Region:Global

Author(s):Geetanshi

Product Code:KRAA1172

Pages:92

Published On:August 2025

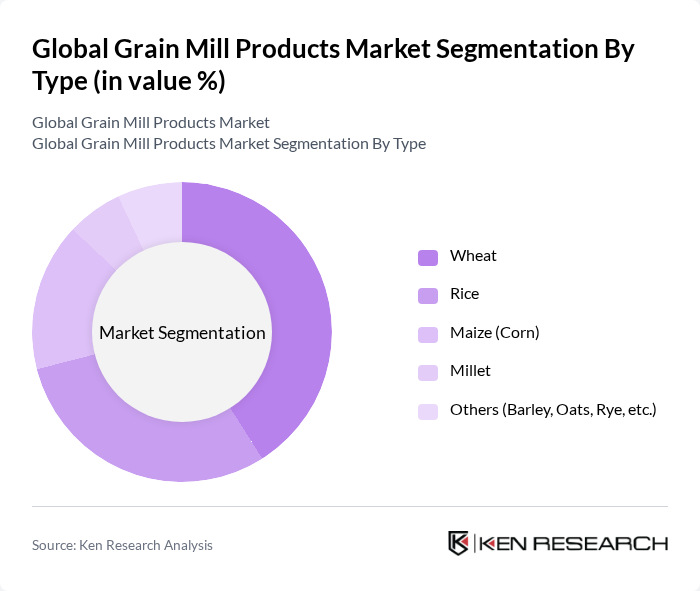

By Type:The market is segmented into various types, including Wheat, Rice, Maize (Corn), Millet, and Others (Barley, Oats, Rye, etc.). Among these, Wheat is the leading sub-segment due to its widespread use in various food products, including bread and pastries. The increasing preference for whole grain and organic wheat products has further boosted its demand. Rice follows closely, especially in Asian markets, where it is a staple food. The growing trend of gluten-free diets has also contributed to the rising popularity of alternative grains like Millet and Others.

By End-Use:The market is divided into Commercial and Residential segments. The Commercial segment dominates the market, driven by the increasing number of bakeries, restaurants, and food processing industries that require large quantities of grain products. The trend towards convenience foods and ready-to-eat meals has also fueled demand in this segment. The Residential segment, while smaller, is growing as more consumers engage in home baking and cooking, particularly during the pandemic and with the rise of health-focused eating habits.

The Global Grain Mill Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company (ADM), Cargill, Incorporated, General Mills, Inc., Bunge Limited, Conagra Brands, Inc., Associated British Foods plc (ABF), Olam International Limited, Wilmar International Limited, Bühler Group, Miller Milling Company, GrainCorp Limited, Tereos S.A., SunOpta Inc., Ag Processing Inc (AGP), The Scoular Company, Ardent Mills, Oy Karl Fazer Ab, King Arthur Baking Company, Goodman Fielder, Grain Millers, Inc., Hodgson Mill contribute to innovation, geographic expansion, and service delivery in this space.

The future of the grain mill products market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek organic and gluten-free options, grain millers are likely to adapt their offerings accordingly. Additionally, the integration of automation and digital technologies in milling processes will enhance efficiency and product quality. The expansion into emerging markets presents further growth potential, as rising incomes and urbanization drive demand for processed food products, creating new opportunities for industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Wheat Rice Maize (Corn) Millet Others (Barley, Oats, Rye, etc.) |

| By End-Use | Commercial Residential |

| By Application | Bakery Products Pasta and Noodles Animal Feed Beverages Others (Sauces, Dressings, etc.) |

| By Distribution Channel | Direct Sales Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Wholesale Distribution |

| By Packaging Type | Bags Cartons Bulk Containers Eco-friendly Packaging |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, Rest of Asia-Pacific) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (South Africa, Saudi Arabia, Rest of Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Flour Production Insights | 150 | Mill Managers, Production Supervisors |

| Grain Supply Chain Analysis | 100 | Supply Chain Managers, Procurement Specialists |

| Consumer Preferences in Grain Products | 140 | Retail Buyers, Market Analysts |

| Export Market Dynamics | 80 | Export Managers, Trade Compliance Officers |

| Health Trends Impacting Grain Consumption | 120 | Nutritional Experts, Food Scientists |

The Global Grain Mill Products Market is valued at approximately USD 830 billion, driven by increasing demand for processed grain products and the expansion of the food and beverage industry.