Global Flow Battery Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD6909

December 2024

82

About the Report

Global Flow Battery Market Overview

- The global flow battery market is valued at USD 381.43 billion, driven by increasing demand for long-duration energy storage systems and the integration of renewable energy sources such as wind and solar. Flow batteries, particularly redox flow batteries, have gained traction due to their longer life cycle and scalability for large-scale energy storage projects. This market is primarily propelled by governmental energy storage mandates, subsidies, and rising industrial demand for backup power.

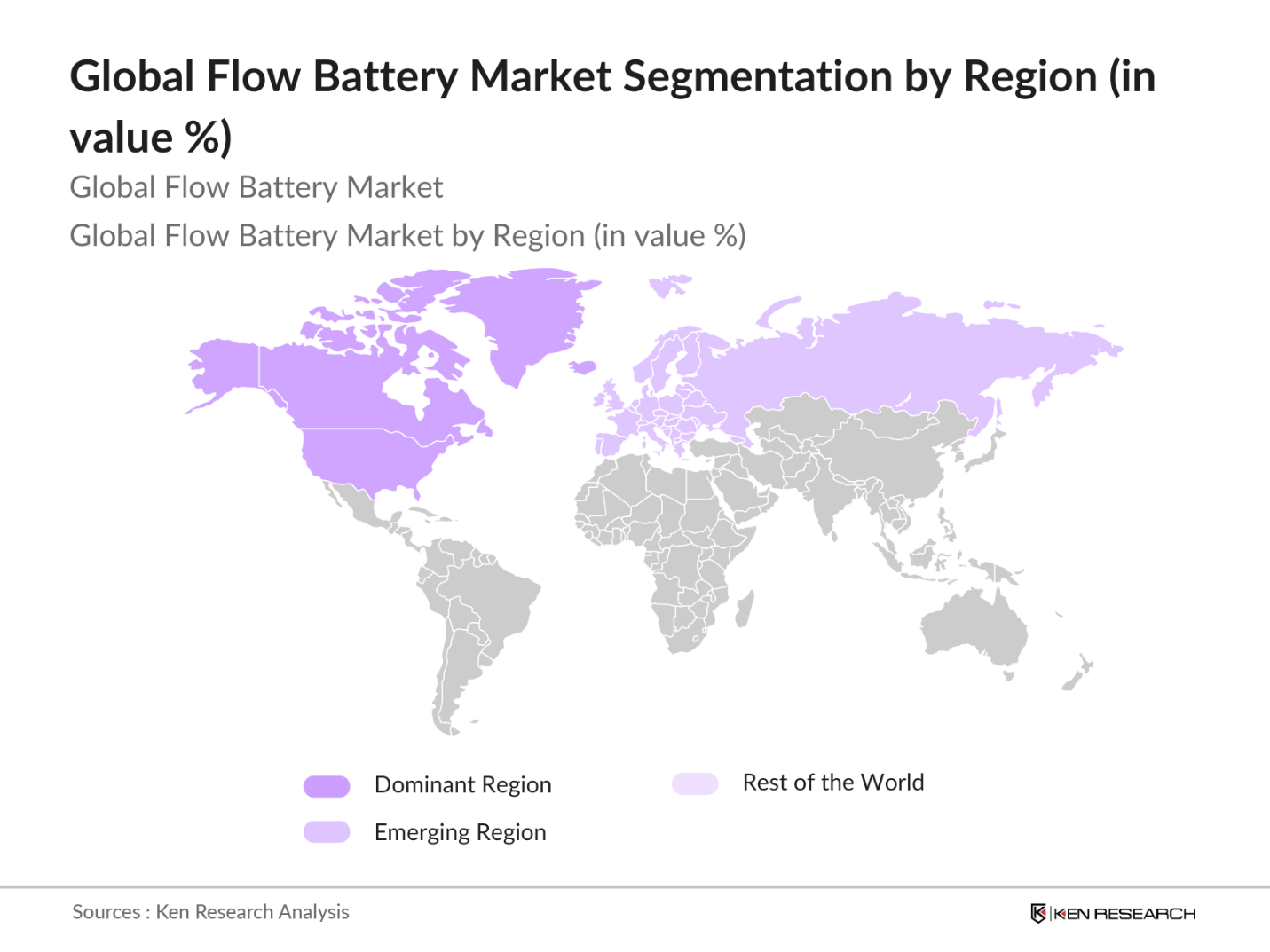

- Countries such as the United States, China, and Germany are dominant in the flow battery market. The United States leads due to its substantial investment in energy infrastructure and renewable integration, while China benefits from extensive manufacturing capabilities and supportive government policies aimed at reducing carbon emissions. Germany stands out for its energy transition initiatives and ambitious targets for renewable energy storage. These countries dominance stems from their focus on renewable energy and their commitment to grid stabilization through energy storage solutions.

