Global Gamma Linolenic Acid Market Outlook of 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6962

December 2024

99

About the Report

Global Gamma Linolenic Acid (GLA) Market Overview

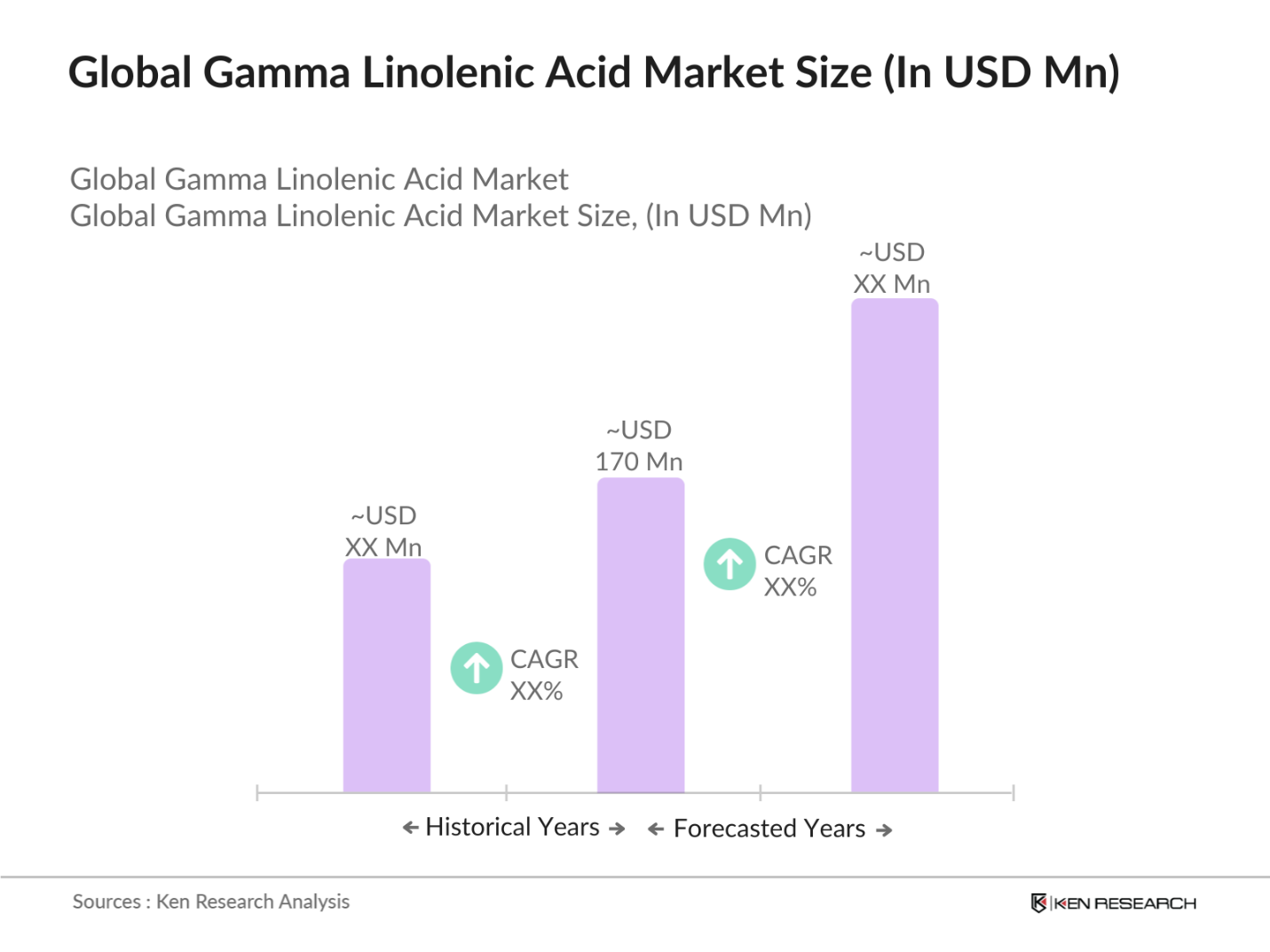

- The global Gamma Linolenic Acid (GLA) market is valued at USD 170 million, driven by the rising demand for dietary supplements, especially those aimed at addressing inflammation, cardiovascular issues, and dermatological conditions. Nutraceutical applications remain a dominant factor in this market, with increasing awareness about GLA's health benefits contributing to its growth. The market's expansion is also fueled by the rising health-conscious consumer base, particularly in developed regions. According to industry reports, the market is further supported by the development of innovative formulations and expanding research into the benefits of GLA across other health-related sectors.

