Global Geothermal Energy Market Outlook to 2030

Region:Global

Author(s):Sanjeev kumar

Product Code:KROD4941

December 2024

84

About the Report

Global Geothermal Energy Market Overview

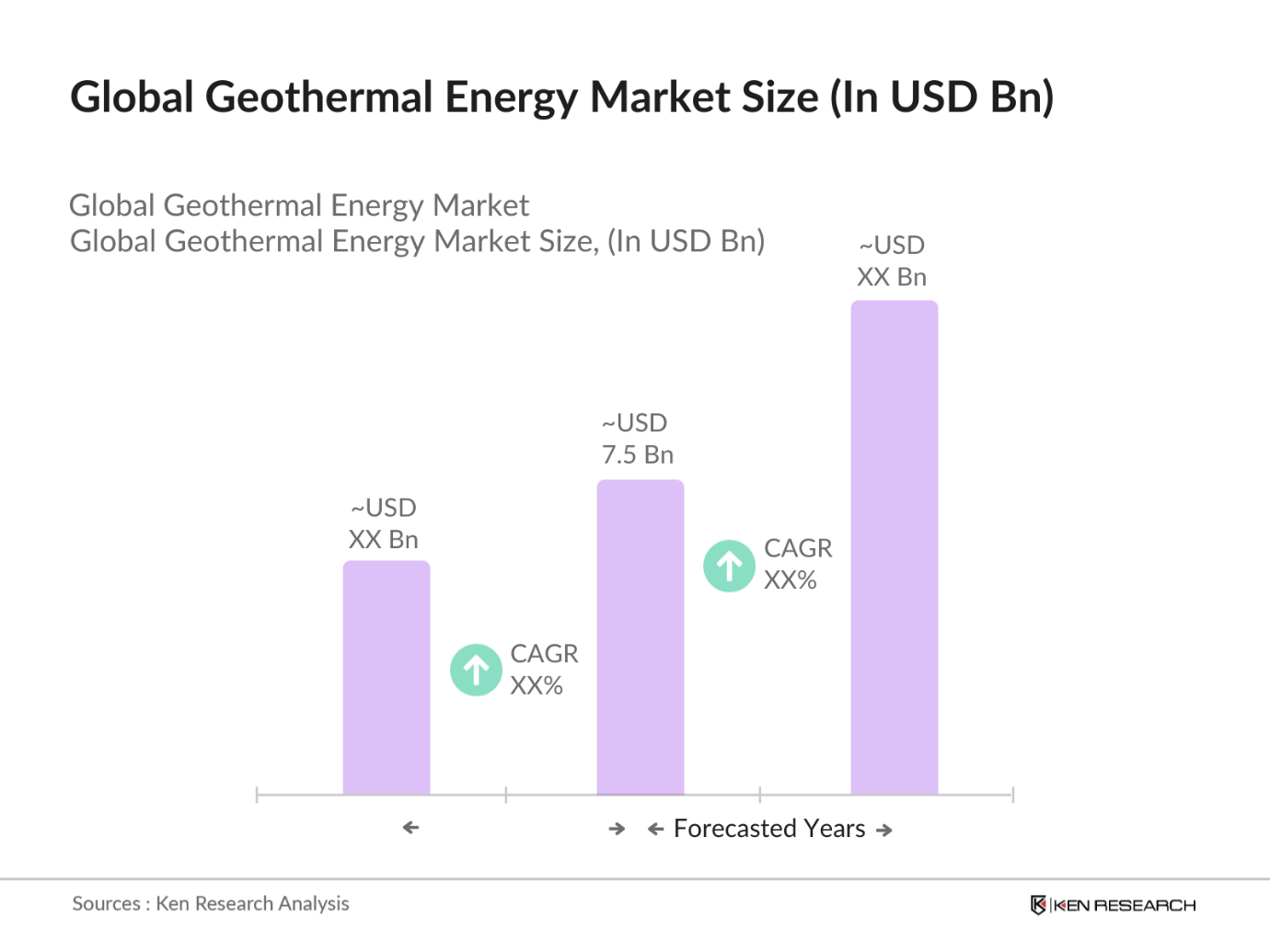

- The global geothermal energy market reached a valuation of USD 7.5 billion, fueled by increasing investments in renewable energy sources and supportive government policies aimed at reducing greenhouse gas emissions. Geothermal energy is a reliable and sustainable power source, with numerous countries focusing on it as a means to meet their energy demands while minimizing carbon footprints. Government incentives and technological advancements in energy extraction have bolstered market growth, establishing a consistent demand from various end-use sectors.

