Global Gene Therapy Market Outlook to 2030

Region:Global

Author(s):Navya Dalakoti

Product Code:KENGR042

October 2024

83

About the Report

Global Gene Therapy Market Overview

- In 2023, the Global Gene Therapy Market was valued at USD 6250 Mn driven by regulatory support and expedited approval processes, increasing investment and funding, expansion of market access and reimbursement, emerging markets and untapped opportunities, and integration with precision medicine approaches.

- The global renewable energy market is highly consolidated with major players, including Kite Pharma, a Gilead Company, Novartis AG, Bristol-Myers Squibb, Johnson & Johnson, Sarapeta Therapeutics, and Krystal Biotech. Kite Pharma and a Gilead Company holds more than half of the market share owing to its pioneering CAR-T cell therapies and strong financial backing from Gilead Sciences, enabling extensive R&D and rapid commercialisation.

- Novartis has entered into a strategic collaboration and capsid license agreement with Voyager Therapeutics to advance the development of gene therapies targeting Huntingtons disease and spinal muscular atrophy (SMA). As part of this partnership, Voyager will receive an upfront payment of USD 100 million from Novartis, along with an additional USD 20 million in equity investment.

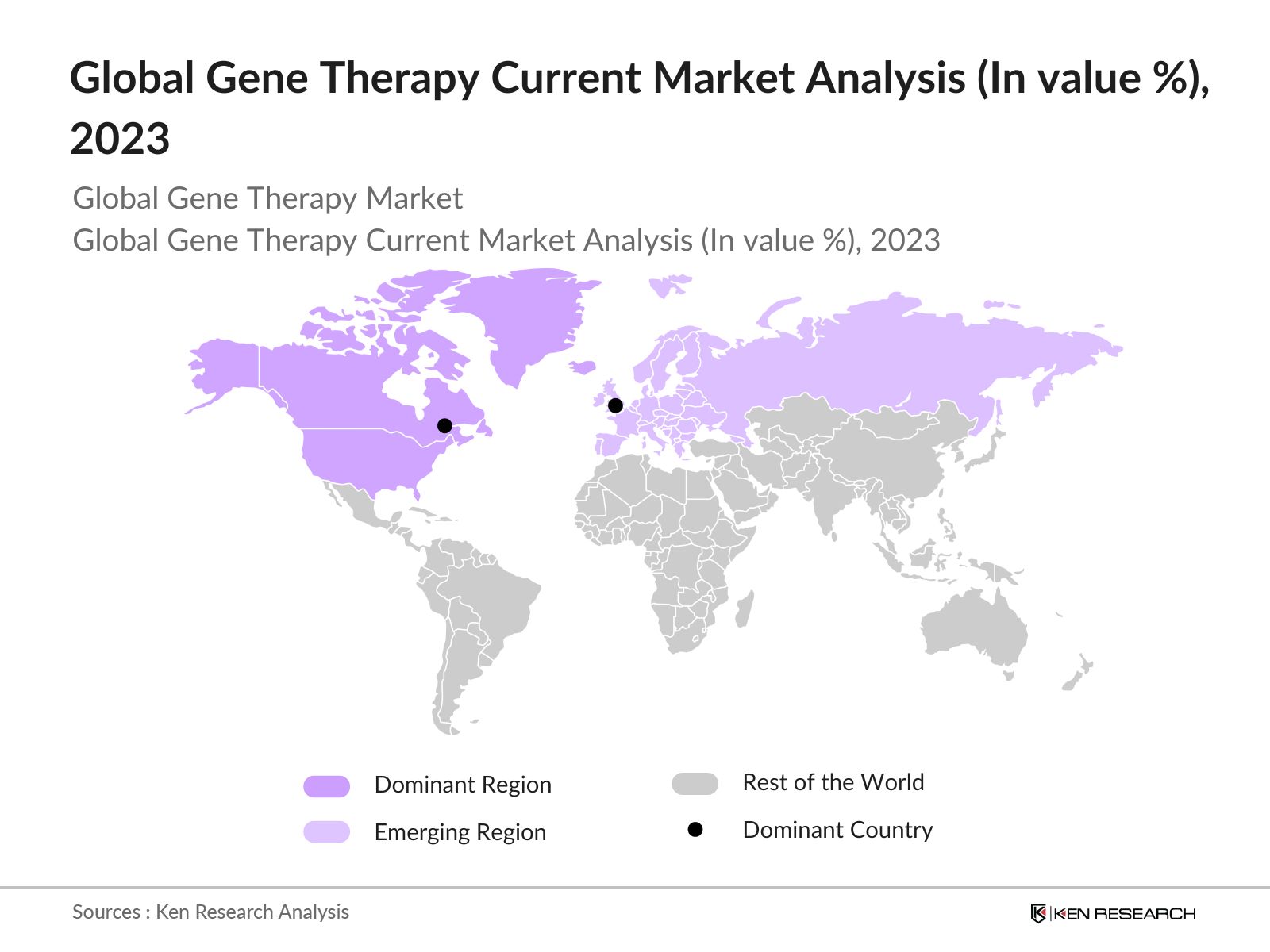

Global Gene Therapy Current Market Analysis

- North America as a dominant region: North America dominates the market due to its advanced healthcare infrastructure, significant investment in research and development, and the presence of major biopharmaceutical companies. In 2024, the United States has 6,120 hospitals, which are crucial for providing a wide range of medical services, including inpatient and outpatient care. Additionally, the U.S. healthcare system is characterized by high spending, with healthcare expenditures projected to reach USD 4.3 trillion in 2024, representing about 18% of the GDP. Further, favorable regulatory frameworks and a high prevalence of genetic disorders contribute to the region's leadership in the adoption and commercialization of gene therapies.