- Key countries dominating the GLA market include the United States, Germany, and China. These countries have a strong presence due to their well-established nutraceutical industries and significant investments in research and development. The U.S. leads the market due to its high demand for dietary supplements and health products, while Germany dominates within the European market owing to strict regulations on product quality and efficacy, driving consumer trust. Chinas dominance is linked to its growing middle class and rising disposable incomes, contributing to increased demand for nutraceuticals and functional foods.

- Globally, manufacturers of GLA-containing products must comply with Good Manufacturing Practices (GMP). The World Health Organization (WHO) has emphasized the importance of GMP compliance, reporting that 85% of dietary supplement manufacturers adhered to GMP standards in 2023. This ensures product safety and quality, providing a level of trust for consumers purchasing GLA-based supplements.

Global Gamma Linolenic Acid (GLA) Market Segmentation

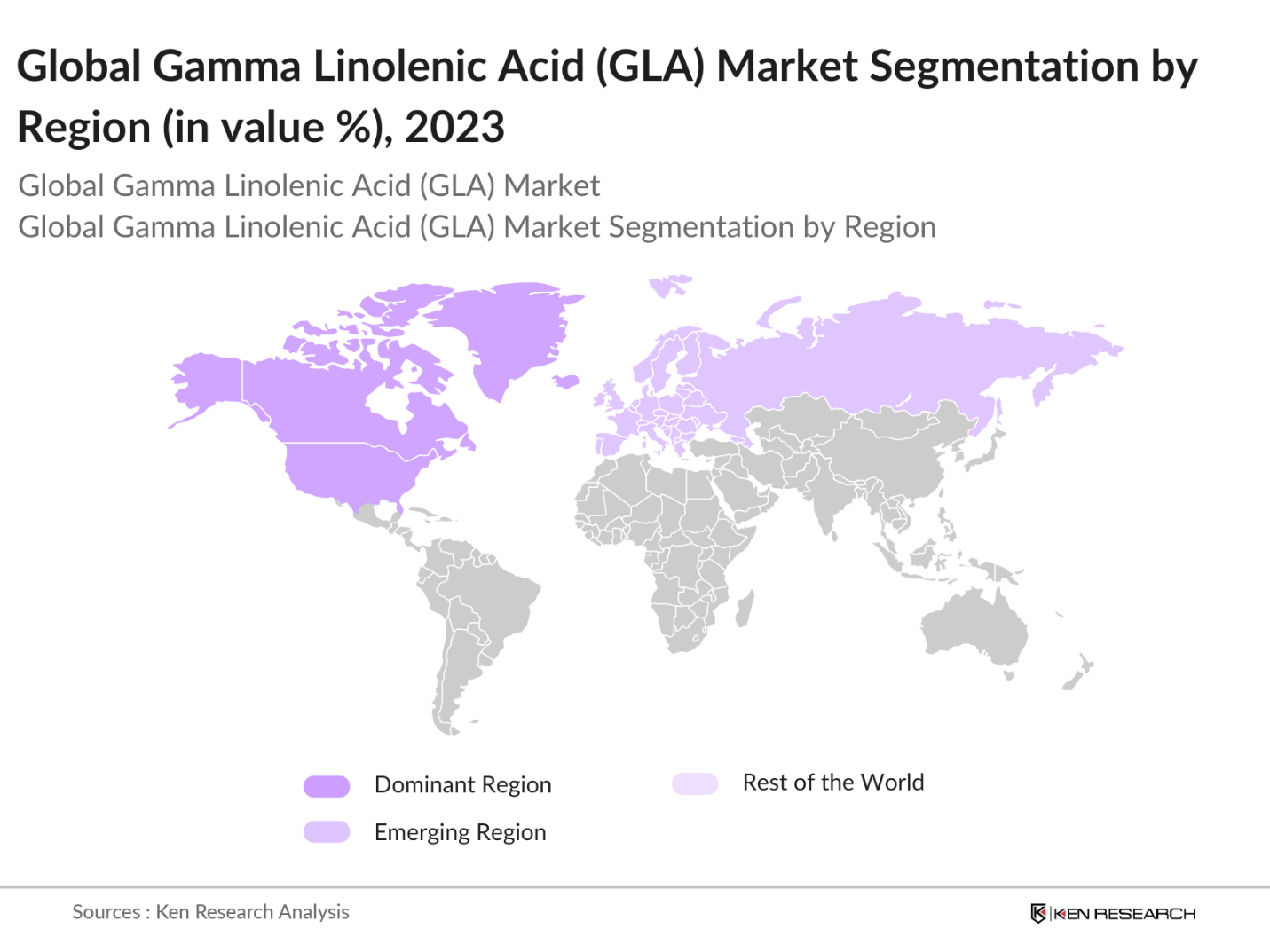

By Region: The GLA market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market due to high demand for dietary supplements and a strong nutraceutical industry, followed closely by Europe, where regulatory frameworks ensure the quality of GLA products. Asia-Pacific is a fast-growing region, with increasing consumer awareness of natural health products driving the demand for GLA.

