Global Flight Simulator Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD1073

October 2024

99

About the Report

Global Flight Simulator Market Overview

- The Global Flight Simulator Market was valued at USD 4.56 billion in 2023. This growth is largely driven by increasing demand for pilot training due to the rapid expansion of the aviation industry, technological advancements in simulation software and hardware, and heightened safety regulations.

- Key players in the market are CAE Inc., Thales Group, L3Harris Technologies, Boeing Company, and Lockheed Martin Corporation. These companies have established themselves as leaders in the market through continuous innovation, strategic partnerships, and acquisitions. They offer a wide range of flight simulation solutions catering to both commercial and military aviation sectors.

- In 2023, CAE Inc. acquired Flight Simulation Company B.V. (FSC) for a cash consideration of approximately 70 million, calculated based on an enterprise value of 100 million.This acquisition expands CAE's ability to address the training market for customers operating in Europe, including airline and cargo operators.

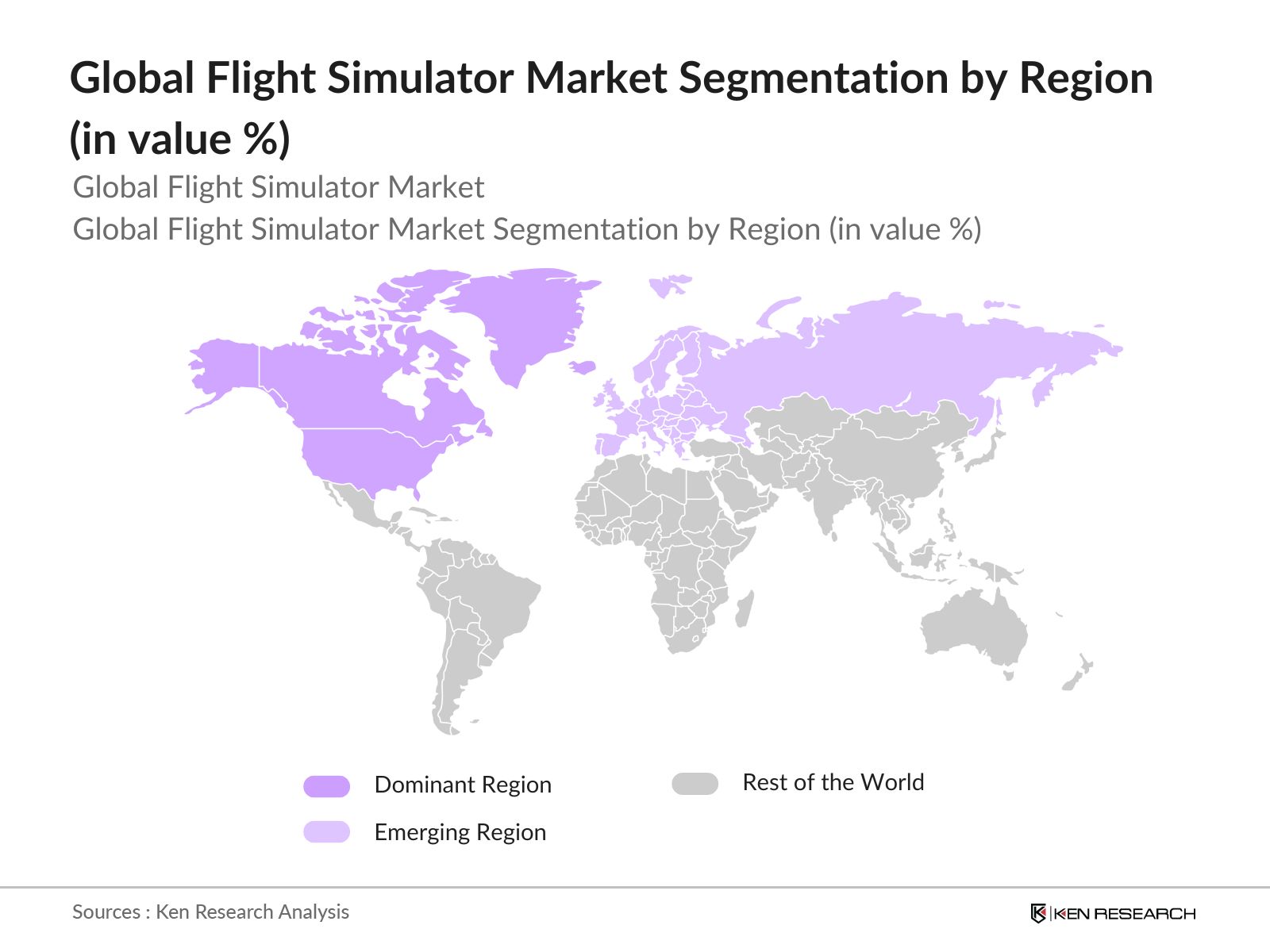

- North America, particularly the United States, dominates the global flight simulator market, due to the presence of major aerospace companies like Boeing and Lockheed Martin, as well as the high demand for both commercial and military pilot training in the region.

