Global Gaming Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD8686

November 2024

91

About the Report

Global Gaming Market Outlook to 2028

Global Gaming Market Overview

- The global gaming market is valued at USD 205.80 billion, underpinned by a historical analysis highlighting robust growth. This expansion is fueled by the rising demand for mobile gaming, improvements in internet connectivity, and the growing trend of cloud gaming services, supported by enhanced 5G networks. As a dynamic industry, gaming continues to attract consumers with innovations in VR and AR, creating a steady influx of new players while retaining existing ones.

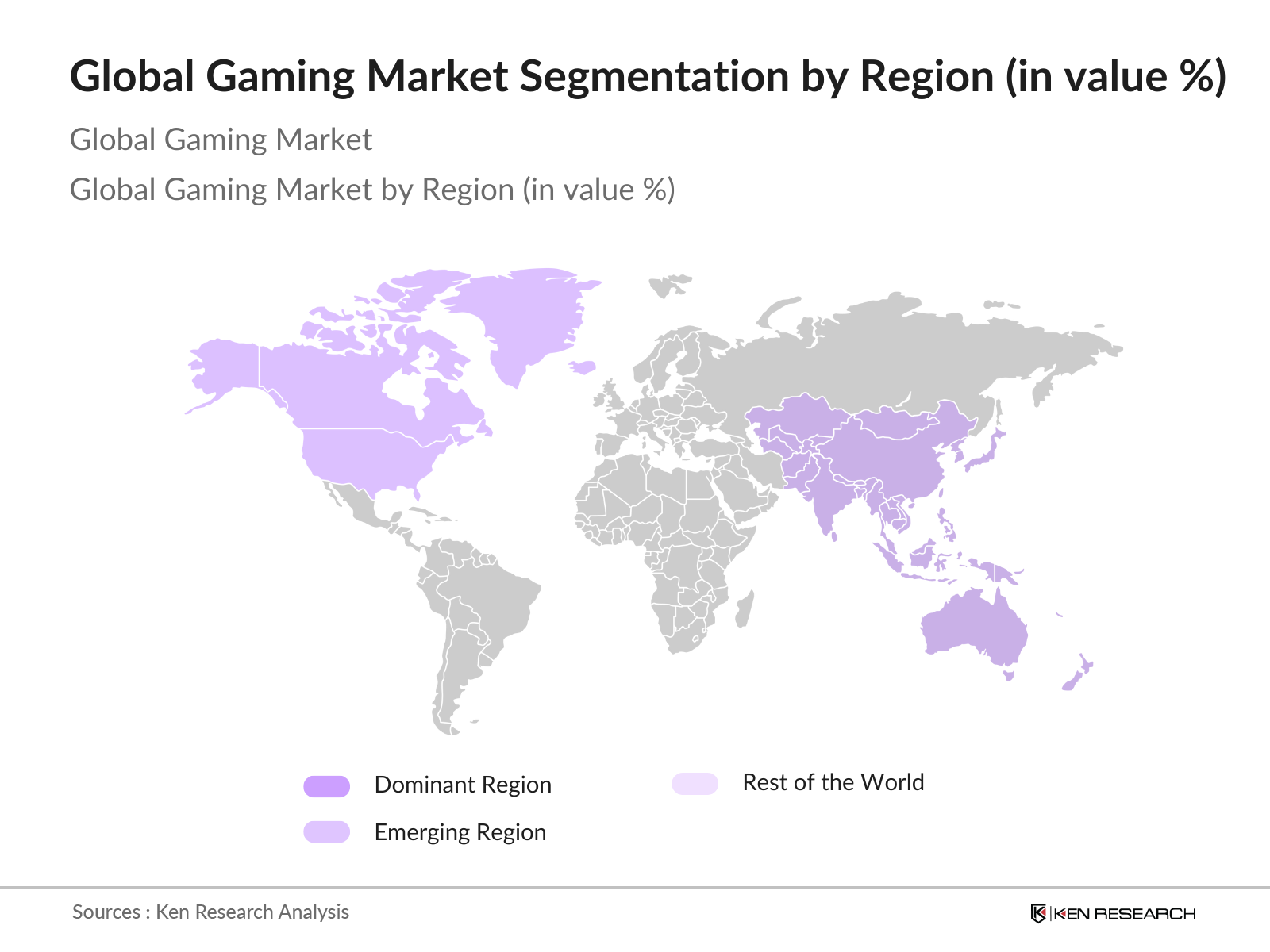

- Key regions dominating the gaming market include North America, Europe, and Asia-Pacific. In North America and Europe, dominance stems from a high degree of technological adoption, strong purchasing power, and a well-established ecosystem of gaming studios and publishers. Asia-Pacific leads due to rapid smartphone penetration and a growing middle class, particularly in China, Japan, and South Korea, who are avid consumers of mobile and online gaming.

- Many countries impose taxes on in-app purchases, impacting gaming revenue. In the U.S., taxation policies add an average of $1.5 billion in annual revenue from in-app purchases, as per U.S. IRS data. Similar taxes are being enforced in European and Asian markets, influencing the revenue potential of game developers and publishers.