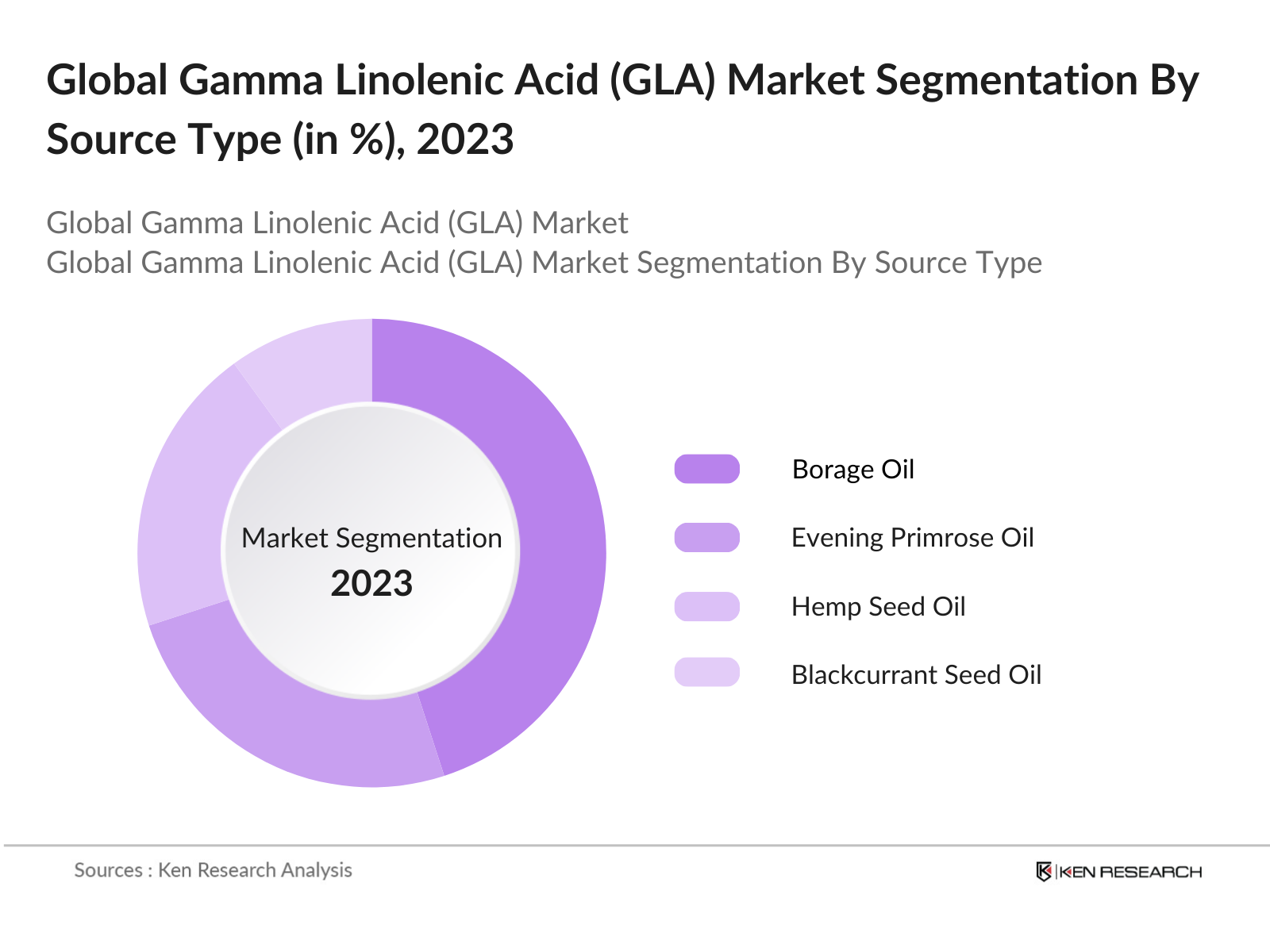

By Source: The global GLA market is segmented by source into borage oil, evening primrose oil, hemp seed oil, and blackcurrant seed oil. Borage oil holds the dominant market share, primarily due to its high GLA content (around 17-25%), making it a preferred source for GLA production. This source's dominance is also linked to its widespread availability and lower cost compared to other sources like evening primrose oil, which is valued for its medicinal properties but has a lower GLA concentration.

Global Gamma Linolenic Acid (GLA) Market Competitive Landscape

The global GLA market is dominated by a few major players, including BASF SE, Cargill Inc., and DSM Nutritional Products, which have established their dominance through strong research and development efforts, vertically integrated supply chains, and a broad product portfolio. These companies are actively engaged in expanding their production capabilities and enhancing their formulations to meet rising consumer demand. The market consolidation around these players reflects their ability to innovate and adapt to regulatory standards across regions, especially in North America and Europe.

|

Company |

Established Year |

Headquarters |

Revenue (USD) |

Product Portfolio |

R&D Expenditure |

Global Presence |

Manufacturing Facilities |

Strategic Partnerships |

Certifications |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Cargill Inc. |

1865 |

Minneapolis, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

DSM Nutritional Products |

1902 |

Heerlen, Netherlands |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Natures Way Products |

1969 |

Green Bay, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Evonik Industries AG |

2007 |

Essen, Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Global Gamma Linolenic Acid (GLA) Industry Analysis

Growth Drivers