Global Flight Simulator Market Segmentation

The market is segmented in various factors like as product, application, and region.

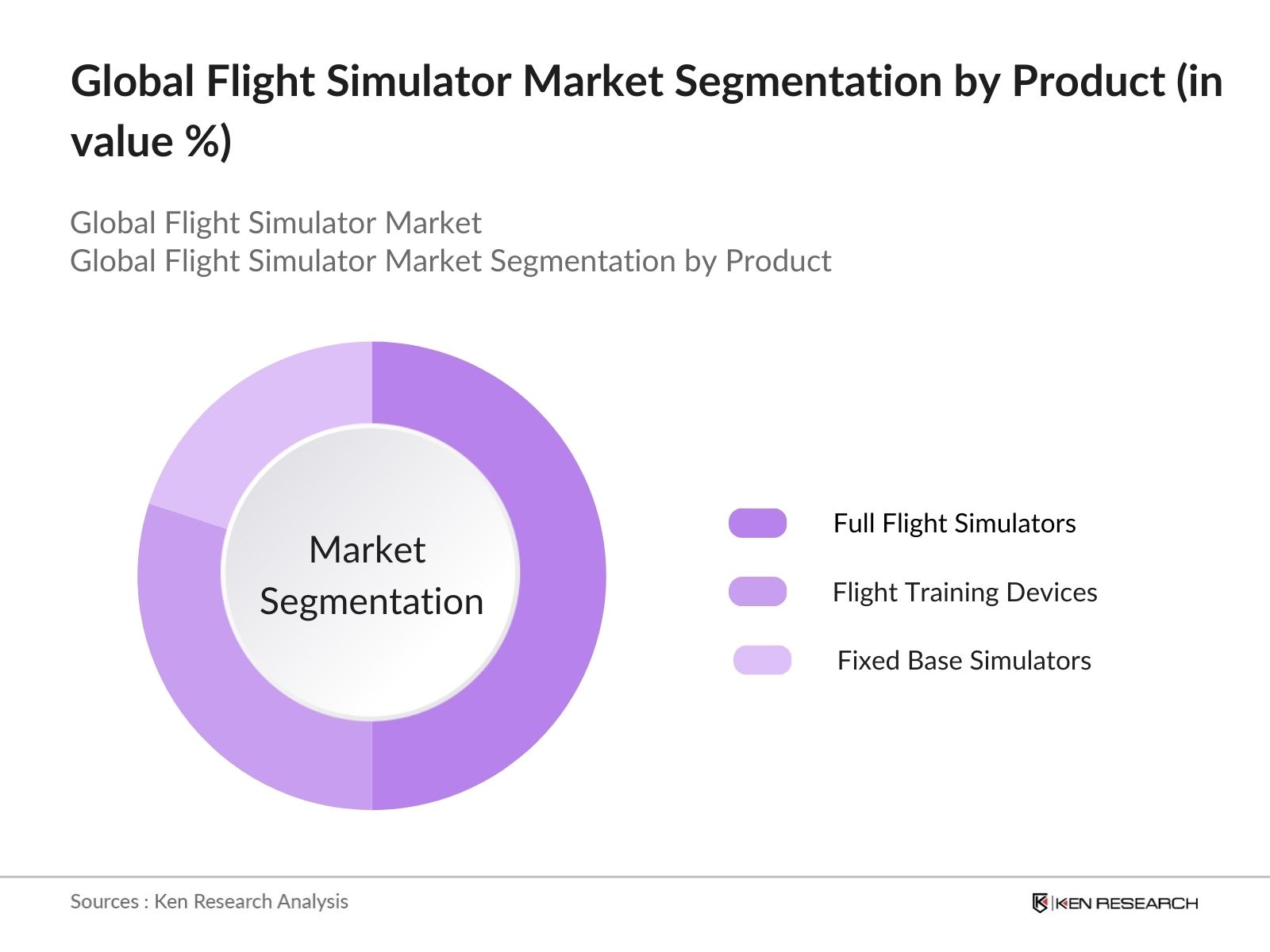

By Product: The market is segmented by product into full flight simulators (FFS), flight training devices (FTD), and fixed base simulators (FBS). In 2023, Full Flight Simulators held a dominant market share, due to the high demand for advanced simulation technologies that offer a comprehensive training experience.

