Global Food Grade Alcohol Market Outlook to 2030

Region:Global

Author(s):Sanjeev kumar

Product Code:KROD6940

December 2024

94

About the Report

Global Food Grade Alcohol Market Overview

- The global food grade alcohol market is valued at USD 3.5 billion, driven by the increasing demand for ethanol and other alcohols in the food and beverage sector. The primary drivers of this market include the rising consumption of processed foods and beverages, along with the growing usage of alcohols in pharmaceutical applications. The surge in demand for organic and non-GMO products has further accelerated the markets expansion, especially as food grade alcohol is used in various formulations, including flavoring agents, preservatives, and antimicrobial applications.

- Countries such as the United States, Brazil, and China are leading the global food grade alcohol market. These countries dominate the market due to their robust production capacities for raw materials like corn and sugarcane, which are the primary sources of ethanol and other food grade alcohols. Additionally, these nations have well-established food processing industries, which consume large amounts of food grade alcohol for both preservation and processing purposes.

- Increased environmental scrutiny is influencing alcohol production processes. In 2023, the European Union introduced stricter regulations on carbon emissions for industrial sectors, including alcohol production. Companies that fail to meet emission targets face penalties, pushing manufacturers toward cleaner production methods. This regulatory pressure is prompting the adoption of sustainable practices and technologies within the industry.

