Global Forklift Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD8126

December 2024

95

About the Report

Global Forklift Market Overview

- The global forklift market was valued at USD 79.88 billion, driven by industrial expansion across manufacturing, logistics, and warehousing sectors. The surge in e-commerce, which has accelerated the demand for efficient material handling solutions, also plays a significant role in the market's growth. Technological advancements, such as the integration of IoT and automation, further enhance the demand for forklifts, with electric forklifts gaining traction due to their eco-friendly benefits. This data is based on a thorough analysis of recent market reports and industry insights.

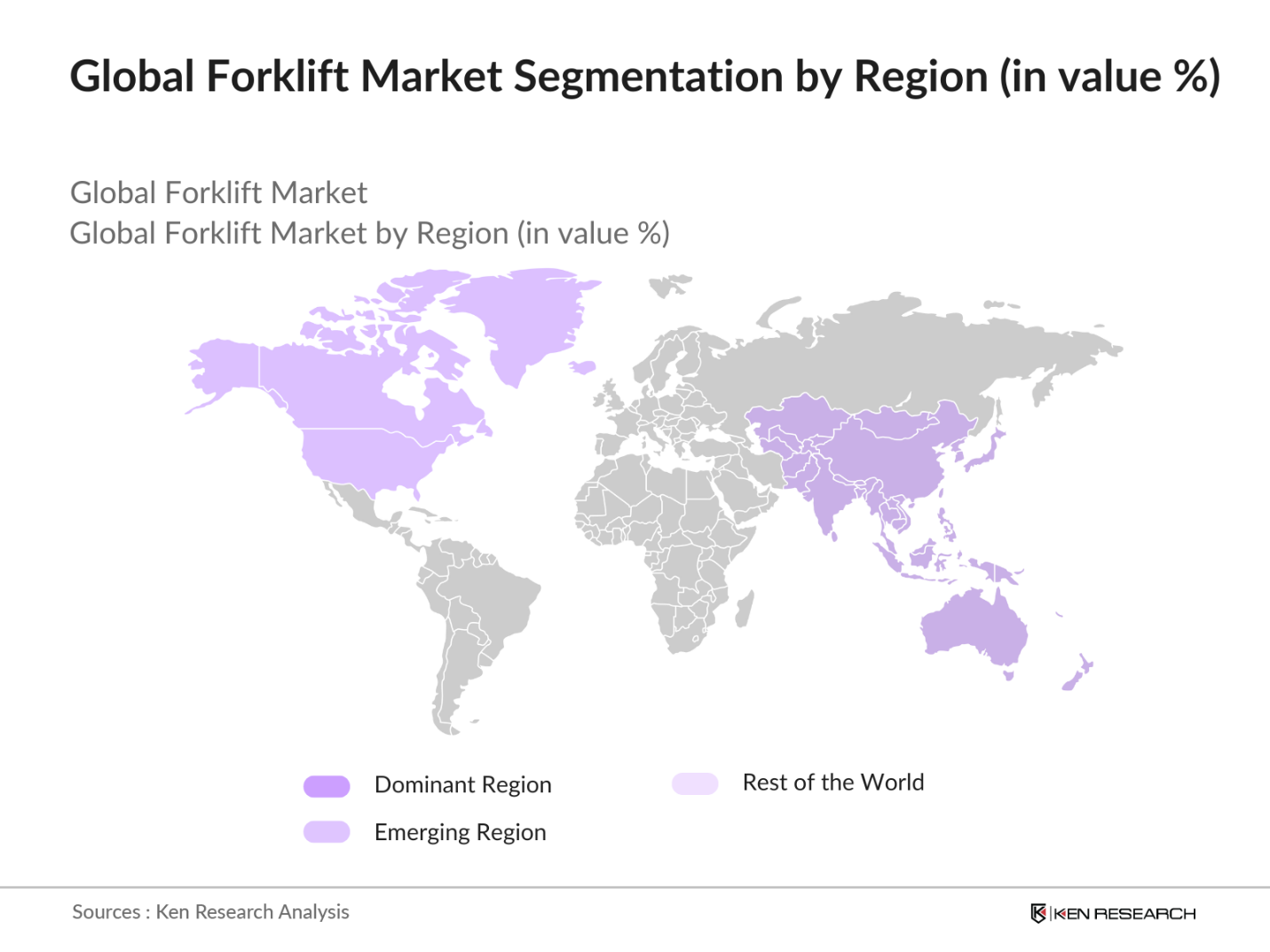

- Dominant regions in the global forklift market include Asia-Pacific, particularly China and India. These countries dominate the market due to their robust manufacturing sectors, large-scale infrastructure development, and high industrial output. The region also benefits from technological innovations, where governments support industrial automation. Europe is also prominent, with a focus on sustainability, driving the demand for electric forklifts.