- Nutraceutical Industry Growth: The global nutraceutical industry has experienced steady growth, particularly between 2022 and 2024, driven by the rising demand for functional foods and dietary supplements. According to the World Bank, consumer spending on health-related products, including nutraceuticals, reached an estimated USD 4.7 trillion globally in 2023, primarily fueled by increasing disposable income in emerging markets such as India and Brazil. The nutraceutical market has benefited from this surge, with GLA being widely recognized for its anti-inflammatory and health-enhancing properties, making it a sought-after ingredient in nutraceutical formulations.

- Increasing Consumer Awareness for Health and Wellness: In 2024, global health awareness increased significantly, with consumers prioritizing wellness products to prevent lifestyle diseases. The IMF reported that healthcare spending per capita in middle- and high-income countries grew by USD 520 per person in 2023. This shift is driving demand for dietary supplements containing GLA, a compound known to support metabolic health and combat obesity-related issues, prevalent in over 650 million adults globally, according to WHO data.

- Expanding Applications in Cosmetics and Pharmaceuticals: The cosmetic and pharmaceutical industries have embraced GLA for its anti-aging and anti-inflammatory properties. In 2023, global spending on cosmetics reached USD 330 billion, according to the World Bank. GLA, especially sourced from evening primrose oil and borage oil, has been incorporated into skincare products for its role in reducing acne and eczema. Additionally, the global pharmaceutical sector saw a USD 1.3 trillion increase in spending during 2023, spurred by the growing need for inflammation-regulating compounds.

Market Challenges

- High Cost of GLA Production: The production of GLA is resource-intensive, particularly when derived from evening primrose and borage oils. In 2023, the cost of borage oil extraction increased due to inflation in agricultural input prices, with global agricultural commodity prices rising by 15% between 2022 and 2023, as per World Bank estimates.This increase in production costs poses challenges for manufacturers in maintaining profitability while meeting the rising demand for GLA-based products.

