Global Grass-Fed Beef Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD6999

November 2024

84

About the Report

Global Grass-Fed Beef Market Overview

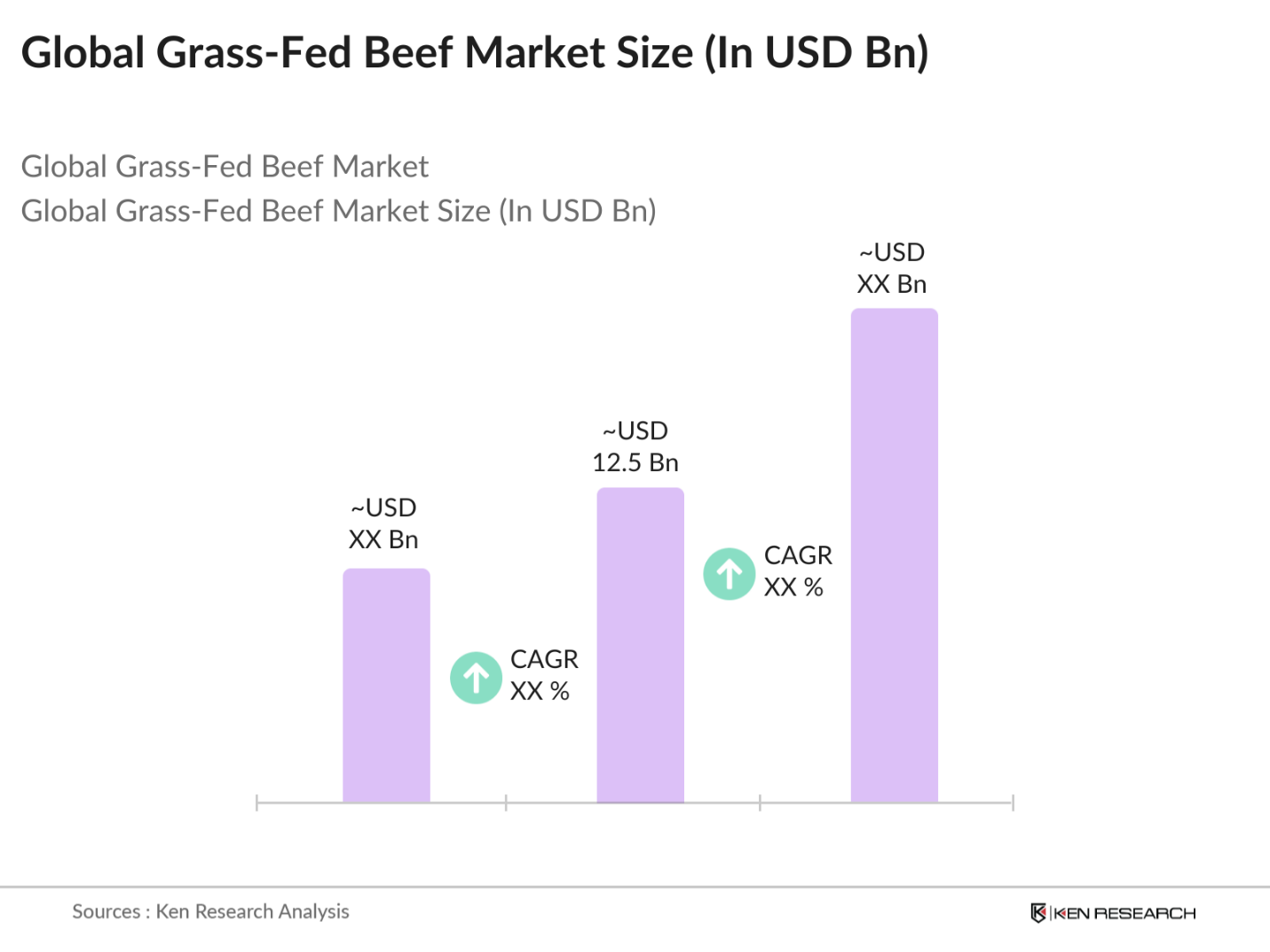

- The global grass-fed beef market is valued at USD 12.5 billion, based on a five-year historical analysis. This market is driven by increasing consumer demand for healthier, natural, and organic food options, as well as the rising awareness of the environmental benefits of grass-fed cattle farming. The growing focus on sustainable and ethical farming practices has further fueled demand, particularly in developed markets where consumers prioritize animal welfare and environmentally responsible sourcing. Key industries such as retail and foodservice are embracing grass-fed beef due to its higher nutritional content, including omega-3 fatty acids and antioxidants, compared to conventionally raised beef.

