Global Frozen Desserts Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2512

December 2024

90

About the Report

Global Frozen Desserts Market Overview

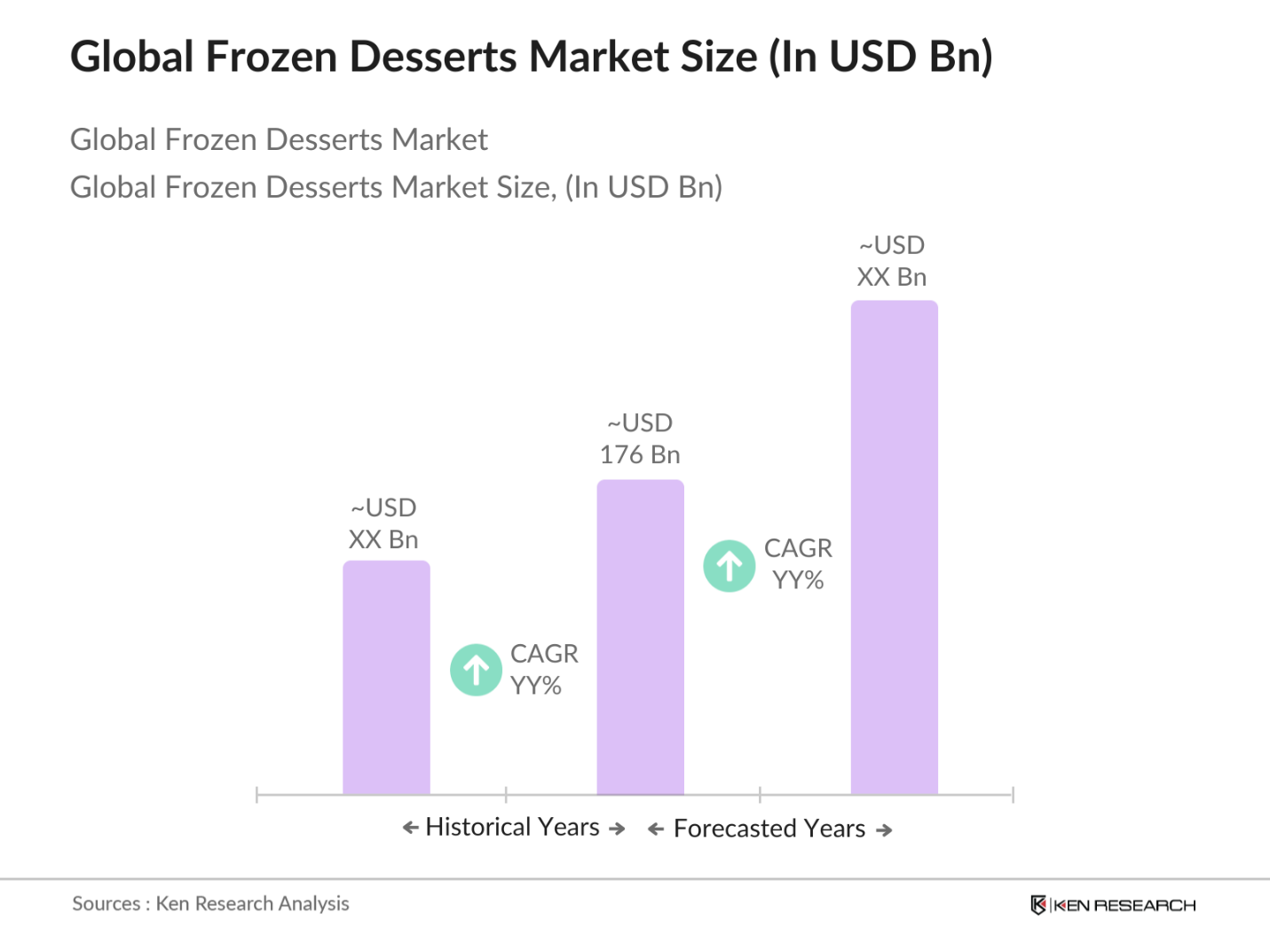

- The global frozen desserts market is valued at approximately USD 176 billion, driven by rising consumer demand for indulgent yet healthier dessert options. Innovations in plant-based and low-sugar frozen desserts are reshaping the market, with brands increasingly focusing on health-conscious consumers. Additionally, the market is bolstered by increasing disposable incomes, particularly in emerging economies, leading to greater consumption of premium frozen desserts. Data from the World Bank and IMF highlight the correlation between rising incomes and the consumption of high-quality frozen treats.