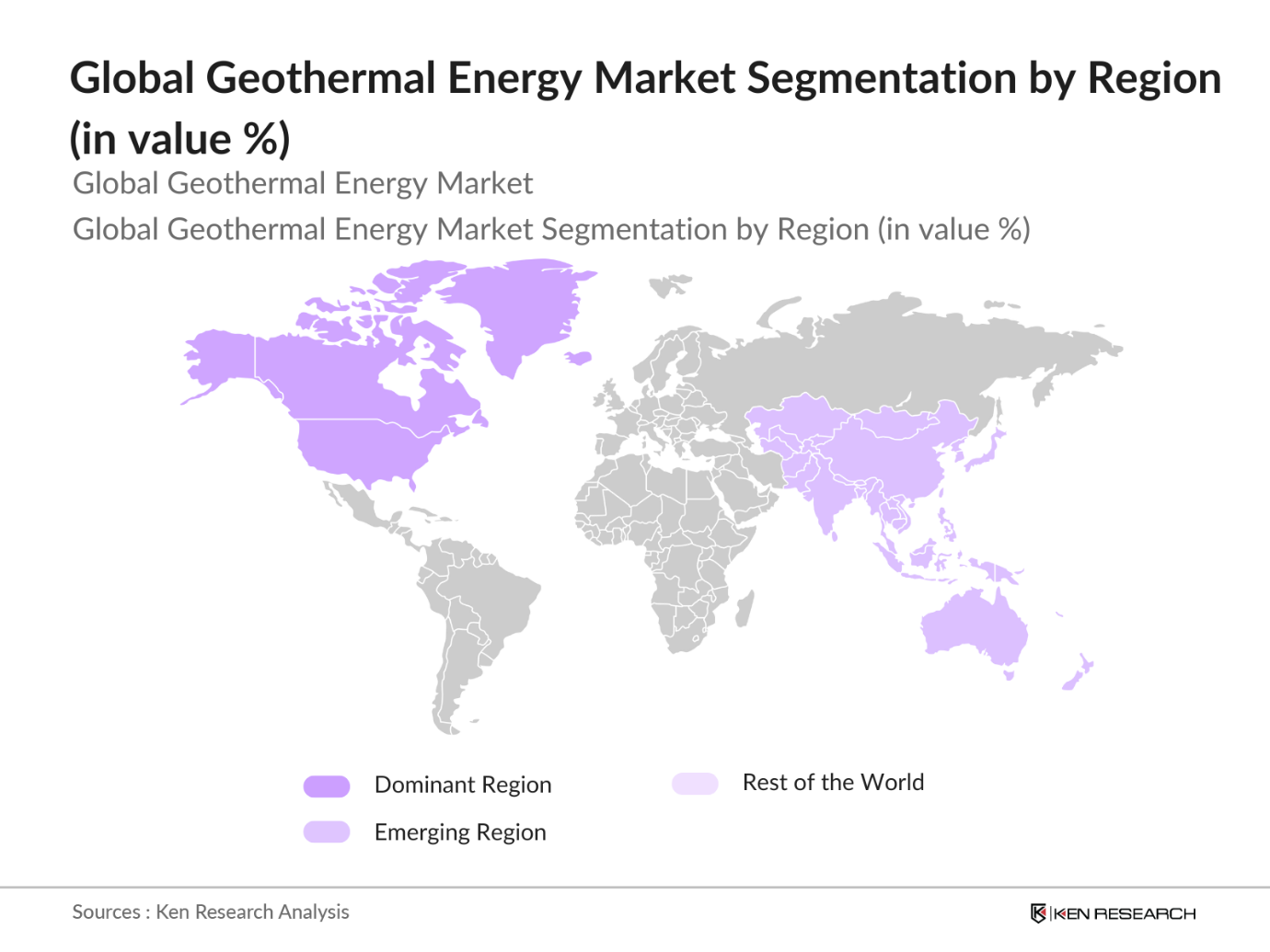

- Key countries leading the geothermal energy market include the United States, the Philippines, and Indonesia. The United States holds a dominant position due to substantial investments in geothermal infrastructure, favorable regulatory frameworks, and advancements in exploration technologies. Meanwhile, Indonesia and the Philippines possess vast geothermal potential due to their geographic locations within the "Ring of Fire," enabling them to develop and expand their geothermal capacities effectively. Both countries benefit from government backing, which supports increased production and capacity expansion in geothermal energy.

- Geothermal projects must adhere to strict emission regulations, as some sites emit gasde. In 2023, the European Union implemented emissions compliance protocols for geothermal plants, capping hydrogen sulfide emissions at 5 ppm, aligning with environmental standards. This has led to the adoption of advanced scrubbers in EU plants, adding an extra layer of compliance to new and existing projects.