- Europe as an emerging region: Europe is emerging as the second largest region in the market due to its strong support for innovative healthcare solutions through government initiatives and funding, a robust pipeline of clinical trials, and a well-established regulatory framework.In 2023, the European Commission and WHO/Europe signed a 12 million agreement to strengthen health information systems and boost health data governance in the WHO European Region.Additionally, the presence of leading biopharma companies and research institutions, coupled with increasing investments in personalized medicine, is driving the growth of the gene therapy market in the region.

- USA as dominant country: USA is the single largest country in the market due to various factors including its advanced biotechnology and pharmaceutical industries, substantial government funding for genetic research, and a strong presence of key market playersThe United States is a leader in healthcare research, with the National Institutes of Health (NIH) budget at aboutUSD 47 billionin 2022, emphasizing the countrys commitment to medical research and innovation.Additionally, the country benefits from a high number of clinical trials, a well-established healthcare infrastructure, and a favorable regulatory environment that supports the development and commercialization of gene therapies.

Global Gene Therapy Market Segmentation

The Global Gene Therapy Market can be segmented based on several factors:

- By Type: The global gene therapy market is segmented by type into Gene Slicing, Gene Augmentation, and Other Therapies. In 2023, the Gene Augmentation sub-segment led the market by type, capturing the largest market share. This dominance is attributed to its widespread application in treating genetic disorders by replacing faulty genes with functional ones, making it a cornerstone approach in gene therapy. Other Therapies, which include RNA interference, DNA & RNA therapeutics, and other advanced techniques, also hold a significant share, reflecting the diversity of approaches being explored in the market.

- By Vector: The segmentation by vector in the global gene therapy market is divided into Viral Vectors and Non-Viral Vectors. Viral Vectors dominate this segment, accounting for the majority of the market share in 2023. This is largely due to their high efficiency in delivering genetic material into cells, making them the preferred choice for most gene therapy applications. Non-Viral Vectors, while growing in popularity due to their lower immunogenicity and advancements in delivery technologies, still hold a smaller share in comparison.