- North America and Europe dominate the frozen desserts market, largely due to their well-established consumer base and strong infrastructure for distribution. In North America, the preference for premium ice cream and non-dairy options has increased significantly. Meanwhile, European consumers favor artisanal frozen desserts, and the region's stringent food safety standards ensure product quality. These regions benefit from large-scale retail networks and the presence of leading brands, which contribute to their market dominance.

- Governments around the world are supporting the transition toward more sustainable food systems, including plant-based alternatives. For example, the European Union launched its "Farm to Fork" strategy in 2022, which encourages the reduction of greenhouse gas emissions and promotes plant-based diets as a means to reduce environmental impact. This initiative supports the production and consumption of plant-based frozen desserts by incentivizing companies that reduce their carbon footprint through sustainable production practices. The EU also offers subsidies to agricultural producers focusing on sustainable ingredients, encouraging the growth of the plant-based food sector.

Global Frozen Desserts Market Segmentation

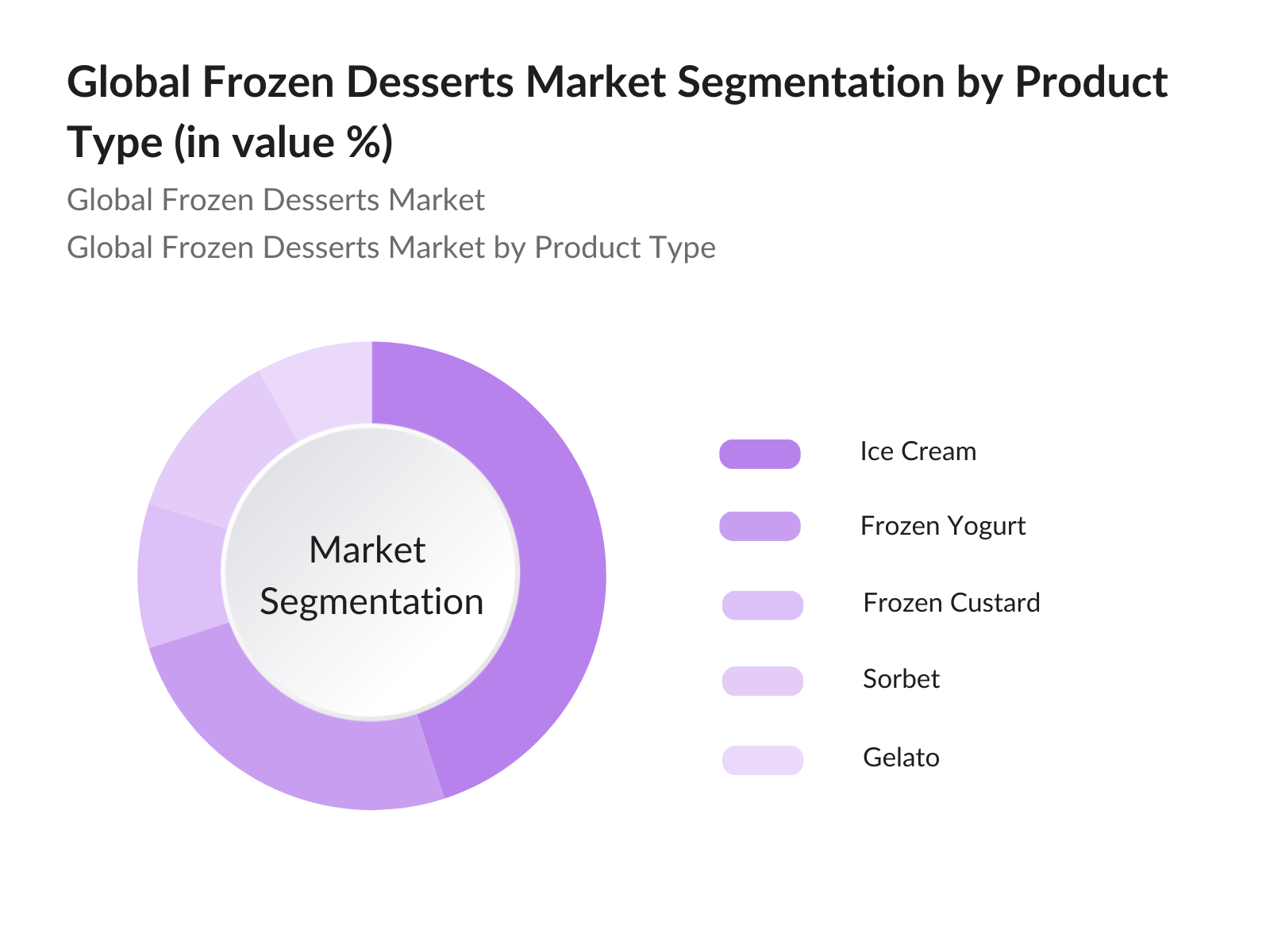

By Product Type: The global frozen desserts market is segmented by product type into ice cream, frozen yogurt, sorbet, frozen custard, and gelato. Ice cream holds a dominant market share due to its widespread popularity across all age groups and continuous innovation in flavors and formats. With established brands like Ben & Jerry's and Hagen-Dazs, ice cream remains a staple in the dessert market. The growing trend toward plant-based and organic ice cream options has further solidified its lead in the segment.

By Region: The global frozen desserts market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by strong consumer preference for frozen yogurt and premium ice creams. The regions developed retail infrastructure and high-income levels support the consumption of high-quality frozen desserts. Europe follows closely due to its artisanal and gelato culture, particularly in countries like Italy, where traditional dessert-making methods drive consumer preference for premium products.

Global Frozen Desserts Market Competitive Landscape

The global frozen desserts market is highly competitive, with a mix of multinational corporations and regional players. The competition is primarily driven by product innovation, brand recognition, and distribution strength. Major brands like Unilever and Nestl continue to lead, leveraging their expansive global distribution networks and strong product portfolios. Meanwhile, new entrants focus on niche segments like organic and plant-based desserts to carve out market share. The market is seeing increasing consolidation, with larger companies acquiring smaller, innovative brands to diversify their portfolios.

