Global Frozen Food Market Outlook to 2030

Region:Global

Author(s):Kartik and Anurag

Product Code:KENGR038

October 2024

82

About the Report

Global Frozen Food Market Overview

- In 2023, global frozen food market was valued at USD 250 Bn driven by rising demand for convenient frozen meals for children, expansion of e-commerce channels in frozen food distribution, advancements in frozen food packaging technologies, and innovations in temperature and location monitoring systems.

- The market is highly fragmented with major players in the market including General Mills Inc., Tyson Foods, JBS, McCain, Unilever, and Nestle. These companies leverage product innovation, strategic partnerships, and expansive distribution networks to maintain their competitive positions and address varied consumer preferences in this fragmented market.

- General Mills is investing USD 48 million to expand its frozen dough plant in Missouri, aiming to boost manufacturing and packaging capacity significantly. Additionally, an investment in Torino's frozen pizza snacks factory in Wellston, Ohio, will create 12 new jobs, enhancing the facilitys operations, which already employ nearly 900 staff.

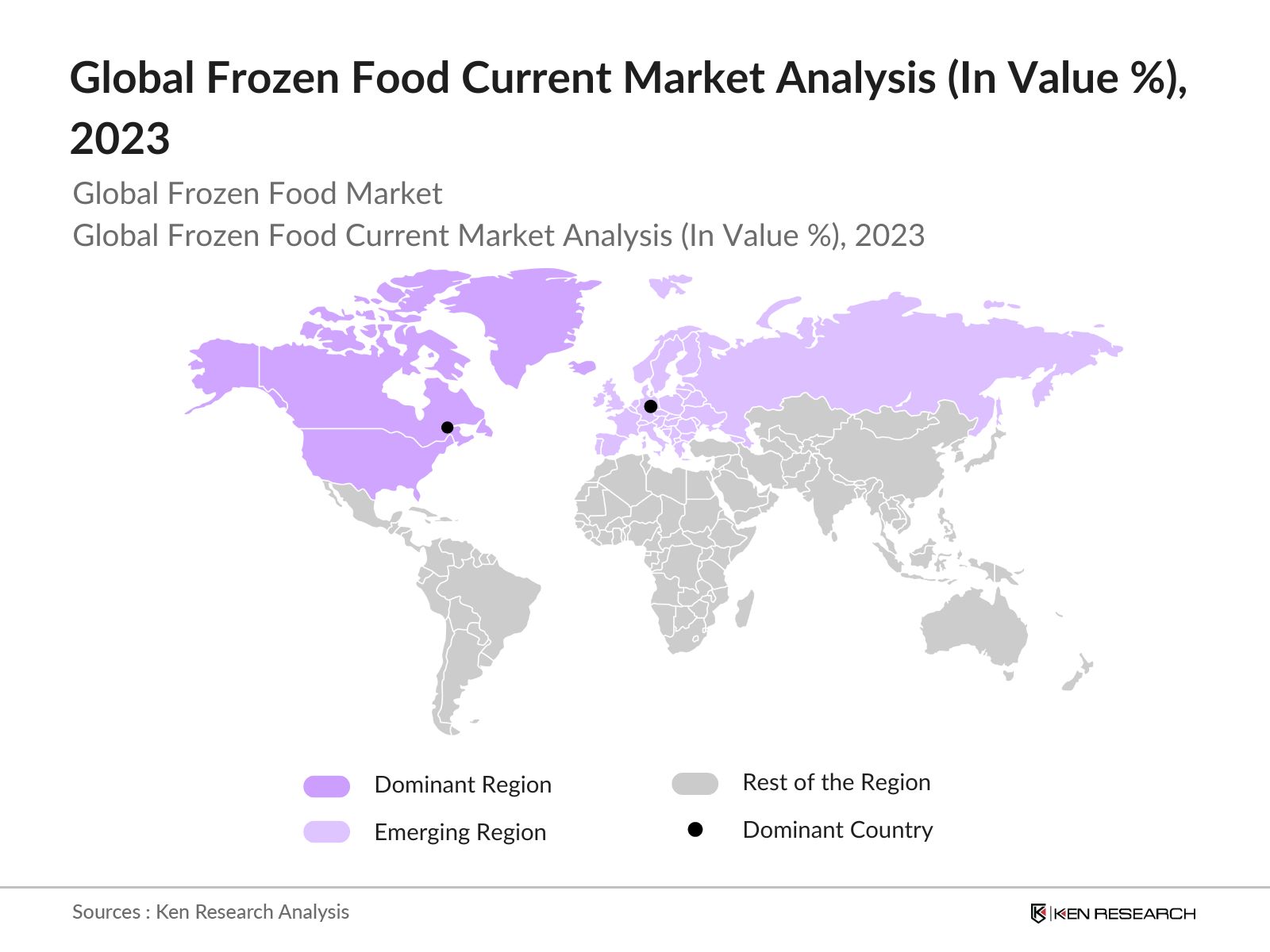

Global Frozen Food Current Market Analysis

- North America as dominant region: North America leads the global frozen food market due to its robust retail infrastructure, high demand for convenience foods, and preference for frozen products.Advanced cold chain logistics, significant investments in food processing, and a wide variety of product offerings further strengthen its market position. In the third