Global Fuel Cell Industry Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4979

December 2024

91

About the Report

Global Fuel Cell Industry Outlook 2028

Global Fuel Cell Industry Overview

- The global fuel cell market is valued at USD 3.3 billion, based on a five-year historical analysis. This market is primarily driven by the transition to green energy and increasing investments in hydrogen infrastructure, alongside the rising adoption of fuel cells in transportation and stationary applications. Government subsidies and decarbonization policies are further accelerating market expansion as industries focus on sustainability, positioning fuel cells as a key alternative to traditional fossil fuels.

- Countries like Japan, South Korea, and Germany dominate the fuel cell market, driven by strong governmental support, robust R&D investments, and advanced hydrogen economies. Japan’s leadership in hydrogen infrastructure and South Korea’s focus on green energy production have given them a significant competitive advantage. Additionally, Germany’s investments in renewable energy and hydrogen technology have cemented its position as a key player in Europe.

- Governments are incentivizing the production and use of green hydrogen, which is produced using renewable energy, to support the fuel cell market. In 2023, the U.S. introduced tax credits under the Inflation Reduction Act, offering up to $3 per kilogram of green hydrogen produced, significantly reducing the cost of hydrogen fuel. Additionally, the European Union introduced a €1 billion fund under its Innovation Fund to support large-scale projects that develop and deploy green hydrogen technologies. These incentives are crucial for reducing costs and scaling the production of fuel cells across industries.

