Global Flexible Packaging Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD2021

November 2024

85

About the Report

Global Flexible Packaging Market Overview

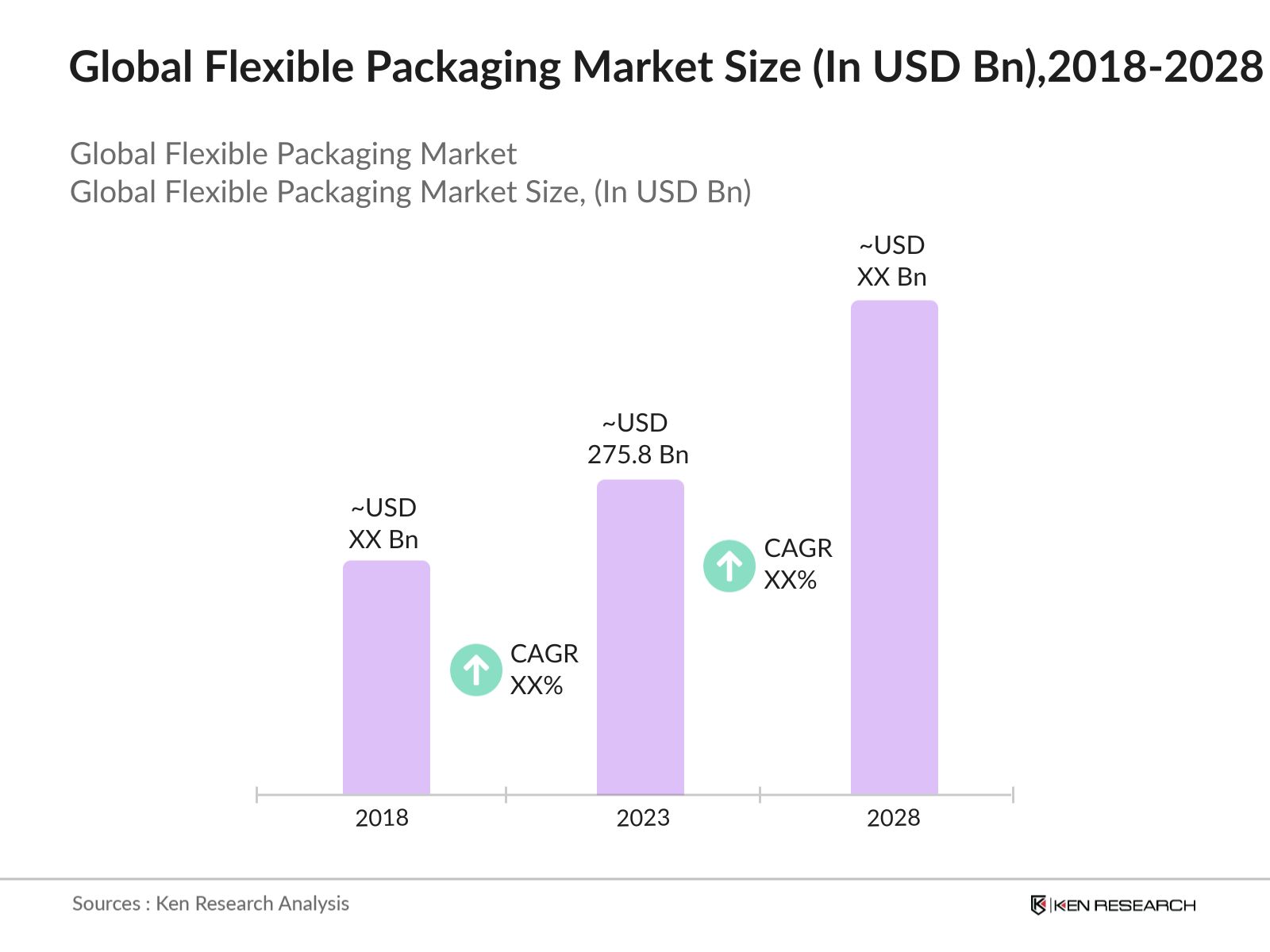

- In 2023, the Global Flexible Packaging Market was valued at USD 275.8 billion, driven by rising demand for lightweight, cost-effective, and eco-friendly packaging solutions across industries such as food, pharmaceuticals, and consumer goods. The market is segmented by material, product type, and application, with plastic materials being the dominant segment due to their versatility and wide usage.

