Global Glucosamine Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD8250

October 2024

92

About the Report

Global Glucosamine Market Overview

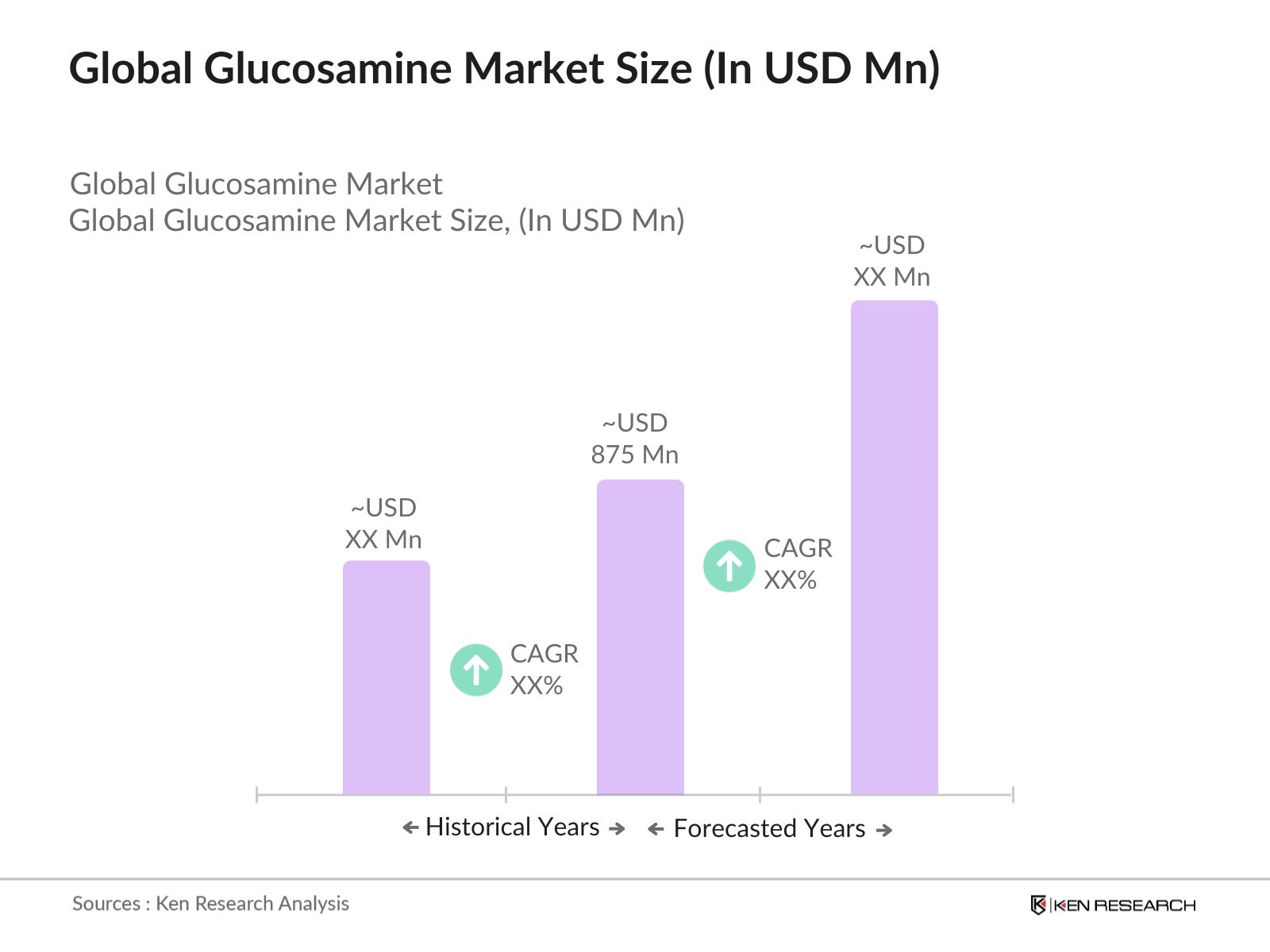

- The global glucosamine market is valued at USD 875 million, driven by increasing demand for joint health supplements and the rising aging population, particularly in developed economies. Glucosamine is widely used in the management of osteoarthritis and other joint disorders, which has accelerated its adoption in nutraceuticals. Growing consumer awareness regarding preventative healthcare and the inclusion of glucosamine in functional foods are further contributing to market growth. These factors underscore the importance of glucosamine in the global dietary supplements market.

