Global GLP-1 Analogues Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8249

November 2024

86

About the Report

Global GLP-1 Analogues Market Overview

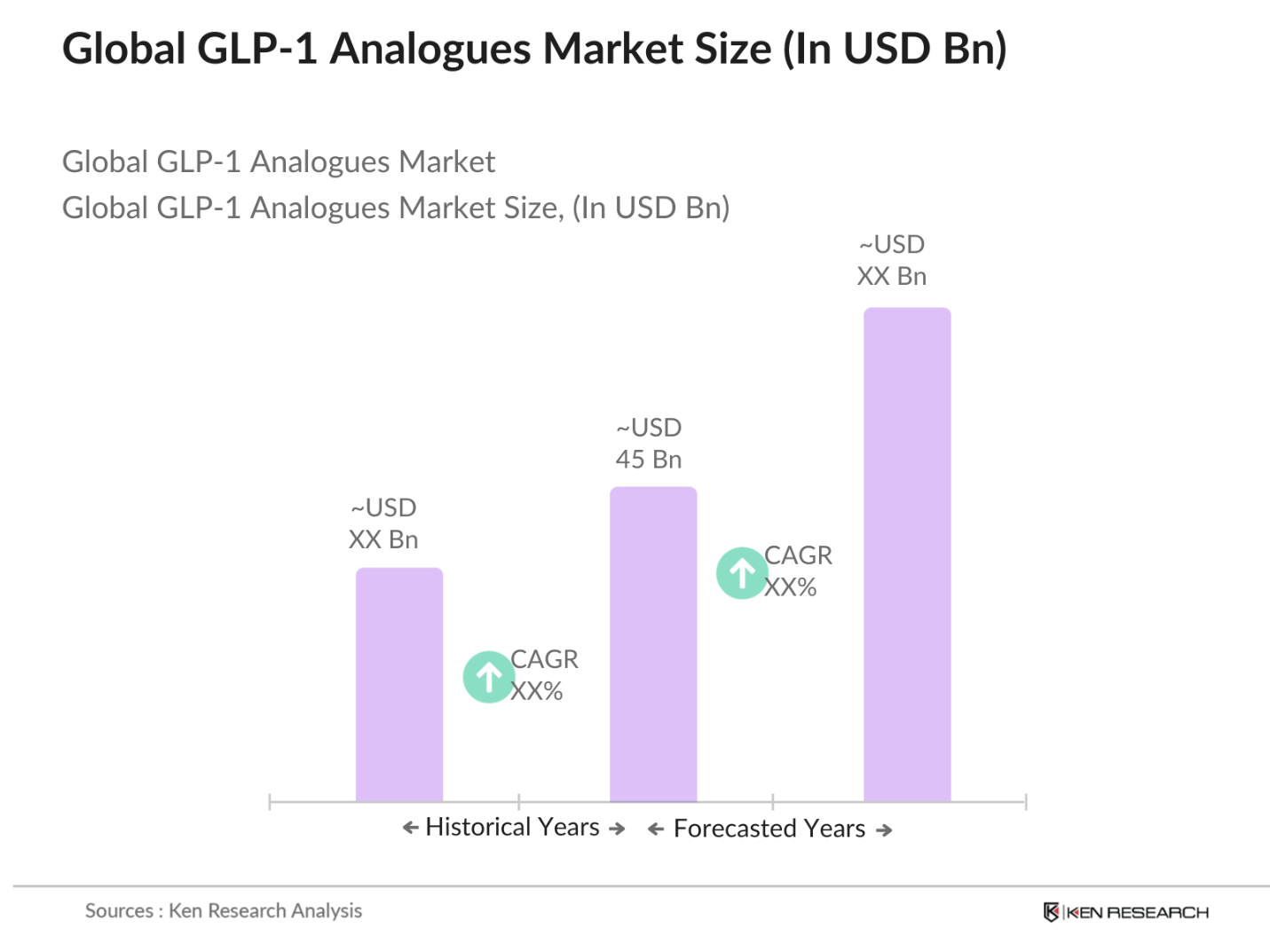

- The Global GLP-1 Analogues market is valued at approximately USD 45 billion based on a five-year historical analysis. The market's growth is primarily driven by the rising prevalence of type 2 diabetes worldwide, which has seen a surge in recent years due to sedentary lifestyles and poor dietary habits. In addition, the development of innovative drug delivery systems, including oral formulations, is enhancing patient compliance, further boosting the adoption of GLP-1 analogues across various regions.