- Major players in the flexible packaging market include Amcor, Mondi Group, Berry Global, Sealed Air, and Huhtamaki. These companies are recognized for their innovations in sustainable packaging solutions, focusing on reducing plastic waste and developing recyclable or biodegradable alternatives.

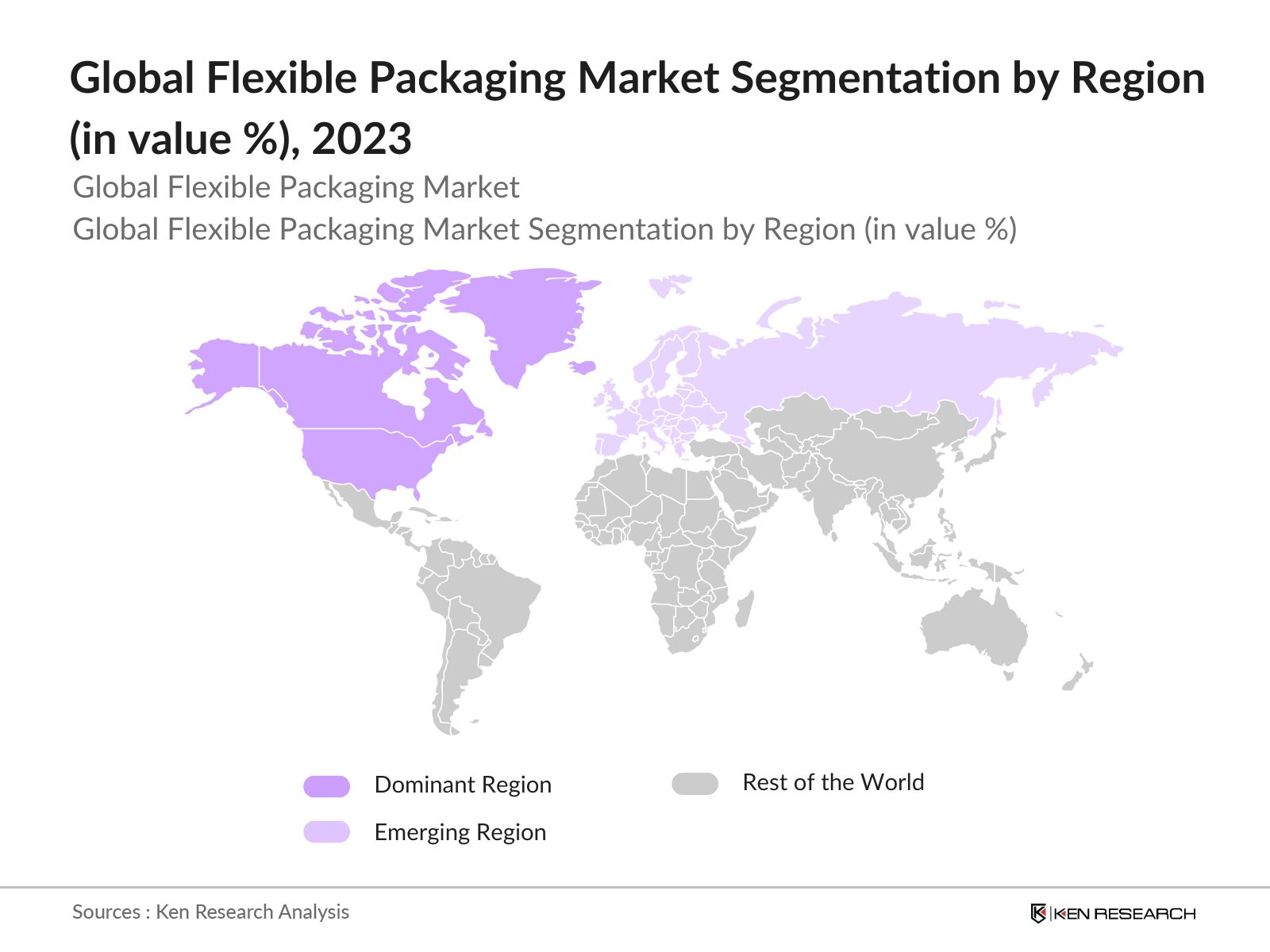

- In North America, the United States leads the market, supported by high consumer demand for convenient, portable packaging. Asia-Pacific is the fastest-growing region, driven by expanding food and beverage sectors, especially in China and India.

- In 2024, Amcor launched a new range of recyclable flexible packaging solutions aimed at reducing the carbon footprint of its packaging products, aligning with the global push towards sustainability in packaging.

