Global Game Streaming Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD8912

December 2024

83

About the Report

Global Game Streaming Market Overview

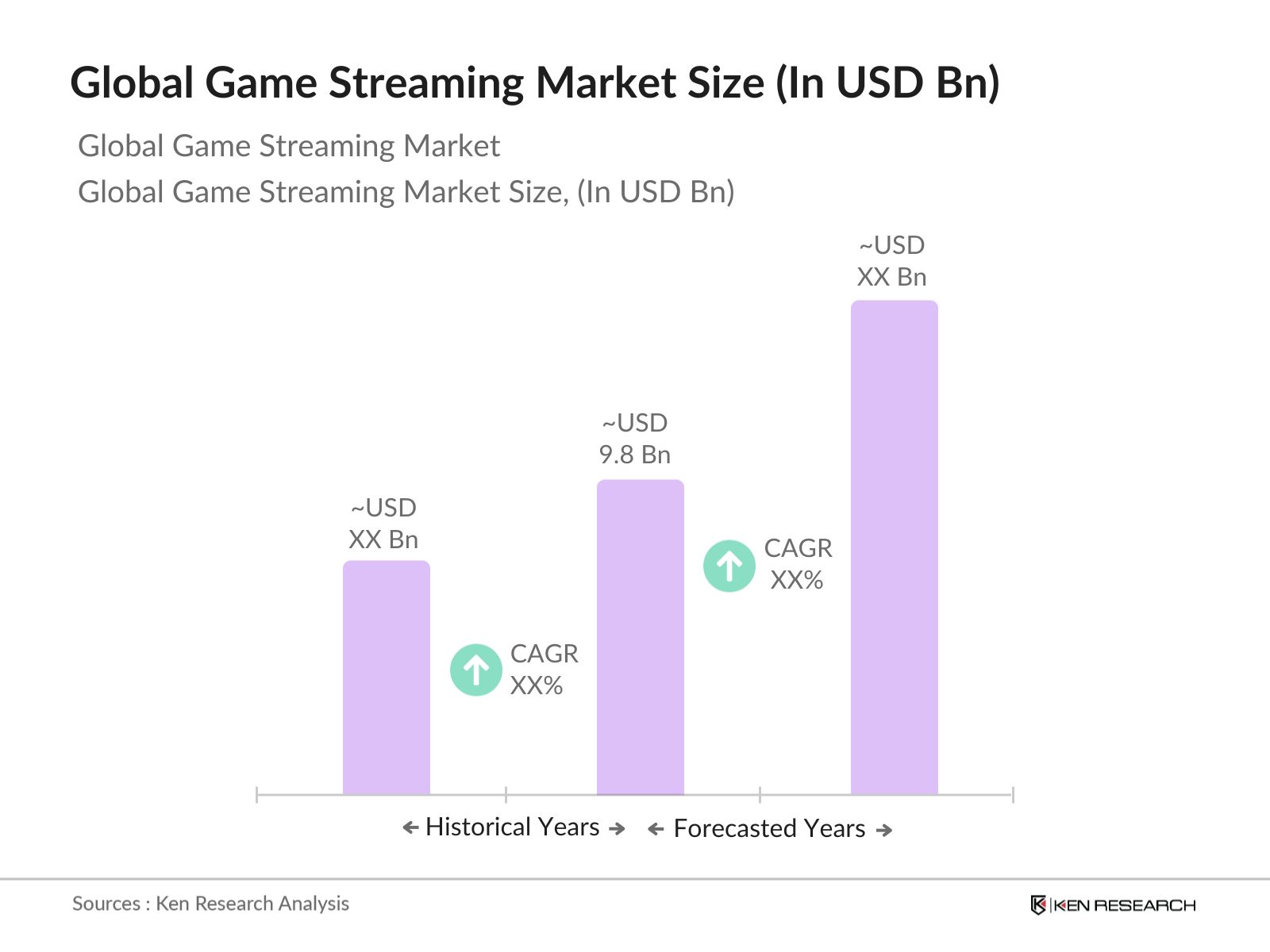

- The Global Game Streaming Market is valued at USD 9.8 billion, based on a comprehensive analysis of recent data. This market has seen consistent growth driven by technological advancements in streaming platforms, cloud computing capabilities, and the widespread adoption of high-speed internet. Increased demand for interactive, on-demand gaming experiences and the growing mobile gaming industry contribute to this expansion, creating a strong foundation for continued market traction.