Global Geothermal Energy Market Segmentation

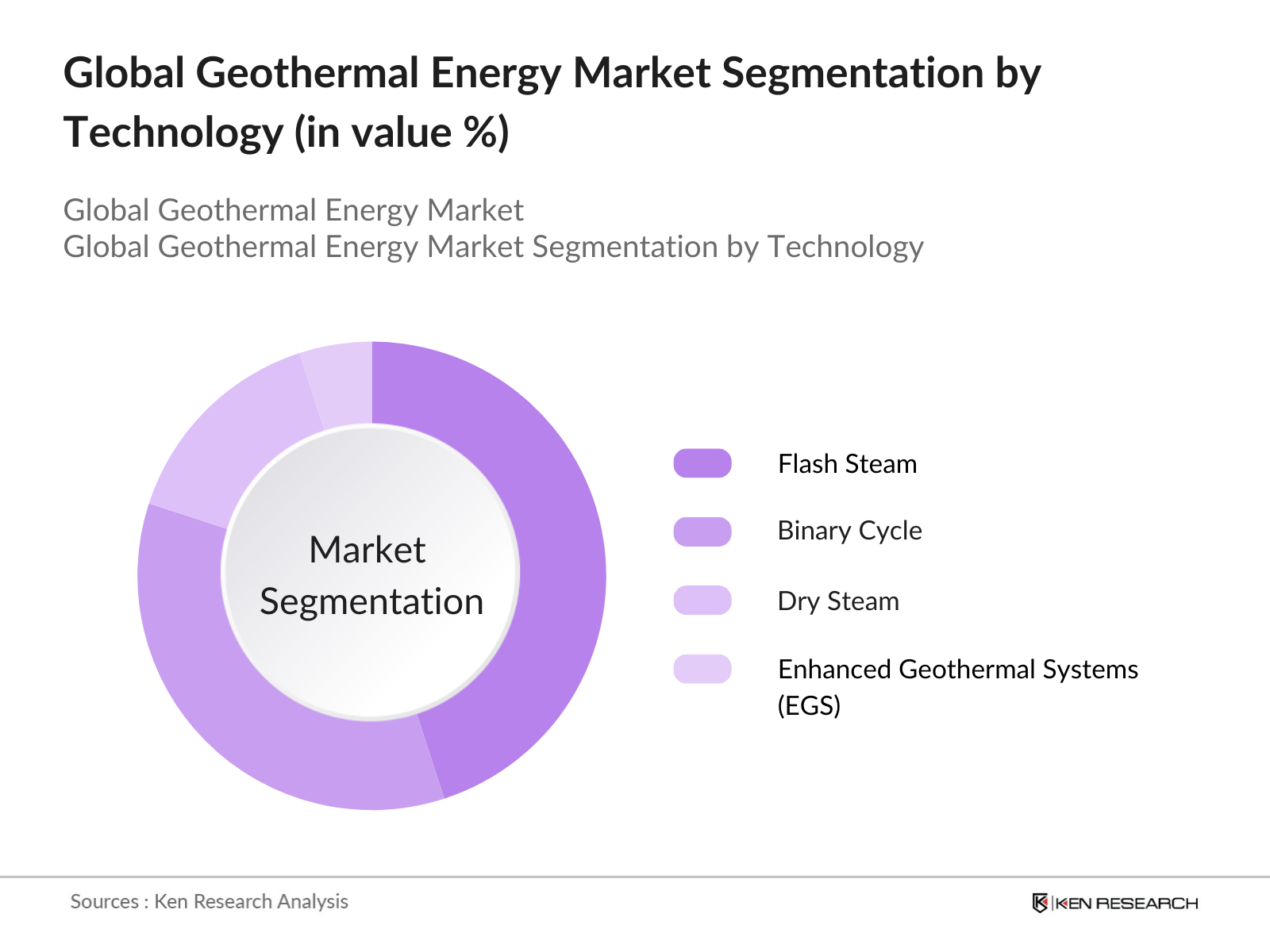

- By Technology: The global geothermal energy market is segmented by technology into flash steam, binary cycle, dry steam, and enhanced geothermal systems (EGS). Flash steam technology holds a significant market share due to its higher efficiency and capability to harness geothermal resources from high-temperature reservoirs. This technology is particularly popular in regions with geothermal reservoirs reaching temperatures above 180C, making it an ideal choice for commercial electricity generation, especially in countries like the U.S. and the Philippines, where high-temperature geothermal resources are prevalent.

- By Region: Regionally, the geothermal energy market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America dominates due to its extensive geothermal infrastructure and government-backed initiatives that promote renewable energy production. The Asia-Pacific region, particularly Indonesia and the Philippines, also represents a substantial share owing to abundant geothermal resources and a strong focus on expanding renewable energy capacities.

- By Application: The geothermal energy market by application is categorized into electricity generation, direct use, and ground source heat pumps. The electricity generation segment leads due to high demand from commercial and industrial sectors seeking sustainable power alternatives. This segment benefits from government policies supporting renewable energy adoption and has shown significant potential in high-capacity projects. Countries like Indonesia and Kenya have heavily invested in geothermal for electricity generation to meet their rising energy demands sustainably.

