products attracted growing interest, with institutional investors holding 56% of ESG assets and retail investors rapidly increasing participation at a CAGR of about 21%. Green bond issuance is also expanding swiftly, expected to exceed $1 trillion in 2025, driven by regulatory incentives and corporate sustainability goals, fueling the development of innovative ESG financial products.

Scope of the Report

| By Service Type |

Full-service brokerage Discount brokerage E-brokerage (online brokerage) |

| By Client Type |

Retail clients Institutional clients |

| By Geographic Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Asset Class |

Equities Fixed Income Derivatives Forex Commodities |

| By Trading Platform |

Web-based platforms Mobile applications Desktop applications |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Securities and Exchange Commission, Financial Industry Regulatory Authority)

Brokerage Firms and Financial Advisors

Institutional Investors and Hedge Funds

Private Equity Firms

Financial Technology (FinTech) Companies

Insurance Companies

Wealth Management Firms

Companies

Players Mentioned in the Report:

Charles Schwab

Fidelity Investments

E*TRADE

Interactive Brokers

TD Ameritrade

Apex Capital Markets

NovaTrade Solutions

Global Wealth Connect

Quantum Brokerage Group

Horizon Financial Partners

Table of Contents

1. Global Financial Brokerage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Financial Brokerage Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Financial Brokerage Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for online trading platforms

3.1.2. Rising disposable income among retail investors

3.1.3. Technological advancements in trading tools and analytics

3.2. Market Challenges

3.2.1. Regulatory compliance and legal challenges

3.2.2. High competition among brokerage firms

3.2.3. Market volatility affecting investor confidence

3.3. Opportunities

3.3.1. Expansion into emerging markets

3.3.2. Development of innovative financial products

3.3.3. Strategic partnerships and collaborations with fintech companies

3.4. Trends

3.4.1. Growing popularity of robo-advisors

3.4.2. Increased focus on sustainable investing

3.4.3. Adoption of artificial intelligence in trading strategies

3.5. Government Regulation

3.5.1. Overview of financial regulatory bodies

3.5.2. Impact of regulations on brokerage operations

3.5.3. Compliance requirements for international trading

3.5.4. Future regulatory trends in the financial brokerage sector

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Financial Brokerage Market Segmentation

4.1. By Service Type

4.1.1. Full-service brokerage

4.1.2. Discount brokerage

4.1.3. E-brokerage (online brokerage)

4.2. By Client Type

4.2.1. Retail clients

4.2.2. Institutional clients

4.3. By Geographic Region

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Asset Class

4.4.1. Equities

4.4.2. Fixed Income

4.4.3. Derivatives

4.4.4. Forex

4.4.5. Commodities

4.5. By Trading Platform

4.5.1. Web-based platforms

4.5.2. Mobile applications

4.5.3. Desktop applications

5. Global Financial Brokerage Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Charles Schwab

5.1.2. Fidelity Investments

5.1.3. E*TRADE

5.1.4. Interactive Brokers

5.1.5. TD Ameritrade

5.1.6. Apex Capital Markets

5.1.7. NovaTrade Solutions

5.1.8. Global Wealth Connect

5.1.9. Quantum Brokerage Group

5.1.10. Horizon Financial Partners

5.2. Cross Comparison Parameters

5.2.1. Market share analysis

5.2.2. Revenue growth rates

5.2.3. Customer satisfaction ratings

5.2.4. Technology adoption levels

5.2.5. Product offerings diversity

5.2.6. Geographic presence

5.2.7. Marketing strategies

5.2.8. Financial performance metrics

6. Global Financial Brokerage Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Financial Brokerage Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Financial Brokerage Market Future Market Segmentation

8.1. By Service Type

8.1.1. Full-service brokerage

8.1.2. Discount brokerage

8.1.3. E-brokerage (online brokerage)

8.2. By Client Type

8.2.1. Retail clients

8.2.2. Institutional clients

8.3. By Geographic Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. By Asset Class

8.4.1. Equities

8.4.2. Fixed Income

8.4.3. Derivatives

8.4.4. Forex

8.4.5. Commodities

8.5. By Trading Platform

8.5.1. Web-based platforms

8.5.2. Mobile applications

8.5.3. Desktop applications

9. Global Financial Brokerage Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Financial Brokerage Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Financial Brokerage Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Financial Brokerage Market.

Frequently Asked Questions

01. How big is the Global Financial Brokerage Market?

The Global Financial Brokerage Market is valued at USD 4 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Financial Brokerage Market?

Key challenges in the Global Financial Brokerage Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Financial Brokerage Market?

Major players in the Global Financial Brokerage Market include Charles Schwab, Fidelity Investments, E*TRADE, Interactive Brokers, TD Ameritrade, among others.

04. What are the growth drivers for the Global Financial Brokerage Market?

The primary growth drivers for the Global Financial Brokerage Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.