- Countries like the United States, Japan, and Germany dominate the glucosamine market. The United States leads due to the high demand for dietary supplements and an aging population. Japan's dominance is linked to its robust functional food market, as well as regulatory support for glucosamine usage in dietary supplements. Germany, being part of the European Union, benefits from high consumer awareness and stringent regulations promoting the use of safe and effective supplements.

- In Europe, the European Food Safety Authority (EFSA) regulates the marketing of glucosamine supplements. Products containing glucosamine must comply with Regulation (EC) No 1924/2006, which governs the use of health claims. According to EFSA, only health claims that are scientifically substantiated are allowed, which has posed a challenge for some companies. In 2023, EFSA approved 18 new glucosamine products for sale in the EU, reflecting a growing market but also highlighting the regulatory hurdles in making health claims for glucosamine.

Global Glucosamine Market Segmentation

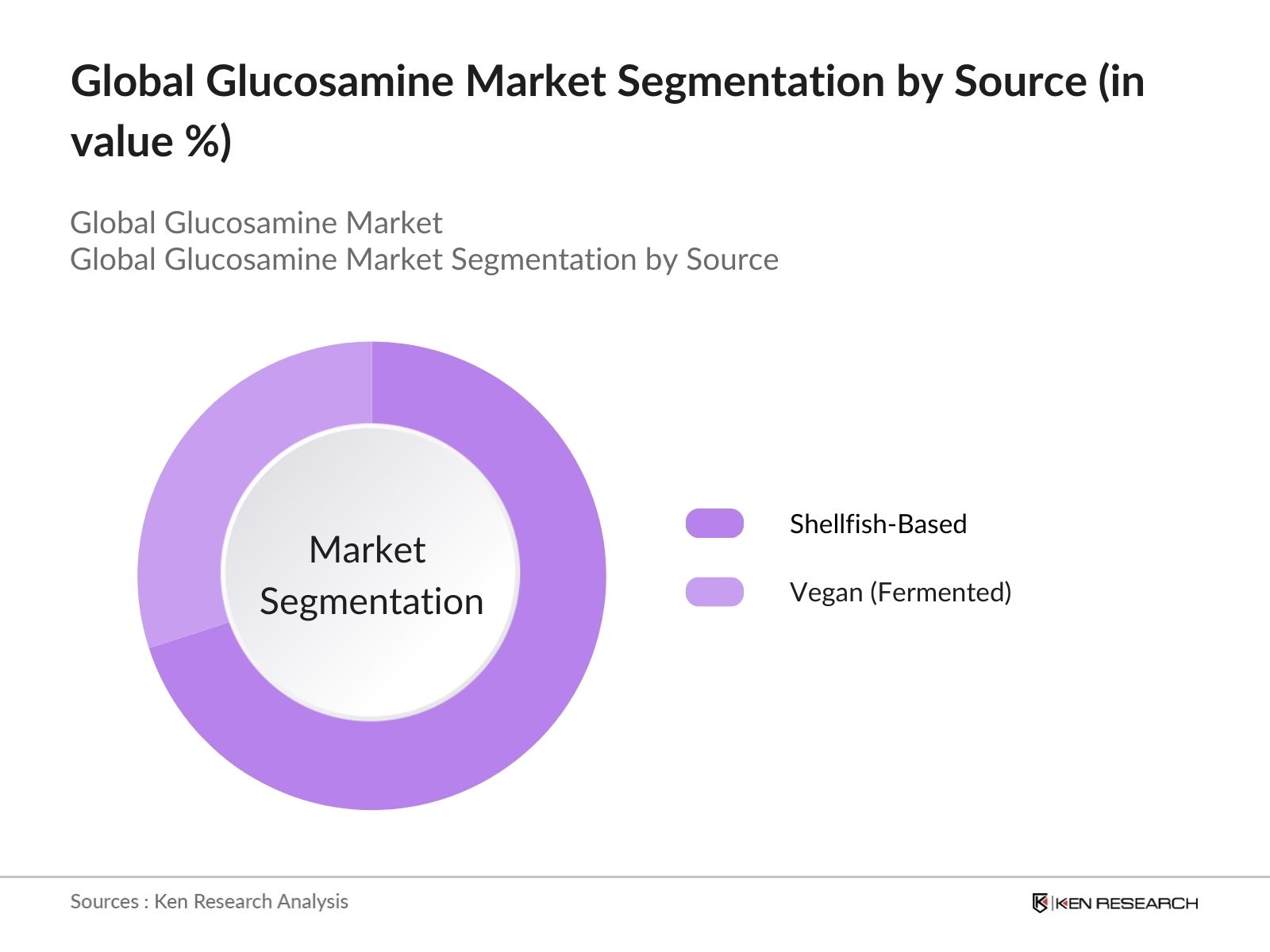

- By Source: The global glucosamine market is segmented by source into shellfish-based glucosamine and vegan (fermented) glucosamine. Shellfish-based glucosamine holds a dominant market share due to its widespread availability and cost-effectiveness. However, vegan glucosamine is rapidly gaining traction, especially among consumers who prefer plant-based alternatives for ethical and dietary reasons. With the growing trend toward veganism and concerns over shellfish allergies, vegan glucosamine is expected to grow substantially.

- By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by high consumer awareness, advanced healthcare infrastructure, and a strong presence of dietary supplement manufacturers. The Asia-Pacific region, particularly Japan, is experiencing growth due to the increasing consumption of glucosamine-infused functional foods.

- By Form: The market is segmented by form into powder, tablet, and liquid. Tablets dominate the market due to their convenience, long shelf life, and established consumer trust in traditional supplement forms. Tablets are preferred in the nutraceutical sector, especially in North America and Europe. On the other hand, liquid glucosamine is gaining popularity among consumers who prefer quick absorption and ease of consumption.

Global Glucosamine Market Competitive Landscape

The global glucosamine market is dominated by both regional and international players. These companies compete based on factors such as product portfolio, innovation, pricing strategies, and distribution networks. The competitive landscape highlights a mix of established pharmaceutical companies and specialized dietary supplement manufacturers. For instance, companies like Cargill and Glanbia dominate due to their extensive R&D capabilities and large-scale production capacities.

