Global Fitness Devices Market Outlook to 2030

Region:Global

Author(s):Shreya Garg

Product Code:KROD2790

November 2024

82

About the Report

Global Fitness Devices Market Overview

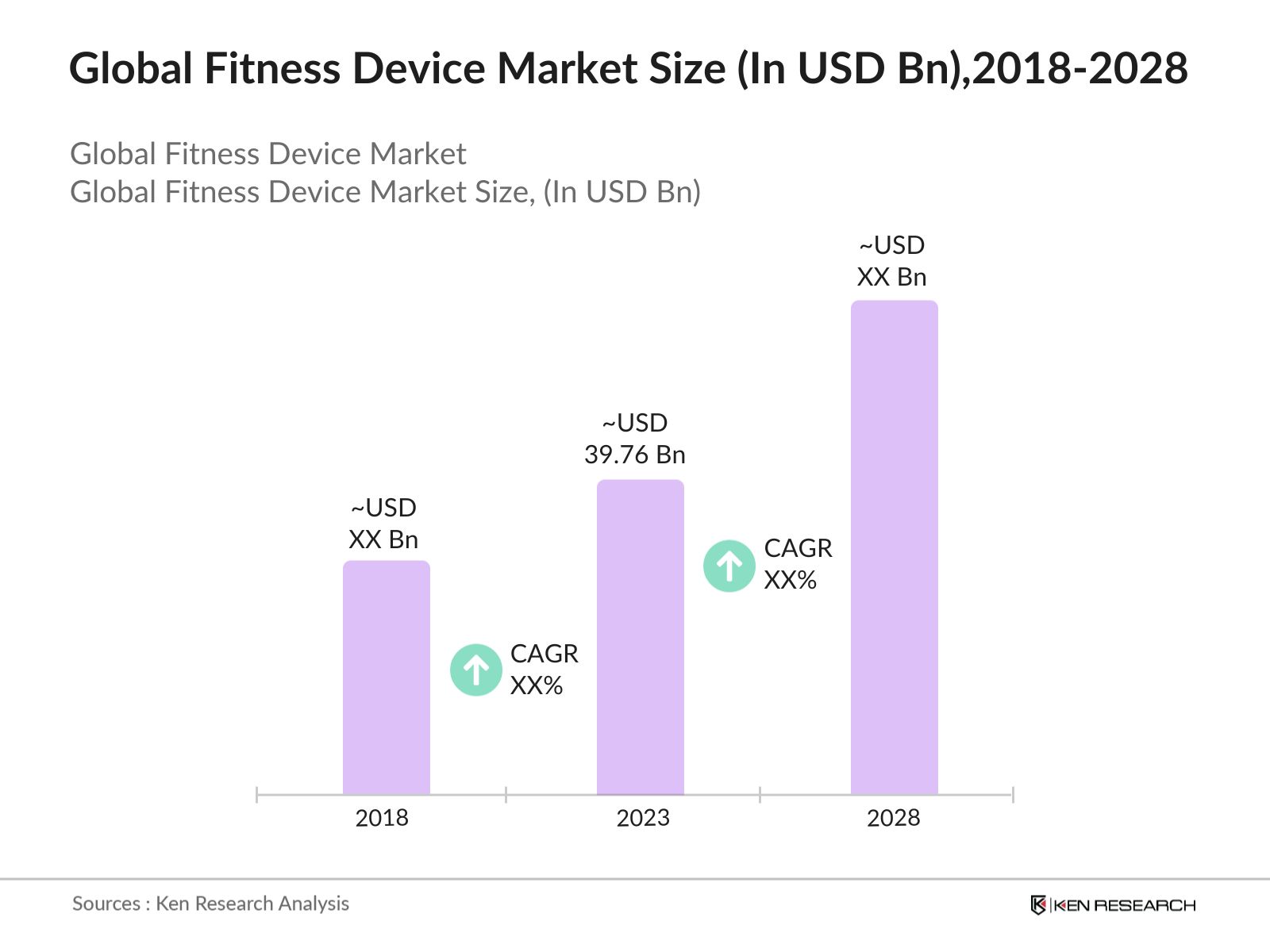

The global fitness devices market was valued at USD 39.76 billion in 2023, it has grown considerably due to the rising demand for wearable technology, including smartwatches, fitness trackers, and smart apparel. This growth is driven by increasing health consciousness, the proliferation of fitness applications, and the integration of advanced sensors and AI in fitness devices. Consumers are more inclined to monitor their health and fitness metrics in real time.