- The Chinese government has introduced a comprehensive subsidy program to encourage the adoption of electric forklifts as part of its broader environmental sustainability goals. In 2023, the government allocated $500 million to industrial equipment subsidies, particularly for electric-powered machinery, including forklifts. Companies adopting electric forklifts are eligible for reimbursement on their purchases. This initiative aims to reduce emissions in the industrial sector, which significantly contributes to Chinas carbon footprint. The subsidy has accelerated the shift toward electric forklifts, with over 60,000 units sold in 2023 under this program.

Global Forklift Market Segmentation

By Product Type: The global forklift market is segmented into electric forklifts, internal combustion (IC) forklifts, and pallet jacks. Electric forklifts dominate this segment due to the growing emphasis on sustainability and their operational advantages, such as lower noise levels and zero emissions. The shift towards electric forklifts is largely attributed to companies aiming to reduce their carbon footprint while adhering to stricter government regulations on emissions.

By Region: The global forklift market is segmented by region into Asia-Pacific, North America, and Europe. Asia-Pacific holds the largest share of the market, led by China and India. This dominance is due to rapid industrialization, high demand from the manufacturing sector, and government policies favoring industrial automation. Europe follows, with a significant focus on eco-friendly forklifts, driven by stringent environmental regulations.

Global Forklift Market Competitive Landscape

The global forklift market is consolidated with several key players dominating the industry. These companies invest heavily in innovation and technology, especially electric forklifts and autonomous material handling solutions. The competitive landscape is marked by alliances, product innovations, and

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Employees |

Market Presence |

Innovation Focus |

Sustainability Initiatives |

Recent Acquisitions |

|

Toyota Material Handling |

1926 |

Japan |

$27B |

|||||

|

KION Group AG |

2006 |

Germany |

$10B |

|||||

|

Jungheinrich AG |

1953 |

Germany |

$5B |

|||||

|

Mitsubishi Logisnext |

1937 |

Japan |

$7B |

|||||

|

Crown Equipment Corp. |

1945 |

USA |

$3.5B |

Global Forklift Market Analysis

Market Growth Drivers

- Expansion of Industrial Sectors: The rapid expansion of the global industrial sector, especially in developing economies like China and India, is a significant driver of forklift demand. In 2022, the World Bank reported an increase in manufacturing output across Asia, spurred by robust industrial activities in construction, automotive, and logistics. In India, the number of industrial establishments grew from 2.2 million to 2.4 million in 2023, adding approximately 200,000 new establishments. This surge in industrial operations directly correlates with increased demand for forklifts used in material handling. Government-backed infrastructure initiatives, particularly in Africa and Southeast Asia, further fuel this demand.

- E-commerce Boom: The e-commerce sector has experienced exponential growth, creating significant demand for forklifts in warehouses and distribution centers. The IMF reports that the global e-commerce industry saw over 8.5 billion parcels delivered annually in major economies like the U.S., China, and Germany in 2023. The logistics demand, driven by online shopping, particularly in Asia-Pacific, led to the establishment of over 500 new warehouses in 2023 alone. Forklifts play a crucial role in managing the increased parcel volume efficiently, making the sector a pivotal growth driver for material handling solutions.

- Increasing Adoption of Automation and IoT (Technological Advancements): Technological advancements such as the Internet of Things (IoT) and automation are transforming the forklift industry. In 2023, North America saw a significant adoption of semi-automated forklifts integrated with IoT systems to improve operational efficiency, as noted in World Bank studies. The growing reliance on smart forklifts capable of real-time data analytics, predictive maintenance, and autonomous navigation is reshaping warehouse operations, enhancing material handling capabilities across industries. Additionally, investments in warehouse automation surged by $3.2 billion in the Asia-Pacific region in 2023 alone, emphasizing the shift towards technology-driven efficiency.

