Global Flex-fuel Vehicle Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD10150

December 2024

89

About the Report

Global Flex-fuel Vehicle Market Overview

- The Global Flex-fuel Vehicle market was valued at USD 98 billion. This market is driven by the increasing demand for eco-friendly vehicles and stringent government regulations regarding emissions. Flex-fuel vehicles (FFVs) allow engines to run on a mixture of gasoline and ethanol (up to 83% ethanol in E85 blends), reducing greenhouse gas emissions and promoting sustainable fuel alternatives.

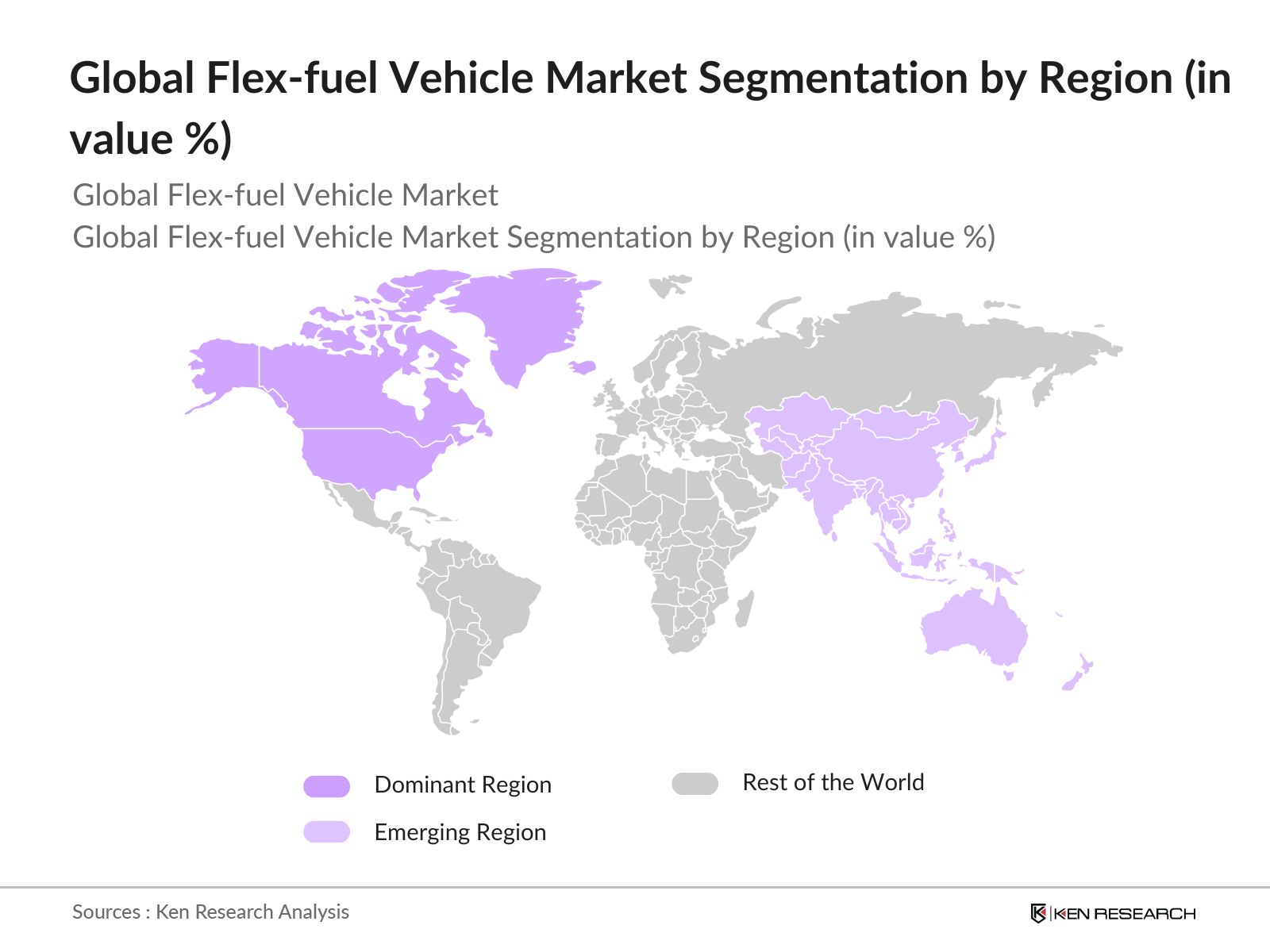

- Key regions dominating the market include North America and Asia-Pacific. In North America, the presence of established automotive manufacturers like Ford and General Motors, combined with consumer preferences for eco-friendly vehicles, has maintained the regions leadership in the market. In Asia-Pacific, countries such as China and India are witnessing growing demand due to government policies encouraging the adoption of ethanol-based fuels, driven by efforts to reduce air pollution and reliance on fossil fuels.

- Brazil, the world leader in ethanol production, has extended its "RenovaBio" program in 2024, aiming to increase ethanol production by 15 billion liters by 2025. This initiative offers fiscal incentives to ethanol producers and supports the infrastructure for FFV sales. This move is expected to boost Brazil's fleet of flex-fuel vehicles, which accounted for 80% of new car sales in the country in 2024.