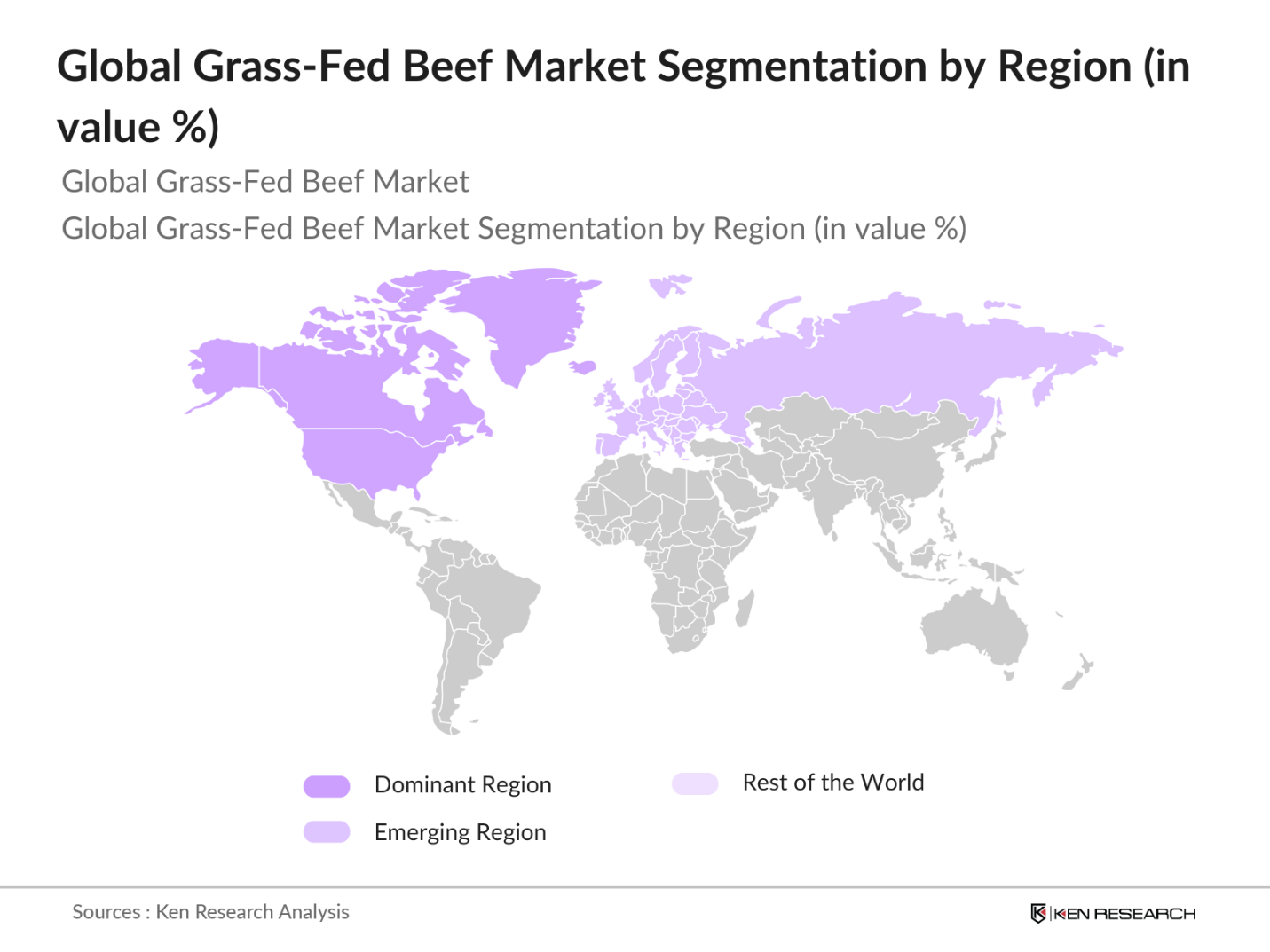

- North America is the dominant region in the global grass-fed beef market, largely driven by the strong consumer demand for organic and natural meat products, particularly in the United States. The region benefits from advanced livestock management practices, a well-established supply chain, and government initiatives that promote sustainable and ethical farming. Additionally, the U.S. market has seen growing domestic demand for healthier meat options, contributing significantly to the regions leadership. Other regions, such as Asia-Pacific, are also gaining traction due to the rising consumer awareness of health benefits and increasing disposable incomes, but North America remains at the forefront.

- Trade policies play a significant role in shaping the global grass-fed beef market. In 2023, the World Trade Organization (WTO) reported that tariffs on beef imports ranged from 10% to 40%, depending on the country. Export quotas and trade agreements, such as the U.S.-Mexico-Canada Agreement (USMCA), also influence market dynamics by regulating the flow of beef between nations.