- Countries like the United States, Japan, and Germany are leading in the GLP-1 analogues market due to their advanced healthcare infrastructure and high rates of diabetes diagnosis and treatment. In the U.S., for example, the healthcare system supports substantial investments in diabetes care, coupled with a high prevalence of obesity, which contributes to the demand for GLP-1 analogues. Japan's well-structured regulatory framework and Germany's strong focus on medical innovation also foster the growth of the GLP-1 analogues market in these regions.

- Regulatory approvals are o the market success of GLP-1 analogues. In 2023, the U.S. FDA approved multiple new GLP-1 drugs for broader indications, including weight management and cardiovascular protection. Similar approvals have been granted in Europe and Asia, where regulatory bodies like the EMA and Japans PMDA are fast-tracking diabetes medications. Real-time data from the European Medicines Agency shows that as of 2024, over 15 GLP-1 products have received market authorization, ensuring their availability across key markets.

Global GLP-1 Analogues Market Segmentation

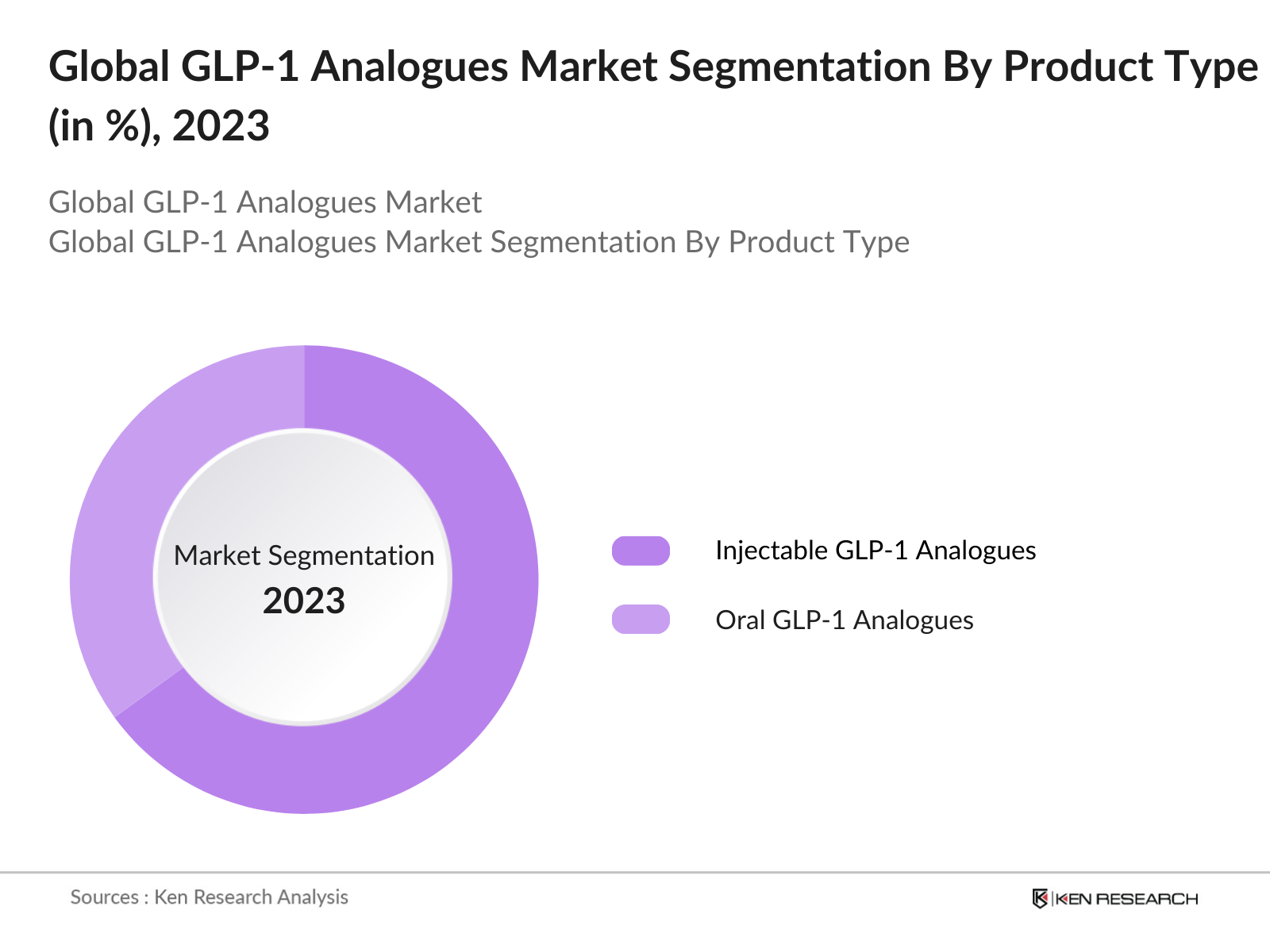

By Product Type: The Global GLP-1 Analogues market is segmented by product type into injectable GLP-1 analogues and oral GLP-1 analogues. Recently, injectable GLP-1 analogues have maintained a dominant market share due to their established efficacy in managing type 2 diabetes and associated weight loss benefits. Although oral formulations are gaining popularity for their ease of use, injectables like liraglutide and semaglutide remain highly preferred by healthcare providers for more complex cases where immediate impact is critical.