- Regulatory Approval Complexities: The global nutraceutical and pharmaceutical markets are subject to stringent regulatory requirements, particularly regarding health claims. For instance, the European Food Safety Authority (EFSA) imposes rigorous guidelines for claims on supplements containing GLA. In 2023, only 12% of applications for health claims were approved by EFSA, reflecting the complexities of regulatory compliance.This regulatory burden adds delays and costs for companies entering the GLA market.

Global Gamma Linolenic Acid (GLA) Future Outlook

Over the next five years, the Gamma Linolenic Acid (GLA) market is expected to witness significant growth driven by the increasing consumer focus on natural health supplements and the rising prevalence of chronic health issues such as cardiovascular diseases and inflammatory disorders. Technological advancements in oil extraction and GLA purification processes are anticipated to further fuel market expansion. Additionally, the increasing penetration of GLA in emerging markets, particularly in Asia-Pacific, will be a key growth driver as consumer awareness and disposable incomes rise in these regions.

Opportunities

- Product Innovations and Expansions: The GLA market is seeing innovations, particularly in product formulations. Manufacturers are focusing on developing more bioavailable GLA supplements. In 2023, R&D spending on nutraceuticals saw a rise to USD 1.4 billion globally. The market is also witnessing geographic expansions, with GLA-based products entering previously untapped markets in Southeast Asia, where health-conscious consumer spending grew by USD 40 billion in 2023 alone.

- Increased Research & Development in Alternative Plant Sources: In response to limited raw material availability, research into alternative GLA-rich plants has gained traction. In 2023, global spending on agricultural biotechnology research reached USD 9.5 billion, supported by government initiatives. This investment is accelerating the discovery of new plant sources with higher GLA content, such as blackcurrant and spirulina, which can serve as cost-effective alternatives for manufacturers in the nutraceutical sector.

Scope of the Report

|

Source |

Borage Oil Evening Primrose Oil Hemp Seed Oil Blackcurrant Seed Oil |

|

Application |

Pharmaceuticals Cosmetics Dietary Supplements Food & Beverages Others (Pet Food, Animal Nutrition) |

|

End-User |

Retail Consumers Industrial Users Healthcare Providers |

|

Distribution Channel |

Online Stores Pharmacies Supermarkets/Hypermarkets Specialty Stores |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Nutraceutical Companies

Dietary Supplement Companies

Pharmaceutical Companies

Functional Food and Beverage Industries

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EFSA)

Cosmetic and Skincare Companies

Health and Wellness Retail Chains

Companies

Players Mentioned in the Report:

BASF SE

Cargill Inc.

DSM Nutritional Products

Natures Way Products, LLC

Evonik Industries AG

Blackmores Limited

Puritans Pride, Inc.

Omega Protein Corporation

Avestia Pharma

Bioriginal Food & Science Corporation

Koninklijke DSM N.V.

Arkopharma

Omegatri AS

Herbalife International of America, Inc.

Gencor Pacific Ltd

Table of Contents

1. Global Gamma Linolenic Acid (GLA) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Gamma Linolenic Acid (GLA) Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Gamma Linolenic Acid (GLA) Market Analysis

3.1. Growth Drivers

3.1.1. Nutraceutical Industry Growth

3.1.2. Increasing Consumer Awareness for Health and Wellness

3.1.3. Expanding Applications in Cosmetics and Pharmaceuticals

3.1.4. Rising Prevalence of Chronic Diseases

3.2. Market Challenges

3.2.1. High Cost of GLA Production

3.2.2. Regulatory Approval Complexities

3.2.3. Limited Availability of Raw Materials (Borage Oil, Evening Primrose Oil, Hemp Oil)

3.3. Opportunities

3.3.1. Product Innovations and Expansions

3.3.2. Increased Research & Development in Alternative Plant Sources

3.3.3. Penetration into Untapped Emerging Markets

3.4. Trends

3.4.1. Shift Toward Sustainable and Organic Products

3.4.2. Growing Popularity of Functional Foods

3.4.3. Increasing Utilization of GLA in Dietary Supplements

3.5. Government Regulation

3.5.1. Nutritional Health Claims Regulations

3.5.2. Food and Drug Administration Guidelines (FDA)

3.5.3. European Food Safety Authority (EFSA) Regulations

3.5.4. Global Good Manufacturing Practices (GMP) Compliance

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Gamma Linolenic Acid (GLA) Market Segmentation