Global Flexible Packaging Market Segmentation

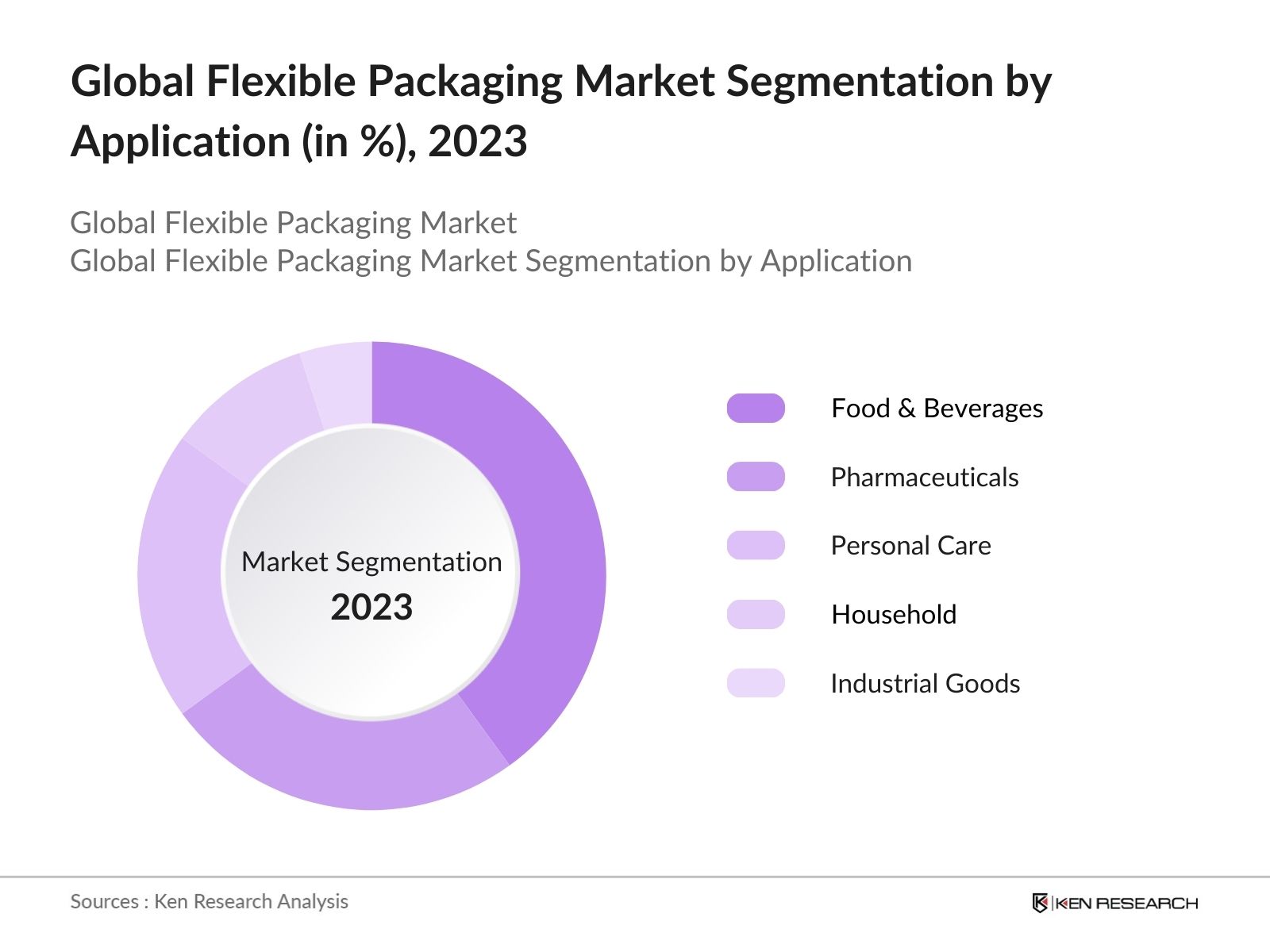

The global flexible packaging market is segmented by application, product type, and region:

- By Application: The market is segmented into Food & Beverage Industry, Healthcare & Pharmaceuticals, Cosmetics & Personal Care, Household Products, and Industrial Goods. In 2023, the food and beverage sector remain the largest application area, driven by the demand for single-use packaging and convenience foods, especially in urban areas.

- By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America leads, driven by demand for sustainable packaging in food, beverage, and pharma sectors.

