Region:Global

Author(s):Geetanshi

Product Code:KRAC0056

Pages:95

Published On:August 2025

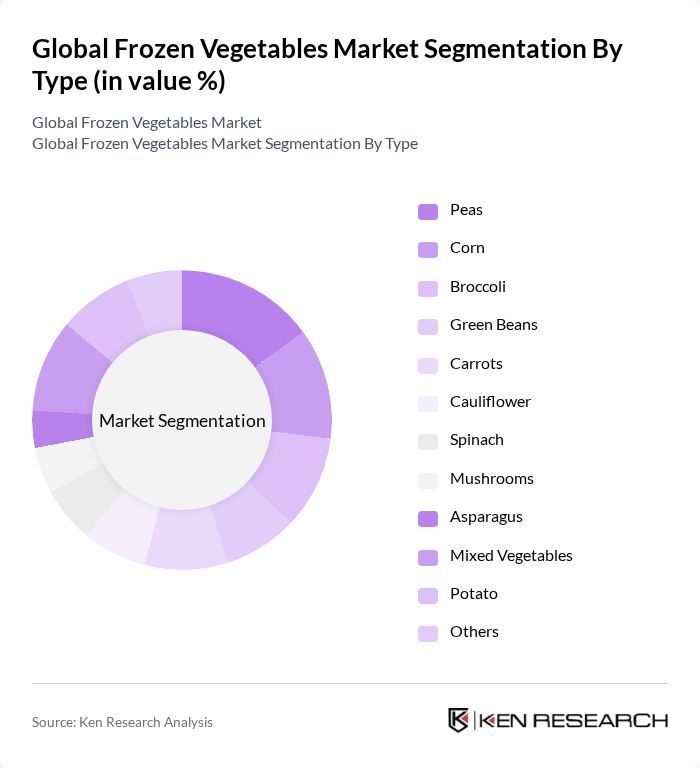

By Type:The frozen vegetables market is segmented into various types, including peas, corn, broccoli, green beans, carrots, cauliflower, spinach, mushrooms, asparagus, mixed vegetables, potato, and others. Each type caters to different consumer preferences and culinary applications, with specific segments gaining popularity based on health trends and convenience. The corn and mixed vegetables segments are particularly prominent, reflecting consumer demand for versatile and easy-to-prepare options .

The segment of mixed vegetables continues to be a key area of growth due to their versatility and convenience. Consumers increasingly prefer mixed vegetable options as they provide a balanced mix of nutrients and save preparation time. The growing trend of meal prepping and the demand for quick-cooking solutions have further propelled the popularity of this segment. Additionally, mixed vegetables are often marketed as a healthy choice, appealing to health-conscious consumers .

By End-User:The market is segmented based on end-users, including household/retail, food service industry, food processing/manufacturers, and institutional buyers. Each segment has unique requirements and purchasing behaviors, influencing the overall market dynamics. The household/retail and food service industry segments are particularly influential, reflecting the widespread adoption of frozen vegetables for both home and commercial food preparation .

The household/retail segment leads the market, driven by the increasing trend of home cooking and the convenience of frozen vegetables. Consumers are opting for frozen options due to their longer shelf life and ease of preparation, making them a staple in many households. The rise in health awareness and the shift towards plant-based diets have also contributed to the growth of this segment .

The Global Frozen Vegetables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Green Giant, Birds Eye, Dole Food Company, McCain Foods, Conagra Brands, Bonduelle, Ardo, Findus, Greenyard, Fresh Frozen Foods, Oerlemans Foods, Vegpro International, The Greenery, Eurogroup, H.J. Heinz Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the frozen vegetables market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for organic and sustainably sourced frozen vegetables is expected to grow. Additionally, innovations in freezing technology will enhance product quality and shelf life, making frozen vegetables an even more attractive option for consumers. Retailers are likely to expand their offerings, particularly in e-commerce, to meet the increasing demand for convenience and variety.

| Segment | Sub-Segments |

|---|---|

| By Type | Peas Corn Broccoli Green Beans Carrots Cauliflower Spinach Mushrooms Asparagus Mixed Vegetables Potato Others |

| By End-User | Household/Retail Food Service Industry Food Processing/Manufacturers Institutional Buyers |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Wholesale Distributors Direct Sales (Farm-to-Consumer, D2C) |

| By Packaging Type | Bags Boxes Bulk Packaging Retail Packs |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Rest of APAC) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (UAE, South Africa, Rest of MEA) |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Whole Vegetables Chopped Vegetables Sliced Vegetables Pureed Vegetables |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Vegetable Sales | 100 | Store Managers, Category Buyers |

| Food Service Industry Insights | 70 | Restaurant Owners, Catering Managers |

| Frozen Vegetable Production Insights | 60 | Farm Owners, Production Managers |

| Consumer Preferences and Trends | 120 | Health-Conscious Consumers, Families |

| Export Market Dynamics | 50 | Export Managers, Trade Analysts |

The Global Frozen Vegetables Market is valued at approximately USD 41 billion, driven by increasing demand for convenient and healthy food options, as well as a growing awareness of the nutritional benefits of frozen vegetables.