- Governments are offering subsidies and grants specifically aimed at promoting the deployment of flow battery technologies. The European Commission has allocated over 1.2 billion in subsidies for flow battery pilot projects across member states in 2023. These subsidies are intended to encourage industries and utilities to adopt long-duration storage solutions. Similarly, in China, the government has launched a national program with $400 million in grants for energy storage projects, with flow batteries being a key focus due to their scalability and operational efficiency.

Global Flow Battery Market Segmentation

By Product Type: The flow battery market is segmented by product type into redox flow batteries and hybrid flow batteries. Redox flow batteries dominate the market due to their higher energy capacity, scalability, and long-duration energy storage capabilities. They are ideal for large-scale energy storage applications such as utility-scale energy storage, which drives their dominance. The key advantage of redox flow batteries is their ability to decouple energy and power, offering flexibility in sizing the energy storage system. Hybrid flow batteries, although gaining interest, are still in the early stages of adoption due to their relatively lower capacity and performance.

By Region: The flow battery market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America is the dominant region, driven by significant investments in renewable energy projects and favorable government policies supporting energy storage. Europe follows closely due to its strong focus on reducing carbon emissions and transitioning to renewable energy sources. The Asia Pacific region is also growing rapidly, led by China, where government support for renewable energy storage and manufacturing capacity drives growth.

Global Flow Battery Market Competitive Landscape

The flow battery market is consolidated with several key players dominating the market. These companies focus on technological innovation, strategic partnerships, and large-scale project deployments to maintain their market positions. The market is led by companies such as ESS Inc., Primus Power, and RedT Energy Plc. These players are investing heavily in research and development to improve battery efficiency and reduce costs, making flow batteries more competitive against other energy storage technologies such as lithium-ion batteries.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD) |

Key Technology |

No. of Employees |

Installed Projects |

Technology Focus |

R&D Investments |

Key Partnerships |

|

ESS Inc. |

2011 |

United States |

$100 million |

||||||

|

Primus Power |

2009 |

United States |

$90 million |

||||||

|

RedT Energy Plc |

2013 |

United Kingdom |

$80 million |

||||||

|

Vionx Energy |

2010 |

United States |

$70 million |

||||||

|

Invinity Energy Systems |

2019 |

United Kingdom |

$60 million |

Global Flow Battery Market Analysis

Market Growth Drivers

- Renewable Energy Integration (Market Parameter: Energy Storage Duration): Flow batteries are increasingly vital in the renewable energy space, offering the ability to store energy for up to 10 hours, compared to the 4-hour limit of lithium-ion batteries. According to the International Energy Agency (IEA), the global capacity for renewable energy is expected to grow by over 300 GW in 2024, necessitating advanced storage solutions. Flow batteries, which have the advantage of long-duration storage, are set to gain traction as energy storage becomes crucial for grid stability. Government investments into renewable energy projects like solar and wind, especially in regions such as Europe and North America, drive this growth.

- Grid Modernization (Parameter: Demand Response Mechanisms): Governments worldwide are focusing on grid modernization to improve energy efficiency and resilience. Flow batteries play a significant role in demand response systems, offering flexible storage solutions that can help stabilize grids. The U.S. Department of Energy has allocated over $13 billion in funding for grid improvements by 2024, with specific programs aimed at incorporating advanced storage technologies like flow batteries into grid management. This modernization is especially important in urban areas where peak energy demands require robust backup storage mechanisms.

- Industrial and Commercial Storage Demand (Parameter: Back-up Power Supply Needs): Flow batteries are becoming the preferred solution for industries requiring large-scale, long-duration energy storage. Industries like manufacturing and data centers need reliable backup power, which flow batteries can provide due to their scalability and ability to store energy for extended periods. As of 2024, industrial energy consumption is projected to increase by 2.5 billion kWh in the Asia-Pacific region alone, driven by industrial expansion, according to World Bank data. Flow batteries' ability to offer reliable energy storage makes them essential for industries managing large energy loads.