Global Food Grade Alcohol Market Segmentation

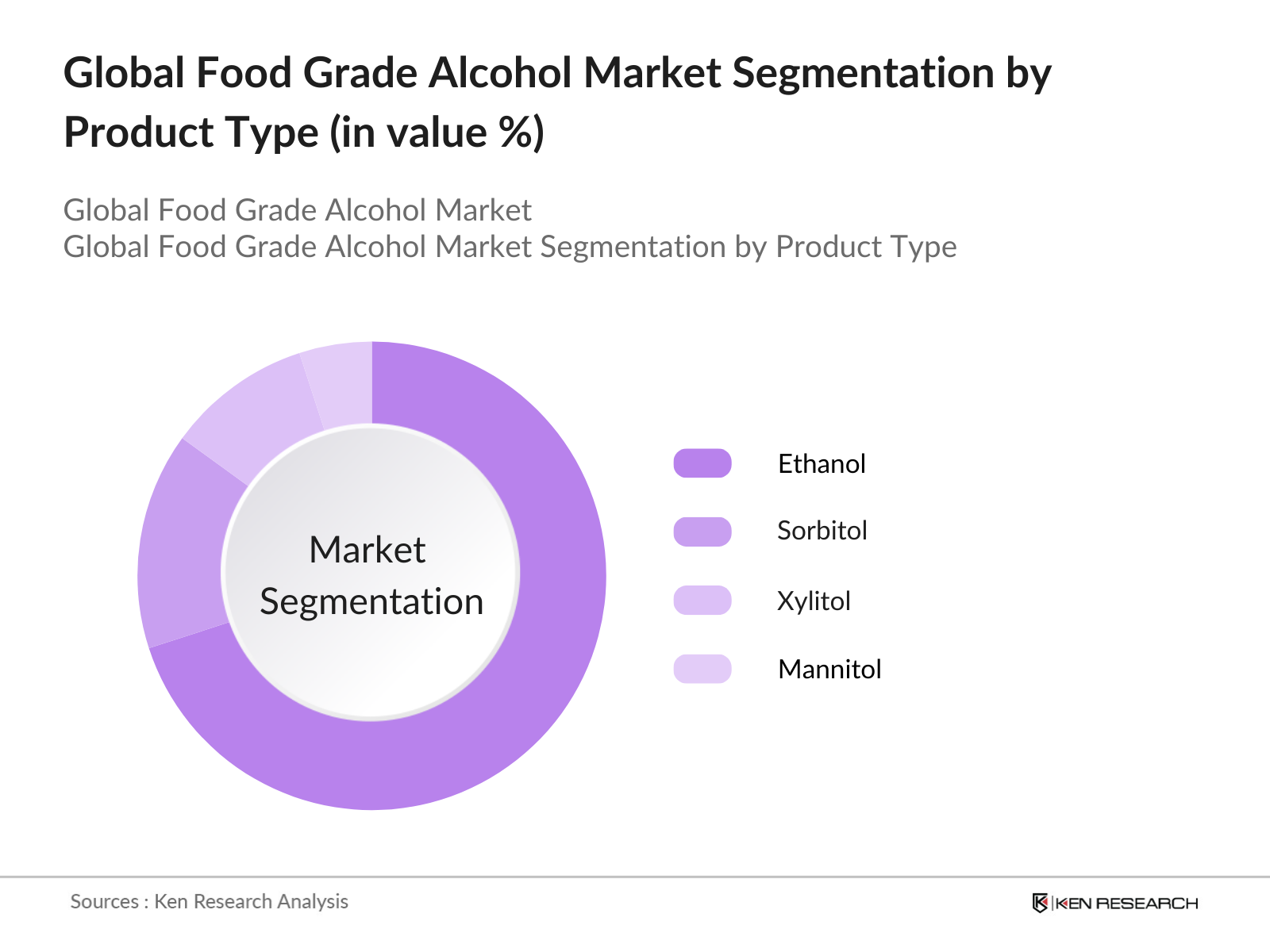

- By Product Type The global food grade alcohol market is segmented by product type into ethanol, sorbitol, xylitol, mannitol, and other alcohols. Ethanol dominates this segment due to its widespread application across multiple industries such as food, beverage, pharmaceuticals, and personal care. The versatility of ethanol, ranging from its role as a solvent in flavorings to its function as a preservative, solidifies its position as the market leader. The increasing consumer preference for ethanol-based beverages and organic food products also plays a key role in its continued dominance.

