Global Fragrance Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD1806

December 2024

80

About the Report

Global Fragrance Market Overview

- The global fragrance market reached a valuation of USD 60 billion in 2023, driven by the increasing consumer demand for premium and niche fragrances. The market's growth is fueled by the expansion of e-commerce platforms, the rising popularity of personalized fragrances, and the growing emphasis on sustainability and ethical sourcing. Advancements in fragrance formulation technologies and sustainable packaging solutions are further enhancing market demand across various regions.

- Major players in the global fragrance market include L'Oral, Este Lauder, Coty Inc., Shiseido, and Procter & Gamble. These companies have solidified their market positions through significant investments in research and development, strategic acquisitions, and a focus on expanding their global distribution networks. Their ability to innovate and introduce sustainable and personalized products has enabled them to maintain a competitive edge in the market.

- In 2023, L'Oral launched a new range of eco-friendly fragrances under its Yves Saint Laurent brand, emphasizing sustainable ingredients and refillable packaging. This new product line has gained significant traction in Europe and North America, reflecting the growing consumer preference for environmentally conscious products. Additionally, Este Lauder expanded its presence in the Middle East with the introduction of a new line of oud-based fragrances, catering to the regional demand for luxury scents.

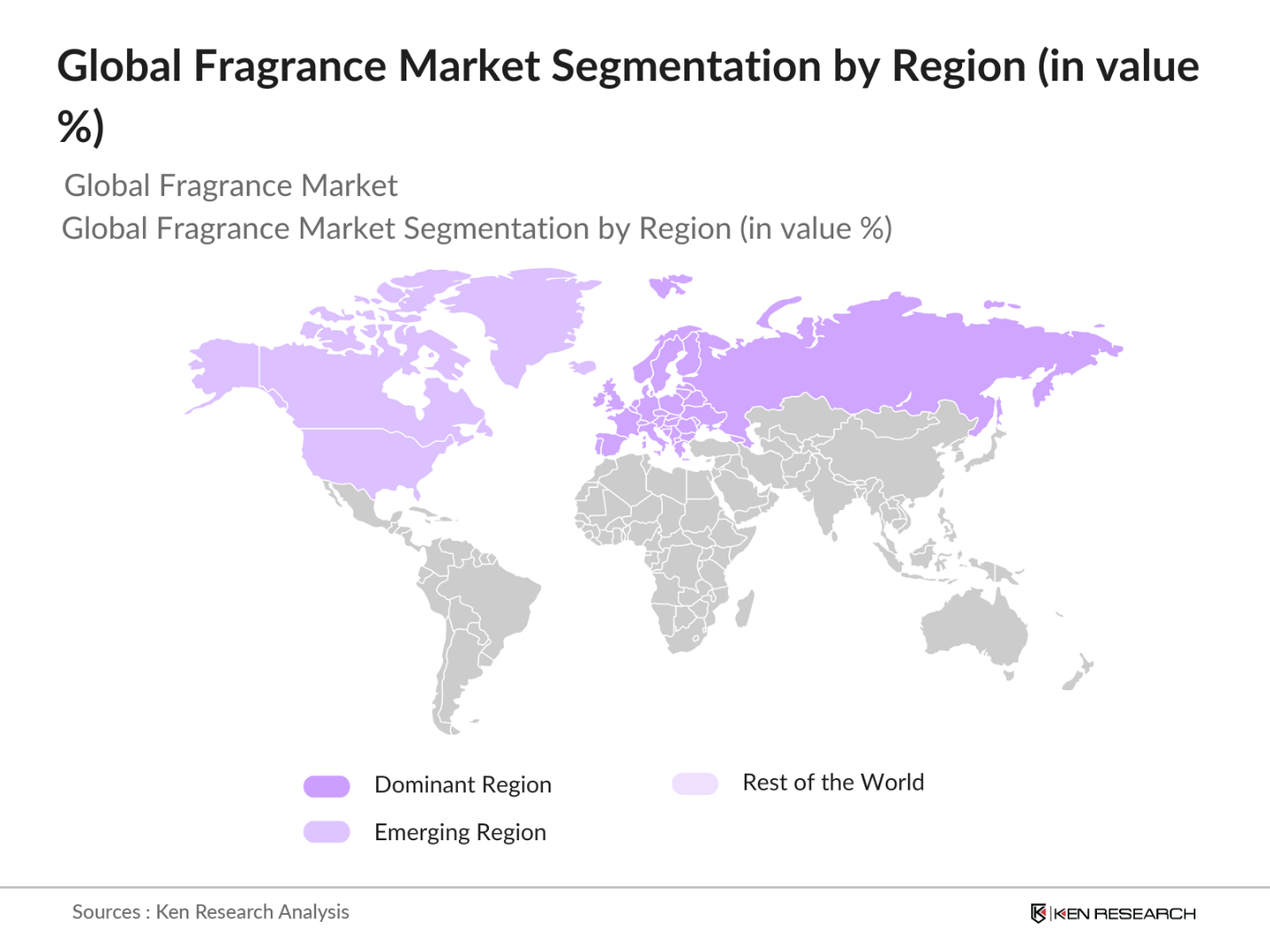

- Europe dominates the global fragrance market, primarily due to the region's long-standing tradition of perfumery and the presence of key luxury fragrance brands. The region's focus on sustainability, coupled with strong consumer purchasing power, contributes to its leadership position. Government initiatives such as the European Unions Green Fragrance Initiative are also driving the adoption of sustainable fragrance products across various industries.

Global Fragrance Market Segmentation

The Global Fragrance Market can be segmented based on Product Type, Distribution Channel, and Region.

By Product Type: The market is segmented by product type into perfumes, deodorants, and scented candles. In 2023, perfumes dominated the market, this is due to their long-standing popularity and the growing consumer preference for premium and luxury fragrances. Brands like Chanel and Dior continue to lead this segment with their iconic fragrances. The deodorant segment also holds a significant market share, driven by its daily use and affordability, making it a staple in personal grooming routines.