Global Gaming Market Segmentation

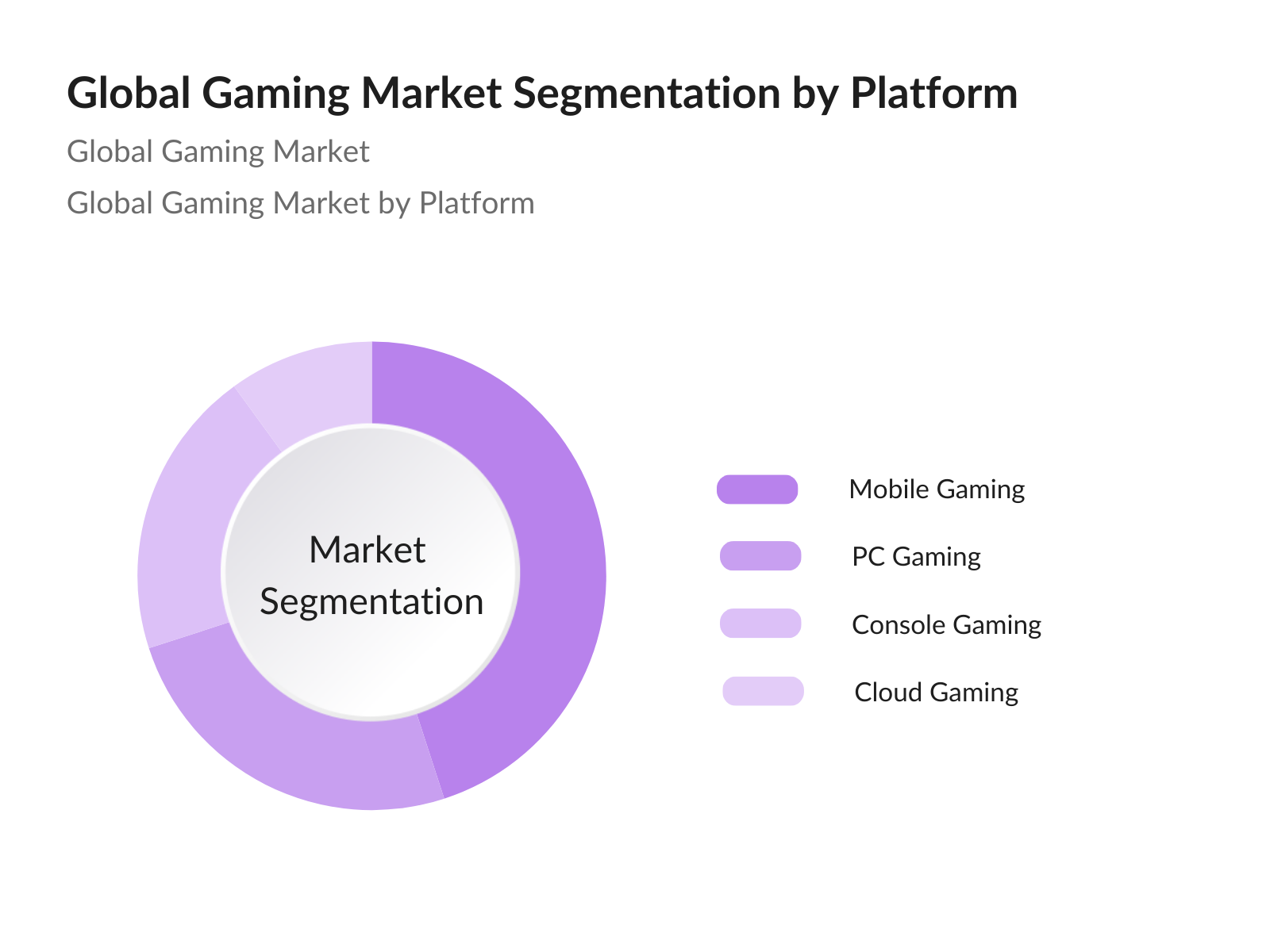

By Platform: The gaming market is segmented by platform into mobile gaming, PC gaming, console gaming, and cloud gaming. Recently, mobile gaming holds the dominant market share within this segmentation, attributed to the global surge in smartphone users, especially in emerging economies. The convenience of mobile gaming, with options for free-to-play models supported by in-app purchases, and accessibility have driven its widespread adoption. Platforms like PUBG Mobile and Genshin Impact further popularize mobile gaming as a staple for gamers globally.

By Region: The gaming market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific dominates in terms of market share due to its massive population base, coupled with increased smartphone penetration and the popularity of online gaming, particularly in China and Japan. The region has also witnessed strong governmental support for tech and gaming industries, aiding in the proliferation of local game development studios and esports platforms.

Global Gaming Market Competitive Landscape

The global gaming market is concentrated among a few key players who maintain strong positions due to their brand power, extensive game portfolios, and innovation. Companies like Tencent, Sony Interactive Entertainment, and Microsoft dominate the industry, leveraging their access to cutting-edge technology and massive customer bases. These companies hold significant influence over the market due to their financial capabilities and continuous R&D investments to enhance gaming experiences.

|

Company |