Global Fuel Cell Industry Market Segmentation

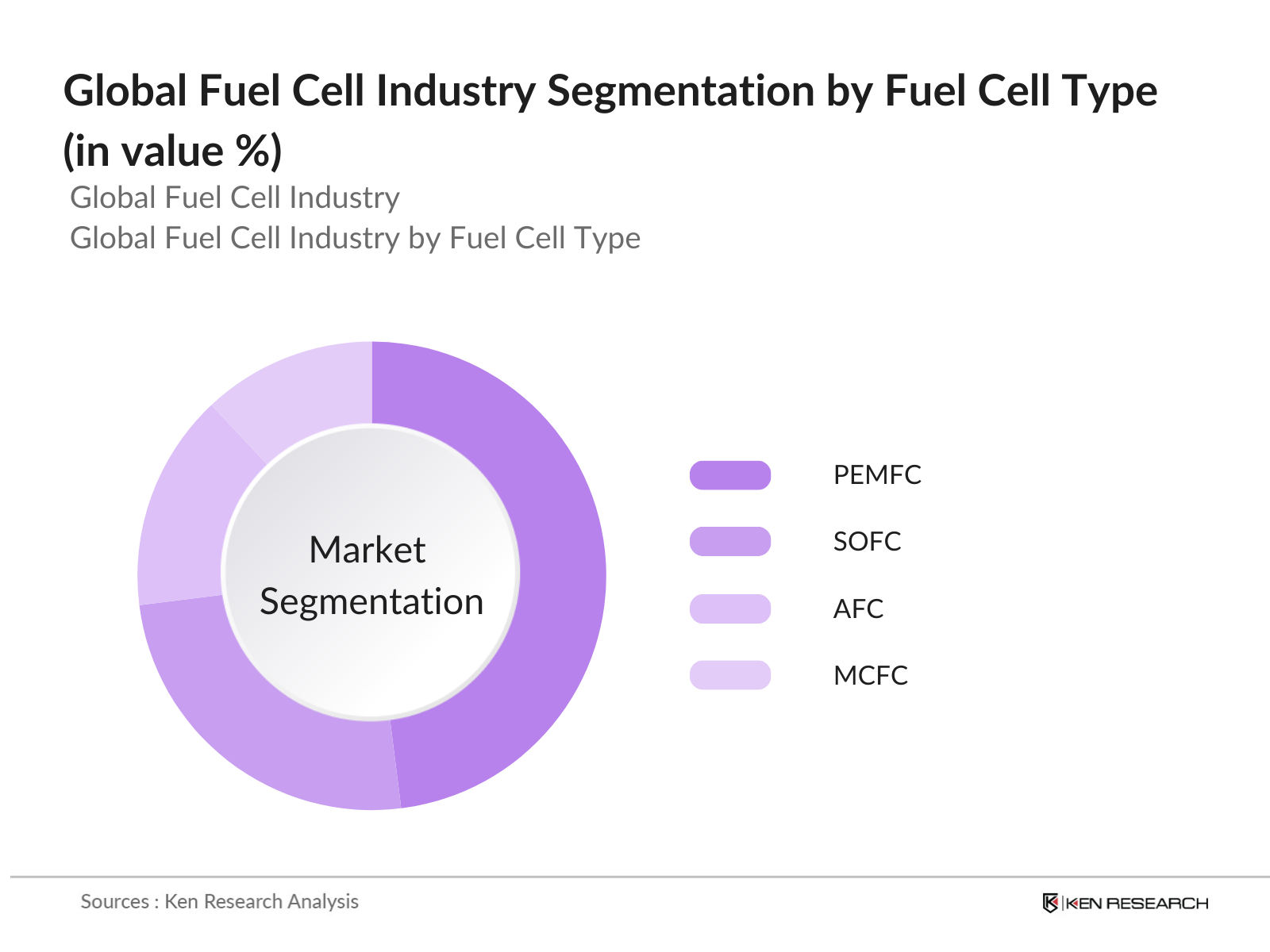

By Fuel Cell: The fuel cell market is segmented into Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Alkaline Fuel Cells (AFC), and Molten Carbonate Fuel Cells (MCFC). PEMFCs have a dominant market share due to their use in automotive applications, especially in the growing hydrogen fuel cell vehicle market. Their efficiency and scalability for portable and stationary power generation contribute significantly to their widespread adoption. In comparison, SOFCs, used predominantly in stationary power, are favored for their high efficiency and fuel flexibility, while AFCs and MCFCs cater to niche industrial applications.

By Region: The fuel cell market is segmented regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the market, led by countries like Japan and South Korea, where government initiatives and extensive R&D funding have accelerated hydrogen infrastructure development. Europe follows closely, with Germany leading the region's push for green energy solutions. North America, driven by the U.S., focuses on transportation applications.

Global Fuel Cell Industry Competitive Landscape:

The global fuel cell industry is concentrated among a few leading players such as Ballard Power Systems, Plug Power, Bloom Energy, and FuelCell Energy, who have strong technological foundations and market presence. The competitive landscape is shaped by continuous R&D investment, strategic partnerships for hydrogen infrastructure, and government subsidies.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Technology Focus |

Major Application |

R&D Expenditure |

Geographical Reach |

Recent Collaborations |

Patent Portfolio |

|

Ballard Power Systems |

1979 |

Burnaby, Canada |

- |

- |

- |

- |

- |

- |

- |

|

Plug Power |

1997 |

Latham, U.S. |

- |

- |

- |

- |

- |

- |

- |

|

Bloom Energy |

2001 |

San Jose, U.S. |

- |

- |

- |

- |

- |

- |

- |

|

FuelCell Energy |

1969 |

Danbury, U.S. |

- |

- |

- |

- |

- |

- |

- |

|

Ceres Power |

2001 |

Horsham, U.K. |

- |

- |

- |

- |

- |

- |

- |

Global Fuel Cell Industry Analysis

Market Growth Drivers

- Transition to Green Energy: The global transition toward green energy is driving the demand for fuel cells, particularly in sectors like transportation, industrial applications, and power generation. According to the International Energy Agency (IEA), global energy investments in clean energy transitions reached $1.4 trillion in 2023, a significant rise from $1.1 trillion in 2021. This shift is particularly noticeable in regions such as Europe and North America, where governments have implemented aggressive carbon reduction targets. The rise in the deployment of fuel cells in industries like logistics and shipping is reflective of this broader trend.

- Favorable Government Policies (Regulations, Subsidies): Governments worldwide are implementing supportive policies to promote the use of fuel cells. In 2023, the U.S. federal government introduced a $369 billion clean energy package under the Inflation Reduction Act, providing incentives for renewable energy technologies, including fuel cells. Similarly, the European Union allocated €5 billion in subsidies to boost hydrogen infrastructure and fuel cell development under the European Green Deal. These policies are encouraging more companies to invest in the fuel cell market, spurring innovation and scaling up production.

- Rising Investments in Hydrogen Infrastructure: Investment in hydrogen infrastructure is on the rise, providing a significant boost to the fuel cell market. According to the World Bank, global investments in hydrogen-related projects were valued at $10 billion in 2022. Japan, one of the leading countries in hydrogen technology, announced a $1.5 billion investment plan to develop hydrogen infrastructure over the next decade, while South Korea invested $400 million in hydrogen-powered transport initiatives in 2023. These investments are paving the way for greater fuel cell adoption in transportation and stationary power applications.

Market Challenges

- High Costs of Fuel Cell Systems: One of the primary challenges facing the fuel cell market is the high cost of production. According to the Hydrogen Council, the cost of hydrogen fuel cells remains between $500 and $600 per kilowatt (kW) in 2023. This cost is significantly higher than traditional energy sources, such as internal combustion engines. Although the cost of fuel cells is expected to decrease with scaling, the current high cost hinders mass adoption, particularly in cost-sensitive sectors like consumer vehicles. This poses a major barrier to growth.