Key players in the global fitness devices market include Apple Inc., Fitbit Inc., Garmin Ltd., Xiaomi Corporation, and Huawei Technologies Co., Ltd. These companies dominate the market due to their strong brand presence, continuous innovation, and extensive distribution networks. They offer a variety of products catering to different segments of the market, from budget-friendly fitness bands to high-end smartwatches with advanced features.

The Apple Watch Series 9, released in September 2023, the New S9 chipwith a 4-core Neural Engine, enabling faster performance and new capabilities like the Double Tap gesture, which is brighter and always-on displaywith up to 2000 nits of brightness, it is Faster on-device Siriwith the ability to access and log health data. It is the watchOS 10with redesigned apps, new Smart Stack, watch faces, cycling and hiking features, and mental health tools.

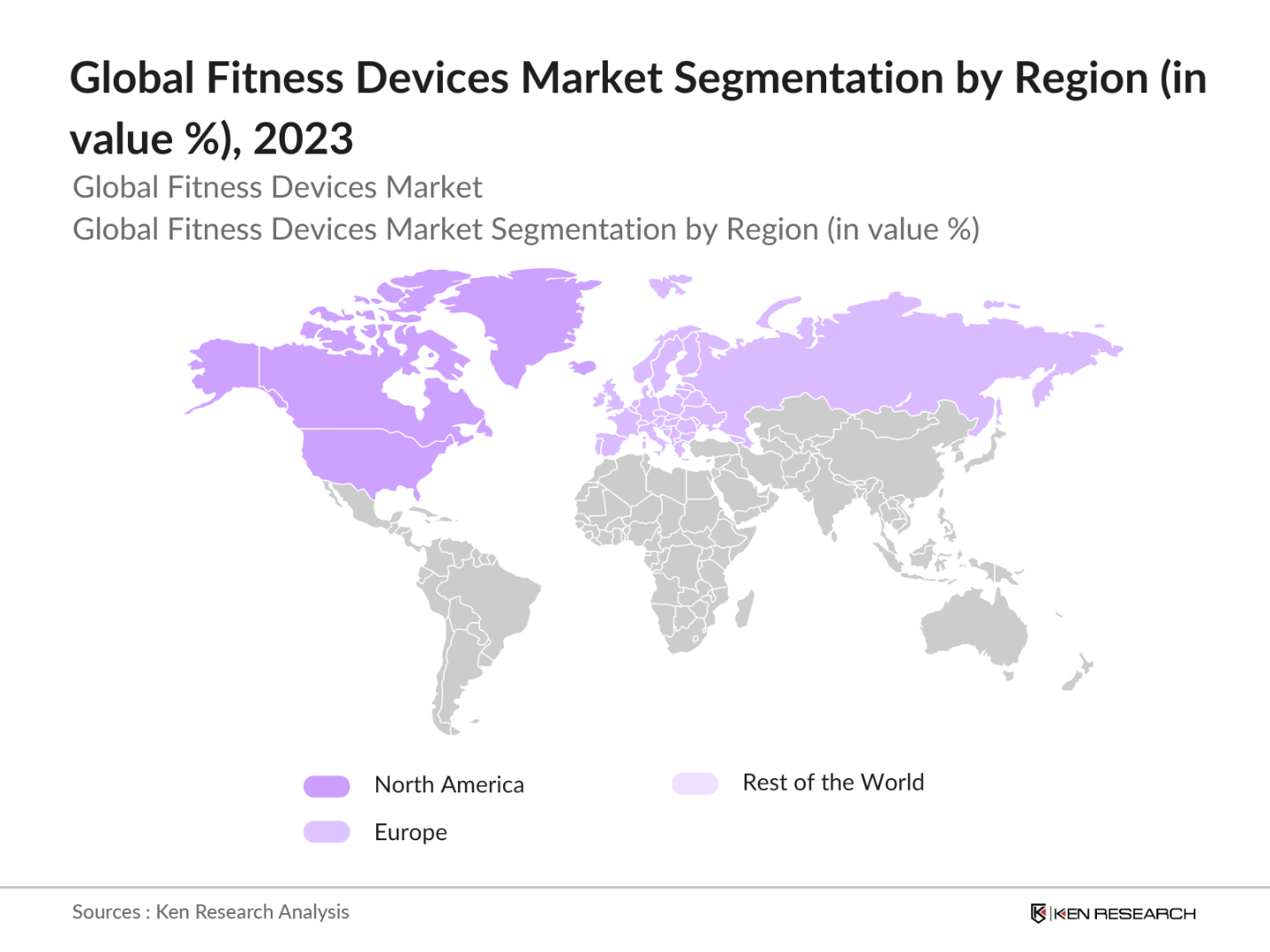

North America, particularly the United States, dominates the global fitness devices industry. The U.S. accounted for more than one third of the market share in 2023, driven by high consumer disposable income, widespread health awareness, and the presence of major market players. The dominance of this region is also supported by strong healthcare infrastructure and a tech-savvy population that readily adopts new wearable technologies.