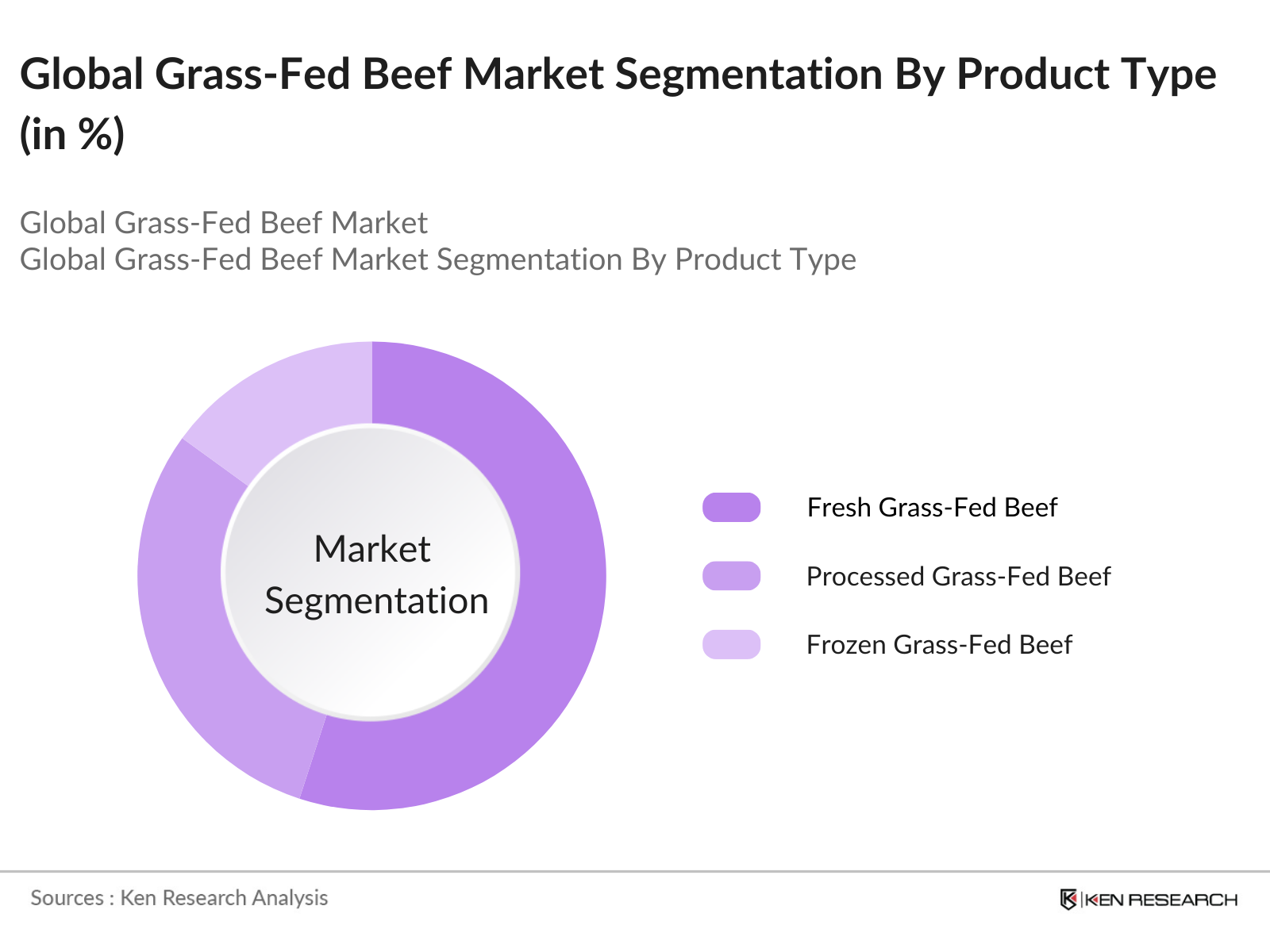

Global Grass-Fed Beef Market Segmentation

By Product Type: The global grass-fed beef market is segmented by product type into fresh grass-fed beef, processed grass-fed beef, and frozen grass-fed beef. Fresh grass-fed beef has emerged as the dominant segment due to consumer preferences for minimally processed, fresh, and natural products. Fresh beef is widely available in supermarkets, specialty stores, and direct-to-consumer sales channels, further enhancing its market penetration.

By Distribution Channel: The distribution channels for grass-fed beef include supermarkets & hypermarkets, online retail, specialty stores, and direct-to-consumer channels. Supermarkets & hypermarkets dominate the distribution channel, as they offer a variety of grass-fed beef options at competitive prices, appealing to a wide consumer base. Their established supply chains ensure consistent availability, which is key to maintaining customer loyalty.

By Region: The regional segmentation of the grass-fed beef market includes North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by strong demand for organic and grass-fed products, along with the presence of well-established producers. The regions advanced farming technologies and government initiatives supporting sustainable beef production also play a key role in its dominance.