Established |

Headquarters |

Revenue |

Games Published |

Active Users |

Employees |

R&D Investment |

Market Penetration |

Technology Partnerships |

|

Tencent Games |

1998 |

Shenzhen, China |

|||||||

|

Sony Interactive Entertainment |

1993 |

San Mateo, CA, USA |

|||||||

|

Microsoft Corporation |

1975 |

Redmond, WA, USA |

|||||||

|

Activision Blizzard |

2008 |

Santa Monica, CA, USA |

|||||||

|

Nintendo Co., Ltd. |

1889 |

Kyoto, Japan |

Global Gaming Market Analysis

Market Growth Drivers

- Increased Mobile and Internet Penetration: Global internet penetration is a critical growth driver in the gaming industry, with 5.3 billion internet users worldwide in 2023. The expansion of mobile networks in emerging markets is also contributing, as 4.7 billion people access mobile internet, according to GSMAs Mobile Economy report. In markets like India, the government has invested $17 billion in digital infrastructure to improve internet access and affordability, boosting online gaming adoption. These developments are particularly impactful in regions with limited previous access to gaming platforms.

- Growth in eSports Popularity: The eSports sector has surged, with an estimated 540 million global viewers by 2024, primarily due to significant interest in South Korea, the U.S., and Southeast Asia. National investments, such as the $1 billion South Korean government support fund, are encouraging eSports development. This viewership surge reflects the global gaming communitys interest in competitive gaming and opens advertising opportunities worth billions, supporting market growth.