Market challenges:

- High Initial Costs: Forklifts, especially electric or autonomous models, require a high initial capital investment, which poses a challenge for small- and medium-sized enterprises (SMEs). Data from the World Bank in 2023 indicates that SMEs in emerging markets, such as those in Southeast Asia, often struggle with access to financing needed for upgrading to advanced forklift technologies. In the U.S., a single electric forklift can cost between $25,000 and $50,000, making it challenging for many businesses to transition from traditional internal combustion models. This high capital intensity slows the adoption of new technologies, particularly in price-sensitive markets.

- Limited Skilled Workforce in Emerging Regions: Despite technological advancements, many regions, particularly in emerging markets, face a shortage of skilled labor to operate advanced forklifts and material handling systems. In 2023, a significant number of workers in South Asias logistics sector were not certified to operate IoT-enabled forklifts, which limits the full potential of forklift automation in these regions, where manual labor still dominates. Government data shows that efforts to train workers in forklift technology have been focused primarily in urban areas, leaving rural industries underserved and hindering broader technological adoption.

Global Forklift Market Future Outlook

Over the next five years, the global forklift market is set to grow substantially, fueled by the rise in e-commerce, industrial automation, and sustainability initiatives. Businesses are expected to continue adopting electric forklifts due to their operational benefits and lower environmental impact. The market will also see advancements in autonomous forklifts, allowing businesses to improve efficiency through automation. Regions like Asia-Pacific are expected to remain dominant, with increased investments in industrial sectors

Market Opportunities:

- Demand for Electric Forklifts (Sustainability, Low Emissions): Electric forklifts are experiencing growing demand globally due to stringent environmental regulations and an increasing focus on sustainability. In the European Union, the adoption of electric-powered forklifts surged in 2023, driven by companies aiming to reduce their carbon footprints and comply with government mandates such as the European Green Deal. In China, government incentives have further fueled the shift towards electric forklifts, resulting in the sale of over 200,000 electric units in 2023. This trend is helping industries meet sustainability goals while reducing emissions in material handling operations.

- Limited Skilled Workforce in Emerging Regions: Despite technological advancements, many regions, particularly in emerging markets, face a shortage of skilled labor to operate advanced forklifts and material handling systems. In 2023, a significant number of workers in South Asias logistics sector lacked certification to operate IoT-enabled forklifts, which limits the full potential of forklift automation in these regions, where manual labor remains prevalent. Additionally, government data indicates that efforts to train workers in forklift technology have largely been concentrated in urban areas, leaving rural industries without adequate access to skilled labor, further hindering technological adoption.

Scope of the Report

|

By Product Type |

Electric Forklifts Internal Combustion Forklifts Pallet Jacks |

|

By Load Capacity |

Below 5 Ton 5-15 Ton Above 15 Ton |

|

By Power Source |

Lead-Acid Batteries Lithium-Ion Batteries Internal Combustion |

|

By End-Use Industry |

Manufacturing Warehousing & Logistics Retail & E-commerce |

|

By Region |

Asia Pacific North America Europe Latin America Middle East & Africa |

Products

Key Target Audience

Forklift Manufacturers

Warehousing and Distribution Companies

Logistics Service Providers

Automotive Manufacturing Plants

Government and Regulatory Bodies (Environmental Protection Agency)

Investments and Venture Capitalist Firms

Retail and E-commerce Companies

Construction Companies

Companies

Players Mention in the Report

Toyota Material Handling

KION Group AG

Jungheinrich AG

Crown Equipment Corporation

Mitsubishi Logisnext Co., Ltd.

Hyster-Yale Materials Handling, Inc.

Doosan Corporation

Hangcha Forklift Co., Ltd.

Komatsu Ltd.

Clark Material Handling

Hyundai Heavy Industries

Godrej & Boyce Manufacturing Co.

Lonking Holdings Limited

Anhui Heli Co., Ltd.

Paletrans Equipment Ltd.