Market Challenges:

- High Initial Capital Costs (Parameter: CAPEX): The initial capital costs for flow batteries are higher compared to conventional lithium-ion batteries. The manufacturing and installation costs, driven by the complexity of the technology and the need for specialized materials like vanadium, create barriers to entry. According to the International Renewable Energy Agency (IRENA), the average cost per kWh of flow batteries stands at around $380 in 2023, which is still substantially higher than alternative energy storage options. While operational costs are lower, the upfront CAPEX limits adoption in cost-sensitive markets.

- Limited Commercial Scale Deployments (Parameter: Installed Base): While the technology behind flow batteries is promising, commercial-scale deployments remain limited. As of 2023, only about 0.4 GW of flow battery capacity was installed globally, compared to over 300 GW for lithium-ion batteries, according to the Global Energy Storage Database. The small installed base is partly due to the lack of standardized solutions and the need for large physical spaces for deployment. Governments are working to increase flow battery installations through pilot projects, but the technology is still in the early stages of commercial adoption.

Global Flow Battery Market Future Outlook

The global flow battery market is expected to show significant growth over the next five years, driven by increased renewable energy penetration, declining costs of critical materials like vanadium, and advancements in battery technology that enhance performance and reduce operational costs. Governments worldwide are introducing policies that mandate energy storage for grid stability, which is expected to boost the demand for flow batteries further. As technological innovations continue, flow batteries are expected to become more competitive with other forms of energy storage, opening up new opportunities in both developed and developing regions.

Market Opportunities:

- Extended Discharge Time Batteries: Flow batteries are gaining attention for their ability to offer extended discharge times, making them suitable for long-duration energy storage. According to the International Energy Agency, flow batteries can discharge energy for up to 10 hours, compared to 4-5 hours for traditional lithium-ion systems. This extended discharge capability is becoming increasingly important as grids rely more on intermittent renewable energy sources like wind and solar. The push for energy resilience in the face of climate change is driving further research and development into these extended-discharge batteries.

- Integration with Renewable Energy Microgrids: Flow batteries are emerging as a key technology for integrating renewable energy into microgrids, especially in remote or off-grid locations. Microgrid projects in rural areas of Africa and Asia are increasingly deploying flow batteries to manage energy storage for small-scale solar and wind power. According to the World Bank, over 2,000 microgrid projects worldwide are utilizing flow batteries as part of their energy storage systems. The modular nature of flow batteries makes them ideal for microgrid setups, offering scalability as energy demands grow.

Scope of the Report

|

By Product Type |

Redox Flow Battery Hybrid Flow Battery |

|

By Application |

Utility-Scale Power Generation Commercial & Industrial Off-Grid Solutions |

|

By Technology |

Vanadium Redox Flow Battery Zinc Bromide Flow Battery Iron-Chromium Flow Battery |

|

By Storage Capacity |

Below 10 MW 10 MW50 MW Above 50 MW |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Utility companies

Energy storage solution providers

Renewable energy project developers

Government and regulatory bodies (U.S. Department of Energy, European Commission)

Investments and venture capitalist firms

Independent power producers (IPPs)

Commercial and industrial energy consumers

Raw material suppliers

Companies

Players Mention in the Report

ESS Inc.