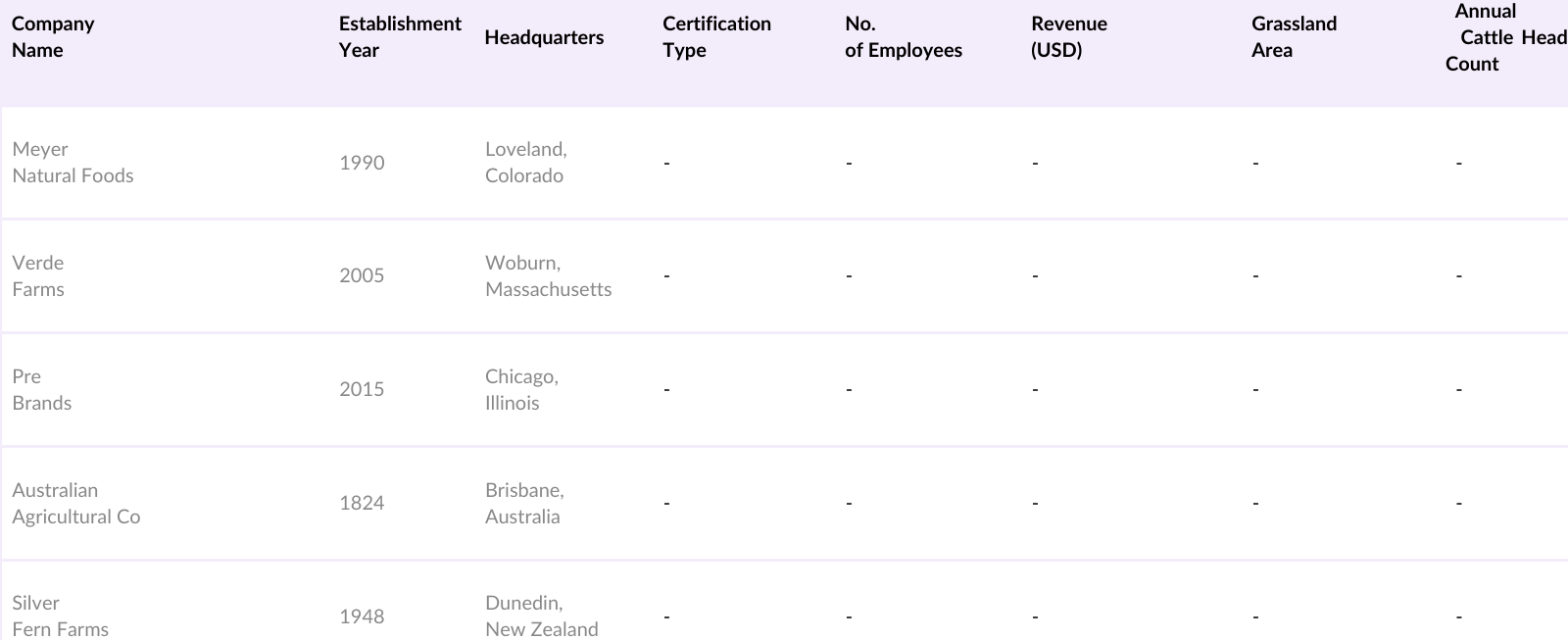

Global Grass-Fed Beef Market Competitive Landscape

The global grass-fed beef market is characterized by a few key players who control a significant portion of the market. These companies have established a reputation for producing high-quality grass-fed beef products and have invested heavily in certifications, sustainability initiatives, and strategic partnerships. Additionally, these companies have developed strong supply chain networks that allow them to meet the growing demand for organic and natural meat.

Global Grass-Fed Beef Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Sustainable and Organic Meat: The global shift towards sustainable food sources has driven significant demand for organic, grass-fed beef. In 2024, consumers, especially in North America and Europe, are increasingly prioritizing sustainably sourced products due to environmental concerns. According to the Food and Agriculture Organization (FAO), organic meat production has been expanding by over 7 million tons annually, driven by consumer preference for sustainable products.

- Rising Awareness of Health Benefits (Nutrient Density, Omega-3 Levels): Consumers are gravitating towards grass-fed beef for its well-documented health benefits. Grass-fed beef contains higher levels of omega-3 fatty acids, antioxidants, and vitamins, which are associated with reduced inflammation and heart disease risk. A 2022 report from the World Health Organization (WHO) noted a 12% increase in consumer awareness of health-oriented dietary choices, driving higher demand for nutrient-dense foods like grass-fed beef.

- Expansion of Ethical Farming Practices: Ethical farming practices are becoming a priority for both consumers and producers, with animal welfare now at the forefront of the grass-fed beef market. The global push for humane livestock treatment has led to a significant expansion in grass-fed cattle farming. According to the Global Animal Partnership (GAP), farms adhering to high animal welfare standards increased by 15% in 2023.

Market Challenges

- Higher Production Costs (Grazing Land Requirements, Slower Growth Rates): Grass-fed beef production is significantly more resource-intensive than conventional beef due to the need for extensive grazing land and slower animal growth rates. According to the United Nations Food and Agriculture Organization (FAO), grass-fed cattle typically take 25-30% longer to reach slaughter weight compared to grain-fed cattle. This results in higher land and feed costs, which are compounded by the reduced availability of suitable grazing land, particularly in highly urbanized or arid regions.

