Global Food and Beverage Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2798

December 2024

99

About the Report

Global Food and Beverage Market Overview

- The global food and beverage market is valued at approximately USD 6576.96 billion, driven by a variety of factors including rising disposable incomes and a shift toward healthier food options. This growth reflects strong economic performance across emerging markets, particularly in Asia-Pacific, which is the largest region for food and beverage consumption. Consumer preferences are evolving toward organic, clean-label products and convenience, pushing companies to innovate continually.

- Countries like the United States, China, and Germany dominate the food and beverage market due to their large populations, advanced retail infrastructure, and strong consumer spending. The presence of numerous multinational corporations and the high rate of urbanization in these countries further contribute to their dominance, fostering a competitive environment that drives market growth

- In the United States, the Department of Agriculture (USDA) has provided incentives to support organic farming and sustainable food production under the Organic Certification Cost Share Program. As of 2023, the USDA allocated over USD 100 million to assist small and medium-sized farms in obtaining organic certification. Additionally, through the 2023 Farm Bill, the USDA committed another USD 10 billion toward research and development of sustainable agricultural practices, helping the U.S. expand its organic farming acreage to over 35 million hectares, boosting the clean-label product market.

Global Food and Beverage Market Segmentation

By Product Type: The global food and beverage market is segmented by product type into alcoholic beverages, non-alcoholic beverages, dairy products, meat, poultry, seafood, grains, and snacks. Among these, non-alcoholic beverages hold a significant market share due to the increasing health consciousness among consumers and the rise in demand for functional drinks, which offer health benefits. This segment appeals to a broad audience looking for healthier alternatives to traditional sugary drinks.

