Global Food Contract Manufacturing Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD10682

December 2024

84

About the Report

Global Food Contract Manufacturing Market Overview

- The Global Food Contract Manufacturing market, valued at USD 144 billion, reflects robust growth fueled by several factors. A notable rise in outsourcing by food manufacturers aiming to cut production costs and enhance operational efficiency has driven the market. Furthermore, the demand for high-quality, specialized food products, such as organic and clean-label items, has led many companies to rely on contract manufacturers with specific expertise, further propelling market expansion.

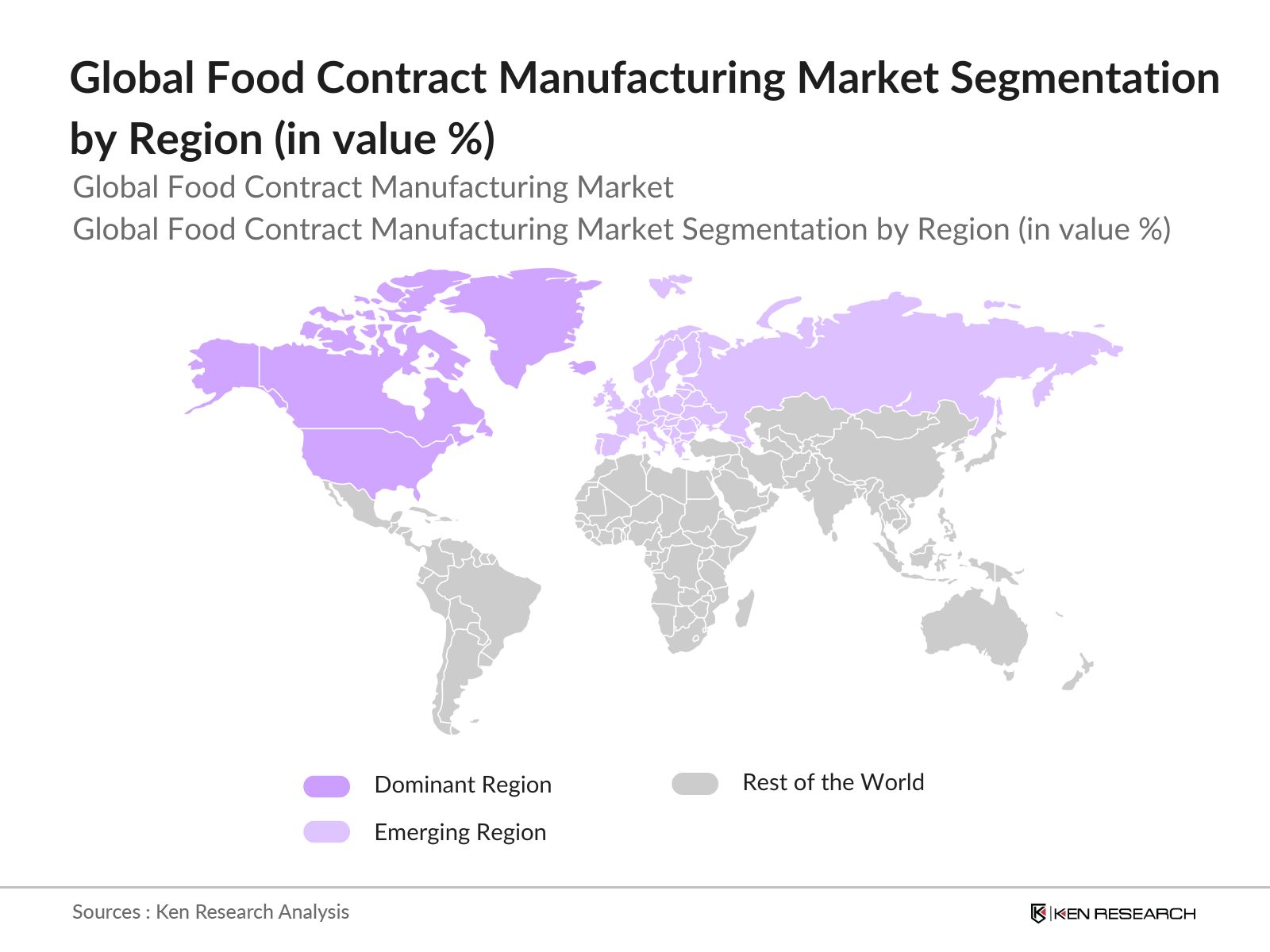

- Key markets leading the food contract manufacturing industry include North America, particularly the United States, and the Asia Pacific region, led by China and India. The dominance of these regions can be attributed to their substantial food and beverage sectors, advanced processing facilities, and extensive distribution networks. Additionally, established regulatory frameworks and a high rate of technological adoption support market growth, ensuring quality and scalability in production.

- Compliance with global food safety standards, such as HACCP and ISO, has become more stringent. The FDA reports that over 80% of food manufacturers in the US have adopted HACCP systems, reflecting the industry's commitment to safety and quality. Contract manufacturers adhering to these standards ensure market competitiveness and legal compliance.

