Global Grease Market Outlook to 2030

Region:Global

Author(s):Sanjeev kumar

Product Code:KROD9625

December 2024

85

About the Report

Global Grease Market Overview

- The global grease market is valued at USD 5.83 billion. This value is driven by a variety of factors including rising industrialization across emerging economies, increasing demand for automotive greases due to higher vehicle production, and the expanding use of high-performance greases in industries such as aerospace, marine, and construction. Industrial applications account for a significant portion of the demand, particularly in sectors that require lubrication for machinery, bearings, and equipment where traditional oils cannot perform effectively.

- Countries like China, the United States, and Germany dominate the grease market due to their vast industrial infrastructure and high automotive production rates. China leads in the manufacturing sector, while the United States has a robust automotive and aerospace industry. Germany, as the center of Europe's automotive industry, also contributes heavily to grease consumption due to its highly advanced manufacturing processes and engineering standards.

- Governments are offering subsidies and R&D grants to support the development of green lubricants. In 2022, the U.S. Department of Energy allocated over $100 million in grants for research in eco-friendly lubrication solutions. Similarly, European governments have introduced subsidy programs to promote the use of biodegradable lubricants in industries such as agriculture and transportation, offering financial incentives for companies investing in sustainable grease solutions.

Global Grease Market Segmentation

- By Product Type: The global grease market is segmented by product type into mineral oil-based greases, synthetic oil-based greases, and bio-based greases. Mineral oil-based greases are dominating this segment due to their cost-effectiveness and broad application range in automotive and industrial sectors. Despite advancements in synthetic and bio-based greases, mineral oil-based greases continue to be the most widely used, primarily because of their availability, affordability, and satisfactory performance under typical industrial conditions.