quarter of 2022, consumer spending on food in Canada reached USD 890 billion, highlighting strong demand for frozen options.According to the US Department of Agriculture, 72.0% of Americans purchase frozen food to accommodate their busy lifestyles.

- Europe as emerging region: Europe is the emerging region of the global frozen food market due to increasing demand for convenience foods, growing urbanization, retail and e-commerce expansion, and rising disposable income.Europe imported 2.8 million tonnes of frozen food valued at USD 3.28 billion in 2021, with 91% coming from within Europe and only 9% from developing countries, this indicates growing demand for frozen food in the country.Additionally, as of the fourth quarter of 2023, disposable personal income in the Euro Area reached USD 2,446,872 million, up from USD 2,416,609 million in the third quarter of 2023.

- USA as the dominant country: USA is the leading country in the global frozen food market owing to high consumer demand, robust distribution networks, retail and e-commerce expansion, and advanced food technology.The American Frozen Food Institute (AFFI) reported that frozen foods generated USD 65.1 billion in retail sales in 2020, marking a 21% increase from the previous year. Advances in food processing technologies, such as high-pressure processing and cryogenic freezing, are being developed in the U.S.These technologies enhance food quality, extend shelf life, and maintain nutritional value, making frozen foods more appealing to consumers.

Global Frozen Food Market Segmentation

The Global Frozen Food Market can be segmented based on several factors:

