Global Fused Deposition Modeling (FDM) 3D Printing Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD10202

December 2024

83

About the Report

Global Fused Deposition Modeling (FDM) 3D Printing Market Overview

- The Global Fused Deposition Modeling (FDM) 3D Printing Market is valued at USD 2 billion. This market size is primarily driven by the cost-effective nature of FDM technology, making it accessible to various industries such as automotive, aerospace, and healthcare. The scalability of FDM printers for prototyping and low-volume production significantly contributes to this growth.

- The United States and Germany are at the forefront of the FDM 3D printing market, owing to their advanced manufacturing sectors and strong innovation ecosystems. In the U.S., the dominance is due to the widespread use of FDM in automotive and aerospace sectors. These countries also benefit from a high number of 3D printing startups and established players, creating a competitive landscape that fosters innovation.

- In 2023, the U.S. Food and Drug Administration (FDA) issued updated guidelines for biocompatible materials used in medical device production via FDM printing. These regulations require manufacturers to demonstrate that the materials used are safe for human contact. Similar regulatory frameworks are being implemented in the European Union, where the use of FDM in producing food-safe packaging must comply with EU Regulation 1935/2004 on materials intended to come into contact with food.

Global Fused Deposition Modeling (FDM) 3D Printing Market Segmentation

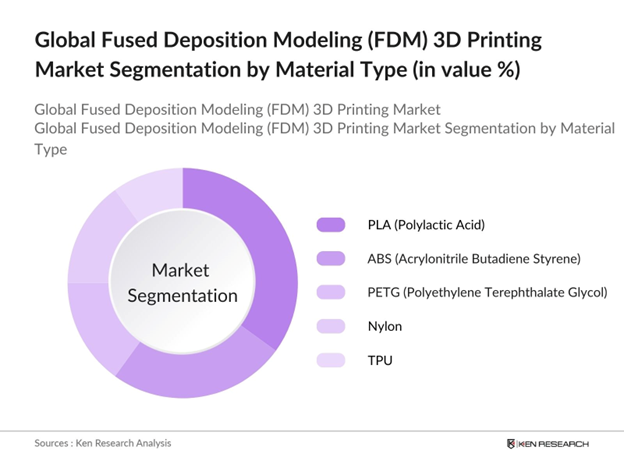

By Material Type The Global FDM 3D Printing Market is segmented by material type into PLA (Polylactic Acid), ABS (Acrylonitrile Butadiene Styrene), PETG (Polyethylene Terephthalate Glycol), Nylon, and TPU (Thermoplastic Polyurethane). PLA currently holds a dominant market share due to its biodegradable properties, making it the most environmentally friendly option for users. Additionally, its ease of use and low printing temperature have made it a popular choice for consumer-level 3D printing. ABS, known for its higher strength and durability, remains prevalent in industrial applications, especially within the automotive and electronics sectors.

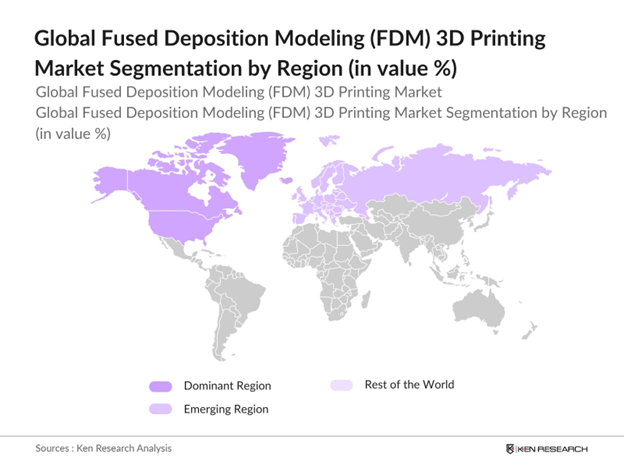

By Region The Global FDM 3D Printing Market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, largely due to the presence of major 3D printer manufacturers, technological advancements, and a well-established user base across industries like automotive, aerospace, and healthcare. The strong governmental support for advanced manufacturing techniques further bolsters this dominance. In contrast, the Asia Pacific region is emerging as a significant market, driven by increased industrialization and the growing demand for 3D printing in consumer electronics and healthcare.