|

Company Name |

Established Year |

Headquarters |

Revenue |

Product Portfolio |

Distribution Network |

R&D Investment |

Global Presence |

Brand Loyalty |

Partnerships |

|

Unilever Plc |

1929 |

London, UK |

High |

- |

- |

- |

- |

- |

- |

|

Nestl S.A. |

1867 |

Vevey, Switzerland |

High |

- |

- |

- |

- |

- |

- |

|

General Mills Inc. |

1928 |

Minnesota, USA |

High |

- |

- |

- |

- |

- |

- |

|

Blue Bell Creameries |

1907 |

Texas, USA |

Medium |

- |

- |

- |

- |

- |

- |

|

Danone S.A. |

1919 |

Paris, France |

High |

- |

- |

- |

- |

- |

- |

Global Frozen Desserts Market Analysis

Market Growth Drivers

- Increased Consumer Preference for Plant-Based Desserts: The global shift towards plant-based diets has significantly impacted the frozen desserts market. According to a report from the Plant-Based Foods Association, sales of plant-based foods in the U.S. alone grew to $7.4 billion in 2023. This shift has been driven by consumer preferences for dairy-free alternatives and the growing concern for sustainability. Emerging markets like India and China are witnessing increased consumption of plant-based frozen desserts as more consumers in urban areas adopt these options for health and environmental reasons.

- Rising Disposable Incomes in Emerging Markets: Emerging economies, particularly in Asia and Latin America, are experiencing a surge in disposable incomes. For instance, Indonesia's GDP per capita rose to $4,587 in 2023, reflecting increased spending power, according to the World Bank . With higher disposable income, consumers in these regions are more willing to spend on premium frozen desserts. In India, household consumption grew by 9% in 2023, as consumers are increasingly purchasing higher-quality frozen desserts that offer better nutritional value. This trend is expected to persist as income levels rise, supporting market growth through greater consumer spending.

- Innovation in Flavors and Ingredients: Consumer demand for novel flavors and innovative ingredients is driving the frozen desserts market globally. Manufacturers are exploring unique ingredients such as exotic fruits and natural sweeteners to cater to evolving consumer preferences. According to Euromonitor International, over 20 new flavor combinations were introduced in major markets like Europe and North America in 2023. Innovation in ingredients like lactose-free and gluten-free alternatives is also contributing to growth, aligning with rising demand for healthier options.