- Expanding Virtual Reality (VR) and Augmented Reality (AR) Applications: VR and AR technologies are transforming immersive gaming experiences. In the U.S., VR headset sales hit 10 million units in 2023, with China and Japan following closely. Governments in Asia have pledged investments over $500 million for AR and VR technology development to enhance consumer experiences. These advancements create new gaming formats and contribute to the overall growth of the gaming industry.

Market Challenges:

- Regulatory Restrictions in Key Markets: Government regulations restrict gaming content in several markets. In China, gaming time for minors is limited to three hours per week, affecting a significant user base. Other regions, such as Europe, are enforcing GDPR regulations that impact game development and player data storage, with fines reaching $20 million or more for non-compliance. Such restrictions present operational challenges to gaming companies worldwide.

- Concerns Over Gaming Addiction: Studies by WHO indicate gaming addiction concerns among of the global population, especially among youth in South Korea and China, where restrictions have been imposed to limit gaming hours. South Korea has allocated $8 million to address gaming addiction, focusing on educational programs and therapy sessions, while China has a gaming curfew to control usage.

Global Gaming Market Future Outlook

The global gaming market is anticipated to experience steady growth in the coming years, driven by advancements in cloud gaming, VR, and AR technologies. Rising internet connectivity and the adoption of 5G will enhance mobile and cloud gaming experiences, making gaming more accessible and seamless. Meanwhile, the growing interest in esports and content creation within the gaming community continues to drive further consumer engagement and attract new players, creating expanded opportunities for market players.

Market Opportunities:

- Advances in 5G Technology: 5G deployment is creating new opportunities for cloud gaming and mobile gaming experiences. With 5G reaching 1.5 billion users globally, countries like South Korea, Japan, and the U.S. lead with widespread 5G adoption, enabling faster and smoother gaming experiences on mobile platforms. Additionally, governments are funding infrastructure projects, like the $25 billion investment in the U.S., to enhance 5G accessibility.

- Expansion into Emerging Markets: Emerging markets, especially in Africa and South Asia, present untapped growth potential for gaming. Internet access rates have grown by 10% in these regions annually, supported by global initiatives like the World Banks $50 million investment in Africas digital infrastructure. These markets have large populations of young people eager to engage in mobile gaming, opening new revenue streams.

Scope of the Report

|

By Platform |

Mobile Gaming PC Gaming Console Gaming Cloud Gaming |

|

By Genre |

Action/Adventure Simulation Sports RPG Puzzle/Strategy |

|

By Business Model |

Free-to-Play (F2P) Pay-to-Play (P2P) Subscription-Based Hybrid Models |

|

By Age Group |

Teenagers Young Adults Adults |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Game Developers and Publishers

Esports Organizations and Tournaments

Mobile Device Manufacturers

Cloud Gaming Providers

Government and Regulatory Bodies (e.g., FCC, Ofcom)

Investment and Venture Capitalist Firms

Online Gaming Platforms

Content Streaming Platforms

Companies

Players Mention in the Report

Tencent Games

Sony Interactive Entertainment

Microsoft Corporation

Activision Blizzard

Nintendo Co., Ltd.

Valve Corporation

Ubisoft Entertainment

NetEase Games

SEGA Corporation

Bandai Namco Entertainment

Zynga Inc.

Electronic Arts (EA)

Take-Two Interactive

Square Enix Holdings Co., Ltd.