By Application The Global FDM 3D Printing Market is segmented by application into prototyping, tooling, and production parts. Prototyping holds a dominant position as the largest sub-segment due to its widespread adoption in product design and development processes across various industries. Prototyping allows companies to create accurate and functional models, which are crucial in industries like automotive and aerospace, where precision is paramount. The tooling segment also shows substantial growth, especially in manufacturing sectors where FDM is used to create jigs, fixtures, and other essential tools.

Global Fused Deposition Modeling (FDM) 3D Printing Market Competitive Landscape

The FDM 3D printing market is characterized by several key players who dominate through continuous innovation, strategic partnerships, and expanding product portfolios. These players are at the forefront of material development, product enhancements, and software integrations, ensuring they remain competitive in this rapidly evolving market.

The competitive landscape in the FDM 3D printing market features prominent manufacturers such as Stratasys and Ultimaker, who offer a wide range of desktop and industrial printers, making them dominant players. Other companies like Creality and FlashForge excel in cost-efficient, consumer-grade printers, catering to hobbyists and small businesses. Additionally, MakerBots focus on educational 3D printing solutions adds a unique edge to the market, especially in academic institutions.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Products Offered |

Key Technology |

R&D Investment |

Geographical Reach |

Key Partnerships |

Notable Innovations |

|

Stratasys Ltd. |

1989 |

Eden Prairie, USA |

- |

- |

- |

- |

- |

- |

- |

|

Ultimaker BV |

2011 |

Netherlands |

- |

- |

- |

- |

- |

- |

- |

|

MakerBot Industries |

2009 |

New York, USA |

- |

- |

- |

- |

- |

- |

- |

|

Creality 3D |

2014 |

China |

- |

- |

- |

- |

- |

- |

- |

|

FlashForge |

2011 |

China |

- |

- |

- |

- |

- |

- |

- |

Global Fused Deposition Modeling (FDM) 3D Printing Market Analysis

Growth Drivers

- Rising Demand for Prototyping: In 2023, the global prototyping market for aerospace alone saw production volumes exceeding 500,000 3D-printed parts. FDM allows for rapid prototyping at a lower cost, which is critical in reducing product development cycles. For instance, in automotive, companies like Ford have used FDM to reduce prototyping time by up to 90%. This growing reliance on 3D-printed prototypes is reflected in the expansion of industry-specific demand for FDM printers.

- Advancements in Printer Capabilities: FDM 3D printers are becoming faster and more versatile, with new models capable of high-speed printing and working with multiple materials simultaneously. For example, in 2023, advanced FDM systems can print at speeds of up to 600 mm/s, allowing manufacturers to increase production throughput. Additionally, the ability to print using composite materials has expanded applications in industries like automotive and healthcare, where multimaterial printing is essential for producing more complex components.

- Cost Efficiency in Manufacturing: FDMs cost efficiency in producing low-volume, customized products is a major growth driver, especially for industries focused on mass customization. In 2024, FDM is expected to reduce production costs for short-run manufacturing by as much as 40% compared to traditional methods. This is particularly advantageous for sectors such as consumer goods and medical devices, where individualized products like orthotics or custom gadgets can be produced at scale without increasing production costs.

Challenges

- Limited Material Options: FDM 3D printing technology is still limited by the types of materials available for printing. In 2024, the material market is primarily dominated by thermoplastics such as ABS and PLA, but newer high-performance materials are still under development. The aerospace industry, for instance, requires materials with higher thermal resistance and mechanical strength, but these materials are not widely available for FDM printing.

- Intellectual Property Concerns: Intellectual property (IP) concerns remain a significant challenge for the FDM 3D printing market, particularly in industries such as consumer goods and automotive, where design copyrights are critical. In 2023, cases of IP infringement related to 3D-printed products rose by 15%, highlighting the vulnerability of proprietary designs. As companies increasingly adopt FDM for prototyping and manufacturing, the risk of unauthorized replication of designs and parts increases.

Global Fused Deposition Modeling (FDM) 3D Printing Market Future Outlook

Global FDM 3D Printing Market is expected to demonstrate consistent growth, driven by advancements in printer capabilities, material innovation, and the increasing demand for on-demand manufacturing solutions. As industries such as healthcare, aerospace, and automotive embrace additive manufacturing, the FDM market will see accelerated adoption. In addition, environmental sustainability concerns are prompting the development of eco-friendly materials, which is likely to shape the future of the market. Government policies supporting advanced manufacturing will also play a key role in fostering growth.

