Global Food Service Market Outlook to 2030

Region:Global

Author(s):Sanjeev kumar

Product Code:KROD10159

December 2024

100

About the Report

Global Food Service Market Overview

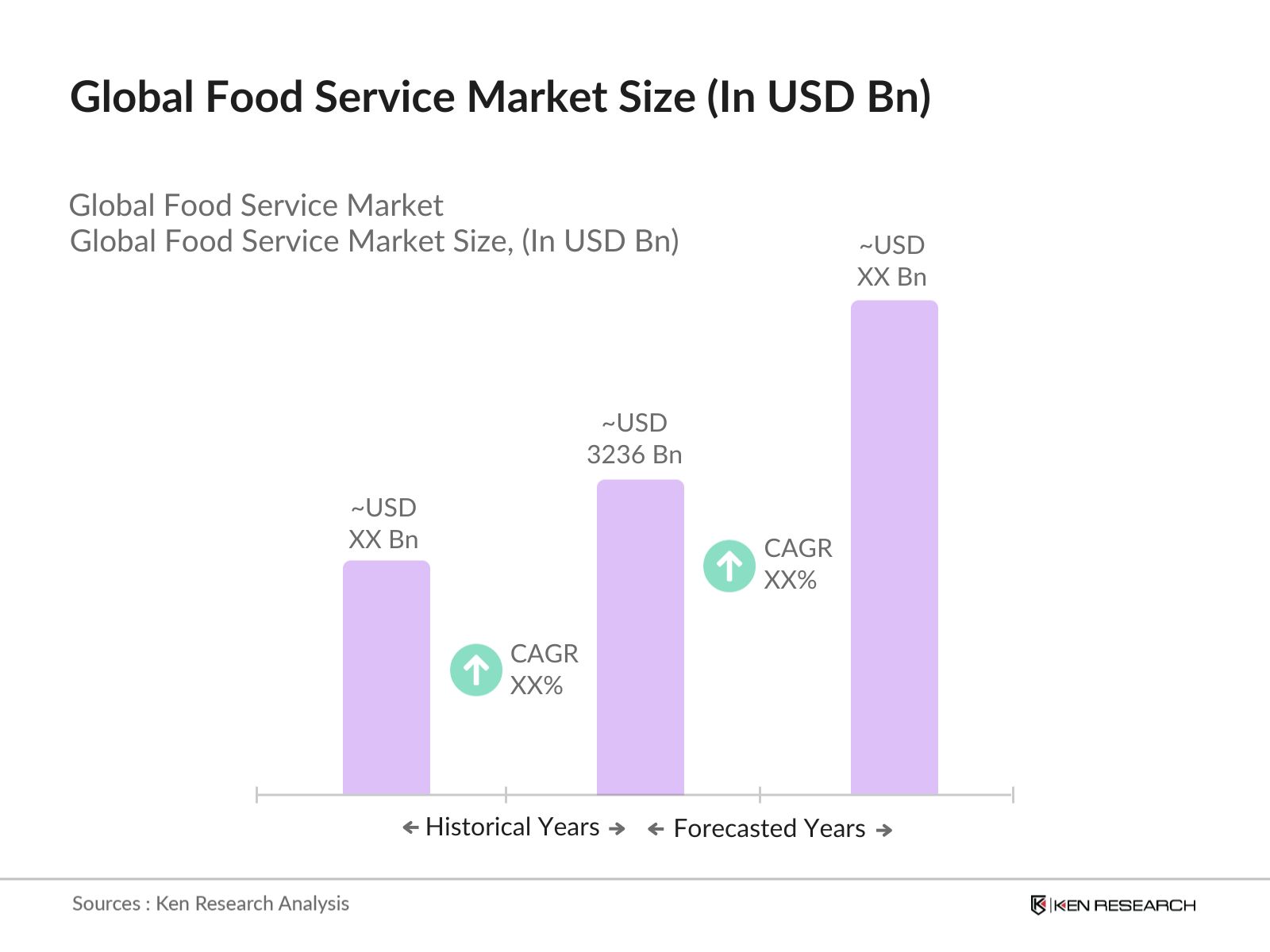

- The global food service market is currently valued at USD 3236 billion, driven by a strong rebound in consumer demand post-pandemic, along with technological integration in food delivery and restaurant operations. Growth in the market is propelled by the increasing consumer preference for dining out, as well as the expansion of online food delivery services, particularly in urban areas. Rapid urbanization and rising disposable incomes have made food service a key industry across major economies. Additionally, increased investment in food service technology has further contributed to the expansion of the market.