|

Company Name |

Year of Establishment |

Headquarters |

No. of Employees |

Annual Revenue |

Product Portfolio |

R&D Investment |

Global Presence |

Strategic Partnerships |

Certifications |

|

Cargill, Inc. |

1865 |

Minneapolis, USA |

|||||||

|

Glanbia Plc |

1997 |

Kilkenny, Ireland |

|||||||

|

Nutramax Laboratories |

1992 |

South Carolina, USA |

|||||||

|

TSI Group Ltd |

1996 |

Shanghai, China |

|||||||

|

Zhejiang Aoxing Biotechnology Co. |

2000 |

Zhejiang, China |

Global Glucosamine Industry Analysis

Growth Drivers

- Increased Demand for Joint Health Supplements: The rising awareness around joint health, especially among aging populations, has driven demand for glucosamine supplements. According to global health data, the elderly population in 2024 has reached 10.3% of the worlds total, especially in developed countries like Japan and Germany, where the aging population exceeds 28%. This increased elderly demographic has pushed demand for joint health supplements, with glucosamine at the forefront due to its established role in maintaining cartilage health. WHO data highlights that osteoarthritis affects over 528 million people globally, further solidifying the demand for glucosamine.

- Aging Population: The global population of people aged 60 years and older is expected to rise significantly, with 1.2 billion individuals in this age group in 2024. Countries like China and India have seen substantial increases in their elderly population, putting pressure on healthcare systems. Joint health products like glucosamine are seen as preventive measures for age-related joint degeneration. According to the World Bank, life expectancy is steadily increasing, and populations aged 65 and older have grown by more than 3.5 million per year, adding to the surge in demand for glucosamine-based supplements.

- Rising Healthcare Awareness: Increased awareness about preventive healthcare is another key driver for glucosamine consumption. A 2023 survey by the Ministry of Health in Japan showed a 20% increase in healthcare expenditure on preventive treatments, including nutraceuticals, of which glucosamine is a major component. Healthcare campaigns in emerging economies such as India and Indonesia, which focus on preventive health, have further accelerated the demand for these products. The IMF reports that healthcare expenditure in emerging markets grew by $200 billion in the past two years, boosting the nutraceutical industry, including glucosamine supplements.