Global Food Contract Manufacturing Market Segmentation

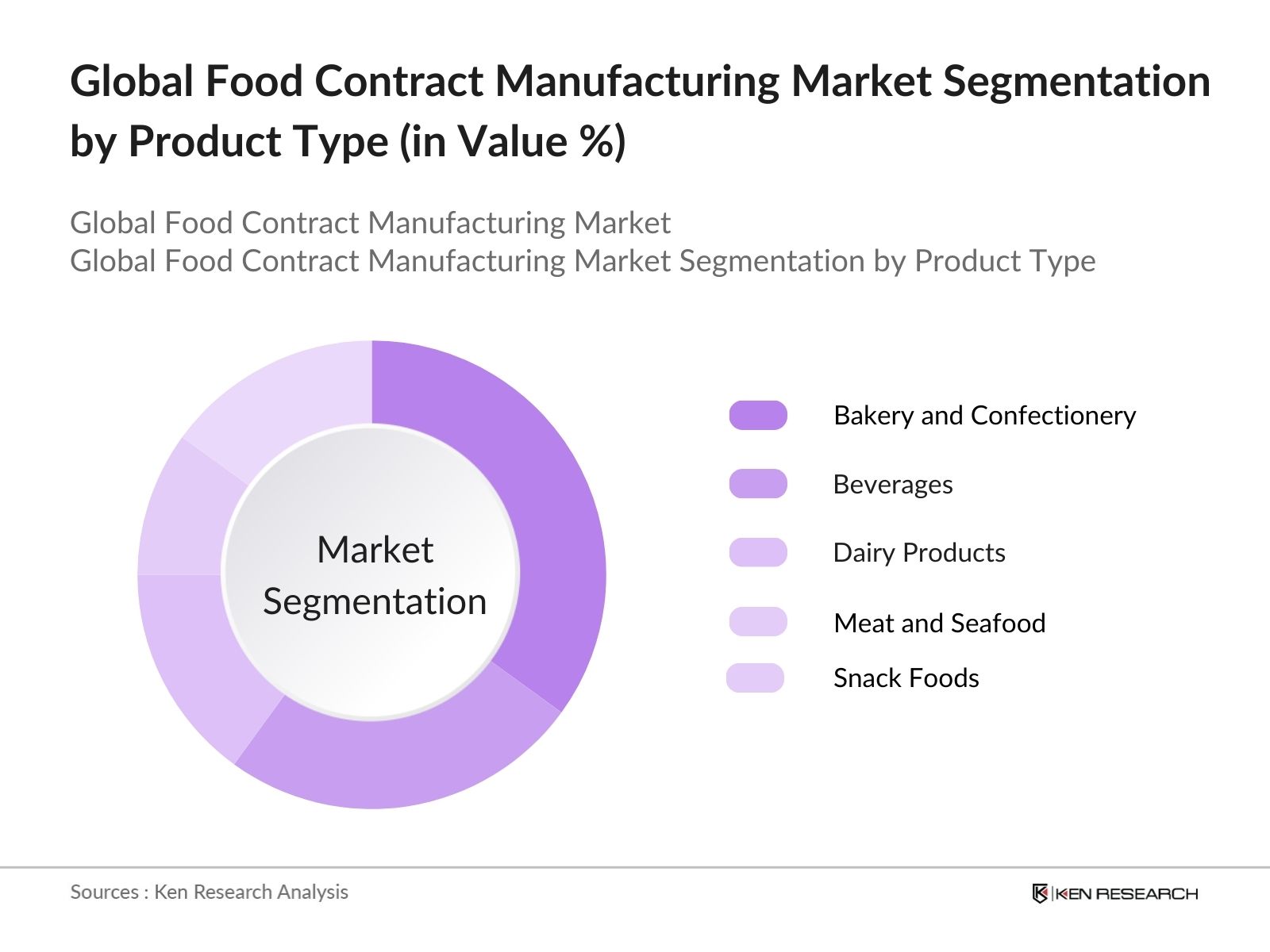

- By Product Type: The market is segmented by product type into Bakery and Confectionery, Beverages, Dairy Products, Meat and Seafood, and Snack Foods. Recently, Bakery and Confectionery has a dominant market share due to the sector's strong consumer demand for convenient, ready-to-eat snacks. High demand for variety in taste, coupled with seasonal and festive sales peaks, has led bakery and confectionery manufacturers to outsource production for enhanced efficiency and product innovation, contributing to this segments leadership.

- By Service Type: The market is further segmented by service type, including Packaging, Production, R&D and Formulation, and Logistics and Warehousing. Production holds a dominant share due to the increasing trend of companies outsourcing manufacturing to leverage cost-effective solutions and advanced technologies. This segments growth is supported by the rising demand for contract manufacturers that can produce diverse, high-quality food products efficiently and with reduced time-to-market, particularly important in the competitive food industry.

- By Region: The food contract manufacturing market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market due to its advanced manufacturing infrastructure and high consumer demand for processed foods. Companies in this region benefit from established partnerships with contract manufacturers, which enhances product quality and innovation. Moreover, stringent regulations and quality standards in the U.S. and Canada ensure compliance, making North America a prime location for food contract manufacturing.

Global Food Contract Manufacturing Market Competitive Landscape

The food contract manufacturing market is competitive, with major players driving innovation and maintaining high standards of food quality and safety. Key players include both global and regional companies, with industry leaders setting benchmarks for quality and operational efficiency.

Global Food Contract Manufacturing Market Analysis

Market Growth Drivers

- Increasing Outsourcing Trends in Food Manufacturing: The trend toward outsourcing in food manufacturing has intensified due to shifts in global labor dynamics and manufacturing cost efficiencies. For instance, according to the International Labour Organization, the global workforce has seen a structural shift toward outsourcing-intensive regions, with labor force growth in Southeast Asia projected to reach over 270 million by 2025, bolstering competitive advantages for outsourced food manufacturing.

- Demand for Cost-Effective Production: Cost-effective production remains a cornerstone of contract manufacturing appeal. The global food production index, reported at 122.1 in 2024 by the FAO, showcases a steady rise in output efficiencies, highlighting manufacturers' ability to scale at lower costs. Additionally, countries like India have capitalized on lower operational costs, driven by labor and material affordability, with average manufacturing costs per unit lower than in Western nations. This economic advantage has spurred a rise in food contract manufacturing, especially for budget-conscious brands seeking to minimize capital expenditures.