- By Product Type: The market includes pouches, bags, Tubes, Sachets, and wraps. Pouches hold the largest share due to their widespread use in food and beverage packaging for products like snacks, frozen foods, and beverages.

Global Flexible Packaging Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Amcor |

1860 |

Zurich, Switzerland |

|

Mondi Group |

1967 |

Vienna, Austria |

|

Berry Global |

1967 |

Evansville, USA |

|

Sealed Air |

1960 |

Charlotte, USA |

|

Huhtamaki |

1920 |

Espoo, Finland |

- Amcor: In 2023, Amcor launched a new range of recyclable flexible packaging solutions aimed at reducing plastic waste. This innovation is part of the companys ongoing efforts to strengthen its leadership in sustainable packaging. The new product line focuses on providing eco-friendly solutions for the food and beverage industry, aligning with global trends toward reducing environmental impact in packaging.

- Mondi Group: In 2024, Mondi Group expanded its sustainable packaging portfolio by introducing fully recyclable paper-based packaging options. These products cater to the growing demand for environmentally friendly packaging in the consumer goods and e-commerce sectors, reinforcing Mondis position as a leader in the eco-conscious packaging market.

Global Flexible Packaging Market Analysis

Market Growth Drivers:

- Rising Demand for Convenient Packaging: In 2023, the global market saw strong demand, especially in the food and beverage sector, with over 160 billion units of flexible packaging consumed globally, driven by consumer preferences for portable, easy-to-use packaging that have increased the demand for convenient packaging.

- Sustainability Concerns: The market has experienced growth in sustainable packaging solutions, with over 70 billion units of recyclable and biodegradable flexible packaging produced worldwide in 2023, as environmental awareness continues to rise.

- Growth in Processed Food Consumption: The increasing consumption of processed and ready-to-eat foods has resulted in the use of flexible packaging for over 100 billion packaged food products in 2023, particularly in urban areas, where convenience is a key factor for the growth of flexible packaging.

Market Challenges:

- Limited Recycling Infrastructure: In many regions, especially in developing markets, inadequate recycling infrastructure limits the ability to recycle flexible packaging, with less than 20 billion units of flexible packaging recycled in 2023, creating environmental and regulatory challenges.

- Consumer Misinformation: A lack of awareness and understanding about the recyclability and sustainability of flexible packaging options among consumers has slowed the adoption of eco-friendly alternatives, affecting over 15 billion units of sustainable packaging that remained underutilized.

- High Initial Costs for Sustainable Solutions: The development and implementation of sustainable packaging solutions come with high initial costs, making it difficult for smaller manufacturers to compete. In 2023, more than 30% of companies reported challenges in adopting eco-friendly packaging due to higher production costs.

Government Initiatives

- Bipartisan Infrastructure Law: The U.S. government has invested USD 275 million in Solid Waste Infrastructure for Recycling grants to improve recycling, composting, and reuse infrastructure. This funding supports various projects aimed at enhancing local waste management practices.

- National Strategy for Reducing Food Loss and Waste and Recycling Organics: This strategy aims to halve food loss and waste in the U.S. by 2030. The Biden-Harris Administration has invested over USD 200 million to support this initiative, which includes enhancing recycling of organic materials.

Global Flexible Packaging Market Future Outlook

The global flexible packaging market is projected to show a substantial growth by 2028, driven by sustainability initiatives and technological advancements in packaging. The rise of e-commerce and the demand for lightweight, cost-effective packaging will further contribute to market growth.

Future Market Trends:

- Growth of E-commerce Packaging: The e-commerce packaging market is experiencing growth, driven by the rapid expansion of online shopping. As consumers increasingly turn to digital platforms for their purchasing needs, the demand for specialized packaging solutions tailored for e-commerce logistics is set to rise.

- Focus on Sustainability: The shift towards circular economy models will lead to innovations in recyclable, reusable, and compostable flexible packaging materials.

Scope of the Report

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

|

By Material Type |

Plastics (Polyethylene, Polypropylene, Polyethylene Terephthalate) Paper Aluminum Biodegradable Materials Multilayer Films |

|

By Product Type |

Pouches Bags Wraps Tubes Sachets |

|

By Application |

Food & Beverage Industry Healthcare & Pharmaceuticals Cosmetics & Personal Care Household Products Industrial Goods |

Products

Key Target Audience:

Flexible Packaging Manufacturers

E-commerce Companies

Food and Beverage Companies

Pharmaceutical Companies

Government and Regulatory Bodies (EPA, MEE, FDA, APCO)

Packaging R&D Firms

Sustainability Advocates

Banks and financial institute

Venture Capital Firms

Time Period Captured:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Amcor

Mondi Group

Berry Global

Sealed Air

Huhtamaki

Sonoco Products Company

Constantia Flexibles

Coveris

Aluflexpack

UFlex

Clondalkin Group

Bemis Company, Inc.