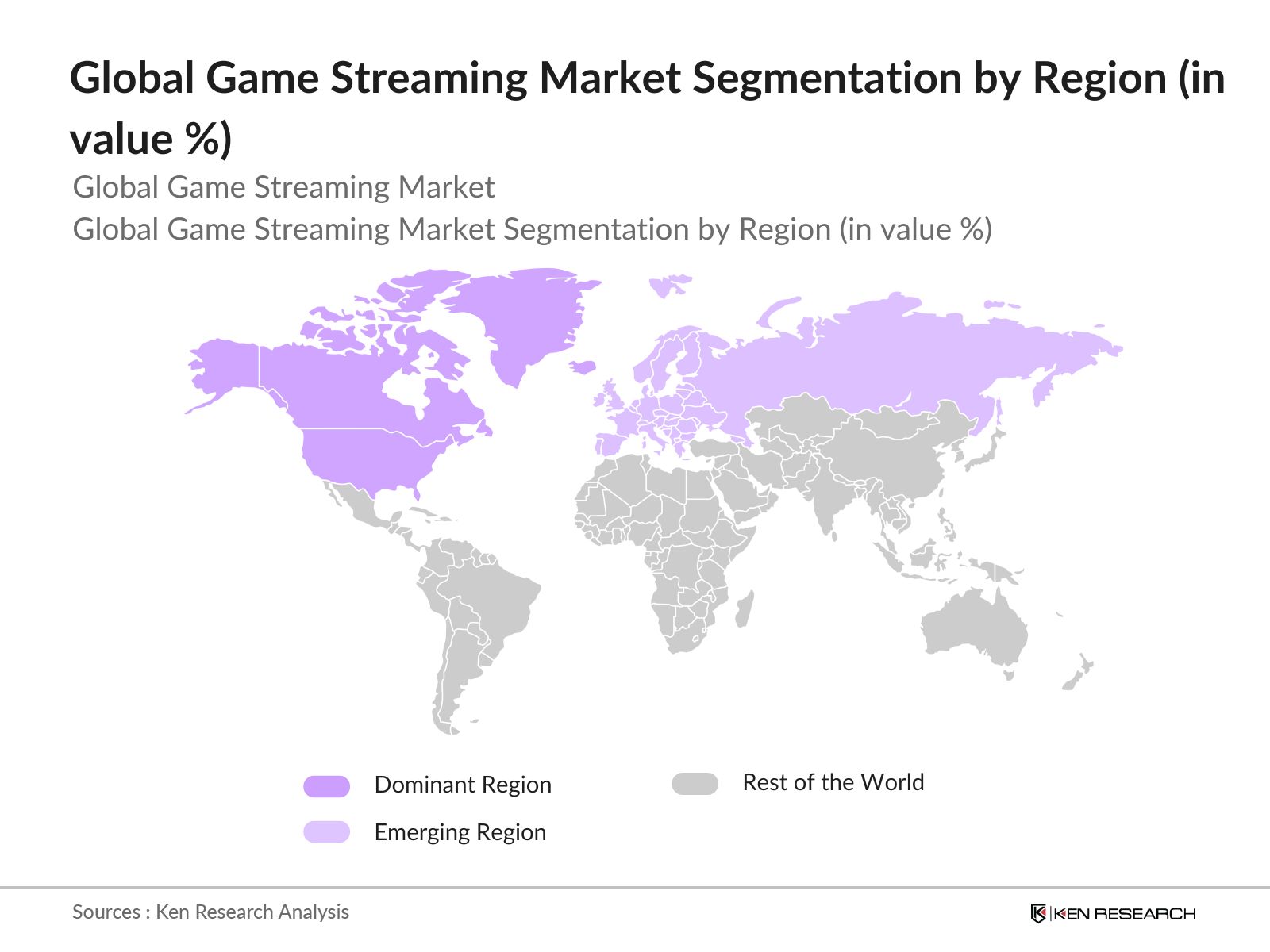

- North America and Asia-Pacific lead the Global Game Streaming Market, with North America benefitting from advanced technological infrastructure and high disposable income among gaming enthusiasts. Asia-Pacifics dominance, particularly in countries like China and South Korea, stems from a tech-savvy population and high internet penetration, combined with regional gaming preferences that drive user engagement and platform adoption.