- By Delivery Method: The market segmentation by delivery method in the global gene therapy market includes In Vivo and Ex Vivo methods. In 2023, the Ex Vivo delivery method emerged as the dominant approach, securing the largest share of the market. This dominance is driven by its ability to provide greater control over the genetic modification process, as cells are altered outside the body before being reintroduced into the patient. This method is particularly favored in complex treatments, such as those for blood-related disorders and certain cancers, where precise genetic alterations are crucial for success.

Global Gene Therapy Market Competitive Landscape

|

Name of Company |

Headquarter |

Establishment Year |

Geographical Presence |

R&D Expense (Mn USD), 2023 |

|

Novartis |

Basel, Switzerland |

1996 |

140 Countries |

11,371 |

|

Bristol-Myers Squibb |

New York City, USA |

1887 |

38 Countires |

9,299 |

|

Bluebird Bio |

Somerville, Massachusetts, USA |

2010 |

~30 |

147 |

|

Johnson & Johnson |

Pennsylvania, United States |

1953 |

150+ |

15,100 |

- Novartis: Novartis has signed a collaboration and capsid license agreement with Voyager Therapeutics to develop gene therapies for Huntingtons disease and spinal muscular atrophy (SMA). Voyager will receive $100m in upfront payment, with USD 20m in equity. Additionally, Novartis has acquired DTx Pharma for up to $1 billion in 2023, in a deal designed to strengthen neuroscience pipeline and expand its capabilities in RNA therapeutics.

- Johnson & Johnson: MeiraGTxs recent decision to hand off its interests in botaretigene sparoparvovec (bota-vec) for X-linked retinitis pigmentosa to Johnson & Johnson in a deal potentially worth up to $415 million is a significant move within the global gene therapy market. This transaction underscores the growing importance of gene therapy as a frontier in treating rare and genetic diseases, where traditional therapies often fall short.

- Sarapeta Therapeutics: In June 2023, Sarepta Therapeutics achieved a significant milestone in the field of gene therapy with the U.S. Food and Drug Administration's (FDA) approval of Elevidys (delandistrogene moxeparvovec). This approval marked a breakthrough in the treatment of Duchenne muscular dystrophy (DMD), specifically targeting boys aged 4-5 years with mutations in the DMD gene.

Global Gene Therapy Industry Analysis

Global Gene Therapy Market Growth Drivers:

- Increasing Investment and Funding: The global gene therapy market has witnessed substantial growth, driven in large part by significant increases in investment and funding. In 2018 alone, global investment in these advanced therapies reached about USD 13 billion. The following year, 19 major mergers and acquisitions in the cell and gene therapy (CGT) space were completed, totalling over USD 156 billion. Additionally, Venture capital investment in cell and gene therapy startups increased by 30% year-over-year, reaching USD 1.8 billion in 2023. This influx of capital is largely attributed to the growing number of biotech startups focusing on gene editing technologies such as CRISPR and advancements in viral vector production.

- Expansion of Market Access and Reimbursement: Market access and reimbursement policies play a critical role in the adoption of gene therapies. By 2023, over 30 gene therapies had received regulatory approval globally, up from just 15 in 2020. The availability of reimbursement pathways has significantly expanded, with countries like the U.S. and various European nations implementing innovative payment models, such as outcome-based reimbursement agreements. The U.S. Centers for Medicare & Medicaid Services (CMS) has adopted value-based purchasing arrangements that link reimbursement to patient outcomes, which has facilitated broader access to costly gene therapies.

- Integration with Precision Medicine Approaches: The integration of gene therapy with precision medicine has become a pivotal growth driver, as it allows for more personalized and effective treatments. Advances in genetic sequencing and bioinformatics have enabled the development of therapies tailored to individual genetic profiles, increasing the efficacy of treatments for conditions like rare genetic disorders and certain cancers. The cost of whole-genome sequencing has dropped from USD 1,000 in 2020 to approximately USD 500 in 2023, making it more accessible and enabling more widespread use of precision gene therapies. This synergy is expected to drive significant growth in the adoption of gene therapies globally

Global Gene Therapy Market Challenges:

- High Development Costs and Investment Risks: The development of gene therapies is an inherently expensive and risky endeavor. Creating a gene therapy involves extensive research and development, which includes years of preclinical studies and multiple phases of clinical trials. These processes require significant financial investment, often running into hundreds of millions of dollars before a therapy can even approach regulatory approval. The high costs are coupled with substantial risks, as many potential therapies fail during clinical trials, resulting in a complete loss of the invested resources.