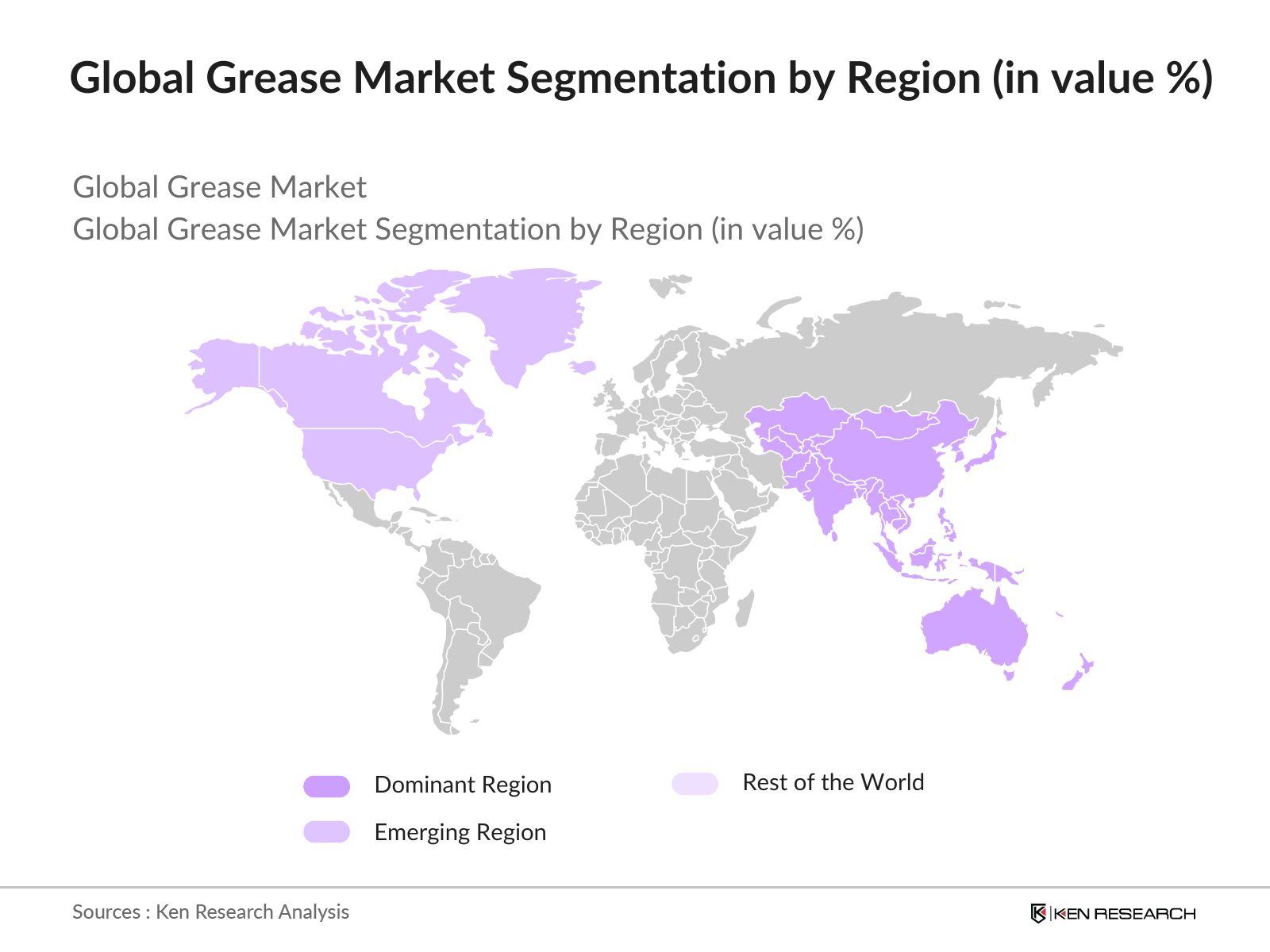

- By Region: The grease market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. The Asia-Pacific region leads the market, primarily due to rapid industrialization, a booming automotive sector, and the presence of large manufacturing hubs in countries like China, India, and Japan. North America holds the second-largest share, driven by strong demand in the automotive, aerospace, and marine sectors.

- By Thickener Type: The global grease market is segmented by thickener type into lithium greases, calcium greases, aluminum complex greases, and polyurea greases. Lithium greases dominate this segment, holding the largest market share due to their superior performance in extreme temperatures and their versatility across a wide range of applications, including automotive and industrial uses. They are favored for their water-resistant properties and ability to work well under high pressure.

Global Grease Market Competitive Landscape

The global grease market is dominated by a mix of established players with a strong global presence and companies with localized operations focusing on specific regions. This competitive landscape is characterized by innovation in product development, particularly in the realm of bio-based and synthetic greases.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity (Tons) |

Product Portfolio |

R&D Expenditure (USD) |

Sustainability Initiatives |

Key Markets |

Number of Employees |

Partnerships/Collaborations |

|

Shell PLC |

1907 |

The Hague, Netherlands |

|||||||

|

ExxonMobil Corporation |

1870 |

Irving, Texas, USA |

|||||||

|

Chevron Corporation |

1879 |

San Ramon, California |

|||||||

|

BP PLC |

1909 |

London, UK |

|||||||

|

FUCHS Petrolub SE |

1931 |

Mannheim, Germany |

Global Grease Industry Analysis

Growth Drivers

- Increased Demand in Industrial Applications (Automotive, Manufacturing): The global grease market is being propelled by a surge in demand from industrial applications, particularly in automotive and manufacturing sectors. According to the International Organization of Motor Vehicle Manufacturers, global automotive production reached over 85 million units in 2023, up from 77 million in 2021, driving significant demand for grease used in bearings and joints. Additionally, the manufacturing sector, contributing approximately $13 trillion to the global economy as per the World Bank data, is heavily reliant on grease for machine maintenance to reduce friction and wear in high-speed machinery.

- Technological Advancements in Lubrication Solutions: Technological advancements in lubrication solutions, including the development of smart greases, are key drivers in the grease market. The rise in automation and robotics, estimated to be valued at $30 billion globally according to the International Federation of Robotics, demands advanced lubrication solutions. Robotics and automated systems require precision lubrication, and the emergence of smart greases that offer enhanced performance is critical for maintaining the efficiency and longevity of machinery.

- Growing Need for Energy-Efficient Machinery: The demand for energy-efficient machinery is driving grease usage, especially in energy-intensive industries. According to the International Energy Agency (IEA), the global energy consumption by industries exceeded 200 exajoules in 2022, with increasing pressure to reduce energy use. Energy-efficient machines are crucial in this context, and the adoption of high-performance greases designed to lower friction can significantly improve energy efficiency, reducing operational costs. These greases are increasingly favored in high-energy-use industries like steel, cement, and manufacturing.

