Global Gaming NFT Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD8369

December 2024

96

About the Report

Global Gaming NFT Market Overview

- The global gaming NFT market reached an estimated valuation of USD 3.76 billion. This growth is driven by a surge in the integration of blockchain technology in the gaming sector, which allows players to own, trade, and monetize unique in-game assets securely. The markets expansion is bolstered by the rising adoption of play-to-earn (P2E) models that offer real-world value, encouraging user engagement and investment. Additionally, the availability of funding from adjacent tech markets enhances the ecosystem for gaming NFTs.

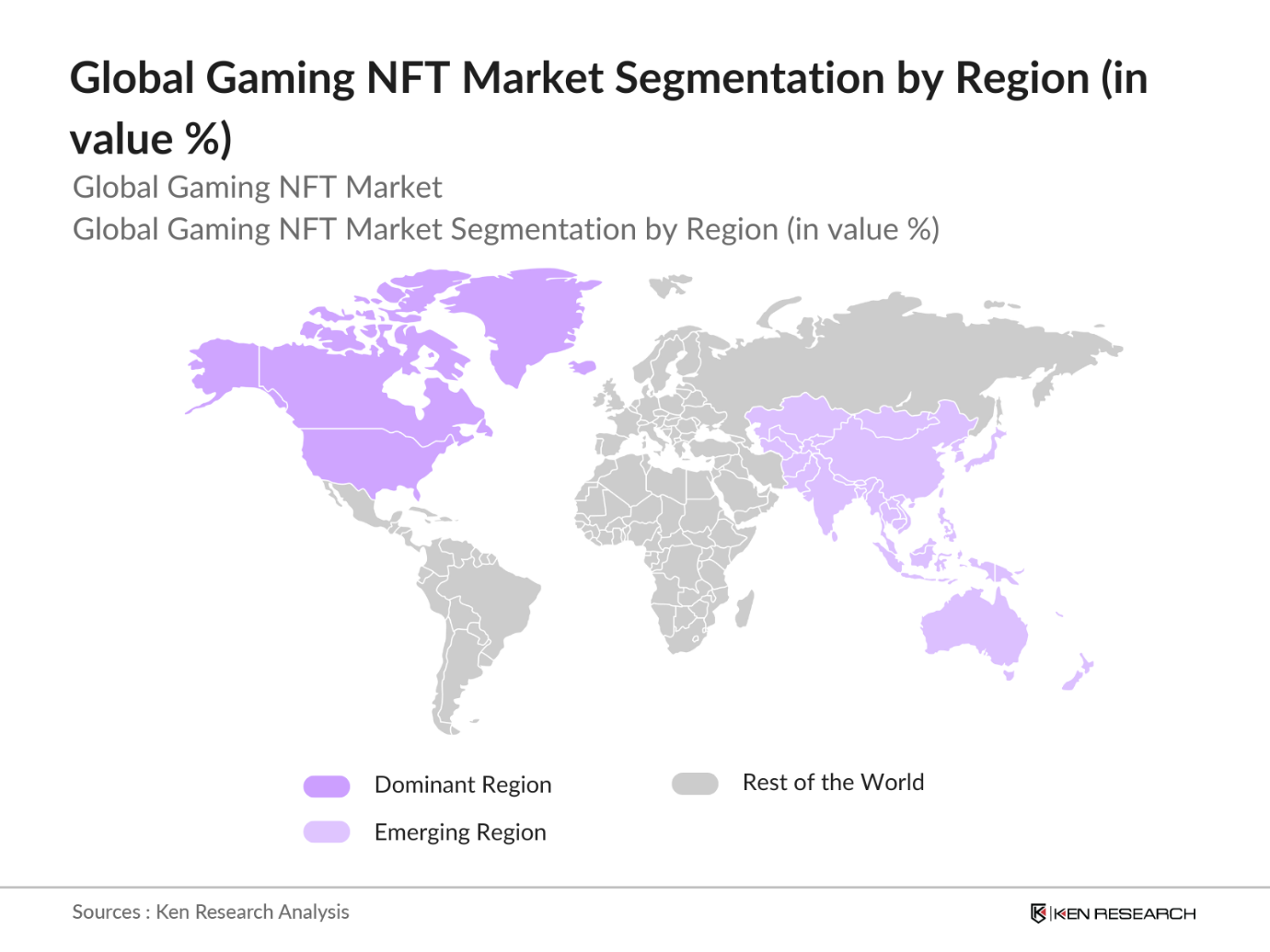

- North America leads the gaming NFT market, largely attributed to its strong tech ecosystem and the prevalence of digital literacy. Countries such as the United States hosts a number of gaming companies and blockchain developers who are at the forefront of NFT innovation. Asia-Pacific, with notable contributions from Japan, South Korea, and China, is also dominant due to the high volume of gamers, mobile gamings popularity, and substantial investments in Web3 technologies by major regional players.

- Different regions have established unique standards for blockchain and NFT compliance. According to the IMF, 22 countries enacted digital asset regulations in 2023 to oversee NFT transactions, enhancing the markets legitimacy. This regulatory structure, while fragmented, aids in establishing minimum security standards, particularly in emerging markets where digital assets are rapidly growing. Compliance standards help create a secure framework, encouraging investment and boosting market stability.

Global Gaming NFT Market Segmentation

- By NFT Type: The market is segmented by NFT type into in-game assets, collectibles, virtual real estate, and cryptocurrency tokens. In-game assets dominate this segment as they provide functional and tradeable digital goods that enhance gameplay and offer monetization opportunities to players. This utility in games like Axie Infinity has driven demand for in-game assets in the gaming NFT market.