Global Fitness Devices Market Segmentation

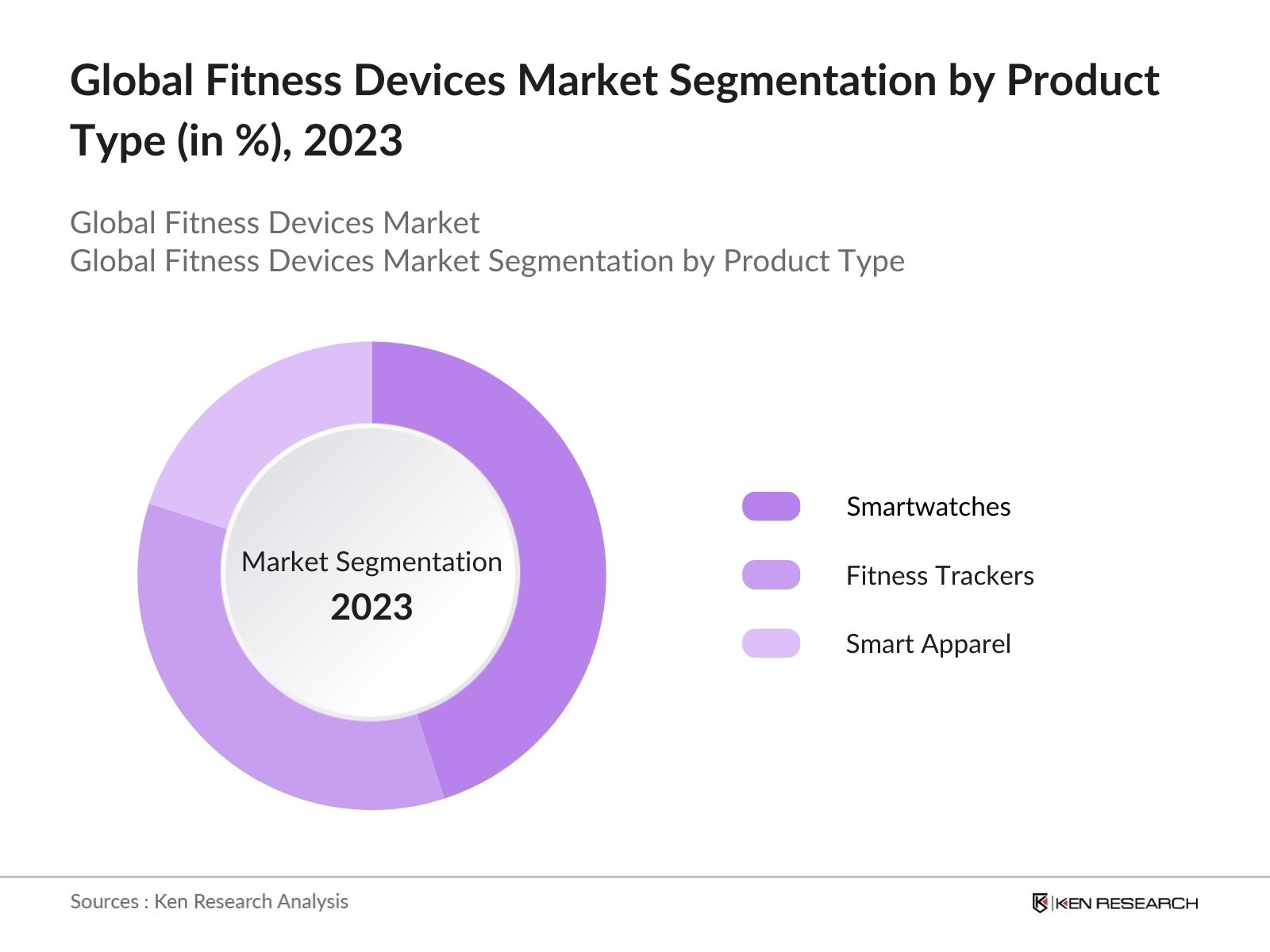

The global fitness devices market is segmented into various factors like product type, End-User and Region etc.

By Product Type: The market is segmented by product type into smartwatches, fitness trackers, and smart apparel. In 2023, smartwatches held the dominant market share. The popularity of smartwatches can be attributed to their versatility, as they not only track fitness metrics but also function as communication devices and health monitors. Brands like Apple and Garmin have leveraged this trend by continuously innovating and offering advanced health features.

By Region: Regionally, the market is segmented into North America, Europe, Asia Pacific, and Rest of the World. In 2023, North America's dominance is due to its high adoption rate of fitness technology, supported by a strong ecosystem of tech companies and health-conscious consumers. The region's well-established infrastructure and the presence of major market players like Apple and Fitbit also contribute to its leading position.

By End-User: The market is also segmented by end-user into individual consumers, fitness centers, and corporate wellness programs. Individual consumers represented the largest share in 2023. The growing awareness of the importance of health and fitness, coupled with the convenience offered by wearable devices, has led to a significant uptake among individual consumers. Fitness centers have also adopted these technologies to enhance their services, offering members personalized fitness plans and tracking.

Global Fitness Device Market Competitive Landscape

|

Company |

Year of Establishment |

Headquarters |

|---|---|---|

|

Apple Inc. |

1976 |

Cupertino, USA |

|

Fitbit Inc. (Google) |

2007 |

San Francisco, USA |

|

Garmin Ltd. |

1989 |

Olathe, USA |

|

Xiaomi Corporation |

2010 |

Beijing, China |

|

Huawei Technologies |

1987 |

Shenzhen, China |

- Fitbits Expansion into Remote Patient Monitoring

In 2024, Fitbit expanded its product offerings to include devices specifically designed for remote patient monitoring. These devices are being used to monitor patients with chronic conditions such as heart disease and COPD, which affect over 300 million people worldwide. Fitbits expansion into this space is expected to generate an additional $1 billion in revenue by the end of the year, as healthcare providers increasingly adopt remote monitoring technologies. - Garmins Introduction of Solar-Powered Fitness Devices: Garmin, in mid-2024, launched its new line of solar-powered fitness smartwatches, which offer extended battery life of up to 50 days. This innovation addresses one of the major consumer complaints regarding battery life, making it ideal for outdoor enthusiasts and athletes who require longer-lasting devices. Garmin has reported strong sales, with over 2 million units sold in the first month.

