Global Ginger Beer Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD8241

December 2024

96

About the Report

Global Ginger Beer Market Overview

- The global ginger beer market is valued at USD 5.12 billion, based on a five-year historical analysis. This growth is driven by increasing consumer preference for low-alcoholic flavoured beverages and the perceived health benefits of ginger, such as aiding digestion and reducing nausea. Additionally, the rise of craft beverages and innovative flavor offerings have contributed to the market's expansion.

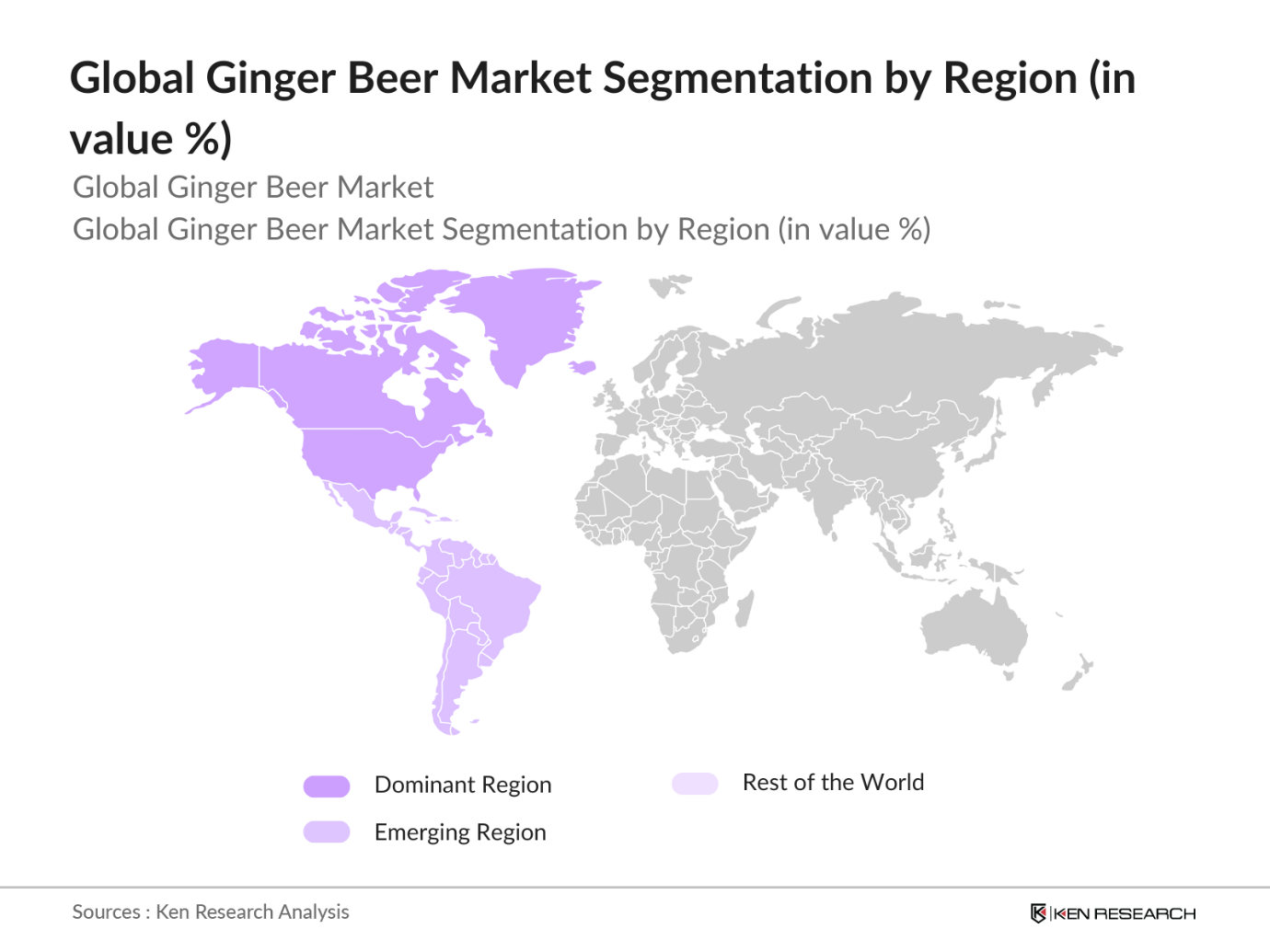

- North America, particularly the United States, dominates the ginger beer market. This dominance is attributed to a well-established beverage industry, high consumer awareness, and a strong presence of key market players. The popularity of ginger beer as a mixer in cocktails and its appeal as a standalone beverage have further solidified its position in this region.