- Limited Availability and Supply Chain Constraints: The supply of grass-fed beef remains constrained by logistical and distribution challenges, particularly in regions where grazing land is scarce. According to a 2023 report by the World Trade Organization (WTO), supply chain disruptions, including transportation bottlenecks and import restrictions, have created obstacles for the distribution of grass-fed beef across borders. This has been exacerbated by trade barriers, with tariffs on beef imports in some regions reaching as high as 40%.

Global Grass-Fed Beef Market Future Outlook

The global grass-fed beef market is poised for significant growth over the next five years, driven by increasing consumer awareness of the health benefits of grass-fed beef and a continued shift toward sustainable and organic products. Government initiatives promoting ethical farming practices, along with the expansion of direct-to-consumer sales channels, are expected to further fuel market growth.

Market Opportunities

- Expanding Markets in Emerging Economies: Grass-fed beef is seeing increasing demand in emerging markets, particularly in Latin America and Asia, where rising incomes and growing middle classes are driving shifts in dietary preferences. According to the World Bank, income per capita in emerging markets grew by 4.2% in 2023, fostering a greater capacity for purchasing premium food products, including grass-fed beef.

- Potential for Branding and Certifications (Organic, Non-GMO, Pasture-Raised): The growing consumer demand for transparency and certification in food production presents a significant opportunity for grass-fed beef producers to differentiate themselves through branding and certification schemes. Certifications such as USDA Organic, Non-GMO, and Pasture-Raised labels have been shown to increase consumer trust and willingness to pay a premium for certified products.

Scope of the Report

|

Product Type |

Fresh Grass-Fed Beef Processed Grass-Fed Beef Frozen Grass-Fed Beef |

|

Distribution Channel |

Supermarkets & Hypermarkets Online Retail Specialty Stores Direct-to-Consumer |

|

End-Use |

Household Consumption Foodservice Retailers and Wholesalers |

|

Source Certification |

Organic Grass-Fed Beef Non-GMO Verified AGA Certified Grass-Fed Beef |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Grass-Fed Beef Producers

Retail Chains and Supermarkets

Online Meat Retailers

Specialty Organic Stores

Direct-to-Consumer Meat Platforms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, AGA, EU Organic Certification Bodies)

Exporters and Importers of Organic Beef

Companies

Players Mentioned in the Report

Meyer Natural Foods

Verde Farms

Pre Brands

Strauss Brands

Panorama Meats

Australian Agricultural Company

OBE Organic

Green Pasture Farms

Thousand Hills Lifetime Grazed

Eversfield Organic

Table of Contents

1. Global Grass-Fed Beef Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Market Volume Growth)

1.4. Market Segmentation Overview

2. Global Grass-Fed Beef Market Size (In USD Bn)

2.1. Historical Market Size (In Value & Volume)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Global Trade, Export/Import Data, Production Trends)

3. Global Grass-Fed Beef Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Sustainable and Organic Meat

3.1.2. Rising Awareness of Health Benefits (Nutrient Density, Omega-3 Levels)

3.1.3. Expansion of Ethical Farming Practices

3.1.4. Shift in Consumer Preferences from Conventional to Grass-Fed Products

3.2. Market Challenges

3.2.1. Higher Production Costs (Grazing Land Requirements, Slower Growth Rates)

3.2.2. Limited Availability and Supply Chain Constraints

3.2.3. Pricing Pressures (Premium Pricing for Grass-Fed Beef)

3.3. Opportunities

3.3.1. Expanding Markets in Emerging Economies

3.3.2. Potential for Branding and Certifications (Organic, Non-GMO, Pasture-Raised)

3.3.3. Growing E-Commerce Distribution Channels for Premium Products

3.4. Trends

3.4.1. Emergence of Direct-to-Consumer Sales Models

3.4.2. Adoption of Regenerative Agriculture Practices

3.4.3. Technological Integration in Grassland Management (Precision Grazing)

3.4.4. Increase in Specialty Retailers and Farmer Market Presence

3.5. Government Regulation

3.5.1. Livestock Production Standards (USDA Organic, AGA Certification)

3.5.2. Export Restrictions and Trade Agreements (Tariffs, Quotas)

3.5.3. Animal Welfare Standards (RSPCA Assured, Global GAP)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Supply Chain, Farmers, Retailers, Distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Grass-Fed Beef Market Segmentation