- Manufacturing Complexity and Scalability: Manufacturing gene therapies is a highly complex process that presents significant challenges in scalability. Unlike traditional pharmaceuticals, gene therapies often rely on the use of viral vectors to deliver therapeutic genes to target cells, which requires specialized manufacturing processes and facilities. The production of these viral vectors is intricate and must meet rigorous quality standards to ensure safety and efficacy. Scaling up production to meet commercial demand while maintaining these standards is challenging, particularly as the demand for gene therapies increases.

Global Gene Therapy Market Government Initiatives:

- Regulatory Frameworks and Fast-Track Approvals: Governments worldwide are increasingly recognizing the potential of gene therapy in addressing unmet medical needs, leading to the establishment of regulatory frameworks that support its development. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have introduced fast-track and priority review programs for gene therapies, expediting the approval process. These initiatives are designed to accelerate the availability of breakthrough therapies for patients with serious conditions, fostering innovation and reducing the time to market for new gene therapies.

- Public Funding and Grants: Several governments are actively providing financial support to promote gene therapy research and development. The National Institutes of Health (NIH) in the United States and the Horizon Europe program in the European Union offer grants and funding opportunities aimed at advancing gene therapy technologies. These programs are crucial in supporting early-stage research, clinical trials, and the commercialization of gene therapies, helping to overcome the high costs and risks associated with developing these treatments.