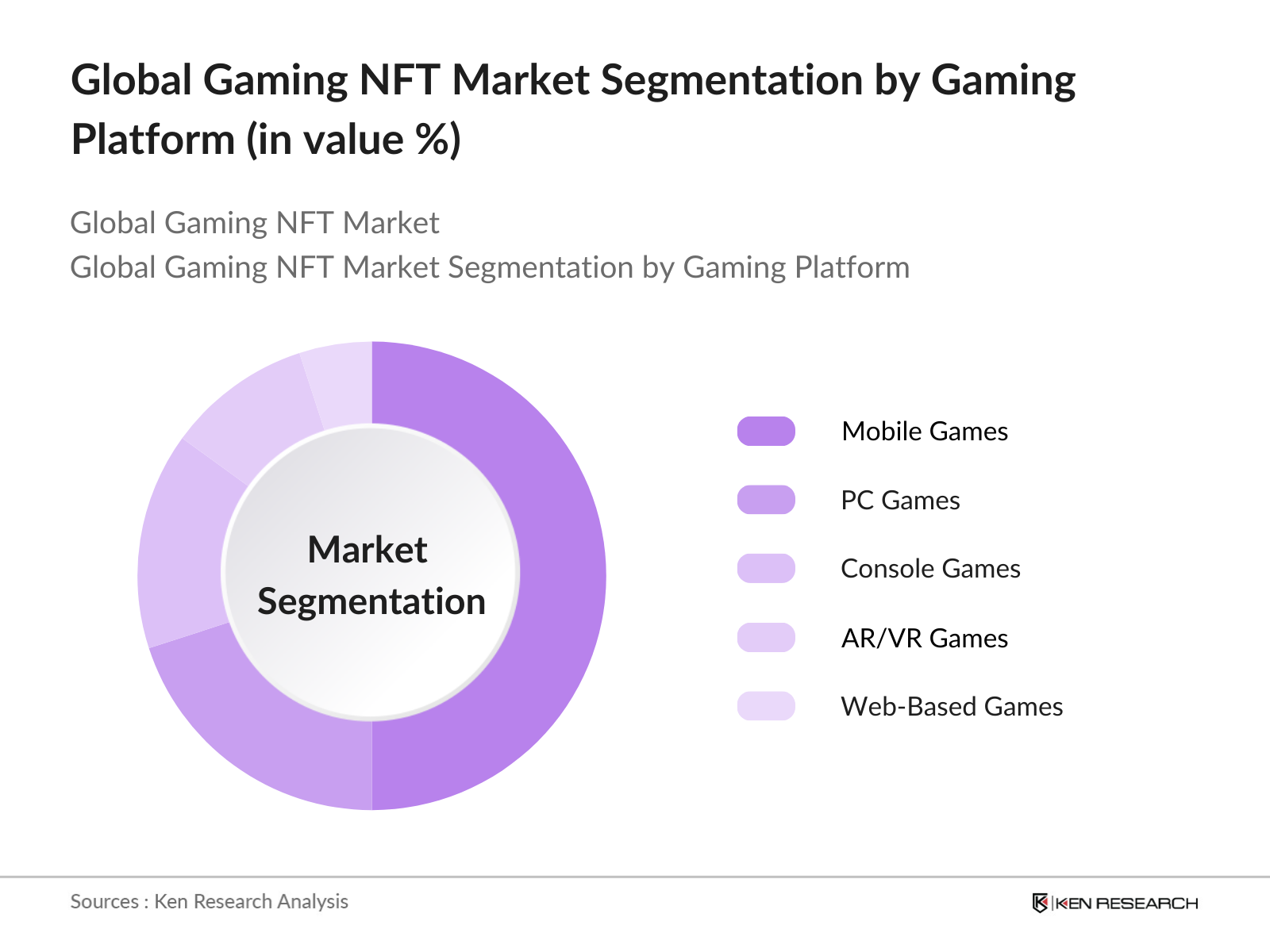

- By Gaming Platform: Segmentation by gaming platform includes PC games, console games, mobile games, AR/VR games, and web-based games. Mobile games hold the largest market share due to their accessibility and increasing popularity in emerging markets where smartphone penetration is high. Additionally, mobile games with integrated P2E features have expanded this segments dominance as players look to capitalize on the convenience of gaming on-the-go.

- By Region: The market is segmented regionally into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America maintains the leading position due to robust technology infrastructure, regulatory support for blockchain, and a strong base of users interested in blockchain applications. Additionally, the presence of key NFT gaming companies in the United States contributes to the regional dominance.

Global Gaming NFT Market Competitive Landscape

The gaming NFT market is dominated by prominent players who continuously innovate through partnerships and advanced gaming technologies. This concentrated market landscape emphasizes the role of well-funded companies with strategic partnerships.

Global Gaming NFT Market Analysis

Global Gaming NFT Market Growth Drivers

- Integration of Blockchain in Gaming: Blockchain integration in gaming is strengthening transparency and digital asset ownership, directly affecting the NFT gaming sector. According to the World Bank's 2024 technology adoption data, blockchain is employed across 30 countries with dedicated digital frameworks supporting blockchain technology, pushing the NFT gaming industry to align with secure and traceable asset frameworks. Blockchains contribution to securing digital assets, including NFTs, supports interoperability, which is crucial for cross-platform asset sharing within the gaming space. Globally, 50% of developed nations have introduced blockchain regulations to safeguard digital ownership.