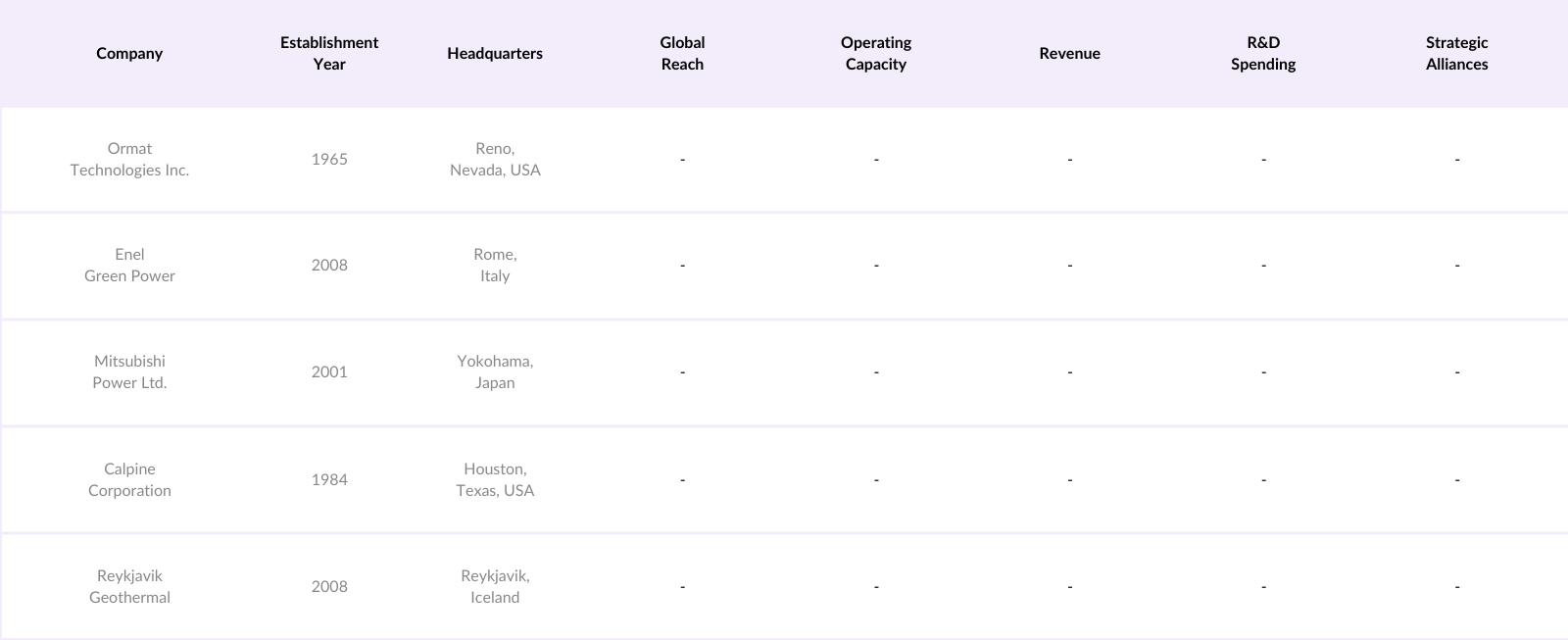

Global Geothermal Energy Market Competitive Landscape

The geothermal energy market is moderately consolidated, with major players contributing significantly to the market's overall structure. Leading players have a diverse range of technology portfolios and actively engage in partnerships and mergers to strengthen their global presence.

Global Geothermal Energy Industry Analysis

Growth Drivers

- Government Incentives & Tax Credits: Governments worldwide have established tax credits and subsidies to support geothermal energy development. For instance, the U.S. offers an Investment Tax Credit (ITC) for geothermal energy projects, covering 30% of initial costs in 2024. Japan allocates approximately $350 million annually for renewable energy incentives, significantly boosting geothermal projects, which contribute 1.2 GW to its energy mix as of 2024nally, the European Unions Renewable Energy Directive mandates member countries to promote geothermal energy, with some countries offering grants covering up to 45% of geothermal installation costs .

- Reasing Demand for Renewable Energy: With rising global energy demand, the shift to renewable sources is vital. As of 2024, global renewable energy consumption reached 13,200 TWh, and geothermal energy is integral to this shift, especially in nations like the Philippines, where geothermal accounts for 10% of its total energy output . Kenya similarlyover $500 million in geothermal plants to reach a 50% renewable energy target. This commitment is echoed globally, driving demand and funding into geothermal development .