- Governments in North America and Europe enforce strict labeling standards that require comprehensive disclosure of ingredients, allergens, and nutritional information on beverage products. For example, the U.S. FDA mandates that all packaged beverages display clear nutritional details, including ingredient lists, to enhance consumer transparency. In the European Union, regulation (EU) No 1169/2011 enforces similar standards, requiring companies to provide detailed labeling to avoid consumer misinformation. Compliance costs are high, with labeling errors leading to penalties ranging from $1,000 to $10,000 per violation in the U.S., and companies risk substantial loss of consumer trust if inaccuracies are discovered.

Global Ginger Beer Market Segmentation

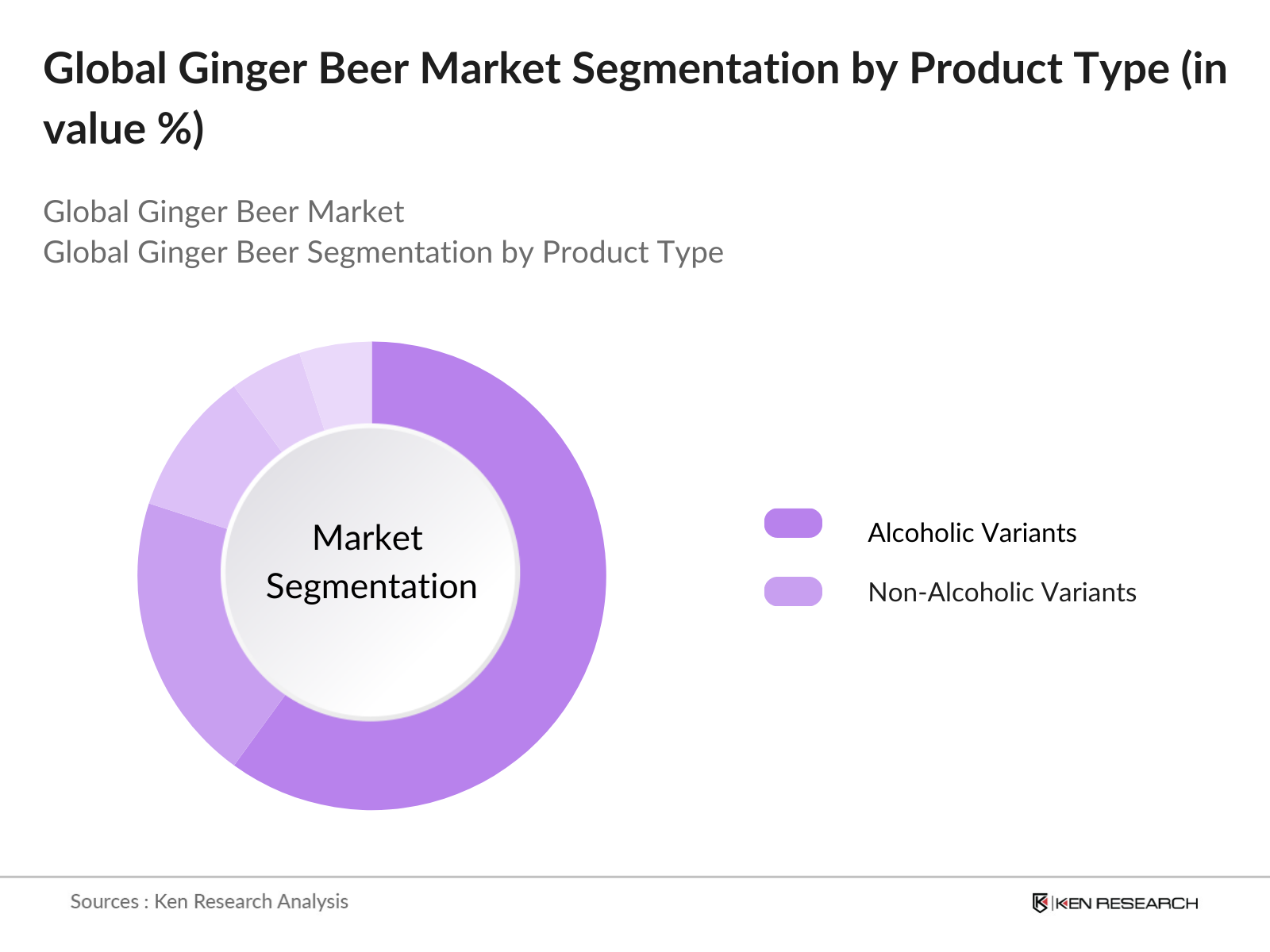

By Product Type: The ginger beer market is segmented by product type into alcoholic and non-alcoholic variants. Non-alcoholic ginger beer holds a dominant market share due to its broad consumer appeal, catering to both adults and younger demographics. Its versatility as a mixer in non-alcoholic cocktails and its suitability for health-conscious consumers contribute to its leading position.