By Distribution Channel: The market is segmented by distribution channel into online, specialty stores, and department stores. In 2023, online sales accounted for 40% of the market share, reflecting the increasing consumer preference for convenient shopping and the availability of a wider variety of products. Specialty stores followed, where consumers seek personalized experiences and expert advice. Department stores, while still relevant, saw a decline in market share as consumers shifted towards more niche and specialized retail channels.

By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and MEA. Europe dominated the market in 2023, driven by the regions rich perfumery heritage and high consumer demand for luxury fragrances.

Global Fragrance Market Competitive Landscape

|

Company Name |

Headquarters |

Establishment Year |

|

L'Oral |

Paris, France |

1909 |

|

Este Lauder |

New York, USA |

1946 |

|

Coty Inc. |

New York, USA |

1904 |

|

Shiseido |

Tokyo, Japan |

1872 |

|

Procter & Gamble |

Cincinnati, USA |

1837 |

- Este Lauder: At the 2024 World Perfumery Congress in Geneva, Este Lauder Companies (ELC) was represented by Senior Vice President Sumit Bhasin. He discussed the evolving fragrance industry, emphasizing the well-being benefits of fragrances and the role of digital technologies in improving consumer education on fragrance performance and safety, highlighting ELC's commitment to fragrance stewardship and innovation.

- Coty Inc.: Coty reported a 10% rise in total net revenues for FY24, with prestige fragrance revenues seeing mid-teens growth. This success was fueled by strong product launches and robust performance of existing brands, notably Burberry Goddess, which became Coty's biggest launch to date and the leading female fragrance innovation in key markets such as the U.S., Canada, and Germany.

Global Fragrance Market Analysis

Market Growth Drivers

- Increased Consumer Demand for Luxury Fragrances: The growing preference for luxury and premium fragrances is a major driver of the global fragrance market. In 2024, sales of luxury fragrances are expected to reach USD 25 billion, driven by strong consumer demand in North America and Europe. The rising disposable income of consumers and their willingness to invest in high-quality products contribute to this trend, which is expected to continue driving market growth.