- Data security laws, particularly in Europe, require stringent compliance measures from game streaming platforms. GDPR compliance, which mandates secure data storage and user consent for data collection, affects nearly 80% of streaming platforms operating in Europe. According to the European Commission, these laws apply to all companies handling user data, creating an operational cost for game streaming providers. In 2024, the global expansion of data privacy laws, including the California Consumer Privacy Act, has led game streaming companies to invest in compliance frameworks, ensuring secure and lawful data handling practices.

Global Game Streaming Market Segmentation

- By Streaming Type: The game streaming market is segmented by type into Video-on-Demand Streaming and Live Game Streaming. Currently, Live Game Streaming holds a dominant share due to the interactive nature that resonates with younger audiences and professional gamers, who seek real-time audience engagement and monetization opportunities. Additionally, platforms like Twitch and YouTube Gaming have popularized live-streaming formats, further solidifying this segment's relevance.

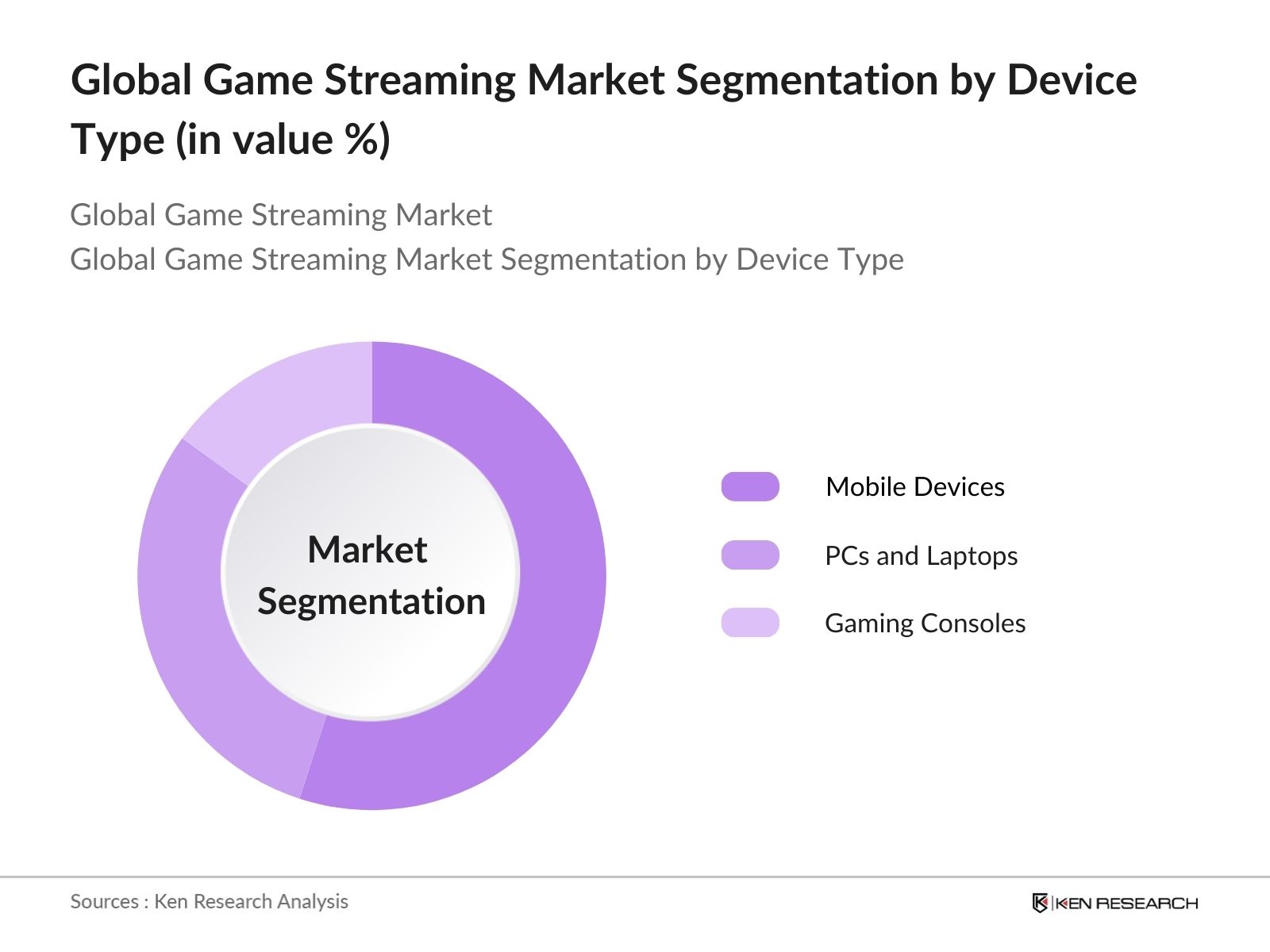

- By Device Type: The market is further segmented by device type into Mobile Devices, PCs and Laptops, and Gaming Consoles. Mobile Devices capture a dominant share due to the proliferation of smartphones and accessibility, making game streaming widely available to casual gamers. The integration of high-performance processors in mobile devices has also enabled users to access streaming services seamlessly, driving this segments growth.

- By Region: The game streaming market spans across regions: North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific dominates due to factors like high mobile penetration, internet connectivity improvements, and cultural trends toward competitive online gaming. Major platforms have invested heavily in the region, capitalizing on a large, engaged audience base.

Global Game Streaming Market Competitive Landscape

The Global Game Streaming Market is influenced by several key players, such as global tech giants and regional streaming companies. Major players leverage platform-specific advantages, innovative user engagement strategies, and diverse content libraries to retain market share and attract new users.

Global Game Streaming Market Analysis

Market Growth Drivers

- Expanding Internet Infrastructure: The global internet infrastructure continues to expand, with speeds in 2024 averaging 100 Mbps in most developed nations, enabling smooth, high-quality game streaming. In the United States alone, fixed broadband subscriptions rose to 120 million, showing a year-over-year increase, according to the International Telecommunication Union (ITU). This infrastructure expansion allows for better data speed and accessibility, essential for game streaming, as approximately 90% of game streaming traffic requires broadband internet connections. Enhanced internet accessibility, particularly in emerging markets, has supported this trend, with internet users globally surpassing 5.5 billion in 2023, aiding the adoption of game streaming across regions.