By Region: The market is segmented by region into North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America. In 2023, North America dominated the market, due to the high demand for pilot training in the U.S. and Canada. The continuous advancements in flight simulation technology in North America are expected to maintain the regions dominance in the market.

By Application: The market is segmented by application into commercial aviation, military aviation, and unmanned aerial vehicles (UAVs). In 2023, Commercial Aviation was the leading segment, by increasing demand for commercial pilots, driven by the rapid growth in air travel, is a key factor contributing to this segment's dominance.

Global Flight Simulator Market Competitive

|

Company |

Establishment Year |

Headquarters |

|

CAE Inc. |

1947 |

Montreal, Canada |

|

Thales Group |

2000 |

Paris, France |

|

L3Harris Technologies |

2019 |

Melbourne, Florida, USA |

|

Boeing Company |

1916 |

Chicago, Illinois, USA |

|

Lockheed Martin Corporation |

1995 |

Bethesda, Maryland, USA |

- Thales Group: In May 2023, Thales and Simaero, in partnership with China Sky-Wings, relocated a H225 Reality H Level D full-flight simulator to China. This initiative enhances civilian pilot training in China, offering advanced simulation capabilities for various mission scenarios and weather conditions, significantly boosting local pilot training quality and safety.

- L3Harris Technologies: In July 2024, L3Harris secured a contract with Air Astana to deliver a second Airbus A320neo Full Flight Simulator (FFS) to the airline's training center at Astana International Airport. This simulator, scheduled to enter service in 2025, will enhance Air Astana's training capacity, supporting the airline's growing fleet and pilot training requirements.

Global Flight Simulator Market Analysis

Market Growth Drivers

- Surge in Global Air Travel Demand: In 2024, the global air travel industry is experiencing a significant uptick, with the International Air Transport Association (IATA) reporting an increase of 4.2 billion passenger journeys. This growth in air travel is driving the demand for new aircraft and, consequently, the need for trained pilots. The rising requirement for pilot training is directly boosting the flight simulator market, as airlines and training centers invest heavily in advanced simulation technologies to meet the growing demand for pilot certification and recurrent training.

- Increased Military Investments in Simulation Training The military sector continues to be a key driver for the flight simulator market. In 2024, the U.S. Department of Defense support training and simulation, reflecting a growing emphasis on cost-effective and safe training methods. Simulation technology allows military pilots to train in complex combat scenarios without the risks associated with live training exercises.

- Advancements in Virtual Reality and Artificial Intelligence: The integration of virtual reality (VR) and artificial intelligence (AI) in flight simulators has revolutionized the training experience, making it more immersive and effective. AI-driven simulators are capable of adapting to a pilot's learning curve, providing personalized training modules that enhance the overall efficiency of pilot training programs.

Market Challenges

- Regulatory Barriers and Certification Processes: The flight simulator industry is heavily regulated, with stringent certification requirements that vary across different regions. In 2024, it is estimated that the certification process for a new flight simulator system can take up to 18 months. These regulatory barriers can delay the deployment of new simulation technologies, limiting the ability of training centers to quickly adapt to the latest advancements.

- Limited Access to Technological Infrastructure in Developing Regions: In developing regions, the lack of access to advanced technological infrastructure, including high-speed internet and specialized training facilities, poses a significant challenge to the adoption of flight simulators. In 2024, it is estimated that only 40% of aviation training centers in Africa have access to the necessary infrastructure to support modern simulation systems.

Government Initiatives

- Federal Aviation Administration (FAA): In 2024, the U.S. Federal Aviation Administration (FAA) launched a USD 50 million initiative to streamline the certification of flight simulators, aiming to reduce approval times by 30%. This effort is expected to enhance the adoption of advanced simulation technologies in the aviation industry.

- Asia-Pacific Region Launch: The Asia-Pacific region has launched a USD 250 million initiative to enhance aviation safety through the adoption of advanced flight simulators. This initiative aims to foster the growth of the flight simulator market, by 2034, with Asia-Pacific leading the expansion.

Global Flight Simulator Market Future Outlook

The future trends in the global flight simulator industry include increased adoption of AI-powered simulators, expansion of simulation-based training in emerging markets, integration of sustainable practices, and the development of autonomous aircraft training simulators.

Future Market Trends

- Increased Adoption of AI-powered flight Simulators: Over the next five years, the adoption of AI-powered flight simulators is expected to become a key trend in the market. These simulators will leverage advanced AI algorithms to create personalized training experiences that adapt to individual pilot performance. By 2028, it is estimated that AI-driven simulators will enhance the effectiveness of their training programs.

- Development of Autonomous Aircraft Training Simulators: The rise of autonomous aircraft technology is expected to create a new segment within the flight simulator market. By 2028, training simulators specifically designed for autonomous aircraft operations will emerge, catering to the growing demand for skilled operators and technicians. These simulators will focus on training individuals in the unique challenges associated with managing autonomous flight systems, including AI-based decision-making processes and advanced system diagnostics.