- Technologicments in Drilling and Exploration: Advanced drilling technologies reduce exploration risks, with costs dropping by nearly 20% since 2022. Iceland, a leader in geothermal technology, has adopted new drilling techniques that reach deeper geothermal reservoirs, increasing power output by 40% . The U.S. Department of Energy als significant advancements, achieving depths of 5,000 meters in 2024, enhancing access to geothermal resources with lower energy requirements .

Market Restraints

- Hl Investment: Initial capital costs for geothermal projects are substantial, with the average cost per megawatt estimated at $4 million globally as of 2024. Countries like Kenya face challenges in financing large-scale geothermal plants, often relying on loans from institutions such as the World Bank, which disbursed $500 million in 2023 specifically for geothermal projects in East Africa . These costs are compounded by the requirement of exsource assessment and environmental studies, making initial investments challenging for emerging economies .

- Environmental & Geographical Limitations: Geothey production is geographically restricted, limited to areas with high tectonic activity. Nations like Japan and Indonesia capitalize on this, with Japan harnessing 2 GW of geothermal power in 2024. However, this concentration in volcanic regions leads to land-use constraints, with only 5% of U.S. geothermal potential feasible for development due to environmental regulations . Earthquakes and land subsidence also pose significant risks, especials prone to seismic activity, adding regulatory and operational burdens .