4.1. By Source (In Value %)

4.1.1. Borage Oil

4.1.2. Evening Primrose Oil

4.1.3. Hemp Seed Oil

4.1.4. Blackcurrant Seed Oil

4.2. By Application (In Value %)

4.2.1. Pharmaceuticals

4.2.2. Cosmetics

4.2.3. Dietary Supplements

4.2.4. Food & Beverages

4.2.5. Others (Pet Food, Animal Nutrition)

4.3. By End-User (In Value %)

4.3.1. Retail Consumers

4.3.2. Industrial Users

4.3.3. Healthcare Providers

4.4. By Distribution Channel (In Value %)

4.4.1. Online Stores

4.4.2. Pharmacies

4.4.3. Supermarkets/Hypermarkets

4.4.4. Specialty Stores

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Gamma Linolenic Acid (GLA) Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Cargill Inc.

5.1.3. Avestia Pharma

5.1.4. Natures Way Products, LLC

5.1.5. Blackmores Limited

5.1.6. Evonik Industries AG

5.1.7. Puritans Pride, Inc.

5.1.8. Efamol Limited

5.1.9. Koninklijke DSM N.V.

5.1.10. Omega Protein Corporation

5.1.11. Gencor Pacific Ltd

5.1.12. Bioriginal Food & Science Corporation

5.1.13. Omegatri AS

5.1.14. Arkopharma

5.1.15. Herbalife International of America, Inc.

5.2. Cross Comparison Parameters (Revenue, Inception Year, Headquarters, Product Portfolio, Employee Count, Research & Development Spend, Manufacturing Facilities, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Global Gamma Linolenic Acid (GLA) Market Regulatory Framework

6.1. Nutraceutical Regulations

6.2. Pharmaceutical Regulations

6.3. Food Safety Standards

6.4. Certification Processes

7. Global Gamma Linolenic Acid (GLA) Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Gamma Linolenic Acid (GLA) Future Market Segmentation

8.1. By Source

8.2. By Application

8.3. By End-User

8.4. By Distribution Channel

8.5. By Region

9. Global Gamma Linolenic Acid (GLA) Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map of the Gamma Linolenic Acid (GLA) market was constructed, identifying major stakeholders such as nutraceutical companies, pharmaceutical manufacturers, and raw material suppliers. The process involved extensive desk research, utilizing secondary data sources to define the key variables influencing the market, including consumer demand, raw material supply, and regulatory impacts.

Step 2: Market Analysis and Construction

Historical data from the past five years was compiled, focusing on market penetration, production volumes, and revenue generation. This data provided a foundation for constructing reliable market models that reflect current market conditions and future trends in the GLA sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the impact of technological advancements and consumer health awareness were validated through interviews with industry experts, including nutraceutical company executives and GLA researchers. These consultations provided critical insights that refined the analysis.

Step 4: Research Synthesis and Final Output

The final research synthesis was conducted through direct engagement with GLA producers to verify market trends, product segmentations, and consumer behavior. This engagement ensured the data's accuracy and the comprehensive understanding of market dynamics necessary for this report.

Frequently Asked Questions

01. How big is the Global Gamma Linolenic Acid (GLA) Market?

The global Gamma Linolenic Acid market is valued at USD 170 million, driven by the rising demand for natural health supplements and nutraceutical products.

02. What are the challenges in the Global Gamma Linolenic Acid (GLA) Market?

Challenges in the GLA market include high production costs, complex regulatory requirements, and the limited availability of GLA-rich plant sources like borage and evening primrose.

03. Who are the major players in the Global Gamma Linolenic Acid (GLA) Market?

Key players include BASF SE, Cargill Inc., DSM Nutritional Products, and Evonik Industries AG, all of which have established dominance through innovation, R&D investments, and global distribution networks.

04. What drives the Global Gamma Linolenic Acid (GLA) Market?

The market is primarily driven by the increasing awareness of GLAs health benefits, particularly its role in reducing inflammation, improving skin health, and supporting cardiovascular health.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.