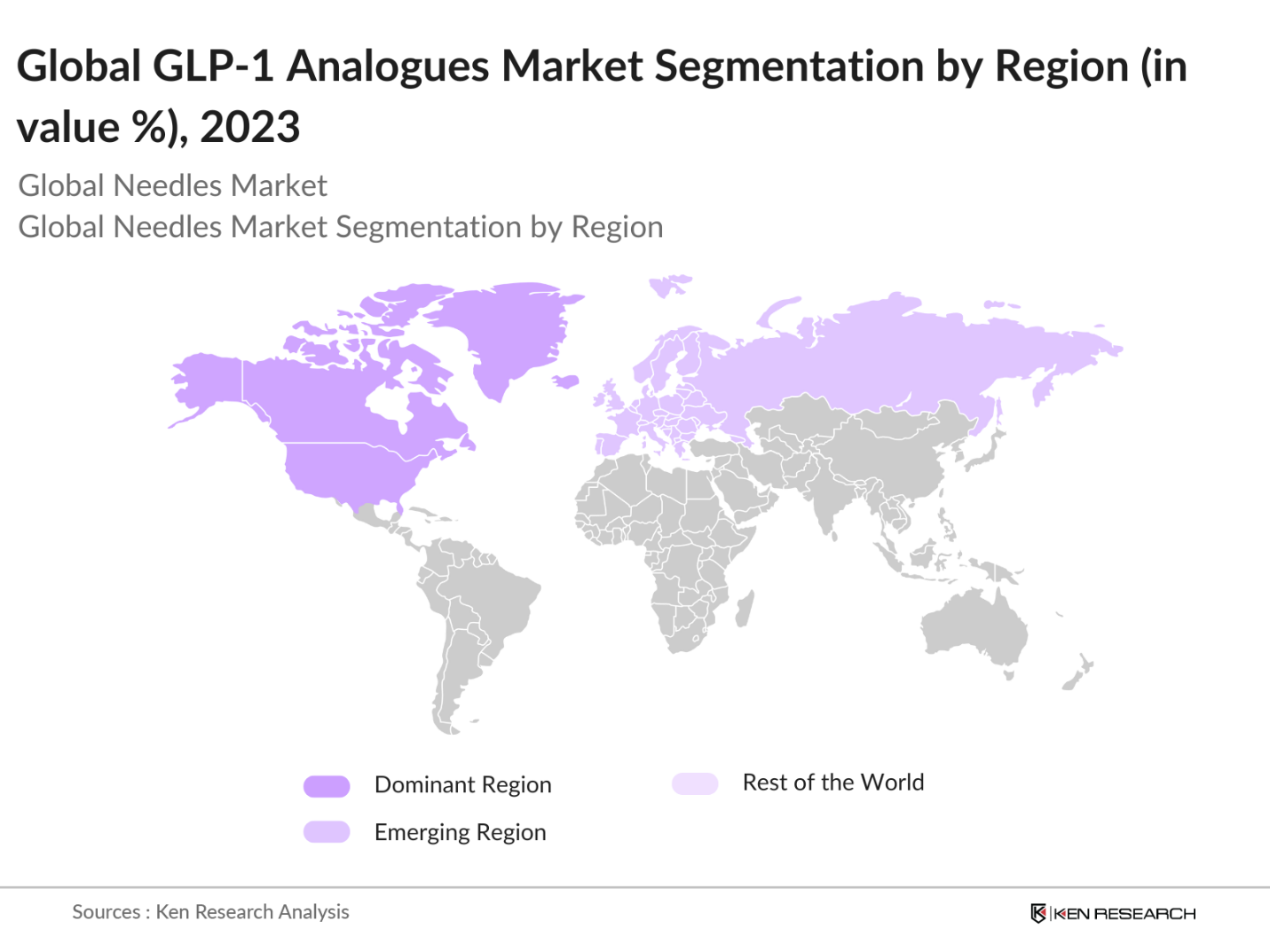

By Region: The market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is the dominant region, primarily due to its advanced healthcare infrastructure, high healthcare spending, and growing diabetic population. Europe follows closely, driven by regulatory support and growing awareness regarding the benefits of GLP-1 analogues in diabetes and obesity management. In Asia Pacific, the market is expanding rapidly due to increasing healthcare investments and a rising incidence of lifestyle-related diseases.

By Application: The market is segmented by application into type 2 diabetes management, obesity management, cardiovascular disease treatment, and renal disease management. Type 2 diabetes management dominates the application segment as the primary use of GLP-1 analogues, due to the global increase in diabetes cases. The widespread use of these analogues to regulate blood sugar levels, coupled with their additional benefit of promoting weight loss, has made them a key therapy in diabetes care.

Global GLP-1 Analogues Market Competitive Landscape

The Global GLP-1 Analogues market is characterized by the presence of a few dominant pharmaceutical companies, such as Novo Nordisk, Eli Lilly, and AstraZeneca. These companies have a strong focus on research and development, enabling them to lead in innovative drug delivery systems and next-generation therapies. The market is highly consolidated, with these key players holding significant market power due to their extensive product portfolios, robust distribution channels, and strong brand recognition.

Global GLP-1 Analogues Industry Analysis

Growth Drivers

- Increasing Incidence of Type 2 Diabetes: The rise in type 2 diabetes cases globally has significantly driven the demand for GLP-1 analogues. According to the International Diabetes Federation, over 537 million adults were living with diabetes in 2021, with numbers expected to continue growing. This epidemic is putting immense pressure on healthcare systems, making it crucial for governments and medical institutions to adopt effective treatments like GLP-1 analogues. These drugs not only regulate blood glucose but also reduce weight, a critical factor for diabetic patients. Real-time data from the World Health Organization highlights an annual increase in diabetes-related healthcare costs, currently standing at $966 billion2 Expansion of Injectable and Oral GLP-1.