Market Restraints

- Fluctuations in Raw Material Prices (Base Oils, Additives): One of the key challenges in the grease market is the fluctuation in raw material prices, including base oils and additives. Crude oil prices, which influence the cost of base oils, fluctuated between $70 to $100 per barrel in 2023, according to the U.S. Energy Information Administration. These fluctuations, coupled with rising costs of additives like thickening agents, present a challenge for grease manufacturers who struggle to maintain profit margins.

- Environmental Regulations on Lubricants (Emission Standards, Waste Management): Strict environmental regulations governing the use of lubricants are a significant challenge in the grease market. The European Union's REACH regulation mandates strict guidelines on chemicals used in lubricants to minimize environmental impact. The U.S. Environmental Protection Agency (EPA) has also set standards for lubricant disposal and emission limits, creating compliance challenges for manufacturers. For instance, the EPAs Hazardous Waste Regulations apply to greases with certain chemical compositions, increasing costs for waste management and product reformulation.

Global Grease Market Future Outlook

Over the next five years, the global grease market is expected to witness steady growth driven by increasing industrial activities across emerging economies, innovations in synthetic and bio-based greases, and a growing emphasis on energy-efficient lubrication systems. The rising demand for electric vehicles (EVs) will open up new opportunities for grease manufacturers, especially for specialized lubricants used in electric motors and drivetrains. Moreover, the shift towards eco-friendly and sustainable products will further fuel innovation in the industry.

Market Opportunities

- Expansion in Developing Markets (India, Southeast Asia): The grease market is witnessing expansion opportunities in developing regions such as India and Southeast Asia. Indias industrial sector grew by $750 billion in 2023, driven by manufacturing and infrastructure development. Similarly, Southeast Asias construction output surpassed $500 billion. These regions, with their fast-growing economies and industrial activities, present significant opportunities for grease manufacturers to meet the increasing demand for industrial lubrication solutions.

- Innovations in Bio-based and Synthetic Greases: Innovation in bio-based and synthetic greases presents growth opportunities. Bio-based greases, derived from renewable resources, are gaining traction due to rising environmental concerns. According to the U.S. Department of Agriculture, the bio-based product industry contributed over $460 billion to the U.S. economy in 2022. This trend is creating opportunities for grease manufacturers to develop eco-friendly solutions, particularly in regions with stringent environmental regulations such as Europe and North America.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Product Type |

Mineral Oil-Based Greases |

|

Synthetic Oil-Based Greases |

|

|

Bio-Based Greases |

|

|

By Thickener Type |

Lithium Greases |

|

Calcium Greases |

|

|

Aluminum Complex Greases |

|

|

Polyurea Greases |

|

|

By Application |

Automotive |

|

Industrial (Machinery, Mining, Construction) |

|

|

Marine and Aerospace |

|

|

Consumer Goods (Home Appliances, Tools) |

|

|

By Distribution Channel |

Direct Sales |

|

Distributor/Dealer Sales |

|

|

Online Sales |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Middle East & Africa |

|

|

Latin America |

Products

Key Target Audience

Automotive Manufacturers

Industrial Machinery Manufacturers

Marine and Aerospace Industries

Lubricant Distributors

Original Equipment Manufacturers (OEMs)

Government and Regulatory Bodies (e.g., Environmental Protection Agency (EPA), European Chemicals Agency (ECHA))

Investors and Venture Capitalist Firms

Raw Material Suppliers (Base Oils, Additives)

Companies

Players Mentioned in the Report:

Shell PLC

ExxonMobil Corporation

Chevron Corporation

BP PLC

FUCHS Petrolub SE

TotalEnergies SE

Royal Purple LLC

Castrol Limited

Sinopec Lubricant Company

Petro-Canada Lubricants Inc.

Klber Lubrication

Idemitsu Kosan Co., Ltd.

Valvoline Inc.

Lucas Oil Products, Inc.

AMSOIL Inc.