Global Geothermal Energy Market Future Outlook

Over the next few years, the geothermal energy market is projected to witness considerable growth, fueled by increased investments, technological advancements, and expanding applications in both electricity generation and direct heating solutions. Growing environmental concerns and the need for reliable baseload power are likely to further drive demand for geothermal energy solutions worldwide. Geothermal's appeal as a renewable, sustainable energy source with low emissions aligns with global trends in reducing dependency on fossil fuels.

Market Opportunities

- Integration with Heating and Cooling Systems: Geothermay's ability to support direct heating and cooling systems presents substantial growth opportunities. In Europe, geothermal heating systems contributed approximately 150 TWh to residential and commercial heating in 2024. The German government introduced incentives totaling $500 million to retrofit buildings with geothermal heating, reducing fossil fuel dependency. In the U.S., around 40,000 geothermal heat pumps were installed in 2024 alone, driven by government support and increasing environmental consciousness.

- Growth in Emerging Markets: Emerging markets like East Africa are increasingly investing in geotgy to diversify their power sources. Kenyas installed geothermal capacity reached 1 GW in 2024, with an additional 100 MW expected to come online due to $500 million in World Bank funding. The Philippines similarly aims to enhance geothermal output, with $200 million allocated to modernize facilities. These initiatives align with goals to reduce reliance on imports and provide stable, clean power.

Scope of the Report

|

Technology |

Flash Steam, Binary Cycle, Dry Steam, EGS |

|

Application |

Electricity Generation, Direct Use, Heat Pumps |

|

End-User Industry |

Residential, Commercial, Industrial |

|

Capacity |

Below 10 MW, 1050 MW, Above 50 MW |

|

Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Renewable Energy Investors and Venture Capital Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, International Renewable Energy Agency)

Power Plant Developers and Operators

Geothermal Drilling Equipment Manufacturers

Environmental Agencies and NGOs

Research and Development Institutions

Public-Private Partnership Facilitators

End-Use Industries (Commercial and Industrial Sectors)

Companies

Players Mentioned in the Report:

Ormat Technologies Inc.

Enel Green Power

Mitsubishi Power Ltd.

Calpine Corporation

Reykjavik Geothermal

Toshiba Energy Systems & Solutions Corporation

Fuji Electric Co. Ltd.

Aboitiz Power Corporation

Pertamina Geothermal Energy

Cyrq Energy Inc.

Philippine Geothermal Production Co. Inc.

Chevron Corporation

AltaRock Energy Inc.

Envirosource Geothermal Inc.

U.S. Geothermal Inc.