- Play-to-Earn (P2E) Models: The Play-to-Earn (P2E) model is reshaping gaming by allowing users to generate revenue through gameplay, boosting the global adoption of NFTs. With P2E gaining traction in 25 countries, notably in regions with high digital engagement, this model provides an economic outlet for gamers and incentivizes NFT purchases as tradable assets. IMF reports show that digital financial transactions involving P2E gaming and NFT trades rose by 40% in 2023 across emerging markets, highlighting the model's increasing role in mainstream gaming economies.

- Corporate Engagement and Partnerships: Corporations are increasingly engaging in NFT partnerships, linking blockchain gaming and digital assets. Large gaming corporations formed over 150 NFT partnerships in 2023 alone, with agreements that allow players to leverage NFTs across multiple gaming platforms. These collaborations, supported by a 35% increase in corporate investment in blockchain infrastructure, show the institutional support backing NFT gamings growth. Such engagement bolsters market expansion and validates NFTs as valuable digital assets, enhancing market trust and transaction volumes.

Global Gaming NFT Market Challenges

- Regulatory Uncertainties: Regulatory uncertainties remain a primary challenge, as more than 40% of countries with high blockchain activity lack NFT-specific legal guidelines, creating compliance complexities. Complex regulations, combined with enforcement disparities across jurisdictions, slow market growth and deter investment. The World Bank highlights that the absence of a consistent global regulatory framework has limited NFT transactions by 15% in key markets, posing a constraint to the NFT gaming market.