Market Restraints

- Regulatory Constraints: One of the major challenges facing the glucosamine market is regulatory compliance across regions. In the United States, glucosamine is classified as a dietary supplement, subject to FDA guidelines. However, in the European Union, the European Food Safety Authority (EFSA) has stricter guidelines for approving health claims, making it harder for companies to market glucosamine as a health supplement. According to the EU's regulatory body, only 43% of submitted health claims for glucosamine have been approved for marketing purposes in the last three years, making regulatory approval a key hurdle.

- Supply Chain Disruptions: The global supply chain has faced significant disruptions due to geopolitical tensions and pandemic-related issues. Key raw materials for glucosamine production, primarily derived from shellfish, have faced delays in shipping from major exporters like China and India. According to the World Bank, international trade disruptions have affected nearly 25% of the raw material supply for the nutraceutical industry in 2023. The rising cost of logistics and shipping has compounded the problem, resulting in delays and inflated production costs for glucosamine supplements.

Global Glucosamine Market Future Outlook

Over the next few years, the global glucosamine market is expected to experience sustained growth, driven by the aging population, increased prevalence of joint-related disorders, and rising awareness of preventive healthcare measures. The demand for vegan and fermented glucosamine is likely to increase as more consumers adopt plant-based diets. Additionally, advancements in the formulation of glucosamine supplements, especially in the nutraceutical industry, will contribute to its wider adoption.

Market Opportunities

- R&D in Bio-based Glucosamine: With increasing consumer demand for vegan and bio-based alternatives, R&D in plant-based glucosamine has expanded significantly. Governments and private enterprises in North America and Europe are investing heavily in research to develop glucosamine derived from non-animal sources. In 2023, the European Union allocated $120 million for research into bio-based alternatives for nutraceuticals, with glucosamine as a primary focus. This presents a significant opportunity for innovation and market expansion, particularly as consumer preferences shift towards sustainable and ethically sourced products.

- Expanding Markets in Asia-Pacific: Asia-Pacific has seen a rising demand for glucosamine, driven by increasing healthcare expenditure and an aging population. Japan, China, and South Korea are leading the way, with Japans healthcare expenditure reaching $470 billion in 2023, partly driven by demand for supplements like glucosamine. Additionally, China's population aged over 60 crossed 280 million in 2024, further fueling the need for joint health products. This creates a fertile ground for the expansion of the glucosamine market, with significant growth potential in other emerging Asian economies like Vietnam and Indonesia.

Scope of the Report

|

By Source |

Shellfish-based, Vegan (Fermented) |

|

By Form |

Powder, Tablet, Liquid |

|

By Application |

Joint Health Supplements, Sports Nutrition, Skin Care, Functional Foods |

|

By Distribution Channel |

Online Retail, Pharmacies, Specialty Stores, Supermarkets/Hypermarkets |

|

By Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Dietary Supplement Manufacturers

Nutraceutical Companies

Healthcare Providers

Sports Nutrition Brands

Functional Food Producers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EFSA)

Pharmacy Chains and Retailers

Companies

Players Mentioned in the Report:

Cargill, Inc.

Glanbia Plc

Nutramax Laboratories

TSI Group Ltd

Zhejiang Aoxing Biotechnology Co.

Blackmores Limited

GNC Holdings, Inc.

Golden-Shell Pharmaceutical Co., Ltd.

Martin Bauer Group

Panvo Organics Pvt. Ltd.

Bio-Tech Pharmacal, Inc.

Health World Limited

Schiff Nutrition International, Inc.

NOW Health Group, Inc.