Market Opportunities

- Expansion in Medical Applications: FDM technology is increasingly being adopted in the medical sector, with applications ranging from surgical models to customized implants. The development of biocompatible materials like PEEK and medical-grade nylon has opened new opportunities for creating patient-specific solutions. The demand for FDM 3D printing in healthcare is growing, particularly in orthopedics, where custom implants can be tailored to fit patients with greater precision than traditional methods. This medical expansion is a key driver for the FDM markets growth.

- Rising Adoption in Aerospace: Aerospace companies are turning to FDM 3D printing for the production of lightweight components with complex geometries. In 2024, it is projected that FDM-printed parts will account for nearly 10% of all 3D-printed components in the aerospace sector. The ability to reduce weight while maintaining structural integrity is critical for fuel efficiency, and FDMs capability to produce intricate designs makes it an ideal technology for this purpose. Boeing and Airbus have already integrated FDM into their manufacturing processes, reducing the cost of production and material waste by significant margins.

Scope of the Report

|

Material Type |

PLA (Polylactic Acid) ABS (Acrylonitrile Butadiene Styrene) PETG (Polyethylene Terephthalate Glycol) Nylon TPU (Thermoplastic Polyurethane) |

|

Application |

Prototyping Tooling Production Parts |

|

End-User Industry |

Automotive Aerospace & Defense Consumer Goods Healthcare Education |

|

Printer Type |

Desktop Printers Industrial Printers |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

3D Printer Manufacturers

Material Suppliers (PLA, ABS, Nylon Manufacturers)

End-User Industries (Automotive, Aerospace, Healthcare)

Investors and Venture Capitalist Firms

Educational Institutions (for R&D in 3D Printing)

Government and Regulatory Bodies (U.S. FDA, European Commission)

3D Printing Software Developers

Industrial Prototyping Companies

Companies

Players Mentioned in the Report

Stratasys Ltd.

Ultimaker BV

MakerBot Industries

Creality 3D

FlashForge

3D Systems Corporation

Zortrax

XYZprinting

Tiertime Technology Co.

Robo3D

Table of Contents

1. Global Fused Deposition Modeling (FDM) 3D Printing Market Overview

1.1. Definition and Scope

1.2. Fused Deposition Modeling (FDM) Technology Landscape

1.3. Market Growth Rate (Key Adoption Factors in 3D Printing Market)

1.4. Market Segmentation Overview (Material, Application, End-User, and Region)

1.5. Industry Stakeholder Overview (Printer Manufacturers, Material Suppliers, Software Developers)

2. Global Fused Deposition Modeling (FDM) 3D Printing Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Growth in Material, Adoption Rate Across Industries)

2.3. Key Market Developments and Milestones (Technological Advancements, Industrial Integration)

3. Global Fused Deposition Modeling (FDM) 3D Printing Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Prototyping (Industry-Specific Demand for FDM)

3.1.2. Advancements in Printer Capabilities (High-Speed Printing, Multimaterial Printing)

3.1.3. Cost Efficiency in Manufacturing (Impact on Mass Customization, Low Batch Production)

3.1.4. Integration with End-to-End Software (Simplification of Design-to-Production Process)

3.2. Market Challenges

3.2.1. Limited Material Options (Material R&D and Availability)

3.2.2. Intellectual Property Concerns (Data Protection and Copyright Issues)

3.2.3. Lack of Standardization in Printer Specifications

3.2.4. Printer Maintenance and Operational Costs (Technical Skill Requirements)

3.3. Opportunities

3.3.1. Expansion in Medical Applications (Biocompatible Materials, Customized Implants)

3.3.2. Rising Adoption in Aerospace (Lightweight Components, Complex Geometries)

3.3.3. Opportunities in the Automotive Sector (Tooling, End-Use Parts Production)

3.3.4. Expanding Consumer Products Market (Personalized Manufacturing)

3.4. Trends

3.4.1. Increasing Adoption of Eco-Friendly Filaments (Recyclable and Biodegradable Materials)

3.4.2. Growth of Distributed Manufacturing (Localized Production Hubs)

3.4.3. Automation in 3D Printing (Integration with Robotics, AI)

3.4.4. Hybrid Manufacturing Techniques (Combination of 3D Printing and Traditional Manufacturing)

3.5. Government Regulations

3.5.1. Material Safety Standards

3.5.2. Intellectual Property Laws

3.5.3. Export Restrictions and Trade Policies (Country-Specific 3D Printing Legislation)

3.5.4. Health and Safety Compliance (For Workplace Integration)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Printer OEMs, Material Suppliers, Service Providers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competitive Rivalry)