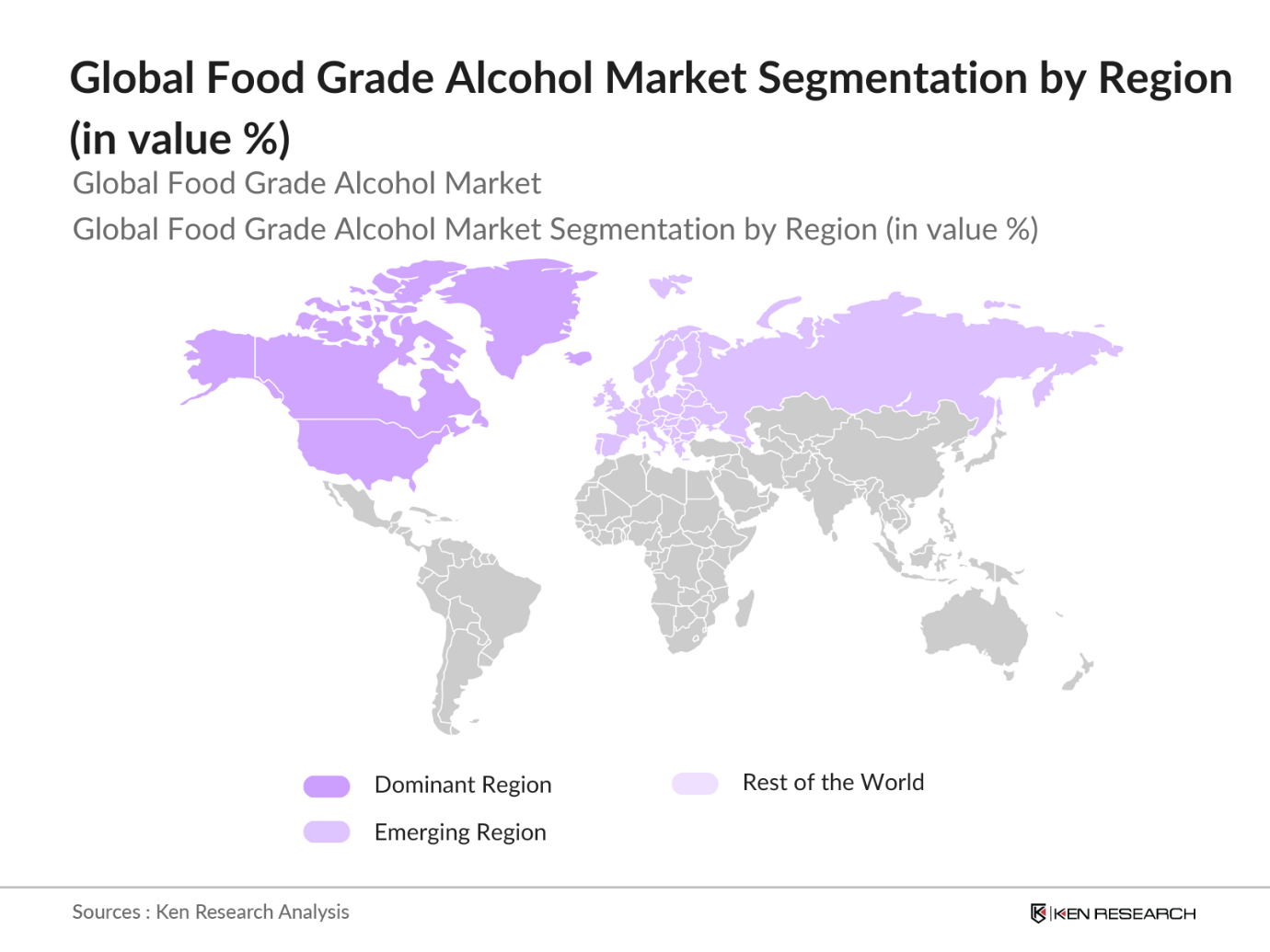

- By Region Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America dominates the market owing to its advanced food processing industry and the large-scale production of raw materials like corn, which is essential for ethanol production. The United States, in particular, is a leader due to its high consumption of food grade alcohol in various sectors, including beverages and pharmaceuticals. Europe follows closely, driven by the demand for clean-label products and organic foods, while the Asia-Pacific region is witnessing rapid growth due to the expanding food and beverage industry in emerging economies like China and India.

- By Application The food grade alcohol market is also categorized by application into food and beverage, pharmaceuticals, personal care, industrial solvents, and biofuel. The food and beverage sector holds the largest market share, primarily due to the use of alcohol as a preservative and flavoring agent. Alcohols like ethanol are vital in the preservation of products such as baked goods, processed foods, and beverages. Moreover, the rise in consumer demand for alcohol-based hand sanitizers and cleaning products, particularly during the pandemic, has also contributed to this segment's strength.