Aspen Nutritionals

Table of Contents

1. Global Glucosamine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Glucosamine Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Glucosamine Market Analysis

3.1 Growth Drivers (Increased Demand for Joint Health Supplements, Aging Population, Rising Healthcare Awareness, Expansion of Nutraceuticals Industry)

3.2 Market Challenges (Regulatory Constraints, Supply Chain Disruptions, High Raw Material Costs, Limited Consumer Awareness in Emerging Markets)

3.3 Opportunities (R&D in Bio-based Glucosamine, Expanding Markets in Asia-Pacific, Rising Demand for Sports Nutrition, Synergistic Supplements with Glucosamine)

3.4 Trends (Shift Towards Vegan Glucosamine, Increased Integration of Glucosamine in Functional Foods, Growth in Online Distribution Channels)

3.5 Government Regulations (FDA Guidelines, European Food Safety Authority (EFSA) Standards, Japans FOSHU Approval, U.S. Dietary Supplement Regulations)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Global Glucosamine Market Segmentation

4.1 By Source (In Value %)

4.1.1 Shellfish-based Glucosamine

4.1.2 Vegan (Fermented) Glucosamine

4.2 By Form (In Value %)

4.2.1 Powder

4.2.2 Tablet

4.2.3 Liquid

4.3 By Application (In Value %)

4.3.1 Joint Health Supplements

4.3.2 Sports Nutrition

4.3.3 Skin Care Products

4.3.4 Functional Foods

4.4 By Distribution Channel (In Value %)

4.4.1 Online Retail

4.4.2 Pharmacies

4.4.3 Specialty Stores

4.4.4 Supermarkets/Hypermarkets

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Glucosamine Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Cargill, Inc.

5.1.2 Glanbia Plc

5.1.3 TSI Group Ltd

5.1.4 Schiff Nutrition International, Inc.

5.1.5 NOW Health Group, Inc.

5.1.6 Nutramax Laboratories Consumer Care, Inc.

5.1.7 Blackmores Limited

5.1.8 GNC Holdings, Inc.

5.1.9 Zhejiang Aoxing Biotechnology Co., Ltd.

5.1.10 Bio-Tech Pharmacal, Inc.

5.1.11 Panvo Organics Pvt. Ltd.

5.1.12 Health World Limited

5.1.13 Martin Bauer Group

5.1.14 Golden-Shell Pharmaceutical Co., Ltd.

5.1.15 Aspen Nutritionals

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Market Share, Number of Employees, Global Presence, R&D Investments, Partnerships, Product Innovations)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Product Launches, Market Expansions, Certifications)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. Global Glucosamine Market Regulatory Framework

6.1 International Standards (FDA, EFSA)

6.2 Compliance Requirements (Labeling, Ingredient Restrictions, Safety Testing)

6.3 Certification Processes (GMP, Organic, Non-GMO)

7. Global Glucosamine Market Future Projections (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Glucosamine Market Future Segmentation

8.1 By Source

8.2 By Form

8.3 By Application

8.4 By Distribution Channel

8.5 By Region

9. Global Glucosamine Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we identify the critical variables influencing the glucosamine market, including supply chain logistics, raw material availability (shellfish), and consumer behavior patterns. Data is gathered using proprietary databases and secondary research sources.

Step 2: Market Analysis and Construction

Historical market data is analyzed to establish a baseline for market growth trends. The key focus areas include market penetration by form (tablet, powder, liquid) and region-specific revenue contributions, which are essential in understanding market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are validated through interviews with leading dietary supplement manufacturers and glucosamine suppliers. These consultations provide real-time insights into operational challenges, emerging trends, and future market expectations.

Step 4: Research Synthesis and Final Output

The final output includes a synthesis of expert insights and statistical data to produce a comprehensive report on the global glucosamine market. This involves corroborating the data through top-down and bottom-up approaches to ensure accuracy.

Frequently Asked Questions

1. How big is the Global Glucosamine Market?

The global glucosamine market is valued at USD 875 million, primarily driven by the aging population and increasing demand for joint health supplements.

2. What are the challenges in the Global Glucosamine Market?

Key challenges include regulatory hurdles, such as obtaining FDA approval, supply chain disruptions for shellfish-derived glucosamine, and fluctuating raw material prices.

3. Who are the major players in the Global Glucosamine Market?

Major players include Cargill, Glanbia, Nutramax Laboratories, TSI Group, and Zhejiang Aoxing Biotechnology, dominating the market due to their expansive product portfolios and large-scale operations.

4. What are the growth drivers of the Global Glucosamine Market?

The market is propelled by the growing prevalence of osteoarthritis, increasing healthcare awareness, and the expansion of the nutraceutical industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.