- Countries like the United States, China, and Japan dominate the global food service market due to their large urban populations and advanced infrastructure in hospitality and food service sectors. The U.S. is home to numerous multinational fast-food and casual dining chains, while Chinas expanding middle class has fueled growth in both traditional and Western-style dining. Japan, with its rich culinary heritage and high dining-out frequency, remains a significant player in the market.

- The emergence of eco-friendly packaging is a growing trend in the food service market as businesses respond to regulatory pressures and consumer demand for sustainable solutions. In 2023, over 10 million tons of eco-friendly packaging materials were produced globally, with key markets in Europe and Asia (FAO). Countries such as France and the U.K. have introduced stringent regulations banning single-use plastics, leading to a shift toward biodegradable and recyclable materials. By mid-2023, 25% of global food service outlets had adopted sustainable packaging practices, up from 18% in 2020.

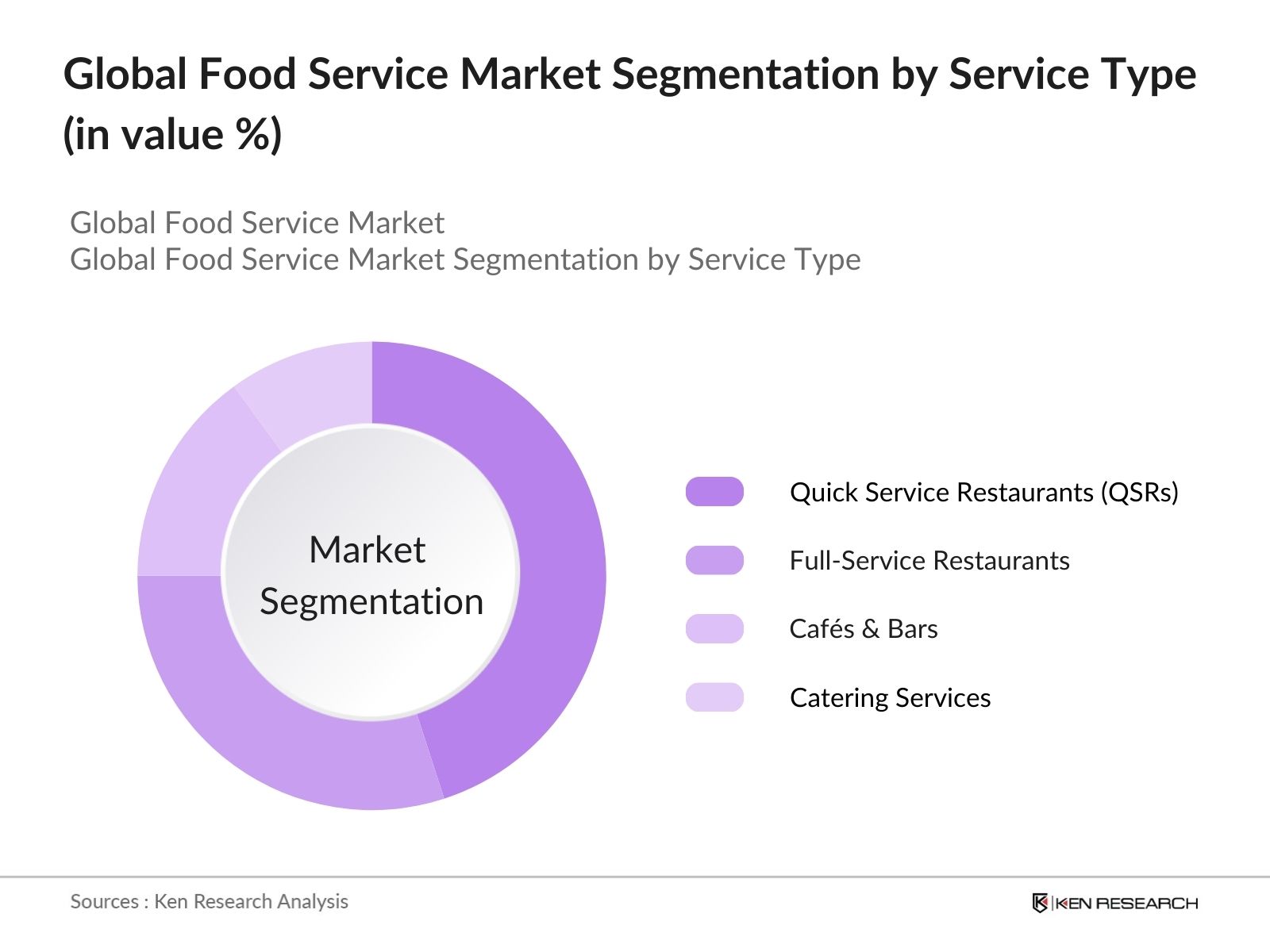

Global Food Service Market Segmentation

- By Service Type: The global food service market is segmented by service type into full-service restaurants, quick service restaurants (QSRs), catering services, cafs and bars, and street vendors. Among these, quick service restaurants (QSRs) hold the dominant market share due to their affordability and convenience. Fast food chains like McDonalds and Subway have a global presence, and their standardized menus cater to a wide demographic. In particular, QSRs have benefitted from advancements in digital ordering and delivery systems, allowing them to serve a larger customer base efficiently. The rise of mobile apps and delivery platforms like Uber Eats has solidified the dominance of QSRs in this segment.

