Global Golf Ball Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6990

December 2024

83

About the Report

Global Golf Ball Market Overview

- The global golf ball market is valued at USD 1.4 billion, driven by rising participation in the sport, particularly in key markets such as the United States and Japan. Increasing disposable incomes, golf tourism, and the rise of high-net-worth individuals have amplified the demand for premium and customized golf balls. The market has benefited from innovations in ball design, optimizing distance and performance, particularly for professional and amateur players. The adoption of technology, such as smart golf balls, is also contributing to the sector's expansion.

- The market is dominated by the United States, Japan, and South Korea due to their established golf culture and infrastructure. In these regions, golf is a highly popular recreational activity, supported by a large number of courses and a professional player base. The U.S. stands out because of its robust demand from both leisure players and professional tournaments, while Japan and South Korea lead due to the integration of golf in corporate networking and leisure activities.

- Environmental concerns are driving demand for sustainable products across industries, including the golf ball market. Manufacturers are increasingly focused on developing biodegradable or recyclable golf balls as sustainability awareness grows. According to the World Bank, environmental regulations tightened by 5.4% globally in 2023, compelling companies to adopt eco-friendly practices. This trend is particularly prominent in markets like Europe and North America, where consumers are actively seeking products that align with their environmental values.

Global Golf Ball Market Segmentation

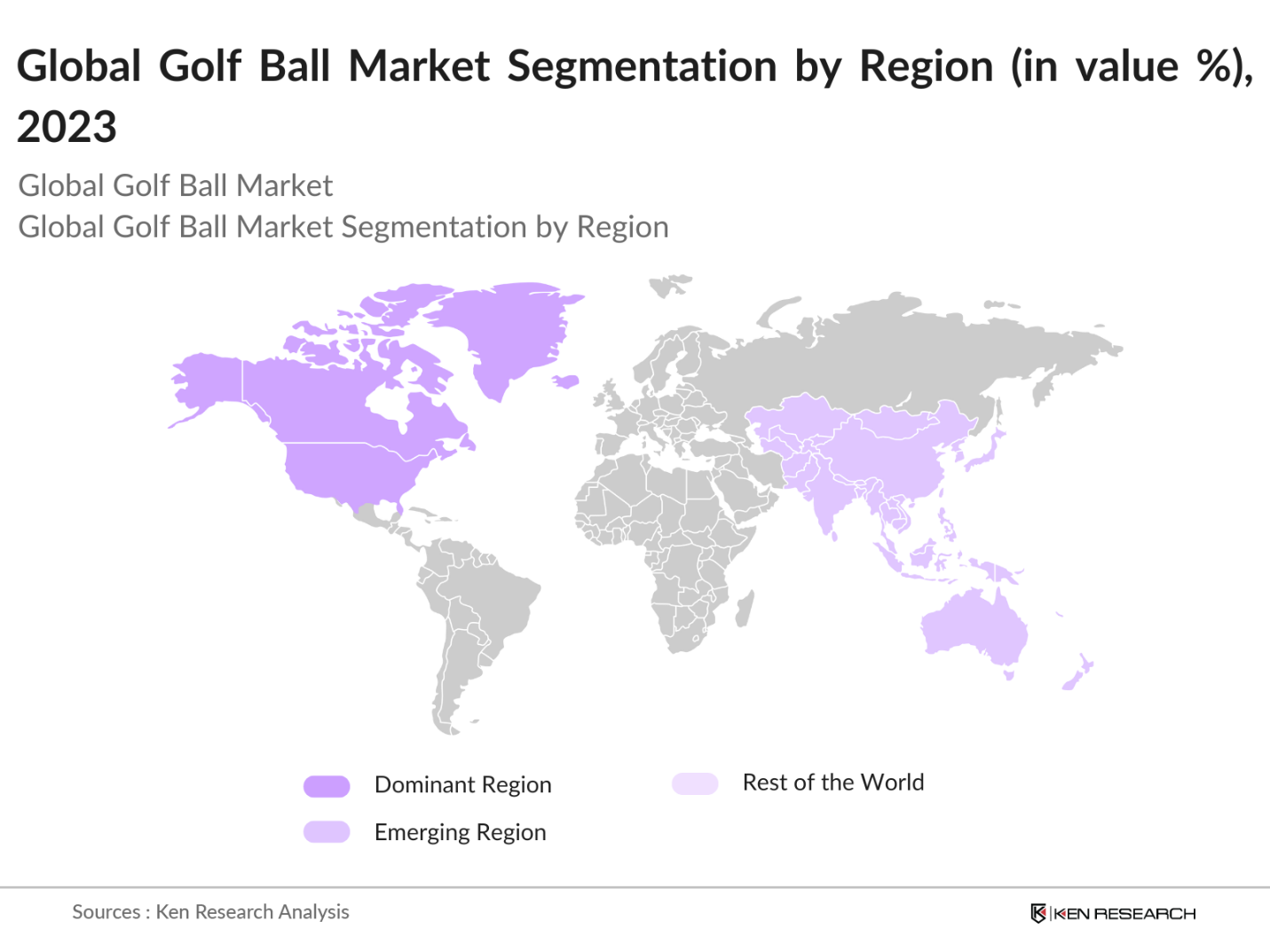

By Region: The market is further segmented by regions including North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market due to its well-established golfing culture, with the U.S. being home to over 15,000 golf courses. The Asia-Pacific region, especially Japan and South Korea, is growing rapidly as golf becomes increasingly popular among business professionals and the affluent population.