Table of Contents

01. Global Forklift Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Drivers: Industrial Expansion, E-commerce Growth)

1.4 Market Segmentation Overview

02. Global Forklift Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis (Drivers: Technological Advancements, Urbanization)

2.3 Key Market Developments and Milestones

03. Global Forklift Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of Industrial Sectors

3.1.2 E-commerce Boom

3.1.3 Increasing Adoption of Automation and IoT (Technological Advancements)

3.2 Market Challenges

3.2.1 High Initial Costs

3.2.2 Limited Skilled Workforce in Emerging Regions

3.3 Opportunities

3.3.1 Demand for Electric Forklifts (Sustainability, Low Emissions)

3.3.2 Integration with Autonomous Operations

3.4 Trends

3.4.1 Use of IoT for Predictive Maintenance

3.4.2 Growth in Lithium-Ion Powered Forklifts

3.5 Regional Analysis

3.5.1 Asia-Pacific Dominance (Industrial Growth, Technological Innovation)

3.5.2 European Market Growth (Sustainability, Government Policies)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis (Power of Suppliers, Competition)

3.9 Competition Ecosystem

04. Global Forklift Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Electric Forklifts

4.1.2 Internal Combustion Forklifts

4.1.3 Pallet Jacks

4.2 By Load Capacity (In Value %)

4.2.1 Below 5 Ton

4.2.2 5-15 Ton

4.2.3 Above 15 Ton

4.3 By Power Source (In Value %)

4.3.1 Lead-Acid Batteries

4.3.2 Lithium-Ion Batteries

4.3.3 Internal Combustion Engines

4.4 By End-Use Industry (In Value %)

4.4.1 Manufacturing

4.4.2 Warehousing & Logistics

4.4.3 Retail & E-commerce

4.5 By Region (In Value %)

4.5.1 Asia Pacific

4.5.2 North America

4.5.3 Europe

4.5.4 Latin America

4.5.5 Middle East & Africa

05. Global Forklift Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Toyota Material Handling

5.1.2 KION Group AG

5.1.3 Jungheinrich AG

5.1.4 Mitsubishi Logisnext Co., Ltd

5.1.5 Crown Equipment Corporation

5.1.6 Hyster-Yale Materials Handling, Inc.

5.1.7 Doosan Corporation

5.1.8 Hangcha Forklift Co., Ltd.

5.1.9 Komatsu Ltd.

5.1.10 Anhui Heli Co., Ltd.

5.1.11 Clark Material Handling

5.1.12 Hyundai Heavy Industries

5.1.13 Godrej & Boyce Manufacturing

5.1.14 Lonking Holdings Limited

5.1.15 Paletrans Equipment

5.2 Cross-Comparison Parameters (Revenue, Headquarters, Production Capacity, Innovation in Automation, Product Portfolio, Sustainability Initiatives, Market Presence, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

06. Global Forklift Market Regulatory Framework

6.1 Environmental Regulations

6.2 Compliance Requirements (Safety and Emissions Standards)

6.3 Certification Processes for Electric Forklifts

07. Global Forklift Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Forklift Market Analysts Recommendations

8.1 Total Addressable Market (TAM) Analysis

8.2 Serviceable Available Market (SAM) Projections

8.3 Customer Cohort Insights

8.4 Key Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping out all major stakeholders in the forklift market, with a focus on material handling and logistics. Through extensive desk research, we identify key variables influencing the market, such as industrial growth, e-commerce expansion, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the forklift market's penetration and segment-wise growth is analyzed. We use this data to construct accurate revenue models and market forecasts, ensuring that the data reflects industry realities.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews, validating the findings from data analysis. These experts provide insights into emerging trends, competitive dynamics, and regional market strategies, which are crucial for market estimation.

Step 4: Research Synthesis and Final Output

We finalize the report through a synthesis of gathered data, providing detailed insights into the product segments, consumer preferences, and emerging technologies. This ensures the data is comprehensive, reliable, and actionable for business professionals.

Frequently Asked Questions

01. How big is the global forklift market?

The global forklift market is valued at USD 79.88 billion, driven by the expansion of e-commerce and the adoption of electric forklifts.

02. What are the challenges in the global forklift market?

The major challenges include the high initial cost of forklifts, a shortage of skilled labor in certain regions, and the increasing need to meet strict environmental regulations.

03. Who are the major players in the global forklift market?

Key players include Toyota Material Handling, KION Group AG, Jungheinrich AG, Crown Equipment Corporation, and Mitsubishi Logisnext, dominating due to their technological innovation and sustainability initiatives.

04. What drives growth in the global forklift market?

The forklift market is driven by industrial expansion, the rise of e-commerce, and technological advancements such as IoT integration and automation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.