Global Food Grade Alcohol Market Competitive Landscape

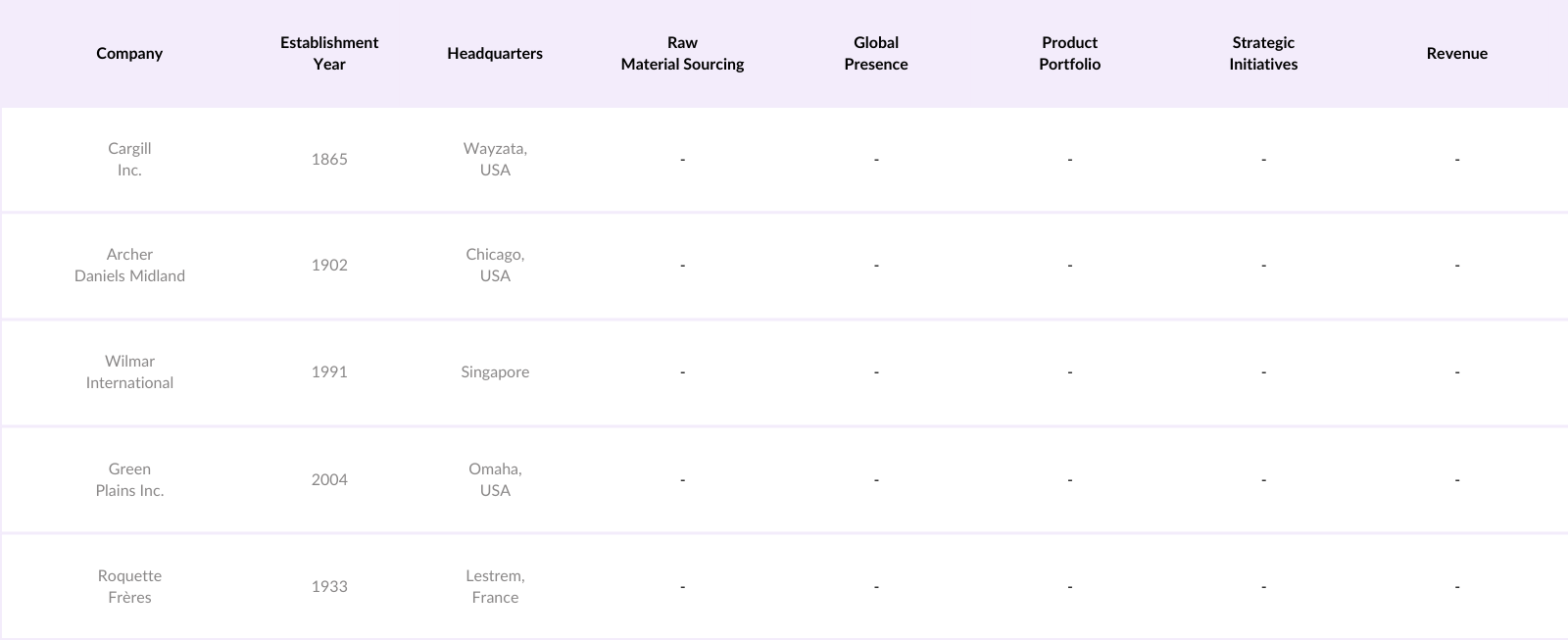

The global food grade alcohol market is dominated by several key players, each with extensive production capacities and diverse product portfolios. The market consolidation highlights the influence of major producers, particularly in regions with abundant raw materials like North America and Latin America.

Global Food Grade Alcohol Industry Analysis

Growth Drivers

- Increased Demand for Processed Food Products: The demand for processed food products has seen a significant rise, with global food processing activities growing consistently, particularly in developing regions. According to the World Bank, the global food manufacturing industry accounted for $1.4 trillion in output in 2022, driven by increased urbanization and changes in dietary preferences. As processed foods often require alcohol for preservation and flavoring, the food-grade alcohol market is poised for growth. Moreover, food-grade alcohol finds extensive use in bakery items, frozen desserts, and confectionery products, creating sustained demand in the industry.

- Rising Application in Pharmaceuticals and Personal Care: Food-grade alcohol plays a pivotal role in the production of pharmaceuticals, especially in the creation of solvents, sanitizers, and disinfectants. In 2023, global pharmaceutical production reached a value of over $1.5 trillion, with increasing usage of ethanol-based products for drug formulations. Additionally, the personal care industry, valued at $534 billion, has also incorporated ethanol as a key ingredient in products such as perfumes and cosmetics. This expanding application base continues to fuel the demand for food-grade alcohol.

- Expansion of Beverage Industry: The beverage industry has witnessed considerable growth, particularly in the alcoholic beverage segment. The global production of alcoholic beverages surpassed 1.2 billion hectoliters in 2023, according to World Bank data. Food-grade alcohol is essential in the distillation process of spirits, wines, and beers, and its usage is expanding as beverage manufacturers explore innovative formulations. The rising popularity of craft spirits and flavored beverages has further strengthened this trend, boosting demand for high-quality food-grade alcohol.