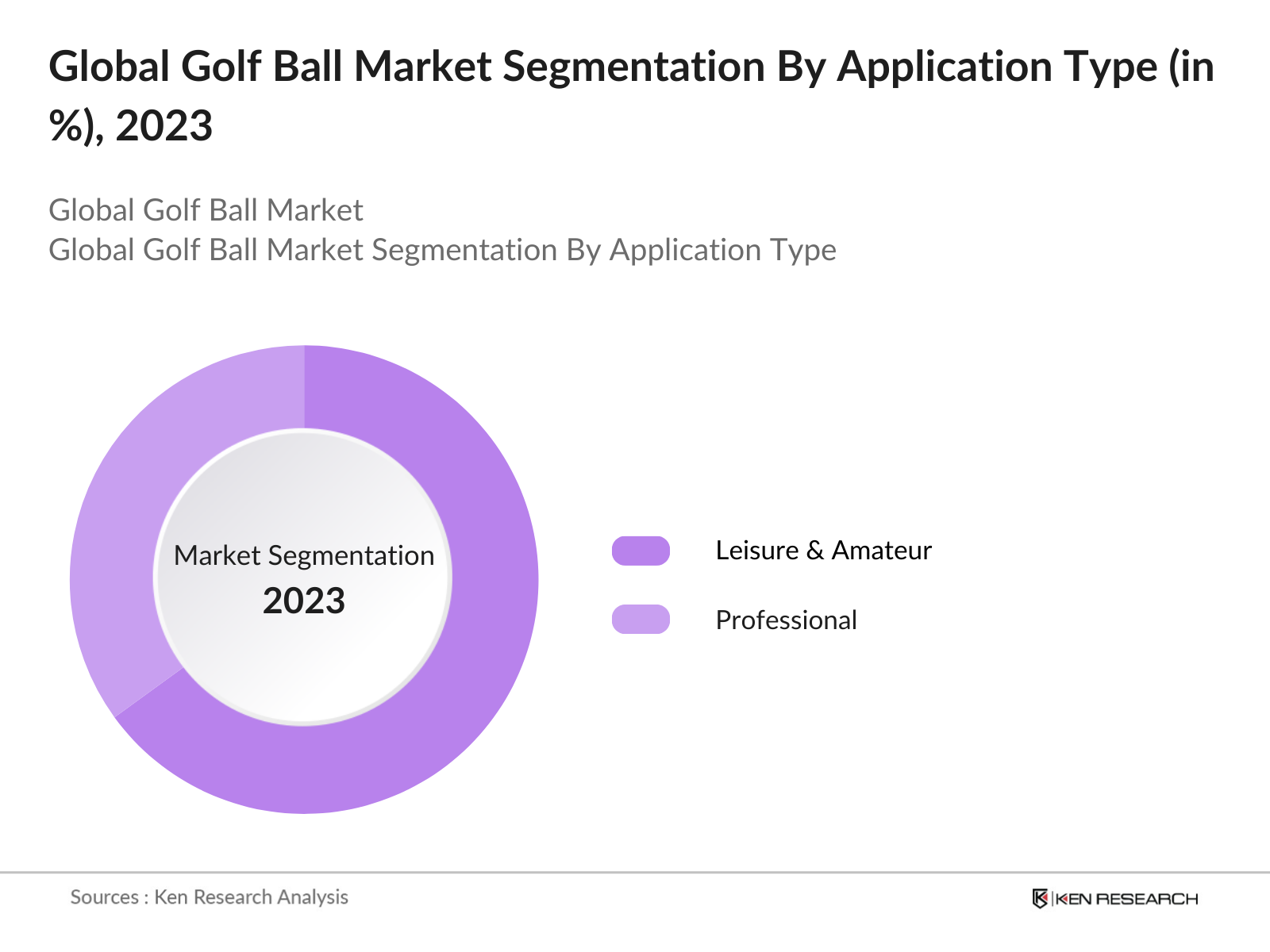

By Application: The global golf ball market is also segmented by application into leisure & amateur and professional categories. The leisure & amateur segment holds the largest share, driven by a vast base of casual players who engage in the sport for recreation rather than competition. Golf is increasingly seen as a social activity, particularly in countries with large golfing communities, which bolsters demand for high-volume, lower-cost golf balls.

Global Golf Ball Market Competitive Landscape

The global golf ball market is highly consolidated, with a few dominant players controlling a significant share of the market. Companies such as Titleist, Callaway Golf, and Bridgestone Golf have long established brand loyalty, with extensive product portfolios catering to both professionals and amateurs. These companies also lead the market due to continuous innovations in ball design and material technology, enhancing performance metrics such as distance, control, and durability.

|

Company |

Year Established |

Headquarters |

Product Innovation |

Sustainability Efforts |

Revenue (USD Mn) |

Global Reach |

R&D Investment |

Key End-Users |

|

Titleist |

1932 |

Fairhaven, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Callaway Golf |

1982 |

Carlsbad, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Bridgestone Golf |

1931 |

Tokyo, Japan |

_ |

_ |

_ |

_ |

_ |

_ |

|

TaylorMade Golf |

1979 |

Carlsbad, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Wilson Sporting Goods |

1913 |

Chicago, USA |

_ |

_ |

_ |

_ |

_ |

_ |

Global Golf Ball Market Industry Analysis

Growth Drivers