ProAmpac

FlexPak Services

Glenroy, Inc.

Table of Contents

1. Global Flexible Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Flexible Packaging Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Flexible Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Convenient Packaging

3.1.2. Sustainability Concerns

3.1.3. Growth in Processed Food Consumption

3.2. Restraints

3.2.1. Limited Recycling Infrastructure

3.2.2. Consumer Misinformation

3.2.3. High Initial Costs for Sustainable Solutions

3.3. Opportunities

3.3.1. Growth of E-commerce Packaging

3.3.2. Technological Innovations

3.3.3. Focus on Sustainability

3.4. Trends

3.4.1. Growth of Biodegradable Packaging

3.4.2. Adoption of Recyclable Solutions

3.4.3. Expansion in Emerging Markets

3.5. Government Regulation

3.5.1. Bipartisan Infrastructure Law

3.5.2. National Strategy for Reducing Food Loss and Waste

3.5.3. Consumer Electronics Battery Recycling Funding

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. Global Flexible Packaging Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Pouches

4.1.2. Bags

4.1.3. Wraps

4.1.4. Tubes

4.1.5. Sachets

4.2. By Application (in Value %)

4.2.1. Food & Beverage Industry

4.2.2. Healthcare & Pharmaceuticals

4.2.3. Cosmetics & Personal Care

4.2.4. Household Products

4.2.5. Industrial Goods

4.3. By Material Type (in Value %)

4.3.1. Plastics

4.3.2. Paper

4.3.3. Aluminum

4.3.4. Biodegradable Materials

4.3.5. Multilayer Films

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

5. Global Flexible Packaging Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Amcor

5.1.2. Mondi Group

5.1.3. Berry Global

5.1.4. Sealed Air

5.1.5. Huhtamaki

5.1.6. Sonoco Products Company

5.1.7. Constantia Flexibles

5.1.8. Coveris

5.1.9. Aluflexpack

5.1.10. UFlex

5.1.11. Clondalkin Group

5.1.12. Bemis Company, Inc.

5.1.13. ProAmpac

5.1.14. FlexPak Services

5.1.15. Glenroy, Inc.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Flexible Packaging Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Flexible Packaging Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Flexible Packaging Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Flexible Packaging Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Material Type (in Value %)

9.4. By Region (in Value %)

10. Global Flexible Packaging Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and packaging trends. We also assess regulatory impacts and market dynamics specific to the global flexible packaging market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (by material, product type, and application), and the distribution of sales channels (supermarkets, e-commerce, and specialty stores). We also analyze market share and revenue generated by leading brands, emerging trends in sustainable packaging, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading flexible packaging manufacturers, distributors, and retailers. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, supply chain management, and sustainability trends.

Step 4: Research Output

Our team interacts with packaging manufacturers, industry experts, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and emerging trends in eco-friendly packaging. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How big is the Global Flexible Packaging Market?

In 2023, the Global Flexible Packaging Market was valued at USD 275.8 billion. The market's growth is driven by the increasing demand for lightweight, convenient, and sustainable packaging solutions, particularly in the food, beverage, and pharmaceutical sectors.

02. What are the challenges in the Global Flexible Packaging Market?

Challenges in the flexible packaging market include rising raw material costs, which impact pricing and profit margins for manufacturers. Additionally, stringent regulatory requirements for sustainable and recyclable materials, as well as increasing competition, pose significant challenges.

03. Who are the major players in the Global Flexible Packaging Market?

Major players in the global flexible packaging market include Amcor, Mondi Group, Berry Global, Sealed Air, and Huhtamaki. These companies lead the market with their innovations in sustainable and recyclable packaging solutions, focusing on reducing plastic waste and developing eco-friendly alternatives.

04. What are the growth drivers of the Global Flexible Packaging Market?

Key growth drivers include the increasing demand for eco-friendly and lightweight packaging, the rising trend of e-commerce, and the ongoing innovations in packaging technology. Additionally, the growing preference for convenient, single-use packaging in the food and beverage sector contributes to the market's expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.