Global Fitness Devices Industry Analysis

Growth Drivers

- Increasing Adoption of Wearable Health Monitoring Devices: Wearable device shipments increased to 440 million unitsin 2023. This surge in adoption is driven by growing consumer awareness about the importance of regular health monitoring. Governments across various countries have also started promoting the use of wearable health devices to manage chronic diseases. This trend is supported by healthcare policies that encourage the integration of wearable technology into medical practice, aiming to reduce the burden on healthcare systems and improve patient outcomes.

- Rising Investments in Health Tech Startups: In 2024, investments in health tech startups focusing on fitness and wellness technology are projected to exceed $20 billion, marking a significant increase from $15 billion in 2023. This influx of capital is enabling startups to develop innovative products, such as AI-powered fitness coaches and advanced biometric sensors, which are expected to fuel the growth of the fitness devices market over the next five years.

- Increased Corporate Wellness Programs: In 2024, corporate wellness programs are expected to engage employees worldwide. A portion of these programs now includes fitness devices to monitor and improve employee health, leading to widespread adoption of fitness devices in workplace wellness initiatives. This trend is particularly strong in North America and Europe, where companies are increasingly integrating wearable technology into their wellness strategies.

Challenges

- Compatibility Issues with Other Health Systems: There are various different types of health monitoring systems and platforms globally, many of which are not fully compatible with the fitness devices available in the market. The lack of standardization across platforms hinders the seamless flow of health data between fitness devices and medical systems, potentially impacting the accuracy of health monitoring and treatment.

- Battery Life and Durability Issues: The average battery life of a fitness device is currently around 24-48 hours, which is insufficient for users who engage in extended outdoor activities or those who forget to charge their devices regularly. Additionally, durability issues, such as water resistance and resistance to wear and tear, remain significant concerns. These issues have led to a high return rate devices being returned within the first year of purchase, challenging manufacturers to improve product design and functionality.

Government Initiatives

- European Unions Funding for Health Tech Innovation

The European Union has earmarked 25 million for unlocking new tools and technologies for a healthy society, which may encompass health tech innovations. This funding is part of the Horizon Europe program and is intended to accelerate the development of next-generation fitness devices with enhanced health monitoring capabilities. The initiative also aims to support the commercialization of these innovations including digital health solutions. - Chinas National Fitness Program: In 2024, the Chinese government launched a national fitness program. The program includes the promotion and subsidization of fitness devices to encourage physical activity among the population. The plan aims to address lifestyle-related diseases affecting approximately 400 million people, which is consistent with the government's health objectives. This initiative is expected to drive the domestic market for fitness devices significantly.

Global Fitness Devices Market Future Outlook

The global fitness devices market is expected to grow exponentially. This growth will be driven by technological advancements, including AI integration, more personalized fitness experiences, and the expansion of health monitoring features. Additionally, the market will benefit from growing consumer interest in maintaining a healthy lifestyle and the increasing incorporation of fitness devices into medical and wellness programs.

Future Trends

- Integration of AI and Machine Learning in Fitness Devices: Over the next five years, AI and machine learning will become increasingly integrated into fitness devices, enabling more personalized and adaptive health monitoring. The future fitness devices will feature AI-driven health insights, capable of predicting potential health issues and recommending preventative measures. This will enhance user engagement and make fitness devices indispensable tools for daily health management.

- Increased Focus on Sustainability and Eco-Friendly Devices: Sustainability will become a key trend in the fitness devices market, with manufacturers focusing on producing eco-friendly products. This shift will be driven by consumer demand for environmentally responsible products and regulatory pressures to reduce electronic waste. Companies that lead in this area are expected to gain a competitive edge, appealing to a growing segment of environmentally-conscious consumers.