Global Gene Therapy Future Market Outlook

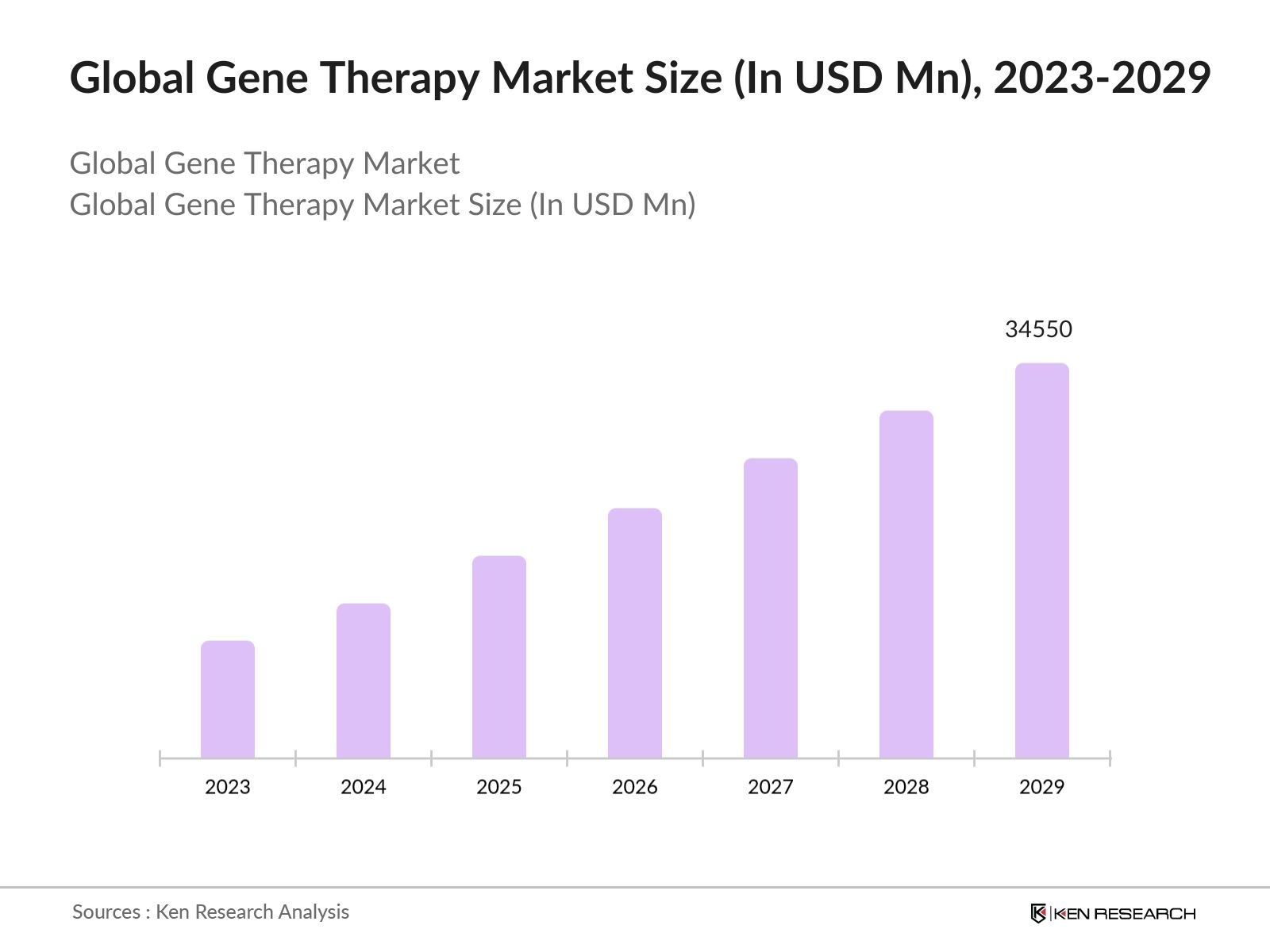

The global market is predicted to grow exceptionally in the forecasted period of 2023-2029 reaching a market size of USD 34550 Mn driven by rise in strategic collaborations and partnerships, shift towards ex vivo gene therapy approaches, emergence of gene therapy platforms, and regulatory harmonization and standardization.

- Rise in Strategic Collaborations and Partnerships: One of the most significant trends shaping the future of the gene therapy market is the increase in strategic collaborations and partnerships. As gene therapy development is both costly and complex, many biotech firms and pharmaceutical companies are recognizing the value of pooling resources, expertise, and technologies to accelerate progress. Collaborations often bring together the innovative capabilities of smaller biotech companies with the financial strength, regulatory experience, and commercialization infrastructure of larger pharmaceutical firms.

- Shift Towards Ex Vivo Gene Therapy Approaches: Another emerging trend in the gene therapy market is the shift towards ex vivo gene therapy approaches. Unlike in vivo gene therapy, where genetic material is directly delivered into the patient's body, ex vivo gene therapy involves modifying a patients cells outside the body and then reintroducing them. This approach offers several advantages, such as greater control over the modification process, the ability to select and cultivate the best cells, and a potentially reduced risk of adverse immune responses.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Type |

Gene Slicing Gene Augmentation Other Therapies |

|

By Vector |

Viral Vectors Non Viral Vectors |

|

By Delivery Method |

In Vivo Ex Vivo |

|

By Application |

Oncological Diseases Neurological Diseases Heamatological Diseases Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical and Biotechnology Companies

Healthcare Providers and Hospitals

Gene Therapy Product Manufacturers

Health Insurance Companies and Payers

Patient Advocacy Groups

Medical Device Companies

Banks and Financial Institutions

Investors and VCs

Regulatory Authorities and Government Bodies (FDA, EMA)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

Novartis

Bristol-Myers Squibb

Bluebird Bio

Johnson & Johnson

Kite Pharma, a Gilead Company

Sarapeta Therapeutics

Krystal Biotech

Pfizer Inc.

Sangamo Therapeutics

Regenxbio Inc.

Orchard Therapeutics

UniQure N.V.