Epic Games

Table of Contents

1. Global Gaming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Revenue Growth, Subscriber Growth)

1.4. Market Segmentation Overview

2. Global Gaming Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Gaming Market Analysis

3.1. Growth Drivers

3.1.1. Increased Mobile and Internet Penetration

3.1.2. Rise in Cloud Gaming Adoption

3.1.3. Growth in eSports Popularity

3.1.4. Expanding Virtual Reality (VR) and Augmented Reality (AR) Applications

3.2. Market Challenges

3.2.1. Regulatory Restrictions in Key Markets

3.2.2. Concerns Over Gaming Addiction

3.2.3. High Hardware Cost

3.3. Opportunities

3.3.1. Advances in 5G Technology

3.3.2. Expansion into Emerging Markets

3.3.3. Growth in Cross-Platform Gaming

3.4. Trends

3.4.1. Blockchain and NFTs in Gaming

3.4.2. Subscription-Based Gaming Services

3.4.3. AI and Machine Learning in Game Development

3.5. Government Regulation

3.5.1. Data Privacy Laws and Compliance

3.5.2. Age and Content Restrictions

3.5.3. Taxation on In-App Purchases

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Gaming Market Segmentation

4.1. By Platform (In Value %)

4.1.1. Mobile Gaming

4.1.2. PC Gaming

4.1.3. Console Gaming

4.1.4. Cloud Gaming

4.2. By Genre (In Value %)

4.2.1. Action/Adventure

4.2.2. Simulation

4.2.3. Sports

4.2.4. Role-Playing Games (RPG)

4.2.5. Puzzle/Strategy

4.3. By Business Model (In Value %)

4.3.1. Free-to-Play (F2P)

4.3.2. Pay-to-Play (P2P)

4.3.3. Subscription-Based

4.3.4. Hybrid Models

4.4. By Age Group (In Value %)

4.4.1. Teenagers

4.4.2. Young Adults

4.4.3. Adults

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Gaming Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tencent Games

5.1.2. Sony Interactive Entertainment

5.1.3. Microsoft Corporation

5.1.4. Activision Blizzard

5.1.5. Electronic Arts (EA)

5.1.6. Take-Two Interactive

5.1.7. Epic Games

5.1.8. Ubisoft Entertainment

5.1.9. Nintendo Co., Ltd.

5.1.10. Valve Corporation

5.1.11. Zynga Inc.

5.1.12. NetEase Games

5.1.13. SEGA Corporation

5.1.14. Square Enix Holdings Co., Ltd.

5.1.15. Bandai Namco Entertainment

5.2. Cross Comparison Parameters (Revenue, Games Published, Active Users, Headquarters, Employees, Market Penetration, R&D Investment, Technology Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Global Gaming Market Regulatory Framework

6.1. Data Protection Regulations

6.2. Monetization and In-App Purchases Policies

6.3. Content Rating Systems

6.4. Compliance Requirements

7. Global Gaming Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Gaming Future Market Segmentation

8.1. By Platform (In Value %)

8.2. By Genre (In Value %)

8.3. By Business Model (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. Global Gaming Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This initial step involves constructing a comprehensive ecosystem map that includes all critical stakeholders within the global gaming market. Through extensive desk research, we analyze data from secondary sources and proprietary databases, identifying variables influencing market performance.

Step 2: Market Analysis and Construction

At this stage, we compile and assess historical market data, considering factors like market penetration, platform usage ratios, and revenue generation. An evaluation of emerging gaming trends is also conducted to support the construction of an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts from diverse segments. Insights gathered via these consultations aid in refining revenue estimates and improving market understanding.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing information from various sources, including direct consultations with gaming companies. This step ensures accurate data verification and provides a detailed, validated analysis of the gaming market landscape.

Frequently Asked Questions

01. How big is the global gaming market?

The global gaming market, valued at USD 205.80 billion, continues to grow, driven by mobile gaming, increasing internet connectivity, and the popularity of VR and cloud gaming.

02. What are the challenges in the global gaming market?

Challenges in the market include regulatory restrictions, high hardware costs, and concerns over gaming addiction. Managing data privacy and implementing age-appropriate content are additional hurdles.

03. Who are the major players in the global gaming market?

Major players in the market include Tencent Games, Sony Interactive Entertainment, Microsoft Corporation, Activision Blizzard, and Nintendo. These companies leverage technological advancements and substantial R&D investments to maintain dominance.

04. What are the growth drivers of the global gaming market?

Key growth drivers include the rise of mobile gaming, improvements in internet connectivity, and the expansion of VR and cloud gaming technologies, which make gaming more accessible and immersive.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.