Increasing Participation in Golf: Globally, approximately 60 million people participated in golf as of 2023, with North America and Europe accounting for over 50% of these players, according to the International Golf Federation. The rise of leisure sports, coupled with golf's status as a prestigious sport, has been driving this trend. Middle-income earners in countries like China and India are now more inclined to participate in sports that offer both social prestige and health benefits. These demographic shifts are fueling market growth, particularly for entry-level golf balls.

Rising Disposable Income: In 2023, global disposable income levels increased by 3.2%, as per the IMF, with significant contributions from emerging economies. This increase has positively impacted leisure spending, including on sports equipment like golf balls. Middle-class growth in countries such as India and Brazil is notable, where expanding consumer power supports premium product purchases. Additionally, the U.S. and Japan remain the largest markets for high-end golf equipment due to their well-established golf culture and high-income consumer bases.

Expanding Golf Courses: According to the World Bank, between 2022 and 2024, over 100 new golf courses were opened globally, particularly in countries aiming to boost tourism and real estate development, such as the UAE, Thailand, and Vietnam. These countries are capitalizing on golf's rising popularity to attract international tourists, contributing to a surge in demand for golf-related equipment. The expansion of golf courses in these regions is supported by government initiatives promoting tourism and real estate development.

Market Challenges:

- High Costs of Golf Equipment: The price of golf equipment, including golf balls, remains a barrier to broader participation, particularly in emerging markets where discretionary spending on sports remains limited. According to the World Bank, economic constraints in low-income countries reduced participation in premium sports like golf by 2% in 2023. Additionally, golf ball prices have not decreased significantly, making it difficult for entry-level players in price-sensitive regions to afford high-quality products.