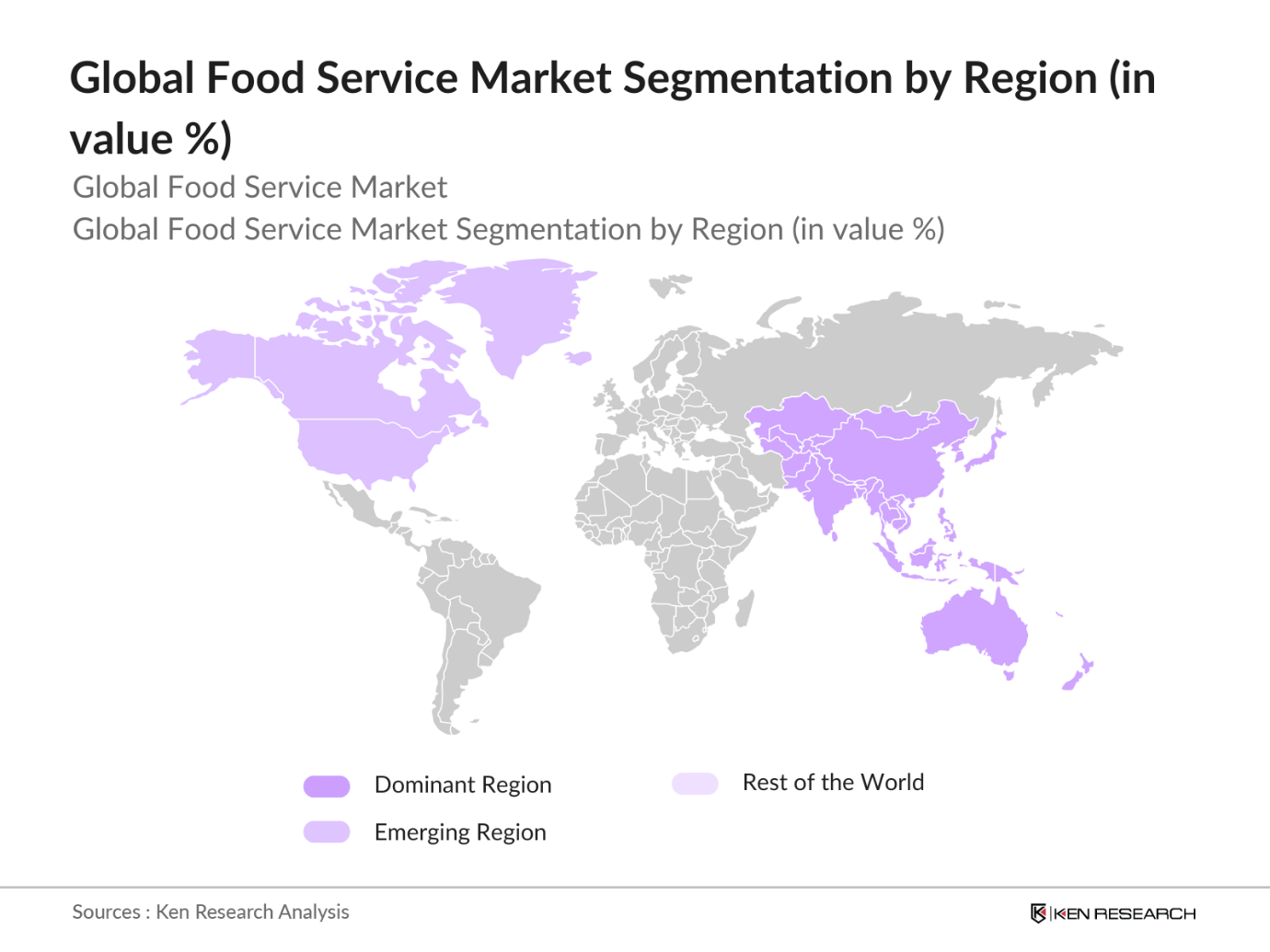

- By Region: The global food service market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest market share due to the rapidly growing middle-class population and increasing urbanization in countries like China and India. China, in particular, has seen a significant rise in food service establishments, supported by the growing influence of Western dining culture. The emergence of technology-driven food services and the rapid expansion of the food delivery market have further contributed to the dominance of the Asia Pacific region.

- By Distribution Channel: The food service market is categorized by distribution channel into dine-in, takeaway, online delivery, and drive-thru. Online delivery has rapidly become the leading sub-segment, capturing significant market share due to the convenience it offers. Companies like DoorDash and GrubHub have revolutionized food delivery services, particularly in urban areas where time-poor consumers prioritize convenience. The growth of ghost kitchens (delivery-only kitchens) has further driven this trend, as it allows restaurants to reduce costs while expanding their delivery capacity. Additionally, the COVID-19 pandemic accelerated the adoption of online delivery, a trend that has continued into 2023.

Global Food Service Market Competitive Landscape

The global food service market is characterized by a few dominant players who have extensive market reach and a wide network of outlets. Key players like McDonalds, Starbucks, and Yum! Brands dominate due to their established brand presence, continuous innovation, and wide distribution networks. These companies have adopted various strategies such as menu innovation, partnerships with delivery platforms, and the introduction of eco-friendly packaging to cater to changing consumer preferences.

|

Company |

Establishment Year |

Headquarters |