Intellia Therapeutics

Editas Medicine

Rocket Pharmaceuticals

Table of Contents

1. Executive Summary

1.1 Global Biopharmaceutical Market

1.1 Global Gene Therapy Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Gene Therapy Industry

2.3 Global Gene Therapy Revenue

2.4 Global Gene Therapy Infrastructure

3. Global Gene Therapy Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

4. Global Gene Therapy Market Size (in USD Bn), 2018-2023

5. Global Gene Therapy Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Type (Gene Slicing, Gene Augmentation, and Other Therapies) in value%, 2018-2023

5.3 By Vector (Viral Vectors and Non-Viral Vectors), 2018-2023

5.4 By Delivery Method (Vivo and Ex Vivo) in value %, 2018-2023

5.5 By Application (Oncological Diseases, Neurological Diseases, Haematological Diseases, and Others) in value %, 2018-2023

6. Global Gene Therapy Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis (By Technology)

6.3 Market Heat Map Analysis (By Offerings)

6.4 Market Cross Comparison

6.5 Comparison Matrix

6.6 Investment Landscape

7. Global Gene Therapy Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

8. Global Gene Therapy Future Market Size (in USD Bn), 2023-2028

9. Global Gene Therapy Future Market Segmentation (in value %), 2023-2028

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2028

9.2 By Type (Gene Slicing, Gene Augmentation, and Other Therapies) in value%, 2023-2028

9.3 By Vector (Viral Vectors and Non-Viral Vectors), 2023-2028

9.4 By Delivery Method (Vivo and Ex Vivo) in value %, 2023-2028

9.5 By Application (Oncological Diseases, Neurological Diseases, Haematological Diseases, and Others) in value %, 2023-2028

10. Analyst Recommendations

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Consolidated Research Approach

11.5 Understanding Market Potential Through In-Depth Industry Interviews

11.6 Primary Research Approach

11.7 Limitations and Future Conclusion

Disclaimer

Contact Us

Research Methodology

Step 01 Literature Review and Secondary Data Collection:

Conducted an extensive review of existing literature, industry reports, and academic publications to gain insights into the global gene therapy landscape. Gathered secondary data on market trends, challenges, and key players in the sustainable packaging sector.

Step 02 Market Segmentation and Value Categorization:

Employed segmentation criteria to categorize the gene therapy market based on value. Criteria included types, applications, and end-user industries. Utilized secondary data sources to obtain value-specific information for each segment.

Step 03 Market Size Calculation Using Bottom-Up Approach:

Calculated the overall market size by bottom -up approach for gene therapy in terms of value, integrating the segmented data from each region.

Step 04 Data Collation and Global Market Overview:

Collated data from individual regional reports to build a comprehensive global overview of the gene therapy market. Emphasized the interplay between regional variations and global trends, providing a nuanced understanding of the market dynamics.

Step 05 Data Validation and Statistical Analysis:

Conducted a rigorous validation process to ensure the accuracy and reliability of the obtained data. Employed statistical methods to assess the robustness of the findings and mitigate any potential biases in the research.

Frequently Asked Questions

01. How big is the global gene therapy market?

The global gene therapy market was valued at USD 6250 Mn in 2023, driven by advancements in genetic research, increasing investment in biotechnology, and the growing prevalence of genetic disorders.

02. What are the challenges in the global gene therapy market?

Challenges in the global gene therapy market include high development costs, complex manufacturing processes, and stringent regulatory requirements. Additionally, the market faces hurdles related to ethical concerns and patient access to costly therapies.

03. Who are the major players in the global gene therapy market?

Key players in the global gene therapy market include Novartis, Bristol-Myers Squibb, Bluebird Bio, Johnson & Johnson, and Kite Pharma, a Gilead Company. These companies are at the forefront of developing and commercializing innovative gene therapies.

04. What are the growth drivers of the global gene therapy market?

The global gene therapy market is propelled by increasing investment and funding, expansion of market access and reimbursement, and the integration of gene therapy with precision medicine approaches. The rise in strategic collaborations also plays a significant role in driving market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.