Global Fire Suppression System Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD1145

October 2024

89

About the Report

Global Fire Suppression System Market Overview

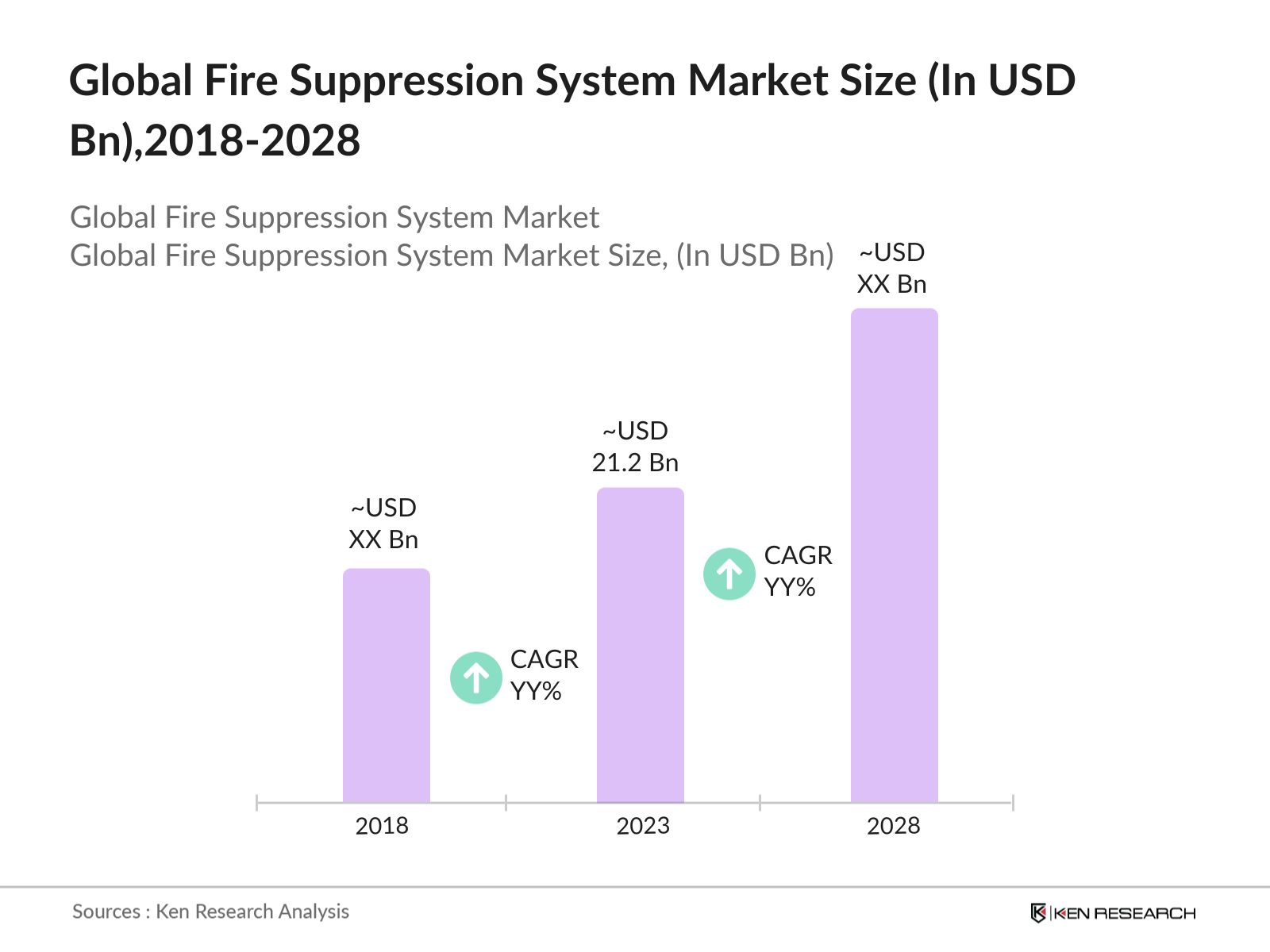

- The Global Fire Suppression System market was valued at USD 21.22 billion in 2023. This market is driven by several factors, including increasing awareness about fire safety, stringent government regulations, and the growing demand from the commercial, residential, and industrial sectors. The rise in urbanization and infrastructural development across various regions has also contributed to the market growth.

- Key players in the market include Johnson Controls, Siemens AG, United Technologies Corporation, Honeywell International Inc., and Tyco International. These companies dominate the market due to their extensive product portfolios, strong distribution networks, and continuous investment in research and development. They offer a wide range of fire suppression systems, including water-based, gas-based, and chemical-based solutions, catering to various end-use industries.