No. of Outlets |

Revenue (2023) |

Global Reach |

Digital Platform |

Brand Positioning |

Product Innovation |

|

McDonalds Corporation |

1940 |

Chicago, USA |

- |

- |

- |

- |

- |

- |

|

Starbucks Corporation |

1971 |

Seattle, USA |

- |

- |

- |

- |

- |

- |

|

Yum! Brands, Inc. |

1997 |

Louisville, USA |

- |

- |

- |

- |

- |

- |

|

Dominos Pizza, Inc. |

1960 |

Michigan, USA |

- |

- |

- |

- |

- |

- |

|

Restaurant Brands International |

2014 |

Toronto, Canada |

- |

- |

- |

- |

- |

- |

Global Food Service Industry Analysis

Growth Drivers

- Consumer Shift towards Out-of-Home Dining: The global shift toward out-of-home dining is significantly influenced by urbanization and higher disposable incomes. In 2023, over 4.4 billion people live in urban areas, an increase from 4.2 billion in 2020 (World Bank). This urban migration has accelerated out-of-home dining habits, especially in cities with busy lifestyles. With global per capita disposable income averaging $12,500 in 2023, more consumers can afford frequent dining experiences outside of home, particularly in developed regions such as North America and Europe. This shift is also driven by time constraints faced by dual-income households in these

- Expansion of Quick Service Restaurants (QSRs): Quick Service Restaurants (QSRs) are experiencing strong growth globally, driven by increasing demand for affordable, fast, and convenient food. In 2023, there are approximately 850,000 QSR outlets worldwide. The U.S. leads with 190,000 locations, followed by China with 130,000 QSRs, reflecting a broader global trend (UNIDO data). These numbers underscore a demand surge among working professionals and younger consumers who prefer quick meals. Additionally, the World Bank reported that the global middle-class population, which drives QSR expansion, has surpassed 3.8 billion in 2023.