Global Flex-fuel Vehicle Market Segmentation

By Vehicle Type: The market is segmented by vehicle type into Passenger Cars and Commercial Vehicles. Passenger cars hold a dominant share, primarily due to increasing consumer preferences for personal vehicles that support sustainable fuels. Brands such as Toyota and Ford have successfully incorporated flex-fuel technology into their popular models, making it accessible to a wide audience. The push towards reducing emissions from personal vehicles further boosts this segment's dominance.

By Fuel Type: Based on fuel type, the market is segmented into Gasoline Flex-fuel and Diesel Flex-fuel. Gasoline Flex-fuel vehicles dominate due to their broader adoption and lower technical barriers in terms of engine modification for ethanol blends. The diesel segment is growing steadily, particularly in commercial and heavy-duty vehicle applications where fuel efficiency and lower carbon emissions are critical.

By Region: Regionally, the market is segmented into North America, Europe, Asia-Pacific, and Rest of the World. North America leads the market owing to government policies and high consumer adoption. Asia-Pacific, led by China and India, is experiencing the fastest growth due to rising environmental awareness and government support for ethanol use.

Global Flex-Fuel Vehicle Market Competitive Landscape

The market is highly competitive, with major players focusing on technological innovation and sustainable solutions. Some of the top companies driving the market include.

|

Company |

Establishment Year |

Headquarters |

Key Market Presence |

Fuel Type Dominance |

Strategic Initiatives |

Key Model |

Revenue |

|

Ford Motor Company |

1903 |

USA |

|||||

|

General Motors |

1908 |

USA |

|||||

|

Toyota Motor Corporation |

1937 |

Japan |

|||||

|

Honda Motor Co. |

1946 |

Japan |

|||||

|

Volkswagen AG |

1937 |

Germany |

Global Flex-fuel Market Analysis

Market Growth Drivers

- Government Incentives and Biofuel Mandates: In 2024, countries like Brazil, the USA, and India have ramped up biofuel mandates, with Brazil aiming for an increase in ethanol blends reaching 30 billion liters by 2024 to reduce dependency on fossil fuels. This shift is crucial in promoting the demand for flex-fuel vehicles (FFVs).

- Energy Security Concerns: As of 2024, the volatility in global crude oil prices, driven by geopolitical conflicts and supply chain disruptions, has pushed major economies to enhance their energy security measures. For instance, the United States dependence on oil imports is expected to decrease significantly, with flex-fuel vehicles contributing to 5 million barrels of oil savings annually by using ethanol.

- Rising Environmental Concerns: With over 7 billion metric tons of CO2 emissions recorded globally in 2024, many countries are aggressively pursuing alternative fuel sources to curb emissions from the transportation sector. Flex-fuel vehicles, capable of running on ethanol blends, are positioned as key contributors to reducing emissions.

Market Challenges

- Fluctuations in Biofuel Production: Biofuel production is heavily dependent on agricultural yields, which are vulnerable to climate change, droughts, and market dynamics. In 2024, ethanol production in Brazil and the U.S. faced reductions due to adverse weather conditions, leading to a supply shortfall of nearly 3 billion gallons of ethanol.

- Consumer Awareness and Misconceptions: Despite the potential benefits, consumer awareness about the advantages of flex-fuel vehicles remains low in several regions. In a 2024 global survey, 40 million potential car buyers reported they were unaware of the fuel-saving benefits offered by FFVs.

Global Flex-fuel Market Future Outlook

Over the next five years, the flex-fuel vehicle industry is expected to experience growth, driven by a combination of government support for alternative fuels, increasing consumer awareness, and advances in hybrid-flex-fuel technology.

Future Market Opportunities

- Increased Adoption in Developing Economies: Over the next five years, flex-fuel vehicles will see expanded adoption in developing economies, particularly in regions such as Latin America, Africa, and Southeast Asia. By 2029, it is projected that there will be over 50 million FFVs on the roads in these regions, supported by government policies favoring biofuel usage and reducing fossil fuel dependence.

- Advancements in Ethanol Production Technology: New ethanol production technologies, such as cellulosic ethanol, will be commercialized by 2028, improving the sustainability of biofuels. These innovations will lead to a 30% reduction in the cost of ethanol production, making it more competitive with gasoline and promoting the global adoption of flex-fuel vehicles.

Scope of the Report

|

Vehicle Type |

Passenger Cars Commercial Vehicles |

|

Fuel Type |

Gasoline Diesel |

|

Ethanol Blend Type |

E10 to E25 E25 to E85 E85 and Above |

|

Engine Type |

Internal Combustion Engines Hybrid Flex-Fuel Engines |

|

Region |

North America Europe Asia-Pacific Rest of the World |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Ethanol Producers

Banks and Financial Institution

Government and Regulatory Bodies (e.g., EPA, NHTSA)

Fuel Station Chains

Private Equity firms

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Ford Motor Company

General Motors

Toyota Motor Corporation

Honda Motor Co.