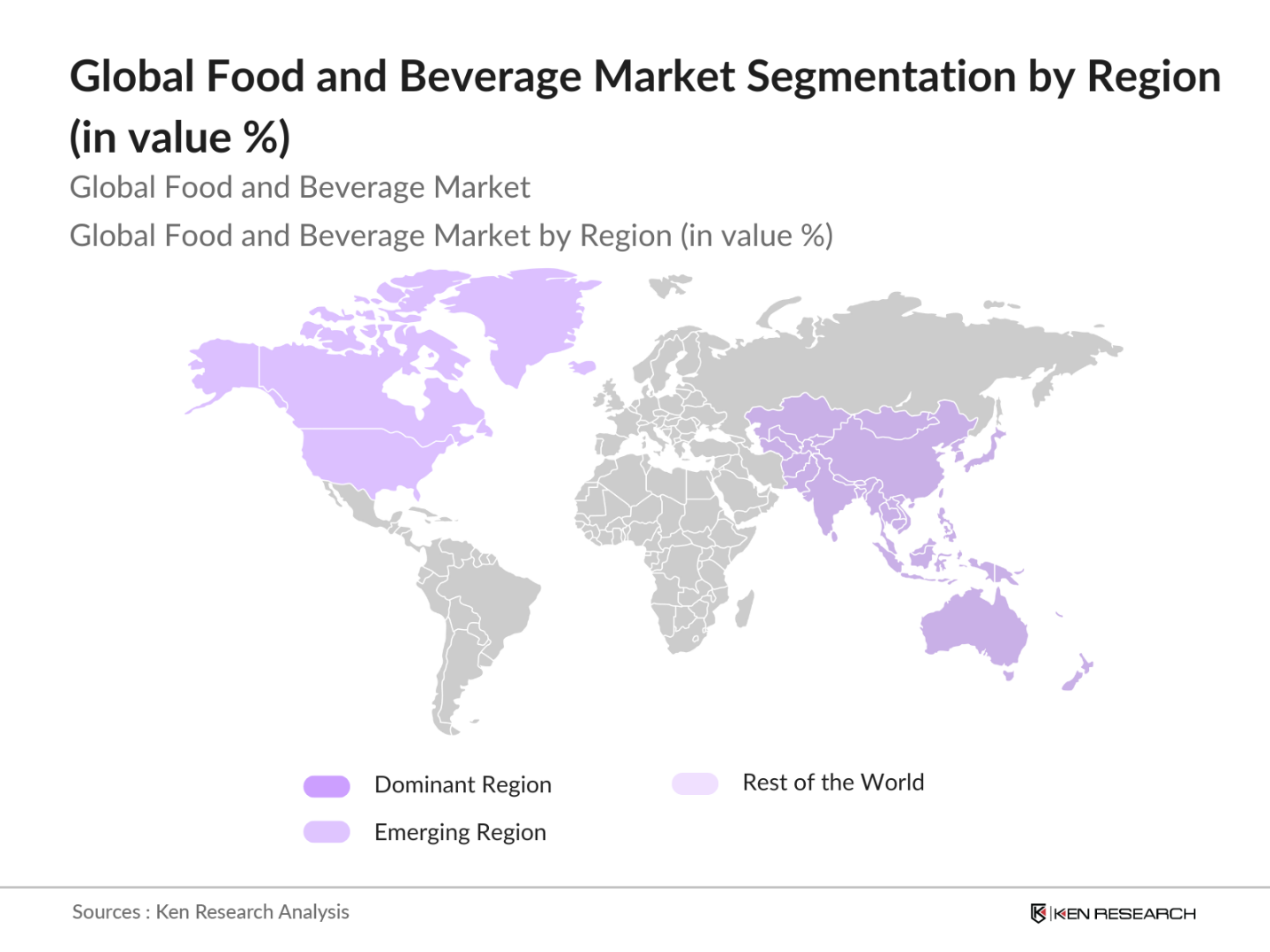

By Region: The food and beverage market is also segmented by region, with Asia-Pacific, North America, and Europe being the dominant regions. Asia-Pacific leads due to its large population base and rapid urbanization, contributing to a growing middle class that seeks diverse food and beverage options. North America follows closely, driven by high disposable incomes and a robust retail sector.

Global Food and Beverage Market Competitive Landscape

The global food and beverage market is characterized by a few key players that dominate the landscape. These include major corporations such as Nestl, PepsiCo, and Anheuser-Busch InBev. These companies have established strong brand loyalty and extensive distribution networks, allowing them to maintain significant market shares.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Product Range |

Market Presence |

R&D Investment |

|

Nestl |

1866 |

Vevey, Switzerland |

||||

|

PepsiCo |

1965 |

Purchase, USA |

||||

|

Anheuser-Busch InBev |

2008 |

Leuven, Belgium |

||||

|

The Coca-Cola Company |

1892 |

Atlanta, USA |

||||

|

JBS S.A. |

1953 |

So Paulo, Brazil |

Global Food and Beverage Market Analysis

Market Growth Drivers

- Rising Disposable Income: The global rise in disposable income, especially in emerging economies, has directly impacted the food and beverage (F&B) market. In countries such as India, where GDP per capita rose from USD 2,140 in 2022 to USD 2,318 in 2024, consumer spending on higher-quality and premium food products has significantly increased. Similarly, China saw a rise in disposable income to USD 6,070 per capita in 2024, according to the World Bank. This increase is encouraging higher spending on organic and specialty foods. Growing middle-class populations in these regions further accelerate this trend, fueling F&B market growth.

- Growth in Organized Retail: Organized retail in developing nations has witnessed a surge, driven by the expansion of supermarkets and hypermarkets, offering increased access to a wide range of F&B products. In 2023, Indias retail sector stood at USD 900 billion, with organized retail comprising USD 200 billion, reflecting the growing infrastructure supporting F&B distribution. Moreover, Indonesia experienced a rapid expansion in organized retail, reaching 25,000 modern retail stores in 2023, providing significant market entry opportunities for new F&B products.

- Demand for Organic and Clean-Label Products

Consumer demand for organic and clean-label products is rising, driven by heightened health awareness. According to the Food and Agriculture Organization (FAO), organic food sales reached USD 125 billion globally in 2023. Organic farming acreage grew by 9 million hectares globally from 2022 to 2023, largely in Europe and North America. The USA saw over 35 million hectares dedicated to organic farming in 2023, enhancing the availability of organic raw materials for clean-label products.

Market Challenges:

- Volatile Raw Material Prices: Raw material price volatility continues to be a significant challenge for the F&B market. In 2023, the World Bank reported a 15% increase in food commodity prices due to supply chain disruptions and climate-related issues. The Food Price Index (FPI) from the FAO averaged 130 points in 2023, illustrating ongoing instability in key inputs like cereals, oils, and sugar. These fluctuations directly impact production costs and profit margins for F&B companies.

- Regulatory Compliance: Strict regulatory frameworks across different regions challenge F&B companies, as they must navigate complex labeling, safety, and environmental compliance. For instance, the European Union enforced stringent food safety regulations under the Food Information to Consumers (FIC) law, affecting 30,000 companies across the region in 2023. The U.S. FDA continues to intensify its scrutiny of food labeling, impacting thousands of domestic and imported products. These measures require extensive adaptation from manufacturers, increasing operational costs.

Global Food and Beverage Market Future Outlook

Over the next five years, the global food and beverage market is expected to experience significant growth. This growth will be driven by continued government support for agriculture, increasing consumer awareness of health and wellness, and innovations in food technology. Additionally, the market will likely benefit from ongoing urbanization and an increase in disposable income across developing regions.

Market Opportunities:

- Sustainable and Ethical Food Sourcing: Sustainable and ethical food sourcing has become a major trend, with consumers increasingly prioritizing environmental responsibility. More food producers are adopting sustainable practices, such as regenerative agriculture, and there is a noticeable shift towards greener supply chains. This reflects the growing consumer demand for responsibly sourced food and beverage products.

- Rise of Functional Beverages: The demand for functional beveragessuch as those fortified with vitamins, minerals, and probioticsis rising rapidly. The global functional beverages market reached USD 120 billion in 2023, according to FAO data. North America leads this growth, with the U.S. accounting for over 35% of global consumption. In 2023, consumer spending on functional drinks in China increased by 25%, as more people seek products that offer health benefits like energy boosts and digestive support.