Market Restraints

- Regulatory Constraints on Alcohol Production: Strict regulations govern the production and distribution of alcohol across various countries. For instance, in India, one of the leading consumers of food-grade alcohol, alcohol is highly regulated under state government norms, leading to restricted production capacities. Global alcohol production is subject to licensing and excise duties, further limiting manufacturers' ability to scale operations. According to the International Monetary Fund (IMF), excise taxes on alcoholic beverages in various countries often account for over 30% of the production cost, affecting profitability.

- High Manufacturing Costs: The production of food-grade alcohol, especially ethanol, requires significant raw materials such as sugarcane, corn, and grains. The World Banks agricultural commodity index indicates that the price of sugar, one of the key raw materials, increased by 20% in 2023, exacerbating manufacturing costs. Additionally, the energy-intensive distillation process adds to operational expenses, leading to higher overall production costs. These factors make it difficult for smaller manufacturers to compete in the global market.

Global Food Grade Alcohol Market Future Outlook

Over the next five years, the global food grade alcohol market is expected to witness significant growth. This expansion will be driven by increasing demand for processed foods and beverages, a growing focus on organic products, and the rising usage of food grade alcohol in pharmaceuticals and personal care products. The adoption of sustainable production practices and advancements in fermentation technologies will also contribute to the market's upward trajectory. Furthermore, emerging economies, particularly in the Asia-Pacific region, are poised to become major growth drivers due to their expanding middle class and increasing consumption of processed foods.

Market Opportunities

- Growth in Biofuel Sector: The biofuel industry has been expanding rapidly as countries aim to reduce carbon emissions. Food-grade alcohol, particularly ethanol, is a primary ingredient in biofuel production. In 2023, global ethanol production reached over 110 billion liters, with the U.S. and Brazil leading the charge in bioethanol production for blending with gasoline. The increasing demand for cleaner fuels presents a lucrative opportunity for the food-grade alcohol market, with governments worldwide providing subsidies for biofuel production.

- Emerging Markets in Asia-Pacific: Asia-Pacific countries like India, China, and Indonesia have seen a surge in alcohol consumption, both for food and beverage purposes. The World Bank reports that Chinas alcohol consumption rose by 15% in 2023, while India's food processing industry continues to grow at an annual rate of 9%. These emerging markets present significant opportunities for food-grade alcohol manufacturers, driven by increasing urbanization and a shift towards processed and packaged foods.

Scope of the Report

|

By Product Type |

Ethanol, Sorbitol Xylitol, Mannitol Other Alcohols |

|

By Application |

Food & Beverage Pharmaceuticals Personal Care Industrial Solvents Biofuel |

|

By Source |

Sugarcane Corn Fruits Grains Others |

|

By Function |

Preservative Antimicrobial Agent Flavoring Agent Solvent Carrier |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Food and Beverage Manufacturers

Pharmaceutical Companies

Personal Care Product Manufacturers

Industrial Solvent Manufacturers

Biofuel Producers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority, U.S. FDA)

Chemical Distributors

Companies

Players Mentioned in the Report:

Cargill Inc.

Archer Daniels Midland Company

Green Plains Inc.

MGP Ingredients

Wilmar International

Roquette Frres

Cristalco

Grain Processing Corporation

Manildra Group

Sigma-Aldrich

Lesaffre Group

Pacific Ethanol Inc.

Koninklijke DSM N.V.

Eastman Chemical Company

Merck KGaA

Table of Contents

1. Global Food Grade Alcohol Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Food Grade Alcohol Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Food Grade Alcohol Market Analysis