- Rising Popularity of Cloud Gaming Platforms: Cloud gaming platforms have surged in popularity as they remove the need for expensive hardware. Data from 2023 shows that the adoption of cloud services, specifically in entertainment sectors, grew by 25%, with game streaming platforms representing a notable share. According to the OECD, approximately 3.2 billion gamers worldwide now access cloud-based games, supporting the trend of affordable, accessible gaming. Cloud storage and processing power allow these platforms to handle heavy-duty graphics and intensive game interactions, further boosted by the fact that over 35% of gamers are accessing games through cloud platforms.

- Increase in Smartphone Penetration: The rise in smartphone ownership directly impacts game streaming markets, with smartphone ownership reaching 6.4 billion globally in 2023. The GSMA reports that mobile gaming has become a primary use for these devices, with 55% of smartphone owners accessing gaming apps. Enhanced processing power in modern smartphones now allows for real-time game streaming, providing increased accessibility to users without high-end gaming consoles. Additionally, smartphone internet speed improvements through 4G and 5G enable stable game streaming experiences. Smartphone penetration is a foundational factor that continues to fuel the demand for mobile-based game streaming services.

Market Challenges

- Bandwidth Constraints: Bandwidth constraints remain a primary hurdle for game streaming, especially in regions with lower broadband speeds. Game streaming services require a minimum of 15 Mbps for stable HD quality, while ultra-HD streaming demands 50 Mbps, as cited by the Federal Communications Commission (FCC). However, data shows that only around 60% of global internet connections meet the minimum requirement for HD game streaming, affecting user experience and adoption. Latency issues are prevalent in areas where average internet speeds fall below 10 Mbps, which poses a barrier to the seamless performance game streaming platforms need to function effectively.

- High Infrastructure Costs: The high infrastructure costs associated with maintaining and scaling game streaming servers present another major challenge. Each data center can cost millions to establish, and maintenance expenses can reach up to $10 million annually, according to ITU. Cloud-based game streaming platforms are especially resource-intensive, requiring vast server arrays to support the demand. Furthermore, energy costs associated with these centers have risen, with server farms consuming 200 terawatt-hours globally, accounting for 1% of global electricity usage in 2023. This high operational cost impacts the pricing structure of game streaming services, limiting affordability for end users.

Global Game Streaming Market Future Outlook

The Global Game Streaming Market is anticipated to experience substantial growth, driven by the development of cloud gaming services, advancements in interactive technologies, and the availability of high-speed internet across regions. As more regions gain improved network access and companies continue to innovate within streaming technology, the market is positioned to attract new user bases while solidifying its appeal among existing audiences.