- Growing Demand for Plant-Based Options: The demand for plant-based food options is growing, with the market seeing substantial consumer interest driven by health-consciousness and sustainability concerns. In 2022, the global consumption of plant-based foods reached 60 million metric tons, up from 55 million tons in 2020 (FAO). This growth is reinforced by global efforts to reduce meat consumption and the rising trend of vegan and vegetarian diets, particularly in Europe and North America. In 2023, the global consumption of meat substitutes stands at 1.2 billion kilograms, a significant jump from previous years.

Market Restraints

- Supply Chain Disruptions: The global food service industry is grappling with supply chain disruptions, especially in sourcing raw materials. In 2023, logistical bottlenecks and shipping delays have added over $50 billion in costs to global food service supply chains (IMF). Additionally, geopolitical tensions have further strained supply routes, particularly affecting key food importers in Asia and Europe. Freight costs have increased by 20% since 2022, and as of mid-2023, global port congestion has slowed the flow of goods by 12%, according to the World Trade Organization.

- Labor Shortages: The food service industry is also facing acute labor shortages, exacerbated by the global pandemic's lasting effects. In 2023, over 35 million jobs in the hospitality sector remain unfilled globally (ILO). The U.S. alone reports a shortfall of 1.2 million restaurant workers as the industry competes with other sectors for labor. The European Union is facing similar challenges, with a deficit of 2.5 million hospitality jobs as of 2023, compounded by aging populations and stringent immigration policies.

Global Food Service Market Future Outlook

Over the next five years, the global food service market is expected to experience significant growth, driven by rapid technological advancements, the rise of delivery-only kitchens, and increasing consumer demand for diverse dining experiences. As more consumers prioritize convenience, digital platforms and app-based food delivery services are expected to continue dominating the market. Additionally, the growing trend of health-conscious dining and sustainability will likely push restaurants to innovate their menus and adopt eco-friendly practices.

Market Opportunities

- Growth in Cloud Kitchens: Cloud kitchens, or ghost kitchens, represent a growing opportunity within the food service industry. In 2023, there were over 15,000 cloud kitchens operating globally, with major hubs in the U.S., India, and China. Driven by low overhead costs and the rise of online food delivery platforms, cloud kitchens are gaining traction. The sector is projected to generate over 20 million food deliveries per day globally in 2024, as more consumers opt for convenient dining solutions (UNIDO). The growth in cloud kitchens is also supported by investments in food tech startups and digital logistics solutions.

- Technological Advancements (AI & Automation): Technological advancements, especially in AI and automation, are reshaping the global food service industry. In 2023, over 30% of restaurants in developed markets have integrated automation technologies such as robotic cooking and AI-driven inventory management systems (World Bank). These technologies are not only reducing labor costs but also enhancing efficiency. AI-based customer service tools have been adopted by nearly 20% of global restaurant chains, allowing for personalized customer experiences and more streamlined operations. As automation becomes more affordable, its adoption is expected to expand across small and medium-sized enterprises.

Scope of the Report

|

Service Type |

Full-Service Restaurants Quick Service Restaurants (QSRs) Catering Services Cafs & Bars Street Vendors |

|

Distribution Channel |

Dine-In Takeaway Online Delivery Drive-Thru |

|

Cuisine Type |

Asian Cuisine Western Cuisine Latin American Cuisine Middle Eastern Cuisine Others |

|

End-User |

Household Corporate & Office Spaces Educational Institutions Hospitals Others |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Restaurant Operators

Franchise Owners

Cloud Kitchen Operators

Food Delivery Platforms

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, European Food Safety Authority)

Food Packaging Suppliers

Technology Providers in Food Service Industry

Companies

Players Mentioned in the Report:

McDonald's Corporation

Starbucks Corporation

Yum! Brands, Inc.

Restaurant Brands International

Dominos Pizza, Inc.

Chipotle Mexican Grill, Inc.

Darden Restaurants, Inc.

Inspire Brands, Inc.

Wendys Company

Jollibee Foods Corporation

Subway

Chick-fil-A, Inc.

Papa Johns International, Inc.