- Expanding Food Product Portfolios: With a global population of over 8 billion in 2024 (UN data), theres an expanding demand for diversified food products tailored to regional and international tastes. This demand has spurred food manufacturers to broaden their product portfolios rapidly. Notably, the FAO highlights a 7% annual increase in processed food varieties across APAC and North America. This diversification trend is driving contract manufacturers to specialize in various food processing segments, catering to a broad spectrum of food categories, from organic to ethnic foods.

Market Challenges

- Quality Control and Compliance: Ensuring compliance with food safety and quality standards, like the FDA and HACCP regulations, is a significant challenge. The U.S. FDA noted over 2,200 food recalls in 2024, a figure highlighting the complexities in maintaining consistent quality. These standards are crucial in a market where safety breaches can lead to costly recalls, impacting the credibility of both the manufacturer and the brand owner.

- Supply Chain Complexity: The food sectors intricate supply chains, marked by global sourcing and distribution, create logistical challenges. According to the World Banks Logistics Performance Index, the average logistics performance in low- and middle-income countries remains below the global median, impacting consistent supply flows. Furthermore, disruptions such as fluctuating fuel pricesreaching $96 per barrel in Q2 2024compound transportation and storage complexities, especially for perishable food items.

Global Food Contract Manufacturing Market Future Outlook

The global food contract manufacturing market is expected to witness substantial growth driven by the evolving consumer preference for processed and ready-to-eat food items. Increased awareness of clean-label and organic products is also anticipated to drive demand for specialized contract manufacturing services. Rising demand in emerging markets, such as Asia Pacific and Latin America, further indicates that food manufacturers will increasingly turn to contract services to meet expanding consumer bases and ensure cost-effective operations.

Market Opportunities

- Growth in Organic and Specialty Foods: Demand for organic food has surged, with global organic production area now exceeding 75 million hectares. Organic and specialty foods require specific production standards that many contract manufacturers are well-positioned to meet. This trend opens significant opportunities for contract manufacturers to cater to niche markets focused on health and wellness.

- Expansion into Emerging Markets: Emerging markets present vast growth opportunities. The World Bank reports that Asia's middle-income population is projected to exceed 2.5 billion in 2024, creating demand for diverse food products. Manufacturers that establish a foothold in these regions stand to benefit from a larger consumer base with increasing purchasing power, encouraging regional partnerships for contract manufacturing.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Bakery and Confectionery Beverages Dairy Products Meat and Seafood Snack Foods |

|

Service Type |

Packaging, Production R&D and Formulation Logistics and Warehousing |

|

Business Model |

Outsourcing Full-Service Contract Manufacturing |

|

Customer Type |

Food and Beverage Companies Retail Chains Private Label Brands |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Food and Beverage Manufacturers

Retail Chains and Supermarkets

Private Label Brands

Contract Packaging Companies

Nutraceutical Manufacturers

Government and Regulatory Bodies (FDA, USDA)

Investors and Venture Capitalist Firms

Ingredient Suppliers

Companies

Players Mentioned in the Report

Kerry Group

Archer Daniels Midland

Cargill Inc.

TreeHouse Foods Inc.

Hearthside Food Solutions LLC

Gehl Foods

SunOpta Inc.

SK Food Group

Crest Foods Co., Inc.

Reily Foods Company

Table of Contents

1. Global Food Contract Manufacturing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Food Contract Manufacturing Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Food Contract Manufacturing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Outsourcing Trends in Food Manufacturing

3.1.2. Demand for Cost-Effective Production

3.1.3. Expanding Food Product Portfolios

3.1.4. Rising Demand for Convenience Foods

3.2. Market Challenges

3.2.1. Quality Control and Compliance

3.2.2. Supply Chain Complexity

3.2.3. High Operational Costs

3.2.4. Limited Scalability for Customization

3.3. Opportunities

3.3.1. Growth in Organic and Specialty Foods

3.3.2. Expansion into Emerging Markets

3.3.3. Adoption of Technological Innovations

3.3.4. Partnerships with Retail Giants

3.4. Trends

3.4.1. Rise of Clean Label Manufacturing

3.4.2. Growth of Plant-Based Contract Manufacturing

3.4.3. Enhanced Focus on Sustainable Production

3.4.4. Implementation of Automation in Production Processes

3.5. Regulatory Landscape

3.5.1. Food Safety Standards (FDA, HACCP, ISO)

3.5.2. Labeling and Ingredient Disclosure Regulations

3.5.3. Environmental Compliance

3.5.4. Trade Tariffs and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Food Contract Manufacturing Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bakery and Confectionery