- Johnson Controls is actively enhancing its fire suppression capabilities, focusing on sustainable and advanced technologies. Their participation in events like WETEX 2023 highlighted their commitment to eco-friendly solutions and showcased state-of-the-art fire suppression systems designed for various applications, including data centers and industrial facilities.

- In 2023, New York City saw a significant increase in fire suppression system installations, driven by updated fire safety regulations and the rise of high-rise residential projects. This development reflects the city's proactive approach to enhancing fire safety amidst growing urbanization and infrastructure investments?.

Global Fire Suppression System Market Segmentation

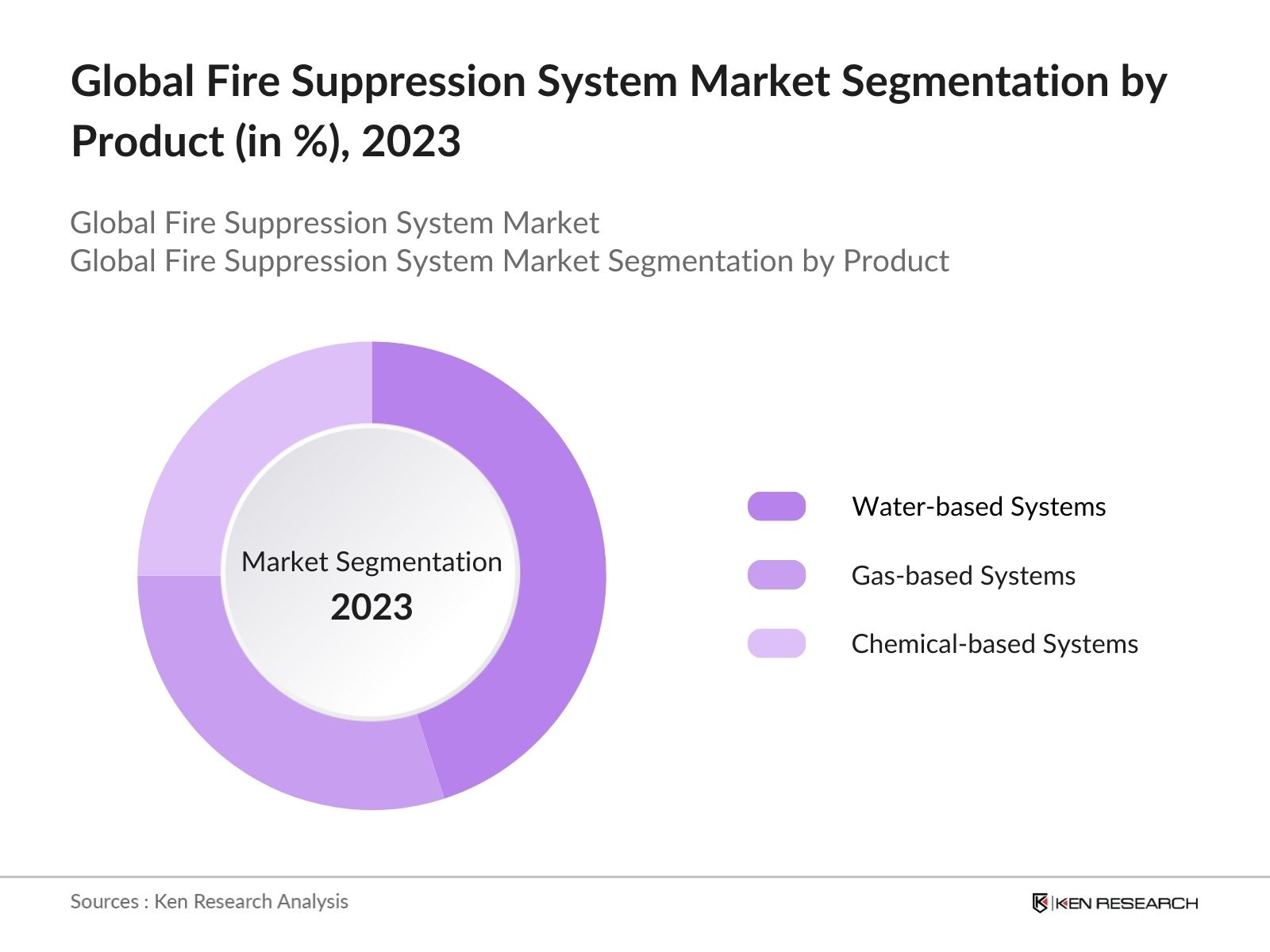

The market can be segmented into various factors like product, end-user, and region.