- Declining Youth Interest in Traditional Sports: A shift in youth preferences toward modern and digital-based sports, such as esports, has negatively impacted traditional sports like golf. According to the IMF, participation in traditional sports among youth (ages 15-24) declined by 4% in 2023 in key markets like the U.S., Europe, and Japan. This trend poses a challenge for the long-term growth of the golf ball market as the younger demographic is less likely to adopt the sport unless efforts are made to modernize its appeal.

Global Golf Ball Market Future Outlook

Over the next five years, the global golf ball market is expected to witness steady growth, driven by rising interest in golf among both young and middle-aged individuals. The expanding popularity of golf tourism, particularly in Asia-Pacific regions, coupled with increased participation in golf tournaments, will continue to drive demand for premium and professional-grade golf balls. Further, advancements in technology, such as smart golf balls that help analyze players performance, will open new avenues for market expansion. Moreover, manufacturers are likely to focus on eco-friendly materials and sustainable production to meet increasing consumer awareness regarding environmental impact.

Opportunities

Growing Interest in Golf Globally: Golf is becoming more popular globally, particularly in developing markets such as China, India, and the UAE. According to the International Golf Federation, the number of registered golfers in these countries grew by 12% in 2023. The growing interest in international golf tournaments, particularly in Asia, is driving market expansion, with new consumer bases creating opportunities for golf ball manufacturers to enter previously untapped markets.

Customization and Personalization of Golf Balls: Customization options, such as personalized logos and unique ball designs, are gaining traction among both amateur and professional golfers. As of 2023, 18% of golfers in North America opted for personalized equipment, including golf balls, according to the International Golf Federation. This trend is driven by consumers' desire for differentiated products, creating a niche market segment for manufacturers to target with premium, personalized golf ball options.

Scope of the Report

|

By Product Type |

Two-Piece Golf Balls Three-Piece Golf Balls Four-Piece Golf Balls Others |

|

By Application |

Leisure & Amateur Professional |

|

By Material Type |

Urethane Ionomer Surlyn Eco-Friendly Materials |

|

By Distribution Channel |

Offline (Sports Stores, Golf Courses) Online (E-commerce, Company Websites) |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Golf Ball Compnaies

Golf Course Companies

Sporting Goods Industries

E-commerce Companies

Professional Golf Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agencies, Sports Equipment Standards Bodies)

Golfing Tourism Industries

Companies

Players Mentioned in the Report:

Titleist

Callaway Golf Company

Bridgestone Golf, Inc.

TaylorMade Golf Company, Inc.

Wilson Sporting Goods Co.

Srixon

Volvik

Vice Golf

Mizuno Corporation

Nike Golf

Dixon Golf

Pinnacle Golf

Kirkland Signature

Honma Golf Co. Ltd.

Bridgestone Corporation

Table of Contents

1. Global Golf Ball Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Golf Ball Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Golf Ball Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Participation in Golf (Leisure Trends, Sports Culture)

3.1.2. Rising Disposable Income (Middle-Class Growth, Premium Purchases)

3.1.3. Expanding Golf Courses (Tourism, Real Estate Development)

3.1.4. Technological Advancements in Golf Ball Design (Aero-dynamic Enhancements, Distance Optimization)

3.2. Market Challenges

3.2.1. High Costs of Golf Equipment (Economic Constraints, Price Elasticity)

3.2.2. Declining Youth Interest in Traditional Sports (Shifts in Sports Preferences)

3.2.3. Environmental Impact of Golf Ball Materials (Sustainability Concerns)

3.3. Opportunities

3.3.1. Growing Interest in Golf Globally (Emerging Markets, International Tournaments)

3.3.2. Customization and Personalization of Golf Balls (Consumer Preferences, Niche Marketing)

3.3.3. Eco-friendly Golf Balls (Sustainability Initiatives, Green Materials)

3.4. Trends

3.4.1. Use of Data and Analytics in Golf Ball Performance (Data-Driven Training, AI)

3.4.2. Smart Golf Balls with Embedded Sensors (IoT Integration)

3.4.3. Expansion of E-commerce Channels (Direct-to-Consumer, Digital Sales Growth)

3.5. Government Regulations

3.5.1. Regulatory Standards for Golf Ball Manufacturing (ISO Certification, Material Safety)

3.5.2. Import-Export Tariffs on Sports Goods (Trade Policies)

3.5.3. Environmental Compliance (Sustainable Production, Recycling Policies)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Golf Ball Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Two-Piece Golf Balls