Scope of the Report

|

By Product |

Full Flight Simulators (FFS) Flight Training Devices (FTD) Fixed Base Simulators (FBS) |

|

By Application |

Commercial Aviation Military Aviation Unmanned Aerial Vehicles (UAVs) |

|

By Platform |

Fixed Wing Simulator Rotary Wing Simulator UAV Simulator |

|

By Region |

North America Europe APAC MEA Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Airlines and Aviation Companies

Aircraft Manufacturers

Government Regulatory Bodies

Financial Institutions and Banks

Aircraft Leasing Companies

Venture Capital

Companies

Players Mentioned in the Report:

CAE Inc.

Thales Group

L3Harris Technologies

Boeing Company

Lockheed Martin Corporation

FlightSafety International

Raytheon Technologies Corporation

Airbus S.A.S.

Textron Inc.

Collins Aerospace

TRU Simulation + Training

Rheinmetall AG

BAE Systems

Cubic Corporation

Saab AB

Table of Contents

1. Global Flight Simulator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Flight Simulator Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Flight Simulator Market Analysis

3.1. Growth Drivers

3.1.1. Surge in Pilot Demand

3.1.2. Military Investments

3.1.3. Technological Advancements

3.1.4. Environmental Concerns

3.2. Restraints

3.2.1. High Initial Costs

3.2.2. Regulatory Barriers

3.2.3. Technical Infrastructure Limitations

3.2.4. Competition from Alternatives

3.3. Opportunities

3.3.1. Emerging Market Expansion

3.3.2. AI and VR Integration

3.3.3. Sustainable Training Solutions

3.3.4. Autonomous Aircraft Simulators

3.4. Trends

3.4.1. AI-Powered Simulators

3.4.2. Global Expansion of Training Centers

3.4.3. Increased Focus on Sustainability

3.4.4. Development of Autonomous Aircraft Simulators

3.5. Government Regulation

3.5.1. EU Aviation Training Modernization

3.5.2. U.S. FAA Simulator Certification

3.5.3. Asia-Pacific Safety Initiative

3.5.4. Middle East and Africa Enhancement Programs

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Flight Simulator Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Full Flight Simulators (FFS)

4.1.2. Flight Training Devices (FTD)

4.1.3. Fixed Base Simulators (FBS)

4.2. By Application (in Value %)

4.2.1. Commercial Aviation

4.2.2. Military Aviation

4.2.3. Unmanned Aerial Vehicles (UAVs)

4.3. By Platform (in Value %)

4.3.1. Fixed Wing Simulator

4.3.2. Rotary Wing Simulator

4.3.3. UAV Simulator

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific (APAC)

4.4.4. Middle East & Africa (MEA)

4.4.5. Latin America

5. Global Flight Simulator Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. CAE Inc.

5.1.2. Thales Group

5.1.3. L3Harris Technologies

5.1.4. Boeing Company

5.1.5. Lockheed Martin Corporation

5.1.6. FlightSafety International

5.1.7. Raytheon Technologies Corporation

5.1.8. Airbus S.A.S.

5.1.9. Textron Inc.

5.1.10. Collins Aerospace

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Flight Simulator Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Flight Simulator Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Flight Simulator Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Flight Simulator Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Platform (in Value %)

9.4. By Region (in Value %)

10. Global Flight Simulator Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step:2 Market Building:

Collating statistics on the Global Flight Simulator industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Flight Simulator industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple technology companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such technology companies.

Frequently Asked Questions

01 How big is the Global Flight Simulator market?

The Global Flight Simulator Market was valued at USD 4.56 billion in 2023. This growth is largely driven by increasing demand for pilot training due to the rapid expansion of the aviation industry, technological advancements in simulation software and hardware, and heightened safety regulations.

02 What are the challenges in Global Flight Simulator market?

The major challenges in the Global Flight Simulator market include such as high initial costs of simulators, regulatory hurdles, limited access to advanced infrastructure in developing regions, and competition from alternative training methods like augmented reality.

03 Who are the major players in the Global Flight Simulator market?

Key players in the Global Flight Simulator market include CAE Inc., Thales Group, L3Harris Technologies, Boeing Company, and Lockheed Martin Corporation, all of which are leaders in providing comprehensive flight simulation solutions across different sectors.

04 What are the main growth drivers of the Global Flight Simulator market?

The main growth drivers in the Global Flight Simulator market include the growing demand for trained pilots, increasing investments in military training, advancements in simulation technology such as AI and VR, and the need for cost-effective and environmentally friendly training solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.