Market Opportunities

- Partnerships with Telecom Providers: Partnerships with telecom providers have emerged as a vital opportunity for game streaming services, allowing for optimized data delivery and improved streaming quality. Collaborations in 2023 saw telecoms integrate game streaming packages into subscription plans, with over 50% of major telecom operators in Asia and Europe offering bundled services. Such partnerships enable lower data costs for consumers and create synergy through network prioritization, boosting the overall user experience. These arrangements have the potential to expand game streaming adoption by leveraging telecom providers infrastructure to deliver optimized connectivity for gamers.

- Rising Adoption of 5G: 5G networks have facilitated substantial improvements in game streaming, offering up to 10 Gbps download speeds and low latency of less than 10 ms. According to GSMA, 5G subscriptions globally surpassed 1 billion in 2024, with over 35% of these subscribers actively engaging in game streaming applications. With 5G enabling seamless gameplay and reducing interruptions, especially for data-heavy games, the technologys reach has proven instrumental for markets aiming to transition users to mobile-based game streaming. The stability and enhanced speeds of 5G directly support high-quality game streaming experiences, creating growth potential in the market.

Scope of the Report

Streaming Type | Video-on-Demand Streaming Live Game Streaming |

Device Type | Mobile Devices PCs and Laptops Gaming Consoles |

Business Model | Subscription-Based Advertising-Based Pay-Per-Game |

End-User | Individual Gamers Professional Gamers and Content Creators |

Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Gaming Device Manufacturers

Investor and Venture Capitalist Firms

Telecom and Network Providers

Government and Regulatory Bodies (FCC, NITA)

Gaming Content Creators and Influencers

Mobile Service Providers

Banks and Financial Institutions

Game Development Companies

Internet Service Providers

Companies

Players Mentioned in the Report

Alphabet Inc. (YouTube Gaming)

Amazon.com Inc. (Twitch)

Microsoft Corporation (Xbox Game Pass)

Sony Interactive Entertainment (PlayStation Now)

Nvidia Corporation (GeForce Now)

Facebook Gaming

Tencent Holdings Ltd. (Trovo)

Apple Inc. (Apple Arcade)

Valve Corporation (Steam Remote Play)

Electronic Arts (EA Play)

Table of Contents

1. Global Game Streaming Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Game Streaming Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Game Streaming Market Analysis

3.1 Growth Drivers

3.1.1 Expanding Internet Infrastructure (Data Speed and Accessibility)

3.1.2 Rising Popularity of Cloud Gaming Platforms (Cloud Storage and Processing)

3.1.3 Increase in Smartphone Penetration (User Reach and Accessibility)

3.1.4 Advancements in Gaming Technology (Real-Time Streaming Capabilities)

3.2 Market Challenges

3.2.1 Bandwidth Constraints (Data Consumption and Latency)

3.2.2 High Infrastructure Costs (Server and Storage Costs)

3.2.3 Content Regulation and Licensing (Intellectual Property and Regional Restrictions)

3.3 Opportunities

3.3.1 Partnerships with Telecom Providers (Network Synergy)

3.3.2 Rising Adoption of 5G (Network Speed and Stability)

3.3.3 Growing Interest in VR Streaming (Enhanced User Engagement)

3.4 Trends

3.4.1 Cross-Platform Integration (Device Compatibility)

3.4.2 Subscription-Based Models (Revenue Model Flexibility)

3.4.3 Interactive Game Features (User Interaction and Retention)

3.5 Government Regulation

3.5.1 Regional Data Security Laws (Data Compliance)

3.5.2 Age-Based Content Regulations (User Safety Protocols)

3.5.3 In-App Purchase and Monetization Regulations (Revenue Control)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape Analysis

4. Global Game Streaming Market Segmentation

4.1 By Streaming Type (In Value %)

4.1.1 Video-on-Demand Streaming

4.1.2 Live Game Streaming

4.2 By Device Type (In Value %)

4.2.1 Mobile Devices

4.2.2 PCs and Laptops

4.2.3 Gaming Consoles

4.3 By Business Model (In Value %)

4.3.1 Subscription-Based

4.3.2 Advertising-Based

4.3.3 Pay-Per-Game

4.4 By End-User (In Value %)

4.4.1 Individual Gamers

4.4.2 Professional Gamers and Content Creators

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Game Streaming Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Alphabet Inc. (YouTube Gaming)