3.9. Competition Ecosystem

4. Global Fused Deposition Modeling (FDM) 3D Printing Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. PLA (Polylactic Acid)

4.1.2. ABS (Acrylonitrile Butadiene Styrene)

4.1.3. PETG (Polyethylene Terephthalate Glycol)

4.1.4. Nylon

4.1.5. TPU (Thermoplastic Polyurethane)

4.2. By Application (In Value %)

4.2.1. Prototyping

4.2.2. Tooling

4.2.3. Production Parts

4.3. By End-User Industry (In Value %)

4.3.1. Automotive

4.3.2. Aerospace & Defense

4.3.3. Consumer Goods

4.3.4. Healthcare

4.3.5. Education

4.4. By Printer Type (In Value %)

4.4.1. Desktop Printers

4.4.2. Industrial Printers

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Fused Deposition Modeling (FDM) 3D Printing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Stratasys Ltd.

5.1.2. Ultimaker BV

5.1.3. MakerBot Industries

5.1.4. 3D Systems Corporation

5.1.5. FlashForge

5.1.6. Creality 3D

5.1.7. Zortrax

5.1.8. XYZprinting

5.1.9. Robo3D

5.1.10. Tiertime Technology Co.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Printer Types, Materials Offered, Geographical Presence, R&D Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, Partnerships, New Product Launches)

5.5. Investment Analysis (Funding Rounds, Private Equity, Government Support)

5.6 Venture Capital Funding

5.7. Mergers and Acquisitions

6. Global Fused Deposition Modeling (FDM) 3D Printing Market Regulatory Framework

6.1. 3D Printing Industry Standards (ISO, ASTM)

6.2. Export Control Regulations (Material and Product Export Policies)

6.3. Environmental Regulations (Material Disposal, Filament Production Standards)

6.4. Health and Safety Regulations (Workplace Integration, Printer Safety Compliance)

7. Global Fused Deposition Modeling (FDM) 3D Printing Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Growth in Industrial Applications, Material Innovations)

8. Global Fused Deposition Modeling (FDM) 3D Printing Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Printer Type (In Value %)

8.5. By Region (In Value %)

9. Global Fused Deposition Modeling (FDM) 3D Printing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identified critical variables affecting the Global FDM 3D Printing Market by conducting a comprehensive analysis of stakeholder needs. This involved desk research, proprietary database analysis, and secondary sources to define the primary variables like material innovations, printer adoption rates, and industrial demand.

Step 2: Market Analysis and Construction

We collected historical data on the FDM market to analyze key market trends and segment performance. This included revenue breakdowns by material type, application, and geography. Data validation was carried out by comparing the growth trajectory across different regions and industries.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts, including 3D printer manufacturers and material suppliers, we verified market assumptions. This involved gathering qualitative and quantitative insights directly from stakeholders via CATIs to ensure the accuracy of the market data.

Step 4: Research Synthesis and Final Output

The final research synthesis involved validating and compiling insights obtained from industry consultations, stakeholder feedback, and proprietary data sources. The data was integrated into comprehensive market models to produce an accurate depiction of the FDM 3D printing market.

Frequently Asked Questions

01. How big is the Global FDM 3D Printing Market?

The Global FDM 3D Printing Market was valued at USD 2 billion in 2023, driven by increasing adoption across industries such as automotive, aerospace, and healthcare.

02. What are the challenges in the Global FDM 3D Printing Market?

Challenges in Global FDM 3D Printing Market include limited material options, high operational costs, and the lack of standardization in printer specifications, which can affect mass adoption.

03. Who are the major players in the Global FDM 3D Printing Market?

Key players in Global FDM 3D Printing Market include Stratasys, Ultimaker, MakerBot, Creality, and FlashForge, all of whom are recognized for their innovation in 3D printing technology and materials.

04. What are the growth drivers of the Global FDM 3D Printing Market?

Growth drivers in Global FDM 3D Printing Market include advancements in printer technology, increasing demand for on-demand manufacturing, and the development of sustainable materials for 3D printing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.