- Expansion of Injectable and Oral GLP-1 Products: The continuous development of injectable and oral GLP-1 products has played a pivotal role in expanding treatment options for patients. As of 2024, drugs like semaglutide (oral) and dulaglutide (injectable) are gaining popularity due to their improved efficacy and patient compliance. Global health expenditure data from the World Bank shows that high-income countries have dedicated over $12,000 per capita annually toward healthcare, with diabetes treatment accounting for a large portion of this figure . The in of more patient-friendly administration forms, such as oral versions, is expected to support widespread adoption across various healthcare systems.

- Rising Healthcare Expenditure: As global healthcare expenditure rises, the cost of chronic disease management, including diabetes, is increasingly becoming a primary concern. According to 2023 data from the IMF, healthcare spending in countries like the U.S. reached upwards of $4.3 trillion, with diabetes care being a substantial part of these costs. The introduction of advanced therapies like GLP-1 analogues offers a cost-effective solution to managing long-term complications of diabetes. Real-time data from healthcare systems in Germany, for example, indicate that around 35 billion is spent annually on diabetes-related treatments, including GLP-1 analogues.

Market Challenges

- High Cost of GLP-1 Analogues: One of the major challenges in the adoption of GLP-1 analogues is their high cost, limiting accessibility, especially in low- and middle-income countries. As of 2023, the average yearly cost of GLP-1 therapy in the United States ranges from $8,000 to $12,000, making it difficult for patients without insurance coverage to afford. Reimbursement policies across different healthcare systems are inconsistent, with many countries facing budgetary constraints. IMF data shows that only a few emerging markets have the necessary healthcare funding to fully cover these expensive therapies, thus hindering broader market penetration.