3.1. Growth Drivers

- Increased Demand for Processed Food Products

- Rising Application in Pharmaceuticals and Personal Care

- Expansion of Beverage Industry

- Shift Toward Natural Ingredients

3.2. Market Challenges

- Regulatory Constraints on Alcohol Production

- High Manufacturing Costs

- Volatility in Raw Material Prices

3.3. Opportunities

- Growth in Biofuel Sector

- Emerging Markets in Asia-Pacific

- Rising Demand for Organic Alcohols

3.4. Trends

- Increasing Usage of Food Grade Alcohol in Natural Flavors

- Adoption of Sustainable Production Practices

- Innovations in Fermentation Technology

3.5. Government Regulations

- Food Safety and Standards Authority Regulations

- Global Alcohol Licensing Norms

- Trade Tariffs and Import/Export Regulations

- Environmental Regulations on Alcohol Production

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Food Grade Alcohol Market Segmentation

4.1. By Product Type (In Value %)

- Ethanol

- Sorbitol

- Xylitol

- Mannitol

- Other Alcohol Types

4.2. By Application (In Value %)

- Food and Beverage

- Pharmaceuticals

- Personal Care

- Industrial Solvents

- Biofuel

4.3. By Source (In Value %)

- Sugarcane

- Corn

- Fruits

- Grains

- Others

4.4. By Function (In Value %)

- Preservative

- Antimicrobial Agent

- Flavoring Agent

- Solvent

- Carrier

4.5. By Region (In Value %)

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

5. Global Food Grade Alcohol Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

- Cargill Inc.

- Archer Daniels Midland Company

- Green Plains Inc.

- MGP Ingredients

- Wilmar International

- Roquette Frres

- Cristalco

- Grain Processing Corporation

- Manildra Group

- Sigma-Aldrich

- Lesaffre Group

- Pacific Ethanol Inc.

- Koninklijke DSM N.V.

- Eastman Chemical Company

- Merck KGaA

5.2. Cross Comparison Parameters (Production Capacity, Raw Material Sourcing, Global Presence, Product Portfolio, Strategic Initiatives, Revenue, Number of Employees, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Food Grade Alcohol Market Regulatory Framework

6.1. Food Safety Standards

6.2. Alcohol Production Compliance

6.3. Certification and Labeling Requirements

7. Global Food Grade Alcohol Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Food Grade Alcohol Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Source (In Value %)

8.4. By Function (In Value %)

8.5. By Region (In Value %)

9. Global Food Grade Alcohol Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Strategic Customer Cohort Analysis

9.3. Innovative Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all key stakeholders in the global food grade alcohol market. This process is carried out through comprehensive desk research, focusing on secondary data sources like proprietary databases and industry reports to identify the critical factors shaping the market.

Step 2: Market Analysis and Construction

In this phase, historical data on market size, industry trends, and product demand are gathered. The primary objective is to evaluate the penetration of food grade alcohol across different sectors, using data on raw material availability and pricing to support the market model.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, including representatives from major manufacturers, provide key insights into the competitive landscape and operational challenges. This validation process helps refine the revenue estimates and market forecasts.

Step 4: Research Synthesis and Final Output

The final stage synthesizes insights from both primary and secondary research, with final checks on industry trends, regulatory changes, and innovations in production processes. The report is compiled into a comprehensive market analysis covering all major segments.

Frequently Asked Questions

01. How big is the Global Food Grade Alcohol Market?

The global food grade alcohol market is valued at USD 3.5 billion, driven by the increasing demand for processed foods and alcohol-based products across multiple industries. The surge in organic food consumption also contributes to market growth.

02. What are the challenges in the Global Food Grade Alcohol Market?

Challenges include regulatory constraints on alcohol production, fluctuating raw material prices, and the high costs of production. Moreover, sustainability concerns have led to tighter environmental regulations, making compliance a challenge for producers.

03. Who are the major players in the Global Food Grade Alcohol Market?

Key players include Cargill Inc., Archer Daniels Midland Company, Green Plains Inc., Wilmar International, and Roquette Frres. These companies dominate due to their extensive production capacities, global reach, and diversified product portfolios.

04. What are the growth drivers of the Global Food Grade Alcohol Market?

The market is driven by rising demand for processed foods, growing use of alcohol in pharmaceuticals and personal care products, and the shift toward organic products. Increasing consumer interest in clean-label and non-GMO products also fuels growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.