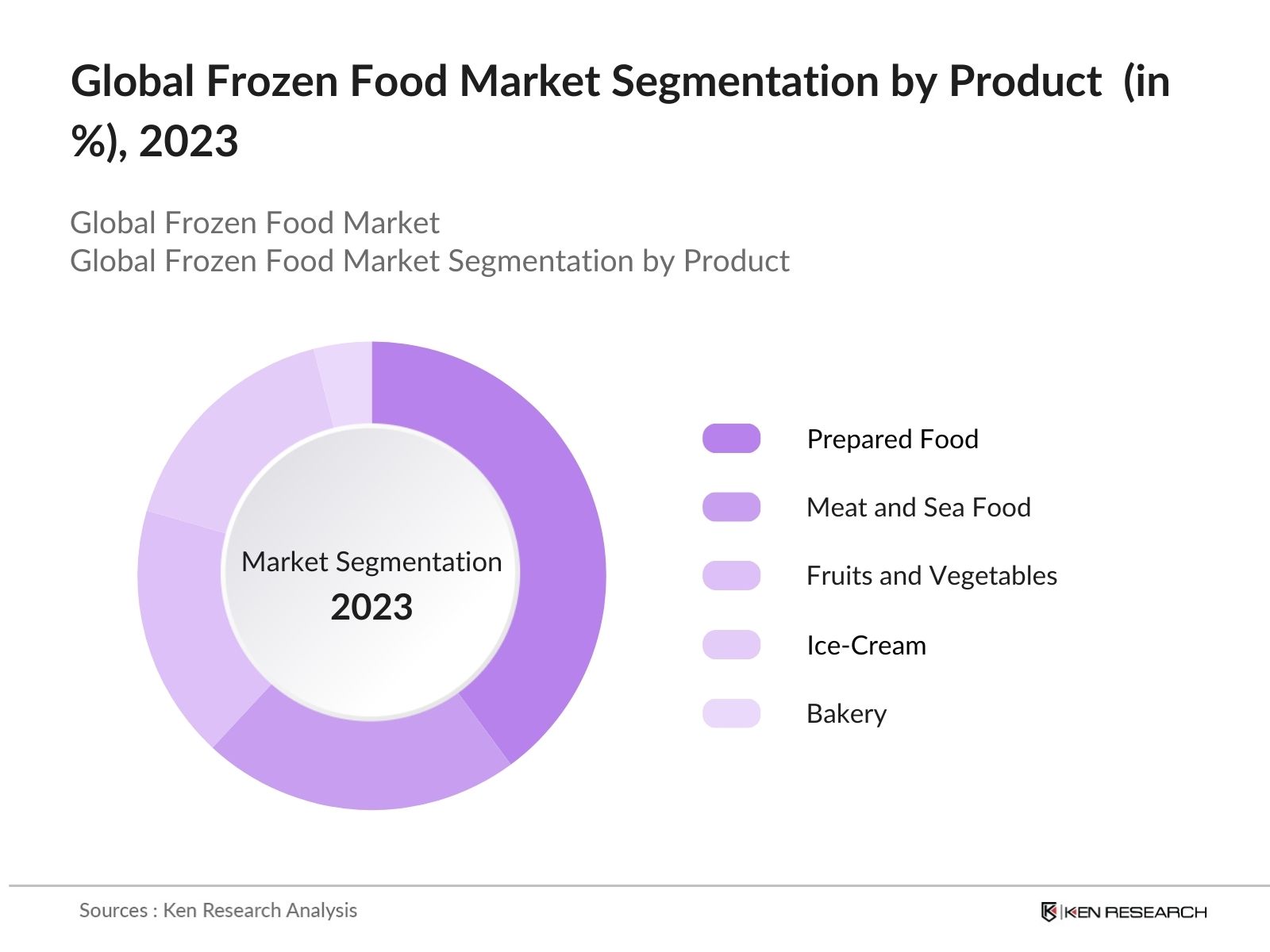

- By Product: The global frozen foods market segmentation by product type is divided into prepared food, meat and seafood, fruits and vegetables, ice-cream, and bakery. In 2023, the Prepared Food dominated the market, accounting for the largest value share. This is driven by the increasing consumer demand for convenient meal solutions and the growing variety of ready-to-eat frozen meals.