Market Challenges:

- Regulatory Compliance on Ingredients and Labeling: Countries are imposing stricter regulations on food labeling and ingredient disclosures. The European Union introduced new rules in 2023 that require frozen dessert manufacturers to provide clear labeling on artificial additives and allergens . In the U.S., the FDA's updated guidelines in 2024 mandated the inclusion of more detailed nutritional information on all frozen food packaging. Such regulations can lead to higher operational costs for manufacturers, as they must adjust their packaging and product formulations to comply with diverse regulatory requirements across multiple regions.

- Intense Market Competition in Key Regions: The frozen desserts market is highly competitive, especially in mature markets like North America and Europe. In the U.S., there were over 500 frozen dessert brands competing in 2023, according to data from the USDA . This intense competition results in price wars, reducing profitability for smaller players. Moreover, established brands dominate shelf space in major retail chains, making it difficult for new entrants to gain a foothold. Companies are focusing on product differentiation and marketing to carve out niche segments in this crowded marketplace.

Global Frozen Desserts Market Future Outlook

The frozen desserts market is expected to witness significant growth over the next five years, driven by increased consumer demand for innovative products, including plant-based and low-calorie frozen treats. As health consciousness continues to rise, the market is likely to see further product diversification, particularly in the areas of sugar-free and non-dairy alternatives. Technological advancements in packaging and cold chain logistics will also play a key role in ensuring product quality and availability across emerging markets, thereby expanding the global market's reach.

Market Opportunities:

- Strategic Partnerships with Retail Chains: Collaborating with large retail chains presents a significant opportunity for frozen dessert manufacturers to expand their market reach. For instance, in 2023, major frozen dessert brands like Ben & Jerrys partnered with Walmart to launch exclusive products, boosting their presence in the U.S. retail market . Such partnerships not only provide greater visibility but also allow brands to leverage the extensive distribution networks of these retailers. By forming strategic alliances, frozen dessert companies can increase their market penetration in key regions while reducing distribution costs.

- Growth in Organic and Natural Frozen Desserts: The organic frozen desserts market has been expanding rapidly, with growing consumer preference for organic and natural food products. In the U.S., sales of organic frozen desserts reached $500 million in 2023, driven by increased awareness of the environmental and health benefits associated with organic farming . Similarly, European countries like Germany and France have seen a significant rise in organic frozen dessert consumption. The trend towards organic products is expected to continue, supported by government subsidies for organic farming and higher consumer demand for sustainable food options.

Scope of the Report

|

By Product Type |

Ice Cream Frozen Yogurt Sorbet and Sherbet Frozen Custard Gelato |

|

By Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Stores Specialty Retailers |

|

By Ingredient Type |

Dairy-Based Frozen Desserts Non-Dairy Frozen Desserts Plant-Based Alternatives Low-Sugar Desserts |

|

By Packaging Type |

Tubs Cones Bars and Sticks Cups |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Frozen dessert manufacturers

Supermarket and hypermarket chains

Online retailers specializing in frozen products

Cold chain logistics providers

Health and wellness product distributors

Investments and venture capitalist firms

Government and regulatory bodies (FDA, EFSA)

Dairy and non-dairy product suppliers

Companies

Players Mention in the Report

Unilever Plc

Nestl S.A.

General Mills Inc.

Blue Bell Creameries

Danone S.A.

Hagen-Dazs (General Mills)

Dairy Farmers of America

Mars Inc.

Yili Group

Lactalis International

Amul (Gujarat Cooperative Milk Marketing Federation)

Lotte Confectionery

Dean Foods

Meiji Holdings Co., Ltd.

The Kraft Heinz Company

Table of Contents

1. Global Frozen Desserts Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Frozen Desserts Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Frozen Desserts Market Analysis