Scope of the Report

|

By Product Type |

Smartwatches Fitness Trackers Smart Apparel |

|

By End User |

Individual Consumers Fitness Centers Corporate Wellness Programs |

|

By Region |

North America Europe Asia Pacific Rest of the World |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Consumer electronics retailers

Corporate wellness programs

Healthcare providers and hospitals

E-commerce platforms

Telemedicine companies

Educational institutions (for health and sports research)

Rehabilitation centers

National Institutes of Health (NIH)

Centers for Disease Control and Prevention (CDC)

European Medicines Agency (EMA)

Investors and VC Firms

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Apple Inc.

Fitbit Inc. (Google)

Garmin Ltd.

Xiaomi Corporation

Huawei Technologies Co., Ltd.

Samsung Electronics

Polar Electro

Suunto

Fossil Group, Inc.

Sony Corporation

Under Armour, Inc.

Nike, Inc.

Adidas AG

Lenovo Group Ltd.

LG Electronics Inc.

Table of Contents

1. Global Fitness Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Fitness Devices Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Fitness Devices Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Wearable Health Devices

3.1.2. Rising Investments in Health Tech Startups

3.1.3. Expansion of Telehealth and Remote Monitoring Services

3.1.4. Corporate Wellness Programs Integration

3.2. Restraints

3.2.1. Data Privacy and Security Concerns

3.2.2. High Cost of Advanced Devices

3.2.3. Battery Life and Durability Issues

3.3. Opportunities

3.3.1. Innovation in AI and Machine Learning Integration

3.3.2. Expansion into Emerging Markets

3.3.3. Collaborations with Healthcare Providers

3.4. Trends

3.4.1. AI Integration for Personalized Health Monitoring

3.4.2. Fitness Devices in Medical Applications

3.4.3. Growth of Corporate Wellness Solutions

3.5. Government Initiatives

3.5.1. U.S. Public Health Programs Using Wearable Technology

3.5.2. EU Research Funding for Fitness Devices

3.5.3. Chinas National Fitness Program

3.5.4. Indias Digital Health Mission

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Fitness Devices Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Smartwatches

4.1.2. Fitness Trackers

4.1.3. Smart Apparel

4.2. By End-User (in Value %)

4.2.1. Individual Consumers

4.2.2. Fitness Centers

4.2.3. Corporate Wellness Programs

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Rest of World

5. Global Fitness Devices Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Fitbit Inc. (Google)

5.1.3. Garmin Ltd.

5.1.4. Xiaomi Corporation

5.1.5. Huawei Technologies

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Fitness Devices Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Fitness Devices Market Regulatory Framework

7.1. Data Privacy Regulations

7.2. Compliance with Health Standards

7.3. Certification and Regulatory Requirements

8. Global Fitness Devices Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Fitness Devices Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

10. Global Fitness Devices Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Fitness Devices industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different fitness device companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple alternative milk products companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such fitness devices companies.

Frequently Asked Questions

01 How big is Global Fitness Devices Market?

The Global Fitness Devices Market, valued at USD 39.6 billion in 2023, is driven by increasing health awareness, advancements in wearable technology, and the growing adoption of fitness monitoring solutions.

02 What are the challenges in Global Fitness Devices Market?

Challenges in the global fitness device market include data privacy concerns, high costs of advanced fitness devices, battery life issues, and the lack of compatibility with various health monitoring systems. These challenges impact the market's ability to expand, particularly in price-sensitive regions.

03 Who are the major players in the Global Fitness Devices Market?

Key players in the global fitness device market include Apple Inc., Fitbit Inc. (Google), Garmin Ltd., Xiaomi Corporation, and Huawei Technologies. These companies dominate the market due to their advanced technology, extensive product offerings, and strong global presence.

04 What are the growth drivers of Global Fitness Devices Market?

The global fitness device market is driven by increasing adoption of wearable health monitoring devices, rising investments in health tech startups, expansion of telehealth and remote monitoring services, and the rise of corporate wellness programs that incorporate fitness devices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.