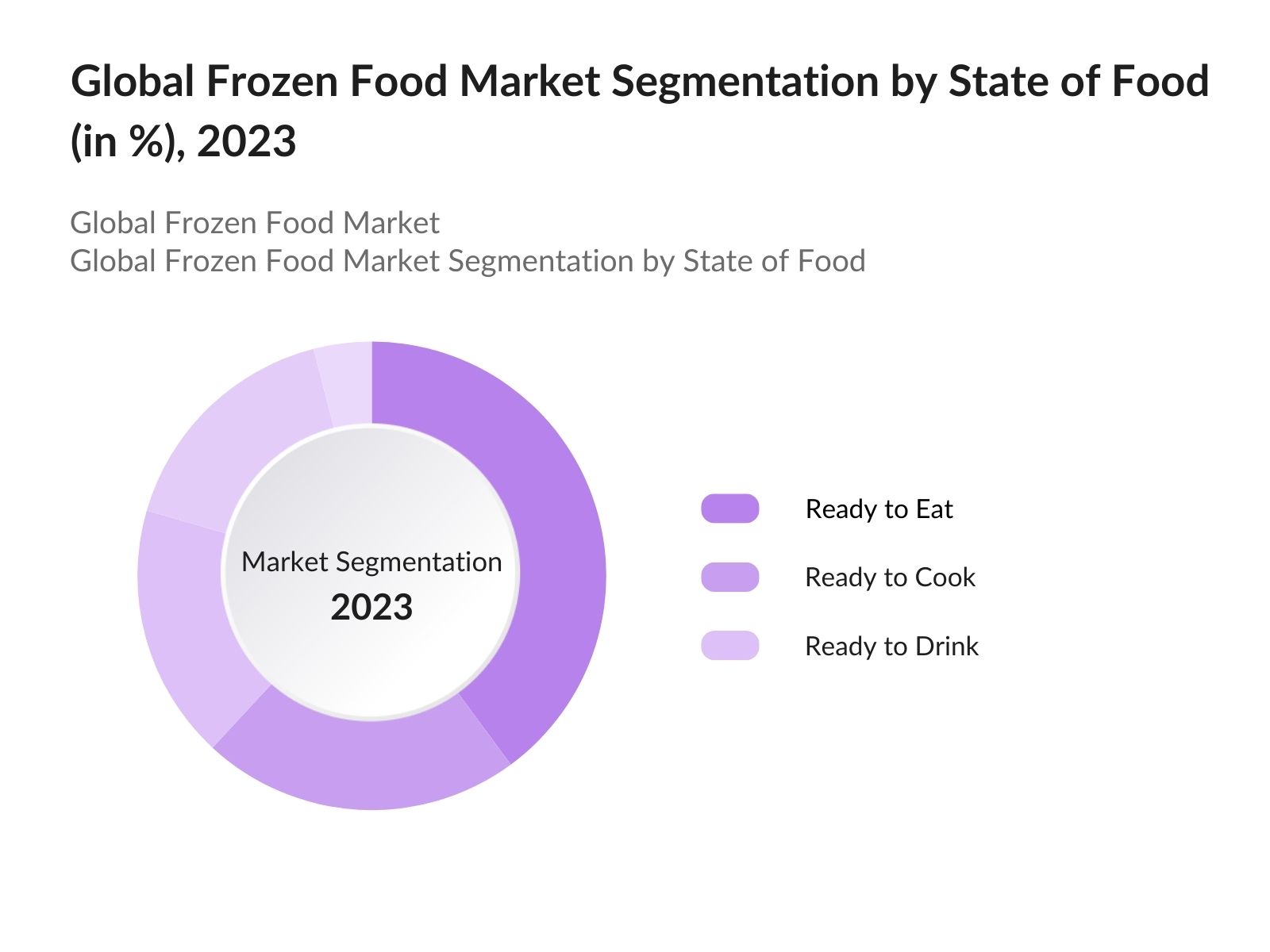

- By State of Food: The global frozen foods market segmentation by state of food is divided into ready to eat, ready to cook, and ready to drink. In 2023, the Ready to Eat dominated the market, accounting for the largest value share. This is driven by the busy lifestyles of consumers and the growing preference for quick and easy meal options that require minimal preparation.

- By End-User: The global frozen foods market segmentation by end-user is divided into Direct Consumers and HORECA (Hotels, Restaurants, and Catering). In 2023, the Direct Consumers dominated the market, accounting for the largest value share. This is driven by the increasing consumption of frozen foods at home, supported by the convenience and long shelf life of these products.

Global Frozen Food Market Competitive Landscape

|

Company |

Headquarter |

Vintage |

Geographical Presence |

# Frozen Food Brands |

|

|

Minnesota, USA |

1928 |

100 |

5 |

|

|

Arkansas, USA |

1935 |

125 |

34 |

|

|

Sao Paulo, Brazil |

1855 |

190 |

16 |

|

|

Toronto, Canada |

1957 |

160 |

6 |

|

|

London, UK |

1930 |

190 |

14 |

|

|

Vevey, Switzerland |

1866 |

188 |

14 |

|

|

Illinois, United States |

1919 |

5 |

21 |

|

|

Chicago and Pittsburgh, USA |

2015 |

40 |

5 |

|

|

Feltham, UK |

2016 |

17 |

7 |

|

|

Tokyo, Japan |

1917 |

36 |

6 |

|

|

Michigan, USA |

1906 |

180 |

1 |

- Mc Cain: McCain Foods, a global leader in the frozen food industry, has made a substantial investment of USD 439.9 million to double the size of its processing facility in Alberta, Canada. This significant financial commitment underscores McCain Foods' dedication to expanding its production capacity and reinforcing its position in the market.

- Tyson Foods: In 2023, Tyson Foods has officially opened a new $300 million fully-cooked food production facility in Danville, Virginia. This state-of-the-art facility is designed to enhance Tyson Foods' production capabilities and meet the increasing demand for fully-cooked food products. In the same year, Tyson Foods has reached an agreement for a two-fold investment with Protix, the leading global insect ingredients company. This partnership aims to innovate and expand the use of insect-based ingredients in the food industry.

