Region:Global

Author(s):Geetanshi

Product Code:KRAC0029

Pages:89

Published On:August 2025

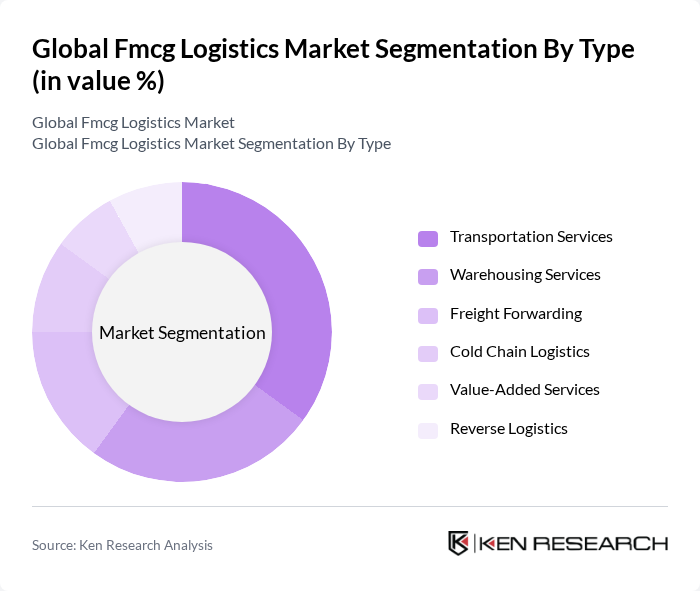

By Type:The FMCG logistics market is segmented into transportation services, warehousing services, freight forwarding, cold chain logistics, value-added services, and reverse logistics. Among these, transportation services remain the largest segment, driven by the growing demand for faster delivery, expansion of e-commerce, and increasing focus on efficient supply chain management. The adoption of advanced technologies such as route optimization and real-time tracking further enhances the importance of transportation in the logistics chain .

By End-User:The end-user segmentation of the FMCG logistics market includes food and beverage, personal care & cosmetics, household products, health and wellness, over-the-counter pharmaceuticals, and others. The food and beverage sector leads the market, driven by the constant demand for perishable goods and the need for efficient supply chain solutions to maintain product freshness and quality. The personal care and household products segments are also significant, reflecting evolving consumer preferences for convenience, health, and sustainability .

The Global FMCG Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, C.H. Robinson, Kuehne + Nagel, DB Schenker, UPS Supply Chain Solutions, FedEx Logistics, J.B. Hunt Transport Services, Ryder Supply Chain Solutions, Geodis, CEVA Logistics, Nippon Express, DSV A/S, Agility Logistics, Toll Group, Yusen Logistics, Sinotrans Limited, Kerry Logistics Network, CJ Logistics, and Dachser Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FMCG logistics market is poised for transformation, driven by the integration of advanced technologies and evolving consumer preferences. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Furthermore, the focus on sustainability will shape logistics strategies, with a growing emphasis on eco-friendly practices. The expansion into emerging markets will also present new opportunities, allowing businesses to tap into previously underserved regions and enhance their global footprint.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Services Freight Forwarding Cold Chain Logistics Value-Added Services Reverse Logistics |

| By End-User | Food and Beverage Personal Care & Cosmetics Household Products Health and Wellness Over-the-Counter Pharmaceuticals Others |

| By Distribution Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation Multimodal Transportation Others |

| By Sales Channel | Direct Sales Online Sales (E-commerce) Retail Sales Wholesale Distribution Others |

| By Packaging Type | Bulk Packaging Retail Packaging Reusable Packaging Sustainable Packaging Others |

| By Service Type | Standard Services Premium Services Customized Services Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FMCG Distribution Logistics | 100 | Logistics Directors, Supply Chain Managers |

| Cold Chain Management | 60 | Operations Managers, Quality Assurance Managers |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, E-commerce Operations Leads |

| Inventory Management Practices | 40 | Warehouse Managers, Inventory Control Specialists |

| Sustainability in Logistics | 40 | Sustainability Managers, Corporate Social Responsibility Managers |

The Global FMCG Logistics Market is valued at approximately USD 1.2 trillion, driven by increasing consumer demand for fast-moving consumer goods and the rapid expansion of e-commerce, alongside advancements in supply chain management technologies.