- Side Effects and Safety Adverse: While GLP-1 analogues are effective, they come with notable side effects, including nausea, vomiting, and increased risk of pancreatitis. Some analogues also carry black box warnings due to potential thyroid cancer risks. The FDA and EMA continue to monitor adverse drug reactions reported through global pharmacovigilance systems. Data from the U.S. FDA in 2022 indicates that over 1,500 cases of serious side effects were reported for various GLP-1 products, impacting patient trust and prescribing behaviors.

Global GLP-1 Analogues Market Future Outlook

Over the next five years, the Global GLP-1 Analogues market is expected to demonstrate significant growth. This will be driven by increased prevalence of type 2 diabetes and obesity, expanding applications in cardiovascular and renal diseases, and ongoing innovations in drug delivery mechanisms. The market is also likely to benefit from the growing preference for oral formulations, improved reimbursement policies, and the rising healthcare expenditure across emerging economies, which will make these drugs more accessible to larger populations.

Opportunities

- Technological Advan Drug Delivery: Advancements in drug delivery technologies, particularly the development of long-acting GLP-1 formulations and oral administration methods, present substantial opportunities. The U.S. FDA approved the first oral GLP-1, semifluid, in 2020, and the market has since witnessed increased demand due to its ease of use compared to injectables. Government-backed health initiatives, such as the European Medicines Agencys 2023 directives for accelerating innovative diabetes treatments, further highlight these advancements. Countries like Japan, with over 70% of diabetic patients preferring oral medications, have seen a rise in prescriptions, reflecting the increasing demand for such innovations.

- Expanding Use in Cardiovascular and Kidney: Diseases studies have shown that GLP-1 analogues also have beneficial effects on cardiovascular and renal health. In 2022, a study published by the American Heart Association reported that GLP-1 analogues reduce major cardiovascular events by 26%, opening the door for their expanded use beyond diabetes. The same year, the FDA approved certain GLP-1 drugs for reducing cardiovascular risks in patients with type 2 diabetes. Furthermore, real-time data from the National Kidney Foundation shows that over 37 million Americans with kidney disease could potentially benefit from GLP-1 therapies.

Scope of the Report

|

Product Type |

Injectable GLP-1 Analogues Oral GLP-1 Analogues |

|

Application |

Type 2 Diabetes Management Obesity and Weight Management Cardiovascular Disease Renal Disease |

|

Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies |

|

End-User |

Hospitals Specialty Clinics Homecare Settings |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report

Hospitals and Specialty Clinics

Pharmaceutical Companies

Diabetes and Endocrinology Companies

Weight Management Companies

Healthcare Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EMA)

Health Insurance Provider Companies

Companies

Players Mentioned in the Report

Novo Nordisk A/S

Eli Lilly and Company

AstraZeneca

Sanofi

Pfizer Inc.

Boehringer Ingelheim

GlaxoSmithKline plc

Merck & Co., Inc.

Amgen Inc.

Johnson & Johnson

Table of Contents

1. Global GLP-1 Analogues Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global GLP-1 Analogues Market Size (In USD Mn)

2.1. Historical Market Size (Therapeutic Classes, Market Size In $)

2.2. Year-On-Year Growth Analysis (Growth Rate by Therapeutic Class)

2.3. Key Market Developments and Milestones (FDA Approvals, Clinical Trial Successes, Commercial Launches)

3. Global GLP-1 Analogues Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Incidence of Type 2 Diabetes

3.1.2. Expansion of Injectable and Oral GLP-1 Products

3.1.3. Rising Healthcare Expenditure

3.1.4. Growing Adoption in Weight Management

3.2. Market Challenges

3.2.1. High Cost of GLP-1 Analogues

3.2.2. Side Effects and Safety Concerns

3.2.3. Limited Access in Emerging Markets

3.3. Opportunities

3.3.1. Technological Advancements in Drug Delivery

3.3.2. Expanding Use in Cardiovascular

3.4. Trends

3.4.1. Transition from Injectables to Oral GLP-1 Analogues

3.4.2. Increasing Focus on Personalized Medicine (Patient Stratification, Precision Dosage)

3.4.3. Collaborative R&D between Pharma and Biotech Companies

3.5. Regulatory Environment

3.5.1. Global and Regional FDA Approvals

3.5.2. EMA and Other Regional Regulatory Requirements

3.5.3. Pricing and Reimbursement Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global GLP-1 Analogues Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Injectable GLP-1 Analogues