- JBS: In 2023, JBS SA acquired a 51% stake in BioTech Foods, a Spanish cultivated meat company. This strategic investment marks JBS SA's entry into the cultivated meat sector, underscoring its commitment to innovative and sustainable protein solutions. By partnering with BioTech Foods, JBS SA aims to leverage cutting-edge biotechnology to produce cultivated meat, reducing the environmental impact of traditional meat production.

Global Frozen Food Industry Analysis

Global Frozen Food Market Growth Drivers:

- Rising demand for convenient frozen meals for children: Frozen foods that appeal to children and are simple for parents to prepare have experienced substantial growth in recent years. According to Conagra annual report, kid-friendly frozen food products now generate over $248 million in annual sales, representing a 122% increase compared to four years ago as of 2024. Families are increasingly turning to frozen foods not only for their convenience and taste but also to help maintain food budgets and minimize food waste. With nearly half of U.S. consumers now eating three or more snacks daily, frozen foods that cater to this trend, such as mini portions and bites, are gaining popularity. This shift towards snacking has further boosted the sales of kid-friendly frozen products.

- Expansion of e-commerce channels in frozen food distribution: The rise of e-commerce platforms and online grocery shopping has expanded the reach of frozen food products to a wider audience. Consumers can conveniently purchase frozen foods online and have them delivered to their doorstep, driving market growth and accessibility. The online segment of frozen food is going to reach USD 39.6 Bn by 2029 indicating the substantial growth of this market. Additionally, E-commerce sales for the frozen food and beverage industry increased by USD 244.2 billion, or 43%, in 2020, rising from USD 571.2 billion to USD 815.4 billion

- Innovations in temperature and location monitoring systems: Real-time temperature monitoring in frozen food supply chains enables immediate intervention to prevent product spoilage, minimize waste, and ensure food safety and quality. In 2023, 30% of food products are wasted globally due to spoilage, with improper temperature control being a significant contributor. The driver is able to diagnose the issue and make temporary repairs to restore the proper temperature. The monitoring system confirms the temperature has returned to the safe zone, allowing the shipment to continue to its destination.

Global Frozen Food Market Challenges:

- Unstable supply chain and high quality lapse rates: The frozen food supply chain faces issues like limited capacity, labor shortages, ingredient shortages, and inflation. Lack of reliable electricity and inadequate cold storage facilities in developing markets also pose challenges. Maintaining the quality, taste, texture, and nutritional value of frozen foods is paramount. Food processors must ensure that freezing doesn't compromise these attributes. Preserving food without using harmful additives is an ongoing challenge.

- Negative perception of consumers towards product's freshness: The negative perception of consumers towards the freshness of frozen food remains a significant challenge in the industry. Many consumers believe that frozen food is inferior to fresh food, particularly concerning taste and nutritional value. This perception often stems from outdated notions and lack of awareness about the advancements in freezing technologies. Educating consumers about the benefits of frozen foods is crucial in changing this mindset. Frozen foods can be just as nutritious, if not more so, than fresh foods because they are often frozen at peak ripeness, preserving their vitamins and minerals

Global Frozen Food Market Government Initiatives:

- Food Safety Modernization Act (FSMA): The Food Safety Modernization Act (FSMA), enacted by the U.S. Food and Drug Administration (FDA), represents a comprehensive overhaul of food safety regulations with a primary focus on preventing food safety issues rather than merely reacting to them. This legislation includes stringent regulations aimed at ensuring the safety and quality of frozen foods throughout the entire supply chain, from production to consumption.

- National Nutrition Plan: Under the National Nutrition Plan, the Chinese government actively promotes the consumption of nutritious frozen foods as an integral part of a balanced diet. This comprehensive initiative includes a range of public campaigns and educational programs designed to highlight the benefits of frozen foods and encourage their inclusion in daily meals.