- Expansion of E-Commerce Channels: The expansion of e-commerce platforms is significantly boosting the global fragrance market. In 2024, online fragrance sales reached USD 18 billion, reflecting the increasing consumer preference for convenient and personalized shopping experiences. The proliferation of digital platforms has enabled consumers to access a wider variety of products and brands, further propelling market growth.

- Sustainability and Ethical Sourcing: The demand for sustainable and ethically sourced fragrance products is growing rapidly. In 2024, sustainable fragrance products generated USD 8 billion in sales, driven by consumer awareness and regulatory pressures. Major fragrance companies are increasingly adopting sustainable practices, such as using renewable ingredients and eco-friendly packaging, to meet the rising consumer demand for environmentally conscious products.

Global Fragrance Market Challenges

- Regulatory Compliance and Ingredient Transparency: The global fragrance market faces significant challenges in meeting regulatory requirements, particularly in regions like Europe and North America. The implementation of the European Unions Green Fragrance Initiative in 2023 has increased compliance costs by USD 2 billion for fragrance manufacturers. Companies are required to disclose ingredient lists and sourcing practices, which has led to increased operational costs and delays in product launches.

- Supply Chain Disruptions: The fragrance market is vulnerable to supply chain disruptions, particularly in sourcing natural ingredients. In 2024, raw material costs increased by 15% due to shortages of key ingredients like sandalwood and lavender. Environmental changes and geopolitical tensions in key producing regions have exacerbated these challenges, forcing companies to seek alternative sourcing options or invest in synthetic substitutes.

Global Fragrance Market Government Initiatives

- European Unions Cosmetic Products Regulation (2024 Update): The European Union updated its "Cosmetic Products Regulation" in 2024, with specific provisions affecting the fragrance industry. The update mandates stricter labeling requirements for fragrance ingredients and increased transparency regarding potential allergens. The regulation also introduced new safety assessments for synthetic fragrance compounds. Companies failing to comply with these regulations face fines and potential bans on their products within the EU market. The initiative has led to a significant increase in R&D spending by fragrance manufacturers to ensure compliance.

- Chinas National Standard for Fragrance Safety (GB 7916-2023): In 2023, China updated its national standards for cosmetics and fragrances under the GB 7916-2023 regulation. This standard imposes stricter safety and labeling requirements for fragrance ingredients used in cosmetic products. The regulation mandates that all fragrance ingredients must be tested for potential allergens and harmful substances before being approved for use. As a result, fragrance manufacturers have had to reformulate many of their products to comply with these new safety standards. This initiative has increased operational costs for companies but is aimed at enhancing consumer safety and product transparency in Chinas rapidly growing fragrance market.

Global Fragrance Market Future Market Outlook

The Global Fragrance Market is poised for significant growth, driven by technological advancements, increased demand for personalized and sustainable products, and the expansion of e-commerce channels.

Future Market Trends

- Technological Advancements in Fragrance Development: By 2028, the fragrance market is expected to witness significant technological advancements, particularly in AI-driven personalized fragrance development. Companies are anticipated to invest heavily in AI technologies that analyze consumer preferences to create customized fragrances in real-time. This trend will likely lead to the proliferation of bespoke fragrance lines, allowing consumers to design their unique scents, further driving market growth.

- Expansion of Sustainable Fragrance Lines: The market for sustainable fragrances is projected to grow significantly by 2028, with consumers increasingly prioritizing eco-friendly products. Companies will continue to innovate in sustainable packaging, such as biodegradable materials and refillable options, to meet regulatory requirements and consumer expectations. The adoption of green chemistry practices will also become more prevalent, driving the production of fragrances that are both luxurious and sustainable.

Scope of the Report

|

By Product |

Perfumes Deodorants Scented Candles |

|

By End-User |

Personal Use Commercial Use Industrial Use |

|

By Region |

North America Europe APAC Latin America MEA |

|

By Distribution Channel |

Online Specialty Stores Department Stores |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Fragrance Manufacturers

Luxury Brand Retailers

Specialty Fragrance Stores

Online Retail Platforms

Packaging Companies

Government and Regulatory Bodies

Investment and Venture Capitalist Firms

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

L'Oral

Este Lauder

Coty Inc.