- Environmental Impact of Blockchain Operations: The environmental cost of blockchain operations, primarily due to energy-intensive processes, remains a concern for NFT gaming. Blockchain networks supporting gaming NFTs contributed to 35 million metric tons of CO in 2023, equating to emissions from 8 million cars annually. The IMFs climate assessment notes that blockchain operations account for 10% of energy consumption in developed nations, pressing the gaming industry to explore more sustainable practices. Environmental concerns could impede growth unless more eco-friendly solutions are adopted.

Global Gaming NFT Market Future Outlook

The global gaming NFT market is poised for substantial growth, fueled by innovations in blockchain, cross-platform integration, and evolving P2E models. The increasing demand for decentralized gaming ecosystems, coupled with the technological advancements in AR/VR, is expected to bring transformative changes. Additionally, ongoing partnerships between Web2 gaming giants and Web3 developers will likely encourage mainstream adoption and increase market depth in the coming years.

Global Gaming NFT Market Opportunities

- Expansion in Augmented Reality (AR) and Virtual Reality (VR) Gaming: The expansion of AR and VR in gaming presents immense opportunities for NFT integration. With 45 million active VR users globally in 2023, NFT adoption in these immersive environments is set to redefine in-game assets. World Bank data shows that VR usage increased by 25% in emerging markets, with NFTs enabling more interactive and customizable experiences. Integrating NFTs into AR/VR gaming can boost user engagement and open new revenue channels.

- Emerging Markets for Digital Collectibles: Emerging markets, especially in Asia and South America, have shown a surge in digital collectible demand, providing a robust base for NFT growth. In 2023, the World Bank reported a 60% rise in digital asset transactions in developing regions, reflecting a favourable landscape for NFTs. The expanding middle class and increased smartphone penetration in these markets present growth avenues for the digital collectibles segment within NFT gaming.

Scope of the Report

NFT Type | In-Game Assets Collectible Cards Virtual Real Estate Cryptocurrency Tokens |

Gaming Platform | PC Games Console Games Mobile Games AR/VR Games Web-Based Games |

Blockchain Type | Ethereum Binance Smart Chain Polygon Flow Blockchain |

Revenue Model | Play-to-Earn Subscription-Based In-Game Purchases Advertising and Sponsorships |

Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Gaming Studios

Blockchain Developers

Investors and Venture Capitalist Firms

Gaming Ecosystem Partners

Banks and financial Instiutions

Government and Regulatory Bodies (e.g., SEC, CFTC)

Digital Asset Management Firms

AR/VR Solution Providers

NFT Marketplaces and Exchanges

Companies

Players Mentioned in the Report

Dapper Labs

Axie Infinity

The Sandbox

Animoca Brands

Illuvium

Sky Mavis

ROKO GAME STUDIOS

Horizon Blockchain Games

CryptoPunks

Gods Unchained

Table of Contents

1. Global Gaming NFT Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Growth Rate and Trajectory

1.4 Market Segmentation Overview

2. Global Gaming NFT Market Size Analysis (in USD Billion)

2.1 Historical Market Size

2.2 Growth Rate Analysis by Region (North America, Asia-Pacific, Europe, Rest of World)

2.3 Key Milestones and Developments

3. Global Gaming NFT Market Dynamics

3.1 Growth Drivers

3.1.1 Integration of Blockchain in Gaming (Blockchain Network)

3.1.2 Play-to-Earn (P2E) Models

3.1.3 Corporate Engagement and Partnerships

3.1.4 Interoperability and Cross-Platform Playability

3.2 Market Challenges

3.2.1 Regulatory Uncertainties (Compliance Complexity)

3.2.2 Environmental Impact of Blockchain Operations

3.2.3 User Education and Awareness on NFTs

3.3 Opportunities

3.3.1 Expansion in Augmented Reality (AR) and Virtual Reality (VR) Gaming

3.3.2 Emerging Markets for Digital Collectibles

3.3.3 Development of NFT Marketplaces (Trading Mechanisms)

3.4 Trends

3.4.1 Integration of High-Profile Entertainment Franchises

3.4.2 Use of Gasless Transactions

3.4.3 Cross-Blockchain Compatibility

3.5 Government Regulations

3.5.1 Regional Compliance Standards

3.5.2 Environmental Standards and Sustainability Initiatives

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7 Industry Ecosystem Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Mapping (Market Concentration)