4.1.2. Three-Piece Golf Balls

4.1.3. Four-Piece Golf Balls

4.1.4. Others

4.2. By Application (In Value %)

4.2.1. Leisure & Amateur

4.2.2. Professional

4.3. By Material Type (In Value %)

4.3.1. Urethane

4.3.2. Ionomer

4.3.3. Surlyn

4.3.4. Eco-Friendly Materials

4.4. By Distribution Channel (In Value %)

4.4.1. Offline (Sports Stores, Golf Courses)

4.4.2. Online (E-commerce, Company Websites)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Golf Ball Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Titleist

5.1.2. Callaway Golf Company

5.1.3. Bridgestone Golf, Inc.

5.1.4. TaylorMade Golf Company, Inc.

5.1.5. Srixon

5.1.6. Wilson Sporting Goods Co.

5.1.7. Volvik

5.1.8. Vice Golf

5.1.9. Mizuno Corporation

5.1.10. Nike Golf

5.1.11. Bridgestone Corporation

5.1.12. Dixon Golf

5.1.13. Pinnacle Golf

5.1.14. Kirkland Signature

5.1.15. Honma Golf Co. Ltd.

5.2. Cross Comparison Parameters (Headquarters, Product Innovation, Number of Patents, Sustainability Efforts, Market Share, Revenue, Distribution Channels, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Golf Ball Market Regulatory Framework

6.1. Environmental Standards for Golf Ball Disposal and Recycling

6.2. Compliance with Sports Equipment Regulations

6.3. Certification Processes for Eco-friendly Golf Balls

7. Global Golf Ball Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Golf Ball Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Material Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Golf Ball Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Customer Cohort Analysis

9.3. Product Development and Marketing Strategies

9.4. White Space Opportunities for Market Expansion

Research Methodology

Step 1: Identification of Key Variables

In this phase, we develop a detailed ecosystem map that includes all relevant stakeholders within the global golf ball market. Extensive desk research, leveraging both proprietary databases and secondary sources, is conducted to compile data on major variables that influence market trends and growth drivers. Key metrics, such as production capacity and technological advancements, are analyzed.

Step 2: Market Analysis and Construction

A detailed analysis of historical data is performed to evaluate market penetration and revenue generation in major regions, such as North America and Asia-Pacific. The ratio of demand from professional and recreational players is also assessed. Data is triangulated using insights from golf ball manufacturers to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

We then develop market hypotheses, which are validated through interviews with industry experts, such as golf equipment manufacturers and sporting goods retailers. These consultations provide deeper insights into consumer preferences, product performance, and demand trends.

Step 4: Research Synthesis and Final Output

The final phase of research synthesis involves combining top-down and bottom-up approaches to create a comprehensive report on the global golf ball market. Direct interactions with key manufacturers ensure that the final analysis is both accurate and detailed, covering product innovations, consumer preferences, and regional dynamics.

Frequently Asked Questions

01 How big is the Global Golf Ball Market?

The global golf ball market was valued at USD 1.4 billion, driven by increasing participation in golf and innovations in ball design, such as smart golf balls.

02 What are the challenges in the Global Golf Ball Market?

Challenges include the high cost of premium golf balls, environmental concerns regarding ball disposal, and the declining youth interest in traditional sports like golf.

03 Who are the major players in the Global Golf Ball Market?

Key players in the market include Titleist, Callaway Golf, Bridgestone Golf, and TaylorMade, all of which dominate through brand loyalty, innovation, and a wide product range.

04 What are the growth drivers of the Global Golf Ball Market?

Growth is fueled by rising disposable incomes, the popularity of golf tourism, and technological advancements in ball performance, such as multi-layer designs for greater control.

05 What trends are emerging in the Global Golf Ball Market?

Key trends include the development of eco-friendly golf balls and the integration of smart technology, such as embedded sensors that track performance metrics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.