4.1. By Product Type (In Value & Volume %)

4.1.1. Fresh Grass-Fed Beef

4.1.2. Processed Grass-Fed Beef (Jerky, Ground Beef, Steaks)

4.1.3. Frozen Grass-Fed Beef

4.2. By Distribution Channel (In Value & Volume %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Online Retail

4.2.3. Specialty Stores

4.2.4. Direct-to-Consumer

4.3. By End-Use (In Value & Volume %)

4.3.1. Household Consumption

4.3.2. Foodservice (Restaurants, Hotels, Catering)

4.3.3. Retailers and Wholesalers

4.4. By Source Certification (In Value %)

4.4.1. Organic Grass-Fed Beef

4.4.2. Non-GMO Verified

4.4.3. AGA Certified Grass-Fed Beef

4.5. By Region (In Value & Volume %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Grass-Fed Beef Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Meyer Natural Foods

5.1.2. Verde Farms

5.1.3. Pre Brands

5.1.4. Strauss Brands

5.1.5. Panorama Meats

5.1.6. Australian Agricultural Company (AACo)

5.1.7. OBE Organic

5.1.8. Green Pasture Farms

5.1.9. Thousand Hills Lifetime Grazed

5.1.10. Eversfield Organic

5.1.11. First Light

5.1.12. Silver Fern Farms

5.1.13. Arcadian Organic

5.1.14. Coonawarra Farm

5.1.15. The Honest Bison

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Grassland Area, Cattle Head Count, Annual Yield, Brand Positioning)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Certifications, Product Line Expansion)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Grass-Fed Beef Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements (Health and Safety, Meat Labeling)

6.3. Certification Processes (Organic, Grass-Fed Certifications)

7. Global Grass-Fed Beef Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Grass-Fed Beef Future Market Segmentation

8.1. By Product Type (In Value & Volume %)

8.2. By Distribution Channel (In Value & Volume %)

8.3. By End-Use (In Value & Volume %)

8.4. By Source Certification (In Value %)

8.5. By Region (In Value & Volume %)

9. Global Grass-Fed Beef Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Brand Positioning, Influencer Campaigns, Certification Advantages)

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping out the key stakeholders within the global grass-fed beef market. Through extensive desk research and proprietary databases, we identified the critical market drivers, including consumer trends, certification processes, and supply chain developments.

Step 2: Market Analysis and Construction

We analyzed historical data on grass-fed beef production and consumption, focusing on market penetration, key distribution channels, and revenue growth. Data on pricing dynamics and supply chain inefficiencies were also compiled to assess current market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through in-depth interviews with industry experts, including grass-fed beef producers, retailers, and distributors. Their insights provided a deeper understanding of operational challenges and future market trends.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing all the data and producing a comprehensive report. Data was cross-referenced with expert insights and primary research to ensure accuracy and reliability, culminating in a thorough analysis of the global grass-fed beef market.

Frequently Asked Questions

1. How big is the Global Grass-Fed Beef Market?

The global grass-fed beef market is valued at USD 12.5 billion, based on a five-year historical analysis. This market is driven by increasing consumer demand for healthier, natural, and organic food options, as well as the rising awareness of the environmental benefits of grass-fed cattle farming.

2. What are the challenges in the Global Grass-Fed Beef Market?

Challenges include high production costs, limited availability due to slower cattle growth rates, and premium pricing that may deter price-sensitive consumers.

3. Who are the major players in the Global Grass-Fed Beef Market?

Key players include Meyer Natural Foods, Verde Farms, Pre-Brands, and Australian Agricultural Company, all known for their large-scale production and strong certifications.

4. What are the growth drivers of the Global Grass-Fed Beef Market?

The market is driven by growing health consciousness, demand for sustainable products, and consumer preference for minimally processed, organic foods.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.