4. Global Gaming NFT Market Segmentation

4.1 By NFT Type (Percentage Share)

4.1.1 In-Game Assets (Characters, Items, Skins)

4.1.2 Collectible Cards and Digital Merchandise

4.1.3 Virtual Real Estate

4.1.4 Cryptocurrency Tokens

4.2 By Gaming Platform (Percentage Share)

4.2.1 PC Games

4.2.2 Console Games

4.2.3 Mobile Games

4.2.4 AR/VR Games

4.2.5 Web-Based Games

4.3 By Blockchain Type (Percentage Share)

4.3.1 Ethereum

4.3.2 Binance Smart Chain

4.3.3 Polygon

4.3.4 Flow Blockchain

4.4 By Revenue Model (Percentage Share)

4.4.1 Play-to-Earn (P2E)

4.4.2 Subscription-Based

4.4.3 In-Game Purchases

4.4.4 Advertising and Sponsorships

4.5 By Region (Percentage Share)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Gaming NFT Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Axie Infinity

5.1.2 The Sandbox

5.1.3 Gods Unchained

5.1.4 CryptoPunks

5.1.5 Bored Ape Yacht Club

5.1.6 Dapper Labs

5.1.7 Splinterlands

5.1.8 Illuvium

5.1.9 Mythical Inc.

5.1.10 ROKO Game Studios

5.1.11 Wemade Co. Ltd.

5.1.12 Uplandme Inc.

5.1.13 Horizon Blockchain Games

5.1.14 Immutable

5.1.15 Animoca Brands

5.2 Cross Comparison Parameters

5.2.1 Geographic Presence

5.2.2 Revenue by Segment

5.2.3 Active User Base

5.2.4 Blockchain Compatibility

5.2.5 Market Share Percentage

5.2.6 Innovation Index

5.2.7 Strategic Partnerships

5.2.8 Growth Initiatives and M&A

5.3 Market Share Analysis (Key Players)

5.4 Strategic Initiatives (Partnerships, Joint Ventures, and Investments)

5.5 Investment and Funding Analysis

5.6 Government Grants and Private Equity Investments

6. Global Gaming NFT Market Regulatory Framework

6.1 Compliance Standards for Digital Assets

6.2 Environmental Standards and Blockchain Sustainability

6.3 Certification Requirements

7. Global Gaming NFT Market Future Insights

7.1 Projections for Future Market Size

7.2 Key Factors Driving Market Growth

8. Global Gaming NFT Market Future Segmentation

8.1 By NFT Type

8.2 By Gaming Platform

8.3 By Blockchain Type

8.4 By Revenue Model

8.5 By Region

9. Global Gaming NFT Market Analyst Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Monetization Strategies

9.3 White Space Opportunity Analysis

9.4 Customer Cohort Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping all critical stakeholders in the gaming NFT market. Extensive desk research and secondary data sources are used to establish variables influencing the market's ecosystem.

Step 2: Market Analysis and Construction

We assess historical data on NFT sales volumes, blockchain transactions, and NFT wallet activity in the gaming sector. The gathered data also includes user behavior analysis, highlighting revenue trends and market maturity.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through consultations with industry experts and Web3 gaming specialists. These insights refine and verify collected data, ensuring reliable market estimates.

Step 4: Research Synthesis and Final Output

Direct consultations with blockchain developers and NFT platforms enrich the data, enabling precise segmentation and validation. This final phase ensures a comprehensive, verified analysis of the gaming NFT market.

Frequently Asked Questions

01. How big is the Global Gaming NFT Market?

The global gaming NFT market was valued at USD 3.76 billion, driven by the expanding adoption of blockchain technology and play-to-earn gaming models.

02. What are the challenges in the Gaming NFT Market?

Major challenges include regulatory complexities surrounding digital asset ownership and the high environmental impact of blockchain technology.

03. Who are the key players in the Gaming NFT Market?

Key players include Dapper Labs, Axie Infinity, The Sandbox, Animoca Brands, and Illuvium, known for their innovative contributions and strategic partnerships.

04. What drives the growth of the Gaming NFT Market?

Growth is fueled by increasing interest in decentralized gaming, blockchain advancements, and the monetization potential for players through in-game NFTs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.