Scope of the Report

|

By Type |

Dairy Products Meat & Poultry Fruits & Vegetables Grains & Cereals Alcoholic Beverages Non-Alcoholic Beverages |

|

By Application |

Home Consumption Commercial Food Services |

|

By Distribution Channel |

Online Offline |

|

By Product Form |

Solid Liquid Semi-Solid |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Retail Chains (Supermarkets and Hypermarkets)

Food Service Providers (Restaurants, Cafs)

E-commerce Platforms

Health and Wellness Brands

Food Manufacturers

Distributors and Wholesalers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EFSA)

Companies

Players Mention in the Report

Nestl

PepsiCo

Anheuser-Busch InBev

The Coca-Cola Company

JBS S.A.

Tyson Foods

Unilever

Mondelez International

General Mills

Kraft Heinz

Danone

Mars, Incorporated

Cargill

Diageo

Fonterra

Table of Contents

01. Global F&B Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Growth Drivers

1.4 Market Segmentation Overview

02. Global F&B Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments

03. Global F&B Market Analysis

3.1 Growth Drivers

3.1.1 Rising Disposable Income

3.1.2 Growth in Organized Retail

3.1.3 Demand for Organic and Clean-Label Products

3.1.4 Expansion of E-commerce in F&B

3.2 Market Challenges

3.2.1 Volatile Raw Material Prices

3.2.2 Regulatory Compliance

3.2.3 Supply Chain Disruptions (COVID-19 Impact)

3.3 Opportunities

3.3.1 Technological Innovations in Food Processing

3.3.2 Plant-Based Food Alternatives

3.3.3 Personalized Nutrition Solutions

3.4 Trends

3.4.1 Rise of Functional Beverages

3.4.2 Growth of Healthy Snacking Options

3.4.3 Sustainable and Ethical Food Sourcing

04. Global F&B Market Segmentation (In Value %)

4.1 By Type

4.1.1 Dairy Products

4.1.2 Meat & Poultry

4.1.3 Fruits & Vegetables

4.1.4 Grains & Cereals

4.1.5 Beverages (Alcoholic & Non-Alcoholic)

4.2 By Application

4.2.1 Home Consumption

4.2.2 Commercial Food Services

4.3 By Distribution Channel

4.3.1 Online

4.3.2 Offline (Supermarkets, Convenience Stores, Specialty Stores)

4.4 By Product Form

4.4.1 Solid

4.4.2 Liquid

4.4.3 Semi-Solid

4.5 By Region

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

05. Global F&B Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Nestl S.A.

5.1.2 PepsiCo, Inc.

5.1.3 JBS S.A.

5.1.4 Anheuser-Busch InBev

5.1.5 Tyson Foods, Inc.

5.1.6 Mars, Incorporated

5.1.7 The Coca-Cola Company

5.1.8 Cargill, Inc.

5.1.9 Unilever

5.1.10 Kraft Heinz Company

5.1.11 Kellogg Company

5.1.12 General Mills

5.1.13 Fonterra Co-operative Group

5.1.14 Danone S.A.

5.1.15 Archer Daniels Midland (ADM) 5.2 Cross Comparison Parameters (Revenue, Headquarters, Number of Employees, Market Share, Geographic Presence, Product Portfolio, Innovations)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

06. Global F&B Regulatory Framework

6.1 Food Safety Regulations

6.2 Nutritional Labeling Standards

6.3 Sustainability Guidelines

6.4 Import/Export Compliance

07. Global F&B Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

08. Global F&B Future Market Segmentation

8.1 By Type

8.2 By Application

8.3 By Distribution Channel

8.4 By Product Form

8.5 By Region

09. Global F&B Market Analyst Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Marketing Initiatives and Recommendations

9.3 Consumer Behavior Insights

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves creating an ecosystem map encompassing all significant stakeholders within the global food and beverage market. Extensive desk research utilizing both secondary and proprietary databases is employed to gather comprehensive industry-level information.

Step 2: Market Analysis and Construction

In this phase, historical data relating to the food and beverage market is compiled and analyzed. This includes assessing market penetration and the relationship between marketplaces and service providers, along with revenue generation evaluation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts across a range of companies. These discussions provide valuable insights that are instrumental in refining market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with food and beverage manufacturers to gather insights into product segments and consumer preferences. This interaction verifies and complements the statistics derived from the bottom-up approach, ensuring an accurate analysis of the market.

Frequently Asked Questions

01. How big is the global food and beverage market?

The global food and beverage market is valued at approximately USD 6576.96 billion, driven by a variety of factors including rising disposable incomes and a shift toward healthier food options.

02. What are the major challenges in the global food and beverage market?

Key challenges include volatile raw material prices, regulatory compliance, and supply chain disruptions that have arisen due to events such as the COVID-19 pandemic and geopolitical tensions.

03. Who are the major players in the global food and beverage market?

Major players include Nestl, PepsiCo, Anheuser-Busch InBev, The Coca-Cola Company, and JBS S.A., which dominate due to their strong brand loyalty and extensive distribution networks.

04. What are the growth drivers of the global food and beverage market?

The market is propelled by increasing disposable income, consumer preferences for organic and clean-label products, and technological advancements in food processing and delivery.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.