- Limited Hydrogen Refueling Infrastructure: The lack of sufficient hydrogen refueling infrastructure is another major challenge. As of 2023, there were approximately 785 hydrogen refueling stations globally, with the majority located in Japan, Germany, and the United States. However, for widespread fuel cell adoption, thousands of additional stations are required to support growing demand, particularly in regions where hydrogen technologies are still emerging. The high capital cost for developing these stations further exacerbates the infrastructure gap, limiting fuel cell adoption in markets such as passenger transportation.

Global Fuel Cell Industry Future Outlook

Over the next five years, the global fuel cell industry is projected to experience substantial growth, driven by advancements in hydrogen fuel infrastructure, the increasing deployment of fuel cells in automotive applications, and supportive government policies worldwide. As more nations aim to reduce carbon emissions, the demand for efficient, clean energy solutions like fuel cells will continue to rise, especially in transportation and power generation sectors.

Market Opportunities:

- Rising Use of Solid Oxide Fuel Cells (SOFC): Solid oxide fuel cells (SOFC) are becoming more prominent due to their high efficiency and ability to operate with various fuels. A 2023 report from the National Renewable Energy Laboratory (NREL) highlighted the growing use of SOFCs for decentralized power generation in both industrial and residential settings. The versatility of SOFCs, which can run on hydrogen, natural gas, and other alternative fuels, makes them a preferred choice for various energy applications. Their ability to offer reliable, decentralized power positions them as a key technology in the evolving global energy landscape.

- Shift Toward Decentralized Power Generation: The fuel cell market is benefiting from a broader shift toward decentralized power generation, especially in regions with unreliable grid infrastructure. The World Bank reported that decentralized energy solutions, including microgrids powered by fuel cells, were deployed in over 30 developing countries by the end of 2022. This trend is driven by the need for resilient and efficient power systems that can operate independently of traditional power grids, particularly in rural and remote areas. Fuel cells are playing a crucial role in enabling energy access in off-grid locations.

Scope of the Report

|

By Type of Fuel Cell |

Proton Exchange Membrane Fuel Cells (PEMFC) Solid Oxide Fuel Cells (SOFC) Alkaline Fuel Cells (AFC) Molten Carbonate Fuel Cells (MCFC) |

|

By Application |

Automotive (Passenger Vehicles Heavy Vehicles) Stationary (Backup Power Distributed Power Generation) Portable (Consumer Electronics Military Equipment) |

|

By End-User |

Commercial Residential Industrial Transportation |

|

By Fuel Type |

Hydrogen Methanol Biogas Natural Gas |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive Manufacturers

Energy Utilities and Providers

Fuel Cell Manufacturers

Government and Regulatory Bodies (e.g., U.S. Department of Energy, European Commission)

Hydrogen Production and Distribution Companies

Investments and Venture Capitalist Firms

Renewable Energy Developers

Hydrogen Infrastructure Providers

Companies

Players Mention in the Report

Ballard Power Systems

Plug Power

Bloom Energy

FuelCell Energy

Ceres Power

Doosan Fuel Cell

Toshiba Energy Systems

Hyundai Motor Company

Toyota Motor Corporation

Nikola Corporation

General Electric

Horizon Fuel Cell Technologies

ITM Power

AFC Energy

Cummins Inc.

Table of Contents

1. Global Fuel Cell Industry Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Value Chain Analysis

1.4. Market Segmentation Overview

1.5. Key Market Trends

2. Global Fuel Cell Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Fuel Cell Market Analysis

3.1. Growth Drivers

3.1.1. Transition to Green Energy

3.1.2. Increasing Demand for Clean Energy Solutions

3.1.3. Favorable Government Policies (Regulations, Subsidies)

3.1.4. Rising Investments in Hydrogen Infrastructure

3.2. Market Challenges

3.2.1. High Costs of Fuel Cell Systems

3.2.2. Limited Hydrogen Refueling Infrastructure

3.2.3. Complex Manufacturing Processes

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Advancements in Fuel Cell Technologies