Primus Power

RedT Energy Plc

Sumitomo Electric Industries

Vionx Energy

UniEnergy Technologies

SCHMID Group

Lockheed Martin Energy

Invinity Energy Systems

ViZn Energy

Gildemeister Energy Solutions

Pellion Technologies

NanoFlowcell

Pu Neng Energy

Enerox GmbH

Table of Contents

1. Global Flow Battery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Flow Battery Technology Ecosystem

1.4. Market Segmentation Overview

1.5. Market Growth Metrics

1.6. Lifecycle Assessment

1.7. Regulatory Environment

2. Global Flow Battery Market Size (In USD Bn)

2.1. Historical Market Size (In USD Bn)

2.2. Year-On-Year Growth Analysis (In Units and USD)

2.3. Key Market Milestones

2.4. Demand Analysis by Technology (Redox, Hybrid, Other Chemistries)

2.5. Installation Capacity Growth (In MW)

3. Global Flow Battery Market Analysis

3.1. Growth Drivers

3.1.1. Renewable Energy Integration (Market Parameter: Energy Storage Duration)

3.1.2. Grid Modernization (Parameter: Demand Response Mechanisms)

3.1.3. Industrial and Commercial Storage Demand (Parameter: Back-up Power Supply Needs)

3.2. Market Challenges

3.2.1. High Initial Capital Costs (Parameter: CAPEX)

3.2.2. Limited Commercial Scale Deployments (Parameter: Installed Base)

3.2.3. Technical Complexities in Chemistry (Parameter: Electrolyte Stability)

3.3. Opportunities

3.3.1. Emerging Applications in Off-Grid Systems

3.3.2. Technological Innovations (Parameter: Extended Lifespan)

3.3.3. Declining Costs of Critical Materials (Parameter: Vanadium Pricing Trends)

3.4. Trends

3.4.1. Extended Discharge Time Batteries

3.4.2. Integration with Renewable Energy Microgrids

3.4.3. Customization for Industrial Applications

3.5. Government Regulations and Incentives

3.5.1. Energy Storage Mandates (Parameter: National Storage Targets)

3.5.2. Subsidies and Grants for Flow Battery Deployment

3.5.3. Public-Private Collaboration Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Flow Battery Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Redox Flow Battery

4.1.2. Hybrid Flow Battery

4.2. By Application (In Value %)

4.2.1. Utility-Scale Power Generation

4.2.2. Commercial and Industrial

4.2.3. Off-Grid Solutions

4.3. By Technology (In Value %)

4.3.1. Vanadium Redox Flow Battery

4.3.2. Zinc Bromide Flow Battery

4.3.3. Iron-Chromium Flow Battery

4.4. By Storage Capacity (In Value %)

4.4.1. Below 10 MW

4.4.2. 10 MW50 MW

4.4.3. Above 50 MW

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. Global Flow Battery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ESS Inc.

5.1.2. Primus Power

5.1.3. RedT Energy Plc

5.1.4. Sumitomo Electric Industries

5.1.5. Vionx Energy

5.1.6. UniEnergy Technologies

5.1.7. SCHMID Group

5.1.8. Lockheed Martin Energy

5.1.9. Invinity Energy Systems

5.1.10. ViZn Energy

5.1.11. Gildemeister Energy Solutions

5.1.12. Pellion Technologies

5.1.13. NanoFlowcell

5.1.14. Pu Neng Energy

5.1.15. Enerox GmbH

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Installed Projects, Technology Focus, Key Partnerships, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Flow Battery Market Regulatory Framework

6.1. Energy Storage Standards (Parameter: Compliance Requirements)

6.2. Safety Regulations (Parameter: Fire Safety Protocols)

6.3. Certification Processes (Parameter: UL, IEC Standards)

7. Global Flow Battery Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Flow Battery Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Storage Capacity (In Value %)

8.5. By Region (In Value %)

9. Global Flow Battery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we constructed an ecosystem map that encompassed all the major stakeholders within the global flow battery market. Using extensive desk research and proprietary databases, we gathered industry-level information to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

Next, we compiled and analyzed historical data related to the global flow battery market. This included assessing market penetration, key performance metrics, and the ratio of market participants to service providers. We further evaluated energy storage deployment statistics to ensure the reliability and accuracy of our revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses were developed and subsequently validated through interviews with industry experts representing a diverse array of companies. These consultations provided valuable insights into market trends and operational performance, ensuring a refined and corroborated market dataset.

Step 4: Research Synthesis and Final Output

In the final phase, we engaged with multiple energy storage solution providers to gain detailed insights into product segments, sales performance, and consumer preferences. This interaction verified the data derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the global flow battery market.

Frequently Asked Questions

01. How big is the Global Flow Battery Market?

The global flow battery market was valued at USD 381.43 billion, driven by increased renewable energy integration and long-duration storage requirements.

02. What are the challenges in the Global Flow Battery Market?

Challenges in the global flow battery market include high initial capital costs, limited commercial-scale deployments, and technical complexities in battery chemistry.

03. Who are the major players in the Global Flow Battery Market?

Key players in the global flow battery market include ESS Inc., Primus Power, RedT Energy Plc, and Vionx Energy, which dominate due to their technological advancements and large-scale project deployments.

04. What are the growth drivers of the Global Flow Battery Market?

The market is driven by renewable energy integration, grid modernization initiatives, and increasing industrial demand for reliable backup power solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.