4.1.2. Oral GLP-1 Analogues

4.2. By Application (In Value %)

4.2.1. Type 2 Diabetes Management

4.2.2. Obesity and Weight Management

4.2.3. Cardiovascular Disease

4.2.4. Renal Disease

4.3. By Distribution Channel (In Value %)

4.3.1. Hospital Pharmacies

4.3.2. Retail Pharmacies

4.3.3. Online Pharmacies

4.4. By End-User (In Value %)

4.4.1. Hospitals

4.4.2. Specialty Clinics

4.4.3. Homecare Settings

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global GLP-1 Analogues Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Novo Nordisk A/S

5.1.2. Eli Lilly and Company

5.1.3. AstraZeneca

5.1.4. Sanofi

5.1.5. Pfizer Inc.

5.1.6. Boehringer Ingelheim

5.1.7. GlaxoSmithKline plc

5.1.8. Merck & Co., Inc.

5.1.9. Amgen Inc.

5.1.10. Johnson & Johnson

5.1.11. Bristol-Myers Squibb

5.1.12. Takeda Pharmaceuticals

5.1.13. Novartis AG

5.1.14. Teva Pharmaceutical Industries Ltd.

5.1.15. Biocon Ltd.

5.2. Cross Comparison Parameters (Revenue, R&D Expenditure, Product Pipeline, Market Penetration, Innovation Index, Sales Distribution, Pricing Strategies, Growth Initiatives)

5.3. Market Share Analysis (By Revenue, By Therapeutic Class, By Region)

5.4. Strategic Initiatives (Partnerships, Licensing Agreements, Market Entry Strategies)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. Global GLP-1 Analogues Market Regulatory Framework

6.1. Drug Approval Pathways

6.2. Pricing Regulations

6.3. Clinical Trial Requirements

6.4. Reimbursement Policies

6.5. Environmental and Safety Compliance

7. Global GLP-1 Analogues Future Market Size (In USD Mn)

7.1. Future Market Size Projections (Product Type, Distribution Channel)

7.2. Key Factors Driving Future Market Growth (Increasing Prevalence of Diabetes, Technological Advancements)

8. Global GLP-1 Analogues Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global GLP-1 Analogues Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Addressable Market (SAM), Serviceable Obtainable Market (SOM)

9.2. Customer Cohort Analysis (Diabetic Population, Obesity Patient Population)

9.3. Marketing Initiatives (Campaign Effectiveness, Digital Marketing Strategies)

9.4. White Space Opportunity Analysis (Emerging Regions, Untapped End-Users)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves building an exhaustive ecosystem map of stakeholders in the Global GLP-1 Analogues Market. This includes conducting detailed secondary research using various databases and publicly available information to identify key variables affecting market dynamics, such as healthcare expenditure, diabetes prevalence, and drug pricing.

Step 2: Market Analysis and Construction

The next step involves analyzing historical data to assess market penetration, product demand trends, and the development of pricing structures. Revenue estimates are cross-verified through detailed study of market reports and databases. Sales trends of major players are tracked to ensure data reliability.

Step 3: Hypothesis Validation and Expert Consultation

During this phase, hypotheses about market trends are formulated and validated through interviews with industry experts from leading pharmaceutical companies. Their insights provide practical perspectives that complement the data collected from secondary sources.

Step 4: Research Synthesis and Final Output

The final step involves direct discussions with GLP-1 analogue manufacturers and healthcare providers. This ensures that product demand, sales performance, and consumer preferences are fully understood, providing a comprehensive analysis of the market.

Frequently Asked Questions

01. How big is the Global GLP-1 Analogues Market?

The Global GLP-1 Analogues Market is valued at USD 45 billion, driven by the increasing prevalence of type 2 diabetes, obesity, and growing applications of these analogues in cardiovascular and renal care.

02. What are the challenges in the Global GLP-1 Analogues Market?

Challenges in the market include high pricing of GLP-1 analogues, limited access in low-income countries, and adverse drug reactions, which may hinder wider adoption.

03. Who are the major players in the Global GLP-1 Analogues Market?

Key players include Novo Nordisk, Eli Lilly, AstraZeneca, Sanofi, and Pfizer, who dominate the market due to their extensive product portfolios, innovative formulations, and strong R&D focus.

04. What drives the growth of the Global GLP-1 Analogues Market?

Growth is driven by increasing diabetes and obesity rates, expanding healthcare expenditure, and innovations in drug delivery systems, particularly the development of oral GLP-1 analogues.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.