By Product: The market is segmented by product type into water-based, gas-based, and chemical-based fire suppression systems. In 2023, water-based fire suppression systems held the largest market share due to their widespread application in residential, commercial, and industrial sectors. Water-based systems, including sprinklers and deluge systems, are highly effective in controlling fires and preventing their spread.

By End-User: The market is segmented by end-use industry into commercial, residential, and industrial sectors. In 2023, the commercial sector dominated the market with the stringent fire safety regulations and the high concentration of commercial buildings, such as offices, shopping malls, and hotels. The need to protect valuable assets and ensure the safety of occupants has led to the widespread adoption of fire suppression systems in this sector.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America dominated the market with stringent fire safety regulations, high awareness levels, and significant investments in fire safety infrastructure. The adoption of smart building technologies and the presence of major market players further contribute to the market dominance of North America.

Global Fire Suppression System Market Competitive Landscape

|

Major Players |

Establishment Year |

Headquarters |

|

Johnson Controls |

1885 |

Cork, Ireland |

|

Siemens AG |

1847 |

Munich, Germany |

|

United Technologies Corporation |

1934 |

Farmington, USA |

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

|

Tyco International |

1960 |

Cork, Ireland |

- Honeywell International Inc.: Honeywell's recent acquisition of United Technologies Corporation (UTC) significantly enhances its product offerings, particularly in aerospace and building technologies. This merger creates a diversified portfolio that includes advanced fire suppression systems, leveraging UTC's expertise in HVAC and fire safety. The combined entity is poised to innovate and expand its market presence, particularly in smart building solutions and integrated safety systems, aligning with industry trends towards automation and IoT integration.

- Siemens AG: Siemens introduced a new digital service offering focused on fire safety. This innovation allows organizations to transition from reactive to proactive fire safety measures. The offering includes a cloud-based portfolio designed to provide comprehensive protection beyond mere compliance with regulations.

Global Fire Suppression System Market Analysis

Global Fire Suppression System Market Growth Drivers

- Stringent Fire Safety Regulations: Governments worldwide are implementing more rigorous fire safety regulations, driving the adoption of fire suppression systems. The United States has updated its National Fire Protection Association (NFPA) codes, requiring businesses to install high-efficiency fire suppression systems. In Europe, the new Fire Safety Standards Enhancement Program (FSSEP) standardize and improve fire safety regulations, resulting in increased installation of fire suppression systems across commercial and residential sectors.

- Increase in Industrial Infrastructure: The rapid development of industrial facilities globally is a significant driver for the fire suppression market. In 2024, global industrial output is, leading to higher demand for fire safety installations in new manufacturing and storage facilities to mitigate fire risks. This expansion of industrial infrastructure, especially in regions like Asia and North America, necessitates the deployment of advanced fire suppression systems to ensure compliance with stringent safety regulations.

- Expansion of Data Centers: By 2024, the global data center market is reached the value of USD 416.10 bn, with significant investments in fire suppression systems to protect sensitive equipment from fire hazards. Companies like Google and Amazon are investing heavily in advanced fire suppression technologies to safeguard their extensive data centers, ensuring minimal downtime and data loss.

Global Fire Suppression System Market Challenges

- High Installation and Maintenance Costs: The significant upfront costs and ongoing maintenance expenses of advanced fire suppression systems pose a challenge. The average installation cost for a fire suppression system in a commercial building can reached USD 1,500 to USD 30,000 or more, deterring smaller businesses from adopting these systems.

- Technological Integration Issues: Integrating fire suppression systems with existing building management systems can be complex and costly. Many older buildings require significant retrofitting to accommodate modern fire suppression technologies, leading to additional expenses and potential operational disruptions. In 2024, it is estimated that the buildings in developed regions will need substantial upgrades to integrate advanced fire suppression systems effectively.

Global Fire Suppression System Market Government Initiatives

- European Fire Safety Standards Enhancement Program: In 2024, the European Fire Safety Alliance introduced an EU-wide standard for fire-safe upholstered furniture and mattresses. This initiative aims to improve escape times during fires and includes broader applications of smoke detectors and the evaluation of Lower Ignition Propensity (LIP) cigarettes.

- India’s National Building Code (NBC) Update: In 2024, India updated its NBC to mandate the installation of fire suppression systems in all new high-rise buildings. This regulation, supported by a 1 billion USD government grant for compliance, aims to enhance fire safety in rapidly urbanizing cities, driving significant demand for fire suppression systems.