Global Frozen Food Future Market Outlook

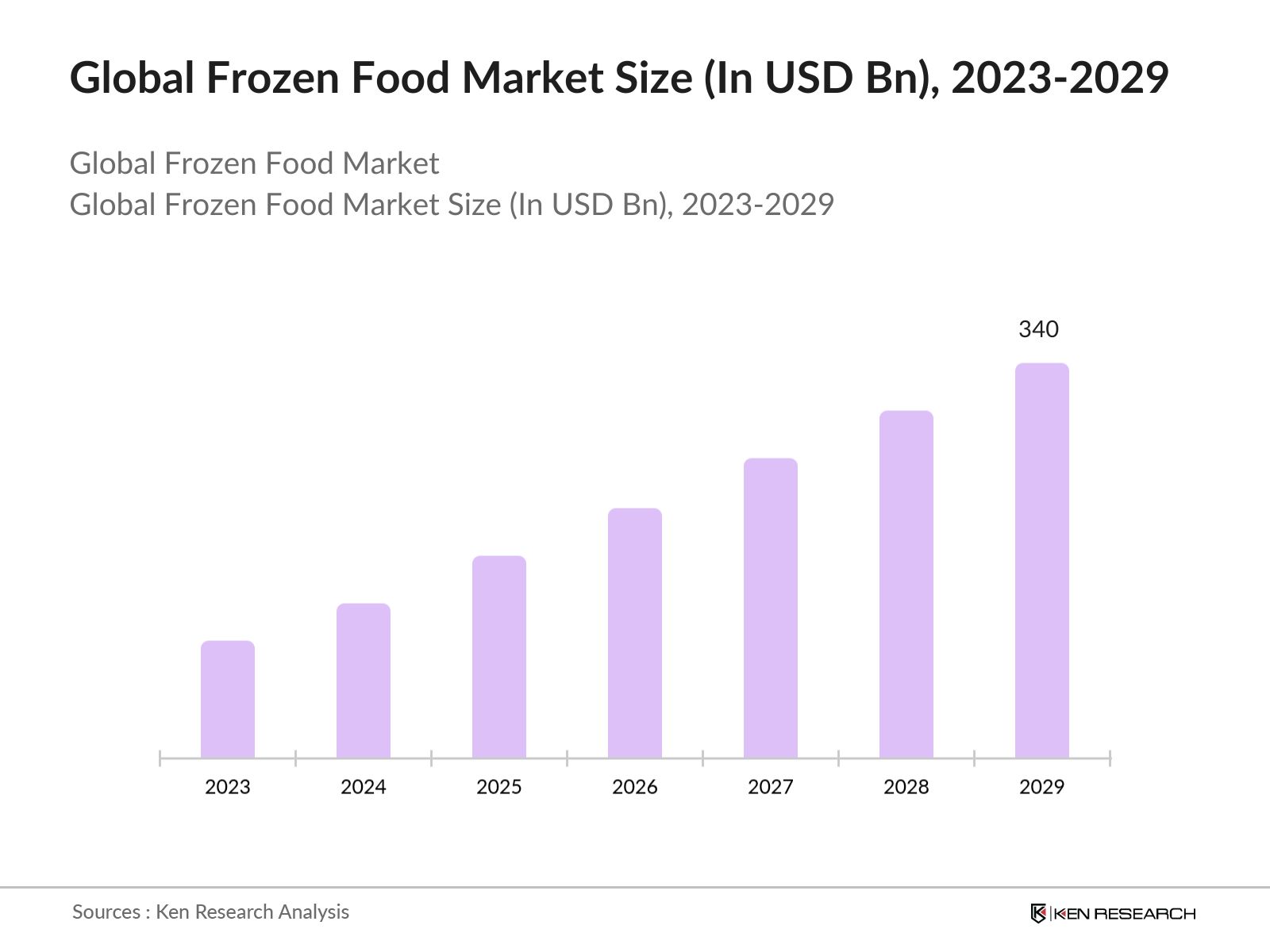

The global frozen food market is predicted to grow exceptionally in the forecasted period of 2023-2029 reaching a market size of USD 340 Bn driven by the growing influence of air fryers on food prep, frozen foods as a staple in breakfast meals, and incorporation of global flavors in frozen food offerings.

- The growing influence of air fryers on food prep: The increasing popularity of air fryers is revolutionizing food preparation methods, making it easier and quicker to cook frozen foods with minimal oil. This trend is driving demand for frozen food products that are compatible with air fryer cooking. Air fryers offer significant health benefits, using much less oil than traditional frying methods, resulting in meals with lower fat content. This appeals to health-conscious consumers who wish to enjoy their favorite fried foods without the associated health risks.