5.1.2 Amazon.com Inc. (Twitch)

5.1.3 Microsoft Corporation (Xbox Game Pass)

5.1.4 Sony Interactive Entertainment (PlayStation Now)

5.1.5 Nvidia Corporation (GeForce Now)

5.1.6 Facebook Gaming

5.1.7 Tencent Holdings Ltd. (Trovo)

5.1.8 Apple Inc. (Apple Arcade)

5.1.9 Valve Corporation (Steam Remote Play)

5.1.10 Electronic Arts (EA Play)

5.1.11 Rakuten Group, Inc. (Rakuten Viki)

5.1.12 Samsung Electronics (Samsung Gaming Hub)

5.1.13 Google Stadia

5.1.14 DLive (TRON Blockchain)

5.1.15 Huya Inc. (Huya Live)

5.2 Cross-Comparison Parameters (Headquarters, Subscriber Count, Monetization Models, Streaming Latency, Regional Presence, Content Partnerships, Platform Compatibility, Subscription Cost)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Game Streaming Market Regulatory Framework

6.1 International Streaming Standards (Data Transfer Protocols)

6.2 Compliance Requirements for Data Privacy (GDPR, CCPA)

6.3 Content Licensing and Distribution Regulations

6.4 Intellectual Property Protection

7. Global Game Streaming Market Analysts Recommendations

7.1 TAM/SAM/SOM Analysis

7.2 Customer Cohort Analysis (Casual vs. Hardcore Gamers)

7.3 Market Entry Strategies

7.4 White Space Opportunity Analysis

8. Global Game Streaming Future Market Segmentation

8.1 By Streaming Type (In Value %)

8.1.1 Video-on-Demand Streaming

8.1.2 Live Game Streaming

8.2 By Device Type (In Value %)

8.2.1 Mobile Devices

8.2.2 PCs and Laptops

8.2.3 Gaming Consoles

8.3 By Business Model (In Value %)

8.3.1 Subscription-Based

8.3.2 Advertising-Based

8.3.3 Pay-Per-Game

8.4 By End-User (In Value %)

8.4.1 Individual Gamers

8.4.2 Professional Gamers and Content Creators

8.5 By Region (In Value %)

8.5.1 North America

8.5.2 Europe

8.5.3 Asia-Pacific

8.5.4 Latin America

8.5.5 Middle East & Africa

9. Global Game Streaming Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Casual vs. Hardcore Gamers)

9.3 Market Entry Strategies

9.4 White Space Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by mapping the core components of the Global Game Streaming Market. Extensive desk research leverages multiple proprietary and public sources, aiming to isolate critical variables influencing this market, such as revenue streams, user behavior patterns, and technology adoption rates.

Step 2: Market Analysis and Construction

Historical data analysis on market growth rates, platform adoption, and regional expansion helps frame the market landscape. Revenue generation from both subscription and advertisement models will be analyzed, providing a clear view of market demand and the proportionate revenue contributions across segments.

Step 3: Hypothesis Validation and Expert Consultation

Following data compilation, hypotheses about key market drivers, challenges, and trends are developed. Validation includes consultations with executives from major game streaming platforms and internet infrastructure providers, ensuring accurate and current insights on market positioning.

Step 4: Research Synthesis and Final Output

In the final stage, interactions with multiple gaming companies provide detailed information on their user demographics, platform strengths, and monetization methods. These insights, coupled with quantitative data, culminate in a validated, data-driven analysis of the Global Game Streaming Market.

Frequently Asked Questions

01. How big is the Global Game Streaming Market?

The Global Game Streaming Market is valued at USD 9.8 billion, primarily driven by innovations in cloud-based gaming and the growing number of mobile gamers worldwide.

02. What are the major challenges in the Global Game Streaming Market?

Key challenges include managing bandwidth demands, the high cost of infrastructure, and compliance with data protection regulations across multiple jurisdictions.

03. Who are the top players in the Global Game Streaming Market?

Major players include Alphabet Inc., Amazon.com Inc., Microsoft Corporation, Sony Interactive Entertainment, and Nvidia Corporation, all of which have strong user bases and advanced streaming technologies.

04. What drives growth in the Global Game Streaming Market?

The market benefits from increasing internet speeds, advancements in device compatibility, and the adoption of cloud technology, which collectively enhance user accessibility and engagement.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.