Global Fire Suppression System Market Future Outlook

Future trends include the increased adoption of AI-integrated fire suppression systems, a shift towards environmentally friendly solutions, the rise of wireless fire suppression technologies, and significant growth in the Asia-Pacific market.

Global Fire Suppression System Future Market Trends

- Expansion of Environmentally Friendly Solutions: The market will see a growing shift towards environmentally friendly fire suppression agents and systems. Companies will invest in the development and deployment of sustainable solutions, driven by regulatory requirements and increasing environmental awareness among consumers and businesses.

- Rise of Wireless Fire Suppression Technologies: The deployment of wireless fire suppression systems will become more prevalent, offering greater flexibility and ease of installation. These systems will be particularly beneficial for retrofitting older buildings and providing seamless integration with modern building management systems.

Scope of the Report

|

By Product |

Water-based Systems Gas-based Systems Chemical-based Systems |

|

By End-User |

Commercial Sector Residential Sector Industrial Sector |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

- Fire Safety Equipment Manufacturers

- Insurance Companies

- Construction Companies

- Oil and Gas Industry Players

- Retail Sector Stakeholders

- Banking and Financial Institutions

- Government Regulatory Bodies

Companies

- Johnson Controls

- Siemens AG

- United Technologies Corporation

- Honeywell International Inc.

- Tyco International

- Minimax Viking GmbH

- Robert Bosch GmbH

- Halma plc

- Hochiki Corporation

- Securiton AG

- Gentex Corporation

- Marioff Corporation Oy

- Kidde Fire Systems

- Ansul Incorporated

- Chemours Company

Table of Contents

1. Global Fire Suppression System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Fire Suppression System Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Fire Suppression System Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Expansion

3.1.2. Government Regulations

3.1.3. Infrastructure Development

3.1.4. Increasing Awareness of Fire Safety

3.2. Restraints

3.2.1. High Installation Costs

3.2.2. Technological Integration Challenges

3.2.3. Supply Chain Disruptions

3.2.4. Regulatory Compliance Issues

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. International Collaborations

3.3.3. Rural Area Penetration

3.3.4. Green Building Initiatives

3.4. Trends

3.4.1. Smart Fire Suppression Systems

3.4.2. Integration with IoT

3.4.3. Environmentally Friendly Solutions

3.4.4. Wireless Fire Suppression Technologies

3.5. Government Regulation

3.5.1. National Fire Safety Standards

3.5.2. Fire Safety Compliance Programs

3.5.3. Subsidies and Incentives

3.5.4. Public Awareness Campaigns

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Fire Suppression System Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Water-Based Systems

4.1.2. Gas-Based Systems

4.1.3. Chemical-Based Systems

4.2. By End-User (in Value %)

4.2.1. Industrial

4.2.2. Commercial

4.2.3. Residential

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

5. Global Fire Suppression System Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson Controls

5.1.2. Siemens AG

5.1.3. Honeywell International Inc.

5.1.4. Tyco International

5.1.5. Minimax Viking GmbH

5.1.6. Halma Plc

5.1.7. Hochiki Corporation

5.1.8. Bosch Security Systems

5.1.9. Robert Bosch GmbH

5.1.10. Raytheon Technologies Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Fire Suppression System Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Fire Suppression System Market Regulatory Framework

7.1. Fire Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Fire Suppression System Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Fire Suppression System Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

10. Global Fire Suppression System Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global fire suppression system industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple fire safety equipment manufacturers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such fire safety equipment manufacturers companies.

Frequently Asked Questions

01 How big is the Global Fire Suppression System market?

The Global Fire Suppression System market was valued at USD 21.22 billion in 2023. This market is driven by several factors, including increasing awareness about fire safety, stringent government regulations, and the growing demand from the commercial, residential, and industrial sectors.

02 What are the challenges in the Global Fire Suppression System market?

Challenges in the Global fire suppression system market include high installation and maintenance costs, technological integration issues, compliance with diverse regulations, and supply chain disruptions affecting the availability of components.

03 Who are the major players in the Global Fire Suppression System market?

Key players in the Global fire suppression system market include Johnson Controls, Siemens AG, Honeywell International Inc., Tyco International, and Minimax Viking GmbH.

04 What are the main growth drivers of the Global Fire Suppression System market?

The growth of the Global fire suppression system market is driven by increasing incidence of fire-related hazards, stringent fire safety regulations, expansion of industrial and commercial infrastructure, and advancements in fire suppression technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.