- Frozen Foods as a Staple in Breakfast Meals: Frozen breakfast foods are becoming a go-to choose for consumers seeking convenient and nutritious morning meal options. This trend includes a wide variety of products, such as frozen waffles, breakfast sandwiches, and smoothie packs, catering to busy lifestyles. These snacks offer a wide range of products that cater to different tastes and dietary preferences. From traditional options like waffles and pancakes to healthier alternatives like protein-packed breakfast burritos and smoothie packs, there is something for everyone.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product |

Prepared Food Meat and Sea Food Fruits and Vegetables Ice-Cream Bakery |

|

By State of Food |

Ready to Eat Ready to Cook Ready to Drink |

|

By End-User |

Direct Consumers HORECA |

|

By Distribution |

Offline Retail Online Retail |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Food Manufacturers and Producers

Retailers and Supermarkets

Foodservice Providers (Restaurants, Hotels, Catering Companies)

Investors and Financial Analysts

Food Packaging Companies

Cold Chain Logistics Providers

Banks and Financial Institutions

Investors and VCs

Government and Regulatory Bodies (FDA, USDA, European Food Safety Authority)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

General Mills Inc.

Tyson Foods

JBS

Mc Cain

Unilever

Nestle

Conagra Foods

The Kraft Heinz

Nomad Foods

Ajinomoto Foods

Kellogs

Table of Contents

1. Executive Summary

1.1 Global Packed Food Market

1.2 Global Frozen Food Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Packed Food Industry

2.3 Global Packed Food (Ready to eat food, ready to heat food and frozen food) Revenue

2.4 Global Frozen Food Infrastructure

3. Global Frozen Food Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

4. Global Frozen Food Market Size (in USD Bn), 2018-2023

5. Global Frozen Food Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Product (Prepared Food, Meat and Sea Food, Fruits and Vegetables, Ice-Cream, and Bakery) in value%, 2018-2023

5.3 By State of Food (Ready to Eat, Ready to Cook, and Ready to Drink), in value %, 2018-2023

5.4 By End-User (Direct Consumers and HORECA) in value %, 2018-2023

5.5 By Distribution (Offline Retail and Online Retail) in value %, 2018-2023

6. Global Frozen Food Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis (By Technology)

6.3 Market Heat Map Analysis (By Offerings)

6.4 Market Cross Comparison

6.5 Comparison Matrix

6.6 Investment Landscape

7. Global Frozen Food Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

8. Global Frozen Food Future Market Size (in USD Bn), 2023-2029

9. Global Frozen Food Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2029

9.2 By Product (Prepared Food, Meat and Sea Food, Fruits and Vegetables, Ice-Cream, and Bakery) in value%, 2023-2029

9.3 By State of Food (Ready to Eat, Ready to Cook, and Ready to Drink), in value %, 2023-2029

9.4 By End-User (Direct Consumers and HORECA) in value %, 2023-2029

9.5 By Distribution (Offline Retail and Online Retail) in value %, 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Hypothesis Creation

The research team framed a hypothesis about the market through an analysis of existing industry factors obtained from company reports, magazines, journals, online articles, ministries, government associations and data from EMIS, WHO, among others.

Step 2: Market Sizing: The market size was estimated based on the frozen food revenue of the major countries constituting a region and hence calculating regional revenue. The regional revenue of the 5 regions ((North America, APAC, Europe, LATAM, MEA) was then summed to arrive at the market size of the Global Frozen Food Market.

Step 3: Hypothesis Testing:

The research team then conducted CATIs with several industry veterans including decision makers from Tyson Foods, Nomad Foods, McCain and others in the ecosystem to get their insights on market and justify the hypothesis framed by the team.

Step 4: Interpretation and Proofreading:

The final analysis was then interpreted in the research report by our expert team.

Frequently Asked Questions

01 How big is the global frozen food market?

In 2023, Global Frozen Food Market was valued at USD 250 Bn driven by rising demand for convenient frozen meals for children, expansion of e-commerce channels in frozen food distribution, advancements in frozen food packaging technologies, and innovations in temperature and location monitoring systems.

02 What are the challenges in the global frozen food market?

Challenges in the global frozen food market include negative consumer perceptions regarding freshness, high competition among brands, and logistical complexities in maintaining cold chain integrity.

03 Who are the major players in the global frozen food market?

Key players in the global frozen food market include Nestl, Conagra Brands, Tyson Foods, and General Mills. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04 What are the growth drivers of the global frozen food market?

The global frozen food market is propelled by factors such as busy lifestyles leading to increased demand for convenience foods, technological advancements in freezing, and rising consumer interest in diverse and healthy frozen food options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.