Table of Contents

1. Global Grease Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Grease Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Grease Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand in Industrial Applications (Automotive, Manufacturing)

3.1.2. Technological Advancements in Lubrication Solutions

3.1.3. Growing Need for Energy-Efficient Machinery

3.1.4. Rising Construction and Mining Activities

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Prices (Base Oils, Additives)

3.2.2. Environmental Regulations on Lubricants (Emission Standards, Waste Management)

3.2.3. Competitive Pricing Pressure from Low-Cost Alternatives

3.3. Opportunities

3.3.1. Expansion in Developing Markets (India, Southeast Asia)

3.3.2. Innovations in Bio-based and Synthetic Greases

3.3.3. Growth in Electric Vehicle Segment (Specialized Lubricants)

3.3.4. Increasing Applications in Aerospace and Marine Industries

3.4. Trends

3.4.1. Adoption of Advanced Manufacturing Techniques (3D Printing, Robotics)

3.4.2. Shift towards High-Performance Greases (Extreme Pressure, High Temperature)

3.4.3. Introduction of Environmentally Friendly Grease Solutions

3.4.4. Integration of IoT for Predictive Maintenance in Machinery

3.5. Government Regulations

3.5.1. Industry Standards (ISO, NLGI Certifications)

3.5.2. Grease Manufacturing Guidelines (EPA Regulations, European REACH Compliance)

3.5.3. Sustainability Initiatives (Carbon Neutrality Targets, Recycling Programs)

3.5.4. Support for Green Lubricants (Government Subsidies, R&D Grants)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, OEMs, End-Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Grease Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Mineral Oil-Based Greases

4.1.2. Synthetic Oil-Based Greases

4.1.3. Bio-Based Greases

4.2. By Thickener Type (In Value %)

4.2.1. Lithium Greases

4.2.2. Calcium Greases

4.2.3. Aluminum Complex Greases

4.2.4. Polyurea Greases

4.3. By Application (In Value %)

4.3.1. Automotive

4.3.2. Industrial (Machinery, Mining, Construction)

4.3.3. Marine and Aerospace

4.3.4. Consumer Goods (Home Appliances, Tools)

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Distributor/Dealer Sales

4.4.3. Online Sales

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Grease Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Shell PLC

5.1.2. Chevron Corporation

5.1.3. ExxonMobil Corporation

5.1.4. BP PLC

5.1.5. TotalEnergies SE

5.1.6. FUCHS Petrolub SE

5.1.7. Royal Purple LLC

5.1.8. Castrol Limited

5.1.9. Sinopec Lubricant Company

5.1.10. Petro-Canada Lubricants Inc.

5.1.11. Klber Lubrication

5.1.12. Idemitsu Kosan Co., Ltd.

5.1.13. Valvoline Inc.

5.1.14. Lucas Oil Products, Inc.

5.1.15. AMSOIL Inc.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, R&D Expenditure, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Grease Market Regulatory Framework

6.1. Industry Standards and Certifications (ISO 6743-9, NLGI 000-3)

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Grease Market Future Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Grease Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Thickener Type (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Grease Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing a comprehensive overview of the grease markets key stakeholders, including manufacturers, distributors, OEMs, and end-users. Extensive desk research is carried out using proprietary databases and market-specific reports to identify the most influential variables in the market.

Step 2: Market Analysis and Construction

Historical data on the grease market is analyzed to understand penetration rates, usage patterns, and revenue generation across various product types and applications. This phase also involves analyzing region-specific data to uncover consumption trends and dominant applications.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formed based on the data collected and validated through interviews with industry experts. These experts provide valuable insights into operational challenges, product innovation, and market dynamics.

Step 4: Research Synthesis and Final Output

In the final phase, data from primary and secondary research is synthesized to deliver a comprehensive analysis. This includes a bottom-up approach to assess market demand across key regions and product categories, ensuring accuracy and reliability in the final market report.

Frequently Asked Questions

01. How big is the global grease market?

The global grease market is valued at USD 5.83 billion, driven by increasing demand in industrial applications and advancements in synthetic grease technology.

02. What are the challenges in the global grease market?

Challenges include volatile raw material prices, stringent environmental regulations, and the growing competition from low-cost alternatives, which affect profitability.

03. Who are the major players in the global grease market?

Key players in the market include Shell PLC, ExxonMobil Corporation, Chevron Corporation, BP PLC, and FUCHS Petrolub SE. These companies lead due to their extensive product offerings, innovation, and global distribution networks.

04. What are the growth drivers of the global grease market?

Key growth drivers include the expansion of industrial activities, increasing automotive production, and rising demand for high-performance greases in aerospace, marine, and manufacturing sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.