Shiseido

Procter & Gamble

Chanel

Dior

Gucci

Calvin Klein

Jo Malone

Table of Contents

1. Global Fragrance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Fragrance Market Size (in USD Billion), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Fragrance Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Luxury and Niche Fragrances

3.1.2. Expansion of E-Commerce Channels

3.1.3. Sustainability and Ethical Consumerism

3.2. Restraints

3.2.1. Regulatory Compliance Challenges

3.2.2. Supply Chain Disruptions

3.2.3. Counterfeit Products

3.3. Opportunities

3.3.1. Innovation in Sustainable Fragrance Products

3.3.2. Growth in Emerging Markets

3.3.3. Technological Advancements in Personalization

3.4. Trends

3.4.1. Rise of AI-Driven Personalized Fragrances

3.4.2. Growth of Clean and Natural Fragrances

3.4.3. Increasing Investment in Sustainable Packaging

3.5. Government Regulations

3.5.1. European Unions Green Fragrance Initiative

3.5.2. U.S. FDAs Fragrance Ingredient Review

3.5.3. Indias National Perfume Policy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Fragrance Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Perfumes

4.1.2. Deodorants

4.1.3. Scented Candles

4.2. By Distribution Channel (in Value %)

4.2.1. Online

4.2.2. Specialty Stores

4.2.3. Department Stores

4.3. By End-User (in Value %)

4.3.1. Personal Use

4.3.2. Commercial Use

4.3.3. Industrial Use

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. MEA

5. Global Fragrance Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. L'Oral

5.1.2. Este Lauder

5.1.3. Coty Inc.

5.1.4. Shiseido

5.1.5. Procter & Gamble

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Fragrance Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Fragrance Market Regulatory Framework

7.1. Environmental and Product Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Fragrance Market Future Market Size (in USD Billion), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Fragrance Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Distribution Channel (in Value %)

9.3. By End-User (in Value %)

9.4. By Region (in Value %)

10. Global Fragrance Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Creating an ecosystem for all major entities within the Global Fragrance Market and referencing a combination of secondary and proprietary databases to conduct desk research. This step involves gathering industry-level information, identifying market trends, and understanding the competitive landscape to ensure a comprehensive analysis.

Step 2: Market Building

Collating statistics on the Global Fragrance Market over the years, analyzing market penetration across various segments, and evaluating the performance of key market players. This includes reviewing production capacities, market shares, and sales data to accurately compute the revenue generated within the global fragrance market. Quality checks are conducted to ensure the accuracy and reliability of the data points shared.

Step 3: Validating and Finalizing

Developing market hypotheses and conducting Computer Assisted Telephone Interviews (CATIs) with industry experts and stakeholders from leading companies in the fragrance market. These interviews are crucial for validating the collected data, refining market forecasts, and obtaining operational and financial insights directly from industry representatives.

Step 4: Research Output

Engaging with multiple key players in the fragrance industry to understand the dynamics of product segments, customer needs, sales patterns, and market challenges. This step involves using a bottom-up approach to validate the data, ensuring that the final statistics and insights accurately reflect market conditions and support strategic decision-making.

Frequently Asked Questions

1. How big is the Global Fragrance Market?

The global fragrance market reached a valuation of USD 60 billion in 2023, driven by the increasing consumer demand for premium and niche fragrances. The market's growth is fueled by the expansion of e-commerce platforms, the rising popularity of personalized fragrances, and the growing emphasis on sustainability and ethical sourcing.

2. What are the challenges in the Global Fragrance Market?

Challenges in the global fragrance market include stringent regulatory compliance, supply chain disruptions for natural ingredients, and the proliferation of counterfeit products, which impact brand reputation and market profitability.

3. Who are the major players in the Global Fragrance Market?

Key players in the global fragrance market include L'Oral, Este Lauder, Coty Inc., Shiseido, and Procter & Gamble. These companies lead the market due to their innovative product offerings, strong brand portfolios, and extensive distribution networks.

4. What are the growth drivers of the Global Fragrance Market?

The market is driven by increased consumer demand for luxury fragrances, the expansion of e-commerce platforms, and the rising focus on sustainability and ethical sourcing in product offerings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.