By Flavor Profile: The market is divided into original and flavored ginger beer. Original ginger beer maintains a dominant market share, as consumers often prefer the traditional, robust ginger taste. However, flavored variants, such as lemon or berry-infused ginger beers, are gaining traction among younger consumers seeking novel taste experiences.

By Region: The ginger beer market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by high consumer awareness and a strong presence of key players. Latin America follows, with a growing trend towards craft beverages and natural ingredients. The Asia-Pacific region is experiencing rapid growth due to increasing urbanization and changing consumer preferences.

Global Ginger Beer Market Competitive Landscape

The global ginger beer market is characterized by the presence of several key players who contribute significantly to market dynamics. These companies are engaged in product innovation, strategic partnerships, and expansion initiatives to strengthen their market position.

Global Ginger Beer Market Analysis

Growth Drivers

- Health Consciousness: The rise in health awareness globally is driving demand for beverages with natural ingredients. Ginger beer, associated with digestive benefits and low-calorie options, aligns well with this trend. The global non-alcoholic beverage market saw a 15% increase in demand for wellness-focused drinks in 2024, particularly in North America and Europe, where consumers prioritize natural and health-enhancing ingredients. This shift is bolstered by consumer trends toward reduced sugar and fewer artificial ingredients in beverages, making ginger beer a popular alternative.

- Flavor Innovation: Manufacturers are increasingly experimenting with new flavor profiles, enhancing consumer appeal. Diverse options such as spiced, citrus-infused, and fruit-flavored ginger beers have driven a 20% rise in sales over recent years. This trend has been especially popular among younger demographics who seek variety and unique taste experiences. Flavor innovations have also expanded market reach, with many brands launching seasonal and limited-edition flavors, which generate excitement and repeat purchases.

- Expansion of Distribution Channels: The rise of e-commerce and specialty retail has made ginger beer more accessible. Online channels, in particular, have expanded the reach of niche brands, increasing their market penetration. In 2024, online beverage sales grew by 18%, driven by convenience and the availability of exclusive flavors. Specialty stores and bars also serve as critical channels, introducing consumers to premium ginger beer options in social settings and fostering brand loyalty.

Global Ginger Beer Market Challenges

- Regulatory Compliance: Adhering to food safety and labeling regulations across regions can complicate market entry for manufacturers. With stringent standards on ingredients, labeling, and health claims, compliance requires significant investment. This is particularly true in North America and Europe, where regulatory bodies closely monitor beverage ingredients for authenticity and health impact, imposing high penalties for non-compliance.

- Supply Chain Disruptions: Ginger, a primary ingredient, is susceptible to supply chain volatility due to agricultural dependency. Climate change and export restrictions in top-producing countries, like India and China, have led to supply fluctuations. In 2023, raw ginger prices rose by 12%, affecting production costs and resulting in higher retail prices, which can limit consumer demand.

Global Ginger Beer Market Future Outlook

Over the next five years, the global ginger beer market is expected to show significant growth driven by continuous product innovation, expanding distribution channels, and increasing consumer demand for natural and health-oriented beverages. The rise of e-commerce platforms and the growing popularity of craft beverages are anticipated to further propel market expansion.

Market Opportunities

- Emerging Markets: Expanding into regions like Asia-Pacific and Latin America presents untapped growth opportunities for ginger beer brands. With increasing urbanization and a shift towards premium lifestyle choices, these markets are poised for growth. In 2024, beverage sales in Asia-Pacific surged by 14%, highlighting the region's readiness for new product categories like ginger beer, especially as consumer interest in international beverage trends rises.