3.3.3. Strategic Collaborations for Research & Development

3.4. Market Trends

3.4.1. Growing Adoption in Automotive Sector

3.4.2. Rising Use of Solid Oxide Fuel Cells (SOFC)

3.4.3. Shift Toward Decentralized Power Generation

3.5. Government Regulations

3.5.1. Zero-Emission Vehicle (ZEV) Mandates

3.5.2. Hydrogen Economy Roadmaps (Country-specific)

3.5.3. Green Hydrogen Policies and Incentives

3.5.4. Public-Private Partnerships

3.6. Competitive Landscape

3.6.1. Porters Five Forces

3.6.2. SWOT Analysis

3.6.3. Key Strategic Initiatives

3.6.4. Stake Ecosystem

4. Global Fuel Cell Market Segmentation (Market-Specific Metrics in Value %)

4.1. By Type of Fuel Cell

4.1.1. Proton Exchange Membrane Fuel Cells (PEMFC)

4.1.2. Solid Oxide Fuel Cells (SOFC)

4.1.3. Alkaline Fuel Cells (AFC)

4.1.4. Molten Carbonate Fuel Cells (MCFC)

4.2. By Application

4.2.1. Automotive (Passenger Vehicles, Heavy Vehicles)

4.2.2. Stationary (Backup Power, Distributed Power Generation)

4.2.3. Portable (Consumer Electronics, Military Equipment)

4.3. By End-User

4.3.1. Commercial

4.3.2. Residential

4.3.3. Industrial

4.3.4. Transportation

4.4. By Fuel Type

4.4.1. Hydrogen

4.4.2. Methanol

4.4.3. Biogas

4.4.4. Natural Gas

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Fuel Cell Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Ballard Power Systems

5.1.2. Bloom Energy

5.1.3. Plug Power Inc.

5.1.4. FuelCell Energy

5.1.5. Ceres Power

5.1.6. Doosan Fuel Cell

5.1.7. Toshiba Energy Systems

5.1.8. Hyundai Motor Company

5.1.9. Toyota Motor Corporation

5.1.10. Nikola Corporation

5.1.11. General Electric

5.1.12. Horizon Fuel Cell Technologies

5.1.13. ITM Power

5.1.14. AFC Energy

5.1.15. Cummins Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Fuel Cell Type, Key Application Area, R&D Expenditure, Patent Portfolio, Regional Presence)

5.3. Market Share Analysis

5.4. Mergers & Acquisitions

5.5. Strategic Collaborations and Joint Ventures

5.6. Investment Analysis (Private Equity, Venture Capital)

6. Global Fuel Cell Market Regulatory Framework

6.1. Environmental and Emission Standards

6.2. Certification and Compliance Requirements

6.3. Government Funding Programs and Subsidies

7. Global Fuel Cell Industry Future Market Size (In USD Billion)

7.1. Market Size Projections

7.2. Factors Driving Future Market Growth

7.3. Key Market Disruptions

8. Global Fuel Cell Industry Future Market Segmentation

8.1. By Type of Fuel Cell

8.2. By Application

8.3. By End-User

8.4. By Fuel Type

8.5. By Region

9. Global Fuel Cell Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Expansion Strategies for New Entrants

9.4. Growth Strategies for Existing Players

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by mapping the fuel cell industry ecosystem, encompassing all key stakeholders, from fuel cell manufacturers to end-users in the transportation and stationary power sectors. Extensive secondary research was conducted, leveraging proprietary databases and publicly available industry data to identify crucial variables shaping the market.

Step 2: Market Analysis and Construction

This step involves analyzing historical data from 2018-2023 to evaluate market trends, growth drivers, and the revenue contribution from various segments. Both top-down and bottom-up approaches were used to estimate market size and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Primary research, including interviews with industry experts and company executives, was conducted to validate key assumptions. These consultations provided practical insights into market trends, challenges, and opportunities that informed our projections.

Step 4: Research Synthesis and Final Output

Data from various sources was synthesized to develop a comprehensive market forecast. Detailed insights into product segments, technological innovations, and competitive positioning were incorporated to ensure the accuracy of market estimations.

Frequently Asked Questions

01. How big is the Global Fuel Cell Market?

The global fuel cell market is valued at USD 3.3 billion, driven by the increasing adoption of hydrogen-based energy solutions across various sectors.

02. What are the challenges in the Global Fuel Cell Market?

Challenges include high production costs, limited hydrogen refueling infrastructure, and technical complexities in scaling fuel cell technologies for widespread commercial use.

03. Who are the major players in the Global Fuel Cell Market?

Key players include Ballard Power Systems, Plug Power, Bloom Energy, FuelCell Energy, and Ceres Power. These companies lead the market through technological innovation and strategic partnerships.

04. What are the growth drivers of the Global Fuel Cell Market?

The market is driven by the transition to clean energy, favorable government policies, increased investments in hydrogen infrastructure, and the growing demand for fuel cell electric vehicles (FCEVs).

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.