Table of Contents

1. Global Geothermal Energy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Value Chain Analysis

1.5. Competitive Landscape Framework

2. Global Geothermal Energy Market Size (in USD Million)

2.1. Historical Market Size

2.2. Annual Growth Analysis

2.3. Key Market Milestones and Developments

2.4. Impact of Regional Subsidies and Grants

2.5. Projected Capacity Additions (GW)

3. Global Geothermal Energy Market Analysis

3.1. Market Drivers (e.g., Renewable Energy Targets, Policy Incentives)

3.1.1. Government Incentives & Tax Credits

3.1.2. Increasing Demand for Renewable Energy

3.1.3. Technological Advancements in Drilling and Exploration

3.2. Market Challenges (e.g., High Initial Costs, Exploration Risks)

3.2.1. High Capital Investment

3.2.2. Environmental & Geographical Limitations

3.2.3. Skilled Workforce Availability

3.3. Market Opportunities (e.g., Expanding Application Areas)

3.3.1. Integration with Heating and Cooling Systems

3.3.2. Growth in Emerging Markets

3.3.3. Public-Private Partnerships

3.4. Key Market Trends (e.g., Direct Use Applications, Hybrid Systems)

3.4.1. Shift Towards Hybrid Renewable Plants

3.4.2. Use of Enhanced Geothermal Systems (EGS)

3.5. Government Regulations and Compliance (e.g., Emission Standards, Permitting)

3.5.1. Emissions Compliance Requirements

3.5.2. Permitting Procedures by Region

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem Analysis

3.8. Porters Five Forces Analysis

3.9. Market Maturity and Lifecycle Analysis

4. Global Geothermal Energy Market Segmentation

4.1. By Technology (in Value %)

4.1.1. Flash Steam

4.1.2. Binary Cycle

4.1.3. Dry Steam

4.1.4. Enhanced Geothermal Systems (EGS)

4.2. By Application (in Value %)

4.2.1. Electricity Generation

4.2.2. Direct Use Applications

4.2.3. Ground Source Heat Pumps

4.3. By End-User Industry (in Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.4. By Capacity (in Value %)

4.4.1. Below 10 MW

4.4.2. 1050 MW

4.4.3. Above 50 MW

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Geothermal Energy Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ormat Technologies Inc.

5.1.2. Toshiba Energy Systems & Solutions Corporation

5.1.3. Fuji Electric Co. Ltd.

5.1.4. Mitsubishi Power Ltd.

5.1.5. Enel Green Power

5.1.6. Reykjavik Geothermal

5.1.7. Calpine Corporation

5.1.8. Chevron Corporation

5.1.9. Aboitiz Power Corporation

5.1.10. Pertamina Geothermal Energy

5.1.11. Cyrq Energy Inc.

5.1.12. Envirosource Geothermal Inc.

5.1.13. Philippine Geothermal Production Co. Inc.

5.1.14. U.S. Geothermal Inc.

5.1.15. AltaRock Energy Inc.

5.2. Cross Comparison Parameters (Revenue, Operating Capacity, Global Reach, R&D Spending, Number of Projects, Patents Owned, Market Presence, Strategic Alliances)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Venture Capital Funding

5.8. Government and Private Equity Investments

6. Global Geothermal Energy Market Regulatory Framework

6.1. Environmental Standards and Compliance

6.2. Emission Reduction Policies

6.3. Certification Processes

6.4. Safety Regulations and Standards

6.5. Permitting Procedures and Land Use Policies

7. Global Geothermal Energy Future Market Size (in USD Million)

7.1. Projected Market Size

7.2. Key Factors Influencing Future Growth

8. Future Market Segmentation

8.1. By Technology

8.2. By Application

8.3. By End-User Industry

8.4. By Capacity

8.5. By Region

9. Market Analyst Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Available Market (SAM) Analysis

9.3. White Space Opportunity Analysis

9.4. Customer Cohort Analysis

9.5. Strategic Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves a thorough mapping of the geothermal energy ecosystem, identifying all stakeholders and market variables that influence dynamics within the sector. This includes extensive desk research, compiling data from government reports, industry journals, and proprietary databases to define market variables.

Step 2: Market Analysis and Data Collection

The market analysis phase entails compiling historical data on geothermal energy capacities, installations, and market developments. Data regarding energy demand, pricing trends, and government policies are examined to construct reliable market projections, with a focus on accuracy and relevance.

Step 3: Hypothesis Validation and Industry Consultation

Market hypotheses are developed and validated through structured interviews with industry professionals, including geothermal plant operators, technology providers, and regulatory authorities. These insights provide granular data on operational and market trends, enriching the research with real-world perspectives.

Step 4: Data Synthesis and Reporting

The final synthesis involves aggregating data from multiple sources, cross-verifying findings, and compiling insights into a comprehensive report. Direct engagement with geothermal companies is used to validate projections and ensure that all findings align with industry realities, thereby delivering a credible and data-backed analysis.

Frequently Asked Questions

01. How big is the global geothermal energy market?

The global geothermal energy market was valued at USD 7.5 billion, driven by increased investments in sustainable power sources and supportive government policies.

02. What are the major challenges in the global geothermal energy market?

Challenges include high initial capital costs, limited resource availability, and environmental concerns related to land use and emissions.

03. Who are the major players in the geothermal energy market?

Key players include Ormat Technologies Inc., Enel Green Power, Mitsubishi Power Ltd., Calpine Corporation, and Reykjavik Geothermal, who dominate due to their extensive geothermal project portfolios and advanced technologies.

04. What drives growth in the global geothermal energy market?

The market's growth is propelled by rising energy demand, government incentives, and advancements in exploration and drilling technology, which make geothermal energy more viable for widespread use.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.