3.1. Growth Drivers

3.1.1. Increased Consumer Preference for Plant-Based Desserts (Consumer Preference)

3.1.2. Rising Disposable Incomes in Emerging Markets (Macroeconomic Indicator)

3.1.3. Innovation in Flavors and Ingredients (Innovation Factor)

3.1.4. Health and Wellness Trends Boosting Demand for Low-Sugar Options (Health Trend)

3.2. Market Challenges

3.2.1. High Storage and Distribution Costs (Supply Chain Challenge)

3.2.2. Regulatory Compliance on Ingredients and Labeling (Regulatory Challenge)

3.2.3. Intense Market Competition in Key Regions (Competitive Pressure)

3.3. Opportunities

3.3.1. Expansion into Non-Dairy Frozen Desserts (Product Innovation)

3.3.2. Strategic Partnerships with Retail Chains (Business Strategy)

3.3.3. Increasing Demand for Clean-Label Products (Consumer Behavior)

3.4. Trends

3.4.1. Growth in Organic and Natural Frozen Desserts (Sustainability Trend)

3.4.2. Increased Adoption of Digital Marketing and Online Channels (Digital Shift)

3.4.3. Development of Premium and Artisanal Frozen Desserts (Premiumization Trend)

3.5. Government Regulation

3.5.1. Nutritional Labeling Requirements (Regulation)

3.5.2. Import/Export Regulations for Dairy and Non-Dairy Ingredients (Trade Regulation)

3.5.3. Taxation on Sugary Products (Fiscal Policy Impact)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Frozen Desserts Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ice Cream

4.1.2. Frozen Yogurt

4.1.3. Sorbet and Sherbet

4.1.4. Frozen Custard

4.1.5. Gelato

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Stores

4.2.4. Specialty Retailers

4.3. By Ingredient Type (In Value %)

4.3.1. Dairy-Based Frozen Desserts

4.3.2. Non-Dairy Frozen Desserts

4.3.3. Plant-Based Alternatives

4.3.4. Low-Sugar or Sugar-Free Desserts

4.4. By Packaging Type (In Value %)

4.4.1. Tubs

4.4.2. Cones

4.4.3. Bars and Sticks

4.4.4. Cups

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Frozen Desserts Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever Plc

5.1.2. Nestle S.A.

5.1.3. General Mills Inc.

5.1.4. Blue Bell Creameries

5.1.5. Dairy Farmers of America

5.1.6. Amul (Gujarat Cooperative Milk Marketing Federation)

5.1.7. Danone S.A.

5.1.8. Mars Inc.

5.1.9. Lotte Confectionery

5.1.10. Meiji Holdings Co., Ltd.

5.1.11. The Kraft Heinz Company

5.1.12. Hagen-Dazs (General Mills)

5.1.13. Lactalis International

5.1.14. Dean Foods

5.1.15. Yili Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Product Portfolio, Distribution Network, Revenue, Global Presence, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Frozen Desserts Market Regulatory Framework

6.1. Food Safety Standards

6.2. Packaging and Labeling Regulations

6.3. Environmental Sustainability Regulations

6.4. Health Standards Compliance

7. Global Frozen Desserts Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Frozen Desserts Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. Global Frozen Desserts Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, we identified key variables influencing the global frozen desserts market, such as changing consumer preferences, disposable income levels, and supply chain capabilities. Extensive desk research was conducted using proprietary and publicly available databases to map industry stakeholders and define critical market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled historical data on market size, product type distribution, and geographic penetration. We analyzed frozen dessert consumption patterns, sales channels, and product innovation to estimate market performance. The analysis included retail and distribution statistics to validate our market size projections.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through consultations with industry experts, including manufacturers and suppliers. These interviews provided first-hand insights into product trends, challenges in logistics, and consumer preferences. Additionally, we utilized Computer-Assisted Telephone Interviews (CATIs) to verify market dynamics and ensure data accuracy.

Step 4: Research Synthesis and Final Output

In the final stage, data collected from industry players was synthesized into a comprehensive report. This synthesis involved reconciling bottom-up market estimates with feedback from market participants to ensure a well-rounded understanding of the frozen desserts industry, its challenges, and growth opportunities.

Frequently Asked Questions

01. How big is the Global Frozen Desserts Market?

The global frozen desserts market was valued at approximately USD 176 billion, driven by innovations in plant-based and low-sugar desserts and increasing demand for premium products in both developed and emerging markets.

02. What are the challenges in the Global Frozen Desserts Market?

Key challenges include high storage and distribution costs, regulatory compliance, and the need for constant innovation in flavors and product offerings. The frozen desserts market also faces competitive pressure from both established brands and new entrants targeting niche segments.

03. Who are the major players in the Global Frozen Desserts Market?

Major players in the market include Unilever Plc, Nestl S.A., General Mills Inc., Blue Bell Creameries, and Danone S.A., which dominate through their extensive distribution networks and innovative product offerings.

04. What are the growth drivers of the Global Frozen Desserts Market?

Growth in the market is driven by increasing consumer demand for healthier alternatives, including plant-based and low-sugar options, as well as the rising popularity of premium frozen desserts. Emerging markets also contribute to this growth, supported by increasing disposable incomes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.