- Product Innovation: Brands focusing on organic, low-sugar, and non-alcoholic variants are likely to attract health-focused consumers. The introduction of organic ginger beer options, for instance, has found success in European markets, appealing to consumers' desire for sustainable, cleaner ingredients. This innovation also taps into the growing low-calorie and wellness trends that are expected to shape the beverage industry for years.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

- Alcoholic Ginger Beer |

|

- Non-Alcoholic Ginger Beer |

|

|

Flavor Profile |

- Original/Traditional |

|

- Flavored |

|

|

- Spicy/Extra Ginger |

|

|

Distribution Channel |

- Supermarkets/Hypermarkets |

|

- Online Retail |

|

|

- Specialty Stores |

|

|

- Bars and Restaurants |

|

|

- Convenience Stores |

|

|

Process |

- Fermented |

|

- Non-Fermented |

|

|

Region |

- North America |

|

- Europe |

|

|

- Asia-Pacific |

|

|

- Latin America |

|

|

- Middle East and Africa |

Products

Key Target Audience

Beverage Manufacturers

Distributors and Wholesalers

Retailers (Supermarkets, Specialty Stores)

Foodservice Industry (Restaurants, Bars)

Health and Wellness Companies

Ingredient Suppliers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food and Drug Administration)

Companies

Players mentioned in the report

Fever-Tree

Crabbie's Ginger Beer

Reed's Inc.

Bundaberg Brewed Drinks

Fentimans Ltd.

Gosling's

Maine Root Handcrafted Beverages

Bruce Cost Fresh Ginger Ale

Stoney's Ginger Beer

Canada Dry

Buffalo Rock Company

John Barritt & Son Ltd.

Q Mixers

Old Jamaica Ginger Beer

Cock'n Bull Ginger Beer

Table of Contents

1. Global Ginger Beer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Ginger Beer Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Ginger Beer Market Analysis

3.1. Growth Drivers

3.1.1. Health Consciousness

3.1.2. Flavor Innovation

3.1.3. Rising Disposable Income

3.1.4. Expansion of Distribution Channels

3.2. Market Challenges

3.2.1. Regulatory Compliance

3.2.2. Supply Chain Disruptions

3.2.3. Competition from Substitutes

3.3. Opportunities

3.3.1. Emerging Markets

3.3.2. Product Innovation

3.3.3. Strategic Partnerships

3.4. Trends

3.4.1. Craft Beverages Movement

3.4.2. Sustainable Packaging

3.4.3. Alcohol-Free Alternatives

3.5. Government Regulations

3.5.1. Labeling Standards

3.5.2. Import Tariffs

3.5.3. Health and Safety Regulations

3.5.4. Environmental Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Ginger Beer Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Alcoholic Ginger Beer

4.1.2. Non-Alcoholic Ginger Beer

4.2. By Flavor Profile (in Value %)

4.2.1. Original/Traditional

4.2.2. Flavored

4.2.3. Spicy/Extra Ginger

4.3. By Distribution Channel (in Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Online Retail

4.3.3. Specialty Stores

4.3.4. Bars and Restaurants

4.3.5. Convenience Stores

4.4. By Process (in Value %)

4.4.1. Fermented

4.4.2. Non-Fermented

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa

5. Global Ginger Beer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Fever-Tree Drinks PLC

5.1.2. Fentimans Ltd.

5.1.3. Bundaberg Brewed Drinks

5.1.4. The Coca-Cola Company

5.1.5. Reed's Inc.

5.1.6. Q Drinks

5.1.7. Crabbies

5.1.8. Goslings Rum Ltd.

5.1.9. Maine Root

5.1.10. Spindrift

5.1.11. Old Jamaica Ginger Beer

5.1.12. Bruce Cost Ginger Ale

5.1.13. Royalty Ginger Beer

5.1.14. Belvoir Fruit Farms

5.1.15. Sekforde Drinks

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Distribution Reach, Product Portfolio, Key Clients, Market Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Ginger Beer Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Future Market Size (in USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Flavor Profile (in Value %)

8.3. By Distribution Channel (in Value %)

8.4. By Process (in Value %)

8.5. By Region (in Value %)

9. Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global ginger beer market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global ginger beer market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple ginger beer manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global ginger beer market.

Frequently Asked Questions

01. How big is the global ginger beer market?

The global ginger beer market is valued at USD 5.12 billion, based on a five-year historical analysis.

02. What are the challenges in the global ginger beer market?

Challenges include high competition from substitute beverages, regulatory constraints on alcoholic content, and supply chain disruptions affecting raw material availability.

03. Who are the major players in the global ginger beer market?

The major players in the global ginger beer market include Fever-Tree, Crabbie's Ginger Beer, Reed's Inc., Bundaberg Brewed Drinks, and Fentimans Ltd. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04. What are the growth drivers of the global ginger beer market?

Key drivers include rising consumer demand for health-oriented beverages, the increasing popularity of natural ingredients, and the beverage's versatility as a mixer in cocktails and non-alcoholic mocktails. Additionally, the trend towards craft and premium beverages supports market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.