4.1.2. Beverages

4.1.3. Dairy Products

4.1.4. Meat and Seafood

4.1.5. Snack Foods

4.2. By Service Type (In Value %)

4.2.1. Packaging

4.2.2. Production

4.2.3. R&D and Formulation

4.2.4. Logistics and Warehousing

4.3. By Business Model (In Value %)

4.3.1. Outsourcing

4.3.2. Full-Service Contract Manufacturing

4.4. By Customer Type (In Value %)

4.4.1. Food and Beverage Companies

4.4.2. Retail Chains

4.4.3. Private Label Brands

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Food Contract Manufacturing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Kerry Group

5.1.2. Archer Daniels Midland

5.1.3. Cargill Inc.

5.1.4. TreeHouse Foods Inc.

5.1.5. Gehl Foods

5.1.6. SunOpta Inc.

5.1.7. Hearthside Food Solutions LLC

5.1.8. SK Food Group

5.1.9. Crest Foods Co., Inc.

5.1.10. Reily Foods Company

5.1.11. PacMoore Products, Inc.

5.1.12. Oak State Products, Inc.

5.1.13. J&J Snack Foods Corp.

5.1.14. The Greenery B.V.

5.1.15. KanPak LLC

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Customer Base, Market Reach, Manufacturing Facilities, Certifications, Strategic Partnerships, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Incentives

5.9. Private Equity Investments

6. Global Food Contract Manufacturing Market Regulatory Framework

6.1. Compliance Standards

6.2. Certification Processes

6.3. Environmental Standards

6.4. Import and Export Regulations

7. Global Food Contract Manufacturing Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Food Contract Manufacturing Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Service Type (In Value %)

8.3. By Business Model (In Value %)

8.4. By Customer Type (In Value %)

8.5. By Region (In Value %)

9. Global Food Contract Manufacturing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first stage involved mapping out the global food contract manufacturing ecosystem. Comprehensive desk research was conducted using proprietary databases to identify essential market drivers, competitive structures, and trends.

Step 2: Market Analysis and Construction

This phase encompassed an in-depth analysis of historical data related to the global food contract manufacturing market. Key metrics, such as production volumes, consumer demographics, and revenue generation, were analyzed to establish accurate projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, expert consultations were conducted with representatives from top contract manufacturing firms. Insights from these experts provided a clearer understanding of operational and financial dynamics within the industry.

Step 4: Research Synthesis and Final Output

The final stage entailed synthesizing data from both quantitative and qualitative sources, ensuring that the report is grounded in accurate, validated insights. This comprehensive approach enabled a detailed examination of current and future market conditions.

Frequently Asked Questions

01. How big is the Global Food Contract Manufacturing Market?

The global food contract manufacturing market was valued at USD 144 billion, driven by outsourcing trends and rising demand for specialty food products.

02. What are the growth drivers in the Global Food Contract Manufacturing Market?

The market is propelled by the need for cost-efficient production, increased demand for clean-label products, and outsourcing by major food brands to optimize operations.

03. Who are the major players in the Global Food Contract Manufacturing Market?

Key players include Kerry Group, Archer Daniels Midland, Cargill Inc., TreeHouse Foods, and Hearthside Food Solutions, who dominate due to their extensive production capabilities and strategic partnerships.

04. What are the challenges in the Global Food Contract Manufacturing Market?

Key challenges include compliance with food safety standards, supply chain complexity, and the need for high scalability without compromising quality.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.