Five Guys Enterprises LLC

Panera Bread

Table of Contents

1. Global Food Service Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Food Service Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Food Service Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Shift towards Out-of-Home Dining

3.1.2 Expansion of Quick Service Restaurants (QSRs)

3.1.3 Growing Demand for Plant-Based Options

3.1.4 Integration of Digital Solutions (POS, Online Ordering)

3.2 Market Challenges

3.2.1 Supply Chain Disruptions

3.2.2 Labor Shortages

3.2.3 Fluctuating Food Prices

3.3 Opportunities

3.3.1 Growth in Cloud Kitchens

3.3.2 Technological Advancements (AI & Automation)

3.3.3 Rising Demand for Healthy & Organic Meals

3.4 Trends

3.4.1 Increased Home Delivery & Takeaway Services

3.4.2 Emergence of Eco-Friendly Packaging

3.4.3 Personalization in Food Offerings

3.5 Regulatory Environment

3.5.1 Food Safety Regulations

3.5.2 Nutritional Labeling Laws

3.5.3 Minimum Wage Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Global Food Service Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Full-Service Restaurants

4.1.2 Quick Service Restaurants (QSRs)

4.1.3 Catering Services

4.1.4 Cafs & Bars

4.1.5 Street Vendors

4.2 By Distribution Channel (In Value %)

4.2.1 Dine-In

4.2.2 Takeaway

4.2.3 Online Delivery

4.2.4 Drive-Thru

4.3 By Cuisine Type (In Value %)

4.3.1 Asian Cuisine

4.3.2 Western Cuisine

4.3.3 Latin American Cuisine

4.3.4 Middle Eastern Cuisine

4.3.5 Others

4.4 By End-User (In Value %)

4.4.1 Household

4.4.2 Corporate & Office Spaces

4.4.3 Educational Institutions

4.4.4 Hospitals

4.4.5 Others

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Food Service Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 McDonald's Corporation

5.1.2 Starbucks Corporation

5.1.3 Yum! Brands, Inc.

5.1.4 Restaurant Brands International

5.1.5 Dominos Pizza, Inc.

5.1.6 Chipotle Mexican Grill, Inc.

5.1.7 Darden Restaurants, Inc.

5.1.8 Inspire Brands, Inc.

5.1.9 Wendys Company

5.1.10 Jollibee Foods Corporation

5.1.11 Subway

5.1.12 Chick-fil-A, Inc.

5.1.13 Papa Johns International, Inc.

5.1.14 Five Guys Enterprises LLC

5.1.15 Panera Bread

5.2 Cross Comparison Parameters (No. of Outlets, Revenue, Headquarters, Inception Year, Employee Count, Market Presence, Delivery Models, Brand Positioning)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Food Service Market Regulatory Framework

6.1 Food Safety and Hygiene Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Global Food Service Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Food Service Market Future Market Segmentation

8.1 By Service Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Cuisine Type (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Food Service Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the food service markets ecosystem, identifying stakeholders like restaurants, food delivery platforms, and cloud kitchens. Extensive desk research utilizing industry databases is conducted to understand the major market drivers and challenges.

Step 2: Market Analysis and Construction

In this phase, historical data on food service operations, menu innovations, and the rise of digital platforms is compiled. Revenue estimates are generated based on past market performance, and a thorough analysis of technological adoption in food service is conducted.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with food service experts from major restaurant chains, tech providers, and delivery platforms validate the initial hypotheses. These insights are gathered through interviews and surveys to refine market forecasts.

Step 4: Research Synthesis and Final Output

The final step synthesizes data from multiple sources, including restaurant chains and food delivery platforms, to produce a comprehensive, validated analysis of the global food service market.

Frequently Asked Questions

01. How big is the global food service market?

The global food service market is valued at USD 3236 billion, driven by the rise in digital food delivery services and consumer demand for convenient, out-of-home dining experiences.

02. What are the key challenges in the global food service market?

Key challenges include labor shortages, fluctuating food prices, and the disruption of supply chains. Additionally, the growing consumer demand for healthy and sustainable options is putting pressure on restaurants to innovate quickly.

03. Who are the major players in the global food service market?

The major players include McDonalds Corporation, Starbucks Corporation, Yum! Brands, Restaurant Brands International, and Dominos Pizza. These companies dominate the market due to their global reach and continuous innovation in food delivery services.

04. What are the growth drivers of the global food service market?

The market is driven by the increasing adoption of food delivery platforms, the rise of cloud kitchens, and the growing consumer preference for dining out, especially in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.