Volkswagen AG

Stellantis NV

Hyundai Motor Company

Fiat Chrysler Automobiles

Volvo Cars

Nissan Motor Co. Ltd

Table of Contents

Global Flex-fuel Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Flex-fuel Vehicle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Flex-fuel Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Environmental Sustainability Efforts

3.1.2. Rising Demand for Alternative Fuels

3.1.3. Government Policies Supporting Ethanol Adoption

3.1.4. Consumer Shift Toward Eco-friendly Vehicles

3.2. Market Challenges

3.2.1. High Production and R&D Costs

3.2.2. Availability of Ethanol Blends in Key Regions

3.2.3. Competition from Electric Vehicles

3.2.4. Lack of Infrastructure for Alternative Fuels

3.3. Opportunities

3.3.1. Growing Adoption in Emerging Markets (APAC, Latin America)

3.3.2. Development of Advanced Engine Technologies

3.3.3. Strategic Collaborations Between Automakers and Ethanol Suppliers

3.3.4. Flex-fuel Technology Integration with Hybrid Systems

3.4. Trends

3.4.1. Increasing Government Regulations on Greenhouse Emissions

3.4.2. Advancements in Biofuel Technology

3.4.3. Flex-fuel Vehicle Penetration in Commercial Segments

3.4.4. Enhanced Fuel Efficiency and Performance Adjustments for E85

3.5. Government Regulation

3.5.1. Subsidies for Ethanol-based Vehicles

3.5.2. Mandates for Ethanol Blends (E85, E25)

3.5.3. Global Environmental Agreements Impacting Vehicle Regulations

3.5.4. Incentives for Green Fleet Conversions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

Global Flex-fuel Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Passenger Cars

4.1.2. Commercial Vehicles

4.2. By Fuel Type (In Value %)

4.2.1. Gasoline

4.2.2. Diesel

4.3. By Ethanol Blend Type (In Value %)

4.3.1. E10 to E25

4.3.2. E25 to E85

4.3.3. E85 and Above

4.4. By Engine Type (In Value %)

4.4.1. Internal Combustion Engines

4.4.2. Hybrid Flex-Fuel Engines

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Rest of the World

Global Flex-fuel Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ford Motor Company

5.1.2. General Motors Company

5.1.3. Nissan Motor Co. Ltd.

5.1.4. Volkswagen AG

5.1.5. Honda Motor Co. Ltd.

5.1.6. Stellantis NV

5.1.7. Fiat Chrysler Automobiles

5.1.8. Hyundai Motor Company

5.1.9. Toyota Motor Corporation

5.1.10. Volvo Cars

5.1.11. Cummins Inc.

5.1.12. Renault Group

5.1.13. Kia Motors Corporation

5.1.14. Mitsubishi Motors

5.1.15. Robert Bosch GmbH

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Offerings, Market Presence, Partnerships, Innovations, R&D Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Private Equity Investments

Global Flex-fuel Vehicle Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

Global Flex-fuel Vehicle Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Flex-fuel Vehicle Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Ethanol Blend Type (In Value %)

8.4. By Engine Type (In Value %)

8.5. By Region (In Value %)

Global Flex-fuel Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we conducted an extensive desk analysis to map all stakeholders in the flex-fuel vehicle market, focusing on regulatory bodies, fuel suppliers, and key automotive players. Our objective was to identify market trends, key growth drivers, and barriers.

Step 2: Market Analysis and Construction

We used historical market data from 2018 to 2023 to assess growth patterns, market share distribution, and key performance indicators for vehicle types and fuel types. These insights were used to construct accurate market models.

Step 3: Hypothesis Validation and Expert Consultation

We engaged industry experts through structured interviews to validate our hypotheses about market drivers, regulatory impacts, and consumer behavior patterns. The insights helped refine market projections.

Step 4: Research Synthesis and Final Output

Finally, we synthesized data from industry reports, government agencies, and primary research to deliver a comprehensive view of the market. This involved integrating insights from automotive manufacturers and ethanol producers to form reliable market forecasts.

Frequently Asked Questions

01. How big is the Global Flex-fuel Vehicle Market?

The Global Flex-fuel Vehicle Market was valued at USD 98 billion, driven by rising demand for alternative fuel vehicles and increasing regulatory pressure on emissions.

02. What are the challenges in the Flex-fuel Vehicle Market?

Challenges in the Global Flex-fuel Vehicle Market include high production costs for ethanol, limited ethanol infrastructure in key regions, and competition from electric vehicles, which have seen faster adoption in recent years.

03. Who are the major players in the Flex-fuel Vehicle Market?

Major players in the Global Flex-fuel Vehicle Market include Ford, General Motors, Toyota, Honda, and Volkswagen. These companies lead the market through technological innovations and broad product offerings.

04. What drives growth in the Flex-fuel Vehicle Market?

Growth in the Global Flex-fuel Vehicle Market is driven by increasing government support for sustainable energy, consumer demand for eco-friendly vehicles, and technological advancements in ethanol fuel systems.

05. What regions dominate the Flex-fuel Vehicle Market?

North America dominates the Global Flex-fuel Vehicle Market due to strong governmental policies, while Asia-Pacific shows rapid growth due to rising ethanol adoption and environmental policies in countries like China and India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.